Smart Gas Meter Market

Smart Gas Meter Market by Technology (AMR and AMI), Type (Smart Ultrasonic Gas Meter and Smart Diaphragm Gas Meter), Component (Hardware and Software), End User (Residential, Commercial, and Industrial), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

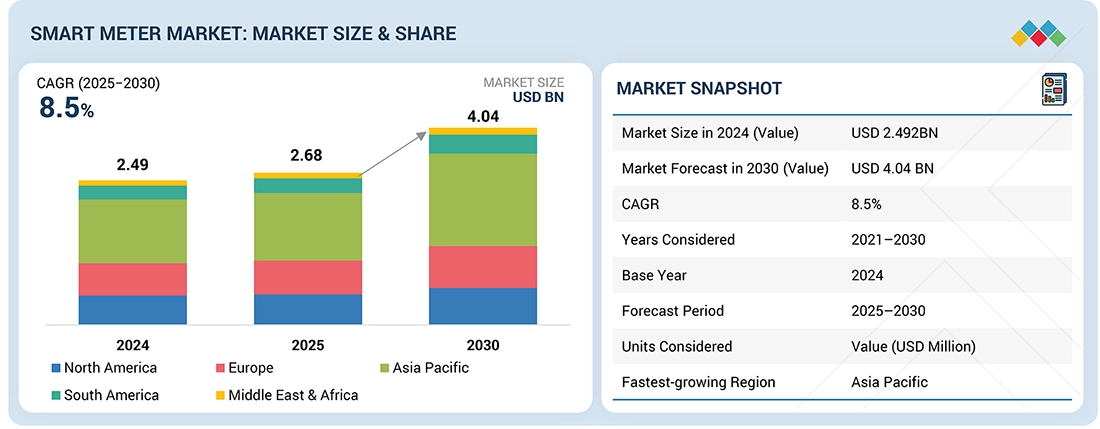

The global smart gas meter market size is projected to reach USD 4.04 billion by 2030, at a CAGR of 8.5%, from an estimated USD 2.49 billion in 2024. The key drivers for the smart gas meter market include the digitalization of distribution grids and optimization of network operations, asset management of advanced metering infrastructure, and increasing investment in smart grid technologies to measure and analyze data.

KEY TAKEAWAYS

-

BY TECHNOLOGYBy technology, the automated meter reading (AMR) segment is expected to grow at the fastest CAGR from 2025 to 2030. The growth of this segment is driven by the growing demand for cost-effective smart gas meters and the need for automated collection of meter readings without physical inspection. In addition, this system can be configured to read multiple meters at a certain fixed time interval—daily, fortnightly, or monthly. AMR provides a cost-effective solution for meter reading and measurement of utility consumption. These factors are expected to drive the market for the automated meter reading (AMR) segment.

-

BY TYPEThe smart diaphragm gas meter segment led the global smart gas meter market by type in 2024. Several key factors drove this trend. The increasing number of residential and light commercial buildings is a main growth driver. These meters accurately measure gas consumption and integrate easily with existing infrastructure. Smart diaphragm gas meters provide benefits like real-time data transmission, remote monitoring, and automated meter reading. These features reduce manual work, lower operational costs, and enhance safety by allowing early detection of leaks or tampering. In Europe, the segment is expected to grow at the highest compound annual growth rate (CAGR). This growth is driven by regulatory requirements, aging infrastructure upgrades, and a focus on energy efficiency and digital change. The rising need for reliable gas supply in urban and suburban areas also boosts market expansion. Furthermore, improvements in hardware, such as sensor technology and communication modules, along with software advancements like analytics and predictive maintenance, are speeding up adoption. These developments help utilities optimize operations and improve customer service. Together, these trends contribute to strong growth in the smart diaphragm gas meter segment worldwide.

-

BY COMPONENTThe hardware segment led the smart gas meter market by component in 2024. This leadership stems from the rising demand for precise, reliable, and automated gas consumption measurements. The need for accurate billing, loss detection, and real-time monitoring drives this demand, which is critical for utility companies and consumers. Manufacturers are focusing on developing hardware components that provide high system integration and simpler designs. This shift makes smart gas meters more compact, user-friendly, and cost-effective. These improvements are crucial for large-scale deployments as urbanization, and the use of natural gas in homes and businesses continue to grow. The use of advanced sensors and computing hardware allows for real-time alerts about gas leaks, helping to prevent hazards and improve safety. Moreover, regulatory requirements and the need for energy conservation are pushing utilities to invest in modern, efficient hardware solutions. The increasing focus on digital infrastructure and automated meter reading also speeds up hardware innovation and adoption, supporting strong market growth for hardware components in smart gas meters.

-

BY END USERThe residential segment is estimated to lead the smart gas meter market during the forecasted period. Asia Pacific was the largest residential end user segment market in 2024. Increasing focus on energy efficiency is expected to drive the smart gas meter market. The other key drivers for the growth of the smart gas meter market for the residential sector are the introduction of mandates and regulations in support of smart gas meters at residential facilities. Countries such as Australia, China, Japan, the UK, France, and Italy have mandated the installation of smart gas meters in residential buildings.

-

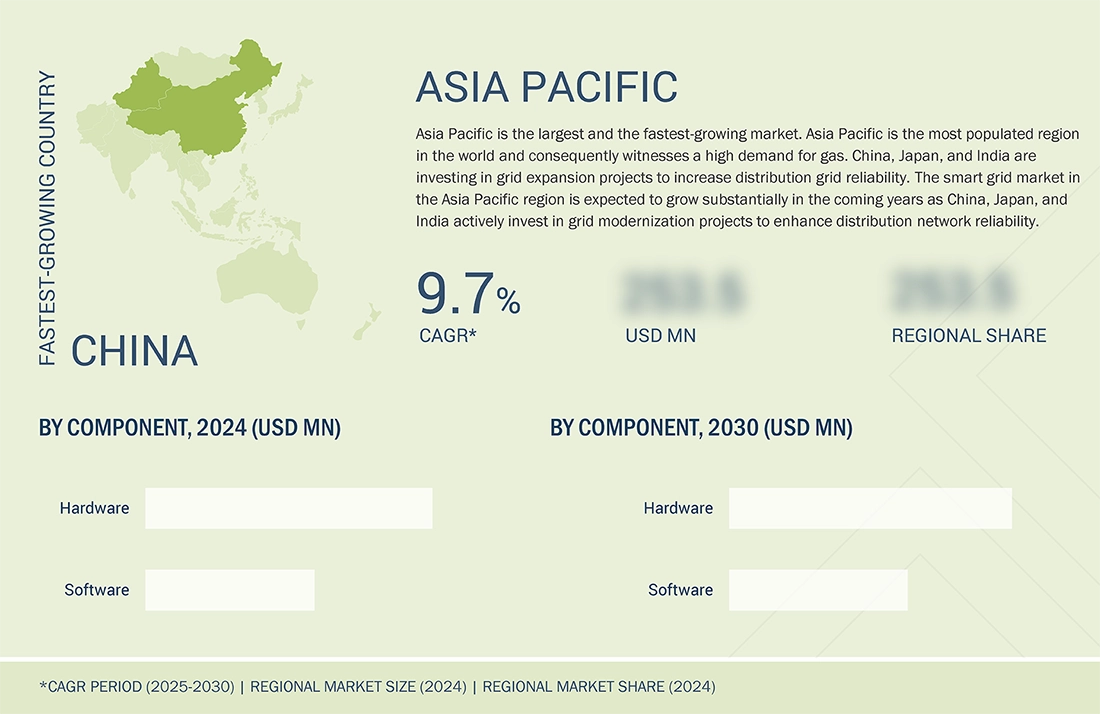

BY REGIONThe smart gas meter market with the fastest rate of growth is Asia Pacific, with Europe coming in second. China, Japan, Malaysia, Australia, Indonesia, Singapore, and the Rest of Asia Pacific are the countries that make up this region. The region's biggest and fastest-growing market is China. Currently, China is at the forefront of new investments in smart grid technologies. Due to the significant changes occurring in the nation's energy sector, China has emerged as the primary user of smart grid technology. Smart grid technologies will become increasingly necessary as a result of the nation's ambitious renewable energy program. China's emphasis on adopting energy efficiency is another factor supporting the need for the smart grid industry, which in turn is driving up demand for smart gas meters.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including expansions, sales contracts, acquisitions, agreements, investments, product launches, partnerships, and collaborations. For instance, Honeywell International Inc. (US) acquired Air Products (US) liquefied natural gas (LNG) process technology and equipment business for USD 1.81 billion in an all-cash transaction. This further expands the comprehensive suite of top-tier solutions Honeywell offers its customers to help them manage their energy transformation journey.

The global smart gas meter market is projected to reach USD 4.04 billion by 2030, up from USD 2.49 billion in 2024, registering a CAGR of 8.5% over the forecast period. The major drivers for the smart gas meter market are the digitalization of distribution grids and network operation optimization, management of advanced metering infrastructure (AMI) assets, and rising investment in smart grid technologies for data measurement and analysis. The rise in focus on smart grid programs, the upgrade of gas networks, and the adoption of AI in smart gas meter processes are high-growth opportunities for the market.

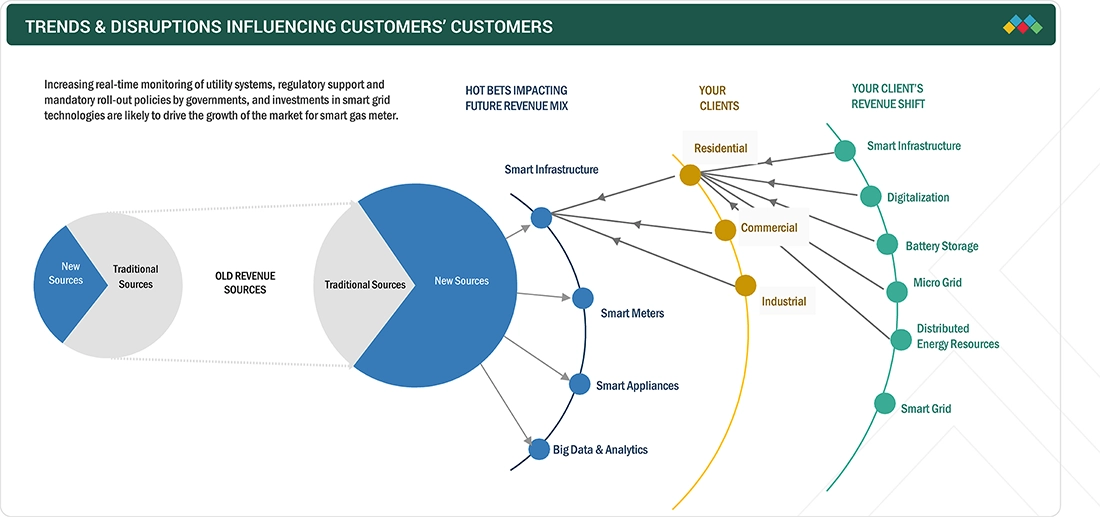

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The smart gas meter market is undergoing significant transformation due to a variety of trends and disruptions that are impacting customer business. The shift towards digitalization and smart infrastructure is accelerating, driven by new use cases, emerging technologies, and evolving ecosystems that enhance operational efficiency and enable innovative products and service offerings. Increasing adoption of big data and analytics empowers customers to make data-driven decisions, optimize energy usage, and improve asset lifecycle management. Additionally, market players are responding to changing client imperatives—such as residential, commercial, and industrial requirements—by developing advanced smart appliances and meters that support integration with distributed energy resources, battery storage, and microgrids. As a result, the future revenue mix for companies in this sector is likely to be dominated by these new technological paradigms, with clients demanding greater flexibility, reliability, and sustainability outcomes through smart grid solutions and interoperable infrastructure.?

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Digitalization of distribution grids and optimization of network operations

-

Benefits of deploying AMI

Level

-

Concerns pertaining to data privacy & security and consumers health

-

High upfront cost for smart gas infrastructure

Level

-

Growing emphasis on smart grid initiatives and modernization of gas networks

-

Integration of AI into smart gas meter operations

Level

-

Delayed realization of return on investment (ROI) due to complexity in integration of devices

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Drivers: Digitalization of distribution grids and optimization of network operations

The Internet of Things (IoT) is a system of interrelated objects and equipment that transmit digital information. The growing adoption of IoT has increased digitalization across multiple industries, such as gas and electricity, at a significant rate. IoT communication networks are enabling grid operators and energy companies to provide modern-day energy services. Besides, the rise in the usage of NB-IoT will create an opportunity for smart gas metering for new customers, as many utilities do not have the funds or ability to own and operate a communication network. Digitalization also includes hybrid cloud infrastructure, which will allow leveraging high data processing capacity and IoT to manage networks in an increasingly flexible and efficient way. For instance, In February 2025, Polaris Smart Metering signed a deal to supply one million NB-IoT-enabled smart gas meters to Think Gas in India. This project includes AI-powered consumption insights and real-time dashboards, positioning Polaris as a market leader. The deployment is a direct result of India's push for digitalization and modernization of gas networks, which is expected to drive significant growth in the smart gas meter market.

Restraints: Concerns pertaining to data privacy & security and consumers health

The data collected from a smart gas meter can be used to monitor the behavior of consumers. According to the US EIA and European Union, periodic measurement of utility consumption by smart gas meters can reveal much more information about consumers, such as the use of household appliances and housework activities. This information regarding utility consumption has high commercial value, e.g., in marketing and advertisement. Smart gas meters can also be used as an infrastructure for mass surveillance. However, the data from smart gas meters is vulnerable to cyber-attacks and data breaches. The personal energy consumption data generated from smart gas meters could be of interest to law enforcement agencies, tax authorities, insurance companies, and other third parties. Thus, government agencies, including the US EIA and European Data Protection Supervisory Authorities, have identified these risks related to the protection of personal data and are formulating new data protection rules for smart gas meter operations. This privacy and security concern is expected to act as a key restraint for the growth of the smart gas meter market. Furthermore, smart gas meters emit radiofrequency (RF) radiations, which affect the biological system. As per the World Health Organization (WHO), these radiations increase the possibility of a malignant type of brain cancer. Moreover, with increased exposure to radiofrequency, the chances of an increase in body temperature are high, which is a concern to human health in the long run. Besides, RF fields change the proliferation rate of cells, which affects the genes in the DNA of cells. On the other hand, published studies in the US on potential health effects associated with a smart gas meter have concluded that the RF emissions are within the US Federal Communications Commission (FCC) limits. These uncertainties associated with smart gas meters could hamper their usage and restrain the growth of the smart gas meter market to an extent.

Opportunities: Growing emphasis on smart grid initiatives and modernization of gas networks

Smart grids represent transformative technologies that have modernized gas networks by equipping both utilities and consumers with the data needed to manage gas use more efficiently. Energy utilities around the world are ramping up investments in smart grid solutions, which allow for automated monitoring and control of gas consumption, foster the emergence of innovative business models, and help minimize outages while speeding up recovery during natural disasters. At the consumer level, smart grids facilitate demand flexibility and empower end users to participate in energy system operations through distributed generation and storage. According to the US Department of Energy (DoE), the adoption of a modernized smart grid in the United States is projected to help consumers save approximately USD 20 billion on utility bills by 2025. The cornerstone of smart grid technology is the smart meter. Once a comprehensive network of smart meters is established, utilities can ensure reliable energy delivery and introduce new efficiency products tailored to customer needs. For example, the Baltimore Gas and Electric Company's (BGE) Smart Grid Initiative involved the widespread installation of advanced metering infrastructure (AMI) across its service area. As part of this effort, BGE introduced a customer web portal and home energy management reports that present usage data using behavioral science principles, encouraging greater energy efficiency and conservation. Additionally, the utility upgraded its customer care and billing systems and implemented a meter data management system (MDMS) to maximize the benefits of these new technologies.

Challenges: Delayed realization of return on investment (ROI) due to complexity in integration of devices

Smart gas meter projects across the globe have witnessed delays or cancellations as their deployment is highly capital-intensive and could be an investment risk for utilities and consumers. The overall cost of installation and operation of smart gas meters is very high. In most countries, states do not provide subsidies, and there are no binding targets or mandates for smart gas meter installations. The entire project is dependent on the utility planning to undertake the rollout, and hence, funding is a serious challenge. Besides, the integration of the devices becomes even more complicated when the number of customers increases, which further delays smart gas meter operations. Even in developed smart gas meter markets, such as Italy and Sweden, utilities are deploying smart meters in different phases to make new-generation smart gas meter integration profitable. The implementation of new-generation smart gas meters in these countries could be extended until 2030 due to limited consumer acceptance. Due to such a long delay in the realization of ROI, companies refrain from installing smart meters.

Smart Gas Meter Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

E.ON Bayern sought to modernize gas metering for its customers in Bavaria, aiming to address the lack of transparency in gas consumption and costs. The company also needed to determine the most effective data transfer communication system for diverse customer environments (urban vs. rural) and to explore new retail product options based on customer preferences. | E.ON Bayern launched a pilot project deploying 10,000 smart meters for power and gas, focusing on both technical and retail aspects. The technical solution involved testing various communication systems for optimal data transfer. Retail customers received hourly gas consumption and cost details via a secure online portal, with plans to offer monthly invoicing in later phases. The pilot included market surveys to gather customer feedback and assess preferences. Early results showed increased customer awareness of energy use and positive feedback on energy savings due to real-time consumption data. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The smart gas meter market ecosystem is changing rapidly as part of the broader transition to smart technologies and digital infrastructure. Key stakeholders in this ecosystem include raw material provider/component suppliers, smart gas meter manufacturers, distributor, and end users.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

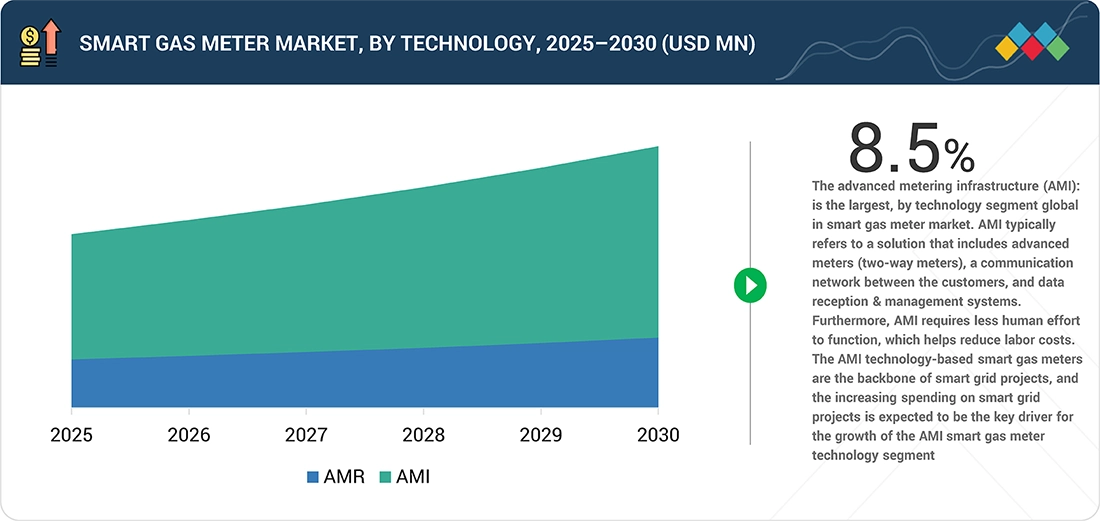

Smart Gas Meter Market, By Technology

The advanced metering infrastructure (AMI): is the largest, by technology segment global in smart gas meter market. AMI typically refers to a solution that includes advanced meters (two-way meters), a communication network between the customers, and data reception & management systems. Furthermore, AMI requires less human effort to function, which helps reduce labor costs. The AMI technology-based smart gas meters are the backbone of smart grid projects, and the increasing spending on smart grid projects is expected to be the key driver for the growth of the AMI smart gas meter technology segment

Smart Gas Meter Market, By Type

The smart ultrasonic gas meter segment is witnessing the fastest growth by component in the global smart gas meter market during the forecasted period. Ultrasound (ultrasonic) waves operate at frequencies above 20 kHz, exceeding the upper limit of human hearing. Growth drivers for this segment include rising demand for highly accurate and reliable metering solutions, ongoing government mandates and incentives for smart meter adoption, the push for improved energy efficiency, real-time monitoring, and advanced data analytics for gas consumption and leak detection. Additional factors fueling adoption are lower maintenance due to the absence of moving parts, expanding smart grid and IoT infrastructure, and increasing utility investments in smart city initiatives.??

Smart Gas Meter Market, By Component

The software segment is experiencing the fastest growth by components of the global smart gas meter market during the forecasted period. Key software elements in smart gas meters include the Customer Information System (CIS), Meter Data Management System (MDMS), and metering and billing software. These software solutions support utilities in managing smart gas meter operations, identifying abnormal utility usage, and producing accurate billing calculations.?

Smart Gas Meter Market, By End User

By end user, the commercial segment is projected to be the second largest contributor during the forecast period. The commercial segment plays an important role in the growth of the global smart meter market. This growth is propelled by the rising need for energy efficiency, cost savings, and sustainability among businesses. Commercial entities, such as offices, retail stores, healthcare facilities, and hotels, are quickly adopting smart meters. These devices help them monitor and manage their energy use in real-time. The shift is also driven by improvements in communication technologies, including IoT integration and better data analysis. These tools allow businesses to make informed choices about their energy use and lower operational costs. As a result, commercial smart meters are becoming vital for meeting regulations, lowering carbon footprints, and supporting larger sustainability objectives.

REGION

Asia Pacific to be largest region in global smart gas meter market during forecast period

Asia Pacific is expected to be the largest smart gas meter market region between 2025–2030. The region's biggest and fastest-growing market is China; the nation is at the forefront of new investments in smart grid technologies. Due to the significant changes occurring in the nation's energy sector, China has emerged as the primary user of smart grid technology. Smart grid technologies will become increasingly necessary as a result of the nation's ambitious renewable energy program. China's emphasis on adopting energy efficiency is another factor supporting the need for the smart grid industry, which in turn is driving up demand for smart gas meters.

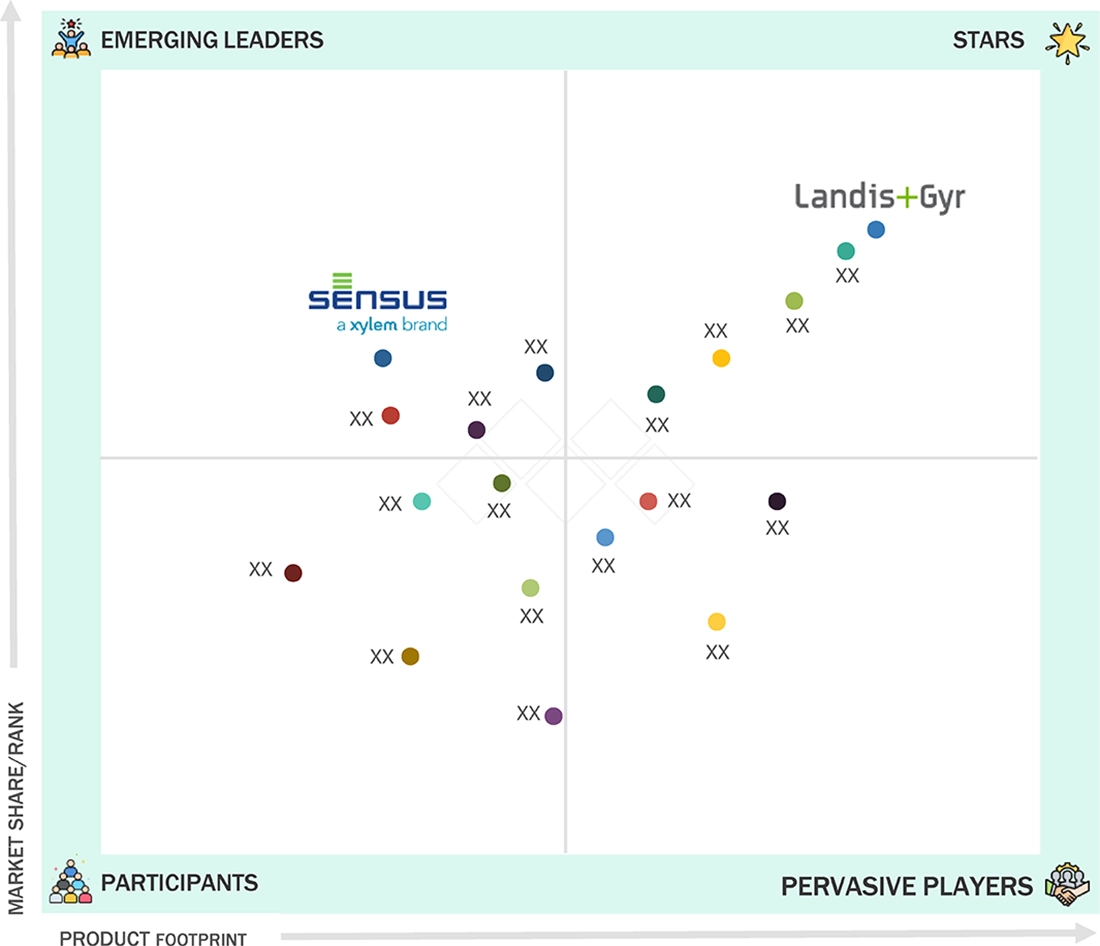

Smart Gas Meter Market: COMPANY EVALUATION MATRIX

In the Smart Gas Meters market matrix, Landis+Gyr (Star), reflecting its leadership in both market share and product footprint. The company stands out due to its robust technology portfolio and ability to deliver innovative smart gas metering solutions catering to diverse client needs. Landis+Gyr's advanced analytics, seamless integration with smart grid infrastructure, and continuous product development strengthen its industry position and drive market growth. Meanwhile, Sensus (a Xylem brand), positioned as an Emerging Leader, showcases strong market presence and an extensive suite of technologies, making it a key competitor for future expansion.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.49 BN |

| Market Forecast in 2030 (Value) | USD 4.04 BN |

| Growth Rate | 8.5% |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Middle East & Africa and South America |

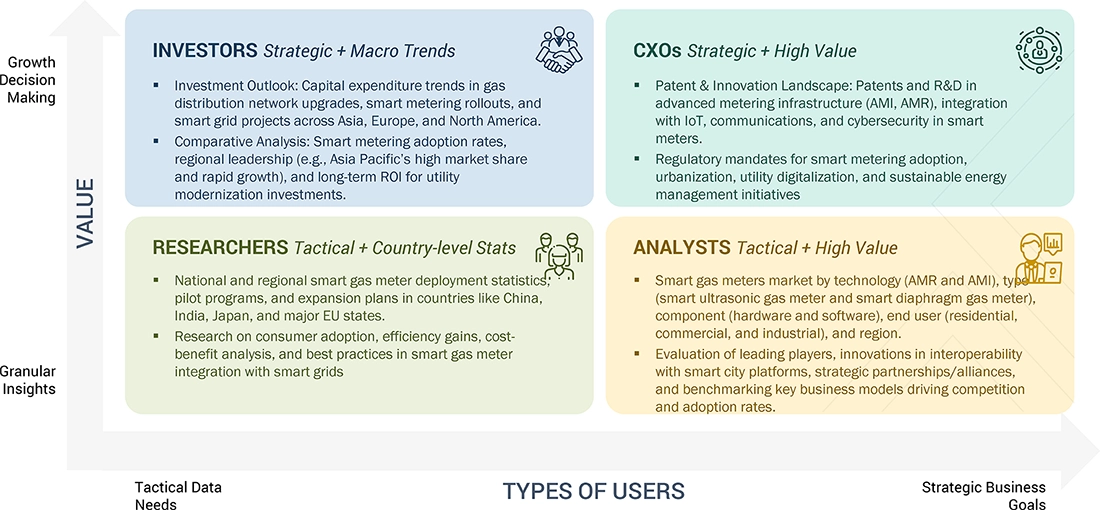

WHAT IS IN IT FOR YOU: Smart Gas Meter Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Client 1 | Product matrix, which gives a detailed comparison of the product portfolio of each company | |

| Client 2 | Further breakdown of the energy as a service market, by country | |

| Client 3 | Detailed analysis and profiling of additional market players (up to five) |

RECENT DEVELOPMENTS

- April 2025 : Landis+Gyr (Switzerland) and Centrica Smart Meter Assets (UK) (Centrica plc's subsidiary, including British Gas) signed a new three-year agreement to supply smart electricity and gas meters. This extends a collaboration that has spanned more than a decade. The partnership aims to advance the UK's smart energy transition further, ensuring that households and businesses benefit from improved energy management.

- September 2024 : Honeywell International Inc. (US) acquired Air Products (US) liquefied natural gas (LNG) process technology and equipment business for USD 1.81 billion in an all-cash transaction. This further expands the comprehensive suite of top-tier solutions Honeywell offers its customers to help them manage their energy transformation journey.

- March 2023 : Diehl Metering (Germany) entered a strategic partnership with STACKFORCE GmbH (Germany) to accelerate IoT opportunities in metering, enhancing connectivity and integration for smart meters.

- April 2022 : Apator Metrix SA (Poland) (a subsidiary of Apator Group) signed a contract with Landis+Gyr (Switzerland) to supply smart gas meters for Belgium's mass smart metering rollout.

Table of Contents

Methodology

The study involved major activities in estimating the current size of the smart gas meter market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the market involved the use of extensive secondary sources, directories, and databases, such as Hoover's, Bloomberg, Factiva, IRENA, International Energy Agency, and Statista Industry Journal, to collect and identify information useful for a technical, market-oriented, and commercial study of the market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The smart gas meter market comprises several stakeholders, such as equipment providers, service providers, and technical providers in the supply chain. The rising demand for smart gas meters of various types, such as smart ultrasonic gas meters and smart diaphragm gas meters, characterizes this market's demand side. The supply side is characterized by rising demand for contracts from the industrial sector and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market size estimations and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process and list key information/insights throughout the report.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following.

Smart Gas Meter Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the total market has been split into several segments and subsegments. Data triangulation and market breakdown processes have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

A smart gas meter is equipment used for measuring the amount of gas consumed in intervals on an hourly or daily basis at home, buildings, or industrial facilities. Smart gas meters are next-generation metering devices that allow remote data collection related to consumers' usage and periodic communication with the utility. They use wireless communication to connect to wide area networks, allowing remote monitoring and automatic billing. Implementing smart gas meters in utilities helps increase energy efficiency and effectively monitor and integrate new utility resources. For consumers, smart gas meters offer a better understanding of their usage or consumption patterns and help in easier supplier switching, fault detection, and clearance. There are two major types of smart gas meter technologies: Automatic Meter Reading (AMR) and Advanced Metering Infrastructure (AMI). Smart gas meters are globally mainly implemented in the residential, commercial, and industrial sectors.

Stakeholders

- Government and research organizations

- Energy service providers (private/government)

- Utilities & retail gas suppliers

- Original equipment manufacturers (OEMs)

- Independent service providers (ISPs)

- Asset owners/operators

- Technology providers

- Spare parts suppliers & logistics

- Consultants/consultancies/advisory firms

- Environmental research institutes

- Private or investor-owned utilities

- State and national regulatory authorities

- Investors/shareholders

Report Objectives

- To define and describe smart gas meter market, based on technology, type, component, and end user

- To provide detailed information on the major factors influencing the growth of the smart gas meter market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, prospects, and contribution of each segment to the market

- To analyze market opportunities for stakeholders and details of a competitive landscape for market leaders

- To forecast the growth of the market with respect to the major regions (Asia Pacific, Europe, North America, South America, the Middle East, & Africa)

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To track and analyze competitive developments, such as new product launches, contracts & agreements, investments & expansions, and mergers & acquisitions, in the market

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakdown of the energy as a service market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What was the size of the smart gas meter market in 2024?

The smart gas meter market reached USD 2.49 Billion in 2024.

What are the major drivers for the smart gas meter market?

The smart gas meter is driven by factors such as the digitalization of distribution grids and optimization of network operations, asset management of advanced metering infrastructure (AMI), and increasing investment in smart grid technologies to measure and analyze data.

Which region will be the most lucrative region in the smart gas market during the forecast period?

Asia Pacific is projected to be the fastest-growing market during the forecast period due to the region's greenfield investments in chemical and oil & gas industries.

By technology, which segment is projected to be the fastest-growing segment in the smart gas meter market during the forecast period?

The AMI segment is projected to be the fastest-growing segment at a CAGR of 8.1% during the forecasted period. The market for AMI is driven by the growing need for accurate meter readings and increasing spending on smart grid projects.

Who are the leading players in the global smart gas meter market?

Landis+Gyr (Switzerland), Itron Inc. (US), Honeywell International Inc. (US), and Apator S.A (Poland). are the leading players in the smart gas meter market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Smart Gas Meter Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Smart Gas Meter Market