High Performance Medical Plastics Market by Type (FP, HPPA, PAEK, PPS, PEI), Application (Medical Supplies, Medical Equipment & Tools, Drug Delivery, Prosthesis & Implants, Therapeutic System), Region - Global Forecast to 2026

Updated on : September 03, 2025

High Performance Medical Plastics Market

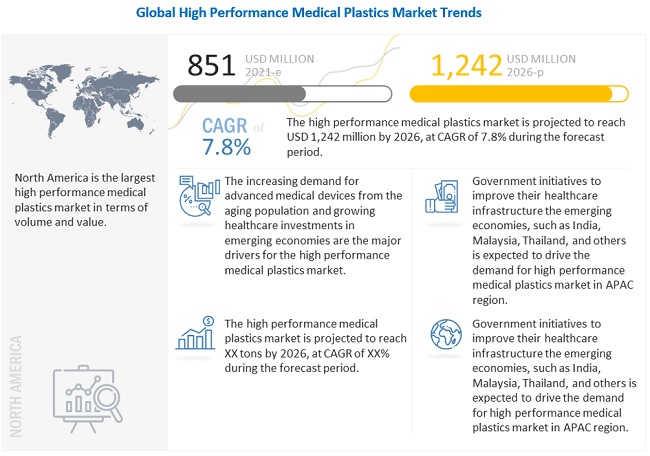

The high performance medical plastics market was valued at USD 851 million in 2021 and is projected to reach USD 1,242 million by 2026, growing at 7.8% cagr from 2021 to 2026. The major drivers for the high performance medical plastics market include demand for advanced medical devices from the aging population and growing healthcare investments in emerging economies such as China and India.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global High Performance Medical Plastics Market

The latest forecasts by multiple sources predict a 4% decrease in the global GDP in 2020 and a slow recovery, making the recession caused by this pandemic worse than the 2009 global recession. Based on these forecasts, the global economy is expected to recover by 2021; but for some countries, including the US, Germany, Canada, Japan, India, Argentina, and South Korea, recovery is predicted to take longer. The medical industry, in general, has bloomed in these pandemic situations due to medical emergencies all across the globe. But the businesses of some application segments of high performance plastics in the medical industry, such as dental, prosthesis, surgical instruments, among others, are adversely affected due to the lockdowns imposed during the COVID-19 pandemic period. This is expected to have a medium to high impact on the high performance medical plastics market in 2020.

In the medical industry, high performance plastics are used in various applications such as medical supplies, medical equipment & tools, surgical instruments, components of medical devices, prostheses, dental implants, orthopedic implants, and drug delivery systems, among others. The impact of the COVID-19 pandemic on these application segments will adversely impact the high performance medical plastics market.

Due to COVID-19, worldwide, various countries had enforced lockdowns and curfews to curb the rise in the number of positive COVID-19 cases. Due to these lockdowns, patients were not able to visit hospitals, OPDs, or clinics. Also, elective surgeries were being denied (canceled/postponed) to reserve or redirect the available limited capacities and resources (like hospital beds and patient care professionals) toward COVID-19 patient care. For example, on March 18, 2020, the US CMS recommended delaying adult elective surgeries and non-essential medical, surgical, and dental procedures to preserve PPE, beds, and ventilators for COVID-19 patients. Hence, the growth of some medical supplies, such as catheters which is a major consumer of high performance plastics, is expected to be negatively impacted due to delays in elective procedures, as these procedures require catheters.

High Performance Medical Plastics Market Dynamics

Driver: Shift toward minimally invasive medical procedures

Minimally invasive surgery or procedures refer to techniques that limit the size of incisions required or have a short recovery time. Traditional open surgeries required a considerable amount of time to heal and recover. Hence minimally invasive procedures are gaining acceptance. The increasing prevalence of diseases, such as arthritis, cancer, and cardiovascular diseases, which necessitate complex surgical treatments, has increased the demand for minimally invasive procedures that offer benefits such as low cost, quick recovery time, and lesser duration of hospital stays. This has boosted the consumption of high performance medical plastics, which are ideal for use in catheters and medical tubing used in minimally invasive medical procedures. High performance medical plastics promote cost efficiency through improved workability and less time consumption in the production of devices, equipment, and other products. For instance, cardiac and urinary catheterization, involving the use of small catheter tubing, reduces the time taken for the concerned medical or surgical procedure, and the use of plastics in their production makes it flexible, cost-effective, and easy to use.

Therefore, the growing demand for minimally invasive medical procedures and the need for increasing the efficiency of such procedures are playing an important role in driving the demand for high performance medical plastics.

Restraint: Time-consuming regulatory approval process

Government control over prices of medical devices, varied regulations, and time-consuming approval process are some of the restraining factors for the high performance medical plastixcs market. Governments control the cost of healthcare facilities to ensure that the facilities are available to all. This price pressure exists across all nodes of the value chain. As a result, medical device manufacturers and raw material suppliers need to control their costs. This reduces the profit margin of these players, along with restructuring their costs.

The global healthcare industry is highly regulated. Medical device approval authorities monitor device safety and performance in various methods and provide product clearance in different time periods. In the US, a device manufacturer receives a marketing clearance (510K) or an approval letter from the FDA. In the European Union, the manufacturer uses Conformité Européene (CE) mark on the device after receiving the CE certificate from the regulatory body. In Canada, a device license is awarded by the Therapeutic Products Directorate. In Australia, the Therapeutic Goods Administration issues an ARTG (Australian Register of Therapeutic Goods) number to devices after clearance. The approval process also varies according to the class of medical devices. In the case of plastics, the materials are considered medical-grade only when they are USP Class V and VI approved. In the US, the FDA Center for Devices and Radiological Health (CDRH) regulates devices, which are inserted into the body. FDA requires more than five months to approve a medical device.

The above-mentioned regulations require manufacturers of high-risk medical devices, such as intraocular lens implants and heart valves, to demonstrate and monitor safety and effectiveness before the devices are marketed. FDA is currently focusing on strengthening and improving the 510 (K) approval process. This has created uncertainty in the approval process. The regulations in European countries are more favorable and faster in response. This has led manufacturers to launch medical devices outside the US.

Opportunity: Development of patient-specific implants and 3D printed devices

Patient-specific technology has gained popularity in the last couple of years. Patient-specific technology or Patient-Specific Instrumentation (PSI) was introduced to attain customized devices such as implants, which gave the user greater accuracy and shortened rehabilitation time and overall costs. In PSI, information is gathered through inputs from surgeons, CT, or MRI scans, and then custom-made disposable cutting blocks are manufactured by specific software programs. The surgeon can adjust the alignment and depth preoperatively. The blocks, thus customized, are meant to fit accurately and are expected to achieve better alignment as compared to conventional jigs. These jigs are then used to manufacture custom implants.

3D printed devices are gaining greater acceptance by healthcare professionals owing to their customizability and low cost of production. The flexibility of 3D printing allows designers to make changes easily without the need to set up additional equipment or tools. It is mainly used to produce implants specific to the patient’s requirement. Medical devices and implants manufactured by 3D printing include orthopedic and cranial implants, surgical instruments, dental restorations such as crowns and external prosthetics.

Medical devices and implants manufactured through 3D printing are highly regulated. For instance, in the US, these devices and implants are regulated through FDA’s Center for Devices and Radiological Health (CDRH), Center for Biologics Evaluation and Research, and Center for Drug Evaluation and Research. Polymers such as PEEK, PEI, and others are being used for producing 3D-printed devices and implants. In the future, low-cost availability and customizability are expected to drive the demand for 3D printing in the healthcare industry, which, in turn, is likely to boost the high performance medical plastics market.

Challenge: Waste management concerns

Plastics contribute around 20–25% of the solid wastes generated by the medical industry. This includes disposable medical devices, recyclable supplies and equipment, syringes, gauzes, and surgical instruments. On the one hand, the shift toward the use of disposables has increased the use of plastics, but on the other, it is generating more plastic wastes. Some single-use devices can also be reused after reprocessing. However, the fear of inadequately decontaminated products causing infection leads to the disposal of these products.

Manufacturers have started recycling plastics, but its wastage is still a major challenge for the high performance medical plastics market. In comparison to other industries, the recycling of plastics is not common in the medical industry because of the toxic nature of medical waste products. These products need to be incinerated. Companies such as Becton, Dickinson and Company (BD), and GlaxoSmithKline (GSK) have started working on recycling plastics within the medical industry. BD recycles its medical devices to manufacture collection tubes and containers, while GSK recycles its disused inhalers. It is often possible to recycle several types of plastics together, such as low- and high-density PE and PP. But high performance plastics are processed differently and need to be recycled separately. However, in many cases, recycled plastic is not re-used because of the standards required in the industry. Various methods of medical waste treatment include incineration, autoclaving, microwaving, chemical treatment, and enzyme treatment.

In the future, various measures around medical waste treatment such as waste classification, proper waste separation, use of proper containers, proper documentation, color coding, and appropriate use of technology would help in proper disposal and hence sustain the healthcare industry.

To know about the assumptions considered for the study, download the pdf brochure

3D printing to drive the growth of the medical equipment & tools application segment in the high performance medical plastics market

By application, the medical equipment & tools segment accounted for the largest market share in 2020. Medical equipment & tools can be classified as diagnostic, surgical, and dental devices used in procedural and surgical applications, along with components used in the manufacturing of medical devices in the healthcare industry. The growing aging population, the emergence of new technologies related to surgery, the use of AI and big data, increasing demand for quality healthcare systems, and growing coverage of health insurance are driving the market for medical equipment & tools, thereby boosting the high performance medical plastics consumption.

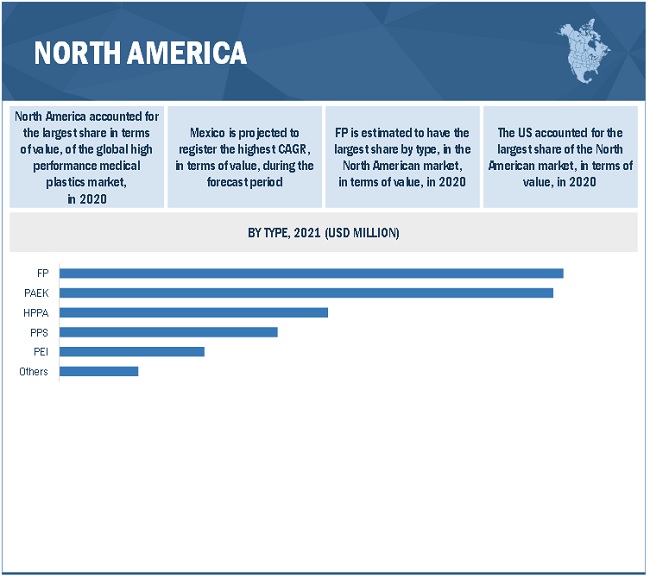

PTFE is the most widely used fluoropolymer (FP) in the high performance medical plastics market

By type, the FP segment accounted for the largest share of the high performance medical plastics market in 2020. PTFE, FEP, and PVDF are the widely used fluoropolymers in the medical industry. The large share of these plastics in the high performance medical plastics market can be attributed to their extensive use in medical supplies such as catheters, vascular grafts, reusable syringes, dialyzers, and surgical instruments, among others. These FPs have greater thermal stability and temperature resistance property and are, thus, widely used to manufacture parts for X-ray and Magnetic Resonance Imaging (MRI) devices as well.

US is the largest consumer of high performance medical plastics in the North American region

North America accounted for the largest share of the high performance medical plastics market in 2020. The high performance medical plastics market in the region is diversified and is strongly focused on the development of new products and advanced technology to cater to the needs of its end users. The demand for high performance medical plastics is primarily driven by the existing medical device manufacturers in the region, technological advancements in design and manufacturing, and product modernization in terms of quality and application development. Asia Pacific is projected to be the fastest-growing market for high performance medical plastics during the forecast period. The US is the largest high performance medical plastics market in North America. The US medical industry is well-known for producing high-quality electro-medical and electrotherapeutic apparatus using innovations in nanotechnology, material science, and imaging science. The demand for medical devices and their associated products is high in the country. Some of the major US medical device companies include Medtronic, GE Healthcare Technologies, Johnson & Johnson, Baxter, and Abbott Labs. The increasing demand for medical devices plays a key role in driving the high performance medical plastics market in North America.

High Performance Medical Plastics Market Players

Solvay SA (Belgium), SABIC (UAE), Mitsubishi Chemical Corporation (Japan), Evonik Industries AG (Germany), Arkema SA (France), Ensinger (Germany), Victrex PLC (UK), Rochling SE & Co. AG (Germany), Raumedic AG (Germany), The Chemours Company (US), DuPont (US), Saint-Gobain Performance Plastics (France), Celanese Corporation (US), Trelleborg (Sweden) and Tekni-Plex (US) are some of the leading players operating in the high performance medical plastics market.

High Performance Medical Plastics Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2019-2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021-2026 |

|

Forecast Units |

Value (USD million) and Volume (Ton) |

|

Segments Covered |

Type, Application, and Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies Covered |

Some of the leading players operating in the high performance medical plastics market include Solvay SA (Belgium), SABIC (UAE), Mitsubishi Chemical Corporation (Japan), Evonik Industries AG (Germany), Arkema SA (France), Ensinger (Germany), Victrex PLC (UK), Rochling SE & Co. AG (Germany), Raumedic AG (Germany), The Chemours Company (US), DuPont (US), Saint-Gobain Performance Plastic (France), Celanese Corporation (US), Trelleborg (Sweden), Tekni-Plex (US), Biomerics (US), RTP Company (US), Gujrat Fluorochemicals Ltd. (India), Drake Medical Plastic (US), Performance Plastic Ltd. (US), Bollinger Group(Austria), China Array Plastic (China), Extra Plastic Industry Co. Ltd. (Taiwan), Spectrum Plastic Group (Atlanta), and Stratasys (Israel). |

This research report categorizes the high performance medical plastics market based on type, application, and region.

High Performance Medical Plastics Market, By Type

- Fluoropolymers (FP)

- High Performance Polyamides (HPPA)

- Polyaryletherketones (PAEK)

- Polyphenylene Sulfides (PPS)

- Polyetherimide (PEI)

- Others (PAI, PFA, ETFE, and PEK)

High Performance Medical Plastics Market, By Application

- Medical Equipment & Tools

- Medical Supplies

- Drug Delivery

- Prosthesis & Implants

- Therapeutic System

- Others (Artificial Cornea, Chemical Tanks, Sterilizing Boxes, Secretion Bottles, And Surgical Theater Luminaries)

High performance medical plastics Market, By Region

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In February 2021, Arkema SA entered into a definitive agreement to invest in its Changshu Site, China. This investment is expected to increase the Kynar High Performance fluoropolymer production by 35% in 2022. The new investment is to cater to the demand for chemical tank liners and semiconductors used in the medical industry.

- In January 2021, Evonik Industries AG entered into a joint venture with Wynka Silicon Material Co. Ltd. (China) for the commencement of a new production facility for AEROSIL (silica manufacturing plant) which will enhance the global production network for fumed silica, a material used in making high performance polymers.

- In December 2020, Solvay SA entered into a partnership with PrinterPrezz (US) to develop 3D printing Selective Laser Sintering (SLS) solutions for implants and other medical devices using high performance polymers.

- In November 2020, Victrex PLC entered into an agreement with In2Bones Global Inc. USA, to commence a research, development, and manufacturing partnership that will share its PEEK-Ultima Ultra Reinforced Carbon Fiber Technology to In2Bones USA to produce medical equipment to cater the growing demand.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 HIGH PERFORMANCE MEDICAL PLASTICS MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.4 INCLUSIONS & EXCLUSIONS

TABLE 1 HIGH PERFORMANCE MEDICAL PLASTICS MARKET, BY TYPE: INCLUSIONS & EXCLUSIONS

TABLE 2 HIGH PERFORMANCE MEDICAL PLASTICS MARKET, BY APPLICATION: INCLUSIONS & EXCLUSIONS

1.4.1 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 1 HIGH PERFORMANCE MEDICAL PLASTICS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 BASE NUMBER CALCULATION

2.2.1 SUPPLY-SIDE APPROACH (VOLUME)

2.2.2 SUPPLY-SIDE APPROACH (VALUE)

2.2.3 DEMAND-SIDE APPROACH

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 2 HIGH PERFORMANCE MEDICAL PLASTICS MARKET: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 3 HIGH PERFORMANCE MEDICAL PLASTICS MARKET: TOP-DOWN APPROACH

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.4.1 SUPPLY SIDE

FIGURE 4 HISTORICAL GROWTH RATES OF COMPANIES IN THE HIGH PERFORMANCE MEDICAL PLASTICS MARKET

2.5 DATA TRIANGULATION

FIGURE 5 HIGH PERFORMANCE MEDICAL PLASTICS MARKET: DATA TRIANGULATION

2.5.1 HIGH PERFORMANCE MEDICAL PLASTICS MARKET ANALYSIS THROUGH PRIMARY INTERVIEWS

2.6 LIMITATIONS

2.7 ASSUMPTIONS

2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 6 MEDICAL EQUIPMENT& TOOLS SEGMENT IS THE LARGEST APPLICATION OF HIGH PERFORMANCE MEDICAL PLASTICS

FIGURE 7 FP SEGMENT IS THE LARGEST TYPE OF HIGH PERFORMANCE MEDICAL PLASTICS

FIGURE 8 APAC TO BE THE FASTEST-GROWING HIGH PERFORMANCE MEDICAL PLASTICS MARKET

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE OPPORTUNITIES IN THE HIGH PERFORMANCE MEDICAL PLASTICS MARKET

FIGURE 9 GROWING DEMAND IN EMERGING ECONOMIES TO DRIVE THE HIGH PERFORMANCE MEDICAL PLASTICS MARKET

4.2 HIGH PERFORMANCE MEDICAL PLASTICS MARKET, BY TYPE

FIGURE 10 PAEK TO BE THE LARGEST TYPE OF HIGH PERFORMANCE MEDICAL PLASTIC

4.3 HIGH PERFORMANCE MEDICAL PLASTICS MARKET, BY REGION

FIGURE 11 APAC TO BE FASTEST-GROWING MARKET BETWEEN 2021 AND 2026

4.4 HIGH PERFORMANCE MEDICAL PLASTICS MARKET IN NORTH AMERICA, BY COUNTRY AND TYPE

FIGURE 12 THE US ACCOUNTED FOR THE LARGEST SHARE IN NORTH AMERICA

4.5 HIGH PERFORMANCE MEDICAL PLASTICS MARKET, BY MAJOR COUNTRIES

FIGURE 13 INDIA TO REGISTER THE HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE HIGH PERFORMANCE MEDICAL PLASTICS MARKET

5.2.1 DRIVERS

5.2.1.1 Rising geriatric population demands advanced medical technologies and devices

TABLE 3 REGION-WISE TRENDS FOR GERIATRIC POPULATION

5.2.1.2 Growing healthcare investments in emerging economies

TABLE 4 HEALTHCARE EXPENDITURE AS A PERCENTAGE OF GDP

5.2.1.3 Shift toward minimally invasive medical procedures

5.2.2 RESTRAINTS

5.2.2.1 Time-consuming regulatory approval process

5.2.3 OPPORTUNITIES

5.2.3.1 R&D to develop advanced plastics

5.2.3.2 Development of patient-specific implants and 3D printed devices

5.2.4 CHALLENGES

5.2.4.1 Waste management concerns

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 15 HIGH PERFORMANCE MEDICAL PLASTICS MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 5 HIGH PERFORMANCE MEDICAL PLASTICS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

6 INDUSTRY TRENDS (Page No. - 58)

6.1 TARIFFS & REGULATIONS

6.1.1 TARIFFS

TABLE 6 NUMBER OF WTO MEMBERS PER AVERAGE MFN APPLIED TARIFF BAND AND AVERAGE MFN TARIFF

6.1.2 REGULATIONS

6.1.2.1 US

6.1.2.2 Europe

6.1.2.3 Country-wise regulations

TABLE 7 LEGAL FRAMEWORK AND REGULATORY AUTHORITIES FOR MEDICAL DEVICES IN MAJOR COUNTRIES

6.2 MACROECONOMIC ANALYSIS

TABLE 8 MACROECONOMIC ANALYSIS OF MAJOR COUNTRIES

6.3 CASE STUDY ANALYSIS

6.4 PRICING ANALYSIS

FIGURE 16 HIGH PERFORMANCE MEDICAL PLASTICS AVERAGE SELLING PRICE, BY REGION

TABLE 9 HIGH PERFORMANCE MEDICAL PLASTICS AVERAGE SELLING PRICE, BY REGION, 2019–2026 (USD/KG)

TABLE 10 NORTH AMERICA: HIGH PERFORMANCE MEDICAL PLASTICS AVERAGE SELLING PRICE, BY TYPE, 2019–2026 (USD/KG)

TABLE 11 EUROPE: HIGH PERFORMANCE MEDICAL PLASTICS AVERAGE SELLING PRICE, BY TYPE, 2019–2026 (USD/KG)

TABLE 12 APAC: HIGH PERFORMANCE MEDICAL PLASTICS AVERAGE SELLING PRICE, BY TYPE, 2019–2026 (USD/KG)

TABLE 13 MIDDLE EAST & AFRICA: HIGH PERFORMANCE MEDICAL PLASTICS AVERAGE SELLING PRICE, BY TYPE, 2019–2026 (USD/KG)

TABLE 14 SOUTH AMERICA: HIGH PERFORMANCE MEDICAL PLASTICS AVERAGE SELLING PRICE, BY TYPE, 2019–2026 (USD/KG)

6.5 TECHNOLOGY ANALYSIS

6.6 VALUE CHAIN ANALYSIS

FIGURE 17 VALUE CHAIN ANALYSIS FOR HIGH PERFORMANCE MEDICAL PLASTICS

6.6.1 RAW MATERIAL SUPPLIERS

6.6.2 RESIN MANUFACTURERS

6.6.3 DISTRIBUTORS/CONVERTORS

6.6.4 OEM/MEDICAL DEVICE MANUFACTURERS

6.7 IMPACT OF COVID-19 ON HIGH PERFORMANCE MEDICAL PLASTICS MARKET

6.7.1 COVID-19

6.7.2 COVID-19 HEALTH ASSESSMENT

FIGURE 18 COUNTRY-WISE SPREAD OF COVID-19

FIGURE 19 IMPACT OF COVID-19 ON DIFFERENT COUNTRIES IN 2020 (Q4)

FIGURE 20 THREE SCENARIO-BASED ANALYSES OF COVID-19 IMPACT ON THE GLOBAL ECONOMY

6.7.3 IMPACT ON HIGH PERFORMANCE MEDICAL PLASTICS MARKET

6.8 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

FIGURE 21 YC-YCC SHIFT FOR HIGH PERFORMANCE MEDICAL PLASTICS MARKET

6.9 ECOSYSTEM/MARKET MAP OF HIGH PERFORMANCE MEDICAL PLASTICS

FIGURE 22 ECOSYSTEM/MARKET MAP OF HIGH PERFORMANCE MEDICAL PLASTICS

TABLE 15 HIGH PERFORMANCE MEDICAL PLASTICS MARKET: ECOSYSTEM

6.10 PATENT ANALYSIS

6.10.1 INTRODUCTION

FIGURE 23 PUBLICATION TRENDS (2012-2020)

6.10.2 INSIGHTS

FIGURE 24 TREND ANALYSIS AND GRAPHICAL REPRESENTATION

6.10.3 TOP ASSIGNEES

7 HIGH PERFORMANCE MEDICAL PLASTICS MARKET, BY TYPE (Page No. - 79)

7.1 INTRODUCTION

FIGURE 25 PAEK TO DOMINATE THE HIGH PERFORMANCE MEDICAL PLASTICS MARKET IN TERMS OF VALUE

TABLE 16 HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2019–2026 (TON)

TABLE 17 HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

7.2 FP

7.2.1 PTFE IS THE MOST WIDELY USED FLUOROPOLYMER

7.2.2 PTFE

7.2.3 FEP

7.2.4 PVDF

TABLE 18 FP: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY REGION, 2019–2026 (TON)

TABLE 19 FP: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.3 HPPA

7.3.1 HPPA ACCOUNTS FOR THE SECOND-LARGEST MARKET SHARE

7.3.2 PA 11

7.3.3 PA 12

7.3.4 PPA

TABLE 20 HPPA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY REGION, 2019–2026 (TON)

TABLE 21 HPPA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.4 PPS

7.4.1 MAINLY USED IN STERILIZATION APPLICATIONS

7.4.2 PPSU

7.4.3 PES

7.4.4 PSU

TABLE 22 PPS: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY REGION, 2019–2026 (TON)

TABLE 23 PPS: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.5 PAEK

7.5.1 HIGHEST UNIT PRICE COMPARED TO OTHER HIGH PERFORMANCE MEDICAL PLASTICS

7.5.2 PEEK

7.5.3 PEKK

TABLE 24 PAEK: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY REGION, 2019–2026 (TON)

TABLE 25 PAEK: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.6 PEI

7.6.1 SECOND-FASTEST-GROWING HIGH PERFORMANCE MEDICAL PLASTIC

TABLE 26 PEI: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY REGION, 2019–2026 (TON)

TABLE 27 PEI: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.7 OTHERS

TABLE 28 OTHERS: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY REGION, 2019–2026 (TON)

TABLE 29 OTHERS: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8 HIGH PERFORMANCE MEDICAL PLASTICS MARKET, BY APPLICATION (Page No. - 91)

8.1 INTRODUCTION

FIGURE 26 MEDICAL EQUIPMENT & TOOLS TO DOMINATE THE HIGH PERFORMANCE MEDICAL PLASTICS MARKET

TABLE 30 HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

8.2 MEDICAL SUPPLIES

8.2.1 EXTENSIVE USE OF HIGH PERFORMANCE MEDICAL PLASTICS IN CATHETERS

TABLE 31 MEDICAL SUPPLIES: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY REGION, 2019–2026 (TON)

8.3 MEDICAL EQUIPMENT & TOOLS

8.3.1 3D PRINTING TO DRIVE THE MARKET GROWTH

8.3.2 SURGICAL INSTRUMENTS

8.3.3 DENTAL TOOLS

8.3.4 DEVICE COMPONENTS

TABLE 32 MEDICAL EQUIPMENT & TOOLS: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY REGION, 2019–2026 (TON)

8.4 PROSTHESIS & IMPLANTS

8.4.1 FASTEST-GROWING APPLICATION SEGMENT

8.4.2 LIMB PROSTHETICS

8.4.3 IMPLANTS

TABLE 33 PROSTHESIS & IMPLANTS: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY REGION, 2019–2026 (TON)

8.5 DRUG DELIVERY

8.5.1 RISING DEMAND FOR INNOVATIVE DRUGS TO DRIVE THE GROWTH OF THE SEGMENT

TABLE 34 DRUG DELIVERY: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY REGION, 2019–2026 (TON)

8.6 THERAPEUTIC SYSTEM

8.6.1 SECOND-FASTEST-GROWING APPLICATION SEGMENT

TABLE 35 THERAPEUTIC SYSTEM: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY REGION, 2019–2026 (TON)

8.6.2 OTHERS

TABLE 36 OTHERS: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY REGION, 2019–2026 (TON)

9 HIGH PERFORMANCE MEDICAL PLASTICS MARKET, BY REGION (Page No. - 98)

9.1 INTRODUCTION

FIGURE 27 HIGH PERFORMANCE MEDICAL PLASTICS MARKET IN INDIA TO REGISTER THE HIGHEST CAGR

TABLE 37 HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY REGION, 2019–2026 (TON)

TABLE 38 HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 28 NORTH AMERICA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SNAPSHOT

TABLE 39 NORTH AMERICA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY COUNTRY, 2019–2026 (TON)

TABLE 40 NORTH AMERICA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 41 NORTH AMERICA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 42 NORTH AMERICA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (TON)

TABLE 43 NORTH AMERICA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

9.2.1 US

9.2.1.1 The country’s advanced medical technology industry is the major driver for the market

TABLE 44 US: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (TON)

TABLE 45 US: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

9.2.2 CANADA

9.2.2.1 The high performance medical plastics market in the country is highly regulated

TABLE 46 CANADA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (TON)

TABLE 47 CANADA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

9.2.3 MEXICO

9.2.3.1 The country is one of the most prominent medical device markets in the region

TABLE 48 MEXICO: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (TON)

TABLE 49 MEXICO: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

9.3 APAC

FIGURE 29 APAC: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SNAPSHOT

TABLE 50 APAC: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY COUNTRY, 2019–2026 (TON)

TABLE 51 APAC: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 52 APAC: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 53 APAC: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (TON)

TABLE 54 APAC: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

9.3.1 CHINA

9.3.1.1 The country attracts international investments in medical device manufacturing units

TABLE 55 CHINA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (TON)

TABLE 56 CHINA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

9.3.2 JAPAN

9.3.2.1 The implementation of AI and big data technologies in the healthcare industry is favorable for the market

TABLE 57 JAPAN: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (TON)

TABLE 58 JAPAN: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

9.3.3 SOUTH KOREA

9.3.3.1 There has been increased domestic manufacturing of smart medical devices in the country

TABLE 59 SOUTH KOREA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (TON)

TABLE 60 SOUTH KOREA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

9.3.4 INDIA

9.3.4.1 Government initiatives for the healthcare sector to boost the demand

TABLE 61 INDIA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (TON)

TABLE 62 INDIA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

9.3.5 REST OF APAC

TABLE 63 REST OF APAC: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (TON)

TABLE 64 REST OF APAC: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

9.4 EUROPE

FIGURE 30 EUROPE: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SNAPSHOT

TABLE 65 EUROPE: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY COUNTRY, 2019–2026 (TON)

TABLE 66 EUROPE: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 67 EUROPE: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

TABLE 68 EUROPE: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (TON)

TABLE 69 EUROPE: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

9.4.1 GERMANY

9.4.1.1 The country is the largest market for dental equipment in Europe

TABLE 70 GERMANY: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (TON)

TABLE 71 GERMANY: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

9.4.2 FRANCE

9.4.2.1 Non-invasive surgery and orthopedics segments offer opportunities for medical device manufacturers

TABLE 72 FRANCE: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (TON)

TABLE 73 FRANCE: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

9.4.3 UK

9.4.3.1 The highly-regulated healthcare industry and strong medical devices market are the driving factors for the market

TABLE 74 UK: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (TON)

TABLE 75 UK: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

9.4.4 ITALY

9.4.4.1 Italy has an established healthcare industry

TABLE 76 ITALY: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (TON)

TABLE 77 ITALY: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

9.4.5 SPAIN

9.4.5.1 Public hospitals, health centers, and research institutions are the major consumers of medical devices in the country

TABLE 78 SPAIN: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (TON)

TABLE 79 SPAIN: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

9.4.6 NETHERLANDS

9.4.6.1 The country is witnessing extensive R&D on medical instrumentation

TABLE 80 NETHERLANDS: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (TON)

TABLE 81 NETHERLANDS: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

9.4.7 REST OF EUROPE

TABLE 82 REST OF EUROPE: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (TON)

TABLE 83 REST OF EUROPE: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

9.5 MIDDLE EAST & AFRICA

TABLE 84 MIDDLE EAST & AFRICA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY COUNTRY, 2019–2026 (TON)

TABLE 85 MIDDLE EAST & AFRICA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 86 MIDDLE EAST & AFRICA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 87 MIDDLE EAST & AFRICA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (TON)

TABLE 88 MIDDLE EAST & AFRICA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

9.5.1 SAUDI ARABIA

9.5.1.1 Initiatives, such as NTP and Vision 2030, are expected to drive the market in Saudi Arabia

TABLE 89 SAUDI ARABIA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (TON)

TABLE 90 SAUDI ARABIA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

9.5.2 UAE

9.5.2.1 The Dubai Industrial Strategy (DIS) 2030 is expected to create opportunities for the market

TABLE 91 UAE: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (TON)

TABLE 92 UAE: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

9.5.3 SOUTH AFRICA

9.5.3.1 The high performance medical plastics market to grow due to the launch of government schemes

TABLE 93 SOUTH AFRICA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (TON)

TABLE 94 SOUTH AFRICA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

9.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 95 REST OF MIDDLE EAST & AFRICA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (TON)

TABLE 96 REST OF MIDDLE EAST & AFRICA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

9.6 SOUTH AMERICA

TABLE 97 SOUTH AMERICA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY COUNTRY, 2019–2026 (TON)

TABLE 98 SOUTH AMERICA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 99 SOUTH AMERICA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 100 SOUTH AMERICA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (TON)

TABLE 101 SOUTH AMERICA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

9.6.1 BRAZIL

9.6.1.1 Brazil has a strong healthcare demographic growth

TABLE 102 BRAZIL: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (TON)

TABLE 103 BRAZIL: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

9.6.2 ARGENTINA

9.6.2.1 The country is an important location for medical tourism

TABLE 104 ARGENTINA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (TON)

TABLE 105 ARGENTINA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

9.6.3 REST OF SOUTH AMERICA

TABLE 106 REST OF SOUTH AMERICA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (TON)

TABLE 107 REST OF SOUTH AMERICA: HIGH PERFORMANCE MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 141)

10.1 INTRODUCTION

FIGURE 31 COMPANIES ADOPTED PRODUCT LAUNCH AS THE KEY GROWTH STRATEGY BETWEEN 2019 AND 2021

10.2 REVENUE ANALYSIS FOR TOP FIVE COMPANIES

FIGURE 32 REVENUE ANALYSIS OF TOP FIVE PLAYERS IN THE HIGH PERFORMANCE MEDICAL PLASTICS MARKET FROM 2016 TO 2020

10.3 MARKET SHARE ANALYSIS, 2020

FIGURE 33 MARKET SHARE ANALYSIS OF KEY PLAYERS IN THE HIGH PERFORMANCE MEDICAL PLASTICS MARKET, 2020

TABLE 108 HIGH PERFORMANCE MEDICAL PLASTICS MARKET: DEGREE OF COMPETITION

10.4 COMPANY EVALUATION QUADRANT

10.4.1 STAR

10.4.2 PERVASIVE

10.4.3 EMERGING LEADER

10.4.4 PARTICIPANT

FIGURE 34 HIGH PERFORMANCE MEDICAL PLASTICS MARKET: COMPANY EVALUATION MATRIX 2020

10.4.5 HIGH PERFORMANCE MEDICAL PLASTICS MARKET

TABLE 109 COMPANY PRODUCT FOOTPRINT

TABLE 110 PRODUCT TYPE FOOTPRINT OF COMPANIES

TABLE 111 APPLICATION FOOTPRINT OF COMPANIES

TABLE 112 REGIONAL FOOTPRINT OF COMPANIES

10.5 STARTUP/SME EVALUATION QUADRANT, 2020

10.5.1 PROGRESSIVE COMPANY

10.5.2 RESPONSIVE COMPANY

10.5.3 DYNAMIC COMPANY

10.5.4 STARTING BLOCK

FIGURE 35 HIGH PERFORMANCE MEDICAL PLASTICS MARKET: STARTUP/SME EVALUATION QUADRANT, 2020

10.6 COMPETITIVE SCENARIO

FIGURE 36 HIGH PERFORMANCE MEDICAL PLASTICS MARKET EVALUATION FRAMEWORK OF KEY COMPANIES

10.6.1 DEALS

TABLE 113 HIGH PERFORMANCE MEDICAL PLASTICS MARKET: DEALS, JANUARY 2018-MARCH 2021

10.6.2 PRODUCT LAUNCHES

TABLE 114 PRODUCT LAUNCH, 2019-2021

10.6.3 OTHER DEVELOPMENTS

TABLE 115 OTHER DEVELOPMENTS, 2019-2021

11 COMPANY PROFILES (Page No. - 159)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 KEY PLAYERS

11.1.1 SOLVAY SA

TABLE 116 SOLVAY SA: COMPANY OVERVIEW

FIGURE 37 SOLVAY SA: COMPANY SNAPSHOT

11.1.2 SABIC

TABLE 117 SABIC: COMPANY OVERVIEW

FIGURE 38 SABIC: COMPANY SNAPSHOT

11.1.3 MITSUBISHI CHEMICAL HOLDINGS

TABLE 118 MITSUBISHI CHEMICAL HOLDINGS: COMPANY OVERVIEW

FIGURE 39 MITSUBISHI CHEMICAL HOLDINGS: COMPANY SNAPSHOT

11.1.4 EVONIK INDUSTRIES AG

TABLE 119 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

FIGURE 40 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

11.1.5 ARKEMA SA

TABLE 120 ARKEMA: COMPANY OVERVIEW

FIGURE 41 ARKEMA SA: COMPANY SNAPSHOT

11.1.6 CELANESE CORPORATION

TABLE 121 CELANESE CORPORATION: COMPANY OVERVIEW

FIGURE 42 CELANESE CORPORATION: COMPANY SNAPSHOT

11.1.7 ENSINGER

11.1.8 VICTREX PLC

TABLE 122 VICTREX PLC: COMPANY OVERVIEW

FIGURE 43 VICTREX PLC: COMPANY SNAPSHOT

11.1.9 ROCHLING SE & CO. KG

11.1.10 RAUMEDIC AG

11.1.11 THE CHEMOURS COMPANY

TABLE 123 THE CHEMOURS COMPANY: COMPANY OVERVIEW

FIGURE 44 THE CHEMOURS COMPANY: COMPANY SNAPSHOT

11.1.12 DUPONT

TABLE 124 DUPONT: COMPANY OVERVIEW

FIGURE 45 DUPONT: COMPANY SNAPSHOT

11.1.13 SAINT-GOBAIN PERFORMANCE PLASTICS

11.1.14 TRELLEBORG

FIGURE 46 TRELLEBORG: COMPANY SNAPSHOT

11.1.15 TEKNI-PLEX

11.2 OTHER COMPANIES

11.2.1 BIOMERICS

11.2.2 RTP COMPANY

11.2.3 GUJRAT FLUOROCHEMICALS LTD.

11.2.4 DRAKE MEDICAL PLASTICS

11.2.5 PERFORMANCE PLASTICS LTD

11.2.6 BOLLINGER GROUP

11.2.7 CHINA ARRAY PLASTICS

11.2.8 EXTRA PLASTIC CO. LTD.

11.2.9 SPECTRUM PLASTIC GROUP

11.2.10 STRATASYS

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 202)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

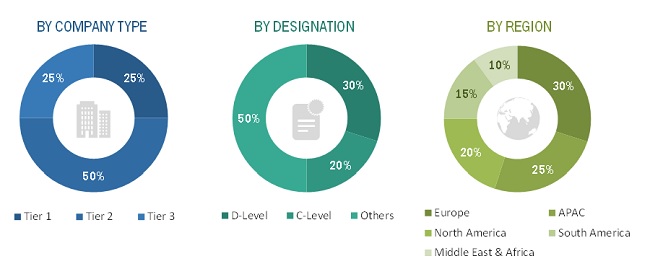

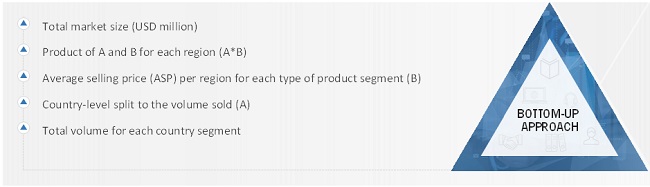

This study involved four major activities in estimating the current size of the high performance medical plastics market. Exhaustive secondary research was undertaken to collect information on the high performance medical plastics market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the high performance medical plastics value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the market. After that, the market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the high performance medical plastics market.

Secondary Research

As a part of the secondary research process, various secondary sources such as Hoovers, Bloomberg, BusinessWeek, Reuters, and Factiva were referred for identifying and collecting information for this study on the high performance medical plastics market. Secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, authenticated directories, and databases.

Secondary research was mainly conducted to obtain key information about the supply chain of the industry, the monetary chain of the market, the total pool of players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments undertaken from both, market- and technology oriented perspectives.

Primary Research

As a part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the high performance medical plastics market. Primary sources from the supply side included industry experts such as chief executive officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the high performance medical plastics market. Primary sources from the demand side included directors, marketing heads, and purchase managers from the medical industry. Following is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the high performance medical plastics market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The supply chain of the industry and the market size, in terms of value, and volume were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were used, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Objectives of the Report

- To define, describe, and forecast the size of the high performance medical plastics market based on type, application, and region

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To forecast the size of the various segments of the high performance medical plastics market based on five regions—North America, Asia Pacific, Europe, South America, and the Middle East & Africa —along with key countries in each of these regions

- To analyze the opportunities in the market for stakeholders and present a competitive landscape for the market leaders

- To analyze recent developments, such as mergers & acquisitions, investments, joint ventures, new product launches, and expansions, in the high performance medical plastics market

- To strategically profile the key players in the market and comprehensively analyze their core competencies*

Note: Core competencies of the companies are determined in terms of product offerings and business strategies adopted by them to sustain in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of companies with the given market data. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in High Performance Medical Plastics Market