Remote Patient Monitoring Market: Growth, Size, Share, and Trends

Remote Patient Monitoring (RPM) Market by Offering (Software, integrated device), Device (Wearable, implants, handheld), Function (Cardiac, Glucose, Multiparameter), Application (Diabetes, Cardio, Neuro), End user, & Region - Global Forecast to 2030

OVERVIEW

-market-img-overview.webp)

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Remote Patient Monitoring (RPM) market is projected to reach USD 56,945.8 million by 2030 from USD 27,720.5 million in 2024, at a CAGR of 12.7% from 2024 to 2030. The growth of the Remote Patient Monitoring (RPM) market is driven by the transformation of patient care through digital innovation, expansion of telehealth in remote patient monitoring, coupled with the rising prevalence of chronic disease, particularly among the growing geriatric population.

KEY TAKEAWAYS

-

By RegionThe North America Remote Patient Monitoring (RPM) market accounted for a 53.4% revenue share of the global RPM market in 2024.

-

By ComponentBy component, the software segment is expected to register the highest CAGR of 14.8%.

-

By IndicationBy Indication, the cardiology segment accounted for the largest share of the global RPM market in 2024.

-

By End UserBy End User, the Patients segment is expected to register the highest CAGR of 13.3%.

The Remote Patient Monitoring (RPM) market is witnessing strong growth driven by digital transformation in patient care, the expansion of telehealth, and the rising burden of chronic diseases. Growing geriatric populations and the need for cost-efficient, home-based care are further boosting adoption. Meanwhile, advances in wearables, mHealth apps, and connected devices are enabling real-time monitoring, predictive insights, and more personalized healthcare delivery.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business in the Remote Patient Monitoring (RPM) market arises from evolving healthcare delivery models and rapid digital disruption. Hospitals, healthcare providers, payers, and homecare organizations are the primary users, leveraging RPM to enhance patient outcomes and operational efficiency. The shift toward continuous, data-driven, and home-based care is transforming clinical workflows, reimbursement structures, and patient engagement models. These changes are redefining how care is delivered and monetized, driving the demand for advanced, interoperable RPM platforms and integrated digital health ecosystems

-market-img-disruption.webp)

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Transformation of patient care through digital innovation

-

Expansion of telehealth in remote patient monitoring

Level

-

High investments and lack of IT expertise

-

Behavioral barriers and healthcare affordability challenges in remote patient monitoring

Level

-

Emergence of AI & ML

-

Gradual shift toward outpatient care environments

Level

-

Concerns associated with data security

-

Data accessibility issues

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Transformation of patient care through digital innovation

The transformation of patient care through digital innovation is a key driver of the Remote Patient Monitoring (RPM) market, enabling continuous, data-driven healthcare beyond traditional clinical settings. Advances in connected devices, cloud-based analytics, and AI-powered insights empower clinicians to monitor patients in real time, personalize treatment, and intervene proactively. This digital shift enhances care coordination, improves chronic disease management, reduces hospital readmissions, and promotes patient engagement ultimately driving better outcomes and cost efficiency across the healthcare continuum.

Restraint: High investments and lack of IT expertise

The high initial investments required for implementing Remote Patient Monitoring (RPM) systems, coupled with a shortage of skilled IT professionals, act as major restraints on market growth. Deploying connected devices, cloud infrastructure, and secure data management platforms demands substantial financial and technical resources, which can be challenging for smaller healthcare providers. Additionally, the lack of in-house IT expertise hinders seamless system integration, data interoperability, and ongoing maintenance, limiting the scalability and effectiveness of RPM solutions across healthcare settings.

Opportunity: Emergence of AI & ML

The emergence of Artificial Intelligence (AI) and Machine Learning (ML) presents significant opportunities for the Remote Patient Monitoring (RPM) market. These technologies enable predictive analytics, early detection of health anomalies, and personalized treatment recommendations by analyzing vast amounts of patient data in real time. AI-driven automation can also enhance clinical decision-making, reduce manual workload, and improve patient adherence through intelligent alerts and adaptive monitoring. As AI and ML continue to evolve, they are set to transform RPM solutions into more proactive, precise, and efficient healthcare management tools.

Challenge: Concerns associated with data security

Concerns associated with data security pose a major challenge to the Remote Patient Monitoring (RPM) market. The continuous transmission and storage of sensitive health data across connected devices and cloud platforms increase the risk of cyberattacks, data breaches, and unauthorized access. Ensuring compliance with stringent healthcare data protection regulations, such as HIPAA and GDPR, adds further complexity. These security concerns can undermine patient trust and deter healthcare organizations from fully adopting RPM solutions, emphasizing the need for robust encryption, authentication, and cybersecurity frameworks.

Remote Patient Monitoring (RPM) Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Virtual Care Management and connected monitoring for chronic conditions (diabetes, COPD, heart disease). | Reduces hospital readmissions, improves outcomes and patient engagement, lowers care costs. |

|

VitalSight home blood pressure and weight monitoring linked to clinicians. | Enables early intervention, better hypertension control, and continuous patient oversight. |

|

MyCareLink Smart and Vital Sync for remote monitoring of implantable and hospital-to-home patients. | Early detection of complications, reduced hospital stay and improved chronic care management. |

|

Deployment of RPM/virtual-care solutions by combining GE’s inpatient/acute monitoring portfolio with home-based virtual-care and remote-monitoring | Extends hospital-grade monitoring to home, improves capacity, and reduces readmissions. |

|

CardioMEMS HF System for remote monitoring of heart-failure patients. | Cuts hospitalizations and mortality, enables proactive treatment, and enhances quality of life. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The remote patient monitoring market's ecosystem comprises entities responsible for the end-to-end workflow of the RPM services workflow. The significant stakeholders present in this market include telecommunications companies, i.e., network, connectivity, and hardware providers; CT tools and electronics manufacturers, i.e., the infrastructure service providers; and service & medical device providers. Healthcare providers (hospitals, health systems, physicians, ACSs, and clinics), Payers, patients/customers, health retailers, senior living/post-acute/hospice centers, start-ups, and governments and regulatory bodies are also stakeholders of this market. Solution and service providers continue to enhance and mature their offerings to increase the value addition. Various hospitals across the world are availing RPM solutions to improve care delivery.

-market-img-ecosystem.webp)

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

-market-img-segment.webp)

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Remote Patient Monitoring (RPM) Market, By Component

As of 2024, the device segment held the largest share of the Remote Patient Monitoring (RPM) market and is expected to maintain its dominance through 2025. This leadership is driven by the widespread adoption of wearable sensors, vital sign monitors, implantable devices, and connected health instruments that enable real-time data collection and continuous patient assessment. These devices are integral to chronic disease management, post-acute care, and preventive health monitoring, offering accuracy, convenience, and early detection of health anomalies. Continuous innovation in miniaturization, connectivity, and integration with AI-powered analytics further strengthens the growth of the device segment within the RPM market.

Remote Patient Monitoring (RPM) Market, By Indication

As of 2024, cardiology accounted for the largest share of the Remote Patient Monitoring (RPM) market and is projected to retain its leading position through 2025. The dominance of this segment is driven by the rising prevalence of cardiovascular diseases, increasing demand for continuous heart health monitoring, and growing use of connected cardiac devices such as ECG monitors, implantable loop recorders, and blood pressure monitors. RPM solutions in cardiology enable early detection of arrhythmias, heart failure, and hypertension, supporting timely intervention and reducing hospital readmissions. The integration of AI and cloud-based analytics further enhances cardiac data interpretation, reinforcing the critical role of RPM in cardiovascular care management.

Remote Patient Monitoring (RPM) Market, By End User

As of 2024, healthcare providers held the largest share of the Remote Patient Monitoring (RPM) market and are expected to continue leading through 2025. This dominance stems from the growing integration of RPM solutions into clinical workflows to enhance patient care, improve treatment adherence, and reduce hospital readmissions. Hospitals, clinics, and home care organizations increasingly rely on connected monitoring systems to manage chronic conditions and track post-discharge patients remotely. The ability of RPM to support value-based care models, optimize resource utilization, and deliver real-time patient insights makes it a critical tool for healthcare providers aiming to improve outcomes and operational efficiency.

REGION

Asia Pacific to be fastest-growing region in global Remote Patient Monitoring (RPM) market during forecast period

The Asia Pacific Remote Patient Monitoring (RPM) market is expected to register the highest CAGR during the forecast period, driven by the rapid digitalization of healthcare systems, growing prevalence of chronic diseases, and increasing government initiatives promoting telehealth and remote care. Countries such as China, India, Japan, and South Korea are witnessing significant adoption of connected health devices and mobile-based monitoring solutions to enhance healthcare accessibility and efficiency. Expanding internet connectivity, rising healthcare expenditure, and strong investments from both public and private sectors are further accelerating the growth of RPM solutions across the region.

-market-img-region.webp)

Remote Patient Monitoring (RPM) Market: COMPANY EVALUATION MATRIX

In the Remote Patient Monitoring (RPM) market matrix, Abbott (Star) leads with a strong market share and an extensive product portfolio, driven by its advanced connected health devices such as glucose monitors, cardiac rhythm management systems, and wearable biosensors. The company’s focus on continuous innovation, clinical accuracy, and global reach has positioned it as a key enabler of data-driven, patient-centric care. Teladoc Health Inc. (Emerging Leader) is rapidly gaining traction with its expanding virtual care ecosystem that integrates RPM solutions, telehealth services, and AI-powered analytics to enhance chronic disease management and remote patient engagement. While Abbott dominates through technological excellence and scale, Teladoc demonstrates strong potential to advance toward the leaders’ quadrant as it continues to expand its digital health platform and strengthen care continuity across global markets.

-market-img-evaluation.webp)

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 27,720.5 Million |

| Market Forecast in 2030 (Value) | USD 56,945.8 Million |

| Growth Rate | CAGR of 12.7% from 2024-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

| Leading Segment | Software segment leads with a 14.8% CAGR |

| Leading Region | North America held a 53.4% share of the global RPM market in 2024 |

| Market Driver | Digital innovation transforming patient care |

| Market Constraint | High investment needs and limited IT expertise |

WHAT IS IN IT FOR YOU: Remote Patient Monitoring (RPM) Market REPORT CONTENT GUIDE

-market-img-content.webp)

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Healthcare Provider |

|

|

| Device Manufacturer |

|

|

| Payer & Insurance Company |

|

|

| Software / Platform Developer |

|

|

| Government / Public Health Agency |

|

|

| Home Healthcare Service Provider |

|

|

RECENT DEVELOPMENTS

- August 2024 : Abbott and Medtronic partnered to integrate its leading FreeStyle Libre continuous glucose monitoring (CGM) technology with Medtronic’s insulin delivery systems, enabling automated insulin adjustments for improved diabetes management. This collaboration expands access to advanced automated insulin delivery solutions for millions of people with diabetes worldwide

- July 2024 : Bon Secours Mercy Health entered into a 10-year partnership with Philips to implement & scale a new patient monitoring platform across its 49 hospitals and 1,200 care sites.

- April 2024 : OMRON Healthcare acquired Luscii to enhance its integrated care solutions. This move aimed to accelerate the adoption of remote patient monitoring and support OMRON's "Going for Zero" vision to reduce cardiovascular and cerebrovascular events

Table of Contents

Methodology

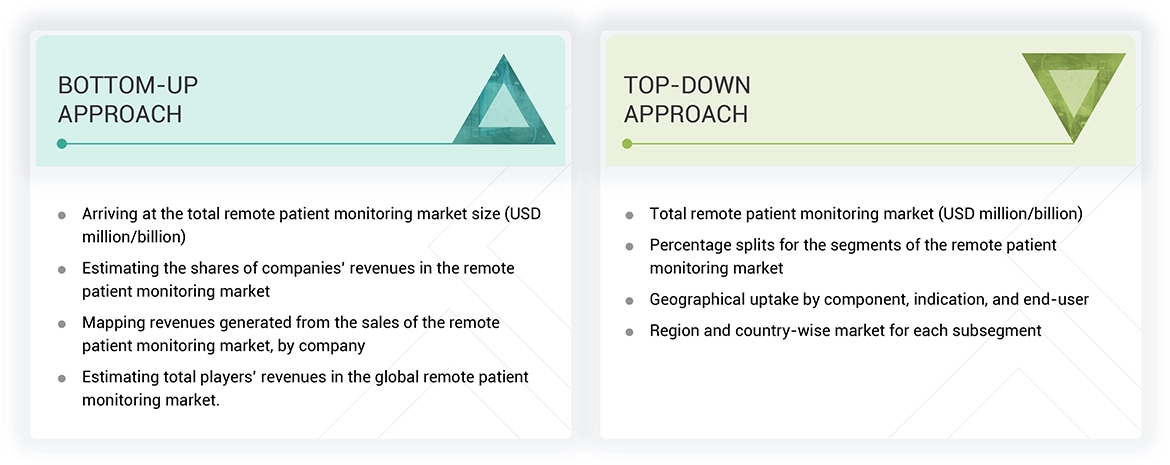

The study involved major activities in estimating the current market size for the remote patient monitoring market. Exhaustive secondary research was done to collect information on the remote patient monitoring industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the remote patient monitoring market.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to in order to identify and collect information for the study of remote patient monitoring market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global remote patient monitoring market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (Hospital directors, Hospital Vice Presidents, Department heads, and Critical care specialists ) and supply side (such as C-level and D-level executives, technology experts, product managers, marketing and sales managers, among others) across five major regions—North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews

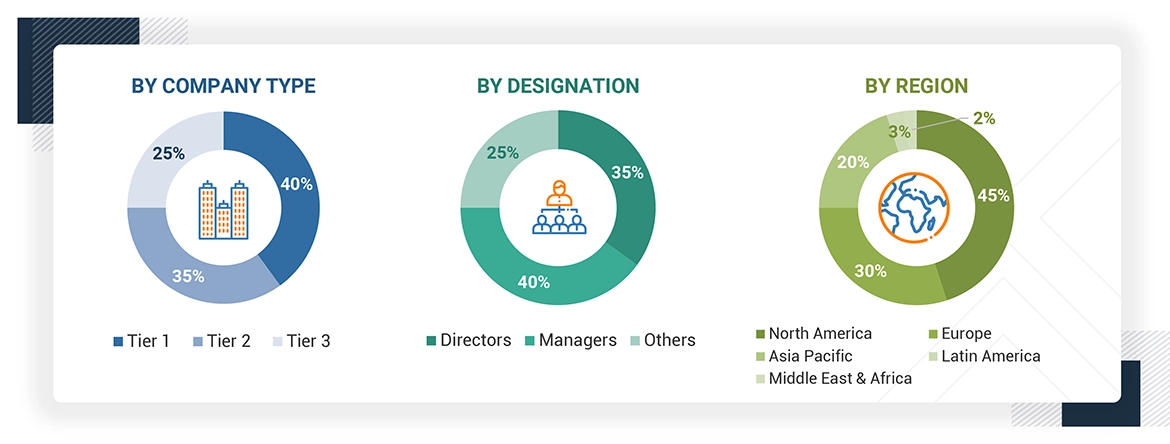

The following is a breakdown of the primary respondents:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tiers of companies are defined on the basis of their total revenues in 2023. Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the remote patient monitoring market. These methods were also used extensively to estimate the size of various subsegments in the market.

The research methodology used to estimate the market size includes the following:

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the remote patient monitoring market.

Market Definition

The remote patient monitoring (RPM) market involves the use of technology to remotely monitor and manage patients' health conditions outside of traditional healthcare settings as well as in patient settings. It leverages devices such as wearables, sensors, and mobile applications to track vital signs and chronic diseases. RPM allows healthcare providers to access real-time data for better decision-making and personalized care.

Stakeholders

- RPM Equipment and devices Manufacturers

- Suppliers and Distributors of RPM Equipment

- RPM software provider

- Healthcare IT Service Providers

- Healthcare Insurance Companies/Payers

- Healthcare Institutions/Providers (Hospitals, Clinics, Medical Groups, Physician Practices, Diagnostic Centers, and Outpatient Clinics)

- Venture Capitalists

- Government Bodies/Regulatory Bodies

- Corporate Entities

- Accountable Care Organizations

- RPM Resource Centers

- Research and Consulting Firms

- Medical Research Institutes

- Clinical Departments

Report Objectives

- To define, describe, and forecast the global remote patient monitoring market based on component, indication, end user, and region.

- To provide detailed information regarding the major factors (such as drivers, restraints, opportunities, and challenges) influencing the market growth

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall remote patient monitoring market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To strategically analyze the market structure profile of the key players of the remote patient monitoring market and comprehensively analyze their core competencies.

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

- To track and analyze competitive developments such as product launches and enhancements and investments, partnerships, collaborations, acquisitions, expansions, funding, grant, agreements, sales contracts, product testing, FDA approval, product approval, and alliances in the remote patient monitoring market during the forecast period.

Key Questions Addressed by the Report

-

Devices

-

By Function

- Cardiac monitoring devices

- Neurological monitoring devices

- Respiratory monitoring devices

- Blood glucose monitoring devices

- Fetal & neonatal monitoring devices

- Weight monitoring devices

- Multiparameter monitoring devices

- Pulse oximeter devices

- Thermometers

- Other monitoring devices (rehabilitation and physical therapy devices, fall detection devices, and others)

-

By Product type

- Wearable devices

- Implantable devices

- Handheld & portable devices

- Others (stationary devices, and others)

-

By Function

-

Software

-

By deployment model

- On-premise model

- Cloud-based model

-

By transmission type

- Synchronous

- Asynchronous

-

By deployment model

- Services

-

Healthcare Providers

- Hospitals

- Ambulatory surgical centers, ambulatory care centers, and other outpatient settings

- Long-term care & assisted living facilities

- Home healthcare

- Other healthcare providers (diagnostics & imagining centers, rehabilitation centers, behavioural health centers, and others)

- Healthcare payers

- Patients

- Pharmaceutical & biotechnology companies

- MedTech companies

- Other end users (employer groups, government organizations, academic institutes, research centers, and others)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Remote Patient Monitoring (RPM) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Remote Patient Monitoring (RPM) Market

Chad

Nov, 2021

Can you explain your reasoning around the projection of the $72.8 Billion Mkt for RPM in North America? Thanks.

Amber

Mar, 2022

Which are growth driving factors for the global growth of Remote Patient Monitoring Market?.

Willie

Mar, 2022

What will be the size of the Remote Patient Monitoring Market for the European region?.