3D Printing High Performance Plastic Market

3D Printing High-Performance Plastic Market by Type (Polyamide (PA), Polyetherimide (PEI), Polyetheretherketone & Polyetherketoneketone (PEEK & PEKK), Reinforced HPP, Other Types), Form (Filament & Pellet and Powder), Technology (Fused Deposition Modeling (FDM)/Fused Filament Fabrication (FFF) and Selective Laser Sintering (SLS)), Application (Prototyping, Tooling, and Functional Part Manufacturing), and End-use Industry (Medical & Healthcare, Aerospace & Defense, Transportation, Oil & Gas, and Other End-use Industries), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The 3D printing high-performance plastics market is projected to grow from USD 0.18 billion in 2025 to USD 0.45 billion by 2030, registering a CAGR of 20.4% during the forecast period. This robust growth is primarily driven by increasing demand for lightweight, high-performance materials across critical applications, advancements in additive manufacturing technologies, and rising investments in infrastructure and industrial modernization.

KEY TAKEAWAYS

-

BY TYPEThe 3D printing high performance plastics market comprises of PA, PEI, PEEK & PEKK, Reinforced HPPs, and other types. The PEEK & PEKK segment dominated the 3D printing high-performance plastic market due to their widespread use in a variety of industries, driven primarily by their unique properties such as biocompatibility, tailorable properties, and superior resistance and durability.

-

BY FORM3D printing high performance plastics is available in powder and filament & pellets. The filament form is expected to have the highest growth in the forecasted period. Filament and pellet form accounted for the largest share in the 3D printing high-performance plastic market in 2024. Filaments are essential for Fused Deposition Modeling (FDM), the fastest-growing 3D printing technology for high-performance plastics, while pellets are increasingly used in large-scale and industrial 3D printing systems, offering flexibility and cost-effectiveness.

-

BY TECHNOLOGYThe technology segment consists of Fused Deposition Modelling (FDM)/ Fused Filament Fabrication (FFF) and Selective Laser Sintering (SLS). SLS leads the high-performance plastics 3D printing market by enabling the creation of strong, complex, and precise parts without needing support structures. It efficiently processes polymers like PEEK and PEKK for demanding industrial applications.

-

BY APPLICATIONPrototyping, Tooling, and Functional Part Manufacturing are the major application of 3D printing high performance plastics market. Prototyping leads the 3D printing high-performance plastics market in 2024 as it enables rapid design iteration and functional testing using materials that mimic end-use performance, helping manufacturers accelerate product development and improve design accuracy.

-

BY END-USE INDUSTRYKey applications of 3D printing high performance plastics span the aerospace & defense, medical & healthcare, transportation, oil & gas and other end-use industries. The medical and healthcare sector is projected to witness the highest CAGR in the 3D printing high-performance plastics market during the forecast period. This growth is primarily driven by the increasing demand for advanced materials capable of meeting stringent regulatory, mechanical, and biocompatibility requirements in medical applications.

-

BY REGIONThe 3D printing high performance plastics market covers Europe, North America, Asia Pacific, South America, the Middle East, and Africa. North America is projected to exhibit the highest growth rate in the 3D printing high-performance plastics market during the forecast period. This growth is driven by increasing adoption of additive manufacturing across high-value industries such as aerospace and defense, healthcare, electrical and electronics, and automotive.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Syensqo (Belgium) and Arkema (France)have entered into a number of agreements and partnerships to cater to the growing demand for 3D printing high performance plastics across innovative applications.

As industries prioritize efficiency, durability, and weight reduction, 3D-printed high-performance polymers are gaining traction in sectors such as aerospace & defense, medical & healthcare, transportation, and energy. In aerospace applications, for example, these materials are increasingly used to produce lightweight and durable components, including interior panels, overhead bin gap fillers, structural brackets, cabin supports, fuel nozzles, and turbine blade housings, contributing to improved fuel efficiency and performance. Technological advancements in additive manufacturing, such as fused deposition modeling (FDM), selective laser sintering (SLS), and powder bed fusion (PBF), are enhancing precision, scalability, and cost efficiency, making high-performance plastic 3D printing more accessible across a wider range of industries.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions affect consumers' businesses. These shifts influence the revenues of end users. As a result, the revenue changes for end users are likely to impact the revenues of 3D printing high performance plastics suppliers, which, in turn, affect the revenues of 3D printing high performance plastics manufacturers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand for 3D printing high performance plastic from medical & healthcare, aerospace & defense , and automotive industries

-

Government initiatives to support adoption of 3D printing high performance plastic technologies in different industries.

Level

-

Environmental concerns regarding disposal of 3D printed plastic products

-

Skepticism regarding acceptance of new technologies in emerging economies

Level

-

Increasing demand for bio-based grades of 3D printing high performance plastic materials

-

Growing penetration od reinforced 3D printing high performance plastics in manufacturing functional parts

Level

-

High manufacturing cost of commercial grades of 3D printing high performance plastic

-

Reducing lead time

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand for 3D printing high performance plastic from medical & healthcare, aerospace & defense , and automotive industries

The 3D printing technology is being significantly used in the aerospace & defense sector. The aircraft sector is among the first ones to use 3D printing high-performance plastic. These are extremely useful for generating complex and intricate components as they can be subjected to very high temperature conditions. The auto and aviation sectors are especially interested since these materials provide a very good balance of rigidity, strength, and thermal resistance. 3D printing high-performance plastic is revolutionizing the manufacturing process in the automotive sector. For example, BMW is working with leading 3D printing firms, such as EOS GmbH Electro Optical Systems (Germany) and Carbon (US), to produce 3D-printed components for commercial vehicles. ULTEM 9085 from Stratasys is perfect for aerospace and automotive markets, offering high-performance components and an exceptionally lightweight metal alternative. Latecoere, a French aircraft manufacturer and design team, employs ULTEM 9085 to create functional models, specialty tools, and air duct housing components.

Restraint: Environmental concerns regarding disposal of 3D printed plastic products

The purchase and upkeep of 3D printing high-performance plastic requires substantial capital outlays. The high cost creates an entry barrier for new firms and restricts the capabilities of small and medium-sized enterprises (SMEs) to purchase advanced machinery, limiting their competitiveness and market entry. SMEs often lack financial capabilities, making it difficult to afford the high upfront costs of purchasing or leasing advanced equipment. This limits their access to productive and efficient machinery, which affects their capacity to compete with larger companies. In some areas, lack of access to financing options worsens the situation, further limiting SMEs capacity to obtain the latest machinery. This can result in a dependence on aged or less effective equipment, which impacts the overall growth of the market. The major players in this market are gradually attempting to overcome this limitation to maintain the market. For example, Evonik Industries launched the first PA12 powder for 3D printing on the basis of bio-circular raw material. Moreover, Arkema initiated a new plant for bio-based polyamide 11 in Singapore that will enhance the 50% capacity of global polyamide 11.

Opportunity: Growing penetration of reinforced 3D printing high-performance plastics in manufacturing functional parts

There is a growing demand for reinforced 3D printing high-performance plastics for functional part production. The grades provide the best performance in the most severe conditions, including corrosive and high-pressure/high-temperature conditions. PEEK, PEKK, and polyamide are reinforced with carbon fibers and glass fibers to enhance their performance. They offer excellent flexural strength and an outstanding stiffness-to-weight ratio and are excellent substitutes for metal parts in functional prototypes and selective end-use parts. The blend of high strength and lightweight enables these materials to substitute heavier metals, enabling manufacturers to reduce part weight without compromising performance. This is especially useful in aerospace and automotive industries, where weight savings equal better fuel efficiency and fewer emissions. The blend of high strength, lightweight, and stiffness makes it a good substitute for heavier metal parts in such applications as functional prototypes and selective end-use parts.

Challenge: High manufacturing cost of commercial grades of 3D printing high-performance plastic

The production of commercial grades of 3D printing high-performance plastic is costly because of various value additions to the raw materials employed for the production of the same. The chain supply for distributing raw materials employed in the development of commercial grades of 3D printing plastics is still being formed in emerging economies. The high-cost value-adding materials, like carbon fiber and glass fiber, applied with base materials, are also costly. Therefore, the steep production expense of commercial grades of 3D printing high-performance plastic serves as a challenge in the 3D printing high-performance plastic industry worldwide.

3D Printing High-Performance Plastic Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Integrating 3D-printed PEEK and titanium aluminide components in GE9X jet engines for Boeing 777X aircraft, including fuel nozzles, turbine blades, and heat exchangers. The GE9X engine incorporates over 300 3D-printed parts consolidating hundreds of traditional components into just seven additive manufactured parts. | 12% improvement in fuel efficiency, 10% reduction in operating costs, 25% lighter weight compared to traditionally manufactured parts, 5x longer lifetime for fuel nozzles, and USD 1.6 million annual fuel savings per engine. |

|

Utilizing 3D-printed ULTEM 9085 resin components for A350 XWB aircraft interior and structural parts, including wall panels, cabinet doors, overhead compartments, and lightweight brackets. Over 1,000 3D-printed plastic parts are currently used in serial A350 production, with consolidation of 30+ fuel system components into single lightweight assemblies . | 55% weight reduction compared to traditionally manufactured parts, 75% weight savings in fuel system components, improved fuel efficiency through lightweighting, and 90% material waste reduction. |

|

Developing patient-specific 3D-printed PEEK cranial implants using 3D Systems' EXT 220 MED printer and Evonik VESTAKEEP i4 3DF PEEK material for cranioplasty procedures. The VSP PEEK Cranial Implant system provides complete FDA-cleared workflow for neurosurgery applications with nearly 40 successful procedures completed across Europe . | Enhanced osteointegration with bone-like mechanics, 115 MPa yield strength exceeding cranial bone (100 MPa), precise "drop-in" fit reducing surgery time, 85% material waste reduction compared to traditional machining, radiolucency enabling clear post-operative imaging, and biocompatibility with no inflammatory response. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The 3D printing high performance plastics market ecosystem consists of raw material supplier (Hexcel Corporation, Cytec), 3D printing high performance plastics suppliers (Arkema, Syensqo), distributor (3D Chimera, Augment 3Di)), and end users (Stratasys, Materialse, ExOne). The raw material suppliers provide fibers, resins, and additives to 3D printing high performance plastics manufacturers. The distributors and suppliers establish contact between the manufacturing companies and end users to streamline the supply chain, increasing operational efficiency and profitability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

3D Printing High Performance Plastics Market, By Type

Polyether ether ketone (PEEK) and Polyether ketone ketone (PEKK) will account for the largest market share in 2030, as the demand is rapidly increasing due to several factors. PEEK & PEKK exhibit exceptional chemical resistance, mechanical strength, high temperature tolerance, and durability, making them ideal for demanding applications in medical & healthcare, aerospace & defense, and transportation. Their capability to function under severe conditions (like high temperatures and harsh chemicals) distinguishes them from common polymers. Both of these materials are biocompatible and radiolucent, important for medical devices and implants. PEEK, for instance, is common in orthopedic and spinal implants as a non-metallic, lightweight option, and is well established in medicine as being compatible with the human body.

3D Printing High Performance Plastics Market, By Form

Filaments and pellets continue to hold substantial market share in the high-performance plastics for 3D printing market segment due to their versatility, reliability of the process and compatibility within FDM and extrusion-based processes. Filaments and pellets deliver reproducible mechanical and thermal performance, can accommodate complex and functional geometries, and drive down the amount of waste associated with other forms of materials. Advanced polymers such as PEEK, PEKK, PPSU, and ULTEM, have increased the availability of filaments and pellets, enabling manufacturers to produce prototypes and end-use components that meet the demanding requirements for many industries. In addition to these benefits, filaments and pellets are easy to store, transport, and to feed into printers. The ability to produce low-to-medium runs of parts at a low cost, makes filaments and pellets an easy choice among many industries such as aerospace, automotive, medical, and defence. Lastly, the ability of filaments and pellets to accommodate emerging developments in 3D printing including multi-material and high-temperature printing, continues to reinforce filaments and pellets as the most suitable and practical form of material in the market.

3D Printing High Performance Plastics Market, By Technology

FDM (Fused Deposition Modeling) and FFM (Fused Filament Fabrication) are the leading technology segment in the high-performance plastics 3D printing market. They represent a proven, low-cost, and scalable way to produce complex parts with high mechanical strength and thermal resistance. They can be compatible with advanced polymers such as PEEK, PEKK, PPSU, and ULTEM (as suggested by more recent applications of these polymers), which means manufacturers can produce functional prototypes, and end-use components in accordance with a strict level of industry standards. These technologies also provide design freedom, fast iteration, and low waste, allowing ease of use in the aerospace, automotive, defense, and medical markets, which often demand precision and performance. Their increasing popularity can be described as ease of operation of the machinery, filament and pellet (available feedstock), printers continually advancing the hardware and software of the machine, all which work to improve print quality, build time, and reliability of parts.

3D Printing High Performance Plastics Market, By Application

Prototyping will continue to dominate the high-performance plastics 3D printing market because it facilitates rapid production of complex, functional parts that closely resemble the final product, in a functional and durable manner. This practice speeds up product development cycles while greatly minimizing the costs associated with design errors, and allows for continual design improvements without the financial commitment of scaling and implementing full production. The value of proven prototypes is one that is heightened in sectors such as aerospace, automotive and healthcare especially when accuracy and reliability are absolutely necessary, and rapid innovation must be maintained as a place to compete. The ability to simulate real-world performance and make updates to the design early in the process is a systems role that makes prototyping the primary application of growth in the 3D printing market today.

3D Printing High Performance Plastics Market, By End-use Industry

The medical and healthcare industry is a key driver of growth in the 3D printing high-performance plastics market. As one of the most innovation-driven sectors, healthcare continuously adopts advanced materials and technologies to address complex clinical needs. High-performance polymers such as PEEK, PEKK, and PPSU are increasingly utilized due to their excellent biocompatibility, chemical resistance, dimensional stability, and creep resistance. These properties make them ideally suited for the fabrication of medical devices, surgical instruments, custom prosthetics and implants, as well as tissue engineering scaffolds. Following the healthcare sector, the aerospace and defense industry is also anticipated to exhibit significant growth, driven by the integration of 3D-printed high-performance components in aircraft systems. These materials offer weight reduction, design flexibility, and resistance to extreme operating environments key advantages for both commercial and defense aerospace applications.

REGION

North America to be fastest-growing region in global 3D printing high performance plastics market during forecast period

The North America region is projected to dominate the 3D printing high performance plastic market during the forecast period due to presence of significant 3D printing high performance plastic manufacturers like Nano Dimensions (Markforged), Oxford Performance Materials, Impossible Objects, and Evonik Industries which are driving the demand of 3D printing high performance plastic in various end-use industries such as medical & healthcare and aerospace & defense. These companies have tried to expand their operations and garner stronger market shares through organic and inorganic strategies like product launches, collaborations, partnerships, and acquisitions. Due to changing consumer preferences and a growing shift toward sustainability, manufacturers are engaged in the production of sustainable products. For instance, Evonik introduced the world’s first PA12 powder for 3D printing based on bio-circular raw material. North America leads in research & development, with significant investments in innovation and manufacturing proficiency. The integration of generative design tools and artificial intelligence further enhanced the infrastructure in North America, fostering the expansion of key industries using 3D-printed high-performance plastics.

3D Printing High-Performance Plastic Market: COMPANY EVALUATION MATRIX

In the 3D Printing High Performance Plastics market matrix, Syensqo (Star) leads with a strong market share and extensive product footprint, driven by its collaborations and partnerships with end-users. Nano Dimensions (Emerging Leader) is gaining visibility with its specialized high performance plastics and tailored solutions for particular applications, strengthening its position through innovation and niche product offerings. While Syensqo dominates through scale and a diverse portfolio, Nano Dimension shows significant potential to move toward the leaders’ quadrant as demand for 3D Printing High Performance Plastics continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.15 Billion |

| Market Forecast in 2030 (value) | USD 0.45 Billion |

| Growth Rate | CAGR of 20.4% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Tons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: 3D Printing High-Performance Plastic Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| 3D printing high performance plastics manufacturer |

|

|

| High Performance Polymer Parts Manufacturers |

|

|

| Industrial 3D Printer OEMs |

|

|

| End -user |

|

|

RECENT DEVELOPMENTS

- May 2025 : Evonik Industries partnered with 3DChimera for the distribution of Evonik’s 3D printing PA12 powders in the US. The agreement covers a select range of Evonik’s high-quality INFINAM powders, including variants that feature high flexibility, high temperature resistance, high stiffness, and a special carbon-black embedded powder.

- June 2024 : Nano Dimensions (Markforged) launched Vega, an ultra high-performance filament designed for 3D printing aerospace components on the FX20 printer. Vega offers exceptional strength but also is expected to bring customers substantial advantages in weight reduction, cost efficiency, and lead time savings.

- September 2023 : Evonik and Lehvoss entered a strategic partnership for industrial 3D printing under which Lehvoss developed new LUVOSINT formulations based on Evonik’s PA613 polymer chemistry.

Table of Contents

Methodology

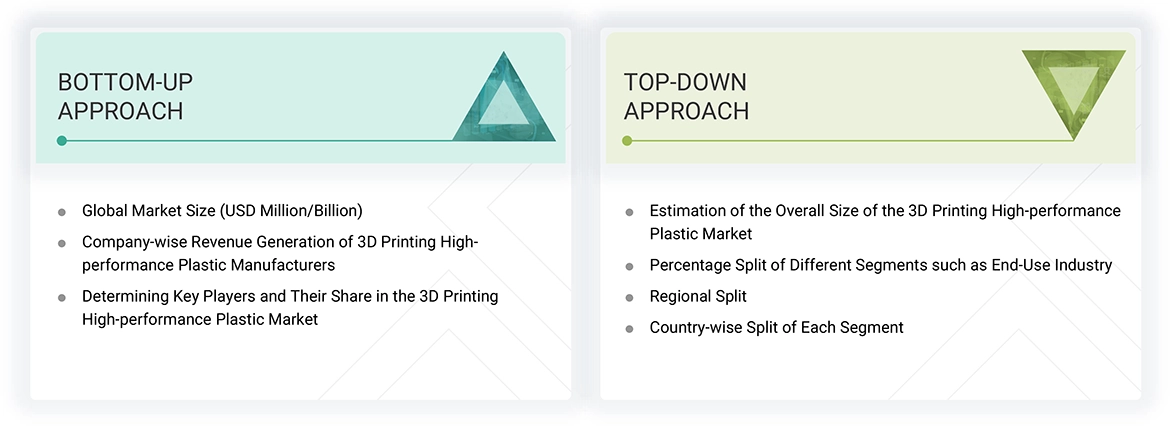

The study involves two major activities in estimating the current market size for the 3D printing high-performance plastic market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering 3D printing high-performance plastic and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the 3D printing high-performance plastic market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the 3D printing high-performance plastic market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as chief experience officers (CXOs), vice presidents (VPs), business development/marketing directors, product development/innovation teams, related key executives from the 3D printing high-performance plastic industry, system integrators, component providers, distributors, and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to product type, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customers/end users who are 3D printing services, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of 3D printing high performance plastic and future outlook of their business which will affect the overall market.

Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the 3D printing high-performance plastic market includes the following details. The market sizing was undertaken from the demand side. The market was upsized based on the demand for 3D printing high-performance plastic in different end-use industries at the regional level. Such procurements provide information on the demand aspects of the 3D printing high-performance plastic industry for each end-use industry. For each end-use industry, all possible segments of the 3D printing high-performance plastic market were integrated and mapped.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

3D printing is the process of producing three-dimensional (3D) objects from digital models using materials such as plastics and other engineered substances. This advanced manufacturing approach enables the creation of stronger, lighter, and more complex components, revolutionizing traditional industrial production.

Within this market, high-performance plastics refer to polymer materials that exhibit superior mechanical strength, purity, stiffness, and resistance to wear and chemicals compared to standard 3D printing materials like PLA and ABS. In addition to a broad spectrum of polymer types, the market includes an extensive array of polymer blends, glass—and carbon-fiber-reinforced polymers, and proprietary composite materials.

High-performance plastics are specifically designed to retain their mechanical, thermal, and chemical properties under extreme conditions—such as elevated temperatures, high pressure, or exposure to corrosive substances—without bending, warping, cracking, or splintering.

In recent years, additive manufacturing has seen significant growth in the use of high-performance polymers, defined as polymers with a heat deflection temperature exceeding 150°C. These materials offer enhanced thermal stability, chemical resistance, mechanical strength, and low density, making them superior to conventional 3D printing polymers such as ABS, PP, and PET.

Examples of 3D printing high-performance plastics include engineered nylons, Polyether ether ketone (PEEK), Polyether ketone ketone (PEKK), Polyetherimide (PEI), Reinforced plastics, Polyphenylsulfone (PPSU), Polyphenylene sulfide (PPS), Polyamide-imide (PAI), and Polyethersulfone (PES).

Advancements in fused deposition modeling (FDM/FFF) and selective laser sintering (SLS) have significantly expanded the feasibility of using these materials in 3D printing. These technologies allow for the production of intricate, high-performance parts, reshaping the manufacturing landscape across multiple sectors.

Key application areas include tooling, prototyping, and functional part production across industries such as medical & healthcare, aerospace & defense, transportation, oil & gas, and others. High-performance plastics for 3D printing are commercially available in filament, pellet, and powder forms, enabling flexibility across different additive manufacturing platforms.

Stakeholders

- 3d printing high-performance plastic manufacturers

- 3d printing high-performance plastic distributors and suppliers

- Universities, governments, and research organizations

- Associations and industrial bodies

- R&D institutes

- Environmental support agencies

- Investment banks and private equity firms

- Research and consulting firms

Report Objectives

- To define, describe, and forecast the 3D printing high-performance plastic market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing the market growth

- To analyze and project the global 3D printing high-performance plastic market by product type, end-use industry, and region

- To forecast the market size concerning five main regions (along with country-level data): North America, Europe, Asia Pacific, the Middle East & Africa, and South America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and product developments/product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Who are the major companies in the 3D printing high-performance plastic market? What key strategies have market players adopted to strengthen their market presence?

Major companies include Evonik Industries, Arkema, Lehmann&Voss&Co., Nano Dimensions, Oxford Performance Materials, EOS GmbH, Solvay, SABIC, Forward AM Technologies GmbH, Impossible Objects, Apium Additive Technologies GmbH, Ensigner, Victrex Plc, Mitsubishi Chemical Corporation, and Toray Industries. Key strategies adopted include product launches, acquisitions, and expansions.

What are the drivers and opportunities for the 3D printing high-performance plastic market?

Key drivers include increasing demand from medical & healthcare and aerospace & defense sectors for lightweight and durable materials. Opportunities lie in the development of sustainable and biocompatible materials.

Which region is expected to hold the largest market share?

North America is projected to hold the largest market share, driven by demand from aerospace & defense, transportation, and oil & gas sectors.

What is the projected growth rate of the 3D printing high-performance plastic market over the next five years?

The market is projected to grow at a CAGR of 20.4% over the next five years (in terms of value).

How is the 3D printing high-performance plastic market aligned for future growth?

The market is aligned for strong future growth due to rising demand for high-performance, lightweight, and durable plastics across diverse industries.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the 3D Printing High-Performance Plastic Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in 3D Printing High-Performance Plastic Market