Spin on Carbon Market Size, Share Analysis Report

Spin-on Carbon Market by Type (Hot-Temperature, Normal-Temperature), Application (Logic Devices, Memory Devices, Power Devices, MEMS, Photonics, Advanced Packaging), and End User (Foundries, IDMs & OSAT Vendors) - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

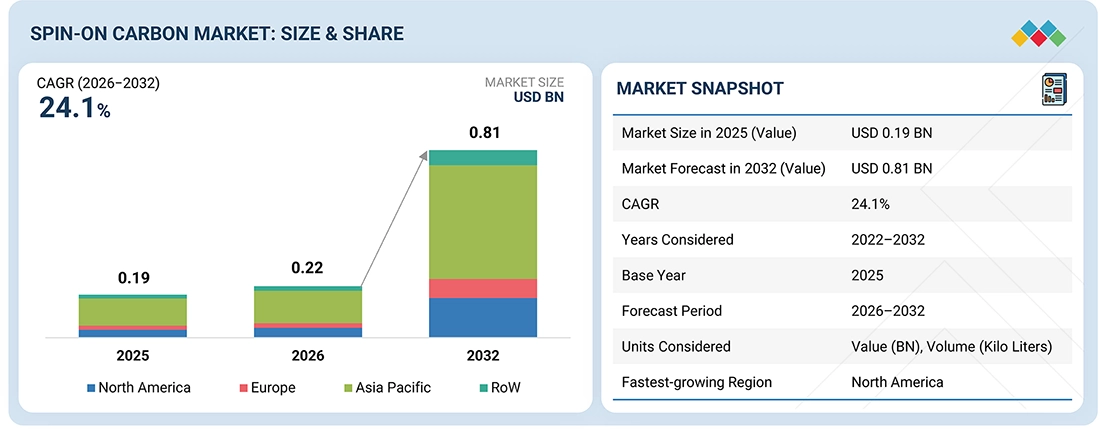

The global spin-on carbon market is projected to grow from USD 0.22 billion in 2026 to USD 0.81 billion by 2032, registering a CAGR of 24.1%. The market is driven by the increasing demand for advanced lithography materials in the manufacturing of logic, memory, and advanced packaging semiconductors. Growth is further supported by continued node scaling, rising adoption of EUV and multi-patterning techniques, and expanding use of SOC hard masks for improved etch selectivity and pattern fidelity. Additionally, rapid fab expansions, growing OSAT activity, and the push toward low-temperature and process-compatible materials to meet sustainability and efficiency goals are accelerating SOC adoption across global semiconductor manufacturing ecosystems.

KEY TAKEAWAYS

-

By RegionAsia Pacific is estimated to account for a 62.6% share of the spin-on carbon market in 2026 due to the strong concentration of semiconductor foundries and IDMs, ongoing wafer fab expansions in China, Taiwan, South Korea, and Japan.

-

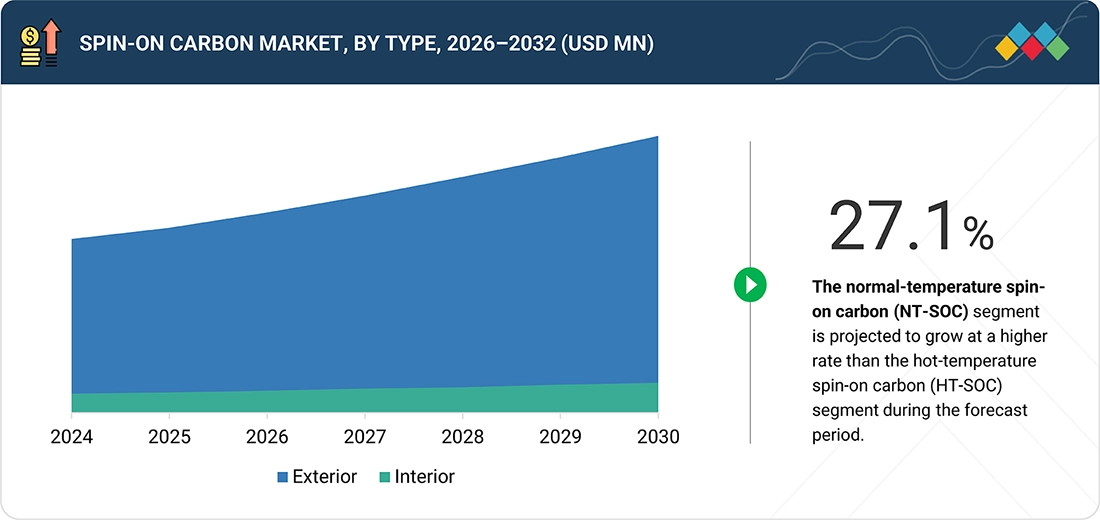

By TypeBy type, the normal-temperature spin-on carbon (NT-SOC) segment is projected to grow at a higher CAGR of 27.1% than the hot-temperature spin-on carbon (HT-SOC) segment from 2026 to 2032.

-

By ApplicationBy application, the logic devices segment is estimated to account for a 31.4% share of the spin-on carbon market in 2026.

-

By End UserBy end user, the foundries segment accounted for the largest market share in 2025 due to high wafer volumes and early adoption of advanced lithography and etch processes requiring spin-on carbon materials.

-

Competitive Landscape - Key PlayersSAMSUNG SDI (South Korea), Shin-Etsu Chemical Co., Ltd. (Japan), and DONGJIN SEMICHEM CO LTD. (South Korea) were identified as some of the star players in the spin-on carbon market (global), given their strong market share and extensive product footprint.

-

Competitive Landscape - Startups/SMEsPibond Oy (Finland) and Irresistible Materials (UK), among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The spin-on carbon market is set for robust growth as semiconductor manufacturers expand advanced lithography and etching processes to improve device performance, yield, and integration density across logic, memory, and power applications. Additionally, the rising demand for high-aspect-ratio patterning, defect-free etch masks, and reliable interlayer dielectrics drives the adoption of spin-on carbon materials that enable precise pattern transfer, planarization, hard masking, and next-generation packaging solutions.

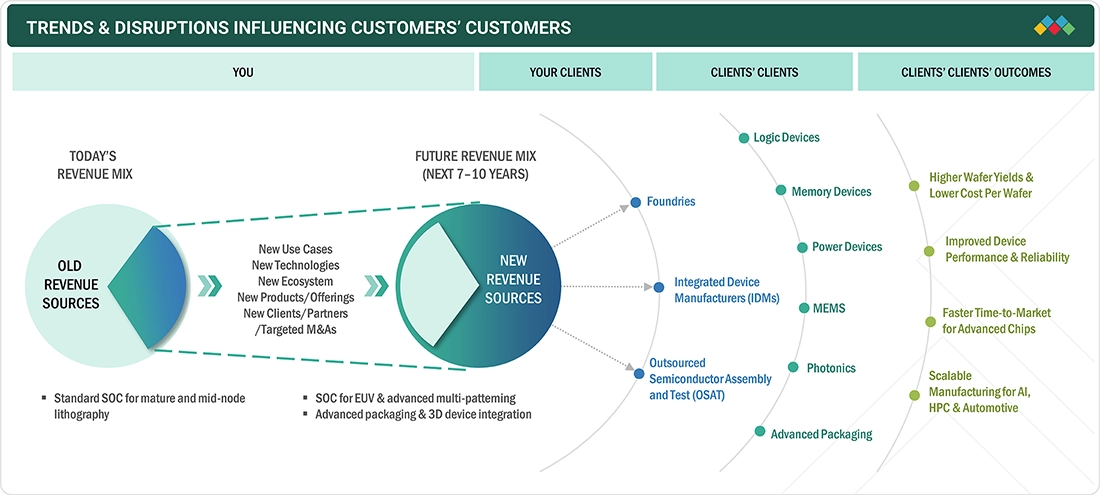

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The spin-on carbon market is evolving from a revenue base dominated by standard SoC materials used in mature and mid-node lithography to high-value growth opportunities driven by advanced semiconductor manufacturing requirements. Future revenue expansion over the next 7–10 years is expected to be fueled by SoC adoption in EUV lithography, advanced multi-patterning, and complex 3D device integration, supported by the growing demand from foundries, integrated device manufacturers, and OSAT.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid advancements in semiconductor manufacturing technologies

-

Increasing need for advanced electronic device packaging

Level

-

Availability of substitute materials

-

High sensitivity of SoC materials to process variations

Level

-

Heightened focus on miniaturization of electronic devices

-

Requirement for next-generation memory devices in emerging technologies

Level

-

Issues selecting suitable SoC materials for integrated circuit manufacturing

-

Challenges scaling SoC materials for next-generation advanced semiconductor nodes

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid advancements in semiconductor manufacturing technologies

Rapid progress in the manufacturing of semiconductors, including EUV lithography, multi-patterning, and advanced etch processes, is driving the demand for spin-on carbon materials. As device geometries shrink and pattern complexity increases, SOC enables high etch selectivity, precise pattern transfer, and improved yield. The transition toward advanced logic, memory scaling, and 3D architectures significantly increases SOC consumption per wafer across leading-edge and mature nodes.

Restraint: Availability of substitute materials

The availability of alternative hard mask and gap-fill materials, such as spin-on glass, amorphous carbon layers deposited by CVD, and other organic hardmasks, restrains the growth of the spin-on carbon market. In certain applications, these substitutes may offer comparable etch resistance or cost advantages. Process-specific preferences, existing tool compatibility, and supplier lock-ins also limit rapid switching to SOC, particularly in mature-node semiconductor manufacturing.

Opportunity: Heightened focus on miniaturization of electronic devices

The growing emphasis on miniaturization across consumer electronics, automotive, and industrial applications creates strong opportunities for spin-on carbon materials. Small device footprints and high integration densities require materials that support fine patterning and high-aspect-ratio structures. SOC enables precise lithography and etch control, making it increasingly essential for advanced nodes, 3D NAND, logic scaling, and heterogeneous integration in advanced packaging.

Challenge: Issues in selecting suitable SoC materials for integrated circuit manufacturing

Selecting the appropriate spin-on carbon formulation remains challenging due to varying process requirements across device types and technology nodes. Differences in curing temperature, carbon content, etch selectivity, and compatibility with photoresists and substrates can impact yield and reliability. Foundries and IDMs must carefully qualify SOC materials to avoid defects, pattern collapse, or integration issues, increasing development time and process complexity.

SPIN ON CARBON MARKET SIZE, SHARE ANALYSIS REPORT: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Development of HTSOC materials to enable normal-temperature integration of advanced pattern transfer processes in semiconductor manufacturing, addressing challenges in double patterning and spacer-based lithography | Enable advanced pattern transfer without high-temperature exposure | Improve process compatibility with sensitive electronic devices | Support reliable spacer and SADP applications |

|

Provision of SOC materials designed to achieve high etch resistance and thermal stability for advanced semiconductor device fabrication with shrinking feature sizes | Enhance etch selectivity | Improve thermal stability during plasma processes | Support finer feature definition | Ensure durability in advanced lithography and etch steps |

|

Supply of high-resolution SOC hardmasks to Intel for advanced nanofabrication, supporting complex architectures such as FinFET and Tri-Gate devices requiring multilayer hardmask stacks | Improve nanofabrication performance | Enable high-aspect-ratio patterning | Support advanced 3D device architectures | Enhance yield and process flexibility in leading-edge manufacturing |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The spin-on carbon ecosystem includes raw material suppliers, SoC manufacturers, distributors, and end users. Raw material suppliers, such as carbon precursors and specialty chemical providers, form the foundation, enabling SoC manufacturers to formulate high-performance carbon hardmask materials tailored for advanced lithography nodes. SoC manufacturers work closely with semiconductor fabs to ensure process compatibility and performance reliability. Distribution is largely handled through specialized electronic material division and select distributors provide logistics, formulation support, and regional access, rather than open third-party resale. Leading semiconductor foundries and IDMs represent primary end users, driving SoC adoption through advanced logic and memory fabrication, where increasing patterning complexity and multi-layer processes continue to reinforce close collaboration across the entire ecosystem.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Spin-on Carbon Market, By Type

The hot-temperature spin-on carbon (HT-SOC) segment is projected to lead the market during the forecast period. This growth is due to its superior etch resistance, film density, and thermal stability required for advanced lithography and aggressive plasma etch processes. The material is widely used in multi-layer hardmask stacks for logic and memory manufacturing, where high-temperature curing ensures robust pattern transfer, dimensional control, and defect reduction in high-volume, leading-edge semiconductor fabrication.

Spin-on Carbon Market, By Application

The logic devices segment is estimated to dominate the spin-on carbon market in 2026. Advanced CPUs, GPUs, and AI accelerators require complex, multi-patterned lithography and tight critical dimension control. Thus, SOC materials are extensively used as hardmasks in logic fabs to support FinFET, GAA, and sub-5 nm nodes, where high etch selectivity, resolution, and process reliability are critical for high-performance and high-yield production.

Spin-on Carbon Market, By End User

The foundries segment is projected to account for the largest share of the spin-on carbon market during the forecast period. Foundries operate high-volume, advanced-node fabrication lines serving multiple fabless customers across logic and HPC applications. Their reliance on EUV, DUV multi-patterning, and multilayer hardmask processes drives consistent SOC consumption, supported by continuous node transitions, capacity expansions, and stringent process requirements that favor proven, high-performance SOC materials.

REGION

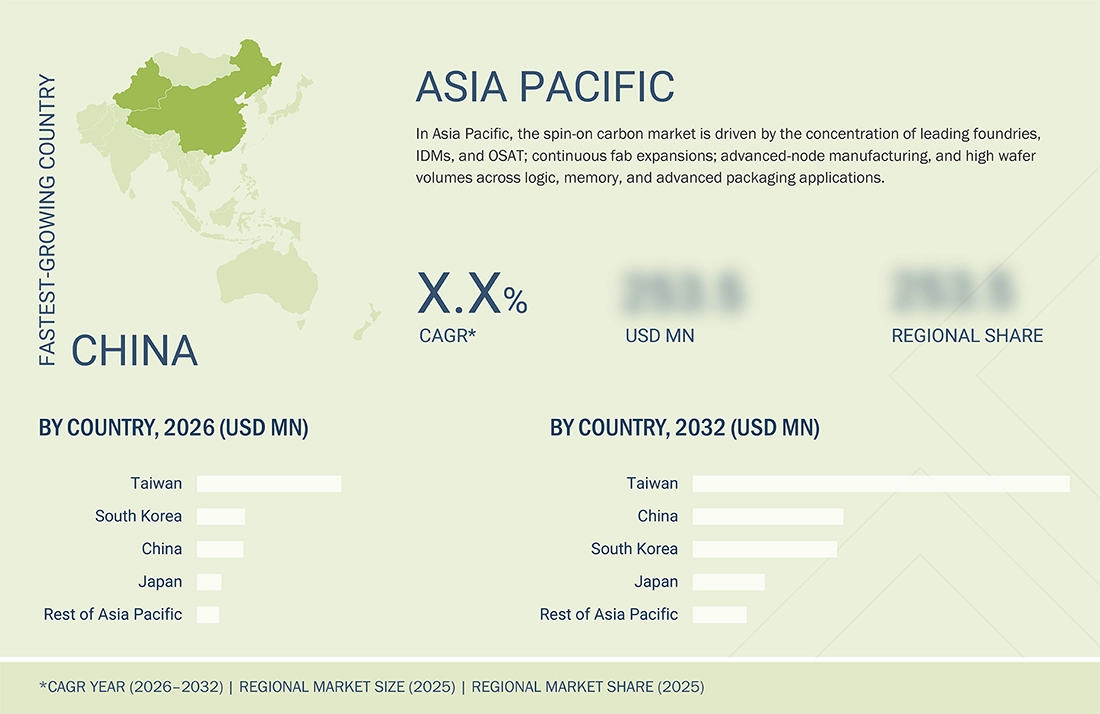

Asia Pacific to account for largest share in spin-on carbon market during forecast period

Asia Pacific is projected to account for the largest share of the spin-on carbon market during the forecast period. This growth is due to the concentration of leading semiconductor foundries, IDMs, and OSAT providers in Taiwan, South Korea, China, and Japan. The region accounts for the majority of global wafer fabrication capacity, spanning advanced and mature nodes that extensively use SOC materials in multilayer lithography, etch processes, and advanced packaging. Additionally, continuous demand for fab expansions, high-volume manufacturing, and strong electronics further reinforce Asia Pacific’s dominance.

SPIN ON CARBON MARKET SIZE, SHARE ANALYSIS REPORT: COMPANY EVALUATION MATRIX

In the spin-on carbon market matrix, Samsung SDI (Star) leads with its strong materials science expertise and large-scale manufacturing capabilities. It offers high-performance SOC solutions with superior etch resistance, thermal stability, and process consistency to support advanced logic, memory, and packaging applications. On the other hand, SK ecoplant (Emerging Leader) strengthens its position through investments in advanced electronic materials, expansion of semiconductor process material capabilities, and growing engagement with regional fabs and OSATs, enabling broad adoption of SOC materials across advanced and mature nodes.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- SAMSUNG SDI (South Korea)

- Shin-Etsu Chemical Co., Ltd. (Japan)

- DONGJIN SEMICHEM CO LTD. (South Korea)

- Merck KGaA (Germany)

- YCCHEM Co., Ltd. (South Korea)

- Brewer Science, Inc. (US)

- JSR Micro, Inc. (US)

- Irresistible Materials (UK)

- KOYJ CO.,LTD. (South Korea)

- Nano-C (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 0.19 Billion |

| Market Forecast in 2032 (Value) | USD 0.81 Billion |

| Growth Rate | CAGR of 24.1% from 2026–2032 |

| Years Considered | 2022–2032 |

| Base Year | 2025 |

| Forecast Period | 2026–2032 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, RoW |

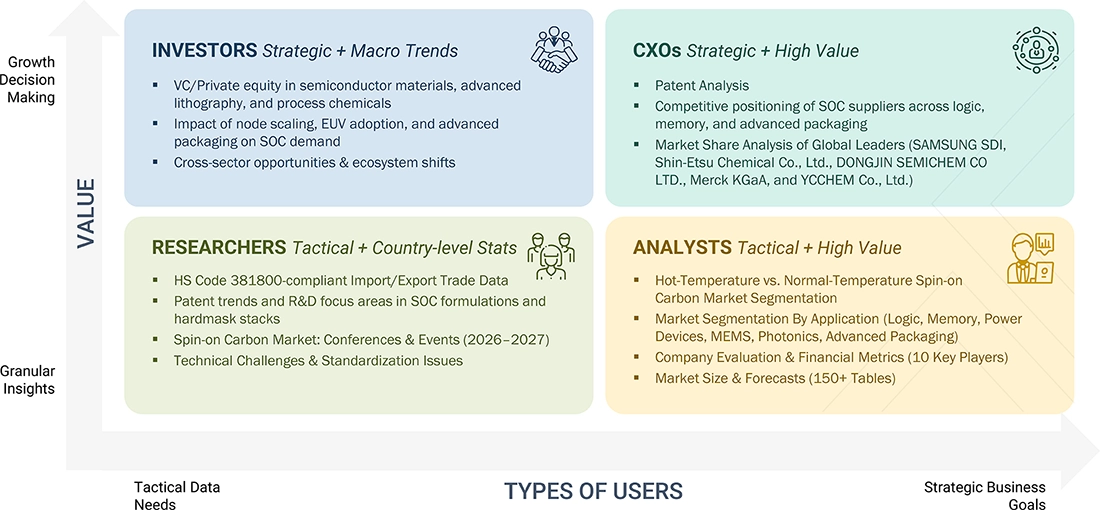

WHAT IS IN IT FOR YOU: SPIN ON CARBON MARKET SIZE, SHARE ANALYSIS REPORT REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Semiconductor Foundry/IDM | Comparative assessment of SOC materials across logic, memory, and advanced packaging nodes to evaluate etch resistance, thermal stability, film uniformity, and compatibility with EUV/DUV and multilayer hardmask stacks |

|

| OSAT/Advanced Packaging Provider | Benchmarking SOC solutions for redistribution layers, interposers, and chiplet-based packaging, including evaluation of low-temperature curing, integration with backend processes, and supplier qualification strategies |

|

| SOC Material Supplier/Chemical Manufacturer | Competitive landscape analysis, application-level demand mapping, pricing and margin benchmarking, and identification of differentiation opportunities across regions and end-user segments |

|

RECENT DEVELOPMENTS

- October 2024 : Merck KGaA opened a new spin-on-dielectric (SOD) application center in Anseong, South Korea, to strengthen collaboration with Korean semiconductor manufacturers. The facility supports the development of advanced SOD materials critical for next-generation DRAM, NAND flash, high-bandwidth memory for AI, and advanced logic chips, reinforcing the company’s role in semiconductor process materials.

- April 2024 : Shin-Etsu Chemical announced plans to build a new semiconductor lithography material manufacturing and R&D plant in Isesaki City, Gunma Prefecture, Japan. The facility would be its fourth production base for this business, with phased investment of about USD 550 million (¥83 billion). The first phase is targeted for completion by 2026.

- August 2022 : JSR Micro, Inc. signed an investment agreement with the Lingang Special Area Government to establish a subsidiary in the Shanghai area. The development would enhance JSR Group’s business activities related to semiconductor materials in the Chinese market.

Table of Contents

Methodology

The research process for this technical, market-oriented, and commercial study of the spin-on carbon market involved systematically gathering, recording, and analyzing data on companies operating within the market. The study extensively utilized secondary sources, such as directories and databases (including Factiva and Oanda), to identify and collect relevant information. In-depth interviews were conducted with primary respondents, including experts from core and related industries as well as preferred manufacturers. These interviews aimed to obtain and verify essential qualitative and quantitative information and to evaluate the growth prospects of the market. Key players in the spin-on carbon market were identified through secondary research, and their market rankings were established through a combination of primary and secondary research. This process included analyzing annual reports of leading companies and interviewing key industry experts, including CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various sources were consulted to gather information relevant to this study. These secondary sources included annual reports, press releases, and investor presentations of companies; white papers; certified publications; and articles from recognized authors, as well as directories and databases. The primary aim of the secondary research was to obtain key information about the supply chain and value chain of the industry. This included identifying a comprehensive list of key players, segmenting the market according to industry trends and geographic locations, and highlighting essential developments from both market and technology perspectives.

Primary Research

During the primary research process, interviews were conducted with primary sources from the supply and demand sides to gather qualitative and quantitative information for this report. On the supply side, primary sources included experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, subject matter experts, consultants, and key executives from major companies and organizations operating in the spin-on carbon market.

After completing the market engineering process—which involved market statistics calculations, market breakdown, market size estimations, market forecasting, and data triangulation—extensive primary research was carried out to collect, verify, and validate crucial market data. Interviews were conducted with experts from the demand and supply sides across four major regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW). Approximately 25% of these primary interviews were conducted with the demand side, while 75% were with the supply side. The primary data was collected through questionnaires, emails, and telephone interviews.

Breakdown of Primary Interview Participants

Others include Technology Heads, Media Analysts, Sales Managers, Marketing Managers, and Product Managers.

The three tiers of the companies are based on their total revenues as of 2024. The categorization is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches were employed, along with various data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments outlined in the report. Comprehensive qualitative and quantitative analyses were conducted to provide key insights related to the spin-on carbon market. Key players in the spin-on carbon market were identified through secondary research, and their rankings in the respective regions were established through primary and secondary research. This process involved reviewing the annual and financial reports of leading companies and conducting interviews with industry experts, including chief executive officers, vice presidents, directors, and marketing executives, to gather quantitative and qualitative insights.

All percentage shares, splits, and breakdowns were derived from secondary sources and verified through primary sources. Every parameter that influences the markets studied in this research was considered in great detail, validated through primary research, and analyzed to generate the final quantitative and qualitative data. This information was consolidated and enhanced with detailed inputs and analyses from MarketsandMarkets and is presented in this report

Bottom-Up Approach

- Companies offering spin-on carbon were identified, and their offerings were mapped based on their type, application, end user, and region.

- The global spin-on carbon market size was derived through the data sanity method. The revenue from spin-on carbon providers was analyzed through annual reports and press releases and summed up to derive the overall market size.

- For each company, a percentage was assigned to the overall revenue to derive the revenues from the spin-on carbon segment.

- Each company’s percentage was assigned after analyzing various factors, including its product offerings, geographical presence, R&D expenditures and initiatives, and recent developments/strategies adopted for growth in the spin-on carbon market.

- For the CAGR, the market trend analysis of spin-on carbon was carried out by understanding the industry penetration rate and the demand and supply of spin-on carbon in different sectors.

- Estimates at every level were verified and cross-checked by discussing them with key opinion leaders, including sales heads, directors, operation managers, and market domain experts of MarketsandMarkets.

- Various paid and unpaid information sources, such as annual reports, press releases, white papers, and databases, were studied.

Top-Down Approach

- The approach focused on the top-line investments and expenditures made in the market ecosystem, further splitting into type, application, end user, and listing key developments in key market areas.

- It identified major players in the spin-on carbon market by type and their penetration in various applications through secondary research, and verified with a brief discussion with industry experts.

- It analyzed revenue, product mix, geographic presence, and key applications for which all identified players served spin-on carbon to estimate and arrive at the percentage splits for all key segments.

- It discussed these splits with the industry experts to validate the information and identify key growth pockets across all key segments.

- It broke down the total market based on verified splits and key growth pockets across all segments.

Spin on Carbon Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size through the estimation process described earlier, the total market was divided into several segments and subsegments. To finalize the market analysis and obtain precise statistics for each segment and subsegment, market breakdown and data triangulation procedures were employed wherever applicable. This data triangulation involved examining various factors and trends from the demand and supply sides. Additionally, we validated the market size using the top-down and bottom-up approaches.

Market Definition

Spin-on carbon (SoC) is a thin-film material based on carbon that is used in semiconductor fabrication. It serves as a hard mask, planarization layer, and insulating layer during advanced lithography and plasma etching processes. SoC is applied through spin coating, which allows it to provide high etch resistance and strong selectivity to silicon. This enables precise pattern transfer for increasingly complex chip architectures with high aspect ratios. SoC is crucial for forming deep and narrow features in advanced technology nodes, supporting innovations like FinFETs and 3D NAND. Overall, it plays a vital role in manufacturing smaller, denser, and more complex semiconductor devices that are essential for modern electronic applications.

Key Stakeholders

- Investors/Venture capitalists

- Raw material suppliers

- SOC manufacturers

- Semiconductor manufacturers (IDMs & foundries)

- OSAT (Outsourced semiconductor assembly & test)

- Equipment manufacturers

- End users

- Research institutes and government organizations

- Electronic device traders, distributors, and suppliers

- Logic device manufacturers

- Semiconductor industry players

Report Objectives

- To describe, segment, and forecast the size of the spin-on carbon market, by type, application, end user, and region, in terms of value

- To forecast the size of the market segments for four major regions: North America, Europe, Asia Pacific, and RoW

- To give detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the spin-on carbon market

- To provide value chain analysis, ecosystem analysis, case study analysis, patent analysis, trade analysis, technology analysis, pricing analysis, key conferences and events, key stakeholders and buying criteria, Porter’s five forces analysis, investment and funding scenario, and regulations about the market

- To strategically analyze micromarkets about individual growth trends, prospects, and contributions to the total market

- To analyze opportunities for stakeholders by identifying high-growth segments of the market

- To strategically profile the key players, comprehensively analyze their market positions in terms of ranking and core competencies, and provide a competitive market landscape

- To analyze strategic approaches, such as product launches and expansions, in the spin-on carbon market

Customization Options

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Informations

- Detailed analysis and profiling of additional market players (up to 7)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Spin-on Carbon Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Spin-on Carbon Market