Nuclear Decommissioning Services Market by Reactor Type (PWR, BWR, & GCR), Strategy (Immediate Dismantling, Deferred Dismantling, and Entombment), Capacity (Up to 800 MW, 801 MW-1,000 MW, and Above 1,000 MW), and Region - Global Forecast to 2021

[134 Pages report] The size of the global nuclear decommissioning services market is estimated to be USD 4.84 Billion in 2016, and is projected to grow at a CAGR of 12.1% from 2016 to 2021, to reach USD 8.55 Billion by 2021. Nuclear accidents, such as the Fukushima Daichii nuclear power plant accident in 2011, and rising political pressure for pre-closure of nuclear power plants, especially in the European countries, are expected to drive the market.

The years considered for the study are as follows:

- Base Year 2015

- Estimated Year 2016

- Projected Year 2021

- Forecast Period 2016 to 2021

2015 has been considered as the base year for company profiles in the report. Wherever information was unavailable for the base year, the prior year has been considered.

Objectives of the study

- To define, describe, analyze, and forecast the global nuclear decommissioning services market based on reactor type, capacity, strategy, and region

- To provide detailed information on major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends and future prospects

- To identify the major stakeholders in the market and draw a competitive landscape for market leaders

- To project the market size of the market and its segments in key regions, namely, North America, Asia-Pacific, and Europe

- To analyze market opportunities for stakeholders by identifying high-growth segments of the market

- To track and analyze recent developments such as expansions, new product launches, mergers & acquisitions, and contracts & agreements in the global market

Research Methodology

This research study involved the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for a technical, market-oriented, and commercial study of the global nuclear decommissioning services market. Primary sources are mainly industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, technology developers, standard and certification organizations of companies, and organizations related to all the segments of this industrys value chain. The points given below explain the research methodology.

- Analysis of key operational and upcoming nuclear decommissioning projects across the globe, along with the plant capacity

- Analysis of the age of nuclear power plants in every country for the past 30 years

- Analysis of various types of nuclear reactors operating in nuclear power plants in different countries

- Major regions have been identified along with countries contributing to the maximum share

- Secondary has been conducted to find out investments in R&D and strategies adopted for decommissioning of nuclear power plants across countries

- Revenue of the top companies (regional/global) and industry trends along with top-down, bottom-up, and MnM KNOW have been used to estimate the market size

- The overall market size has been finalized by triangulating the supply-side data, which include product development and supply chain. worldwide

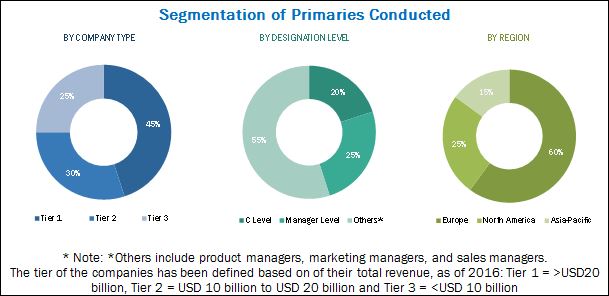

After arriving at the overall market size, the total market has been split into several segments and subsegments. The figure below provides a breakdown of primaries conducted during the research study, based on company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem:

The ecosystem of the global nuclear decommissioning services market starts with decommissioning service providers that include prominent global players as well as small and medium enterprises. Key contracting agencies include Areva Group (France), Babcock International Group PLC. (U.K.), Studsvik (Sweden), AECOM (U.S.), and Westinghouse Electric (U.S.). Global companies, given their wide geographical presence and extensive network, provide services themselves and through a larger network of third-party agencies. The end-users of decommissioning services include nuclear power plant operators and government bodies. These end-users offer contracts to service providers for decommissioning, such as Areva Group (France), Babcock International Group PLC. (U.K.), Studsvik (Sweden), AECOM (U.S.), and Westinghouse Electric (U.S.).

Target Audience:

- Nuclear decommissioning contractors

- Nuclear decommissioning equipment manufacturers

- Government and research organizations

- Consulting companies in the energy sector

- Nuclear decommissioning associations

- Environmental associations

- Investment banks

Scope of the Report:

- By Reactor Type

- Pressurized Water Reactor

- Boiling Water Reactor

- Gas-Cooled Reactor

- Other Reactors (which include pressurized heavy water reactor, fast breeder reactor, and light water graphite reactor)

- By Strategy

- Immediate Dismantling

- Deferred Dismantling

- Entombment

- By Capacity

- Up to 800 MW

- 801 MW-1,000 MW

- Above 1,000 MW

- By Region

- Europe

- North America

- Asia-Pacific

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for this report:

- Detailed analysis and profiling of additional market players (Up to 5).

- Further breakdown of regional markets

- Detailed country analysis

Regional Analysis

Further breakdown of region/country-specific analysis

Company Information

Detailed analysis and profiling of additional market players (Up to 5)

The global nuclear decommissioning services market is projected to reach USD 8.55 Billion by 2021, at a CAGR of 12.1% from 2016 to 2021. This growth can be attributed to nuclear accidents and rising political pressure for pre-closure of nuclear power plants.

The report segments the nuclear decommissioning services market based on reactor type into water cooled and gas-cooled reactors. Water cooled reactor has been further segmented into Pressurized Water Reactor (PWR), Boiling Water Reactor (BWR), Pressurized Heavy Water Reactor (PHWR), and other reactors. The BWR segment held the largest market size in 2015, as it is used in majority of the nuclear power plants.

The nuclear decommissioning services market has also been categorized based on capacity into up to 800 MW, 801 MW1,000 MW, and above 1,000 MW. The nuclear power reactors up to 800 MW are expected to occupy the largest market size during the forecast period, due to pre-closure of nuclear power plants, whose capacities were below 800 MW, in the European region.

The nuclear decommissioning services market has also been segmented based on strategy into immediate dismantling, deferred dismantling, and entombment. The immediate dismantling segment is expected to occupy the largest market size during the forecast period, due to early phase-out of nuclear power plants in the European region, especially in Germany and Italy.

Europe held the largest market share, followed by North America and Asia-Pacific. In 2015, Germany dominated the European nuclear decommissioning services market. This can be attributed to government support, followed by public concern for pre-closure of nuclear power plants. Meanwhile, the market is estimated to grow the fastest in Asia-Pacific, owing to more number of nuclear power plants in Japan and South Korea. The figure given below indicates the market size of various regions by 2021, with their respective CAGRs.

The decommissioning cost on an average ranges in between USD 600 Million to USD 750 Million. However, the actual cost incurred can be more than the average estimated cost since many factors are involved in decommissioning a nuclear power plant. These factors are restraining the growth of the market.

Some of the leading players in the nuclear decommissioning services market include Areva Group (France), Babcock International Group PLC. (U.K.), Studsvik AB (Sweden), AECOM (U.S.), and Westinghouse Electric (U.S.), among others. Contracts & agreements was the most commonly adopted strategy by the top players in the market, followed by expansions and other developments.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Limitations

3 Executive Summary (Page No. - 25)

3.1 Introduction

3.1.1 Historical Backdrop

3.2 Current Scenario

3.3 Future Outlook

3.4 Conclusion

4 Premium Insights (Page No. - 29)

4.1 Nuclear Decommissioning Services Market Outlook, 20162021

4.2 Europe Held the Largest Share in the Market in 2015

4.3 North America: Fastest Growing Market During the Forecast Period

4.4 Market, By Capacity

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Reactor Type

5.2.2 By Capacity

5.2.3 By Decommissioning Strategy

5.2.4 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Accidents and Rising Political Pressure for Pre-Closure

5.3.2 Restraints

5.3.2.1 High Cost of Decommissioning

5.3.3 Nuclear Decommissioning Services Market Opportunities

5.3.3.1 Aging Nuclear Power Plants

5.3.4 Nuclear Decommissioning Services Market Challenges

5.3.4.1 Selection of Decommissioning Technology

5.3.4.2 Nuclear Waste Disposal

6 Nuclear Decommissioning Services Marketindustry Trends (Page No. - 41)

6.1 Introduction

6.2 Supply Chain Analysis

6.3 Porters Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Nuclear Decommissioning Services Market, By Reactor Type (Page No. - 46)

7.1 Introduction

7.1.1 Pressurized Water Reactor

7.1.2 Boiling Water Reactor

7.1.3 Other Reactors

7.2 Gas-Cooled Reactor

8 Nuclear Decommissioning Services Market, By Decommissioning Strategy (Page No. - 50)

8.1 Introduction

8.2 Immediate Dismantling

8.3 Deferred Dismantling

8.4 Entombment

9 Nuclear Decommissioning Services Market, By Capacity (Page No. - 53)

9.1 Introduction

9.2 Up to 800 MW

9.3 801 MW1,000 MW

9.4 Above 1,000 MW

10 Nuclear Decommissioning Services Market, By Region (Page No. - 57)

10.1 Introduction

10.2 an Overview of the Market in North America

10.2.1 U.S.

10.2.2 Canada

10.3 an Overview of the Market in Europe

10.3.1 Germany

10.3.2 France

10.3.3 U.K.

10.3.4 Lithuania

10.3.5 Italy

10.3.6 Russia

10.3.7 Rest of Europe

10.4 Asia-Pacific

10.4.1 Japan

10.4.2 Rest of Asia-Pacific

11 Competitive Landscape (Page No. - 85)

11.1 Overview

11.2 Competitive Situation & Trends

11.3 Contracts & Agreements

11.4 New Product/Technology Developments

11.5 Mergers & Acquisitions

11.6 Expansions

11.7 Joint Ventures / Collaborations

12 Company Profile (Page No. - 93)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Introduction

12.2 Aecom

12.3 Areva Group

12.4 Babcock International Group PLC.

12.5 Studsvik AB

12.6 Westinghouse Electric Company

12.7 Ansaldo Nes (Nuclear Engineering Services Limited)

12.8 Enercon Services, Inc.

12.9 Energysolutions

12.10 GD Energy Services-Nuclear

12.11 KDC Contractors Limited

12.12 Nuvia Group

12.13 Onet Technologies

12.14 Sogin S.P.A (Societΰ Gestione Impianti Nucleari)

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 126)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

List of Tables (65 Tables)

Table 1 Nuclear Decommissioning Services Market Size, By Reactor Type, 20142021 (USD Million)

Table 2 Pressurized Water Reactor: By Market Size, By Region, 20142021 (USD Million)

Table 3 Boiling Water Reactor: By Market Size, By Region, 20142021 (USD Million)

Table 4 Other Reactors: By Market Size, By Region, 20142021 (USD Million)

Table 5 Gas-Cooled Reactor: By Market Size, By Region, 20142021 (USD Million)

Table 6 Market Size, By Decommissioning Strategy, 20142021 (USD Million)

Table 7 Immediate Dismantling: By Market Size, By Region, 20142021 (USD Million)

Table 8 Deferred Dismantling: By Market Size, By Region, 20142021 (USD Million)

Table 9 Entombment: By Market Size, By Region, 20142021 (USD Million)

Table 10 Market Size, By Capacity, 20142021 (USD Million)

Table 11 Up to 800 MW: By Market Size, By Region, 20142021 (USD Million)

Table 12 801 MW1,000 MW: By Market Size, By Region, 20142021 (USD Million)

Table 13 Above 1,000 MW: By Market Size, By Region, 20142021 (USD Million)

Table 14 Market Size, By Region, 20142021 (USD Million)

Table 15 North America: Market Size, By Country, 20142021 (USD Million)

Table 16 North America: By Market Size, By Decommissioning Strategy, 20142021 (USD Million)

Table 17 North America: By Market Size, By Reactor Type, 20142021 (USD Million)

Table 18 North America: By Market Size, By Capacity, 20142021 (USD Million)

Table 19 U.S.: Market Size, By Decommissioning Strategy, 20142021 (USD Million)

Table 20 U.S.: By Market Size, By Reactor Type, 20142021 (USD Million)

Table 21 U.S.: By Market Size, By Capacity, 20142021 (USD Million)

Table 22 Canada: Market Size, By Decommissioning Strategy, 20142021 (USD Million)

Table 23 Canada: By Market Size, By Reactor Type, 20142021 (USD Million)

Table 24 Canada: By Market Size, By Capacity, 20142021 (USD Million)

Table 25 Europe: Nuclear Decommissioning Services Market Size, By Country, 20142021 (USD Million)

Table 26 Europe: By Market Size, By Decommissioning Strategy, 20142021 (USD Million)

Table 27 Europe: By Market Size, By Reactor Type, 20142021 (USD Million)

Table 28 Europe: By Market Size, By Capacity, 20142021 (USD Million)

Table 29 Germany: Nuclear Decommissioning Services Market Size, By Decommissioning Strategy, 20142021 (USD Million)

Table 30 Germany: By Market Size, By Reactor Type, 20142021 (USD Million)

Table 31 Germany: By Market Size, By Capacity, 20142021 (USD Million)

Table 32 France: Nuclear Decommissioning Services Market Size, By Decommissioning Strategy, 20142021 (USD Million)

Table 33 France: By Market Size, By Reactor Type, 20142021 (USD Million)

Table 34 France: By Market Size, By Capacity, 20142021 (USD Million)

Table 35 U.K.: Nuclear Decommissioning Services Market Size, By Decommissioning Strategy, 20142021 (USD Million)

Table 36 U.K.: By Market Size, By Reactor Type, 20142021 (USD Million)

Table 37 U.K.: By Market Size, By Capacity, 20142021 (USD Million)

Table 38 Lithuania: Nuclear Decommissioning Services Market Size, By Decommissioning Strategy, 20142021 (USD Million)

Table 39 Lithuania: By Market Size, By Reactor Type, 20142021 (USD Million)

Table 40 Lithuania: By Market Size, By Capacity, 20142021 (USD Million)

Table 41 Italy: Nuclear Decommissioning Services Market Size, By Decommissioning Strategy, 20142021 (USD Million)

Table 42 Italy: By Market Size, By Reactor Type, 20142021 (USD Million)

Table 43 Italy: By Market Size, By Capacity, 20142021 (USD Million)

Table 44 Russia: Nuclear Decommissioning Services Market Size, By Decommissioning Strategy, 20142021 (USD Million)

Table 45 Russia: By Market Size, By Reactor Type, 20142021 (USD Million)

Table 46 Russia: By Market Size, By Capacity, 20142021 (USD Million)

Table 47 Rest of Europe: Nuclear Decommissioning Services Market Size, By Decommissioning Strategy, 20142021 (USD Million)

Table 48 Rest of Europe: By Market Size, By Reactor Type, 20142021 (USD Million)

Table 49 Rest of Europe: By Market Size, By Capacity, 20142021 (USD Million)

Table 50 Asia-Pacific: Nuclear Decommissioning Services Market Size, By Country, 20142021 (USD Million)

Table 51 Asia-Pacific: By Market Size, By Decommissioning Strategy, 20142021 (USD Million)

Table 52 Asia-Pacific: By Market Size, By Reactor Type, 20142021 (USD Million)

Table 53 Asia-Pacific: By Market Size, By Capacity, 20142021 (USD Million)

Table 54 Japan: Nuclear Decommissioning Services Market Size, By Decommissioning Strategy, 20142021 (USD Million)

Table 55 Japan: By Market Size, By Reactor Type, 20142021 (USD Million)

Table 56 Japan: By Market Size, By Capacity, 20142021 (USD Million)

Table 57 Kanupp Nuclear Power Plant Decommissioning Phases

Table 58 Rest of Asia-Pacific: Nuclear Decommissioning Services Market Size, By Decommissioning Strategy, 20142021 (USD Million)

Table 59 Rest of Asia-Pacific :By Market Size, By Reactor Type, 20142021 (USD Million)

Table 60 Rest of Asia-Pacific: By Market Size, By Capacity, 20142021 (USD Million)

Table 61 Contracts & Agreements, 20152016

Table 62 New Product/Technology Developments, 20132016

Table 63 Mergers & Acquisitions, 20142016

Table 64 Expansions, 2015

Table 65 Joint Ventures/Collaborations, 20152016

List of Figures (41 Figures)

Figure 1 Nuclear Decommissioning Services: Market Segmentation

Figure 2 Nuclear Decommissioning Services Market: Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Assumptions of the Research Study

Figure 6 Limitations of the Research Study

Figure 7 Europe Dominated the Market in 2015

Figure 8 BWR Segment to Occupy the Largest Market Share (Value) During the Forecast Period

Figure 9 Market Size, By Capacity, 2016 & 2021 (USD Million)

Figure 10 Immediate Dismantling Segment is Expected to Generate the Highest Demand From 2016 to 2021

Figure 11 Attractive Market Opportunities

Figure 12 Boiling Water Reactor Segment is Estimated to Dominate the Market During the Forecast Period

Figure 13 BWR Reactor Type Segment Accounted for the Largest Share in the European Market, 2015

Figure 14 North America is Expected to Grow at the Highest CAGR in the Market , 20162021

Figure 15 Europe is Expected to Account for the Largest Share of Up to 800 MW Within the Market During the Forecast Period

Figure 16 Nuclear Decommissioning Services Market: Market Segmentation

Figure 17 By Reactor Type

Figure 18 By Capacity

Figure 19 By Decommissioning Strategy

Figure 20 By Region

Figure 21 Compatibility to Explosive and Hazardous Environments and Compact Nature of Nuclear Decommissioning Services to Drive the Market

Figure 22 Operational Nuclear Reactors By Age

Figure 23 Supply Chain Analysis: Market

Figure 24 Porters Five Forces Analysis: Market

Figure 25 Market Share (Value), By Capacity, 20162021

Figure 26 Country-Wise Snapshot of the Nuclear Decommissioning Services Market, in Terms of CAGR, During the Forecast Period

Figure 27 Market Share (Value), By Region, 2015

Figure 28 North America & Europe are Projected to Dominate the Market, in Terms of CAGR, During the Forecast Period

Figure 29 Companies Adopted Contracts & Agreements and New Product/Service/Technology Developments to Capture the Market

Figure 30 Battle for Market Share: Contracts & Agreements Was the Key Strategy, 20132016

Figure 31 Market Evaluation Framework: Contracts & Agreements, Expansions, and New Product Launches Fueled the Growth of Companies From 2012-2016

Figure 32 Region-Wise Revenue Mix of the Top 4 Market Players

Figure 33 Aecom: Company Snapshot

Figure 34 Aecom: SWOT Analysis

Figure 35 Areva Group: Company Snapshot

Figure 36 Areva Group.: SWOT Analysis

Figure 37 Babcock International Group PLC.: Company Snapshot

Figure 38 Babcock International Group PLC.: SWOT Analysis

Figure 39 Studsvik AB: Company Snapshot

Figure 40 Studsvik AB: SWOT Analysis

Figure 41 Westinghouse Electric Company: SWOT Analysis

Growth opportunities and latent adjacency in Nuclear Decommissioning Services Market