AI in Clinical Trials Market: Growth, Size, Share, and Trends

AI in Clinical Trials Market by Function (Patient Recruitment, Site Optimization, Data Management, Quality, Regulatory), Phase (I, II, III), Indication (Cancer, CNS, CVS), Tool, End-User (Pharma/Biotech, CRO, Hospitals) & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

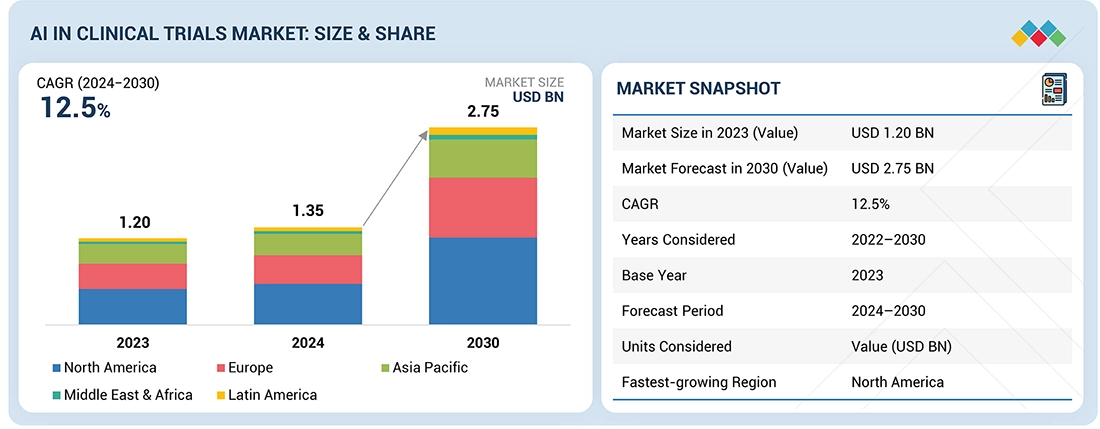

The AI in clinical trials market is projected to reach USD 2.75 billion by 2030 from USD 1.35 billion in 2024, at a CAGR of 12.5% from 2024 to 2030. The growth of the AI in clinical trials market is driven by the growing adoption of advanced analytics to improve trial efficiency and patient recruitment. Rising R&D spending, increasing trial complexity, and the need to reduce costs and timelines are also accelerating the use of AI-enabled solutions in clinical research.

KEY TAKEAWAYS

-

By RegionThe North America AI in clinical trials market accounted for a 41.6% revenue share in 2023.

-

By OfferingBy offering, the niche solutions segment is expected to register the highest CAGR of 13.9%.

-

By FunctionBy function, the drug repurposing segment is projected to grow at the fastest rate from 2024 to 2030

-

By PhaseBy phase, the phase II clinical trials segment is expected to dominate the market.

-

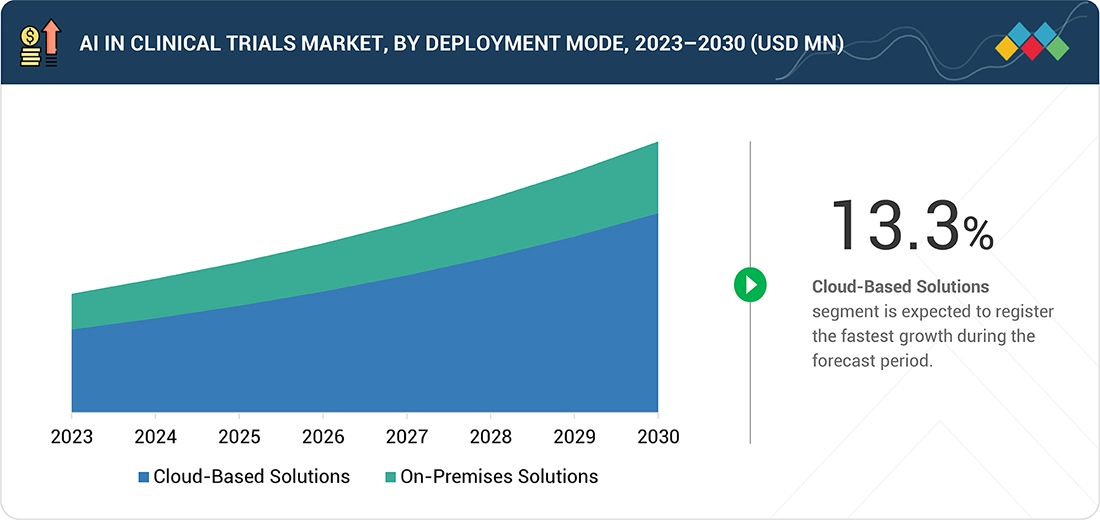

By Deployment ModeBy deployment mode, the cloud-based solutions segment will grow the fastest during the forecast period.

-

By IndicationBy indication, the oncology segment is expected to grow at the highest CAGR.

-

By TechnologyBy technology, the machine learning segment is expected to dominate the market.

-

By ApplicationBy application, the biomarkers segment is expected to dominate the market, growing at CAGR of 12.1%.

-

By End UserBy end user, the pharmaceutical & biopharmaceutical companies segment accounted for the largest share in 2023.

-

Competitive LandscapeIQVIA Inc. (US), Dassault Systèmes (Medidata) (France), and Insilico Medicine (US) were identified as some of the star players in the AI in clinical trials market (global), given their strong market share and product footprint.

-

Competitive LandscapeReviveMed Inc. (US), Euretos (Netherlands), and VeriSIM Life (US), among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The AI in clinical trials market is experiencing strong growth as life sciences organizations increasingly leverage advanced algorithms to streamline study design, optimize site selection, and accelerate patient recruitment. AI and machine learning powered platforms are improving data quality, enabling real-time monitoring, and reducing operational burdens across trial phases. Additionally, rising investment in digital transformation, expanding use of decentralized and adaptive trial models, and growing collaborations between biopharma companies and technology providers are driving broader adoption of intelligent solutions to enhance trial efficiency and success rates.

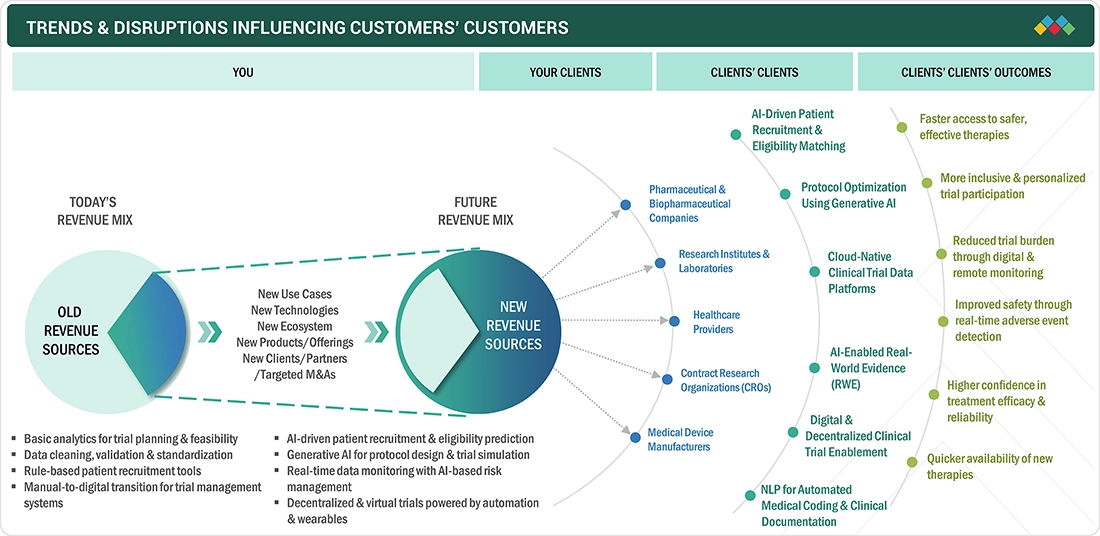

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business in the AI in Clinical Trials market is driven by rising expectations for faster, more accurate, and cost-efficient drug development. Pharmaceutical companies, CROs, and research institutions are the primary end users, and their growing need for automated data processing, predictive analytics, and AI-enabled patient recruitment tools directly influences market uptake. Shifts toward decentralized trials, real-time monitoring, and adaptive study designs significantly enhance operational productivity, trial success rates, and ultimately the financial performance of AI-based clinical trial solution providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand for personalized treatments

-

Support for decentralized and global trials

Level

-

Integration challenges with legacy systems and resistance from healthcare professionals

-

Data privacy and security concerns

Level

-

Use of predictive analytics in clinical trials

-

Development of virtual control arms for faster trials

Level

-

Addressing algorithm bias and fairness

-

Insufficient technical expertise in Al-based solutions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand for personalized treatments

The increasing demand for personalized treatments is a major driving factor in the AI in clinical trials market. As precision medicine expands, trial designs require deeper insights into genetic, biomarker, and phenotype data to match patients with highly targeted therapies. In 2023, the FDA approved 20 personalized medicines, along with several gene and cell-based therapies, reinforcing the need for sophisticated tools that can handle complex data. AI supports this shift by enabling faster patient stratification, improving endpoint prediction, and enhancing trial efficiency, making it essential for the development of personalized and rare-disease therapies.

Restraint: Integration challenges with legacy systems and resistance from healthcare professionals

Integration challenges with legacy systems and resistance from healthcare professionals act as significant restraining factors in the AI in clinical trials market. Many research organizations still rely on outdated infrastructure that is incompatible with advanced AI platforms, leading to costly and time-consuming system upgrades. Additionally, concerns about data accuracy, transparency, and workflow disruptions contribute to hesitancy among clinical teams. This resistance slows adoption and limits the ability of organizations to fully leverage AI-driven tools for improving trial efficiency and decision-making.

Opportunity: Use of predictive analytics in clinical trials

The use of predictive analytics presents a significant opportunity in the AI in clinical trials market. Advanced algorithms can forecast patient enrollment trends, identify potential dropouts, and predict clinical outcomes with greater accuracy. These capabilities help optimize study design, reduce trial delays, and improve resource allocation. As biopharmaceutical companies increasingly rely on data-driven strategies, predictive analytics offers substantial potential to enhance trial efficiency, lower operational risks, and support faster, more informed decision-making.

Challenge: Addressing algorithm bias and fairness

Addressing algorithm bias and ensuring fairness is a key challenge in the AI in clinical trials market. AI models trained on incomplete or non-representative datasets can lead to skewed predictions and uneven patient selection, potentially impacting trial outcomes and regulatory acceptance. Ensuring diverse data inputs, transparent model development, and continuous monitoring is essential to minimize bias. Overcoming these issues is critical for building trust, improving patient safety, and supporting the ethical deployment of AI-driven trial solutions.

AI IN CLINICAL TRIALS MARKET: GROWTH, SIZE, SHARE, AND TRENDS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

AI-powered clinical trial platforms integrating patient recruitment, site selection, real-world evidence analytics, and protocol optimization. | Faster trial initiation, improved patient matching, reduced trial timelines, and enhanced data accuracy. |

|

Cloud-based AI solutions for electronic data capture (EDC), decentralized trials, and predictive analytics for study design and risk monitoring. | Improved trial efficiency, reduced operational risk, and enhanced patient engagement through digital and remote trial capabilities. |

|

AI-driven drug discovery and clinical trial simulation platforms using deep learning to model disease progression and predict trial outcomes. | Shortened drug development cycles, reduced trial failures, and optimized clinical study planning. |

|

AI platforms integrating genomic, molecular, and clinical data to support patient stratification and precision-driven clinical trial enrollment. | More personalized trial matching, improved recruitment effectiveness, and enhanced success rates in targeted therapies. |

|

AI computing infrastructure and simulation tools for large-scale clinical data processing, digital twins, and predictive modeling. | Accelerated data analysis, deeper real-time insights into trial performance, and improved forecasting of safety and efficacy outcomes. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The AI in clinical trials market ecosystem includes key players such as IQVIA Inc., Dassault Systèmes (Medidata), and Insilico Medicine, which offer advanced platforms for trial design, patient recruitment, and AI-driven data analytics. These technologies enhance accuracy, streamline workflows, and support decentralized and adaptive trials. Cloud, big data, and automation partners further improve scalability and real-time insights. Pharmaceutical companies, biotech firms, and CROs rely on these solutions to accelerate development and boost trial success. Growing collaboration among industry stakeholders continues to advance innovation in clinical research.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

AI in Clinical Trials Market, By Offering

Based on offering, the end-to-end solutions segment holds the largest share of the AI in clinical trials market in 2023. The growth of this segment is attributed to the rising demand for streamlined, unified platforms that integrate study design, site selection, patient recruitment, and real-time data analytics in a single workflow. End-to-end solutions reduce operational complexity, minimize errors associated with multiple disconnected systems, and accelerate trial timelines. Their ability to offer greater scalability, enhanced compliance, and improved data transparency makes them increasingly preferred by pharmaceutical companies, biotech firms, and CROs seeking more efficient and cost-effective trial management.

AI in Clinical Trials Market, By Function

In 2023, the patient recruitment segment accounted for the largest share of the AI in clinical trials market. This dominance is driven by the increasing use of AI to identify eligible participants more accurately and reduce recruitment timelines, which remain one of the most significant bottlenecks in clinical research. AI-powered tools analyze electronic health records, genetic data, and real-world evidence to match patients with trial criteria more efficiently. These capabilities help improve enrollment rates, lower trial costs, and enhance the overall success of clinical studies, leading to strong adoption across pharmaceutical companies and CROs.

AI in Clinical Trials Market, By Phase

In 2023, the phase II clinical trials segment accounted for the largest share of the AI in clinical trials market. This is largely due to the growing complexity of mid-stage trials, where determining optimal dosing, assessing efficacy, and identifying patient subgroups require advanced analytical support. AI tools enhance decision-making by predicting treatment responses, improving protocol design, and enabling more precise patient stratification. As phase II outcomes heavily influence go/no-go decisions for later-stage development, the use of AI to reduce risks, shorten timelines, and improve data quality has driven greater adoption in this segment.

AI in Clinical Trials Market, By Deployment Mode

By deployment mode, the cloud-based solutions segment will grow the fastest during the forecast period. This rapid growth is driven by the need for scalable, flexible, and cost-efficient platforms that can manage large and complex clinical trial datasets. Cloud solutions support real-time data access, remote monitoring, and easier integration with decentralized trial technologies. With faster deployment, enhanced security, and improved collaboration across global teams, cloud-based platforms are becoming increasingly essential for accelerating AI adoption in clinical research.

AI in Clinical Trials Market, By Indication

By indication, the oncology segment is expected to dominate the market, growing at the highest CAGR. This growth is driven by the rising global burden of cancer and the increasing demand for advanced tools to manage complex oncology trial designs. AI enables faster identification of biomarkers, improved patient stratification, and more accurate prediction of treatment responses. With a surge in targeted therapies, immunotherapies, and personalized medicines, the need for AI-powered analytics continues to expand. As a result, oncology trials are adopting AI at a faster pace to enhance efficiency, reduce timelines, and improve clinical outcomes.

AI in Clinical Trials Market, By Technology

By technology, the machine learning segment is expected to dominate the market. This dominance is driven by the growing use of machine learning algorithms to analyze large, complex clinical datasets and generate predictive insights that enhance trial design and execution. ML supports faster patient identification, improved endpoint prediction, and real-time anomaly detection, helping reduce delays and operational risks. As biopharmaceutical companies increasingly rely on data-driven decision-making, machine learning has become essential for improving accuracy, efficiency, and overall trial success rates.

AI in Clinical Trials Market, By Application

By application, the biomarkers segment is expected to dominate the market. The segment leads the market due to the growing emphasis on precision medicine and the need to identify targeted patient populations more effectively. AI accelerates biomarker discovery by analyzing genetic, proteomic, and clinical data to uncover patterns that support better patient stratification and treatment response prediction. As oncology, rare diseases, and personalized therapies expand, biomarker-driven trials increasingly rely on AI to improve accuracy, shorten development timelines, and boost clinical success rates.

AI in Clinical Trials Market, By End User

The pharmaceutical and biopharmaceutical companies segment accounted for the largest share in 2023, supported by their growing reliance on AI to streamline drug development and reduce trial timelines. These organizations handle large, complex datasets and increasingly adopt AI for patient recruitment, protocol optimization, and real-time monitoring. With rising R&D investments and a strong focus on precision medicine, pharma and biotech firms are integrating AI across multiple trial phases to enhance efficiency, lower operational costs, and improve the likelihood of successful outcomes.

REGION

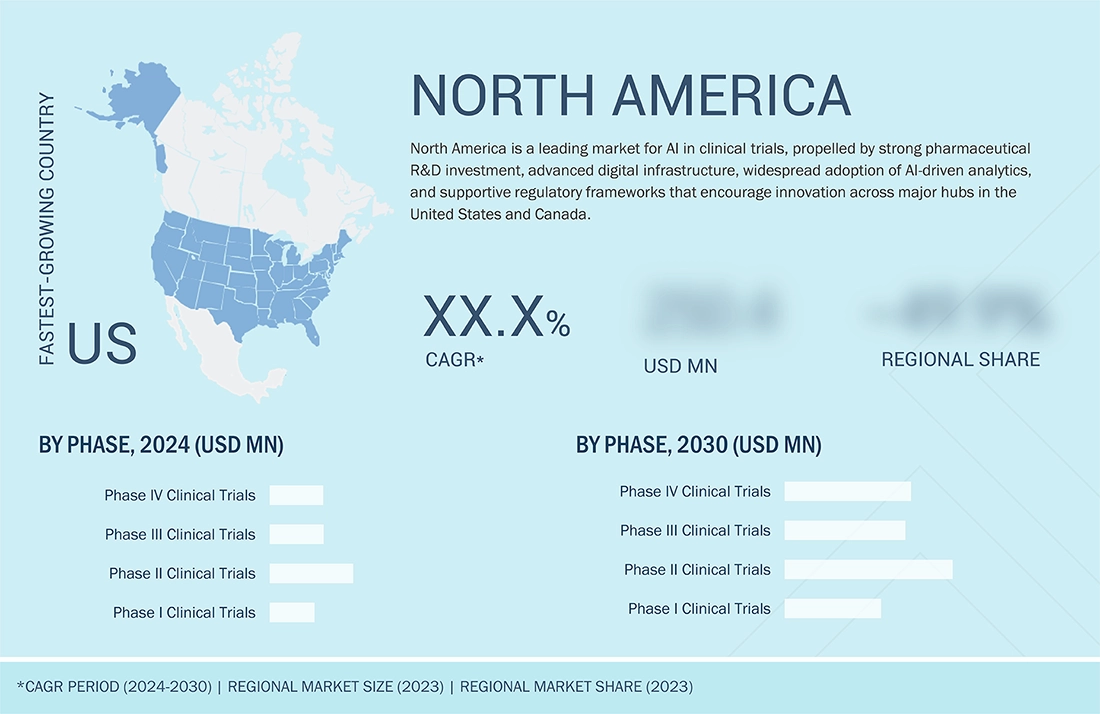

North America to be fastest-growing region in global AI in Clinical Trials market during forecast period

The North American AI in clinical trials market is expected to register the highest CAGR during the forecast period, supported by strong digital transformation initiatives across the US and Canada. Major pharmaceutical companies, biotech firms, and CROs in the region are rapidly adopting AI for patient recruitment, protocol optimization, real-time monitoring, and predictive analytics. Increasing R&D spending, a high volume of clinical trials, and favorable regulatory support for decentralized and data-driven research models further boost market growth. Expanding investments in precision medicine and advanced analytics continue to accelerate AI adoption across the region.

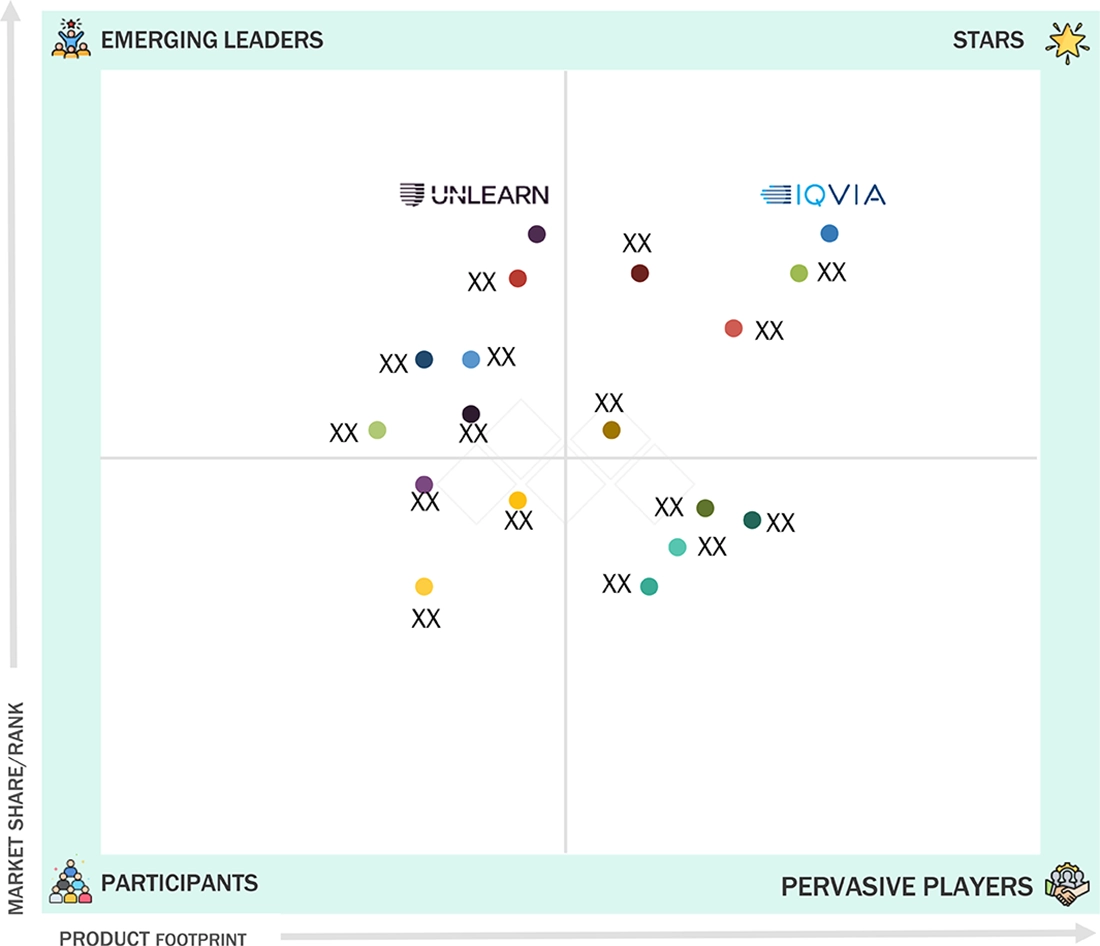

AI IN CLINICAL TRIALS MARKET: GROWTH, SIZE, SHARE, AND TRENDS: COMPANY EVALUATION MATRIX

In the AI in clinical trials market matrix, IQVIA Inc. (Star) holds a leading position with its extensive global footprint and comprehensive suite of AI-enabled platforms that support patient recruitment, site optimization, and real-time trial analytics. Its strong integration of advanced data science, predictive modeling, and decentralized trial capabilities reinforces its dominance. Unlearn.ai, Inc. (Emerging Leader) is rapidly gaining momentum through its innovative digital twin technology, which enhances trial efficiency by improving control group design, reducing variability, and accelerating evidence generation.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- IQVIA Inc. (US)

- Dassault Systèmes (Medidata) (France)

- Insilico Medicine (US)

- Tempus AI, Inc. (US)

- NVIDIA Corporation (US)

- Saama (US)

- Phesi (US)

- PathAI, Inc. (US)

- Unlearn.ai, Inc. (US)

- Deep6.ai (US)

- Microsoft (US)

- IBM (US)

- ConcertAI. (US)

- AiCure. (US)

- Median Technologies. (France)

- Lantern Pharma Inc. (US)

- Citeline, a Norstella Company (US)

- TriNetX, LLC (US)

- ReviveMed Inc. (US)

- Euretos. (US)

- VeriSIM Life. (US)

- Triomics (US)

- Ardigen (Poland)

- QuantHealth Ltd. US)

- DEEP GENOMICS. (Canada)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 1.20 Billion |

| Market Forecast in 2030 (Value) | USD 2.75 Billion |

| Growth Rate | CAGR of 12.5% from 2024-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

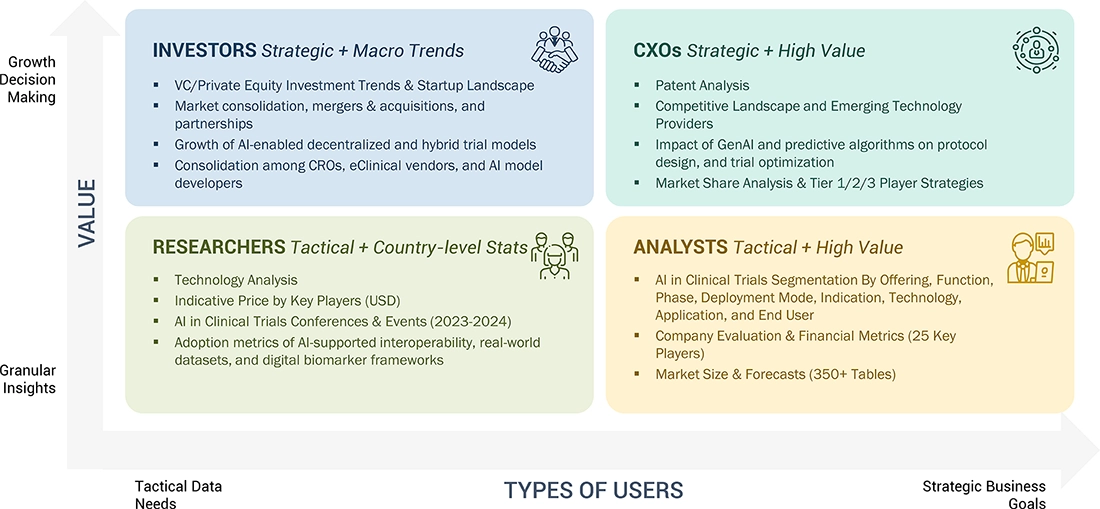

WHAT IS IN IT FOR YOU: AI IN CLINICAL TRIALS MARKET: GROWTH, SIZE, SHARE, AND TRENDS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Competitive Landscape Mapping | Profiles of key AI vendors (e.g., Medidata, IQVIA, Saama, Deep 6 AI) covering capabilities in patient recruitment, protocol design, analytics, and trial monitoring. | Enables benchmarking, identifies differentiation levers, and supports partnership and portfolio decisions. |

| Market Entry & Growth Strategy | Regional assessment of AI adoption in trials, CRO partnerships, funding trends, and high-growth therapeutic areas. | Reduces entry risk, guides market prioritization, and supports scalable expansion planning. |

| Regulatory & Operational Risk Analysis | Evaluation of FDA/EMA expectations for AI validation, data integrity, model transparency, and compliance with HIPAA/GDPR. | Ensures regulatory readiness, improves data governance, and strengthens credibility with sponsors. |

| Technology Adoption Trends | Insights into AI use for patient matching, site selection, synthetic arms, adaptive designs, and digital biomarkers. | Drives product roadmap focus, enhances market positioning, and supports targeted tech investments. |

RECENT DEVELOPMENTS

- November 2024 : Bioforum and Medidata have expanded their partnership, offering Bioforum's biotech clients enhanced access to Medidata's Al-powered technologies. In addition to Medidata Rave EDC and RTSM, Bioforum will utilize Medidata Clinical Data Studio and Medidata eConsent to improve data flow, integrity, and compliance across clinical studies.

- September 2024 : Signant Health collaborated with IQVIA in its One Home for Sites initiative to streamline clinical trial site operations. The collaboration enables trial sites to access multiple eClinical technologies through a single sign-on, simplifying trial conduct.

- June 2024 : Medidata launched Clinical Data Studio, a unified platform integrating data from Medidata and non-Medidata sources. The technology accelerates decision- making, improves risk management, and enhances patient safety by enabling faster data review and issue identification throughout clinical trials.

Table of Contents

Methodology

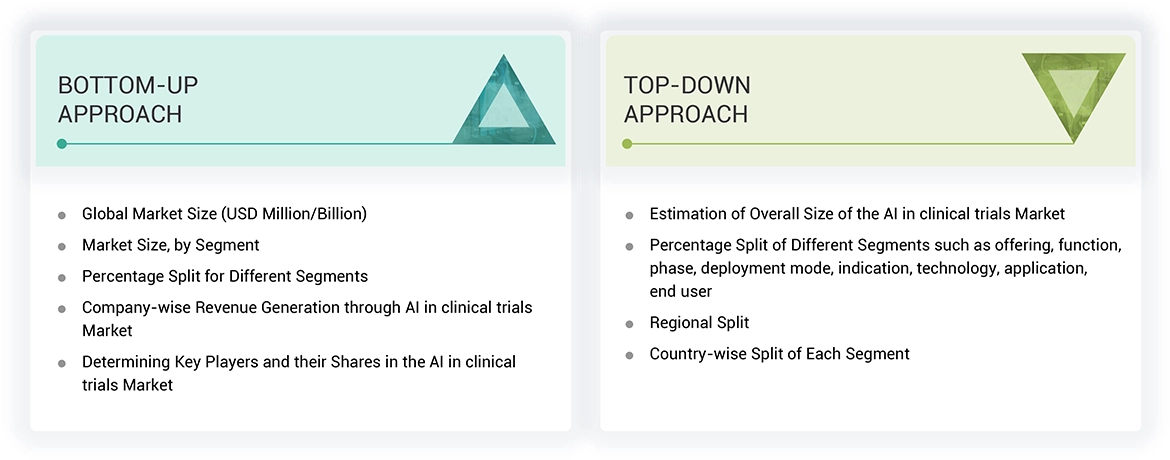

The study involved significant activities to estimate the current size of the AI in clinical trials market. Exhaustive secondary research was done to collect information on the AI in clinical trials market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the AI in clinical trials market.

Secondary Research

This research study involved the wide use of secondary sources, directories, and databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva; white papers, annual reports, and companies’ house documents; investor presentations; and the SEC filings of companies. The market for the companies offering AI in clinical trials solutions is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

Various secondary sources were referred to in the secondary research process to identify and collect information related to the study. These sources included annual reports, press releases, investor presentations of AI in clinical trials vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

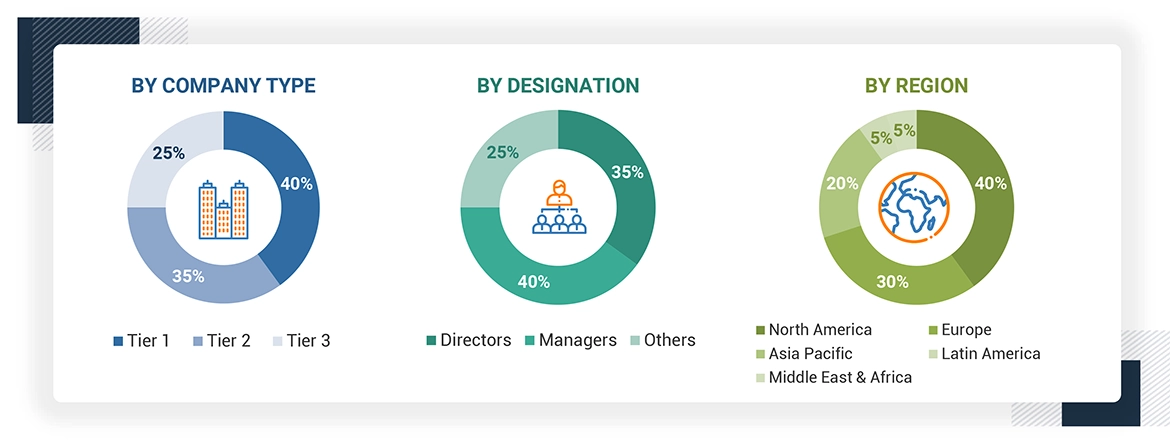

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the AI in clinical trials market.

After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also undertaken to identify the segmentation types, industry trends, competitive landscape of AI in clinical trials solutions offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Breakdown of Primary Participants:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tiers of companies are defined based on their total revenues in 2023. Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the AI in clinical trials market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

The AI in clinical trials market refers to the utilization of artificial intelligence-based tools to improve the different phases as well as steps of clinical research process activity such as trial development, enrolment of patients, data management and analysis and therapeutic monitoring. Al assists in accomplishing such tasks by automating the collection of data, enhancing the efficiency of patient matching and improving prediction of outcomes of trials which in turn helps in reducing the timeline and cost associated with these processes. This allows for a clearer understanding of large amounts of information, for example, within patient charts or genome information, so that the appropriate information is available for making decisions for particular trials. Clinical trials become highly efficient, cheaper, and more precise with the integration of Al technologies into the processes which significantly helps in drug development reducing the waiting time and the success rate improves. With more and more applications of AI in the healthcare sector, this healthcare services market is projected to grow as there will be a rise in the need for improved clinical research within a short turnaround time.

Stakeholders

- Pharmaceutical and Biotechnology Companies

- Contract Research Organizations (CROs)

- Technology and AI Companies

- Regulatory Authorities

- Hospitals and Healthcare Providers

- Patients and Patient Advocacy Groups

- Clinical Trial Investigators and Site Coordinators

- Data Management and Analytics Firms

- Academic Institutions and Research Organizations

- Investors and Venture Capital Firms

- Clinical Trial Software Providers

- Ethics Committees and Institutional Review Boards (IRBs)

- Insurance Companies

Report Objectives

- To define, describe, and forecast the AI in clinical trials market based on offering, function, phase, deployment mode, indication, technology, application, end user, and region.

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To analyze opportunities for stakeholders by identifying the high-growth segments of the market

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To analyze subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To profile the key players and comprehensively analyze their market sizes and core competencies.

- To track and analyze competitive developments such as acquisitions, collaborations, agreements, mergers, product launches & updates, partnerships, expansions, and other recent developments in the market globally.

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the AI in Clinical Trials Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in AI in Clinical Trials Market