Sleep Software Market: Growth, Size, Share, and Trends

Sleep Software Market by Function (Sleep Tracking, Analysis, Disorder Management, Improvement), Indication (Insomnia, Sleep Apnea), Offering (Platforms, Apps (Mobile)), End-user (Providers, Individual), Deployment, Type, & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global sleep software market is expected to reach USD 1,569.2 million by 2030 from USD 878.9 million in 2024, at a CAGR of 10.1% during the forecast period. The market growth is mainly fueled by increased awareness of sleep health and the rising adoption of wearable technologies and AI-based solutions. Consumer-focused applications and healthcare tools are key segments driving the market, providing personalized insights and remote monitoring capabilities.

KEY TAKEAWAYS

-

BY REGIONThe North America sleep software market dominated, with a share of 42.6% in 2024.

-

BY TYPEBy type, the integrated software segment is expected to register the highest CAGR of 11.5%.

-

BY OFFERINGBy offering, the applications segment is projected to grow at the fastest rate from 2025 to 2030.

-

BY FUNCTIONBy function, the sleep improvement segment is expected to dominate the market.

-

BY INDICATIONBy indication, the sleep apnea segment is expected to register the highest CAGR of 11.0%.

-

BY DEPLOYMENTBy deployment, the cloud-based models segment is expected to dominate the market.

-

BY END USERBy end-users, the individual users segment will grow the fastest during the forecast period.

-

COMPETITIVE LANDSCAPEKoninklijke Philips N.V., Nihon Kohden Corporation, ResMed, Calm, and Sleep Cycle were identified as Star players in the sleep software market, as they have focused on innovation and have broad industry coverage and strong operational & financial strength.

The sleep software market is experiencing steady growth driven by increasing sleep disorder prevalence, rising consumer focus on wellness, and integration of AI, wearables, and remote monitoring technologies that enable personalized insights, improved diagnosis, and better adherence to sleep therapy programs across clinical and home settings.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' businesses in the sleep software market stems from evolving customer needs and industry disruptions. Healthcare providers, individual users, sports and fitness centers, sleep centers, and corporate entities are the primary users of sleep software, with sleep monitoring and management as the key focus area. Shifts toward remote monitoring, performance analytics, insights, and workflow automation have a direct impact on the operational performance and revenues of end users. These impacts, in turn, drive the demand for advanced sleep software, shaping the market's growth trajectory.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Vast population of undiagnosed sleep apnea patients

-

Expansion of telehealth and remote patient monitoring

Level

-

Data privacy and security concerns

-

Use of alternative therapies and medications for sleep disorders

Level

-

Development of mHealth tools

-

Rising potential of AI & ML in sleep medicine

Level

-

Strategic challenges in monetizing sleep apps

-

Lack of clinical validation of sleep apps

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Vast population of undiagnosed sleep apnea patients

The rising prevalence of sleep disorders, driven by stress, obesity, and digital lifestyles, presents a growing market opportunity. With significant health risks like cardiovascular issues and mental health challenges linked to poor sleep, the demand for advanced diagnostics, treatment solutions, and wellness innovations is accelerating across the healthcare, consumer tech, and corporate wellness sectors. Although highly prevalent in the elderly population, sleep apnea affects people of all ages and is one of the most common sleep disorders globally. The health impact of sleep apnea is quite substantial but under-recognized.

Restraint: Data privacy and security concerns

Data security and privacy concerns present significant barriers in the sleep software market, primarily due to the sensitive nature of the health-related data these applications collect. Sleep apps often gather personal and biometric data, which makes them attractive targets for cyber threats. Inadequate encryption and vulnerability in data storage and transmission heighten the risk of unauthorized access, exposing users to potential privacy violations. Furthermore, the lack of transparency regarding how user data is utilized or shared with third parties can lead to issues with user trust and compliance. With stringent regulations like GDPR and HIPAA, companies must adhere to data protection standards to avoid legal and financial repercussions.

Opportunity: Development of mHealth tools

The development of mobile health (mHealth) tools for sleep solutions transforms healthcare delivery by enhancing patient engagement, streamlining communication, and improving access to medical information. The widespread adoption of smartphones offers innovative solutions for healthcare delivery. mHealth tools include apps for tracking fitness, managing chronic diseases, telemedicine consultations, accessing health education, and monitoring sleep health. With smartphone penetration increasing globally, mHealth tools provide scalable and accessible healthcare, particularly in underserved regions. mHealth applications facilitate easier access to medical records, allowing healthcare providers and patients to manage and retrieve health information efficiently. This capability reduces the paperwork burden and minimizes diagnostic errors by ensuring that relevant patient data is readily available to clinicians at the point of care.

Challenge: Variability in regulatory standards across regions

Monetizing sleep apps presents several strategic challenges. The primary issues are user trust and skepticism. Many apps lack clinical validation and scientific evidence, causing users to hesitate before paying for premium features or subscriptions. This can limit revenue potential, especially when apps are perceived as unreliable. The highly competitive market and saturation make differentiation difficult. With many free and paid apps offering similar features, such as sleep tracking and smart alarms, users are often unwilling to pay for services they can access for free. A key challenge is the lack of a clear value proposition. While some apps offer basic tracking, others provide advanced features like AI-driven insights. Users may not see the tangible benefits without clinical validation, reducing their willingness to pay for these features.

Sleep Software Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Mobile sleep and mindfulness app using behavioral and audio-based interventions for stress and insomnia. | Enhances sleep quality, reduces anxiety, and supports mental well-being. |

|

Guided meditation and sleep aid platform integrating CBT and relaxation exercises. | Promotes better sleep hygiene and improves user engagement in wellness programs. |

|

Cloud-based sleep management platform connecting CPAP devices, patients, and clinicians. | Enables remote monitoring, improves therapy adherence, and drives data-driven care. |

|

AI-enabled sleep tracking and apnea detection ecosystem integrated with wearable and home devices. | Provides personalized insights, enhances diagnostic accuracy, and supports chronic care management. |

|

Cloud-connected neurostimulation system for obstructive sleep apnea management. | Offers continuous therapy optimization, reduces intervention frequency, and improves long-term outcomes. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The sleep software market operates within a dynamic ecosystem involving multiple stakeholders, including individual users seeking better sleep quality, patients managing sleep disorders, healthcare providers leveraging digital tools for monitoring and therapy, and corporate wellness programs promoting employee well-being. Device manufacturers and wearable companies play a vital role by integrating software with CPAP systems, smart beds, and sensors for real-time monitoring, while software developers enable AI-driven analytics and IoT connectivity for seamless interoperability. Regulatory bodies ensure data security and clinical efficacy. Key trends such as AI-enabled personalization, wearable integration, mental health focus, and telehealth expansion are collectively driving the market’s evolution toward holistic and connected sleep management.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Sleep Software Market, By Type

In 2024, the integrated software segment accounted for the largest share of the sleep software market, driven by growing demand for unified platforms that consolidate data from wearables, medical devices, and mobile applications. These solutions enable real-time monitoring, AI-driven insights, and automated reporting, facilitating seamless clinician-patient interaction, improved therapy adherence, and better management of sleep disorders across clinical and home environments.

Sleep Software Market, By Offering

In 2024, by offering, the application segment held the largest share of the sleep software market. This dominance is attributed to the increasing use of mobile and web-based applications that deliver personalized sleep tracking, behavioral interventions, and AI-driven analytics, empowering users to monitor sleep patterns, improve sleep hygiene, and manage disorders conveniently through digital, user-friendly platforms.

Sleep Software Market, By Function

In 2024, by function, the sleep improvement segment accounted for the largest share of the sleep software market. This dominance is driven by increasing consumer awareness of sleep health, rising stress-related sleep disorders, and growing adoption of AI-enabled and behavioral therapy-based applications. These solutions provide personalized recommendations, guided relaxation programs, and cognitive behavioral therapy techniques, helping users enhance sleep quality, manage insomnia, and maintain long-term wellness through data-driven insights and continuous self-monitoring across connected devices and platforms.

Sleep Software Market, By Indication

In 2024, by indication, the general sleep improvement segment held the largest share of the sleep software market. This growth was fueled by the rising prevalence of lifestyle-induced sleep disturbances, growing awareness of preventive sleep health, and increasing adoption of digital wellness apps. These platforms leverage AI-driven analytics, mindfulness tools, and personalized recommendations to help users monitor sleep patterns, improve sleep hygiene, and enhance overall well-being across both consumer and clinical applications.

Sleep Software Market, By Deployment

In 2024, by deployment, the cloud-based segment accounted for the largest share of the sleep software market. This dominance is attributed to the scalability, remote accessibility, and seamless data integration offered by cloud platforms. Cloud-based solutions enable real-time sleep data analysis, remote monitoring, and multi-device synchronization—supporting healthcare providers, researchers, and users with secure storage, continuous updates, and advanced AI-driven insights for improved sleep disorder management and personalized therapy optimization.

Sleep Software Market, By End User

In 2024, by end user, the individual users segment held the largest share of the sleep software market. This was driven by increasing consumer awareness of sleep health, rising use of smartphones and wearables, and growing interest in self-care and wellness tracking. Individual users are adopting mobile apps and AI-enabled platforms for personalized sleep monitoring, behavioral recommendations, and lifestyle management, enabling proactive improvement of sleep quality and overall well-being without requiring clinical intervention.

REGION

Asia Pacific to be fastest-growing region in global Sleep Software market during forecast period

In 2024, Asia Pacific emerged as the fastest-growing region in the sleep software market. Growth is driven by rising awareness of sleep health, increasing smartphone and wearable penetration, expanding healthcare digitalization, and government initiatives promoting mental wellness. Additionally, growing urbanization, lifestyle-induced sleep disorders, and investments from global and regional digital health companies are accelerating adoption of AI-driven and app-based sleep solutions across major markets such as Japan, China, India, and Australia.

Sleep Software Market: COMPANY EVALUATION MATRIX

In the sleep software market matrix, Calm (Star) leads with a dominant position and a comprehensive digital wellness portfolio, underpinned by its evidence-based sleep, meditation, and stress management programs. The company’s strong brand equity and integration with leading wearable and mobile platforms enable seamless, data-driven personalization and broad consumer engagement across demographics. Natus Medical (Emerging Leader) is rapidly expanding its footprint through clinically validated sleep diagnostics and monitoring solutions that bridge hardware and software capabilities, offering advanced polysomnography analytics, cloud-enabled data sharing, and AI-assisted sleep disorder detection tailored for hospitals and sleep clinics.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 0.78 BN |

| Market Forecast in 2030 (value) | USD 1.57 BN |

| Growth Rate | CAGR of 10.1% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2023 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Sleep Software Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Competitive Landscape Mapping | Profiles of leading sleep software vendors (e.g., Calm, Headspace, ResMed, Philips, Inspire Medical) covering solution portfolios, subscription models, integration with wearables/IoT, and AI-based sleep analytics. | Enables competitive benchmarking, identifies product differentiation opportunities, and supports partnership evaluation and digital health ecosystem positioning. |

| Market Entry & Growth Strategy | Regional analysis of adoption trends, reimbursement models, digital health policies, and consumer behavior across North America, Europe, and Asia Pacific. | Reduces go-to-market risks, aligns regional growth strategy with local wellness and telehealth ecosystems, and supports new market localization. |

| Regulatory & Data Compliance Review | Assessment of HIPAA, GDPR, and country-specific data protection norms impacting sleep tracking, cloud data storage, and AI analytics. | Strengthens compliance readiness, supports vendor credibility, and ensures data privacy alignment for secure patient and consumer engagement. |

| Technology Adoption & Integration Trends | Insights into AI/ML-driven sleep monitoring, cloud deployment models, wearables integration, and personalized sleep improvement algorithms. | Guides R&D and platform roadmaps, enables differentiation through predictive and personalized insights, and enhances user retention via continuous innovation. |

RECENT DEVELOPMENTS

- December 2024 : Calm partnered with the National Childbirth Trust (NCT) to support new mothers by donating USD 12k for wholesome meals and contributing to the NCT’s Infant Feeding Line. Additionally, Calm offered free access to its content, including lullabies and soundscapes, to support maternal mental health and comfort new mothers and their babies.

- November 2024 : Headspace Health acquired Sayana Inc., a startup that enhances mobile apps with AI-driven chat features and mood tracking. This acquisition strengthens Headspace's ability to personalize user experiences, offering tailored self-help tools and therapeutic practices, including cognitive behavioral therapy (CBT), acceptance commitment therapy (ACT), and dialectical behavioral therapy (DBT).

- September 2024 : ResMed introduced new patient-centric innovations for sleep apnea therapy, including smartwatch compatibility and advanced myAir app features such as sleep staging and holistic health tracking. These tools enhance CPAP engagement, integrate wearable data, and deliver personalized coaching for better outcomes.

Table of Contents

Methodology

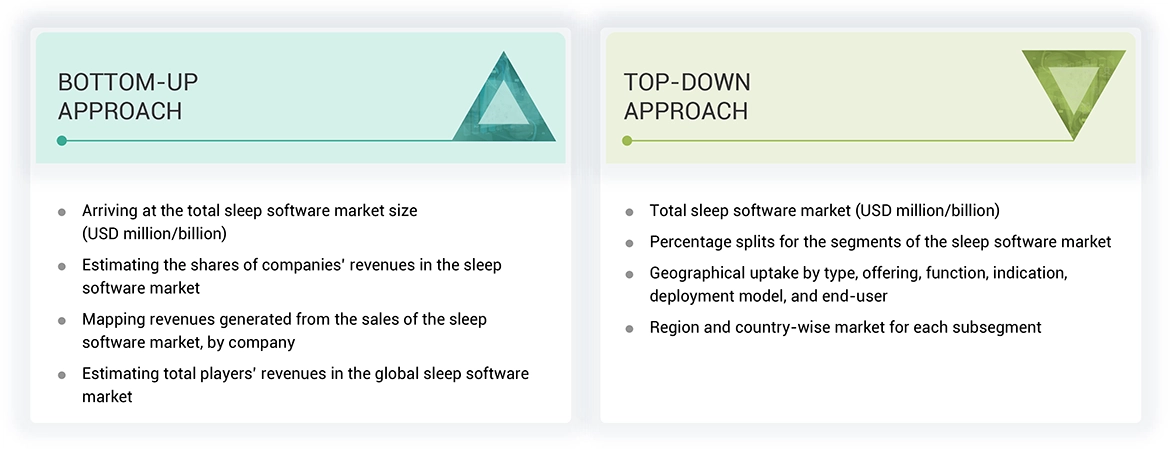

The study involved significant activities to estimate the current size of the sleep software market. Exhaustive secondary research was done to collect information on the sleep software market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the Sleep Software market.

Secondary Research

This research study involved the wide use of secondary sources, directories, and databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva; white papers, annual reports, and companies’ house documents; investor presentations; and the SEC filings of companies. The market for the companies offering Sleep Software solutions is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

Various secondary sources were referred to in the secondary research process to identify and collect information related to the study. These sources included annual reports, press releases, investor presentations of Sleep Software vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources are mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess prospects.

Primary research was conducted to identify segmentation types, industry trends, key players, and key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies adopted by key players.

After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

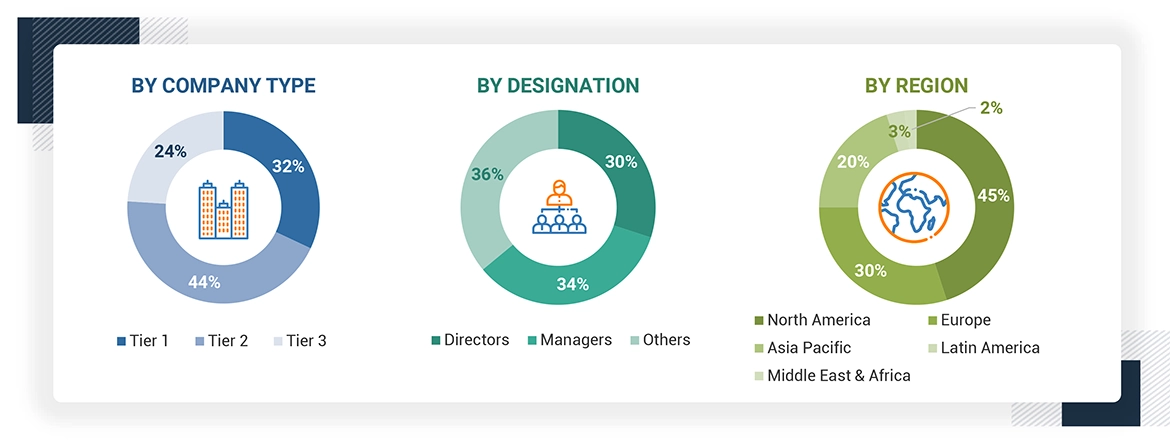

Breakdown of the Primary Respondents:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2023: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and top-down approach (assessment of utilization/adoption/penetration trends by type, offering, function, indication, deployment model, end user, and region).

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Sleep Software market.

Market Definition

The sleep software market refers to the industry that encompasses software applications and platforms designed to monitor, manage, and improve sleep quality. These software solutions may include mobile apps, wearable device integrations, smart home devices, and other digital tools for sleep tracking, analysis, and enhancement. They often use data such as sleep patterns, duration, environmental factors, and health metrics to offer insights or personalized recommendations.

Stakeholders

- Manufacturers & distributors of body composition analyzers

- Hospitals

- Fitness centers and wellness centers

- Healthcare corporations

- Medical service providers

- Ambulatory surgery centers

- Appliance suppliers

- Consulting firms

- Government associations

- Venture capitalists and investors

- Government organizations

- Academic research institutes

- Institutional investors and investment banks

- Investors/Shareholders

- Venture capitalists

- Research and consulting firms

Report Objectives

- To define, describe, and forecast the global sleep software market based on type, offering, function, indication, deployment model, end user, and region

- To provide detailed information regarding the factors influencing the growth of the market (such as the drivers, restraints, opportunities, and challenges)

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall Sleep Software market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the sleep software market in five main regions (along with their respective key countries): North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players and comprehensively analyze their product portfolios, market positions, and core competencies in the market

- To track and analyze competitive developments such as product & service launches; expansions; partnerships, agreements, and collaborations; and acquisitions in the Sleep Software market

- To benchmark players within the sleep software market using the Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Key Questions Addressed by the Report

- Platforms

- Applications

- Individual Users

- Healthcare Providers

- Others

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Sleep Software Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Sleep Software Market