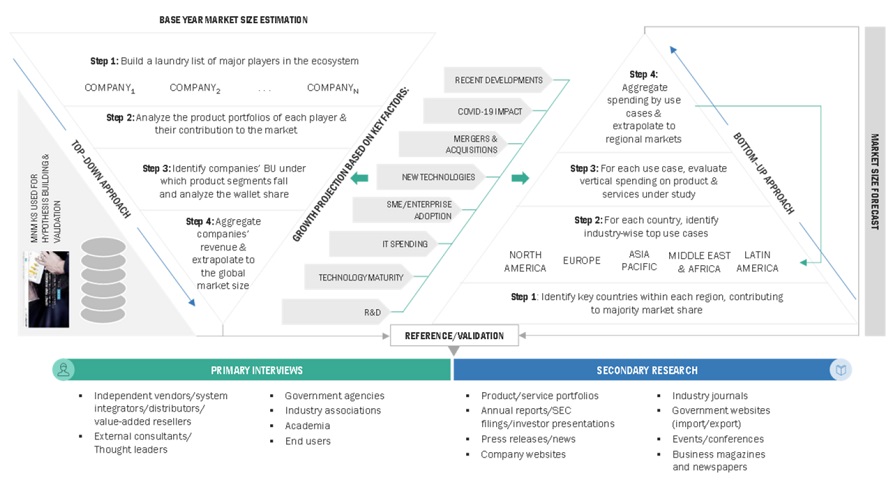

The study involved four major activities in estimating the 3d digital asset market. We conducted secondary research to gather information on the market, competitors, and parent market. The next stage was to validate these findings and assumptions and size them with industry professionals across the value chain using primary research. Top-down and bottom-up methodologies were used to determine the total market size. We used the market breakup and data triangulation techniques to estimate the market size of the different segments in the 3d digital asset market.

Secondary Research

Several sources were used to locate and collect information for this study during the secondary research process. Secondary sources included company annual reports, press announcements, investor presentations, white papers, journals, certified publications, and articles from well-known writers, directories, and databases. Data was also gathered from other secondary sources, such as journals, government websites, blogs, and vendor websites.

Primary Research

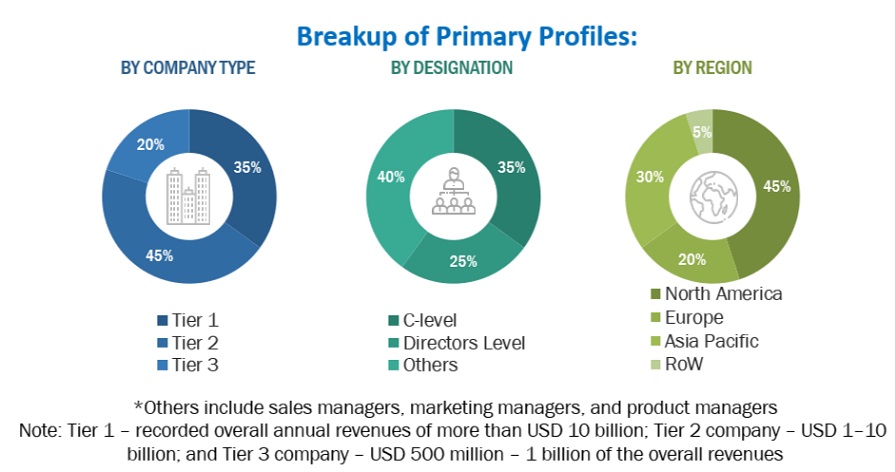

Primary sources included industry experts from the core and associated industries, preferred software suppliers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations representing all parts of the industry's value chain. In-depth interviews were conducted with primary respondents, including major industry participants, subject-matter experts, C-level executives of important market companies, and industry consultants, to acquire and verify critical qualitative and quantitative data and analyze the market's potential.

We performed primary interviews to gain insights such as market statistics, the current trends disrupting the industry, new use cases applied, revenue data collected from products and services, market breakdowns, market size projections, market predictions, and data triangulation. Primary research also helped me grasp different technology trends, segmentation types, industry trends, and geographies. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and Chief Security Officers (CSOs); installation teams of governments/end users using 3d digital asset solutions and services; and digital initiatives project teams, were interviewed to understand the buyer's perspective on suppliers, products, service providers, and their current use of services, which will affect the overall data center networking market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

We estimated and forecasted 3d digital asset and other related submarkets using top-down and bottom-up methodologies. We used a bottom-up approach to calculate the overall market size by analyzing the revenues and offerings of significant market players. This study used data triangulation methods and validation through primary interviews to determine and confirm the precise worth of the whole parent market. We used the overall market size in the top-down process to estimate the size of other particular markets using percentage splits of market segments.

We used top-down and bottom-up approaches to estimate and validate the 3d digital asset market and other dependent subsegments.

The research methodology used to estimate the market size included the following details:

-

We identified key players in the market through secondary research. We then determined their revenue contributions in the respective countries through primary and secondary research.

-

This procedure included studying top market players' annual and financial reports and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

-

All percentage splits and breakups were determined using secondary sources and verified through primary sources.

We estimated and forecasted 3d digital asset and other related submarkets using top-down and bottom-up methodologies. We used a bottom-up approach to calculate the overall market size by analyzing the revenues and offerings of significant market players. This study used data triangulation methods and validation through primary interviews to determine and confirm the precise worth of the whole parent market. We used the overall market size in the top-down process to estimate the size of other particular markets using percentage splits of market segments.

3d digital asset market: Top-down and Bottom-up approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After determining the overall market size, the market was divided into segments and subsegments using the previously described market size estimating techniques. Where applicable, data triangulation and market breakup methods were used to complete the whole market engineering process and ascertain the exact numbers for each market segment and subsegment. The data was triangulated by evaluating many elements and trends on the demand and supply sides of the 3d digital asset market.

Market Definition

"The creation, distribution, and monetization of three-dimensional digital content used in various industries such as entertainment, gaming, e-commerce, architecture, education, and manufacturing. This market includes 3D models, textures, materials, animations, and environments created using software like Maya and Photoshop and distributed through platforms like Unity Asset Store and Sketchfab. Key applications range from immersive experiences in VR and AR to product visualization in e-commerce and architectural visualizations."

Key Stakeholders

-

3D Artists and Designers

-

Software Developers

-

Marketplace Platforms

-

Game Developers

-

Film and Animation Studios

-

Virtual and Augmented Reality Companies

-

Architectural and Engineering Firms

-

Education and Training Providers

-

Manufacturers and Product Designers

-

Advertising and Marketing Agencies

Report Objectives

-

To define, describe, and forecast the global 3D Digital Asset market based on component, application, deployment mode, vertical, and region

-

To forecast the market size of the five major regional segments: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

-

To strategically analyze the market subsegments concerning individual growth trends, prospects, and contributions to the total market

-

To provide detailed information related to the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

-

To strategically analyze macro and micro markets concerning growth trends, prospects, and their contributions to the overall market

-

To analyze industry trends, patents and innovations, and pricing data related to the 3D Digital Asset market

-

To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for prominent players

-

To profile key players in the market and comprehensively analyze their market share/ranking and core competencies

-

To track and analyze competitive developments, such as mergers & acquisitions, product developments, and partnerships & collaborations in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company's specific needs. The following customization options are available for the report:

Product Analysis

-

The product matrix provides a detailed comparison of each company's product portfolio.

Geographic Analysis

-

Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

-

Further breakup of the North American market into countries contributing 75% to the regional market size

-

Further breakup of the Latin American market into countries contributing 75% to the regional market size

-

Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

-

Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in 3D Digital Asset Market