This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

This research study used widespread secondary sources; directories, databases such as Dun & Bradstreet, Bloomberg BusinessWeek, and Factiva; white papers; annual reports; and companies’ house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the global pulse oximeters market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply & demand sources were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the pulse oximeters market. The primary sources from the demand side include key executives from hospitals, physicians, clinicians, and research institutes.

A breakdown of the primary respondents is provided below:

Note 1: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 2: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = < USD 1.00 billion.

To know about the assumptions considered for the study, download the pdf brochure

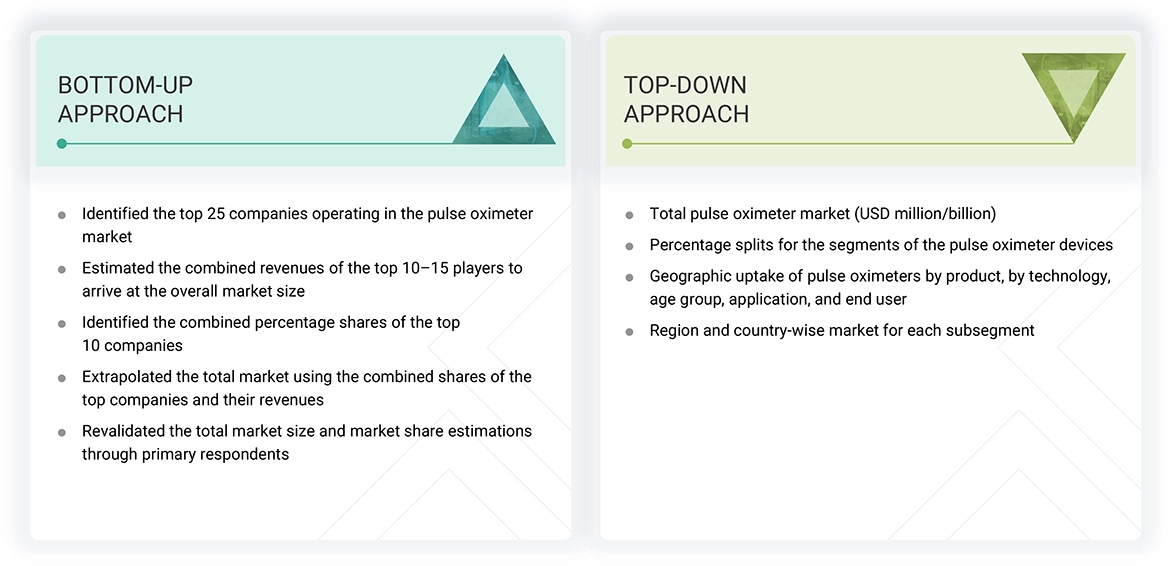

Market Size Estimation

For the global market value, annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs active in the global pulse oximeter market. All the major product manufacturers were identified at the global and/or country/regional level. Revenue mapping for the respective business segments/sub-segments was made for the major players (who contribute at least 60-70% of the market share at the global level). Also, the global pulse oximeter market was split into various segments and sub-segments based on:

-

List of major players operating in the pulse oximeter devices market at the regional and/or country level

-

Product mapping of various pulse oximeter device manufacturers at the regional and/or country level

-

Mapping of annual revenue generated by listed major players from the pulse oximeter segment (or the nearest reported business unit/product category)

-

Revenue mapping of major players to cover at least 70-75% of the global market share as of 2024

-

Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

-

Summation of the market value of all segments/subsegments to arrive at the global pulse oximeter market

Data Triangulation

After arriving at the market size, the total pulse oximeters market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation and market breakdown procedures were employed, wherever applicable.

Market Definition

A pulse oximeter is a non-invasive medical device used to measure the blood's oxygen saturation level (SpO2) and pulse rate. It typically works by emitting light through a body part—usually a fingertip or earlobe—and detecting the amount of oxygenated and deoxygenated hemoglobin based on light absorption.

Stakeholders

-

Medical device manufacturers

-

Regulatory authorities (e.g., the US FDA and the EMA, among others)

-

Hospitals & clinics

-

Physicians & anesthesiologists

-

Home healthcare providers

-

Distributors & suppliers

-

Research institutes & labs

-

Health insurance companies

-

Government health departments

-

Patients & end-users

-

Medical research institutes

-

Business research & consulting service providers

Report Objectives

-

To define, describe, segment, and forecast the pulse oximeters market by product, type, age group, technology, end user, and region.

-

To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

-

To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall pulse oximeter market

-

To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

-

To forecast the size of the pulse oximeters market in five regions (along with their respective key countries), namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

-

To profile the key players in the pulse oximeters market and comprehensively analyze their core competencies and market shares

-

To track and analyze competitive developments such as acquisitions, product launches, expansions, collaborations, agreements, partnerships, and R&D activities of the leading players in the pulse oximeters market

-

To benchmark players within the pulse oximeters market using the Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Raymond

Jun, 2022

In what way COVID-19 impacting the growth of Pulse Oximeter Market?.

Richard

Jun, 2022

What are the recent trends providing opportunities for revenue expansion in pulse oximeter industry?.

Jerome

Jun, 2022

How big is pulse oximeter market?.