Major activities have been focused to estimate the market size of the Refurbished medical equipment sector at present. Extensive secondary research has been conducted to collate information regarding the refurbished medical equipment industry. Many different methodologies were used for estimating the overall market size, involving the top-down and bottom-up approaches. The next step involved primary research with industry experts along the value chain to validate these findings, assumptions, and market sizing. To do so, we employed market segmentation and data triangulation techniques to get an accurate market size across different market segments and subsegments of the Refurbished medical equipment market.

Secondary Research

Secondary research sources of this study include directories and databases, such as D&B Hoovers and Factiva; white papers; Bloomberg Businessweek; annual reports; SEC filings; business filings; and investor presentations. The above sources have given information on leading companies and market segmentation that reflects the industry trend and technological perspectives of the Refurbished medical equipment market.

Primary Research

Major research activities entailed interviewing the supply side and the demand side, using both a quantitative and qualitative approach to data collection. Supply side information was obtained from key informants like CEOs, area sales managers, territory sales managers, regional sales managers, and other high-level officials from leading companies, while on the demand side, it mainly comprised physicians, researchers, department heads, and staff from diagnostic imaging centers, hospitals, and research institutions. This study was conducted for the purpose of ensuring that assumptions were validated through interaction with relevant stakeholders.

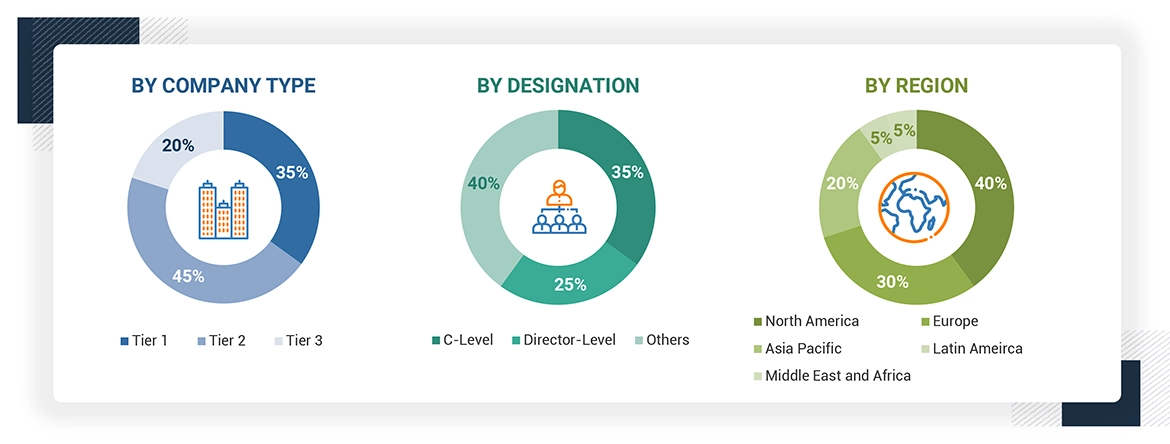

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = >USD 1 billion, Tier 2 = < USD 500 million, and Tier 3 = < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

This research involves revenue sharing review of the leading players in the Refurbished medical equipment market. Primary and secondary research methods were adopted to determine the key players in the industry and to gain some level of understanding of their financial performance and market share. The primary research was more detailed interviews taken from the directors, CEOs and senior marketing executives, whereas the secondary research primarily relied upon the annual and financial reports issued by the major players in the industry. the revenue details of the leading solution providers were further used to differentiate between sources and services and a segment-based strategy was followed to determine the market value across the globe.

Procedures Covered:

Identify the companies around the world who are leading Refurbished medical equipment industry and note down their respective annual revenues or specific product category/business division.

The revenue mapping of the key competitors, based on 2024, is in fact a major share of the market for this analysis, thus extrapolated to total global value for the Refurbished medical equipment market.

Data Triangulation

The Refurbished medical equipment market is segmented into various segments and subsegments based on the methodology adopted in this report. Data triangulation and the segmentation process are next undertaken to ensure the accuracy of data for all segments. Drivers and trends have been identified from both the supply and demand sides. The results obtained from both the top-down and bottom-up approaches have been utilized for deriving the results of the Refurbished medical equipment market analysis.

Market Definition

Refurbished medical equipment is used medical devices restored to their original operational condition and safety standards by the original manufacturer or a certified third-party provider. This typically includes cleaning, repairing, re-testing, and replacement of any worn-out components so that they meet regulatory and industry standards and are then deemed safe and effective. Refurbished equipment can add life to the original device, enabling the hospital and clinic facilities to save costs while using devices of worthy price and performance. Most of the time, warranties will show that there will be reliability of the equipment after restoration.

Stakeholders

-

Manufacturers and distributors of Refurbished medical equipment devices

-

Healthcare institutions (hospitals)

-

Diagnostic imaging centers

-

Research institutions.

-

Healthcare institutions (Rehabilitation centers, OPDs)

-

Research and consulting firms.

-

Contract research organizations (CROs) and contract manufacturing organizations (CMOs)

-

Academic medical centers and universities

-

Market research and consulting firms

-

Clinical research organizations

-

Ambulatory Care Centers

-

Group Purchasing Organizations (GPOs)

-

Medical Research Laboratories

-

Academic Medical Centers and Universities

-

Accountable Care Organizations (ACOs)

Report Objectives

-

To define, describe, and forecast the global Refurbished medical equipment market based on product, application, end user, and region.

-

To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

-

To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

-

To profile the key market players and comprehensively analyze their market shares and core competencies2

-

To forecast the revenue of the market segments in five main regions: North America (the US and Canada), Europe (Germany, France, the UK, Italy, Spain, and Rest of Europe), the Asia Pacific (China, Japan, India, South Korea, Australia, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa (GCC Countries and the Rest of Middle East & Africa)

-

To track and analyze competitive developments such as product launches and approvals, agreements, partnerships, expansions, acquisitions, and collaborations in the Refurbished medical equipment market.

Growth opportunities and latent adjacency in Refurbished Medical Equipment Market