AI Agents Market Size, Share, Growth & Latest Trends

AI Agents Market by Agent Role (Productivity & Personal Assistant, Sales, Marketing, Code Generation, Operations & Supply Chain), Offering (Vertical AI Agents, Horizontal AI Agents), Agent System (Single Agent, Multi Agent) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The AI Agents market is projected to grow from USD 7.84 billion in 2025 to USD 52.62 billion by 2030, registering a CAGR of 46.3%. This explosive growth is being driven by the convergence of foundation models, autonomous task execution, and enterprise demand for intelligent copilots across business functions. The integration of foundation models, such as large language models (LLMs) is transforming AI agents from simple rule-based bots into autonomous, multi-step task performers. These agents can now Interpret complex instructions, Make contextual decisions, Execute workflows with minimal human intervention. Vendors like Cognosys and Adept are pioneering agentic systems that automate high-effort tasks such as invoice reconciliation, SOC alert triage, and data entry, reducing manual workloads by over 60%. The demand for AI copilots is surging across CRM, ERP, and developer tools. Enterprises are embedding AI agents to Automate repetitive tasks, Provide contextual recommendations, Enhance user productivity. Microsoft, for instance, is integrating AI agents into Dynamics 365 and GitHub Copilot, enabling real-time assistance in sales, customer service, and software development environments. AI agents are gaining traction in verticals such as Healthcare for Automating patient intake, clinical documentation, and claims processing, Retail for Powering intelligent customer service, inventory management, and personalization, Financial Services for Streamlining compliance workflows, fraud detection, and client onboarding. These agents are enabling faster response times, tailored interactions, and regulatory compliance, making them indispensable in high-stakes, data-intensive environments. For enterprises, AI agents represent a leap toward autonomous operations, enabling cost savings, scalability, and agility in decision-making. For vendors, the focus is shifting to domain-specific agents, multi-agent orchestration, and secure, explainable AI frameworks to meet enterprise-grade requirements.

KEY TAKEAWAYS

- The North America AI Agent market is projected to hold the largest market share in 2025.

- By offering, Vertical AI agents segment is expected to register highest CAGR of 62.7% during the forecast period 2025-2030.

- By agent system, the multi-agent systems segment is projected to register a CAGR of 48.5% during the forecast period.

- By agent role, The coding & software development segment is projected to register a CAGR of 52.4% during the forecast period.

- By product type, the ready to deploy agents segment is expected to hold largest market share in 2025.

- By end users, BFSI end users are projected to register the largest market size in 2025.

- Companies such as OpenAI, Google, and Amelia were identified as some of the star players in the AI agent Market, given their strong market share and product footprint.

- Companies Leena AI, Cognigy, and Aisera, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The AI Agents market is witnessing exponential growth as organizations increasingly deploy conversational AI, task automation agents, and intelligent virtual assistants to enhance customer experience, streamline operations, and enable real-time decision-making. Powered by advancements in natural language processing (NLP), sentiment analysis, generative AI, and multimodal AI, these agents are becoming integral to enterprise digital strategies. Leading vendors such as Google Cloud, IBM Watson, Microsoft Azure, and AWS are investing in scalable, ready-to-deploy AI agent platforms that deliver personalized, automated, and compliance-ready solutions across industries.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The AI Agents market is transforming enterprise operations as organizations increasingly adopt autonomous agents for decision-making, workflow automation, and real-time task execution. Key drivers include demand for intelligent virtual assistants, collaborative multi-agent systems, and context-aware automation. Enterprises leverage AI agents for customer engagement, code generation, process orchestration, and compliance monitoring, improving operational efficiency and scalability. Emerging trends such as integration with RPA, generative AI-powered copilots, and hyper-personalized agent workflows enhance productivity. Real-time data processing, privacy-by-design architectures, and multilingual capabilities remain critical for secure, adaptive, and globally deployable AI agent solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing integration of AI agents with enterprise-level automation tools

-

Accelerated development of NLP technologies is enhancing AI agents’ understanding and interaction capabilities

Level

-

High implementation costs restricting access to advanced AI agent solutions

Level

-

Emergence of vertical AI agents tailored for niche business roles

-

Multilingual capabilities in AI agents will increase global market penetration and adoption

Level

-

Enhancing contextual understanding of AI agents

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver – Increasing Integration of AI Agents with Enterprise Automation Tools

The integration of AI agents with enterprise automation platforms—including Business Process Management (BPM), Robotic Process Automation (RPA), and Customer Relationship Management (CRM) systems—is a primary growth driver. These agents enable Autonomous task orchestration, Real-time decision-making, Operational efficiency at scale. In industries such as banking, insurance, and retail, AI agents are automating complex workflows like fraud detection, compliance monitoring, and customer support. Vendors like UiPath and Blue Prism are embedding AI into their RPA platforms, enabling end-to-end automation and real-time analytics. This trend positions AI agents as foundational to enterprise AI strategies, enabling organizations to scale automation across business units while reducing manual intervention.

Restraint – High Implementation Costs and Data Privacy Concerns

Adoption of AI agents is constrained by High implementation and integration costs, Data privacy and compliance concerns. Deploying AI agents requires access to large volumes of structured and unstructured data, often containing sensitive personal information. Compliance with global regulations such as GDPR, HIPAA, and CCPA adds complexity, especially for multinational organizations navigating cross-border data laws. According to industry estimates, nearly 60% of enterprises cite non-compliance risks and data governance concerns as key barriers to adoption. In response, vendors are investing in Privacy-by-design architectures, Federated learning frameworks, Synthetic data generation to reduce reliance on real-world sensitive data.

Opportunity – Emergence of Vertical AI Agents for Niche Roles

The emergence of vertical AI agents tailored for niche business roles presents a significant growth opportunity. These agents are designed for domain-specific tasks such as Document drafting in legal tech, Claims processing in insurance, Patient support in healthcare, Fraud detection in financial services. According to MarketsandMarkets, vertical AI agents are expected to grow at a CAGR of ~35% over the next five years. Vendors that leverage proprietary datasets and deep domain expertise can achieve competitive differentiation and high customer stickiness. These agents enable hyper-personalized automation, reduce manual workloads, and improve productivity across specialized workflows.

Challenge – Enhancing Contextual Understanding of AI Agents

Despite advancements, AI agents still face limitations in contextual understanding, particularly in Multi-turn conversations, Idiomatic expressions and sarcasm, Cultural and linguistic nuances. These gaps hinder the deployment of AI agents in complex, high-stakes workflows that require human-like comprehension. Vendors are addressing this through Reinforcement Learning from Human Feedback (RLHF), Memory-augmented models, Conversational context retention techniques. However, bridging the gap between human-level understanding and AI-generated responses remains a critical challenge for achieving enterprise-grade conversational intelligence.

AI Agents Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Telefónica replaced outdated voice systems with Amelia’s AI agents to manage customer interactions in Peru, improving resolution efficiency and communication. | Handled 4.5 million monthly calls, achieved 90% intent accuracy, and significantly increased customer satisfaction. |

|

Mercado Libre leveraged Stability AI’s Stable Diffusion technology to develop GenAds, an automated generative-AI tool that creates high-quality, customized product advertisements to enhance engagement and seller visibility. | Achieved 25% higher click-through rates (CTR) for GenAds images compared to traditional ads and recorded a 45% increase in display ad impressions, significantly expanding campaign reach across Latin America. |

|

CGI implemented Amelia as a virtual engineer to automate IT service workflows, proactively resolve Level 0–1 incidents, and enhance overall operational efficiency across client systems. | Deployed over 12,000 automation workflows, reducing client outages by 30%, improving response times, and enabling continuous service availability through proactive monitoring. |

|

Cencora integrated Infinitus’ AI-powered digital assistant into its benefit verification system to automate verification processes, minimize manual errors, and accelerate patient access to therapies. | Achieved fourfold faster verification turnaround, offset over 100 full-time roles, and seamlessly scaled operations during peak re-verification seasons without compromising accuracy. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The AI agent ecosystem spans diverse functions, reflecting its deep integration across industries. In Productivity and Sales, AI tools like Grammarly and HubSpot optimize creativity, workflow, and lead generation. Marketing leverages AI for SEO, campaign management, and personalized experiences through tools like Surfer and Albert. Customer Support harnesses chatbots like Ada and sentiment analysis with Observe-AI. Legal sectors benefit from AI in research (Harvey) and compliance (LexCheck). Product Management employs AI for automation and resource allocation, while Coding tools enhance software development with debugging and CI/CD. In Business Intelligence, data analytics and forecasting dominate, complemented by AI-driven fraud detection in Finance.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

AI Agents Market, By Agent Systems

The Multi-Agent Systems (MAS) segment is the fastest-growing in the AI Agents market, driven by the need for collaborative, autonomous agents capable of solving complex, distributed problems across enterprise environments. These systems enable Real-time coordination among multiple agents, Decentralized task execution, and context-aware decision-making. Industries such as BFSI, healthcare, and logistics are leveraging MAS to manage high-volume, dynamic workflows—from fraud detection and claims processing to supply chain optimization. Key enablers include Multi-agent reinforcement learning (MARL), Advanced coordination protocols, Scalable agent orchestration frameworks.

AI Agents Market, By Agent Role

The Coding and Software Development agent role is experiencing the fastest adoption, as enterprises integrate AI agents into DevOps pipelines to Automate code generation and debugging, Accelerate software delivery cycles, Ensure code quality and consistency. Powered by large language models (LLMs), these agents assist developers in Writing production-ready code, Conducting automated testing, Managing CI/CD workflows. Vendors like GitHub (Copilot), Amazon CodeWhisperer, and Replit are leading this space, offering AI-powered development assistants that enhance productivity and reduce time-to-market.

AI Agents Market, By Product Type

The Build-Your-Own Agents segment is leading growth as enterprises seek customizable, domain-specific AI agent platforms. These solutions enable organizations to Design, train, and deploy tailored agents, Integrate with internal systems (CRM, ERP, analytics), Automate unique workflows and customer interactions. The rise of no-code/low-code platforms and pre-trained model libraries is accelerating adoption across sectors such as healthcare, finance, and professional services. These platforms support Rapid prototyping and deployment, Real-time decision support, and Scalable, adaptive automation.

AI Agents Market, By End User

Professional service providers—including law firms, consulting agencies, and IT service companies—represent the fastest-growing end-user segment. These organizations are deploying AI agents to Automate research and document analysis, Enhance client communication and advisory services, Streamline project and knowledge management. AI agents are helping service providers deliver personalized insights, reduce manual workloads, and scale operations efficiently. Integration with CRM systems, analytics platforms, and collaboration tools further amplifies their impact. This segment is seeing strong growth across Asia-Pacific and other global markets, driven by the need for agility, cost-efficiency, and competitive differentiation.

REGION

Asia Pacific to be the fastest-growing region in the AI agents Market during the forecast period

Asia Pacific is emerging as the fastest-growing region in the AI Agents market due to its rapid enterprise digitalization, strong government support for AI innovation, and expanding ecosystem of intelligent automation. Countries such as China, Japan, India, and South Korea are deploying AI agents for customer service, sales enablement, process optimization, and virtual assistance. The region’s dominance stems from its massive data availability, multilingual digital population, and demand for personalized, real-time interactions. Rising investments in generative AI, agentic platforms, and 5G-powered cloud infrastructure further accelerate deployment, positioning Asia Pacific as a global hub for AI agent innovation.

AI Agents Market: COMPANY EVALUATION MATRIX

In the AI Agents market matrix, OpenAI (Star) leads with a dominant market presence and an extensive portfolio of agentic AI capabilities, including autonomous reasoning, task orchestration, multimodal understanding, and enterprise copilots. Its ecosystem powers scalable deployment of intelligent agents across industries, from customer support and content generation to workflow automation. Microsoft (Emerging Leader) is rapidly advancing through its integration of AI agents within Microsoft 365 Copilot, Azure AI Studio, and Dynamics platforms. These solutions enable contextual, domain-specific automation and seamless collaboration across enterprise environments. While OpenAI leads with innovation, scale, and foundational model strength, Microsoft demonstrates accelerating momentum, steadily advancing toward the Star quadrant through deep enterprise integration and user accessibility.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 5.26 Billion |

| Market Forecast in 2030 | USD 52.62 Billion |

| Growth Rate | CAGR of 46.3% during 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Solution Provider (US) | Delivered competitive profiling of additional vendors, brand comparative analysis, and a drill-down of country-level segmentation across key markets. | Enabled competitive positioning insights, product differentiation clarity, and multi-country market intelligence, supporting go-to-market strategy refinement and stakeholder alignment. |

| Leading Solution Provider (Europe) | Provided competitive profiling, brand benchmarking, and segmentation analysis across additional geographies. | Delivered in-depth market insights, comparative brand positioning, and segment-level intelligence, empowering strategic decision-making and regional growth planning. |

RECENT DEVELOPMENTS

- April 2025 : Google introduced the code customization feature for chat in VS Code and IntelliJ Gemini Code Assist. This feature enables developers to receive contextually relevant code suggestions and insights directly within the Gemini Code Assist chat interface of their IDEs. No additional configuration is required to use this functionality, simplifying the integration process. Developers can leverage this feature to enhance coding efficiency and streamline workflows.

- February 2025 : Salesforce expanded its partnership with Google to offer businesses more choice and flexibility in building AI-powered agents. Salesforce's Agentforce will integrate with Google's Gemini models, allowing agents to process images, audio, and video, leveraging Gemini's multimodal capabilities and real-time insights from Google Search via Vertex AI. The collaboration aims to enhance AI-driven customer service with real-time voice translation, intelligent agent handoffs, and AI-driven conversational insights.

- January 2025 : NVIDIA released new AI Blueprints, which allow enterprises to build agentic AI applications capable of performing multi-level task executions. Such focus enables developers to create custom AI "knowledge robots" that can understand and analyze data from video and PDF formats, among others. Major partners such as CrewAI, Daily, LangChain, LlamaIndex, and Weights & Biases worked with NVIDIA to further orchestrate their tools within the NVIDIA AI Enterprise platform, assisting the development of agentic AI across many enterprises.

- January 2025 : OpenAI launched ChatGPT Gov, aimed at US government agencies. This specialized version of ChatGPT offers secure and compliant access to GPT-4 models via Microsoft Azure Government. It is designed for use cases such as document summarization, data analysis, and customer interaction in highly regulated environments.

- January 2025 : NTT DATA unveiled the Smart AI Agent. This enterprise-focused solution autonomously extracts, organizes, and executes tasks from natural language commands. It is particularly targeted at industries like healthcare, finance, and logistics, aiming to reduce operational overhead and improve task management.

Table of Contents

Methodology

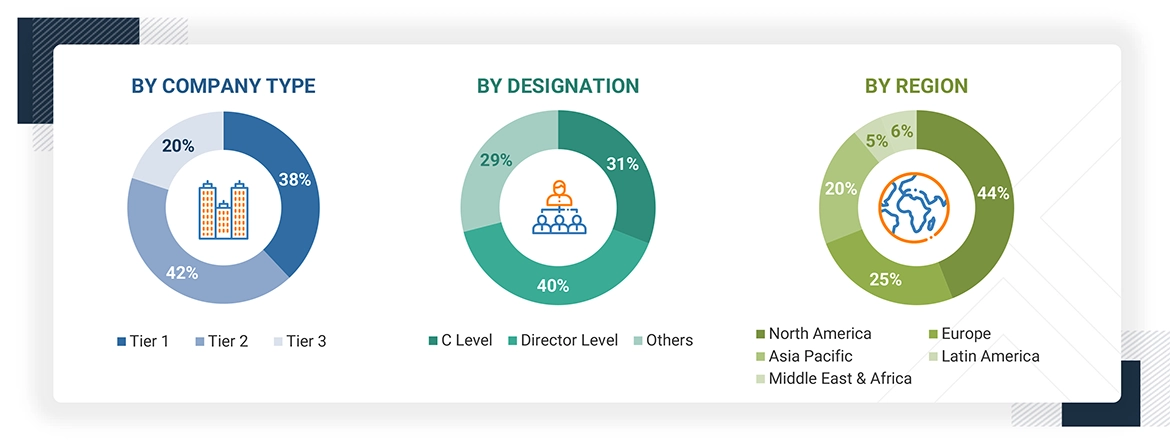

The AI agents market research study involved extensive secondary sources, directories, journals, and paid databases for secondary research. Primary sources were mainly industry experts from the core and related industries, preferred cybersecurity providers offering generative AI-infused solutions, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. Additional data was gathered by utilizing other secondary sources, such as blogs, government whitepapers, journals, and vendor websites. Different nations' spending on AI agents was gathered from the corresponding sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to agent systems, product type, agent roles, end users, and region, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development and marketing teams; related key executives from AI agent solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather qualitative and quantitative insights, which include but are not limited to market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Inputs from primary research were also leveraged to understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using AI agent solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of AI agents solutions and services, which would impact the overall AI agents market.

Note: Tier 1 companies account for annual revenue of >USD 10 billion; tier 2 companies’ revenue ranges between

USD 1 and 10 billion; and tier 3 companies’ revenue ranges between USD 500 million and USD 1 billion

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

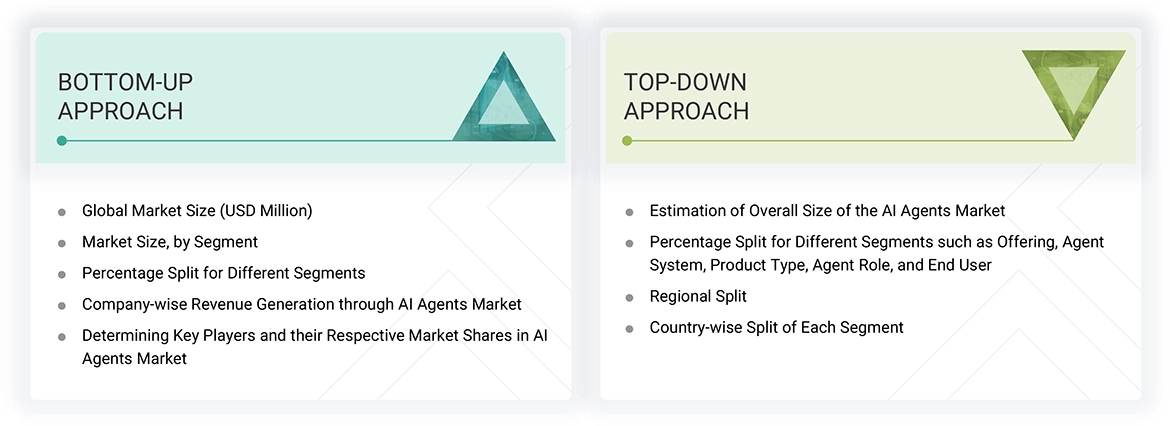

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the AI agents market. The first approach involved estimating the market size by the summation of companies’ revenue generated through the sale of solutions and services.

Market Size Estimation Methodology: Top-down approach

In the top-down approach, an exhaustive list of all the vendors offering solutions and services in the AI agents market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on the breadth of software and services according to the agent system, product type, agent role, and end user. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Market Size Estimation Methodology: Bottom-up approach

In the bottom-up approach, the adoption rate of AI agent solutions and services among different end users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of AI agent solutions and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the regional penetration of AI agents in the market. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major AI agent providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primary interviews, the exact values of the overall AI agents market size and the segments’ size were determined and confirmed using the study.

AI Agents Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

AI agents are autonomous or semi-autonomous software entities designed to perform specific tasks or roles within a digital environment by leveraging artificial intelligence techniques such as machine learning, natural language processing, and decision-making algorithms. These agents operate independently or in conjunction with other agents and systems to achieve predefined goals, often mimicking human behaviors such as understanding, reasoning, learning, and interacting with users or other systems. AI agents can range from simple rule-based bots to complex, multi-agent systems capable of sophisticated interactions and collaboration. They are widely used across various industries for tasks like customer service automation, data analysis, process optimization, and personalized recommendations, offering scalability, efficiency, and enhanced user experiences.

Stakeholders

- Ready-to-Deploy AI Agent Vendors

- AI Agent Development Platform Vendors

- Business Analysts

- Cloud Service Providers

- Build-Your-Own Agent Service Providers

- Enterprise End Users

- Distributors and Value-added Resellers (VARs)

- Government Agencies

- Independent Software Vendors (ISV)

- Managed Service Providers

- Market Research and Consulting Firms

- Support & Maintenance Service Providers

- System Integrators (SIs)/Migration Service Providers

- Technology Providers

Report Objectives

- To define, describe, and predict the AI agents market by offering, agent system, product type, agent role, end user, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for the five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies.

- To analyze competitive developments, such as partnerships, product launches, and mergers & acquisitions, in the market

- To analyze the macroeconomic outlook (including the impact of Trump tariffs) across all regions in the AI agents market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product quadrant, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

- Further breakup of the North American AI agents market

- Further breakup of the European market

- Further breakup of the Asia Pacific market

- Further breakup of the Middle Eastern & African market

- Further breakup of the Latin America AI agents market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What are AI agents?

AI agents are software entities that autonomously or semi-autonomously execute tasks and make decisions, leveraging machine learning, NLP, and other AI technologies. They operate within specific environments, interfacing with users, systems, or other agents, and are characterized by their capacity for adaptive learning, context-aware processing, and autonomous function across varied applications.

What is the total CAGR expected to be recorded for the AI agents market during 2025-2030?

The AI agents market is expected to record a CAGR of 46.3% from 2025-2030.

How are generative AI and cybersecurity amalgamating into a converged technology?

Generative AI is revolutionizing the AI agents market by significantly enhancing their ability to create, adapt, and respond in more human-like and contextually nuanced ways. Integrating generative models like GPT-4/4o allows AI agents to engage in more natural and dynamic interactions, whether it is crafting personalized customer service responses, generating content, or even writing complex code. This capability is expanding the applications of AI agents across industries, making them more versatile and effective, and driving their adoption as they can now offer more sophisticated, tailored solutions that were previously beyond the reach of traditional AI agents?.

Which are the key drivers supporting the growth of the AI agents market?

The key factors driving the growth of the AI agents market include the accelerated development of natural language processing (NLP) technologies enhancing AI agents’ understanding and interaction capabilities, demand for hyper-personalized digital experiences driving higher adoption of AI agents in customer-facing roles, and the integration of AI agents into enterprise business process automation to improve operational efficiency and reducing costs.

Which are the top end users prevailing in the AI agents market?

The leading enterprise end users in the AI agents market include BFSI, healthcare & life sciences, and professional service providers.

Who are the key vendors in the AI agents market?

Some major players in the AI agents market include Microsoft (US), IBM (US), Google (US), Oracle (US), AWS (US), NVIDIA (US), Meta (US), Salesforce (US), OpenAI (US), LivePerson (US), Tempus AI (US), Kore.ai (US), LeewayHertz (US), CS DISCO (US), Aerogility (UK), GupShup (US), HireVue (US), Helpshift (US), Fluid AI (India), Amelia (US), Irisity (Sweden), Cogito (US), SmartAction (US), Cognosys (Canada), Aisera (US), Markovate (US), Rasa (US), Stability AI (UK), Infinitus Systems (US), Sierra (US), Level AI (US), Sybill (US), Truva (US), Leena AI (US), Tars (US), Talkie.ai (US), HeyMilo AI (US), CUJO AI (US), K Health (US), Locale.ai (US), Newo.ai (US), Beam AI (US), and Cognigy (Germany), CausaLens (UK), Krisp (US), Relevance AI (Australia), Spell (Germany), BlueJ (US), Luminance (UK), LawGeex (US) and Tovie AI (UK).

What are AI agents and how do they differ from AI assistants?

AI agents are autonomous software programs that perform tasks and make decisions independently, often handling complex workflows across industries without human intervention. AI assistants are a subset of AI agents designed specifically to support users by managing tasks like scheduling, answering questions, or providing personalized help through conversational interfaces. In short, all AI assistants are AI agents, but AI agents cover a broader range of autonomous functions beyond just assisting users.

What is the forecasted CAGR for the AI agents market in Asia Pacific over the upcoming years?

The Asia Pacific AI agents market is expected to grow at a compound annual growth rate of 48.5% during the forecast period.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the AI Agents Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in AI Agents Market