The study involved four major activities in estimating the current size of the all-terrain vehicle market. Exhaustive secondary research was conducted to collect information on the market, peer, and parent markets. The next step was to validate these findings and assumptions and size them with industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

The all-terrain vehicle market is directly dependent on vehicle production. ATV sales/registration volume was derived through secondary sources such as automotive industry organizations; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, paid repository, and automotive associations such as Motorcycle Industry Council, Abraciclo, Agricultural Engineers Association (AEA), and Canadian Off-Highway Vehicle Distributors Council. Historical sales/registration data was collected and analysed, and the industry trend was considered to arrive at the forecast, further validated by primary research.

Primary Research

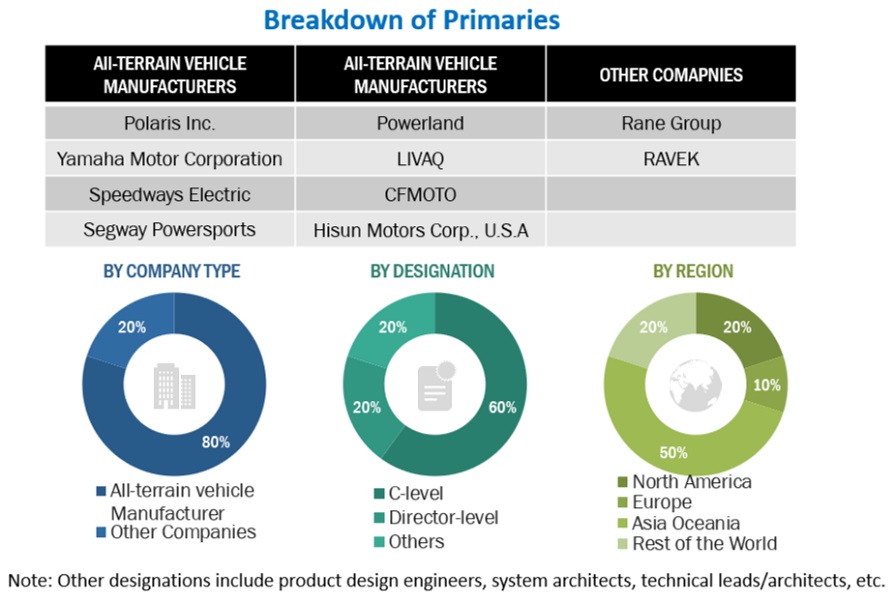

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as CXOs, vice presidents, directors from business development, marketing, and product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews were conducted to gather insights such as vehicle sales/registrations forecast, all-terrain vehicle market forecast, future technology trends, and upcoming technologies in the all-terrain vehicle industry. Data triangulation of all these points was done using the information gathered from secondary research and model mapping. Stakeholders from the demand and supply sides were interviewed to understand their views on the points above.

Primary interviews were conducted with market experts from both the demand (ATV manufacturers) and supply (component manufacturers) sides across four major regions: North America, Europe, Asia, Oceania, and the Rest of the World. Approximately 80% and 20% of primary interviews were conducted by OEMs and others, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales and operations, were covered to provide a holistic viewpoint in the report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from primaries. This, along with the opinions of the in-house subject matter experts, led to the findings described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

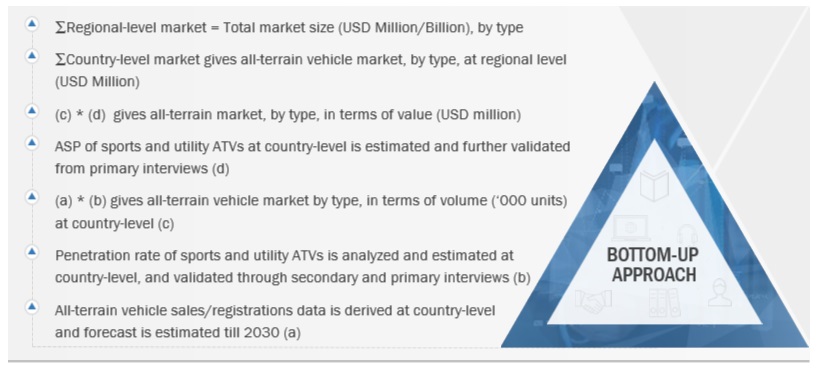

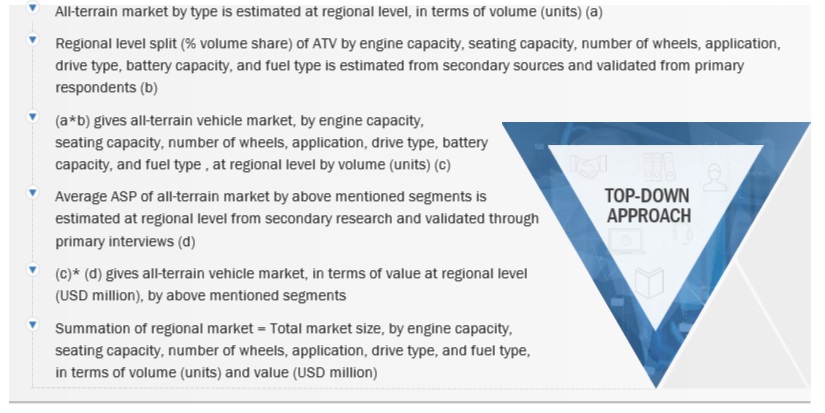

As mentioned below, a detailed market estimation approach was followed to estimate and validate the value of the all-terrain vehicle market and other dependent submarkets.

-

Key players in the all-terrain vehicle market were identified through secondary research, and their global market share was determined through primary and secondary research.

-

The research methodology included studying annual and quarterly financial reports, regulatory filings of significant market players (public), and interviews with industry experts for detailed market insights.

-

All regional-level penetration rates splits, and breakdowns for the all-terrain vehicle market were determined using secondary sources and verified through primary sources.

-

All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain validated and verified quantitative and qualitative data.

-

The gathered market data was consolidated, enhanced with detailed inputs, analyzed, and presented in this report.

Bottom-up approach: all-terrain vehicle market by type and region

To know about the assumptions considered for the study, Request for Free Sample Report

top-down approach: by seating capacity, number of wheels, drive type, engine capacity, application, fuel

Data Triangulation

-

All percentage shares, splits, and breakdowns were determined using secondary sources and verified by primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in the report. The following figure illustrates the overall market size estimation process employed for this study.

Market Definition:

According to Polaris Inc., an all-terrain, or ATV, is a four-wheeled off-road vehicle with straddle/motorcycle-style seating and handlebar steering. While two-person models are available, a typical ATV accommodates a single rider. Also known as quads or four-wheelers, ATVs are generally smaller than UTVs, more physically intensive to operate than UTVs, and generally easier to transport long distance than UTVs, as they can fit in the beds of most full-size pickups and many standard utility trailers.

Key Stakeholders:

-

ATV and Side-by-Side Vehicle Manufacturers (OEMs)

-

Component Manufacturers

-

Raw Material Suppliers for ATVs (Suppliers for OEMs)

-

Traders, Distributors, and Suppliers of ATVs and Side-by-Side Vehicles

-

Automotive Industry Associations, Government Authorities, and Research Organizations

-

Country/Regional Level All-terrain Vehicle Associations

-

Organized and Unorganized ATV Suppliers

Report Objectives

-

To define, describe, and forecast the all-terrain vehicle market in terms of value (USD million) and volume (units) based on the following segments:

-

Drive Type (2WD, 4WD, and AWD)

-

Fuel type (gasoline and electric)

-

Application (sports, agricultural, entertainment, military & defense, and others)

-

Engine Capacity (<400 cc, 400 – 800 cc, and > 800 cc)

-

Seating Capacity (one-seater and ≥two-seater)

-

Type (Utility and sport)

-

All-terrain Vehicles, by number of wheels (four wheel and ≥ four wheel)

-

Side-by-Side Vehicle Market, by number of wheels (four wheel and ≥ four wheel)

-

Electric ATV Market, By Battery Capacity (<10 kWh and >10 kWh)

-

To segment the market and forecast its size by volume and value based on region (Asia Pacific, Europe, North America, and the Rest of the World)

-

To identify and analyze key drivers, restraints, opportunities, and challenges influencing market growth

-

To strategically analyze markets concerning individual growth trends, prospects, and contributions to the overall market

-

To analyze opportunities for stakeholders and the competitive landscape for market leaders

-

To study the supply chain analysis, ecosystem mapping, trade analysis, case studies, pricing analysis, conferences and events, patent analysis, trends and disruptions impacting customer business, technology trends, total cost of ownership, impact of AI/Gen on ATV market, funding and investment scenario, consumer buying criteria, and regulatory analysis concerning the market

-

To analyze the key players offering the all-terrain vehicle concerning OEM analysis.

-

To strategically profile key players and comprehensively analyze their market share

-

To track and analyze competitive developments such as product launches/developments, deals (acquisitions, partnerships, and collaborations), and other developments carried out by key industry participants

-

To analyze the competitive evaluation quadrant to identify and showcase opportunities for stakeholders and the competitive landscape for global and regional market players

AVAILABLE CUSTOMIZATIONS

SIDE-BY-SIDE VEHICLE MARKET BY APPLICATION

-

SPORTS

-

ENTERTIANMENT

-

AGRICULTURE

-

MILITARY AND DEFENCE

-

OTHERS

-

SIDE-BY-SIDE VEHICLE MARKET BY FUEL TYPE

-

SIDE-BY-SIDE VEHICLE MARKET BY BATTERY CHEMISTRY

-

DETAILED ANALYSIS AND PROFILING OF ADDITIONAL MARKET PLAYERS (UP TO 3)

amit

May, 2020

Interested in All-terrain vehicle to understand the electrification trend in ATV and by when it will have a considerable impact on conventional fuel engines .

amit

May, 2020

If I purchase a single license, can I print the material or copy the graph to a ppt file? And, can I share the pdf file to my colleagues? If not, is it OK to share a ppt file to quote your report?.