Mining Waste Management Market by Mining Method (Surface, and Underground), Metals/Minerals (Thermal Coal, Coking Coal, Iron Ore, Gold, Copper, Nickel), Waste Type (Overburden/Waste Rock, Tailings, and Mine Water), and Region - Global Forecast to 2022

Mining Waste Management Market Size And Forecast

[267 Pages Report] The mining waste management market was valued at 165.22 Billion Tons in 2016 and is expected to reach 233.56 Billion Tons by 2022, at a CAGR of 6.1% from 2017 to 2022.

Years considered for this study on the mining waste management market are as follows:

- Base Year – 2016

- Estimated Year – 2017

- Projected Year – 2022

- Forecast Period – 2017 to 2022

- For company profiles in the report, 2016 has been considered as the base year. In certain cases, wherein information is unavailable for the base year, the years prior to it have been considered.

The objectives of this study are:

- To define, describe, and forecast the mining waste management market based on mining method, metals/minerals, waste type, and region

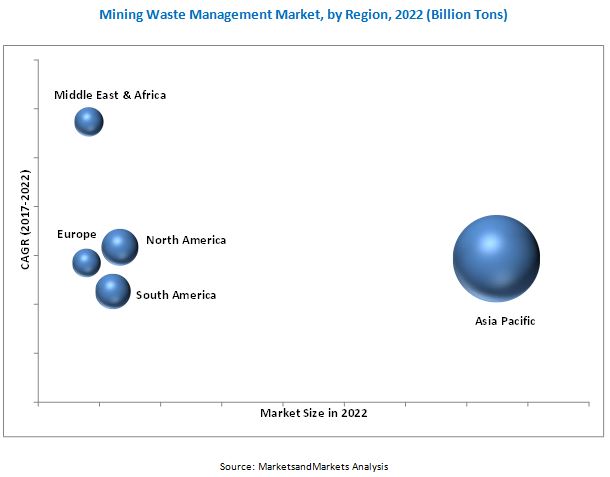

- To forecast the size of the mining waste management market, in terms of volume, in 5 main regions, namely, Asia Pacific, North America, Europe, South America, and the Middle East & Africa, along with their respective key countries

- To provide detailed information on key factors such as drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the mining waste management market

- To list different regulations related to mining and disposing of the mining waste across regions

- To analyze growth opportunities for different stakeholders in the mining waste management market

- To analyze competitive developments such as acquisitions, investments, expansions, partnerships, agreements, joint ventures, and new product launches in the mining waste management market

- To provide ranking of key companies operating in the mining waste management market for 2016

- To strategically profile key players in the mining waste management market and comprehensively analyze their core competencies

Research Methodology

The research methodology that has been used to estimate and forecast the mining waste management market began with obtaining data from secondary sources, such as Hoovers, Bloomberg, Chemical Weekly, Factiva, International Mining & Minerals Associations (IMM), International Council on Mining & Metals (ICMM), the American Exploration & Mining Association, the Global Mining Association of China, the American Exploration & Mining Association, the Australian Mining Association, the Australian Mines and Metal Association (AMMA), the China Mining Association, the United States Geological Survey (USGS), the British Geological Survey (BGS), and other government and private websites have been referred to identify and collect information useful for this technical, market-oriented, and commercial study on the mining waste management market.

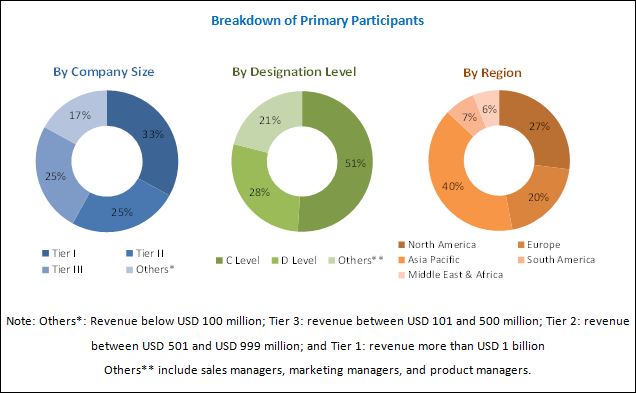

Mining waste management services offered by various companies have been taken into consideration to determine the size of the mining waste management market. After arriving at the overall market size, the total market has been split into several segments and subsegments, which have been later verified through primary research by conducting extensive interviews with key personnel such as chief executive officers (CEOs), vice presidents, directors, and executives of the leading companies in the mining companies and mining waste management service providing companies. Data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments of the market. The breakdown of profiles of primaries has been depicted in the figure below.

To know about the assumptions considered for the study, download the pdf brochure

The mining waste management market has a diversified ecosystem of upstream players, including mining waste management companies, environmental engineering companies, mine operators, mine equipment manufacturing companies, and government organizations. Companies operating in the mining waste management market are Amec Foster Wheeler (UK), Ausenco (Australia), EnviroServ (South Africa), Interwaste Holdings Ltd. (South Africa), Veolia Environnement (France), Golder Associates (Canada), Hatch Ltd. (Canada), Teck (Canada), Tetra Tech, Inc. (US), Toxfree Solutions Ltd. (Australia), Tetronics International (UK), Aevitas (Canada), Global Mining Solutions (Canada), Zeal Environmental Technologies Ltd. (Ghana), Ramboll Group (Denmark), Knight Piésold (South Africa), Metsana Group (South Africa), Earth Systems (Australia), American Waste Management Services, Inc. (US), ATC Williams (Australia), Jones & Wagener (South Africa), Cleanway Environmental Services (Australia), Cleanways (Australia), Stantec (US), Enviropacific Services (Australia), Daiseki Co., Ltd. (Japan), and Averda (UAE).

Target Audience

- Environmental Engineering Companies

- Mine Operators

- Mining Equipment Manufacturers

- Regulatory Bodies, Government Agencies, and Non-Governmental Organizations (NGOs)

- Research & Development (R&D) Institutions

- Financial Institutions

- Importers and Exporters of Mining Commodities

- End-use Industries

- Consulting Firms, Trade Associations, and Industry Bodies

- Investment Banks and Private Equity Firms

- Environment Support Agencies

- Investment Banks and Private Equity Firms

“This study answers several questions for stakeholders, primarily market segments, which they need to focus on during the next two to five years, so that they can prioritize their efforts and investments accordingly.”

Scope of the Report: This research report categorizes the mining waste management market based on mining method, metals/minerals, waste type, and region. It forecasts revenues as well as analyzes trends in each of the submarkets.

-

Mining Waste Management Market, by Mining Method:

- Surface

- Underground

-

Mining Waste Management Market, by Metals/Minerals:

- Thermal Coal

- Coking Coal

- Iron Ore

- Gold

- Copper

- Nickel

- Lead

- Zinc

- Bauxite

-

Mining Waste Management Market, by Waste Type:

- Overburden/Waste Rock

- Tailings

- Mine Water

-

Mining Waste Management Market, by Region:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

The following customization options are available for the report:

With the given market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report on the mining waste management market:

Mine wastes of other metals/minerals

- Estimation of mine wastes of platinum group metals, diamond, silver, and other non-ferrous metals and minerals

Mining waste analysis from specific mines

- Country level volume analysis of output generated by specific mines in each country

Mining Services

- Value analysis of mining wastes handling services offered in each country

The mining waste management market is estimated to be 173.64 Billion Tons in 2017 and is expected to reach 233.56 Billion Tons by 2022, at a CAGR of 6.1% from 2017 to 2022. The increasing demand for metal & minerals from the automotive industry, the development of various infrastructures, the growing global power & energy sector, and increasing environmental concerns are expected to drive the mining waste management market in the coming years.

Among mining methods, the surface mining method segment is projected to lead the mining waste management market during the forecast period. Surface mining is low cost, safe, and has a high exploration rate as compared to the underground mining method. Surface mining is widely adopted in the extraction of coal, iron, gold, nickel, zinc, and other metal and minerals. The growing use of these metals and minerals in various end-use industries will drive the surface mining activities across the globe. This, in turn, will fuel the growth of the mining waste management market.

Among metals/minerals, the thermal coal segment is projected to lead the mining waste management market from 2017 to 2022. Thermal coal is widely used in generating power and energy, and in cement production. The demand for power and energy is increasing due to rapid industrialization, urbanization, and growth of the transportation industry. The growing building & construction market is fueling the demand for cement, which is expected to drive the mining waste management market in the near future.

Based on waste type, the tailings segment of the mining waste management market is projected to grow at the highest CAGR during the forecast period. Tailings are water-based waste products left after the removal of gangue from ores during surface mining operations, and a large amount of tailings is generated during the production and exploration of thermal coal, iron ore, copper, coking coal, and other metal and minerals. The production and exploration of these metals and minerals are likely to create huge amounts of mining waste, which is expected to drive the mining waste management market in the coming years.

The Asia Pacific region is expected to lead the mining waste management market in 2017. China, Australia, Kazakhstan, and India are the key countries contributing a major share to the mining waste management market. The growing population, rapid industrialization, and improving economic conditions of these countries are expected to fuel the growth of various end-use industries, such as automotive, electrical & electronics, power & energy, and construction market in the region. There is a high demand for metals & minerals, and coal from these end-use industries. This factor is expected to propel the growth of the mining waste management market in the region.

Factors inhibiting the growth of the mining waste management market are acid rain drainage and operational challenges for managing the waste. Lack of skilled workforce is also hampering the growth of the mining waste management market. However, the growth of the mining waste management market can be attributed to the increasing demand for metal & minerals from various end-use industries, the growing power & utility sector, rising concerns over environment-related issues, and the introduction of advanced mining waste management technology.

Key players in the mining waste management market are Amec Foster Wheeler (UK), Ausenco (Australia), EnviroServ (South Africa), Interwaste Holdings Ltd. (South Africa), Veolia Environnement (France), Golder Associates (Canada), Hatch Ltd. (Canada), Teck (Canada), Tetra Tech, Inc. (US), Toxfree Solutions Ltd. (Australia), Tetronics International (UK), Aevitas (Canada), Global Mining Solutions (Canada), Zeal Environmental Technologies Ltd. (Ghana), Ramboll Group (Denmark), Knight Piésold (South Africa), Metsana Group (South Africa), Earth Systems (Australia), American Waste Management Services, Inc. (US), ATC Williams (Australia), Jones & Wagener (South Africa), Cleanway Environmental Services (Australia), Cleanways (Australia), Stantec (US), Enviropacific Services (Australia), Daiseki Co., Ltd. (Japan), and Averda (UAE).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Markets Scope

1.3.1 Years Considered for the Study

1.4 Units Considered

1.5 Limitations

1.6 Stakeholders

2 Research Methodology

2.1 Research Data

2.1.1 Key Data From Secondary Sources

2.1.2 Key Data From Primary Sources

2.1.2.1 Key Industry Insights

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Breakdown & Data Triangulation

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Research Assumptions

3 Executive Summary

4 Premium Insights

4.1 Attractive Growth Opportunities in the Mining Waste Management Market

4.2 Mining Waste Management Market, By Mineral/Metal

4.3 Mining Waste Management Market, By Waste Type and Region

4.4 Mining Waste Management Market: Emerging & Developed Countries

5 Market Overview

5.1 Introduction

5.1.1 Mining Methods

5.1.2 Waste Types

5.2 Market Dynamics

5.2.1 Drivers

5.2.2 Restraints

5.2.3 Opportunities

5.2.4 Challenges

5.3 Regulations

5.3.1 US

5.3.2 Canada

5.3.3 Mexico

5.3.4 India

5.3.5 China

5.3.6 Indonesia

5.3.7 Australia

5.3.8 Russia

5.3.9 European Union

5.3.10 South Africa

5.3.11 Argentina

5.4 Mining Disasters

6 Mining Waste Management Market, By Mining Method

6.1 Introduction

6.2 Surface Mining

6.3 Underground Mining

7 Mining Waste Management Market, By Mineral/Metal

7.1 Introduction

7.2 Thermal Coal

7.3 Coking

7.4 Iron Ore

7.5 Gold

7.6 Copper

7.7 Nickel

7.8 Lead

7.9 Zinc

7.10 Bauxite

8 Mining Waste Management Market, By Waste Type

8.1 Introduction

8.2 Mine Water

8.3 Overburden/Waste Rock

8.4 Tailings

9 Mining Waste Management Market, By Region

9.1 Introduction

9.2 Asia Pacific

9.2.1 Asia Pacific Mining Waste Management Market, By Country

9.2.2 China

9.2.3 Australia

9.2.4 India

9.2.3 Indonesia

9.2.6 Kazakhstan

9.2.7 Asia Pacific Mining Waste Management Market, By Mining Method

9.2.8 Asia Pacific Mining Waste Management Market, By Mineral/Metal

9.2.9 Asia Pacific Mining Waste Management Market, By Waste Type

9.3 North America

9.3.1 North America Mining Waste Management Market, By Country

9.3.2 US

9.3.3 Canada

9.3.4 Mexico

9.3.5 North America Mining Waste Management Market, By Mining Method

9.3.6 North America Mining Waste Management Market, By Mineral/Metal

9.3.7 North America Mining Waste Management Market, By Waste Type

9.4 Europe

9.4.1 Europe Mining Waste Management Market, By Country

9.4.2 Russia

9.4.3 Poland

9.4.4 Ukraine

9.4.5 Sweden

9.4.6 New Caledonia

9.4.7 Europe Mining Waste Management Market, By Mining Method

9.4.8 Europe Mining Waste Management Market, By Mineral/Metal

9.4.9 Europe Mining Waste Management Market, By Waste Type

9.5 South America

9.5.1 South America Mining Waste Management Market, By Country

9.5.2 Brazil

9.5.3 Chile

9.5.4 Peru

9.5.5 Colombia

9.5.6 Venezuela

9.5.7 South America Mining Waste Management Market, By Mining Method

9.5.8 South America Mining Waste Management Market, By Mineral/Metal

9.5.9 South America Mining Waste Management Market, By Waste Type

9.6 Middle East & Africa

9.6.1 Middle East & Africa Mining Waste Management Market, By Country

9.6.2 South Africa

9.6.3 Congo

9.6.4 Zambia

9.6.5 Iran

9.6.6 Turkey

9.6.7 Middle East & Africa Mining Waste Management Market, By Mining Method

9.6.8 Middle East & Africa Mining Waste Management Market, By Mineral/Metal

9.6.9 Middle East & Africa Mining Waste Management Market, By Waste Type

10 Competitive Landscape

10.1 Overview

10.2 Market Ranking of Key Players, 2016

10.3 Competitive Scenario

10.3.1 Acquisitions

10.3.2 Agreements

10.3.3 Expansions

10.3.4 Partnership

10.3.5 Alliances/Joint Ventures

11 Company Profile

11.1 AMEC Foster Wheeler

11.2 Ausenco

11.3 Enviroserv

11.4 Interwaste Holdings Ltd.

11.5 Veolia Environnement

11.6 Golder Associates

11.7 Hatch Ltd.

11.8 Teck

11.9 Tetra Tech, Inc.

11.10 Toxfree Solutions Ltd.

11.11 Other Leading Players

11.11.1 Tetronics International

11.11.2 Aevitas

11.11.3 Global Mining Solutions

11.11.4 Zeal Environmental Technologies Limited

11.11.5 Ramboll Group

11.11.6 Knight Piésold

11.11.7 Metsana Group

11.11.8 Earth Systems

11.11.9 American Waste Management Services, Inc

11.11.10 ATC Williams

11.11.11 Jones & Wagener

11.11.12 Cleanway Environmental Services

11.11.13 Cleanways

11.11.14 Stantec

11.11.15 Enviropacific Services

11.11.16 Daiseki Co., Ltd.

11.11.17 Averda

12 Appendix

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Marketsandmarkets Knowledge Store : Snapshot

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (78 Tables)

Table 1 Mining Waste Management Market, By Mining Method, 2017 & 2022 (Billion Tons)

Table 2 Surface Mining Waste Management Market, By Region, 2015-2022 (Billion Tons)

Table 3 Underground Mining Waste Management Market, By Region, 2015-2022 (Billion Tons)

Table 4 Thermal Coal Mining Waste Management Market, By Region, 2015-2022 (Billion Tns)

Table 5 Thermal Coal Mining Waste Management Market, By Waste Type, 2015-2022 (Billion Tons)

Table 6 Coking Coal Mining Waste Management Market, By Region, 2015-2022 (Million Tons)

Table 7 Coking Coal Mining Waste Management Market, By Waste Type, 2015-2022 (Billion Tons)

Table 8 Iron Ore Mining Waste Management Market, By Region, 2015-2022 (Billion Tons)

Table 9 Iron Ore Mining Waste Management Market, By Waste Type, 2015-2022 (Billion Tons)

Table 10 Gold Mining Waste Management Market, By Region, 2015-2022 (Million Tons)

Table 11 Gold Mining Waste Management Market, By Waste Type, 2015-2022 (Million Tons)

Table 12 Copper Mining Waste Management Market, By Region, 2015-2022 (Million Tons)

Table 13 Copper Mining Waste Management Market, By Waste Type, 2015-2022 (Billion Tons)

Table 14 Nickel Mining Waste Management Market, By Region, 2015-2022 (Million Tons)

Table 15 Nickel Mining Waste Management Market, By Waste Type, 2015-2022 (Million Tons)

Table 16 Lead Mining Waste Management Market, By Region, 2015-2022 (Million Tons)

Table 17 Lead Mining Waste Management Market, By Waste Type, 2015-2022 (Million Tons)

Table 18 Zinc Mining Waste Management Market, By Region, 2015-2022 (Million Tons)

Table 19 Zinc Mining Waste Management Market, By Waste Type, 2015-2022 (Million Tons)

Table 20 Bauxite Mining Waste Management Market, By Region, 2015-2022 (Million Tons)

Table 21 Bauxite Mining Waste Management Market, By Waste Type, 2015-2022 (Million Tons)

Table 22 Mining Waste Management Market, By Waste Type, 2015-2022 (Billion Tons)

Table 23 Mining Waste Management Market, By Waste Type, 2017 & 2022 (Billion Tons)

Table 24 Mine Water Mining Waste Management Market, By Region, 2015-2022 (Billion Tons)

Table 25 Mine Water Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 26 Overburden/ Waste Rock Mining Waste Management Market, By Region, 2015-2022 (Million Tons)

Table 27 Overburden/Waste Rock Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 28 Tailings Mining Waste Management Market, By Region, 2015-2022 (Billion Tons)

Table 29 Tailings Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 30 Mining Waste Management Market, By Region, 2015-2022 (Billion Tons)

Table 31 Asia Pacific Mining Waste Management Market, By Country, 2015-2022 (Billion Tons)

Table 32 China Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 33 Australia Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 34 India Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 35 Indonesia Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 36 Kazakhstan Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 37 Asia Pacific Mining Waste Management Market, By Mining Method, 2015-2022 (Billion Tons)

Table 38 Asia Pacific Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 39 Asia Pacific Mining Waste Management Market, By Waste Type, 2015-2022 (Billion Tons)

Table 40 North America Mining Waste Management Market, By Country, 2015-2022 (Billion Tons)

Table 41 US Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 42 Canada Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 43 Mexico Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 44 North America Mining Waste Management Market, By Mining Method, 2015-2022 (Billion Tons)

Table 45 North America Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 46 North America Mining Waste Management Market, By Waste Type, 2015-2022 (Billion Tons)

Table 47 Europe Mining Waste Management Market, By Country, 2015-2022 (Million Tons)

Table 48 Russia Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 49 Poland Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 50 Ukraine Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 51 Sweden Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 52 New Caledonia Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 53 Europe Mining Waste Management Market, By Mining Method, 2015-2022 (Million Tons)

Table 54 Europe Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 55 Europe Mining Waste Management Market, By Waste Type, 2015-2022 (Billion Tons)

Table 56 South America Mining Waste Management Market, By Country, 2015-2022 (Million Tons)

Table 57 Brazil Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 58 Chile Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 59 Peru Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 60 Colombia Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 61 Venezuela Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 62 South America Mining Waste Management Market, By Mining Method, 2015-2022 (Million Tons)

Table 63 South America Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 64 South America Mining Waste Management Market, By Waste Type, 2015-2022 (Billion Tons)

Table 65 Middle East & Africa Mining Waste Management Market, By Country, 2015-2022 (Million Tons)

Table 66 South Africa Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 67 Congo Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 68 Zambia Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 69 Iran Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 70 Turkey Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 71 Middle East & Africa Mining Waste Management Market, By Mining Method, 2015-2022 (Million Tons)

Table 72 Middle East & Africa Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 73 Middle East & Africa Mining Waste Management Market, By Mineral/Metal, 2015-2022 (Million Tons)

Table 74 Acquisitions

Table 75 Agreements

Table 76 Expansions

Table 77 Partnership

Table 78 Alliances/Joint Ventures

List of Figures (57 Figures)

Figure 1 Mining Waste Management Market: Market Breakdown & Data Triangulation

Figure 2 Market Size Estimation: Top-Down Approach

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Mining Waste Management Market, By Mining Method, 2017 & 2022

Figure 5 Mining Waste Management Market, By Metal/Mineral, 2017 & 2022 (Billion Tons)

Figure 6 Mining Waste Management Market, By Waste Type, 2017 & 2022 (Billion Tons)

Figure 7 Key Countries Growth Rate in The Mining Waste Management Market

Figure 8 Increase in Mineral Exploration Activities is Projected to Drive The Growth of The Mining Waste Management Market

Figure 9 Thermal Coal Segment is Projected to Lead The Mining Waste Management Market Between 2017 and 2022

Figure 10 Mine Water Segment is Estimated to Account for The Largest Share of The Mining Waste Management Market in 2017

Figure 11 Mining Waste Management Market in Indonesia is Projected to Grow at The Highest CAGR From 2017 to 2022

Figure 12 Mining Waste Management Market Share, By Mining Method, 2017 (%)

Figure 13 Surface Mining Waste Management Market, By Region, 2017 & 2022 (Billion Tons)

Figure 14 Underground Mining Waste Management Market, By Region, 2017 & 2022 (Million Tons)

Figure 15 Mining Waste Management Market, By Mineral/Metal, 2017 & 2022

Figure 16 Thermal Coal Mining Waste Management Market, By Region, 2017 & 2022 (Billion Tons)

Figure 17 Thermal Coal Mining Waste Management Market, By Waste Type, 2017 & 2022 (Billion Tons)

Figure 18 Coking Coal Mining Waste Management Market, By Region, 2017 & 2022 (Million Tons)

Figure 19 Coking Coal Mining Waste Management Market, By Waste Type, 2017 & 2022 (Billion Tons)

Figure 20 Iron Ore Mining Waste Management Market, By Region, 2017 & 2022 (Billion Tons)

Figure 21 Iron Ore Mining Waste Management Market, By Waste Type, 2017 & 2022 (Billion Tons)

Figure 22 Gold Mining Waste Management Market, By Region, 2017 & 2022 (Million Tons

Figure 23 Gold Mining Waste Management Market, By Waste Type, 2017 & 2022 (Million Tons)

Figure 24 Copper Mining Waste Management Market, By Region, 2017 & 2022 (Billion Tons)

Figure 25 Copper Mining Waste Management Market, By Waste Type, 2017 & 2022 (Billion Tons)

Figure 26 Nickel Mining Waste Management Market, By Region, 2017 & 2022 (Million Tons)

Figure 27 Nickel Mining Waste Management Market, By Waste Type, 2017 & 2022 (Billion Tons)

Figure 28 Lead Mining Waste Management Market, By Region, 2017 & 2022 (Million Tons)

Figure 29 Lead Mining Waste Management Market, By Waste Type, 2017 & 2022 (Million Tons)

Figure 30 Zinc Mining Waste Management Market, By Region, 2017 & 2022 (Million Tons)

Figure 31 Zinc Mining Waste Management Market, By Waste Type, 2017 & 2022 (Billion Tons)

Figure 32 Bauxite Mining Waste Management Market, By Region, 2017 & 2022 (Million Tons)

Figure 33 Bauxite Mining Waste Management Market, By Waste Type, 2017 & 2022 (Million Tons)

Figure 34 Mining Waste Management Market, By Waste Type, 2017 & 2022 (Billion Tons)

Figure 35 Mining Waste Management Market Share, By Waste Type, 2017 (%)

Figure 36 Mine Water Mining Waste Management Market, By Region, 2017 & 2022 (Billion Tons)

Figure 37 Overburden/Waste Rock Mining Waste Management Market, By Region, 2017 & 2022 (Billion Tons)

Figure 38 Tailings Mining Waste Management Market, By Region, 2017 & 2022 (Billion Tons)

Figure 39 Mining Waste Management Market, By Region, 2017 & 2022 (Billion Tons)

Figure 40 Asia Pacific Mining Waste Management Market, By Country, 2017 & 2022 (Billion Tons)

Figure 41 Asia Pacific Mining Waste Management Market, By Mining Method, 2017 & 2022 (Billion Tons)

Figure 42 Asia Pacific Mining Waste Management Market, By Waste Type, 2017 & 2022 (Billion Tons)

Figure 43 North America Mining Waste Management Market, By Country, 2017 & 2022 (Billion Tons)

Figure 44 North America Mining Waste Management Market, By Mining Method, 2017 & 2022 (Billion Tons)

Figure 45 North America Mining Waste Management Market, By Waste Type, 2017 & 2022 (Billion Tons)

Figure 46 Europe Mining Waste Management Market, By Country, 2017 & 2022 (Million Tons)

Figure 47 Europe Mining Waste Management Market, By Mining Method, 2017 & 2022 (Million Tons)

Figure 48 Europe Mining Waste Management Market, By Waste Type, 2017 & 2022 (Billion Tons)

Figure 49 South America Mining Waste Management Market, By Country, 2017 & 2022 (Million Tons)

Figure 50 South America Mining Waste Management Market, By Mining Method, 2017 & 2022 (Million Tons)

Figure 51 South America Mining Waste Management Market, By Waste Type, 2017 & 2022 (Million Tons)

Figure 52 Middle East & Africa Mining Waste Management Market, By Country, 2017 & 2022 (Million Tons)

Figure 53 Middle East & Africa Mining Waste Management Market, By Mining Method, 2017 & 2022 (Million Tons)

Figure 54 Middle East & Africa Mining Waste Management Market, By Waste Type, 2017 & 2022 (Billion Tons)

Figure 55 Market Rankings, 2016

Figure 56 Acquisitions Was The Major Growth Strategies Adopted By The Key Players Between 2012 and 2017

Figure 57 Companies Adopted The Strategy of Expansions to Achieve Growth in The Mining Waste Management Market Between 2012 and 2017 (Till September)

Growth opportunities and latent adjacency in Mining Waste Management Market