Simulators Market Size, Share & Trends, 2025 To 2030

Simulators Market by Type (Full Flight, Full Mission, Tactical Training, Fixed Base, Full Mission Bridge, Part-Task Trainers, Operational Workstation, C2, ATC, Vessel Traffic), Platform, Solution, Technique, Application, Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Simulators Market is projected to reach USD 19.4 billion by 2030 from USD 13.6 billion in 2025, at a CAGR of 7.3% from 2025 to 2030. The procurement of simulators is estimated to grow from 1,594 units in 2025 to 2,326 units by 2030. The growth of the simulators market is driven by the rising training requirements from both commercial and military end users, along with growing regulations and mandates for training.

KEY TAKEAWAYS

- North America is expected to account for a 33.4% share of the Simulators Industry in 2025.

- By solution, the services segment is projected to grow at the fastest rate from 2025 to 2030.

- By platform, the air segment is expected to dominate the market throughout the forecast period.

- By application, the commercial training segment is projected to register the highest CAGR from 2025 to 2030.

- Northrop Grumman, Safran S.A., and Thales Alenia Space were identified as star players in the simulators market, given their strong market share and extensive product footprint.

- Schott and JBRND have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The growing integration of artificial intelligence, virtual reality, and cloud-based training modules is expanding simulator applications beyond the cockpit to maintenance crews, command centers, and autonomous system operators. The rise of new aviation platforms, such as electric vertical takeoff and landing (eVTOL) aircraft and uncrewed combat aerial vehicles (UCAVs), is creating demand for custom simulation ecosystems.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Hotbets are clients of simulator manufacturers, and target applications are clients of simulator products and services. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbets, which will further affect the revenues of simulator manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for skilled personnel

-

Imposition of mandatory training standards by civil aviation

Level

-

Lengthy procurement and certification cycles

-

Limited infrastructure in emerging economies

Level

-

Adoption of subscription and pay-per-use models

-

Growing adoption of unmanned aerial vehicles and unmanned ground vehicles

Level

-

Simulator obsolescence due to rapid platform updates

-

Storage and shelf-life limitations

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for skilled personnel

According to Airbus’s Global Market Forecast 2023, more than 40,850 new passenger and freighter aircraft are expected to be delivered globally by 2042, with over 22,000 units bound for the Asia Pacific. Boeing’s 2024 Pilot and Technician Outlook projects the need for approximately 2.3 million new aviation personnel by 2043 including 649,000 new pilots, 690,000 maintenance technicians, and 938,000 cabin crew members.

Restraint: Lengthy procurement and certification cycles

The post-installation certification timeline can range from 6 to 18 months, depending on the country and system complexity. In more challenging scenarios—such as EASA’s Full Flight Simulator Type 7 (FSTD Type 7) approvals certification delays can extend up to 24 months, driven by testing backlogs and the need for re-certification after software updates.

Opportunity: Adoption of subscription and pay-per-use models

As simulation technology continues to mature and cloud connectivity improves, simulator OEMs and training solution providers are increasingly adopting subscription-based, leasing, and pay-per-use commercial models. These flexible approaches are proving especially valuable for small and mid-sized operators that lack the capital to invest in full-scale simulator installations. Simulator access is becoming more democratized and scalable across regions with constrained infrastructure by shifting from capital expenditure (CAPEX) to operational expenditure (OPEX) models.

Challenge: Simulator obsolescence due to rapid platform updates

One of the most critical challenges in the simulators market is the accelerated obsolescence of training systems, which is primarily driven by the frequent updates in avionics, software, and digital hardware across the platforms these simulators are meant to replicate. As original equipment manufacturers (OEMs) release new aircraft and system variants, simulators must be periodically updated to reflect the latest logic, control systems, and interface behaviors.

simulators market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Full-flight simulators used for type-rating commercial pilots on Airbus A320 and Boeing 737 | Cuts training costs and flight hours while ensuring pilots meet regulatory certification standards |

|

Cabin crew simulators replicate in-flight emergencies such as fire, decompression, and evacuation | Improves crew readiness and compliance with safety mandates |

|

Military jet trainers with high-fidelity cockpits for tactical flight missions | Enables safe training of combat maneuvers without risking aircraft or pilots |

|

Armored vehicle simulators replicate battlefield driving and gunnery scenarios | Reduces fuel, ammunition, and maintenance costs during crew training |

|

Bridge simulators for ship navigation and maneuvering in congested ports | Enhances ship safety and reduces collision or grounding risk |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The simulators market ecosystem consists of service providers (Cubic, Havelsan), manufacturers (CAE, TRU, L3Harris, Thales, Kongsberg), system integrators (Elbit Systems, Indra), and end users (Emirates, Delta Air, Lufthansa). Service providers then deliver training-as-a-service through leased simulators, training centers, and certification programs, enabling users to access capability without full ownership. Collaboration across the value chain is key to innovation and market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Simulators Market, By Solution

The products segment is divided into hardware and software. Simulators in this segment range from flight and driving simulators to marine and military training systems. Flight simulators replicate the cockpit experience, allowing pilots to practice maneuvers, emergency procedures, and overall flight proficiency. Driving simulators provide a realistic environment for honing driving skills, contributing to road safety and driver education. Marine simulators offer training scenarios for ship navigation, crisis management, and engine room operations, ensuring that marine professionals are well-prepared for diverse sea conditions.

Simulators Market, By Platform

Advanced land-based simulators now incorporate high-fidelity physics modeling, immersive visual environments, AI-based opponent behavior, and networked multi-unit training. As smart mobility, urbanization, and defense modernization accelerate globally, land simulators are critical in workforce readiness, skill standardization, and cost-effective training across civilian and defense sectors.

Simulators Market, By Type

Flight Training Devices (FTDs) are gaining popularity due to their affordability, scalability, and regulatory relevance in commercial and military pilot training programs. These devices replicate essential cockpit functions and flight environments without requiring motion systems, making them cost-effective alternatives to Full Flight Simulators (FFS).

Simulators Market, By Application

The push for net-zero aviation also contributes to simulator demand, as synthetic training lowers carbon emissions and reduces dependency on live aircraft. Simulators increasingly integrate advanced technologies like virtual reality (VR), AI-based learning analytics, and cloud deployment, allowing customized and immersive training experiences.

Simulators Market, By Technique

Live simulation is growing steadily due to its ability to replicate real-world operations using actual equipment and personnel in controlled field environments. It offers unmatched realism in scenarios such as force-on-force training, battlefield drills, and weapons practice without actual combat risk. Defense agencies and security forces favor live simulations to evaluate readiness and physical response under stress.

REGION

North America to be largest-growing region in global simulators market during forecast period

The North American region is witnessing a surge in naval modernization programs and marine fleet expansion, particularly as the US Navy and Royal Canadian Navy continue replacing aging vessels and increasing deployment footprints. According to the US Department of Defense FY 2025 budget, over USD 9.3 billion has been allocated toward training and simulation technologies, including ship-bridge simulators and tactical command simulation suites, to train new ship commanders and crews.

simulators market: COMPANY EVALUATION MATRIX

The star companies have a significant market share, wide applications, geographical use cases, and a strong product footprint. CAE Inc. (Canada), Wärtsilä (Finland), Kongsberg Gruppen (Norway), Thales (France), Rheinmetall AG (Germany), and L3Harris Technologies, Inc. (US) are some of the key players in this category. Emerging leaders demonstrate substantial product innovations as compared to competitors. A few major emerging leaders in the simulators market are TRU Simulation + Training Inc. (US) and RTX (US).

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

List of Top Simulators Market Companies

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 12.8 Billion |

| Market Forecast in 2030 (value) | USD 19.4 Billion |

| Growth Rate | CAGR of 7.3% from 2025 to 2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD million/billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Middle East, Rest of the World |

WHAT IS IN IT FOR YOU: simulators market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Subsystem Manufacturer |

|

Highlight opportunities for visualization hardware across air, UAV, racing car, and UMV simulators |

RECENT DEVELOPMENTS

- April 2025 : CAE Defense & Security was awarded a contract for USD 180 million to support the US Army’s Advanced Helicopter Flight Training Support (AHFTS) program, providing comprehensive training support for advanced airframes through 2030.

- April 2025 : Thales was awarded a contract to modernize the Tactical Indoor Simulator (TACTIS) training center for the Royal Netherlands Army. The upgrade included AI-based behavioral engines, Unreal Engine 5 integration, and support for over 20 new vehicle types, including the CV90 MkIV and LEO2A8.

- January 2025 : L3Harris signed a two-year agreement with Thai Airways International to provide training services on its A320 Full Flight Simulator (FFS). Training will be conducted at L3Harris’ pilot training facility adjacent to Suvarnabhumi International Airport in Bangkok, Thailand.

Table of Contents

Methodology

The study involved four major activities in estimating the current size of the simulators market. Exhaustive secondary research collected information on the market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analyses were carried out to estimate the overall size of the market. After that, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the simulators market.

Secondary Research

In the secondary research process, various sources were referred to, to identify and collect information for this study. The secondary sources included government sources, such as SIPRI; corporate filings, such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

Extensive primary research was conducted after acquiring information regarding the simulators market scenario through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East, and the Rest of the World, which includes Africa and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

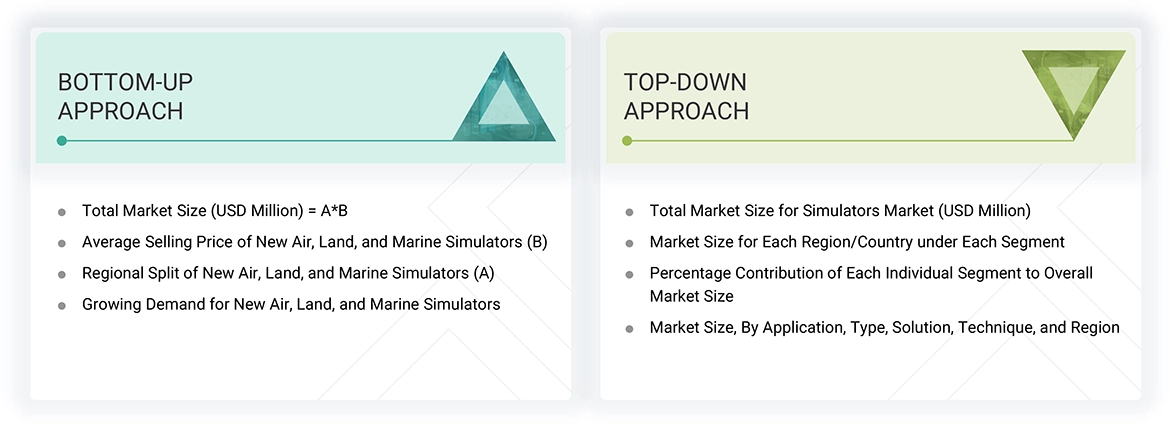

The top-down and bottom-up approaches were used to estimate and validate the size of the simulators market. The research methodology used to estimate the market size included the following details.

- Key players in the simulators market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews with leaders such as directors, engineers, marketing executives, and other stakeholders of leading companies operating in the simulators market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the Simulators market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Simulators Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated market numbers for the market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Market Definition

Simulators combine software and hardware to provide training in a simulated environment. They are used for training, skill development, and entertainment purposes and form a dynamic market with specialized devices designed to replicate real-world environments. These devices use advanced technologies, such as virtual reality (VR), augmented reality (AR), and haptic feedback, to deliver highly realistic and immersive experiences. Simulators are used across diverse industries, such as aviation for pilot training, automotive for driver education, healthcare for medical procedures, and gaming for recreational purposes.

In addition to their applications in various industries, 3D cameras have become increasingly popular in recent years in the consumer market. They are used by hobbyists, enthusiasts, and professionals alike to capture 3D photos and videos of landscapes, people, animals, and more.

Key Stakeholders

- Simulator manufactures

- Air, land, and naval platform manufacturers

- Technology providers

- System integrators

- Transport industry players

- Simulator service providers

- Pilot training institutes

- Regulatory bodies

- Simulator suppliers and distributors

- Software providers

- End users

Report Objectives

- To define, describe, and forecast the size of the simulators market based on platform, solution, application, type, technique, and region from 2025 to 2030

- To forecast the size of market segments concerning five major regions, namely North America, Europe, Asia Pacific, the Middle East, and the Rest of the world

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the market

- To analyze opportunities for stakeholders in the market by identifying key market trends

- To analyze competitive developments, such as contracts, acquisitions, expansions, agreements, joint ventures and partnerships, product developments, and research and development (R&D) activities in the market

- To provide a detailed competitive landscape of the market in addition to an analysis of business and corporate strategies adopted by leading market players

- To strategically profile key market players and comprehensively analyze their core competencies2

Customization Options

MarketsandMarkets offers the following customization options for this report:

- Additional country-level analysis of the simulators market

- Profiling of other market players (Up to five)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the simulators market

Key Questions Addressed by the Report

Which are the major companies in the simulators market? What strategies do they use to strengthen their market presence?

Some of the key players in the simulators market are CAE Inc. (Canada), Rheinmetall AG (Germany), Kongsberg Gruppen ASA (Norway), Thales Group (France), and Saab AB (Sweden). These players have relied on securing contracts to strengthen their presence in the market.

What are the drivers and opportunities for the simulators market?

Key drivers of the simulators market include the growing need for cost-effective, risk-free training across defense and civil aviation sectors. Additionally, rising geopolitical tensions and modernization programs are pushing militaries to adopt advanced synthetic training environments. In civil aviation, pilot shortages, regulatory mandates, and fleet expansion are fueling the demand for recurrent and type-specific simulator training. Moreover, technological advancements, such as AI-driven scenarios, VR/AR integration, and cloud-based access enhance training realism and scalability, offering opportunities for growth to market players.

Which region is projected to account for the largest share in the next five years?

North America is projected to account for the largest share from 2025 to 2030, showcasing strong demand for simulator solutions. The presence of major companies in the region is driving the market growth.

What are the trends disrupting the simulators market?

The flight simulators market is undergoing significant disruption. Virtual Reality (VR) and Augmented Reality (AR) enhance immersion and accessibility, making training more cost-effective. Artificial Intelligence (AI) is revolutionizing simulators by enabling personalized learning, predictive analytics for maintenance, and autonomous scenario generation, creating highly adaptive and realistic training environments. Additionally, a growing focus on sustainability drives the demand for simulators as a greener alternative to actual flight hours.

What is the projected CAGR of the simulators market?

The simulators market is projected to grow at a CAGR of 7.3% during the forecast period.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Simulators Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Simulators Market

Jake

Mar, 2019

Working on a report for Cornell analyzing the market for satellite simulators. (market size/share, potential ROI, etc...).