Advanced Wound Care Market Size, Growth, Share & Trends Analysis

Advanced Wound Care Market by Product (Dressings (Foam, Hydrocolloid, Film), NPWT, Debridement Devices, Biological Skin Substitutes, Topical Agents), Wound Type (Surgical, Traumatic, Ulcers, Burns), End User (Hospital, Homecare), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

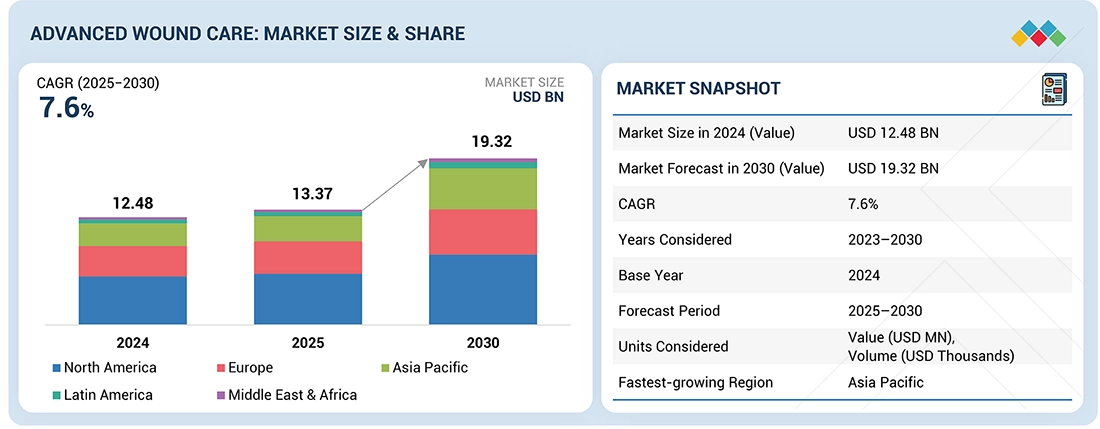

The global advanced wound care market is projected to reach USD 19.32 billion by 2030 from USD 13.37 billion in 2025, at a CAGR of 7.6 % during the forecast period. The advanced wound care market is primarily driven by several factors: the increasing geriatric population, the rising prevalence of chronic diseases, and a growing number of traumatic and burn injuries. These elements have significantly boosted the demand for effective wound management solutions. Furthermore, supportive government initiatives and reimbursement frameworks contribute to market growth.

KEY TAKEAWAYS

-

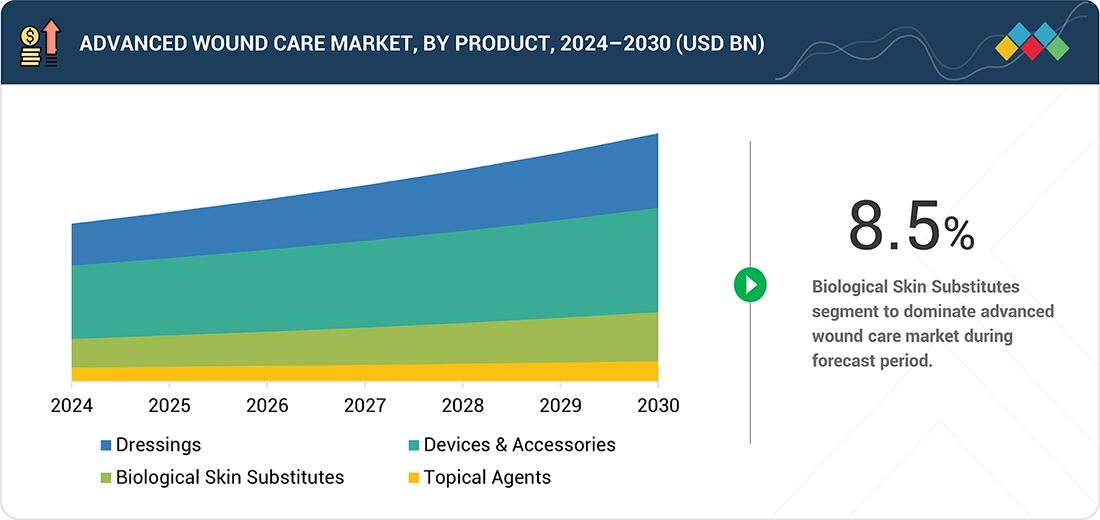

BY PRODUCTBy product, the dressings segment, which includes a range of advanced wound care dressings played a key role in wound management. The growing awareness of advanced wound care and the increasing rates of hospital-acquired infections (HAIs) are expected to drive the adoption of solutions essential for effective wound treatment. Other notable segments were device & accessories, biological skin substitutes, and topical agents which also drive the market.

-

BY WOUND TYPEBy wound type, the surgical & traumatic wounds segment encompasses a variety of advanced wound care needs. Diabetic foot ulcers, pressure ulcers, venous leg ulcers, and burns and other wounds are also part of this segment. The rising number of procedures worldwide, along with advancements in treatment methods, has contributed to this expansion. Additionally, the use of advanced wound care solutions that improve healing and reduce complication risks has boosted their uptake.

-

BY END USERBy end user, the hospitals, ASCs, and wound care centers segment includes a range of advanced wound care settings, such as hospitals, specialized centers, and other care units. These environments are equipped to manage diverse wound cases, supported by skilled professionals and modern medical technology, making them vital in the field of advanced wound care.

-

BY REGIONThe global advanced wound care market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific is witnessing strong growth due to its aging population, inceasing healthcare costs, and a rising prevalnce of chronic wound.

-

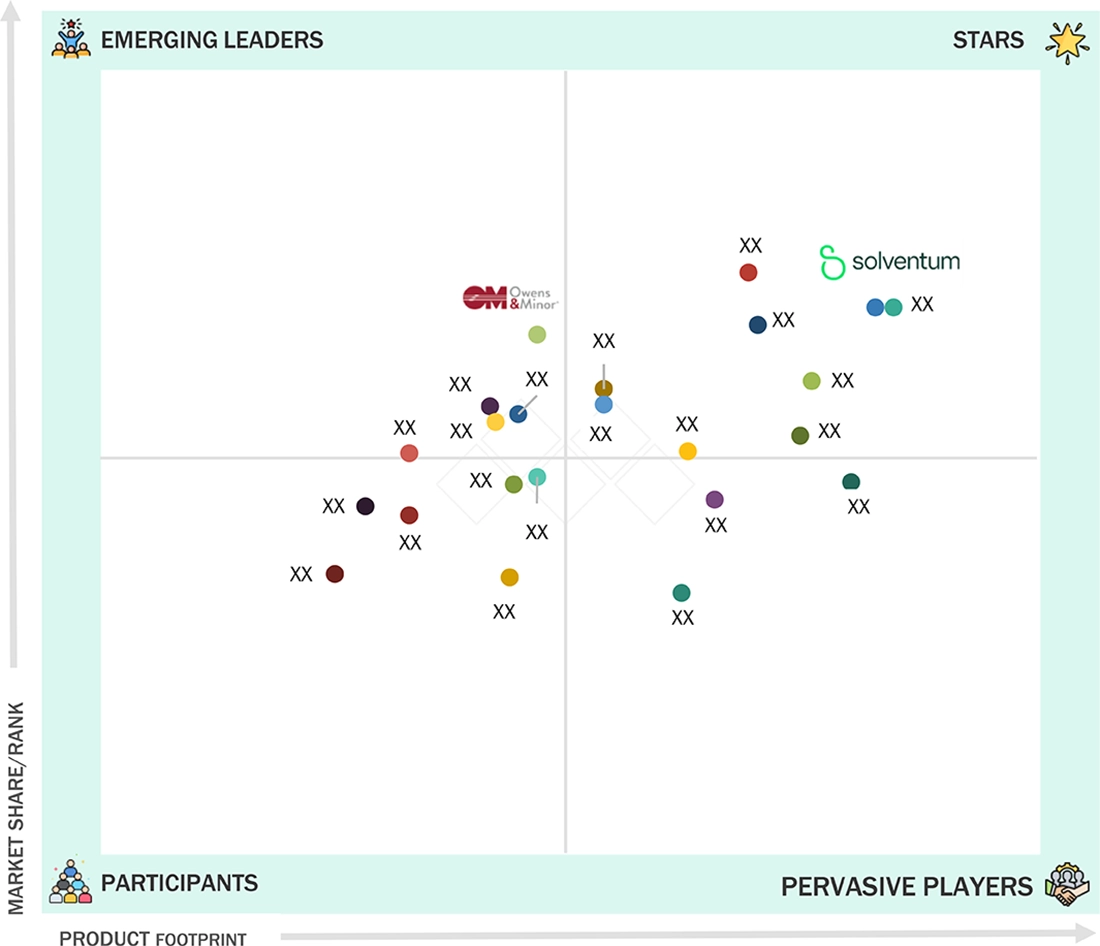

COMPETITIVE LANDSCAPEThe global advanced wound care market is steadily growing, driven by strategic partnerships and strong R&D investments. Key players like Solventum (US), Smith+ Nephew (UK), Mölnlycke AB (Sweden), Convatec Group PLC (UK), Coloplast Group (Denmark) and others leverage diverse product portfolios and innovation to expand globally through collaborations, acquisitions, and new product launches.

The global advanced wound care market is expected to grow significantly by the end of the forecast period from its current value. This growth is driven by several factors, including the increasing geriatric population, the rising prevalence of chronic diseases, and a growing number of traumatic and burn injuries. These elements have significantly boosted the demand for effective wound management solutions. Furthermore, supportive government initiatives and reimbursement frameworks contribute to market expansion.

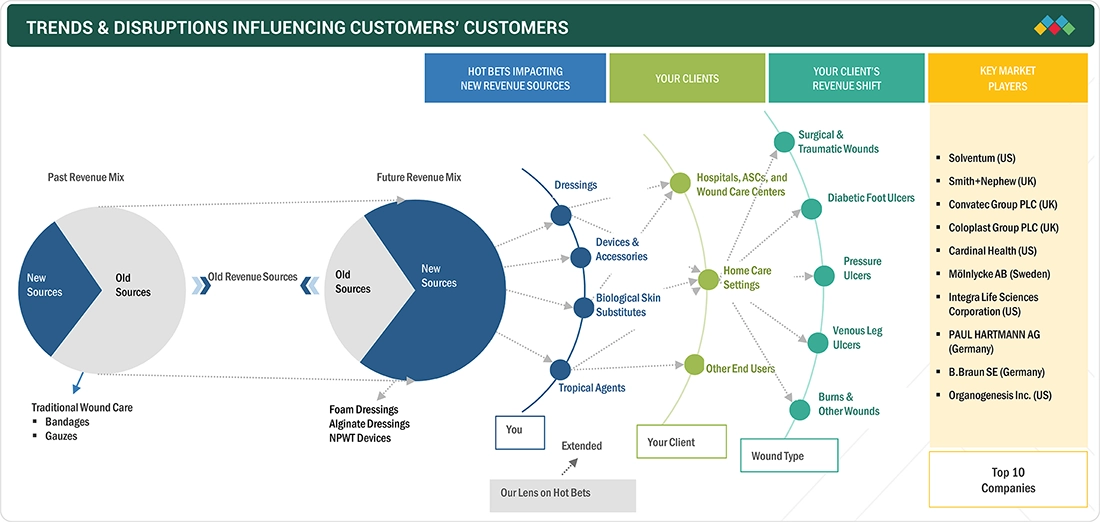

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on the advanced wound care market stems from evolving healthcare needs and advancements in wound solutions. Hospitals, ambulatory surgery centers (ASCs), home care settings, and other end users form the core customer base, addressing verious wound types such as surgical & traumatic wounds, diabetic foot ulcers, venous leg ulcers. Additionally, the focus on reducing complications through innovative treatments is fueling the demand for more advanced wound care products. These trends shape customer decisions and attract investments in innovative advanced wound care solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing cases of traumatic injuries

-

Government initiatives and reimbursement policies

Level

-

High cost of advanced wound care products

-

Risks associated with use of advanced wound care products

Level

-

Technological advancements in wound care

-

Technological advancement in wound care

Level

-

Shortage of trained healthcare professionals

-

Limited awareness in underdeveloped regions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver:Increasing cases of traumatic injuries

The increasing frequency of traumatic injuries, particularly from road accidents and workplace incidents, is a major driver of the advanced wound care market. According to the World Health Organization, road traffic accidents claim approximately 1.3 million lives annually, with 20 to 50 million more sustaining nonfatal injuries. Vulnerable road users such as pedestrians and motorcyclists make up over half of these deaths. The International Labour Organization also reports around 270 million occupational accidents globally each year. These injuries often result in severe wounds requiring advanced care to prevent complications like infection and tissue damage. As trauma-related cases rise, the need for comprehensive and effective wound management solutions becomes increasingly critical across both clinical and emergency care settings.

Restraint: High cost of advanced wound care products

The high cost of advanced wound care products poses a significant barrier to their adoption, especially in low- and middle-income countries with limited healthcare budgets and insurance coverage. Treatments involving bioengineered skin substitutes, antimicrobial dressings, and advanced wound systems offer clinical benefits but come with substantial financial burdens. An article published in Advances in Wound Care found that chronic non-healing wounds target around 1% to 2% of the population; treating this wound type can go up to around USD 50 million annually. Foot ulcers, prevalent among people with diabetes, affect about 25% of the diabetic population and are a leading cause of hospitalization, contributing to high healthcare costs. According to the World Health Organization, the recurring nature of care—such as frequent dressing changes and follow-ups—further escalates costs.

Opportunity: Technological advancements in wound care

The growing integration of technology in wound management presents a key opportunity in the advanced wound care market. Simplified smart devices and advanced dressings are improving patient outcomes and enabling more efficient care. For example, smart bandages that detect infection and transmit healing data remotely facilitate personalized treatment in real-time. At the same time, the development of extended-wear NPWT systems is improving ease of use and comfort for patients outside traditional clinical settings. These innovations support better adherence, reduce the burden on healthcare infrastructure, and are gaining traction in hospital and homecare environments.

Challenge: Shortage of trained healthcare professionals

One of the significant challenges in adopting advanced wound care is the shortage of adequately trained healthcare professionals, especially in under-resourced regions. Effective wound management requires access to specialized products and skilled clinical application, patient monitoring, and decision-making based on wound complexity. However, many nurses and general physicians lack formal knowledge of wound care protocols, resulting in delays, misdiagnoses, and poor utilization of advanced therapies. This limits their ability to handle complex cases, such as diabetic foot ulcers or pressure injuries, which demand precise and evidence-based treatment approaches.

Advanced Wound Care Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Offers a wide range of advanced wound care dressings, including foam, hydrocolloid, alginate, and film dressings designed for acute and chronic wound management across healthcare settings. | Promotes faster healing, protects against infection, maintains optimal moisture balance, enhances patient comfort, and supports cost-effective wound management. |

|

Provides innovative wound care solutions such as ALLEVYN foam, and PICO negative pressure systems for complex wounds, diabetic foot ulcers, and surgical incisions. | Delivers effective infection management, maintains an ideal healing environment, reduces healing time, and improves clinical outcomes across high-risk wound types. |

|

Offers advanced dressings like AQUACEL hydrofiber, foam, and silver dressings for chronic wounds, pressure ulcers, and infection-prone wounds. | Provides superior fluid absorption and infection protection, promotes moist wound healing, enhances patient comfort, and reduces dressing change frequency. |

|

Develops advanced wound care products including Biatain silicone foam and hydrocolloid dressings for exuding and chronic wounds, pressure ulcers, and postoperative care. | Ensures gentle yet secure adhesion, enhances healing through moisture balance, minimizes trauma during dressing changes, and supports faster recovery. |

|

Supplies a comprehensive range of traditional and advanced wound care products including foam, alginate, hydrocolloid, and composite dressings for hospitals, clinics, and home healthcare. | Ensures reliable performance and accessibility, supports cost-effective exudate management, enhances healing efficiency, and maintains strong supply chain reliability for healthcare providers. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

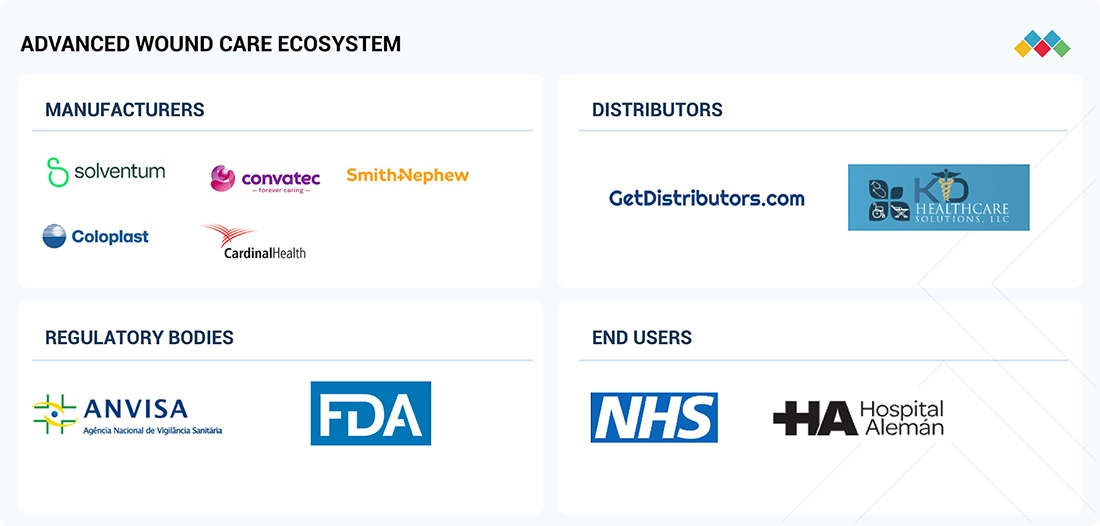

MARKET ECOSYSTEM

The ecosystem market map of the advanced wound care industry includes its key elements, which are defined by the organizations involved. Product manufacturers of advanced wound care products are companies engaged in research, product development, optimization, and launching. Manufacturers of advanced wound care products include organizations engaged in research, product development, optimization, and launch. To get items to end users—Hospitals, ASCs, wound care centers, homecare settings, and other healthcare facilities, who advanced wound care products for treatments of surgical & traumatic wounds, pressure ulcers, diabetic foot ulcers, venous leg ulcers, and burns & other wounds. Regulatory agencies monitor product safety, quality, and conformity to industry standards.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Advanced Wound Care Market, By Product

By product, the market is segmented by dressings, devices & accessories, biological skin substitutes, and topical agents. The dressing segment accounted for the largest market share in 2024. The key factors contributing to market growth include the growing awareness of wound care and the rising rates of hospital-acquired infections (HAIs), which are expected to fuel the uptake of dressings essential for effective management.

Advanced Wound Care Market, By Wound Type

The advanced wound care market is divided based on wound types, including surgical & traumatic wounds, diabetic foot ulcers, pressure ulcers, venous leg ulcers, burns, and other wounds. In 2024, the surgical & traumatic wounds segment accounted for the largest share of the market. The growth in this segment is attributed to the rising number of surgical procedures worldwide. With more surgeries being performed, the need for reliable wound care products has increased. At the same time, the number of surgical site infections (SSIs) has also increased, fueling the uptake of advanced wound treatments that can help heal faster and lower the risk of complications.

Advanced Wound Care Market, By End User

The advanced wound care market is segmented into hospitals, ASCs, and wound care centers; home care settings; and other end users. In 2024, hospitals, ASCs (Ambulatory Surgical Centers), and wound care centers accounted for the largest segment of the advanced wound care market. This leading position is due to more patients seeking treatment for chronic wounds, like pressure ulcers, diabetic foot ulcers, and venous leg ulcers. These facilities have expert staff and the latest medical gear, so they're well-equipped to manage even complicated wound cases.

REGION

Asia Pacific is the fastest growing region in the advanced wound care market

Asia Pacific is emerging as the fastest-growing region in the advanced wound market, driven by a combination of demographic, economic, and healthcare system advancements. The region is witnessing a sharp rise in the prevalence of chronic wounds, fueled by aging populations and changing lifestyles which leads do wound injuries like diabetic foot ulcers. Expanding healthcare infrastructure, growing availability of specialized wound care, and increasing adoption of advanced medical technologies are further accelerating market growth. Governments across several Asia Pacific countries are boosting investments in healthcare and supporting regulatory reforms that encourage the introduction of innovative solutions. Additionally, rising disposable incomes, improving insurance coverage, and growing awareness among patients and clinicians are contributing to higher treatment uptake. Global manufacturers are also expanding their presence through partnerships, training programs, and localized manufacturing to tap into the region’s vast, underserved patient base, positioning Asia Pacific as a key growth engine for the advanced wound care industry.

Advanced Wound Care Market: COMPANY EVALUATION MATRIX

In April 2024, after its spinoff from 3M company, Solventum began a new path as a standalone company. Although it has profited from 3M's assets and reputation in the past, it is now focusing on creating its own brand identity. To meet the needs of customers and patients, Solventum develops, produces, and markets a range of products. The company primarily operates through four business segments: MedSurg, Dental Solutions, Health Information Systems, and Purification & Filtration. Solventum focuses on innovation and strategic expansion to support growth in these areas. Integrating material science and digital capabilities enhances the company's competitive edge, leading to improved clinical and economic outcomes for healthcare providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 12.48 Billion |

| Revenue Forecast in 2030 | USD 19.32 Billion |

| Growth Rate | CAGR of 7.6% from 2025-2030 |

| Actual data | 2023-2030 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Million), Volume (USD Thousands) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Latin America and the Middle East & Africa |

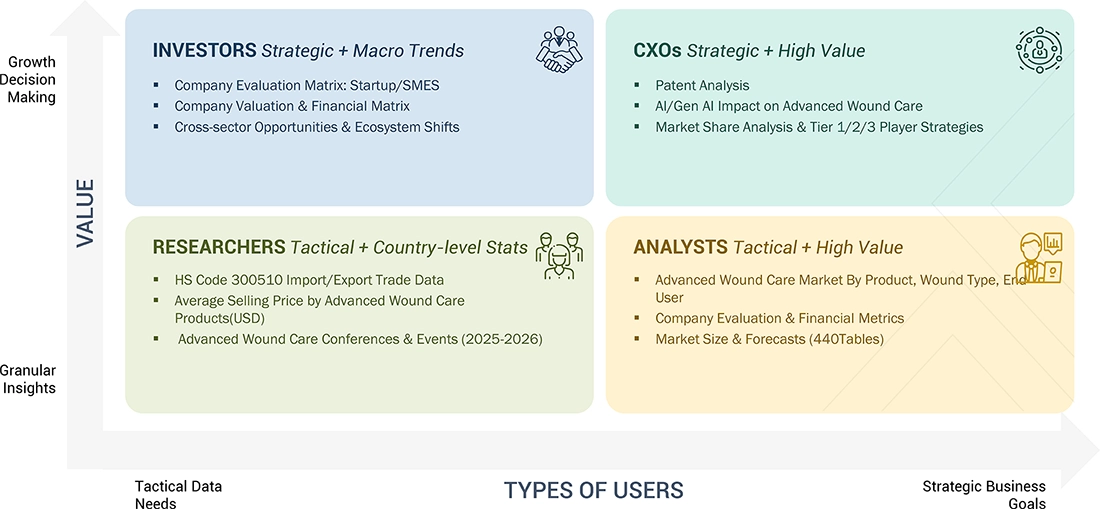

WHAT IS IN IT FOR YOU: Advanced Wound Care Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Product Matrix, which provide a detailed comparison of the product portfolio of each company in the market. | Enables identification of treatment adoption shifts across hospitals, ASCs, home care settings and other end users; highlights efficiency, and compliance trends influencing purchasing decisions. |

| Company Information | Detailed analysis and profiling of additional market players (Up to five) | Provides insights into competitive strategies, innovation focus , and partnerships shaping the advanced wound care products and supplies landscape. |

| Geographic Analysis | Further breakdown of the advanced wound care market into specific countries for the Rest of Europe, the Rest of Asia Pacific, the Rest of Latin America, and the Middle East & Africa | Country level demand mapping for new product launches and localization strategy planning. |

RECENT DEVELOPMENTS

- April 2024 : Smith+Nephew (UK) introduced the RENASYS EDGE System designed for home care patients with chronic wounds, such as ulcers

- March 2025 : Convatec Group PLC (UK) and the Wound, Ostomy, and Continence Nurses Society (US) collaborated to launch two free educational programs to improve ostomy care knowledge for healthcare professionals in 2025.

- January 2025 : Cardinal Health (US) opened a distribution center in Fort Worth, Texas, to support its At-Home Solutions business

- July 2024 : Mölnlycke AB (Sweden) and MediWound Ltd. (Israel) entered into an agreement to strengthen their partnership

Table of Contents

Methodology

The study involved major activities in estimating the current market size for the advanced wound care market. Exhaustive secondary research was done to collect information on the advanced wound care industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the advanced wound care market.

The four steps involved in estimating the market size are:

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, investor presentations, SEC filings of companies and publications from government sources [such as National Institutes of Health (NIH), US FDA, US Census Bureau, World Health Organization (WHO), Global Burden of Disease Study, and Centers for Medicare and Medicaid Services (CMS)]were referred to identify and collect information for the global advanced wound care market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market & technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various companies and organizations in the advanced wound care market. The primary sources from the demand side include pharmaceutical companies, biotechnology companies, CROs, pharmacies, medical device companies, and research academics and universities. Primary research was conducted to validate the market segmentation, identify key players, and gather insights on key industry trends & key market dynamics.

The following is a breakdown of the primary respondents:

Note 1: Others include sales, marketing, and product managers.

Note 2: Companies are classified into tiers based on their total revenues. As of 2024, Tier 1 = >USD 100 million, Tier 2 = USD 10 million to USD 100 million, and Tier 3 = < USD 10 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For the global market value, annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs active in the global advanced wound care market. All the primary service providers were identified at the global and/or country/regional level. Revenue mapping for the key players was done for the respective business segments/subsegments. The global advanced wound care market was split into various segments and subsegments based on:

- List of leading players operating in the products market at the regional and/or country level

- Product mapping of advanced wound care providers at the regional and/or country level

- Mapping of annual revenue generated by listed major players from advanced wound care (or the nearest reported business unit/product category)

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the global advanced wound care market

The above data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

The research methodology used to estimate the market size includes the following:

Data Triangulation

The total market was split into several segments after arriving at the overall market size by applying the abovementioned process. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Advanced wound care encompasses specialized dressings and therapies to promote optimal wound healing. These may include hydrogels, foams, and alginates, among others. Advanced therapies like negative pressure wound therapy (NPWT) substitutes offer innovative solutions for complex wounds, enhancing healing rates and reducing complications.

Stakeholders

- Advanced Wound Care Product Manufacturers

- Wound Care Associates

- Research & Consulting Firms

- Distributors of Advanced Wound Care Devices

- Contract Manufacturers of Advanced Wound Care Products

- Healthcare Institutes (Hospitals, Medical Schools, Diagnostic Centers, and Outpatient Clinics)

- Research Institutes

- Venture Capitalists

Report Objectives

- To define, describe, segment, and forecast the global advanced wound care market by product, wound type, end user, and region

- To provide detailed information regarding the primary factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall advanced wound care market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To benchmark players within the market using the proprietary Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business and product excellence

- To study the impact of AI/Gen AI on the market, along with the macroeconomic outlook for each region

Frequently Asked Questions (FAQ)

Which are the top industry players in the Advanced Wound Care market?

Solventum (US), Smith+Nephew (UK), Mölnlycke AB (Sweden), Convatec Group PLC (UK), Coloplast Group (Denmark), Cardinal Health (US), Integra LifeSciences Corporation (US), PAUL HARTMANN AG (Germany), B. Braun SE (Germany), Organogenesis Inc. (US), MIMEDX Group, Inc. (US), Essity Aktiebolag (Sweden), AVERY DENNISON CORPORATION (US), MATIV HOLDINGS, INC. (US), Owens & Minor (US), Zimmer Biomet (US), Bioventus (US)

What are some of the major drivers for this market?

The market is driven by increasing prevalence of diabetes, rising geriatric population, and growing cases of burn injuries and trauma. Government initiatives to improve healthcare infrastructure are also supporting market growth.

Which products have been included in the global advanced wound care market?

Dressings, devices & accessories, biological skin substitutes, and topical agents. In 2024, the dressings segment held the largest market share due to high adoption and ongoing product innovation.

Which end users have been included in the global advanced wound care market?

- Hospitals, ASCs, and wound care centers

- Home Care Settings

- Other End Users

Which region is lucrative for the global advanced wound care market?

Asia Pacific is expected to witness the highest CAGR due to a growing elderly population, increasing healthcare spending, and rising incidence of chronic wounds.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Advanced Wound Care Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Advanced Wound Care Market

Joshua

Mar, 2022

What are the growth estimates for Advanced Wound Care Market till 2026?.

Kenneth

Mar, 2022

Which is the fastest growing market of Advanced Wound Care Market?.

Kevin

Mar, 2022

Can you enlighten us with your market intelligence to grow and sustain in Advanced Wound Care Market?.