Surgical Gowns and Drapes Market Size, Growth, Share & Trends Analysis

Surgical Gowns and Drapes Market by Product Type (Drapes, Gowns), Usage (Disposable, Reusable), Material [Nonwoven (PP, PE), Woven (Cotton, Polyester)], Sterility, Application (Cardiovascular, Laparoscopy, End User (Hospitals, ASCs) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

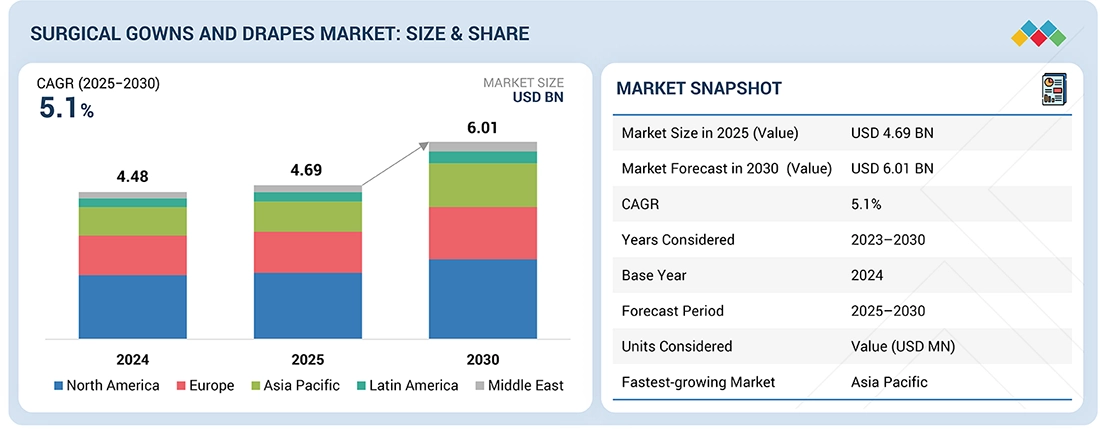

The global surgical gowns and drapes market, valued at US$4.48 billion in 2024, stood at US$4.69 billion in 2025 and is projected to advance at a resilient CAGR of 5.1% from 2024 to 2030, culminating in a forecasted valuation of US$6.01 billion by the end of the period. Key drivers for market growth include the increasing prevalence of healthcare-associated infections (HAIs), rising numbers of surgical procedures, and ongoing advancements in infection control technologies. Additionally, growing demand for sterilization and disinfection methods, coupled with technological innovations in surgical gown and drape materials, is supporting market expansion. However, the market faces challenges, including the high cost of surgical gowns and drapes, as well as concerns about environmental impact and waste management. Opportunities in the market include the increasing adoption of disposable surgical products, the growing emphasis on patient safety, and advancements in eco-friendly materials.

KEY TAKEAWAYS

- The surgical gowns and drapes market is segmented based on product types, focusing on the varying requirements of healthcare settings. Different types cater to specific needs such as disposability, ease of use, and longevity, addressing various preferences in hospitals and clinics. These variations ensure that surgical gowns and drapes meet the diverse demands of infection control, comfort, and operational efficiency in medical environments.

- The material segment of the surgical gowns and drapes market is defined by the fabrics and textiles used in manufacturing these products. With a focus on enhancing performance, durability, and protection, materials range from nonwoven fabrics to woven options. The choice of materials plays a crucial role in ensuring the gowns and drapes offer optimal protection, comfort, and cost-effectiveness, while aligning with the varying needs of healthcare providers.

- Sterility is a critical factor in surgical gowns and drapes, as it directly influences their effectiveness in preventing infections during medical procedures. This segment is divided between sterile and non-sterile products, each serving a specific purpose in various healthcare settings. Sterile gowns and drapes are essential for surgeries requiring a high level of infection control, while non-sterile options are used in less critical procedures, providing flexibility and cost efficiency.

- The application segment of the surgical gowns and drapes market focuses on the diverse medical fields in which these products are used. With specific types designed for various specialties such as general surgery, ophthalmology, and cardiovascular procedures, this segment ensures that the surgical products cater to the unique requirements of each application. The versatility of surgical gowns and drapes makes them essential in a wide range of medical environments, supporting infection control and enhancing patient safety.

- The end user segment of the infection control market plays a crucial role in driving demand, as organizations increasingly prioritize infection prevention and safety. Growth in this segment is fueled by rising awareness of hygiene standards, stricter regulatory requirements, and the need to minimize the risk of infections across various settings. End users are increasingly adopting infection control solutions to improve operational safety, ensure compliance, and enhance overall results, making this segment a major driver of the market’s growth.

- The global surgical gowns and drapes market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific is witnessing strong growth due to its rising HAI prevalence and increasing number of surgeries.

- The global surgical gowns and drapes market is steadily growing, driven by strategic partnerships and strong R&D investments. Key players like Cardinal Health (US), Owens & Minor (US), Medline Industries, LP. (US), McKesson Corporation (US), and Mölnlycke AB (Sweden) and others leverage diverse product portfolios and innovation to expand globally through collaborations, acquisitions, and new product launches.

The surgical gowns and drapes market is driven by several factors, including the rising demand for infection prevention in healthcare settings, fueled by the increasing number of surgeries and medical procedures. Advances in materials technology, such as the development of antimicrobial, fluid-resistant, and breathable fabrics, are enhancing the performance of surgical gowns and drapes, leading to greater adoption. Additionally, stricter healthcare regulations and heightened awareness of patient safety and infection control are pushing hospitals and clinics to invest in high-quality, reliable infection control products. The growing trend of minimally invasive surgeries and the increasing number of outpatient procedures further contribute to the demand for surgical gowns and drapes, as these settings require advanced infection prevention measures.

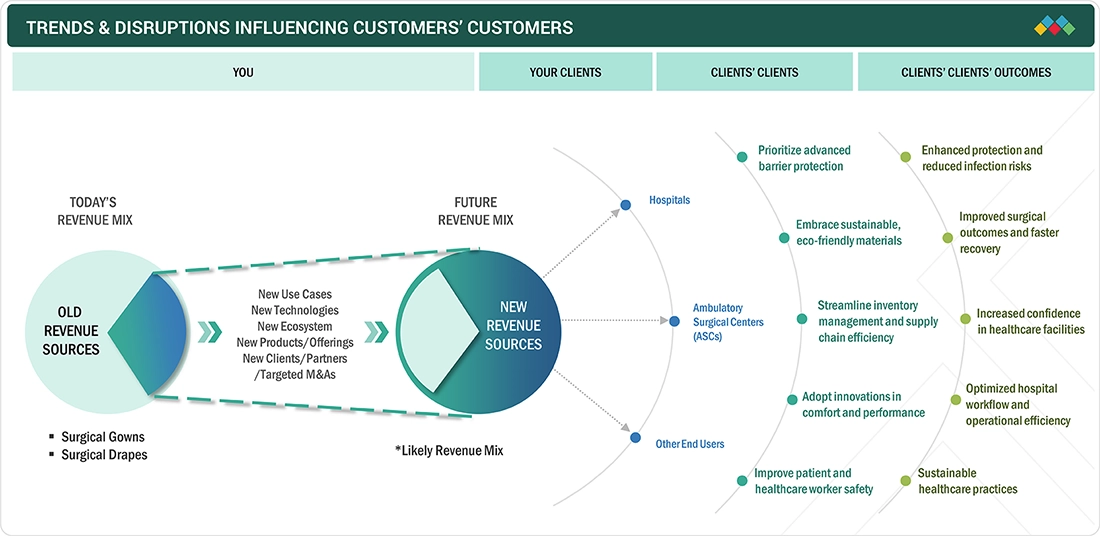

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on the surgical gowns and drapes market is closely tied to shifts in customer demand and treatment practices. Hospitals, ambulatory surgical centers (ASCs), and other end users are the primary end users of surgical gowns and drapes product manufacturers. Changes in treatment protocols, adoption of advanced products, or disruptions in product delivery directly influence demand from end users. This, in turn, affects the procurement decisions of healthcare facilities, ultimately impacting the revenues of surgical gowns and drapes product manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing prevalence of HAIs

-

Increasing number of surgical procedures

Level

-

Reuse of surgical gowns and drapes in developing regions

-

High cost of premium disposable products

Level

-

Growth opportunities in emerging countries

-

Adoption of advanced fabric technologies

Level

-

Supply chain volatility in raw materials

-

Quality inconsistency among low-cost suppliers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing prevalence of HAIs

The rising prevalence of healthcare-associated infections (HAIs) is a major driver for the surgical gowns and drapes market. As healthcare settings increasingly focus on reducing the risk of infections, particularly during surgical procedures, the demand for high-quality infection control products, such as surgical gowns and drapes, continues to rise. Surgical gowns and drapes act as critical barriers to prevent the transmission of pathogens, offering essential protection to both patients and healthcare workers. As the incidence of HAIs rises, hospitals, surgical centers, and clinics are prioritizing investments in effective infection control measures, thereby accelerating the market's growth. This heightened focus on patient safety and infection prevention is expected to drive sustained demand for surgical gowns and drapes in the coming years.

Restraint: High cost of premium disposable products

One of the key restraints in the surgical gowns and drapes market is the high cost associated with premium disposable products. While these products offer the benefit of convenience and enhanced protection, their cost can be prohibitive, especially for healthcare facilities operating under tight budgets. Disposable gowns and drapes made from advanced materials and designed for superior infection control can be significantly more expensive than reusable alternatives. This price disparity can pose challenges for hospitals, especially in developing regions or those facing budget cuts. As a result, healthcare providers may opt for more cost-effective alternatives that may not provide the same level of safety or performance, potentially limiting the overall market potential for premium products.

Opportunity: Adoption of advanced fabric technologies

The adoption of advanced fabric technologies presents a significant opportunity for the surgical gowns and drapes market. Innovations such as antimicrobial coatings, fluid-resistant materials, and breathable fabrics are transforming the capabilities of surgical gowns and drapes. These advanced materials enhance infection prevention while offering better comfort and durability for healthcare professionals and patients. As hospitals and healthcare providers increasingly demand products that combine high performance with cost-effectiveness, the incorporation of cutting-edge fabric technologies offers an opportunity to meet these needs. This could lead to the development of more efficient, durable, and eco-friendly surgical gowns and drapes, fostering market growth as healthcare providers seek to improve patient outcomes while managing costs.

Challenge: Quality inconsistency among low-cost suppliers

A significant challenge faced by the surgical gowns and drapes market is the inconsistency in quality among low-cost suppliers. While affordable alternatives to premium surgical gowns and drapes can help healthcare facilities save money, these lower-cost options often come with quality trade-offs. Variability in material quality and performance can result in products that do not provide the same level of protection or comfort, which is crucial in infection control during surgical procedures. For instance, cheaper products may not meet required safety standards or may degrade more quickly, compromising their effectiveness. As healthcare providers prioritize patient safety and high standards of infection control, ensuring consistent quality across all price points remains a significant challenge for the industry.

Surgical Gowns and Drapes Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides a broad portfolio of sterile and non-sterile surgical gowns and drapes designed for high-volume hospitals and ASC environments, offering AAMI-rated protection, procedure-specific drape sets, and customizable surgical packs to support diverse surgical workflows | Improves patient and staff safety through strong barrier performance, reduces infection risks in operating rooms, enhances procedural efficiency with ready-to-use drape sets, and supports compliance with global infection-prevention standards |

|

Delivers advanced surgical textiles through its HALYARD brand, including high-barrier surgical gowns, specialty procedure drapes, and sterile surgical kits engineered for fluid management, high-risk procedures, and multi-specialty surgical settings | Enhances OR protection with superior fluid-resistant materials, strengthens infection control across surgical procedures, improves workflow efficiency through integrated procedure packs, and supports consistent surgical outcomes |

|

Offers a comprehensive portfolio of surgical gowns, drapes, and custom procedure trays designed for all surgical specialties, integrating AAMI-rated protection, ergonomic design, and convenience-focused packaging for high-volume hospital systems | Reduces infection risk with high-quality barrier fabrics, optimizes OR productivity, improves ease of use for surgical teams, supports standardization across health systems, and enhances patient safety through reliable sterile protection |

|

Supplies reliable, cost-effective surgical gowns, drapes, and procedure packs designed to meet daily OR demands, with consistent AAMI-rated barrier protection for general surgery, outpatient procedures, and multispecialty operating environments | Strengthens infection-prevention performance, supports consistent surgical workflows, provides dependable sterile protection for routine and high-volume procedures, and enables healthcare facilities to maintain cost-effective surgical operations |

|

Provides high-performance surgical gowns and drapes engineered with advanced nonwoven materials for superior fluid control, breathability, and comfort, offering specialty-specific drape sets for cardiovascular, ortho, gynae, and ophthalmic surgeries | Improves clinical outcomes with high-barrier protection, enhances staff comfort during long surgeries, reduces surgical-site contamination risks, supports specialty-specific procedural needs, and promotes efficiency through optimized drape designs |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The surgical gowns and drapes market ecosystem comprises a network of manufacturers, distributors, healthcare providers, and development partners working together to ensure adequate infection control in the surgical procedures. Manufacturers drive innovation by developing surgical gowns and drapes products. Distributors, logistics providers, and group purchasing organizations ensure the timely supply and availability of products across regional and global healthcare markets. Hospitals, ambulatory surgical centers, and other healthcare facilities are the primary end users, adopting surgical gowns and drapes products to improve patient safety. Strategic partnerships, technological advancements, and increased investments are expanding access to surgical gowns and drapes products, enabling broader adoption and enhancing the quality of care across diverse healthcare facilities.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

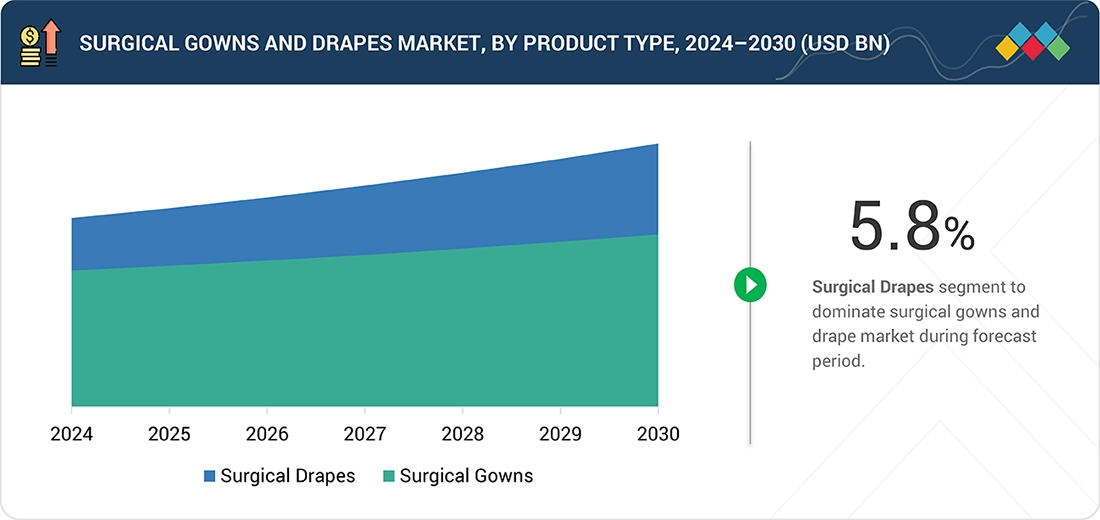

Surgical Gowns and Drapes Market, By Product type

The product type segment consists of surgical drapes and surgical gowns, with surgical drapes being the leading subsegment. Surgical drapes play a critical role in creating a sterile field during medical procedures, covering the patient and surrounding area to minimize the risk of infection. The growing demand for surgical drapes is driven by the increasing number of surgical procedures and the need for infection prevention in healthcare settings. Their ability to provide superior coverage, flexibility, and ease of use makes them indispensable in hospitals and outpatient surgical centers. With innovations in materials such as fluid-resistant and antimicrobial fabrics, the performance of surgical drapes has been significantly enhanced, making them a preferred choice in infection control. As the focus on patient safety continues to rise, the demand for surgical drapes is expected to lead the market.

Surgical Gowns and Drapes Market, By Material

The material segment consists of nonwoven materials, woven fabrics, and biodegradable materials, with nonwoven materials being the leading subsegment. Nonwoven materials are favored for their excellent balance of durability, infection control, and cost-effectiveness. These materials offer superior fluid resistance, breathability, and protective barriers against contaminants, making them ideal for surgical gowns and drapes. The widespread use of nonwoven materials is driven by their cost-effectiveness and mass-production capability, providing affordable disposable products without compromising quality. As the demand for disposable surgical products grows, nonwoven materials continue to dominate the market, with ongoing innovations enhancing their performance and making them more suitable for high-demand healthcare environments.

Surgical Gowns and Drapes Market, By Sterility

The sterility segment consists of sterile and non-sterile products, with sterile products being the leading subsegment. Sterile surgical gowns and drapes are crucial in preventing infections during surgical procedures, particularly in invasive surgeries where the risk of contamination is higher. These products undergo rigorous sterilization processes to ensure they meet stringent safety standards and create a sterile environment in the operating room. The increasing focus on patient safety, along with the rising incidence of healthcare-associated infections (HAIs), has driven the demand for sterile surgical products. Sterile surgical gowns and drapes provide a vital barrier to contaminants, making them the preferred choice for hospitals and surgical centers that prioritize infection control and patient safety.

Surgical Gowns and Drapes Market, By Application

The application segment consists of cardiovascular, general surgery, gynecology, ophthalmology, lithotomy & laparoscopy, and other applications, with general surgery being the leading subsegment. General surgery encompasses a wide range of procedures, from appendectomies to gallbladder removals, and requires extensive use of surgical gowns and drapes to maintain a sterile environment. As one of the most commonly performed types of surgery globally, general surgery drives significant demand for these products. The growing number of surgeries and the increased focus on infection control in general surgery settings have contributed to the rising need for surgical gowns and drapes. With advancements in materials and an ongoing emphasis on patient safety, general surgery remains the leading application segment, bolstering market growth.

Surgical Gowns and Drapes Market, By End User

Based on end users, the infection control market is divided into hospitals, ambulatory surgical centers (ASCs), and other end users. Among these, hospitals accounted for the largest market share in 2024, as they face the highest risk of infection transmission due to high patient volumes, frequent invasive procedures, and extensive use of protection gears. The need for infection control, and hygiene protocols, along with regulatory compliance and accreditation requirements, drives continuous investment in surgical gowns and drapes solutions. Their pivotal role in healthcare delivery positions hospitals as the primary end users in the market.

REGION

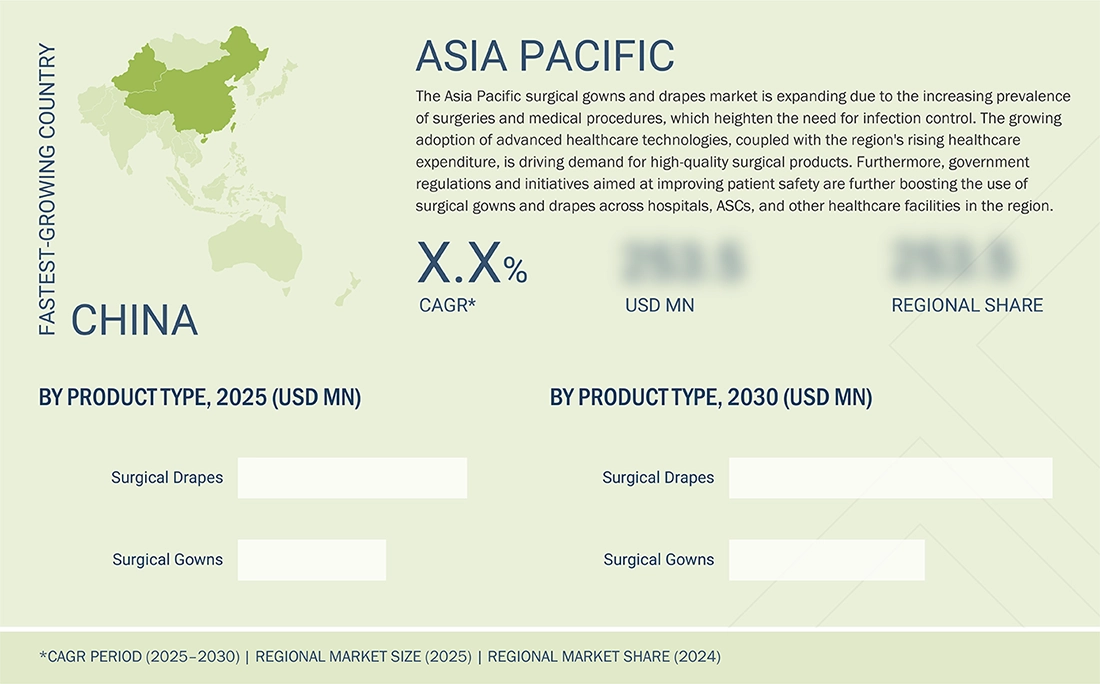

Asia Pacific is projected to be the fastest-growing market of the surgical gowns and drapes market during the forecast period

The Asia Pacific is the fastest-growing region in the surgical gowns and drapes market, driven by several key factors, including the expansion of healthcare infrastructure and the rising number of surgeries and medical procedures. Rapid urbanization, coupled with rising healthcare expenditures in emerging economies, has significantly enhanced access to advanced medical technologies and infection control products. As the region’s healthcare systems evolve, there is a growing emphasis on improving patient safety, which drives the demand for high-quality surgical gowns and drapes. Additionally, the rising prevalence of healthcare-associated infections (HAIs) and a greater awareness of infection prevention further fuel market growth. Government initiatives in countries like India, China, and Southeast Asia to improve healthcare standards and reduce infection rates also play a vital role in promoting the adoption of surgical gowns and drapes. Moreover, with a large population base and an increasing number of surgeries performed annually, the demand for disposable, cost-effective infection control products is growing. These factors collectively contribute to the Asia Pacific region's position as the fastest-growing market for surgical gowns and drapes.

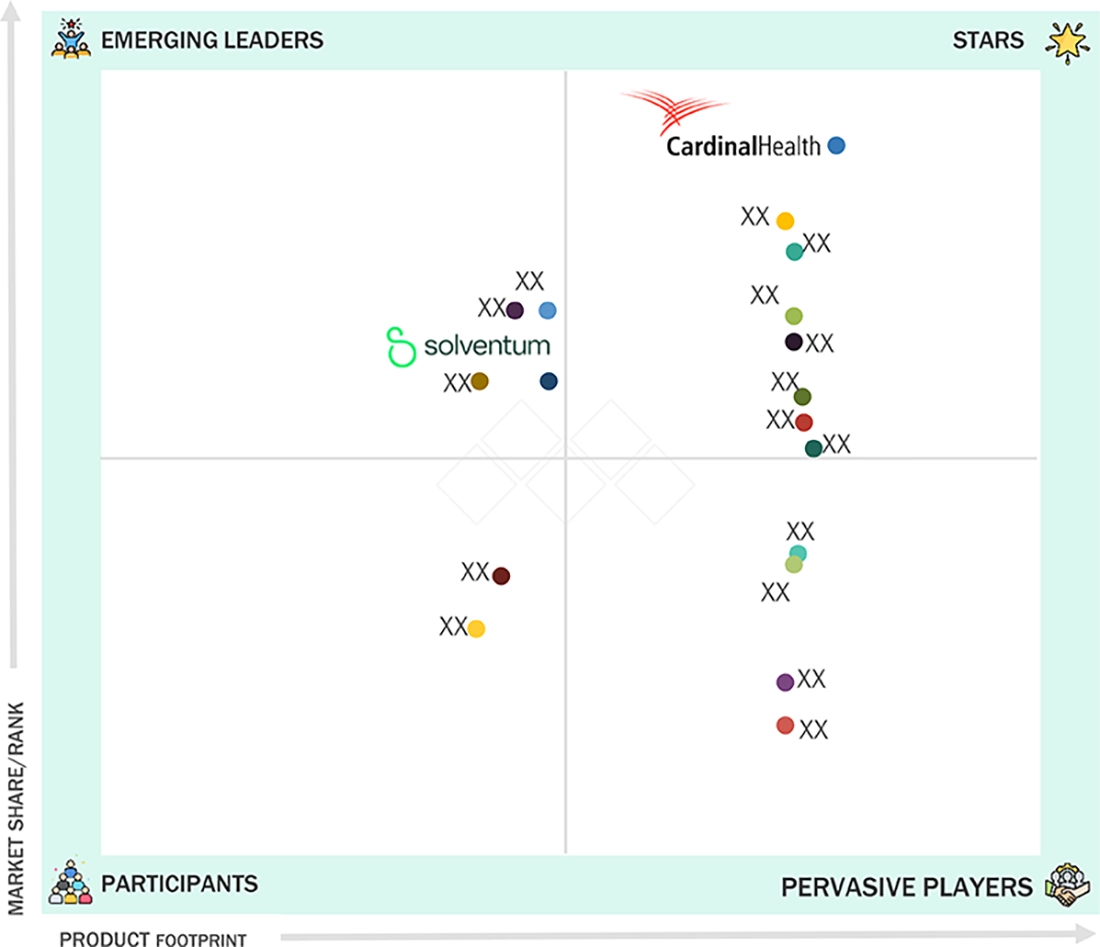

Surgical Gowns and Drapes Market: COMPANY EVALUATION MATRIX

Cardinal Health (US) (Star) holds a prominent position in the surgical gowns and drapes market due to its comprehensive portfolio of high-quality infection control products and services. The company's strong focus on innovation, adherence to stringent regulatory standards, and commitment to meeting the evolving needs of healthcare facilities have established it as a trusted provider of surgical gowns and drapes globally. Cardinal Health benefits from its well-established global presence, robust customer relationships, and continuous investment in research and development, enabling it to offer advanced solutions that meet the demands of hospitals and surgical centers. Additionally, the company’s dedication to maintaining high performance and safety standards ensures it continues to lead in the competitive surgical gowns and drapes market. Solventum (US) (Emerging Leader) is one of the leading emerging players, known for its innovative approach in providing high-quality infection control solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Cardinal Health (US)

- Owens & Minor (US)

- Medline Industries, LP. (US)

- McKesson Corporation (US)

- Mölnlycke AB (Sweden)

- Solventum (US)

- PAUL HARTMANN AG (Germany)

- Winner Medical Co., LTD. (China)

- STERIS (US)

- ALPHAPROTECH (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2025 (Value) | USD 4.69 Billion |

| Market Forecast in 2030 (Value) | USD 6.01 Billion |

| Growth Rate | CAGR of 5.1% from 2025 to 2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Product Type [Surgical Drapes (Disposable Drapes, Reusable Drapes), Surgical Gowns (Usage Pattern (Disposable Gowns, Reusable Gowns)], Type (Standard Performance Gowns, Reinforced Gowns, High-Performance Gowns)), By Material (Nonwoven Materials (Polypropylene (PP), Polyethylene (PE), Spunbond-Meltblown-Spunbond (SMS), Spunlace, Other Nonwovens), Woven Fabrics (Cotton, Polyester-Cotton Blends, Polyester, Microfiber Fabrics, Laminated/Coated Materials), Biodegradable Material), By Sterility (Sterile, Non-Sterile), By Application (General Surgery, Cardiovascular, Gynecology, Ophthalmology, Lithotomy & Laparoscopy, Other Applications), By End User (Hospitals, Ambulatory Surgical Centers (ASCs), Other End Users) |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

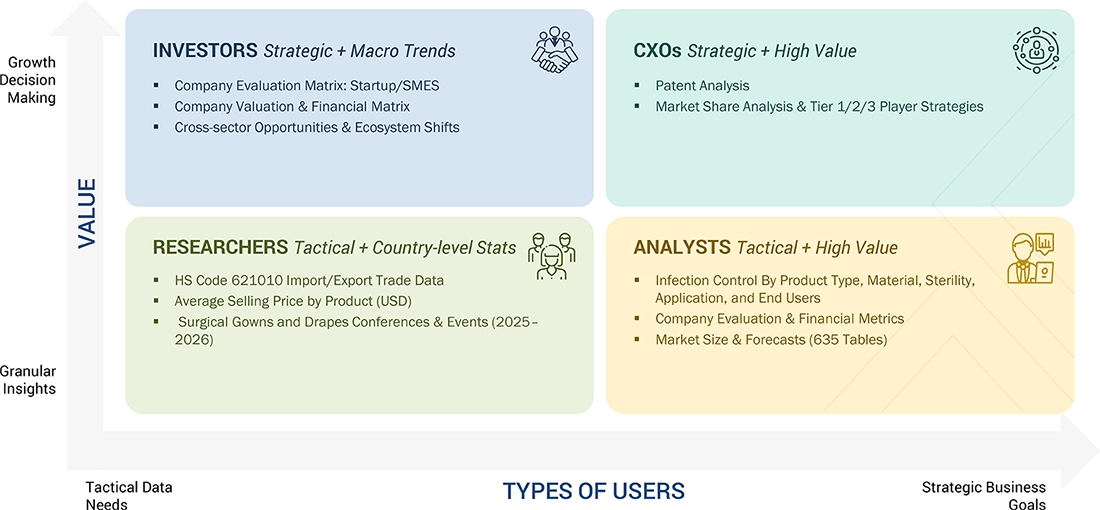

WHAT IS IN IT FOR YOU: Surgical Gowns and Drapes Market REPORT CONTENT GUIDE

RECENT DEVELOPMENTS

- November 2023 : Cardinal Health announced the US launch of its SmartGown EDGE Breathable Surgical Gown with ASSIST Instrument Pockets, created to provide surgical teams safe and convenient instrument access in the operating room.

- August 2024 : Medline acquired the global surgical solutions business of Ecolab Inc., further strengthening its position as a leading manufacturer and supplier of medical supplies and solutions.

- December 2022 : The HARTMANN Group partnered with the health-tech start-up Rimasys Group to integrate leading OR products with advanced surgical training. This collaboration is designed to support surgeons, particularly those in orthopedics and emergency care.

- April 2024 : Solventum completed its spinoff from 3M and has advanced its healthcare solutions by integrating material and data science to improve patient outcomes and support healthcare professionals.

Table of Contents

Methodology

The objective of the study is to analyze the key market dynamics of the surgical gowns and drapes sector, including drivers, opportunities, restraints, challenges, and key player strategies. It aims to monitor company developments such as acquisitions, product launches, expansions, agreements, and partnerships among leading players. The competitive landscape is evaluated to assess market players across various parameters within the broad categories of business and product strategy. The market size is estimated using top-down and bottom-up approaches, while market breakdown and data triangulation methods are employed to determine the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources included industry experts from core and related industries, as well as preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as assess prospects.

Note 1: Others include sales managers, marketing managers, and product managers. Note 2: Companies are classified into tiers based on their total revenues. As of 2024, Tier 1 = >USD 100 million, Tier 2 = USD 10 million to USD 100 million, and Tier 3 = < USD 10 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of surgical gowns and drapes. These methods were also used extensively to estimate the size of various market segments. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The revenues generated by leading players operating in the surgical gowns and drapes industry have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After determining the overall market size using the above-mentioned process, the total market was divided into several segments and subsegments. To complete the overall market engineering process and obtain precise statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, as applicable. The data was triangulated by studying various factors and trends from the demand and supply sides.

Market Definition

A surgical gown is a sterile garment worn by members of the surgical team during a surgical procedure to prevent the transfer of infectious agents. A surgical drape is a sterile material used to cover the patient or equipment during a surgical procedure to prevent the transfer of infectious agents.

Stakeholders

- Surgical Gowns & Drapes and Related Device Manufacturing Companies

- Vendors and Distributors of Surgical Drapes and Gowns

- Academic and Research Institutions

- Medical Devices Companies

- Venture Capitalists and Investors

- Healthcare Institutions/Providers

Report Objectives

- To define, segment, and forecast the global surgical gowns and drapes by product type, material, sterility, application, end user, and region

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall surgical gowns and drapes

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to six regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze company developments such as product launches & approvals, partnerships, acquisitions, agreements, and other developments

- To benchmark players within the surgical gowns and drapes using the company evaluation matrix framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offerings

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Surgical Gowns and Drapes Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Surgical Gowns and Drapes Market