Propylene Oxide Market

Propylene Oxide Market by Production Process (Chlorohydrin Process, Styrene Monomer Process), Application (Polyether Polyols, Propylene Glycol), End-use Industry (Automotive, Building & Construction, Chemicals), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

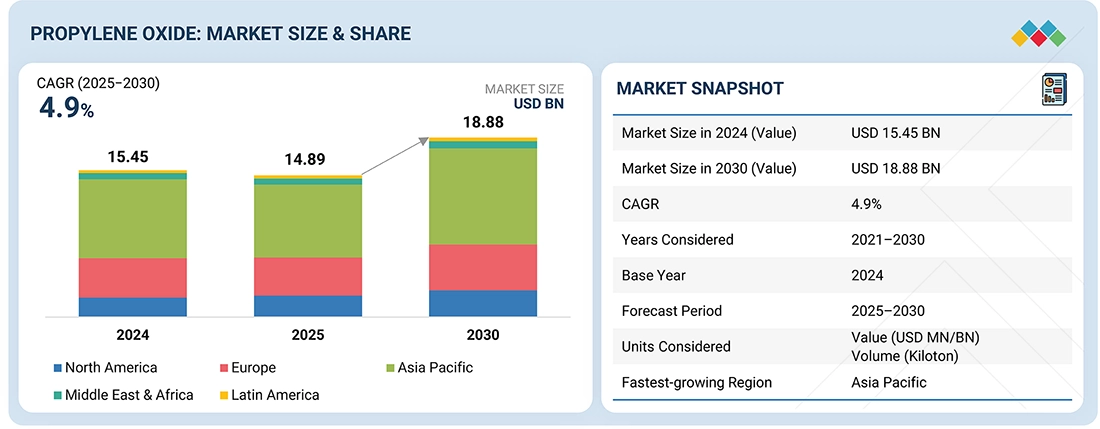

The global propylene oxide market is projected to grow from USD 14.89 billion in 2025 to USD 18.88 billion by 2030, at a CAGR of 4.9% during the forecast period. There is an increasing demand for polyurethane foams and related systems in a variety of industries, including the construction industry (consider energy-efficient insulation materials for buildings), the automotive industry (lightweight components for electric vehicles), and the furniture industry (cushioning), as well as other industries like adhesives and coatings. Sustainability and the demand for improved thermal efficiency and durability are also influencing the market for propylene oxide.

KEY TAKEAWAYS

-

BY REGIONAsia Pacific is projected to be the fastest-growing region in the global propylene oxide market.

-

BY END-USE INDUSTRYBy end-use industry, the automotive sector was the largest segment of the market, accounting for a 26.7% share of the overall market in terms of volume in 2024.

-

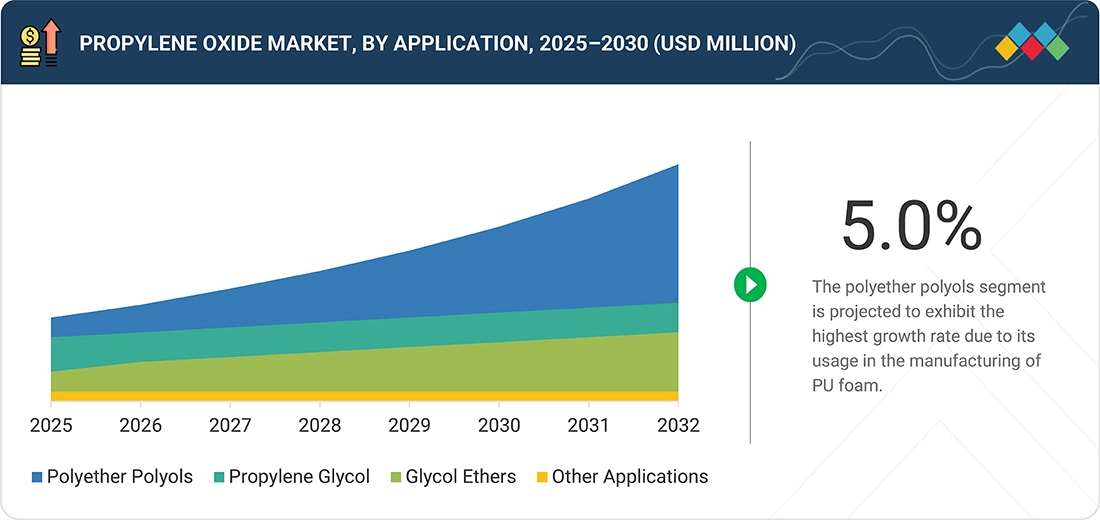

BY APPLICATIONBy application, the polyether polyols segment dominated the market during the forecast period, accounting for a 69.9% share of the overall market in terms of value in 2024.

-

BY PRODUCTION PROCESSBy production process, the hydrogen peroxide process segment is projected to grow the fastest at a CAGR of 4.9% in terms of volume during the forecast period.

-

Competitive Landscape - Key PlayersDow, LyondellBasell Industries Holdings B.V., Shell, Indorama Ventures Public Company Limited, and SABIC were identified as some of the star players in the propylene oxide market (global), given their strong market share and product footprint.

-

Competitive Landscape - Startups/SMEsPCC, Wanhua, and Oltchim, among others, have distinguished themselves as startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The primary factors driving the propylene oxide market include an increasing demand for polyether polyols, which are essential for the production of polyurethanes, as well as a growing requirement from various end-use industries, including automotive, chemical, and pharmaceutical sectors.

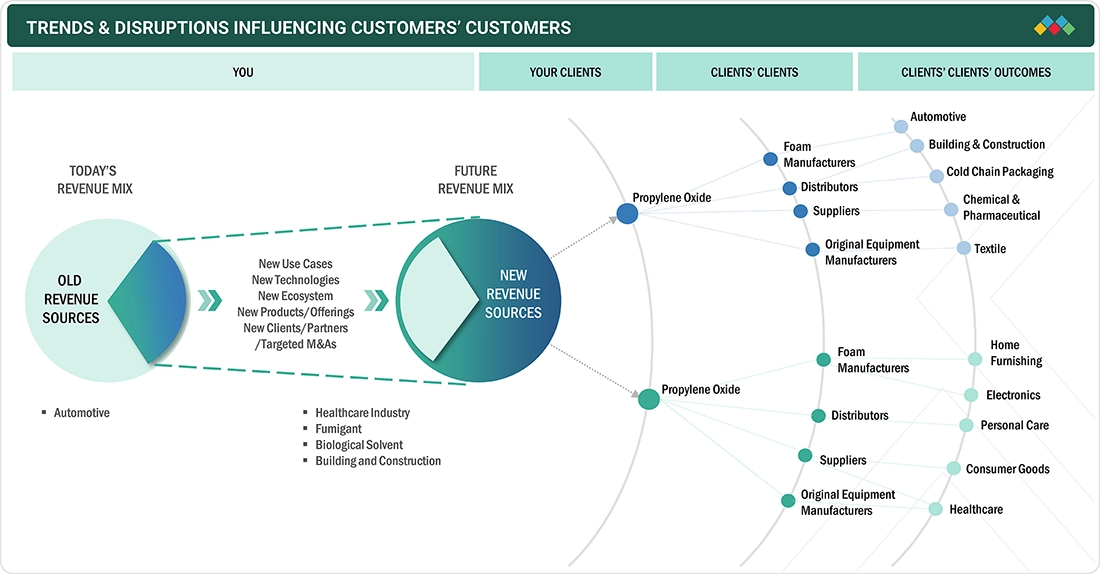

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The propylene oxide market is growing due to the increasing demand from the polyurethane foam market, particularly in building and construction insulation, car seats, and furniture. In addition, the use of propylene glycol in the pharmaceutical, personal care, food, and industrial sectors is also rising. Energy efficiency regulations, the rising demand for rigid insulating foams, and the restart of global car manufacturing are also driving the market. Though the key participants, such as LyondellBasell, Dow, BASF, and Shell, are concentrating on capacity optimization, HPPO technology, and the reduction of carbon intensity, they are also expanding their production capacity in the high-growth market of Asia Pacific.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for polyether polyols for the production of polyurethanes

-

Growing demand from other end use industries

Level

-

Health hazard classification and toxic nature of propylene oxide

-

Occupational safety and compliance constraints

Level

-

Development and adoption of cleaner production technologies

-

Expanding opportunities in developing markets

Level

-

Price volatility of raw materials

-

Use of bio-based feedstock for polyurethane foam instead of petroleum

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for polyether polyols for the production of polyurethanes

Propylene oxide is a key raw material for producing polyether polyols, which are essential in creating polyurethane foams, elastomers, adhesives, coatings, and thermal insulation materials. The demand for polyether polyols is driven by their role in manufacturing polyurethane foam, used in various applications, including automotive components. Mixing polyols with different isocyanates results in various types of polyurethane. The polyurethane industry is vital for Europe's economy, with over 80,000 businesses generating EUR 149 billion annually and employing nearly 700,000 people. Additionally, more than 1.7 million businesses linked to these products contribute EUR 84 billion and support over 6.5 million jobs in Europe.

Restraint: Health hazard classification and toxic nature of propylene oxide

The global propylene oxide market faces significant restraint due to its classification by the International Agency for Research on Cancer (IARC) as possibly carcinogenic to humans (Group 2B). This designation prompts increased scrutiny from regulators and consumers. Short-term exposure can irritate the eyes and respiratory tract, while skin contact may cause irritation and necrosis. Chronic inhalation can lead to respiratory inflammation and neurological effects. Propylene oxide has also been linked to tumor induction in rodents. As a result, customers in sensitive sectors may seek safer alternatives, limiting demand growth. The Environmental Protection Agency has categorized it as a likely human carcinogen (Group B2), which may impose further regulatory challenges.

Opportunity: Development and adoption of cleaner production technologies

The move toward environmentally friendly production is accelerating, transforming chemical manufacturing. A prime example is the hydrogen peroxide to propylene oxide process, which replaces traditional chlorohydrin production that uses chlorine and generates significant waste. HPPO, in contrast, only requires hydrogen peroxide and propylene, producing water instead of chlorinated waste. This shift is not just intuitive but supported by data, showing a potential 70–80% reduction in wastewater discharge and 35% less energy consumption compared to conventional methods. Regulatory bodies like the US Environmental Protection Agency and the European Commission emphasize waste reduction and resource efficiency as critical for compliance. Producers of propylene oxide who adopt cleaner methods will likely have better opportunities for permits and upgrades amid tightening environmental regulations through 2025 and beyond.

Challenge: Use of bio–based feedstock for polyurethane foam instead of petroleum

There is a growing trend in the use of bio-based polyols derived from renewable resources like vegetable oils and polysaccharides in polyurethane synthesis and foam production. These polyols serve as substitutes for conventional polyether polyols, which are typically made from propylene oxide. Since polyether polyols are the largest consumers of propylene oxide, using bio-based alternatives reduces propylene oxide consumption per foam unit produced. Companies like Covestro are creating more sustainable polyether polyols from bio waste and renewable materials, maintaining equivalent quality to fossil fuel-derived products. Dow has received the ISCC PLUS certification for its use of circular feedstocks, emphasizing a shift towards sustainable practices. BASF has introduced Lupranol Balance 50, which includes around 31% renewable castor oil as a substitute in flexible polyurethane foams. This rise in bio-based feedstocks poses a potential threat to the growth of the propylene oxide market.

PROPYLENE OXIDE MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Produces propylene oxide for polyether polyols used in polyurethane foams for insulation, furniture, and automotive interiors | Improves energy efficiency in buildings and vehicles | Enables lightweighting | Supports durable and high-performance materials |

|

Uses propylene oxide to manufacture polyether polyols and propylene glycols for construction, packaging, and consumer goods | Enhances thermal insulation | Improves product durability | Supports sustainable building solutions |

|

Produces PO via advanced technologies (including PO/TBA route) for polyurethane foams and industrial chemicals | Cost-efficient large-scale production | High product purity | Broad application flexibility |

|

Manufactures propylene oxide using the Shell PO/SM process for downstream polyurethane and chemical applications | Integrated value chain efficiency | High yields | Reduced by-product waste |

|

Uses propylene oxide to produce polycarbonate polyols and polyurethane raw materials for coatings, adhesives, and elastomers | Enables high-performance coatings | Improved durability and flexibility | Supports low-VOC formulations |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The supply chain of the global propylene oxide (PO) market ecosystem starts from raw material suppliers. They sell key feedstocks: propylene, cumene, and hydrogen peroxide. These feedstocks are mainly sourced from integrated petrochemical producers. Propylene oxide manufacturers such as Dow, LyondellBasell, Shell, Repsol, and SKC have large integrated units where they operate on established routes to ensure cost efficiency and supply security. PO is produced close to downstream consumers, as PO production is concentrated in one region due to logistics and safety considerations-prompting distributors to confine their sales within regional markets rather than go into long-distance trading. End users such as Covestro, Huntsman, LANXESS, and Mitsui Chemicals convert PO into value-added derivatives. They are important for applications in polyether polyols, propylene glycols, glycol ethers, and other specialty chemicals, which drive demand into construction, automotive, packaging, and industrial sectors.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Propylene Oxide Market, By Application

The propylene oxide market has been categorized, based on application, into polyether polyols, propylene glycol, glycol ethers, and others. The segment of polyether polyols leads the propylene oxide market, as polyurethane foams account for the bulk of PO usage. Strong demand in the construction sector for insulation materials supports high volume usage of polyols. Growth of demand from automotive seating, interiors, and lightweight components further enhances demand. Expanding furniture and bedding provide constant consumption for flexible foams. Polyether polyols are also characterized by low-cost processing and a wide range of performance properties. Further, great emphasis is presently laid upon energy efficiency in buildings and comfort applications, which fortifies their leading position.

Propylene Oxide Market, By End-use Industry

The propylene oxide market is primarily driven by the automotive end-use industry because of its high foam consumption, particularly for polyurethane foams, which are propylene oxide-based polyether polyols. Such foams are used for seating, headrests, armrests, and some automotive interior panels to give comfort and safety in vehicles. Also, a salient cause of the use of PU materials is the growing demand for weight optimization in vehicles to improve fuel efficiency and reduce emissions. Propylene oxide derivatives are also utilized in coatings, adhesives, sealants, and elastomers in automotive assembly. The growing demand for vehicles in the world, especially in Asia Pacific, brought an additional boost in PO requirements from OEMs. Further, the trend change toward electric vehicles also requires sophisticated materials and thermal management solutions applied to vehicle interiors, thus promoting the sustained consumption of propylene oxide.

Propylene Oxide Market, By Production Process

Due to its capacity to co-produce two high-value products—namely, PO and styrene—jointly in one integrated process, the styrene monomer (SM) production process takes precedence over the propylene oxide (PO) market. Economics from these co-products enhance the overall profitability of the plant over the standalone PO routes. The process enables the production to be at large scales continuously, thus making it apt for supplying high global demands in the polyurethane and polystyrene markets. The strong demand for styrene in packaging, appliances, and construction guarantees a consistent offtake and reduces the market risk for PO producers. Moreover, the SM route is pre-established and widely commercialized, leading to regular operations on well-known technological grounds. This makes it favorable for producers to use this route in optimizing asset use and margins, thus sustaining its central role in the global PO market.

REGION

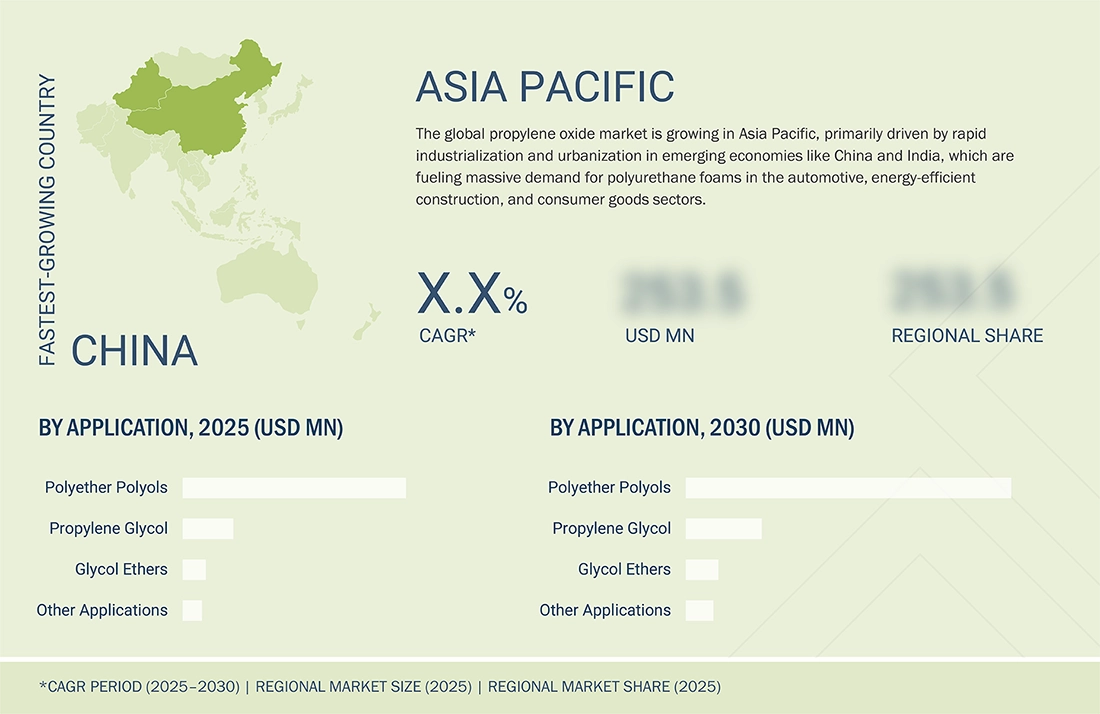

Asia Pacific is projected to be the fastest-growing regional market during the forecast period

The increasing utilization of polyurethane products, particularly within the construction, automotive, and appliance sectors, presents a significant opportunity for propylene oxide in the Asia Pacific region. Established manufacturing centers in countries such as China, South Korea, and various Southeast Asian nations ensure a consistent and robust demand for derivatives of propylene oxide. The high availability of propylene and the presence of integrated petrochemical complexes serve to lower production costs and enhance supply reliability. This sustained demand is largely driven by ongoing infrastructure development and urbanization efforts. Recent construction activities have prominently featured the use of centralized installations for insulation foams and coatings. Furthermore, capacity expansions among major propylene oxide producers are expected to bolster the region's self-sufficiency. Favorable government policies, coupled with increased industrial growth, are anticipated to further stimulate internal consumption by end-use industries.

PROPYLENE OXIDE MARKET: COMPANY EVALUATION MATRIX

In the propylene oxide market matrix, Dow (Star) leads with a strong market share and extensive product footprint, driven by its propylene oxide solutions, which are adopted by various end users. BASF (Emerging Leader) demonstrates substantial product innovations compared to its competitors. While Dow dominates through scale and a diversified portfolio, BASF’s propylene oxide shows significant potential to move toward the leaders’ quadrant as demand for propylene oxide continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Dow (US)

- LyondellBasell Industries Holdings B.V. (Netherlands)

- Shell (UK)

- Indorama Ventures Public Company Limited (Thailand)

- SABIC (Saudi Arabia)

- BASF (Germany)

- AGC (Japan)

- Repsol (Spain)

- Tokuyama (Japan)

- Sumitomo Chemical Co. (Japan)

- SKC (South Korea)

- Evonik (Germany)

- Tokyo Chemical Industry Co. (Japan)

- Balchem (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 15.45 BN |

| Market Forecast in 2030 (Value) | USD 18.88 BN |

| Growth Rate | CAGR of 4.9% from 2025 to 2030 |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD MN/BN), Volume (Kiloton) |

| Report Coverage | The report defines, segments, and projects the size of the propylene oxide market based on application, production process, end-use industry, and region. It strategically profiles the key players and comprehensively analyzes their market share and core competencies. It also tracks and analyzes competitive developments, including product launches, agreements, acquisitions, and expansions, in the market. |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, South America, Middle East & Africa |

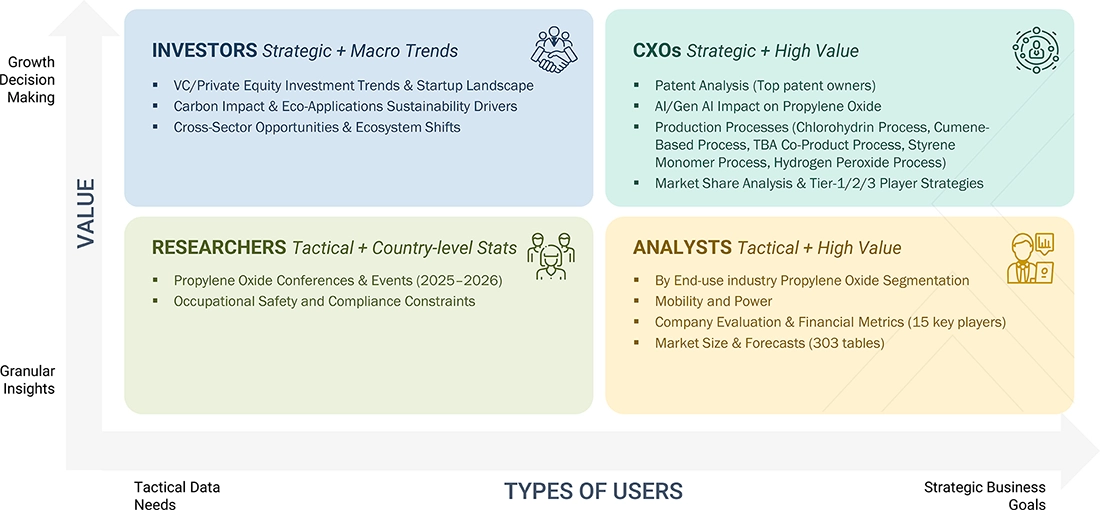

WHAT IS IN IT FOR YOU: PROPYLENE OXIDE MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Propylene Oxide Producers & Integrated Petrochemical Players |

|

|

| Downstream Polyurethane & Chemical Manufacturers |

|

|

| New Entrants, Investors & Technology Licensors |

|

|

RECENT DEVELOPMENTS

- March 2025 : LyondellBasell declared its intention to increase propylene output at its Channelview Complex located near Houston. Construction begins in 2025, with startups expected in late 2028. The new unit would produce around 400,000 metric tons of propylene per year, create 750 construction jobs, and add 25 permanent positions upon completion.

- May 2024 : Dow initiated its propylene glycol capacity expansion project at its Map Ta Phut integrated facility in Thailand. The project added 80,000 tons per year, bringing total capacity to 250,000 tons per year, making it the largest PG plant in Asia Pacific. The site’s back-integration with propylene oxide (PO) production ensured a cost-competitive and reliable supply, supporting growth in downstream high-value PG markets.

- September 2023 : Qixiang Tengda started its new 300,000-ton-per-year propylene oxide plant in Zibo City, China, operated using HPPO technology that it licensed from Evonik and ThyssenKrupp Uhde. The facility operated two main components, which include a large-scale HPPO plant and an adjacent hydrogen peroxide megaplant.

- April 2021 : SABIC strengthened its focus on petrochemicals while Aramco's trading arm concentrates on fuels. The shift would introduce 900,000 metric tons of new products to SABIC's product line, which will include polyurethane, propylene oxide, and butyl glycol ethers. The expansion would enable SABIC to launch new products, helping the company gain polymer and chemical market share while strengthening its position as Saudi Aramco's dedicated chemicals division.

Table of Contents

Methodology

The research methodology used to estimate the current size of the propylene oxide market consisted of four major activities. Extensive secondary research was performed to acquire detailed information about the market, peer markets, and parent markets. These findings, assumptions, and metrics were verified through primary research with experts from both the demand and supply sides of the propylene oxide value chain. Both top-down and bottom-up approaches were used to estimate the total market size. The estimation of market sizes for various segments and subsegments in the market was finalized using full market segmentation and data triangulation techniques.

Secondary Research

The research methodology for estimating and forecasting the propylene oxide market begins with gathering data on key vendors’ revenues by doing secondary research. The secondary research process involves consulting a range of secondary sources, including Hoover’s, Bloomberg Businessweek, Factiva, the World Bank, and industry-specific journals. These secondary sources encompass annual reports, press releases, investor presentations, white papers, certified publications, articles from recognized authors, regulatory notifications, trade directories, and databases. Also, vendor offerings are taken into consideration to inform market segmentation.

Primary Research

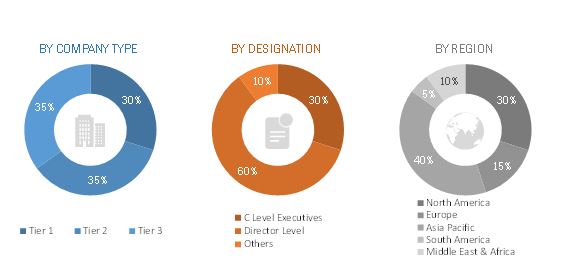

The propylene oxide market comprises several stakeholders, including raw material suppliers, processors, end-product manufacturers, and regulatory organizations, throughout the supply chain. The demand side of this market is characterized by the development of various industries, including mobility, power, chemicals, industrial, and grid injection, among others. The supply side is characterized by advancements in technology and a wide range of diverse applications. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

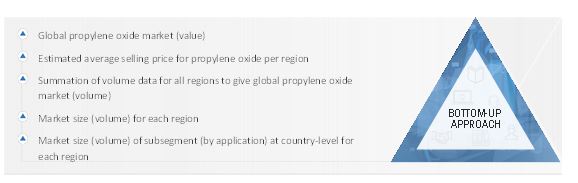

The top-down and bottom-up approaches have been used to estimate and validate the total size of the propylene oxide market. These approaches have also been used extensively to estimate the size of various dependent market subsegments. The research methodology used to estimate the market size included the following.

The following segments provide details about the overall market size estimation process employed in this study:

- Extensive primary and secondary research was done to identify the key players.

- The value chain and market size in terms of value of the propylene oxide market were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were collected through secondary sources and verified through primary sources.

- All possible parameters that affect the market were covered in this research study and are viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives, is included in this research.

Propylene oxide Market Size: Bottom-Up Approach

Data Triangulation

After estimating the overall market size using the above estimation process, the market was split into various segments and subsegments. Data triangulation and market segmentation techniques, along with the market engineering process, were employed to obtain precise market analysis data for each segment and its subsegments.

Objectives of the Report

- To define, describe, and forecast the size of the propylene oxide market, in terms of volume and value; based on application, production process, end–use industry, and region

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry–specific challenges, influencing the growth of the propylene oxide market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value and volume, with respect to five main regions (along with their respective key countries), namely, North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa

- To provide ecosystem analysis, case study analysis, value chain, patent analysis, technology analysis, pricing analysis, Porter’s five forces analysis, key stakeholders and buying criteria, investment and funding scenario, trade analysis, impact of AI/Gen AI and 2025 US tariff, key conferences and events, regulatory bodies, government agencies, and regulations pertaining to the market under study

- To strategically profile the key players and comprehensively analyze their core competencies

- To analyze competitive developments such as mergers & acquisitions, product launches, and research & development in the propylene oxide market

- To provide the macroeconomic outlook for all regions considered under the study

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

- Additional country-level analysis of the propylene oxide market

- Profiling of additional market players (up to five)

Product Analysis

-

Product matrix, which provides a detailed comparison of each company’s product portfolio.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Propylene Oxide Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Propylene Oxide Market