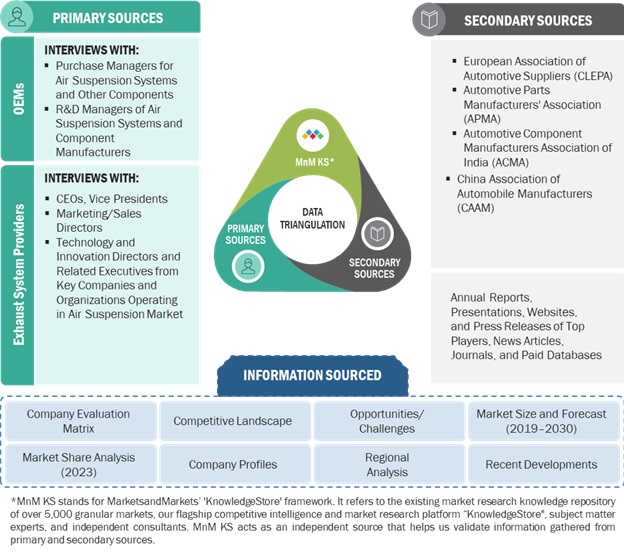

The study encompassed four primary tasks to determine the present scope of the Air Suspension market. Initially, extensive secondary research was conducted to gather data on the market, its related sectors, and overarching industries. Subsequently, primary research involving industry experts across the value chain corroborated and validated these findings and assumptions. Employing both bottom-up and top-down methodologies, the complete market size was estimated. Following this, a market breakdown and data triangulation approach were utilized to determine the size of specific segments and subsegments within the market.

Secondary Research

The Secondary sources referred to in this research study include the Organization Internationale des Constructeurs d'Automobiles (OICA); European Automobile Manufacturers Association (ACEA); National Association of Automobile Manufacturers of South Africa (NAAMSA); corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and automotive associations, databases such as Factiva, MarkLines, and Bloomberg. The secondary data was collected and analyzed to determine the overall market size, further validated by primary research. Historical production data has been collected and analyzed, and the industry trend is considered to arrive at the forecast, further validated by primary research.

Primary Research

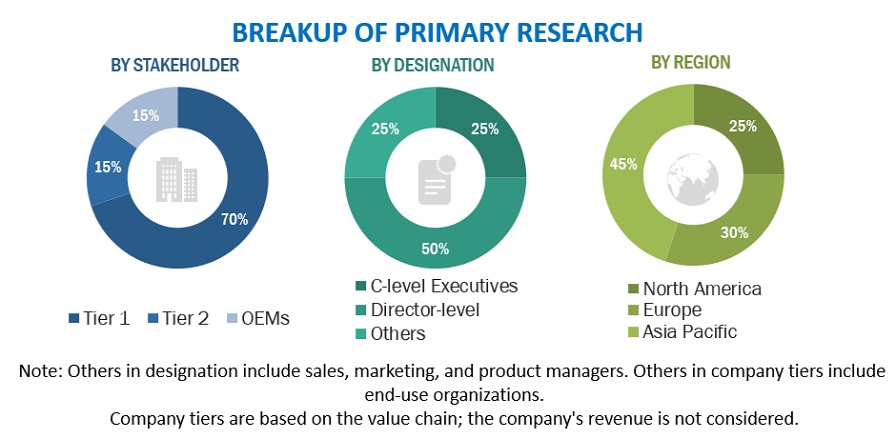

Extensive primary research has been conducted after understanding the air suspension market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- (OEMs) and the supply side (air suspension and component manufacturers) across major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. Approximately 85% and 15% of primary interviews have been conducted from the supply side and industry associations & dealers/distributors, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This and the in-house subject matter experts’ opinions have led us to the conclusions described in the remainder of this report.

Market Size Estimation

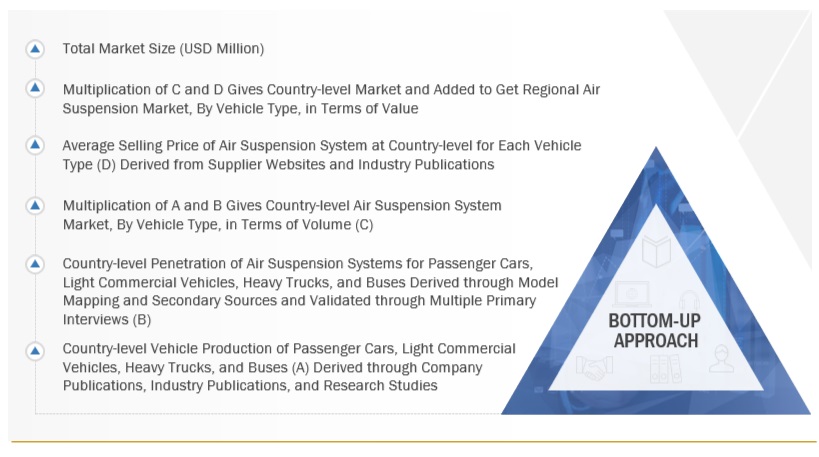

A detailed market estimation approach was followed to estimate and validate the value and volume of the air suspension market and other dependent submarkets, as mentioned below:

-

Key players in the air suspension market were identified through secondary research, and their global market shares were determined through primary and secondary research.

-

The research methodology included studying annual and quarterly financial reports, regulatory filings of significant market players (public), and interviews with industry experts for detailed market insights.

-

All industry-level penetration rates, percentage shares, splits, and breakdowns for the air suspension market were determined using secondary sources and verified through primary sources.

-

All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and qualitative data.

-

The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

Bottom-up approach: Air suspension Market, by vehicle type

To know about the assumptions considered for the study, Request for Free Sample Report

Market Breakdown and Data Triangulation

After arriving at the overall market size of the global market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact data for the market by value for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand- and supply-side participants.

Data Triangulation

Market Definition

Air Suspension Systems:

An air suspension system replaces traditional metal springs, such as coils or leaf springs, with air springs or airbags to support the vehicle on its axles. This system relies on a network of airbags to provide the necessary suspension. Bellow type air suspension, piston-type air suspension, and elongated bellows type air suspension are the three prominent types of air suspension used in currently.

The key components of an air suspension system are air bellows, air compressors, and shock absorbers. Air suspension is crucial to a vehicle as it provides comfort, ride quality, stability, and safety.

Key Stakeholders

-

Senior Management

-

End User Finance/Procurement Department

-

R&D Department

Report Objectives

-

To define, describe, and forecast the air suspension market in terms of volume (units) and value (USD million)

-

OE Market By Component (air springs, shock absorbers, compressors, electronic control units, air reservoirs, height sensors, solenoid valves, and pressure sensors)

-

By Technology (electronically controlled and non-electronically controlled)

-

By Vehicle Type (passenger cars, LCVs, trucks, and buses)

-

Cabin Air Suspension Market By Vehicle Type (rigid trucks and semi-trailers)

-

Aftermarket, By Component (air bellows and shock absorber bushes)

-

Electric & Hybrid HDVs Air Suspension Market, By Vehicle Type (Light-duty Vehicles, Trucks and buses)

-

Electric & Hybrid HDVs Air Suspension Market, By Technology (Electronically controlled and Non-electronically controlled)

-

By Region (Asia Pacific, Europe, North America, and Rest of the World)

-

To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the air suspension market

-

To analyze the market share analysis of key players operating in the air suspension market

-

To analyze the competitive landscape and company profiles of global players operating in the air suspension market

-

To understand the dynamics of competitors and distinguish them into stars, emerging leaders, pervasive players, and emerging companies according to the strength of their product portfolio and business strategies

-

Strategically analyze the market with patent, trade, and supply chain analyses.

-

To analyze and understand the customer buying behavior in the air suspension market

-

To analyze recent developments, alliances, joint ventures, mergers & acquisitions, new product launches, and other activities carried out by key industry participants in the air suspension market

AVAILABLE CUSTOMIZATIONS

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Air Suspension Market, by Vehicle Type & Technology

-

Light Duty Vehicles

-

Trucks

-

Buses

Note: The market of Electronically Controlled vs. Non-electronically Controlled Air Suspension can be provided for each mentioned vehicle type in terms of volume and value

Air Suspension Componen Market by Vehicle Type

-

Light Duty Vehicles

-

Trucks

-

Buses

Note: The market of each considered component in the study can be provided for each mentioned vehicle type in terms of volume and value detailed analysis and profiling of additional market players (UP TO 5)

User

Aug, 2019

I am interested to get the report for Vietnam manufacturer air suspension market and how many registered car user with car brand in Vietnam market. .

User

Aug, 2019

As a supplier of air suspension in the heavy duty market we are very experienced in this field. For the current development of a LCV range we are analysing some market information and found your report. We would like to now if this is the latest updated report and if you have some more detailed information? Does it give information on market players(suppliers) and also the aftermarket distribution channel of this product? how the retrofit market works in specific countries, if there is any. Many thanks for your feedback, kind regards rutger devoldere.

User

Jul, 2019

In which vehicles in general are air suspension compressors to find? In which vehicles worldwide can they be installed? (types, quantity, not only OEMs) Data about air suspension compressors on the commercial vehicle market in China: Trucks, agricultural vehicle Is there a tendency, that EVs use air suspension compressors regulary?.