The study involved four major activities in estimating the current market size for absorbent paper. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various sources have been referred to for identifying and collecting information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research. Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The absorbent paper market involves a variety of stakeholders across the value chain, including raw material suppliers, manufacturers, and end-users. For this study, both the supply and demand sides of the market were interviewed to gather qualitative and quantitative information. Key opinion leaders from various end-use sectors were interviewed from the demand side, while manufacturers and associations were interviewed from the supply side.

Primary interviews helped to gather insights on market statistics, revenue data, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped to identify trends related to grade, application, end-use industries, and region. C-level executives from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand their perspective on suppliers, products, and component providers, which will affect the overall market.

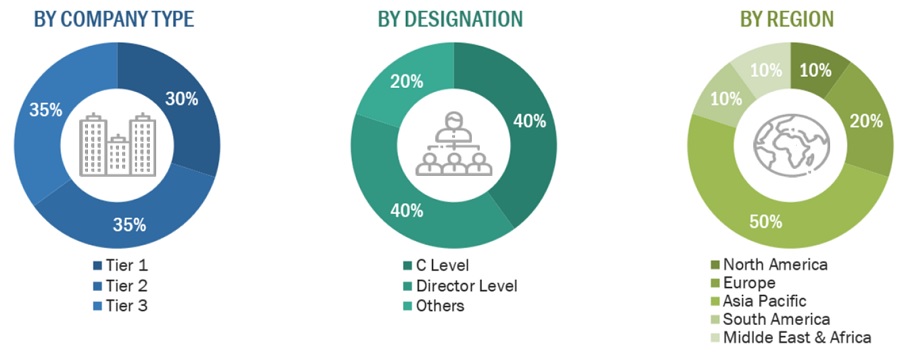

Breakdown of primary interviews

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023 available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name

|

Designation

|

|

Kimberly-Clark Corporation

|

Sales Manager

|

|

Ahlstrom

|

Sales Manager

|

|

Essity Aktiebolag

|

Technical Sales Manager

|

|

Kruger Inc.

|

Marketing Manager

|

|

Domtar Corporation

|

R&D Manager

|

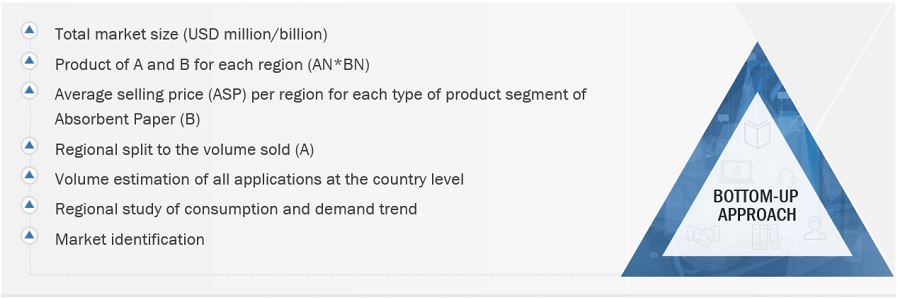

Market Size Estimation

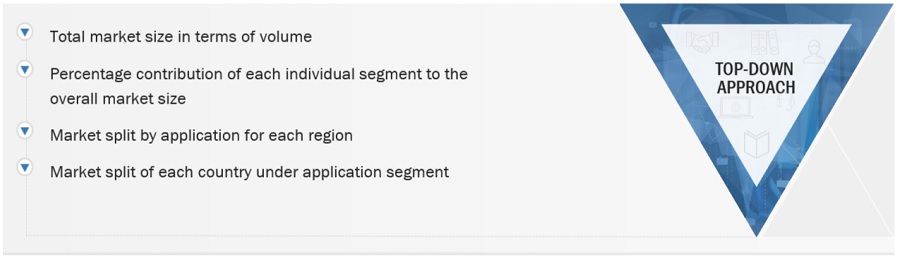

The top-down approach was used to estimate and validate the size of various submarkets for absorbent paper for each region. The research methodology used to estimate the market size included the following steps:

-

The key players in the industry have been identified through extensive secondary research.

-

The supply chain of the industry has been determined through primary and secondary research.

-

The global market was then segmented into five major regions and validated by industry experts.

All percentage shares, splits, and breakdowns based on type, application, and end-use industry, and country were determined using secondary sources and verified through primary sources.

All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed input and analysis and presented in this report.

Absorbent Paper Market: Bottum-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Absorbent Paper Market: Top-Down Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply of absorbent paper and their applications.

Market Definition

Absorbent paper is a highly porous material designed to rapidly absorb liquids and moisture. Wet crepe, dry crepe, tissue, scrim reinforced papers are various types of absorbent papers finds application in personal care, medical, home care, beauty, and packaging. Tissue paper, known for its softness, finds use in facial tissues and paper towels, excelling in quick liquid absorption. Coffee filters, designed with fine pores, are adept at separating coffee grounds while allowing liquid permeation. Scrim-reinforced tissue integrates strength through a reinforcing mesh, ideal for applications demanding both absorbency and durability, such as medical and industrial wipes. These absorbent papers cater to specific needs, offering a range of properties from gentleness and quick absorption in tissue paper to precision filtration in coffee filters and enhanced strength in scrim-reinforced tissue, enhancing their versatility across industries. Overall, absorbent paper products serve as indispensable tools in maintaining cleanliness, hygiene, and efficiency across numerous sectors.

Key Stakeholders

-

Manufacturers of absorbent paper products

-

Raw Material Suppliers

-

Manufacturers In End-use Industries

-

Traders, Distributors, and Suppliers

-

Regional Manufacturers’ Associations

-

Government and regional Agencies and Research Organizations

Objectives of the Study:

-

To analyze and forecast the size of the absorbent paper market in terms of value and volume.

-

To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market

-

To analyze and forecast the market by type, application and end-use industry, and region.

-

To forecast the size of the market with respect to five regions: Asia Pacific, Europe, North America, South America, and the Middle East & Africa, along with their key countries

-

To strategically analyze micromarkets1 with respect to individual trends, growth prospects, and their contribution to the overall market

-

To analyze opportunities in the market for stakeholders and provide a competitive landscape for the market leaders.

-

To analyze competitive developments in the market, such as investment & expansion, joint venture, partnership, and merger & acquisition

-

To strategically profile key players and comprehensively analyze their market shares and core competencies2.

Notes: Micromarkets1 are the sub-segments of the absorbent paper market included in the report.

Core competencies2 of companies are determined in terms of their key developments, SWOT analysis, and key strategies adopted by them to sustain in the market.

Available Customizations:

MarketsandMarkets offers the following customizations for this market report.

-

Additional country-level analysis of the absorbent paper market

-

Profiling of additional market players (up to 3)

Growth opportunities and latent adjacency in Absorbent Paper Market