AI PC Market Size, Share, Trends and Growth Analysis

AI PC Market by Product (Desktops & Notebooks, Workstations), Operating System (Windows, macOS, Chrome), Compute Type (GPU, NPU <40 TOPs, 40–60 TOPS), Compute Architecture (X86, ARM), Price (USD 1,200, USD 1,200 and Above) - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The AI PC market is projected to reach USD 260.43 billion by 2030 from USD 91.23 billion in 2025, at a CAGR of 19.1% from 2025 to 2030. AI PCs are next-generation personal computers equipped with dedicated AI accelerators such as NPUs and GPUs that enable on-device processing of artificial intelligence tasks for enhanced performance, efficiency, and personalization. The growth of AI PCs is driven by the rising demand for on-device generative AI capabilities, which reduce dependency on cloud computing and enhance data privacy. Additionally, advancements in AI-optimized processors and strategic OEM–chipmaker collaborations are accelerating the adoption of AI-powered laptops, desktops, and workstations across consumer and enterprise segments.

KEY TAKEAWAYS

-

BY PRODUCTProduct segment includes desktop and notebook PCs integrated with AI-capable processors, NPUs, and GPUs for consumer and enterprise applications. Desktop/Notebook segment is expected to dominate the market as OEMs increasingly embed on-device AI capabilities in personal computing systems to enhance productivity and performance.

-

BY OPERATING SYSTEMOperating system segment includes AI PCs operating on Windows, macOS, and other systems such as Linux or ChromeOS. Windows is expected to hold the largest market share owing to its extensive enterprise deployment, compatibility with AI frameworks, and strong ecosystem support from OEMs and chipmakers.

-

BY COMPUTE ARCHITECTURECompute architecture segment includes systems based on x86 and ARM architectures used to power AI PCs across desktops, notebooks, and workstations. ARM segment leads the market as its energy-efficient design and scalable performance are driving wider adoption in AI-optimized, mobile, and hybrid computing devices.

-

BY COMPUTE TYPECompute architecture comprises AI PCs equipped with GPUs and NPUs for accelerated AI workloads and inference. GPU segment is projected to grow at the highest CAGR driven by rising adoption of AI-driven content creation, data processing, and generative AI applications.

-

BY PRICEThis segment includes AI PCs priced below USD 1,200 and those above USD 1,200 catering to different performance and affordability tiers. Less than USD 1,200 segment is expected to grow at a high rate due to increasing availability of affordable AI-enabled notebooks for mass consumer and SMB markets.

-

BY END USEREnd users include consumers and enterprises utilizing AI PCs for personal, professional, and organizational computing applications. Enterprise segment leads the market as businesses increasingly deploy AI PCs to enhance productivity, enable on-device AI processing, and support secure, efficient generative AI workflows across departments.

-

BY REGIONAI PC markeet is studied for North America, Europe, Asia Pacific, and Rest of the World (RoW). Asia Pacific region is anticipated to grow at the highest rate fueled by strong manufacturing ecosystems, rapid AI adoption in consumer electronics, and government-backed digital initiatives.

-

COMPETITIVE LANDSCAPELeading players in the AI PC market are integrating advanced AI accelerators, neural processing units (NPUs), and hybrid architectures into next-generation computing devices. Companies such as Apple Inc. (US), Dell Inc. (US), HP Development Company, L.P. (US), Lenovo (China), ASUSTeK Computer Inc. (China) are forming strategic collaborations with software partners and cloud service providers to deliver on-device AI capabilities.

The AI PC market is witnessing exponential growth driven by the rising integration of on-device artificial intelligence capabilities and increasing demand for personalized, efficient computing experiences. The transition from traditional PCs to AI-accelerated systems is fueled by advances in NPU-powered processors, hybrid CPU–GPU architectures, and the need for generative AI applications that operate seamlessly offline. Enterprises are rapidly adopting AI PCs to enhance productivity and streamline workflows, while consumers are embracing them for creative and immersive experiences.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The AI PC market is poised to reshape revenue streams for businesses and their clients, driven by the integration of advanced AI-powered hardware such as NPUs, GPUs, and AI accelerators. As emerging technologies gain traction, they are expected to create a growing demand for AI-driven applications, particularly in content creation and gaming, while shifting the revenue mix from traditional sources to innovative future solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Adoption of digital platforms

-

Advancements in GenAI and ML

Level

-

Shortage of qualified professionals

-

Requirement of specialized hardware components

Level

-

Increasing adoption in commercial sector

-

Integration into IoT ecosystem

Level

-

High costs of AI-optimized hardware

-

Rapid shifting landscape technology in AI industry

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Adoption of digital platforms

The growing adoption of digital platforms across industries is a key driver for the AI PC market. As businesses and consumers increasingly rely on cloud services, virtual collaboration tools, and AI-driven applications, the need for powerful, intelligent computing systems is rising. AI PCs enable seamless execution of digital workloads, improved multitasking, and enhanced user experiences. Their ability to process data locally also supports real-time analytics and personalization, making them vital for the expanding digital ecosystem.

Restraint: Shortage of qualified professionals

The shortage of skilled professionals capable of developing, deploying, and managing AI-driven systems poses a significant restraint to market growth. Integrating AI workloads into PC environments requires specialized knowledge in machine learning, neural network optimization, and hardware–software integration. The limited availability of such expertise slows adoption, particularly among enterprises with limited technical resources. Addressing this talent gap through upskilling programs and AI education initiatives will be crucial to sustaining market expansion.

Opportunity: Increasing adoption in commercial sector

The commercial sector presents a major growth opportunity for the AI PC market, as enterprises increasingly integrate AI-powered systems to enhance productivity and decision-making. AI PCs enable on-device data processing, intelligent automation, and improved cybersecurity, catering to business needs across finance, healthcare, education, and retail. With growing demand for hybrid work solutions and generative AI tools, commercial adoption is expected to surge, driving large-scale procurement of AI-enabled desktops and notebooks in enterprise environments.

Challenge: High costs of AI-optimized hardware

The high cost of AI-optimized hardware, including NPUs, GPUs, and hybrid processors, remains a critical challenge for mass adoption. Developing and integrating these advanced components increases manufacturing expenses, making AI PCs significantly more expensive than traditional systems. This limits affordability for budget-conscious consumers and small businesses. As the market matures, scaling production, improving chip efficiency, and expanding supply chain capabilities will be essential to reduce costs and make AI PCs more accessible globally.

AI PC Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deloitte deployed AI-enabled Dell Latitude laptops with Intel Core Ultra processors for developers to run Generative AI applications (Code Llama 7B) locally. | Reduced project development time by 50%; cost-effective AI deployment; data privacy maintained as data stays on the device. |

|

Integrated AI into next-generation PCs using Intel Core Ultra processors (CPU + GPU + NPU hybrid) and OpenVINO toolkit for AI acceleration. | Supercharged speed and efficiency for AI workloads; enhanced privacy and security; optimized deployment of AI models across CPU, GPU, and NPU. |

|

Integrated NVIDIA GPUs (RTX 5000 Ada, RTX 6000 Ada, A800 40GB) in Dell Precision workstations for AI development and inferencing. | Up to 80% faster AI performance than previous generation; enhanced computational power for training, fine-tuning, and inferencing AI workloads. |

|

Delivered TravelMate Spin B3 laptops with 360° hinge, HDR camera, Wacom pen, 4G LTE, and Full HD display for students to enhance learning. | Improved user-friendliness, battery life, and durability; flexibility for tablet and laptop use; supports interactive learning with Wacom pen. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The AI PC market ecosystem is a dynamic network of innovation and collaboration, encompassing R&D engineers and designers who pioneer cutting-edge hardware, component manufacturers who produce essential AI-enabled chips, software developers who create intelligent applications, and assembly and system integrators who bring these elements together into functional devices. This interconnected framework drives the development and adoption of AI-powered personal computing, fostering advancements in performance, efficiency, and user experience across diverse industries and applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

AI PC Market, By Product

The desktop/notebook segment is expected to dominate the AI PC market owing to its widespread adoption among both consumers and enterprises. Major OEMs such as Dell, HP, and Lenovo are launching AI-powered laptops equipped with NPUs and hybrid CPU–GPU architectures to enhance on-device performance and power efficiency. The rising trend of remote and hybrid work is further accelerating the demand for portable AI-enabled notebooks. Additionally, AI integration in everyday productivity, gaming, and creative applications is making notebooks the preferred choice among users.

AI PC Market, By Operating System

Windows-based AI PCs are projected to hold the largest market share due to strong enterprise penetration and wide compatibility with AI software ecosystems. Microsoft’s partnerships with Intel, AMD, and Qualcomm are enabling the rollout of AI-ready Windows platforms optimized for on-device generative AI experiences. The ecosystem’s openness to diverse hardware architectures and developer tools further supports innovation. As enterprises upgrade to AI-capable systems, Windows continues to dominate as the primary OS for both business and personal computing environments.

AI PC Market, By Compute Type

The GPU segment is anticipated to register the highest CAGR in the AI PC market as demand for AI-driven workloads, gaming, and creative applications continues to surge. GPUs offer exceptional parallel processing capabilities that accelerate AI inference, deep learning, and content rendering tasks. With chipmakers like NVIDIA and AMD optimizing GPU designs for AI acceleration, users benefit from improved performance and lower latency. The growing need for local generative AI execution and immersive computing is further propelling GPU integration in next-generation PCs.

AI PC Market, By Compute Architecture

The ARM segment is emerging as a leader in the AI PC market owing to its power efficiency, scalability, and growing ecosystem of AI-optimized designs. ARM-based processors enable longer battery life and superior performance per watt, making them ideal for thin and light AI notebooks. Major manufacturers are transitioning towards ARM architectures to integrate NPUs and AI accelerators directly into their chipsets. The architecture’s flexibility and suitability for mobile-first and edge AI applications are fueling its widespread adoption.

AI PC Market, By Price

AI PCs priced below USD 1,200 are expected to grow rapidly as manufacturers focus on expanding accessibility to mass-market consumers and small enterprises. Affordable AI laptops with integrated NPUs are being introduced to cater to productivity, education, and light creative workloads. This price segment benefits from increasing cost optimization in chip manufacturing and economies of scale. As AI becomes a mainstream feature, the sub-USD 1,200 category is likely to drive large-volume sales globally.

AI PC Market, By End User

The enterprise segment leads the AI PC market as organizations adopt AI-powered systems to enhance productivity, automation, and decision-making efficiency. AI PCs enable businesses to process data locally, reducing latency and strengthening data privacy. Enterprises are leveraging AI PCs for applications such as predictive analytics, content generation, and intelligent workflow management. The growing focus on hybrid work environments and secure computing is further driving large-scale enterprise adoption.

REGION

Asia Pacific to be fastest-growing region in global AI PC market during forecast period

Asia Pacific is expected to record the fastest growth in the AI PC industry, driven by strong manufacturing ecosystems and early adoption of AI technologies. Countries such as China, Japan, South Korea, and Taiwan are leading in semiconductor innovation and AI hardware integration. Rapid digitization, government-backed AI initiatives, and growing consumer demand for smart devices are further accelerating regional expansion. Additionally, local OEMs and chipmakers are actively investing in AI-enabled product development, reinforcing Asia Pacific’s leadership in market growth.

AI PC Market: COMPANY EVALUATION MATRIX

The company evaluation matrix for the AI PC companies highlights the positioning of leading players based on their technological innovation, product portfolio breadth, and ecosystem integration capabilities. In the AI PC market matrix, Apple Inc. leads with its advanced integration of custom silicon (M-series chips with dedicated NPUs) and seamless hardware–software optimization, delivering high performance, energy efficiency, and on-device AI experiences across its Mac lineup. Microsoft is rapidly growing in the market through strategic partnerships with OEMs and chipmakers such as Intel, AMD, and Qualcomm to power AI-ready Windows PCs, embedding generative AI tools like Copilot and enhancing productivity through hybrid AI computing environments.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 48.69 Billion |

| Market Forecast in 2030 (Value) | USD 260.43 Billion |

| Growth Rate | CAGR of 19.1% from 2025-2031 |

| Years Considered | 2022-2031 |

| Base Year | 2024 |

| Forecast Period | 2025-2031 |

| Units Considered | Value (USD Million/Billion), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, RoW |

WHAT IS IN IT FOR YOU: AI PC Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Local Competitive Landscape | Profiles of key regional players in AI PCs, including market share, revenue, product portfolios, and strategic initiatives in hardware and software | Facilitated competitive benchmarking and informed strategy development |

| Regional Market Entry Strategy | Country- or region-specific go-to-market strategies including barriers, regulations, and competitive landscape for AI PCs | Minimized entry risk and accelerates market adoption |

| Local Risk & Opportunity Assessment | Identification of regional risks, barriers, and untapped opportunities by market or sector in AI PC applications | Enabled proactive risk mitigation and strategic investments |

| Technology Adoption by Region | Insights on local adoption of key AI PC compute types (e.g., GPU, NPU) and integration technologies | Guided R&D, product positioning, and investment decisions |

| Vertical-Specific Custom | Tailored analyses for sectors like gaming, enterprise, and education, covering AI PC use cases, integration challenges, and scalability | Enhanced sector-specific innovation and deployment efficiency |

RECENT DEVELOPMENTS

- January 2025 : Dell Inc. (US) introduced the Pro Max portfolio, a high-performance lineup designed for demanding applications. It features Intel Core Ultra AMD Ryzen, and AMD Threadripper processors with professional graphics. These devices deliver next-level performance for intensive tasks like animation, video rendering, AI inferencing, and fine-tuning large language models (LLMs).

- January 2025 : Acer Inc. (China) has expanded its Copilot+ PC lineup, introducing a range of AI-powered laptops and desktops. The offerings include the Swift Go 14 AI and Swift Go 16 AI thin-and-light laptops, Aspire 14 AI for value-conscious users, Aspire S AI and Aspire C AI all-in-one desktops, and the compact yet powerful Revo Box AI mini PC. All devices feature the latest processors with integrated neural processing units (NPUs) to efficiently handle AI-driven workloads.

- January 2025 : Advanced Micro Devices, Inc. (US) and Dell Inc. (US) announced collaboration to integrate AMD processors into Dell devices. Dell's new Pro devices will be the first commercial PCs to feature AMD Ryzen AI PRO processors. This milestone highlights the growing strategic partnership between AMD and Dell, bringing advanced AI capabilities to Dell's commercial lineup.

- October 2024 : Apple Inc. (US) introduced the M4 Max chip featuring up to a 16-core CPU and 40-core GPU, which is up to 2.5x faster than the latest AI PC chip. It handles the demanding workflows with support for up to 128GB unified memory and 546GB/s bandwidth that is 4x that of leading AI PC chips.

- September 2024 : HP Development Company, L.P. (US) acquired Austin-based Vyopta, a leading provider of collaboration management solutions specializing in analytics and monitoring for large UC networks. This acquisition enhances HP’s Workforce Experience Platform by leveraging Vyopta’s expertise and infrastructure to deliver advanced insights and capabilities to customers.

Table of Contents

Methodology

The study utilized four major activities to estimate the AI PC market size. Exhaustive secondary research was conducted to gather information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

In the secondary research process, various sources were used to identify and collect information on the AI PC market for this study. Secondary sources for this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of key secondary sources

|

Source |

Web Link |

|

Generative AI Association (GENAIA) |

https://www.generativeaiassociation.org/ |

|

Association for Machine Learning and Applications (AMLA) |

https://www.icmla-conference.org/ |

|

Association for the Advancement of Artificial Intelligence (AAAI) |

https://aaai.org/ |

|

European Association for Artificial Intelligence (EurAI) |

https://eurai.org/ |

|

International Monetary Fund (IMF) |

https://www.umaconferences.com/ |

Primary Research

Primary interviews were conducted to gather insights on market statistics, revenue data, market breakdowns, market size estimations, and forecasting. Additionally, primary research was used to comprehend various trends related to technology, type, end user, and region. Interviews with stakeholders from the demand side, including CIOs, CTOs, CSOs, and customer/end-user installation teams using AI PC offerings and processes, were also conducted to understand their perspective on suppliers, products, component providers, and their current and future use of AI PC, which will impact the overall market. Several primary interviews were conducted across major countries in North America, Europe, Asia Pacific, and RoW.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

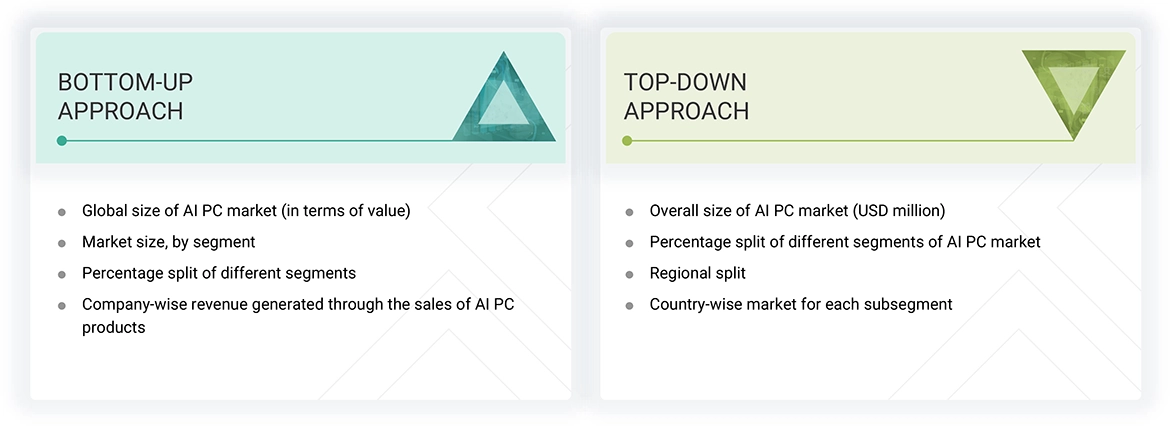

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods have been used to estimate and forecast the overall market segments and subsegments listed in this report. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figure represents this study's overall market size estimation process.

AI PC Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall size of the AI PC market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. Various factors and trends from the demand and supply sides were studied to triangulate the data. The market was validated using both top-down and bottom-up approaches.

Market Definition

An AI PC is any laptop, desktop, or workstation with a neural processing unit (NPU) or a GPU (graphics processing unit) explicitly designed for AI tasks, enabling them to perform AI-related computations more efficiently than standard PCs. These devices are designed to handle machine learning, data analysis, and other AI-driven applications that require significant computational power. It can be optimized for various forms of AI, with a core focus at the outset on enabling support for generative AI models and services.

The report comprehensively analyzes the AI PC market based on product, operating system, compute architecture, compute type, price, end user, and region. A few key manufacturers of AI PCs are Apple Inc. (US), Dell Inc. (US), HP Development Company, L.P. (US), Lenovo (China), and ASUSTeK Computer Inc. (Taiwan).

Key Stakeholders

- Hardware manufacturers

- Software developers

- System integrators

- Retailers and distributors

- Government councils

- Standardization bodies

- Research institutions and analysts

- Business analysts

- Financial services firms

Report Objectives

- To describe and forecast the AI PC market size by product, operating system, compute architecture, compute type, price, end user, and region, in terms of value

- To describe and forecast the market for various segments across four main regions, namely, North America, Europe, Asia Pacific, and RoW, in terms of value

- To describe and forecast the market by product, in terms of volume

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and contributions to the markets.

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing market growth.

- To analyze opportunities for stakeholders by identifying high-growth segments in the market

- To provide a detailed overview of the AI PC value chain

- To strategically analyze key technologies, average selling price trend, trends impacting customer business, ecosystem, regulatory landscape, patent landscape, Porter's five forces, import and export scenarios, trade landscape, key stakeholders, buying criteria, and case studies pertaining to the market under study

- To strategically profile key players in the AI PC market and comprehensively analyze their market share and core competencies

- To analyze competitive developments such as partnerships, acquisitions, expansions, collaborations, and product launches, along with R&D in the AI PC market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the AI PC market

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company in the AI PC market.

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the AI PC Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in AI PC Market