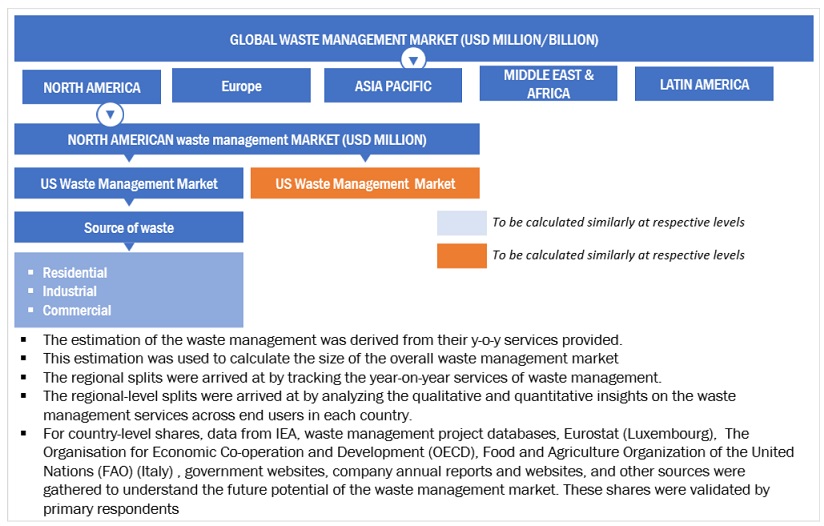

The study involved major activities in estimating the current size of the waste management market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the waste management market involved the use of extensive secondary sources, directories, and databases, such as Eurostat (Luxembourg), The Organisation for Economic Co-operation and Development (OECD) (France), The World Bank Group (US), Food and Agriculture Organization of the United Nations (FAO) (Italy), United Nations Environment Programme (UNEP), UNIDO United Nations Industrial Development Organization (Austria) to collect and identify information useful for a technical, market-oriented, and commercial study of the waste management market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

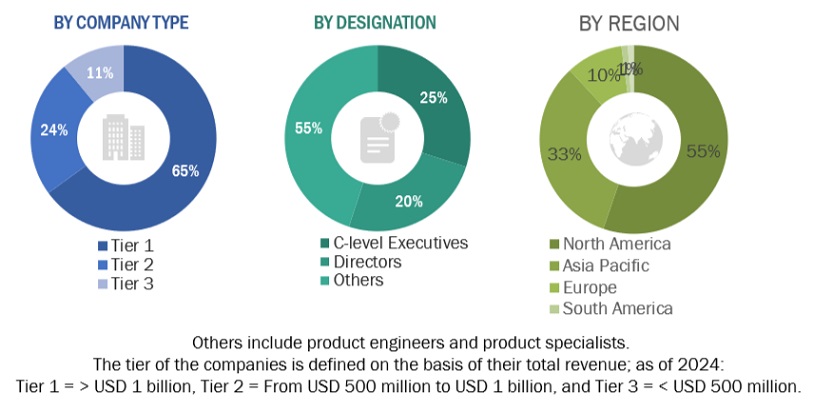

The waste management market comprises several stakeholders, such as waste management manufacturers, technology providers, and technical support providers in the supply chain. The demand side of this market is characterized by the rising demand for waste management in various sources such as residential, industrial, and commercial sectors. The supply side is characterized by rising demand for contracts from the industrial sector and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the waste management market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

-

The key players in the industry and market have been identified through extensive secondary research, and their market share has been determined through primary and secondary research.

-

The industry’s value chain and market size, in terms of value, have been determined through both primary and secondary research processes.

-

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Waste management Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Waste management Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the total market has been split into several segments and subsegments. Data triangulation and market breakdown processes have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

Waste management refers to the various schemes and strategies used to manage and dispose of different types of waste, including industrial, biological, household, municipal, organic, biomedical, and radioactive wastes. It encompasses processes such as waste collection, transport, treatment, and disposal, as well as monitoring and regulation of the waste management process and waste-related laws, technologies, and economic mechanisms. It involves the implementation of comprehensive strategies to efficiently manage waste, including methods such as recycling, composting, incineration, landfills, bioremediation, waste to energy, and waste minimization.

Key Stakeholders

-

Maintenance and other major service providers

-

Waste management component manufacturers

-

Government and research organizations

-

Institutional investors

-

National and local government organizations

-

Waste management equipment manufacturers

-

Waste management manufacturing companies

-

Technology standard organizations, forums, alliances, and associations

State and national regulatory authorities Objectives of the Study

-

To define, describe, segment, and forecast the size of the waste management market based on waste type, disposal method and by source in terms of value.

-

To describe and forecast the market for five key regions: Asia Pacific, North America, Europe, Latin America, and Middle East & Africa, along with their country-level market sizes in terms of value.

-

To forecast the waste management market by region, in terms of volume

-

To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing the growth of the market.

-

To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall market size.

-

To provide the supply chain analysis, trends/disruptions impacting the customer’s business, market map, pricing analysis, and regulatory analysis of the waste management market.

-

To analyze opportunities for stakeholders in the waste management market and draw a competitive landscape of the market.

-

To strategically analyze the ecosystem, tariffs and regulations, patent landscape, trade landscape, Porter’s five forces, and case studies pertaining to the market under study.

-

To benchmark market players using the company evaluation quadrant, which analyzes market players on broad categories of business and product strategies adopted by them.

-

To compare key market players with respect to product specifications and applications.

-

To strategically profile key players and comprehensively analyze their market rankings and core competencies.

-

To analyze competitive developments, such as contracts & agreements, investments & expansions, mergers & acquisitions, new product launches, partnerships, joint ventures & collaborations, in the waste management market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

-

Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

-

Detailed analyses and profiling of additional market players

Haris

Jun, 2022

Which are the most innovative companies in Waste Management Market?.

Zofia

May, 2022

I believe that this Waste Management Market has a more positive impact on the industry and high quality innovation. It is so nice to see PDF brochure of your report to enhance growth opportunities.Lets go green!.