Software-defined Wide Area Network (SD-WAN) Market

Software-defined Wide Area Network (SD-WAN) Market by Offering (Solutions (Software and Appliances) and Services (Professional Services and Managed Services), Organization Size, End Users (Service Providers and Enterprises) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The SD-WAN market is projected to expand from USD 7.91 billion in 2025 to USD 21.67 billion by 2030, at a CAGR of 22.3% during the forecast period. By early 2025, more than 70% of enterprise workloads had migrated outside traditional data centers. This transition compelled organizations to completely rearchitect their networks, elevating SD-WAN from merely an upgrade to a fundamental necessity.

KEY TAKEAWAYS

-

BY END USERSoftware-defined wide area network enables BFSI organizations to securely connect branches, ATMs, data centers, and cloud applications with high performance and reliability. It reduces dependency on costly MPLS links, improves application visibility, ensures compliance with stringent security standards, and supports rapid deployment of digital banking services across distributed networks. Other end users include manufacturing, healthcare & life sciences, retail & ecommerce, education, IT & ITeS, government & public sector, among others.

-

BY REGIONAsia Pacific is expected to grow fastest, with a CAGR of 24.4%. While North America continues to lead in SD-WAN adoption due to its advanced cloud ecosystem and managed services maturity, Asia Pacific is witnessing the fastest growth, driven by SME digitalization and regional telco initiatives. For instance, Tata Communications in India expanded its SD-WAN managed services for mid-sized enterprises, enabling cloud-based scalability across sectors.

-

COMPETITIVE LANDSCAPEThe major market players have adopted organic and inorganic strategies, including partnerships, collaborations, and investments. For instance, in June 2025, Nokia signed a multi-year SD-WAN deal with Telefónica to transform enterprise connectivity using Nuage Networks. The deployment leverages Nuage SD-WAN to deliver scalable, policy-driven networking across Telefónica’s enterprise customer base.

The software-defined wide area network market has been broadly categorized into solutions and services based on offering. The solutions segment has been further sub-segmented into software and appliances. The services segment has been bifurcated into professional services (consulting, deployment & integration, and support & maintenance) and managed services.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Software-defined wide area network simplifies network management with centralized control, enhances security across branches and cloud connections, and ensures seamless access to cloud and SaaS applications. Additionally, SD-WAN enables rapid scalability and resilient operations, supporting business continuity and agility. The impact on consumers’ business emerges from customer trends or disruptions. The revenue impact on end users will affect the revenue of hotbeds, which will further affect the revenues of software-defined wide area network solution providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for cloud applications and SaaS adoption

-

Growth of remote and hybrid work models

Level

-

Complexity in integration with legacy infrastructure

-

Initial deployment costs

Level

-

Digital transformation across organizations

-

5G integration for next-gen SD-WAN solutions

Level

-

Concerns over SD-WAN security

-

Vendor lock-in risks

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for cloud applications and SaaS adoption

The rapid shift of enterprises to cloud environments has created a surge in demand for SD-WAN solutions. Businesses are increasingly using SaaS platforms, such as Microsoft 365, Salesforce, and Zoom, which require high-performance, reliable, and secure connectivity. Traditional WAN architecture, dependent on backhauling traffic to centralized data centers, often leads to latency and poor user experiences for cloud applications. SD-WAN overcomes these limitations by enabling direct-to-cloud access at branch locations, optimizing traffic routing, and ensuring application-level performance visibility. This capability has become critical as cloud-first strategies dominate IT roadmaps across industries. For instance, Liberty Mutual Insurance in the US migrated 70% of its core enterprise applications to Microsoft Azure and implemented Cisco SD-WAN to connect global offices via local internet breakout. This initiative led to a 40% reduction in latency for business-critical tools, such as Salesforce and Workday, and significantly improved SLA compliance. The widespread use of real-time collaboration platforms, such as Zoom, Google Workspace, and Microsoft Teams, further underscores the need for dynamic bandwidth management and application prioritization core capabilities embedded within SD-WAN. As enterprises scale their digital initiatives and migrate workloads to the cloud, SD-WAN is rapidly becoming essential for enabling performance optimization, network visibility, and centralized policy enforcement in decentralized environments.

Restraint: Reliability issues in SD-WAN

While SD-WAN offers compelling advantages, reliability remains a key restraint, mainly in regions with inconsistent internet connectivity. Unlike MPLS, which offers dedicated and SLA-backed links, SD-WAN typically operates over broadband, LTE, or fiber circuits, all of which are subject to performance variability. Issues such as jitter, packet loss, and link degradation can significantly impact the quality of service for latency-sensitive applications, including VoIP and video conferencing. For instance, the Saskatchewan Health Authority in Canada deployed broadband-based SD-WAN across several remote clinics to improve telehealth access. Although initial cost savings were realized, frequent complaints arose due to inconsistent performance during virtual consultations and EMR access. The organization eventually adopted a hybrid MPLS-SD-WAN model using Cisco Meraki appliances, incorporating managed failover and backup circuits to stabilize performance, which increased overall uptime by 22%. These challenges demonstrate that SD-WAN reliability is heavily dependent on link quality and monitoring. Enterprises, particularly in healthcare and BFSI sectors, must invest in resilient network architectures often supported by professional and managed services to ensure performance parity with traditional WAN systems.

Opportunity: Rising adoption by SMEs

There is a substantial opportunity in serving the SME segment through managed SD-WAN services. SMEs often lack in-house IT expertise and prefer subscription-based models that reduce upfront costs. Managed service providers (MSPs) and telecom operators offering SD-WAN as a service (SD-WANaaS) are poised to capture this demand. Moreover, the integration of Artificial Intelligence (AI) and Machine Learning (ML) into SD-WAN platforms for predictive analytics, automated troubleshooting, and dynamic policy enforcement can further differentiate offerings. Growth in emerging markets such as Asia Pacific, Latin America, and Africa—driven by rapid digitization and mobile-first enterprises—represents another untapped growth area.

Challenge: Concerns over SD-WAN security

Security remains one of the most pressing challenges in SD-WAN adoption. Traditional WANs relied on centralized gateways and perimeter-based security, but SD-WAN introduces distributed connectivity that can bypass standard inspection points if not properly configured. Without integrated controls, such as firewalls, zero-trust access, or traffic encryption, SD-WAN deployments can expose critical vulnerabilities, particularly at the edge. For instance, Kerry Logistics in Southeast Asia suffered a security breach after deploying SD-WAN without embedded threat prevention or policy segmentation. The compromise was traced to misconfigured edge devices that lacked encrypted overlays and permitted lateral movement across sites. Following the incident, the company transitioned to Fortinet’s Secure SD-WAN solution, integrating next-generation firewall (NGFW), ZTNA enforcement, and centralized security orchestration. This transition closed attack surfaces and reduced policy drift across its logistics network. These cases reinforce the growing consensus that SD-WAN must be treated not merely as a connectivity upgrade but as a core part of the enterprise security architecture. Integrated security features, real-time monitoring, and expert-managed deployment are now indispensable to protect against evolving threats in a decentralized, cloud-first landscape.

Software-defined Wide Area Network (SD-WAN) Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Cloud-first enterprises needing consistent app performance across hybrid and multi-cloud environments | Application-aware routing ensures optimal performance |

|

Organizations requiring end-to-end visibility and security | Unified fabric with embedded security |

|

Enterprises looking for WAN edge modernization with strong WAN optimization capabilities | WAN optimization reduces bandwidth costs |

|

Security-sensitive organizations (healthcare, BFSI, government) requiring deep security + networking convergence | Reduced complexity via unified networking and security stack |

|

Retail chains, BFSI, and manufacturing that require scalable branch deployments | Hardware acceleration for high-performance WAN edge |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The SD-WAN market is highly consolidated and comprises various vendors that offer solutions to a specific or niche market segment. Several changes have occurred in the market in recent years. The vendors are involved in various partnerships and collaborations to develop comprehensive solutions that address a wide range of requirements.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Software-defined Wide Area Network Market, By End User

The healthcare & life sciences segment among enterprise end users is projected to register the fastest growth rate during the forecast period. This sector is undergoing a profound digital shift, with rising dependence on telehealth, cloud-based electronic health records, diagnostic imaging platforms, and AI-powered drug discovery, each demanding secure, high-performance connectivity. SD-WAN is rapidly emerging as the backbone of this transformation by ensuring low-latency access to cloud applications, enforcing zero-trust policies across remote clinics, and enabling real-time data exchange between connected care environments. In April 2025, a US-based hospital group integrated Aruba EdgeConnect appliances with full-service deployment to connect 140+ outpatient sites, reducing critical system outages by 50% and accelerating patient onboarding times. In another instance, a Japanese biotech company deployed HPE SD-WAN software across global research labs to enable real-time collaboration and ensure compliance with data integrity standards set by regulatory bodies, such as the FDA and EMA. As this sector prioritizes resiliency, regulatory compliance, and always-on care delivery, SD-WAN when bundled with consulting and managed services, delivers the network flexibility and the embedded security needed to sustain its accelerated digital trajectory.

REGION

North America is estimated to account for the largest market share during the forecast period

North America leads the SD-WAN market, underpinned by its mature enterprise IT ecosystem, widespread cloud adoption, and early embrace of managed and security-integrated network solutions. The region benefits from a dense presence of global SD-WAN vendors, MSPs, and cloud hyperscalers, enabling faster rollouts, bundled offerings, and deep technical support. In March 2025, a leading US-based financial services firm deployed Palo Alto’s Prisma SD-WAN across 4,000+ branches, using managed services for SLA enforcement and advanced security orchestration, resulting in a 28% reduction in threat exposure and a 60% improvement in policy consistency across its network. Meanwhile, major telecom providers, such as Lumen and AT&T, are integrating into SD-WAN with 5G and edge services to offer turnkey solutions for sectors like education and logistics. This infrastructure maturity, along with high digital penetration and regulatory readiness, positions North America as the largest market and the most innovative-driven, setting benchmarks that shape global SD-WAN deployment strategies.

Software-defined Wide Area Network (SD-WAN) Market: COMPANY EVALUATION MATRIX

In the software-defined wide area network market matrix, Cisco (Star) leads with a strong market presence and a wide product portfolio, offering robust, secure, and scalable solutions that integrate seamlessly with its broader networking and security portfolio. Tata Communications (Pervasive player) is gaining traction by providing comprehensive SD-WAN solutions that combine global connectivity with cloud-ready, secure, and easily managed networks.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 6.46 Billion |

| Market Forecast in 2030 (value) | USD 21.67 Billion |

| Growth Rate | CAGR of 22.3% from 2025–2030 |

| Years Considered | 2019–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD) Million/Billion |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Offering, Organization Size, End User, and Region |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: Software-defined Wide Area Network (SD-WAN) Market REPORT CONTENT GUIDE

RECENT DEVELOPMENTS

- June 2025 : Nokia signed a multi-year SD-WAN deal with Telefónica to transform enterprise connectivity using Nuage Networks. The deployment leverages Nuage SD-WAN to deliver scalable, policy-driven networking across Telefónica’s enterprise customer base.

- May 2025 : Fortinet expanded its collaboration with Google Cloud to offer secure SD-WAN connectivity via Google Distributed Cloud Edge, targeting high-compliance sectors. This allows Fortinet SD-WAN users to directly connect and secure edge workloads across distributed cloud environments.

- April 2025 : Aryaka partnered with Orange Business to deliver co-managed SD-WAN services across Europe and Asia, accelerating enterprise deployments. The partnership expands Aryaka’s SD-WAN reach and simplifies deployments for global enterprises seeking managed connectivity.

- March 2025 : HPE acquired Axis Security to integrate zero-trust capabilities into its Aruba SD-WAN solutions, strengthening its SASE strategy. This enhances Aruba’s SD-WAN by embedding secure remote access, critical for hybrid workforce models and distributed edge environments.

- February 2025 : Cato Networks raised USD 150 million to scale its global cloud-native SD-WAN and SASE backbone, with a focus on mid-market enterprises. The funding supports infrastructure expansion and product innovation in Cato’s all-in-one SD-WAN and security-as-a-service platform.

Table of Contents

Methodology

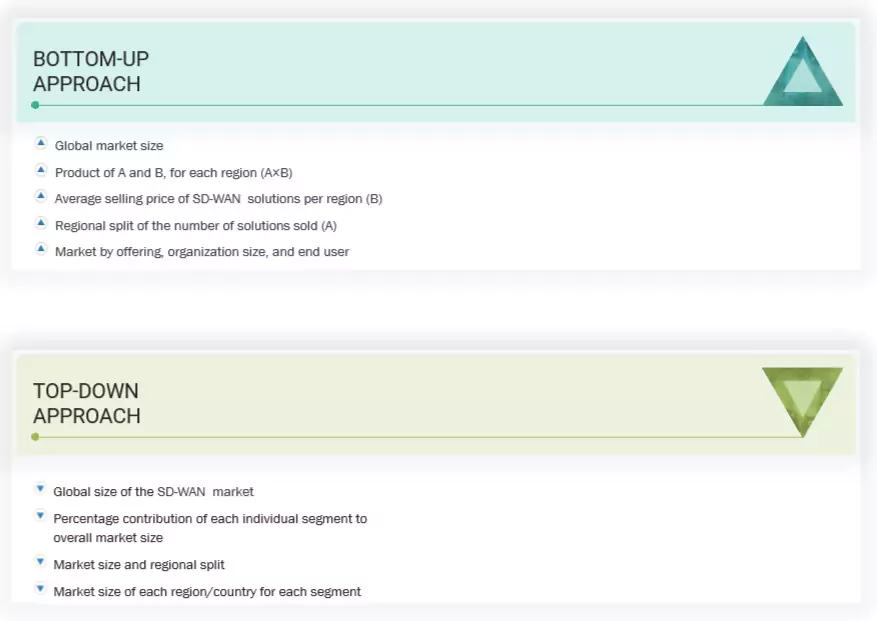

The research study involved four major activities in estimating the SD-WAN market size. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step was to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. The top-down and bottom-up approaches were used to estimate the market size. After the market breakdown, data triangulation was used to estimate the sizes of segments and sub-segments.

Secondary Research

The market size of the companies offering SD-WAN solutions to various end users was determined based on the secondary data available through paid and unpaid sources, analyzing the product portfolios of major companies in the ecosystem, and rating the companies based on their performance and quality. In the secondary research process, various sources were referred to identify and collect information for the study. These include annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources.

Secondary research was mainly used to obtain critical information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation based on the industry trends to the bottom-most level, regional markets, and key developments from market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from SD-WAN solutions vendors, system integrators, professional and managed service providers, industry associations, independent consultants, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data on revenue collected from platforms and services, market breakups, market size estimations, market forecasts, and data triangulation. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use SD-WAN solutions, were interviewed to understand buyers’ perspectives on suppliers, products, service providers, and their use of SD-WAN solutions which is expected to affect the overall SD-WAN market growth.

Note: Tier 1 companies have revenues over USD 1 billion, Tier 2 companies have revenues between

USD 500 million and 1 billion, and Tier 3 companies have revenues less than USD 500 million.

Other designations include sales managers, marketing managers, and product managers.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the SD-WAN market. These methods were also used extensively to estimate the size of various subsegments in the market.

Software-defined Wide Area Network (SD-WAN) Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size from the above estimation process, the SD-WAN market was split into several segments and sub-segments. Data triangulation and market breakdown procedures were used, wherever applicable, to complete the overall market engineering process and determine the exact statistics for all segments and sub-segments. The data was triangulated by studying various factors and trends from the demand and supply sides. The SD-WAN market size was validated using top-down and bottom-up approaches.

Market Definition

According to Cisco, SD-WAN is a software-defined approach to managing the WAN. It enables reducing costs with transport independence across MPLS, 4G/5G LTE, and other connection types, improving application performance and increasing agility. It also optimizes user experience and efficiency for software-as-a-service (SaaS) and public-cloud applications, and simplifies operations with automation and cloud-based management.

Stakeholders

- SD-WAN solution providers

- SD-WAN service providers

- Wireless service providers

- Information technology (IT) solution providers

- Telecom providers

- Cloud service providers

- Network solution providers

- System integrators

- Independent service providers

Report Objectives

- To determine, segment, and forecast the global SD-WAN market by offering, organization size, end user, and region in terms of value

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the SD-WAN market

- To study the complete value chain and related industry segments, and perform a value chain analysis of the SD-WAN market landscape

- To strategically analyze the macro and micromarkets1 concerning individual growth trends, prospects, and contributions to the total SD-WAN market

- To analyze the industry trends, pricing data, patents, and innovations related to the SD-WAN market

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the SD-WAN market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies2To track and analyze competitive developments, such as mergers and acquisitions, product launches and developments, partnerships, agreements, collaborations, business expansions, and research and development (R&D) activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Geographic Analysis as per Feasibility

- Further break-up of the Asia Pacific market into countries contributing 75% to the regional market size

- Further break-up of the North American market into countries contributing 75% to the regional market size

- Further break-up of the Latin American market into countries contributing 75% to the regional market size

- Further break-up of the Middle East & African market into countries contributing 75% to the regional market size

- Further break-up of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is SD-WAN?

According to Cisco, SD-WAN is a software-defined approach to managing the WAN. It enables reducing costs with transport independence across MPLS, 4G/5G LTE, and other connection types, improving application performance and increasing agility, optimizing user experience and efficiency for software-as-a-service (SaaS) and public-cloud applications, and simplifying operations with automation and cloud-based management.

What is the size of the SD-WAN market?

The SD-WAN market is projected to grow from USD 7.91 billion in 2025 to USD 21.67 billion by 2030, at a CAGR of 22.3% during the forecast period.

What are the major drivers of the SD-WAN market?

Major drivers of the SD-WAN market include cloud migration, hybrid workforce expansion, application performance optimization, zero-trust security adoption, demand for operational agility, rising use of SaaS and IaaS platforms, increased remote site connectivity needs, regulatory compliance requirements, growth of managed and professional services, and AI-driven network intelligence.

Who are the key players operating in the SD-WAN market?

The major players in the SD-WAN market include Cisco (US), HPE (US), Nokia (Finland), Broadcom (US), Fortinet (US), Oracle (US), Huawei (China), Juniper Networks (US), Extreme Networks (US), Tibco Software (US), Ciena (US), Epsilon Telecommunications (US), Palto Alto Networks (US), Riverbed Technology (US), and Ericsson (Sweden), BT (UK), Colt Technology Services (UK), NEC Corporation (Japan), Tata Communications (India), Martello Technologies (Canada), Arelion (Sweden), Aryaka (US), FlexiWAN (Israel), Cato Networks (Israel), Nour Global (Saudi Arabia), Sencinet (Brazil), MVM Telecom (Brazil), InterNexa (Colombia), FatPipe Networks (US), Lavelle Networks (India), and Bigleaf Networks (US).

What are the opportunities for new entrants in the SD-WAN market?

Opportunities in the SD-WAN market include digital transformation across sectors, SME adoption acceleration, integration with 5G and edge computing, rise in cloud-native architectures, demand for bundled solutions and service offerings, AI-enabled network automation, vertical-specific deployments in healthcare, retail, and manufacturing, and increased focus on security-driven SD-WAN platforms.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Software-defined Wide Area Network (SD-WAN) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Software-defined Wide Area Network (SD-WAN) Market