The study involved major activities in estimating the current size of the small modular reactor market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles by recognized authors; and databases of various companies and associations. Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both, market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, and related key executives from various companies and organizations operating in the small modular reactors market.

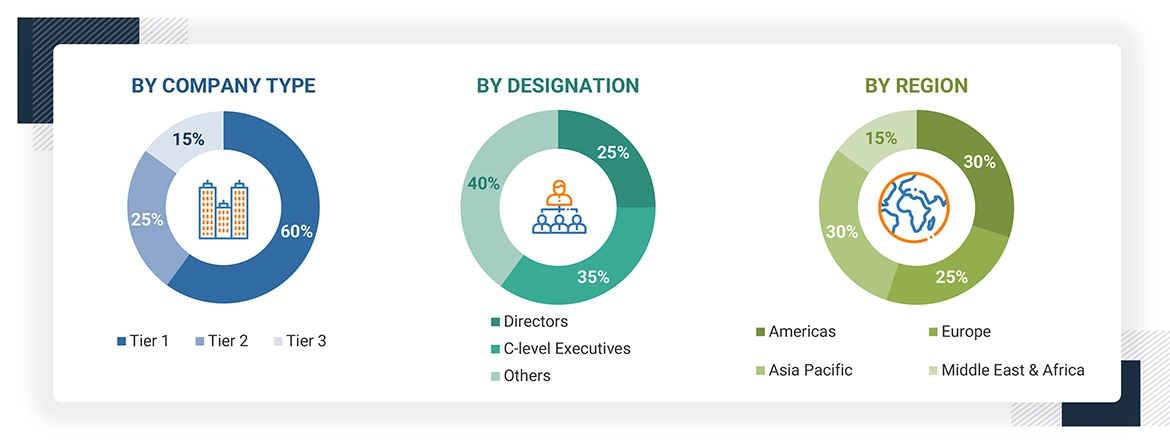

In the complete market engineering process, the top-down and bottom-up approaches, along with several data triangulation methods, were extensively used to perform the market size estimations and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process and list key information/insights throughout the report. Following is the breakdown of primary respondents:

Note: Other designations include sales managers, engineers, and regional managers.

The tier of the companies is defined based on their total revenue; as of 2023: Tier 1 = > USD 1 billion, Tier

2 = From USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the small modular reactors market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Small Modular Reactor Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was validated using the top-down and bottom-up approaches.

Market Definition

According to the World Nuclear Association, “Small modular reactors (SMRs) are defined as nuclear reactors generally 300 MWe equivalent or less, designed with modular technology using module factory fabrication, pursuing economies of series production and short construction times.” SMRs vary in terms of size and thermal output. These reactors can be used for various applications, such as power generation, process heating, desalination, and industrial uses. Their designs may employ light water as a coolant or other coolants, such as gases, liquid metals, or molten salts. Small modular reactors offer multiple benefits, such as small physical footprints, reduced capital investments compared with traditional nuclear power plants, the ability to be sited in locations not possible for larger nuclear plants, and provisions for incremental power additions.

The small modular reactors market size is defined as the sum revenue generated by global companies' manufacturing small modular reactors.

Stakeholders

-

Consulting companies in energy & power sector

-

Government and research organizations

-

Investment banks

-

Nuclear power plant operators

-

Power and energy associations

-

Small modular reactor support service providers

-

Manufacturers of small modular reactors

-

Small modular reactor component manufacturers and fuel fabricators

-

Power generation companies

-

Heavy industries

Report Objectives

-

To describe, segment, and forecast the small modular reactors market based on type, coolant, connectivity, deployment, location, power rating, and application, in terms of value

-

To describe and forecast the market for four key regions: Americas, Europe, Asia Pacific, and Middle East & Africa, along with their country-level market sizes, in terms of value

-

To forecast the small modular reactors market by type and region, in terms of volume

-

To strategically analyze micromarkets1 with respect to individual growth trends, future expansions, and their contribution to the overall small modular reactors market.

-

To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing the growth of the market

-

To provide the supply chain analysis, trends/disruptions impacting customers’ businesses, ecosystem analysis, regulatory landscape, pricing analysis, patent analysis, case study analysis, technology analysis, key conferences and events, trade analysis, Porter’s Five Forces analysis, and key stakeholders and buying criteria sections in the small modular reactors market

-

To analyze opportunities for stakeholders in the small modular reactors market and draw a competitive landscape

-

To benchmark market players using the company evaluation quadrant, which analyzes market players on broad categories of business and product strategies adopted by them

-

To compare key market players with respect to product specifications and applications

-

To strategically profile key players and comprehensively analyze their market rankings and core competencies2

-

To analyze competitive developments such as contracts and agreements, investments and expansions, mergers and acquisitions, partnerships, joint ventures, and collaborations in the small modular reactors market

-

To study the impact of AI/Gen AI on the market under study, along with the global macroeconomic outlook

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

-

Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

-

Detailed analyses and profiling of additional market players

Gajanan

Jul, 2022

Our report is primarily a demand-based coverage that states the Historic, Current and Future revenues of SMR at a regional and country level for which we had contacted several primary respondents from supply and demand side of the business to obtain the qualitative and quantitative information. We have forecasted the market size in terms of Value ($ Million) till year 2026, which is broken down by Reactor Type, Connectivity, Deployment, Location, and Application, and Region. Contracts awarded to key players for the 2020, 2021 and 2022 till date, market share analysis of key player for the year 2021, including their financials and revenues for the last 3 years, will be studied to derive the market share for top players and ranked them based on their product portfolio strength, global reach, and business strategy excellence. Also, we will profile each player including their service portfolio, regional ranking, key customers, organic and in-organic growth strategies, and SWOT analysis..

Tom

Jun, 2022

Interested in the profile key players and comprehensively analyze their market ranking and core competencies in the global small modular reactor market..