The study involved major activities in estimating the current size of the produced water treatment market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the produced water treatment market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and United States Energy Association, to identify and collect information useful for a technical, market-oriented, and commercial study of the global market. The other secondary sources included annual reports of the companies involved in the market, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The produced water treatment market comprises several stakeholders such as produced water treatment manufacturers, produced water treatment service companies, suppliers and distributors of produced water treatment in the supply chain. The demand side of this market is characterized by the increasing oil & gas exploration activities. The supply side is characterized by rising demand for contracts from the oil & gas sector and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

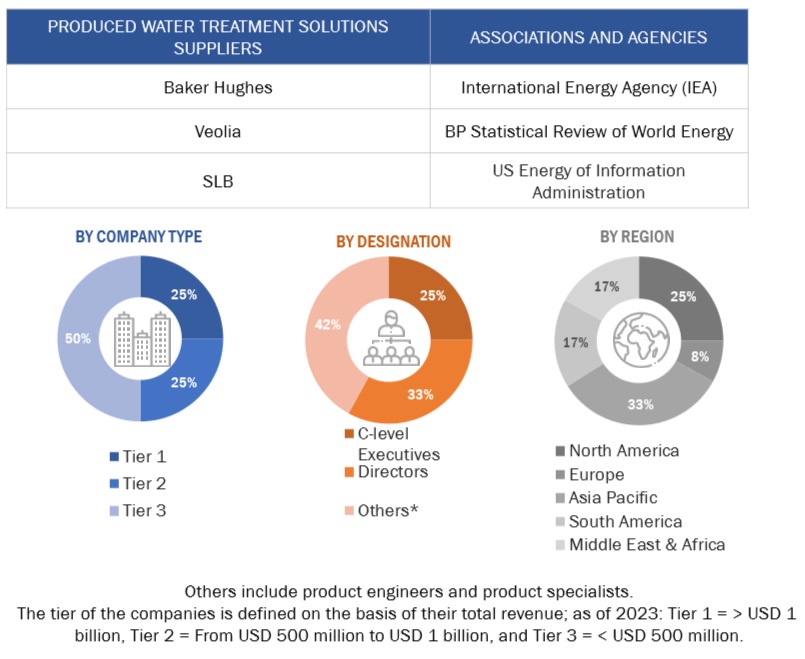

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

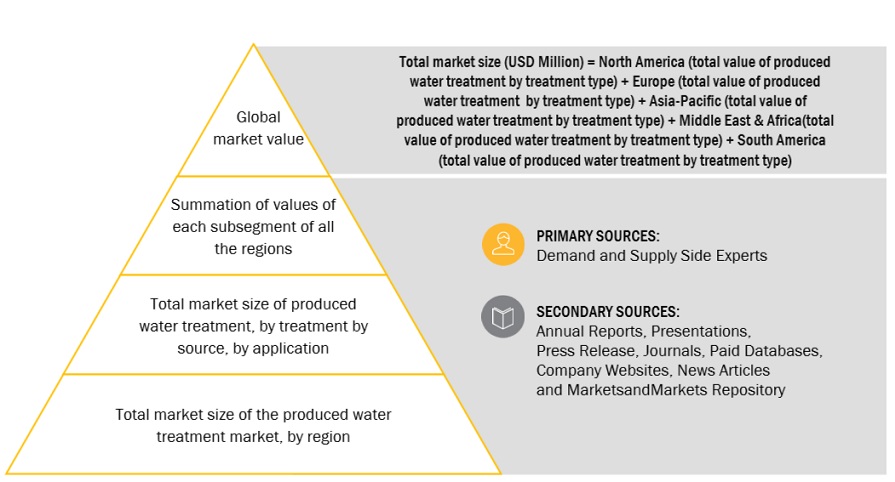

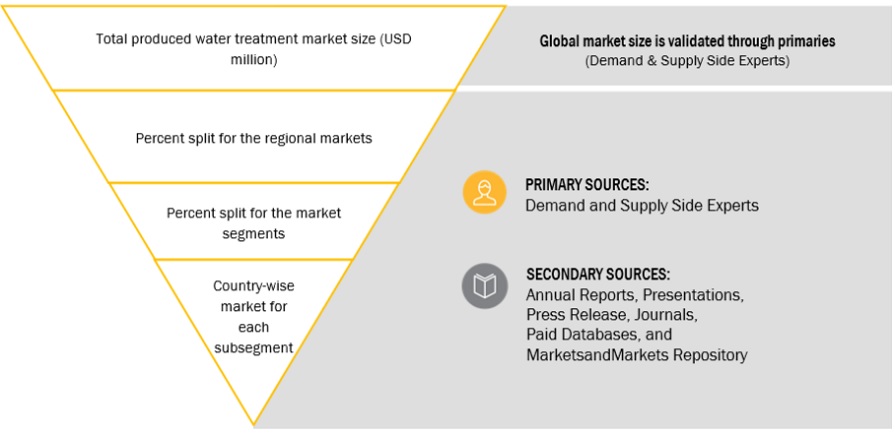

Both top-down and bottom-up approaches were used to estimate and validate the total size of the produced water treatment market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

-

The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions has been determined through both secondary and primary research.

-

The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

-

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primaries.

Global Produced Water Treatment Market Size: Top-down Approach

Global produced water treatment Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. The complete market engineering process is done to arrive at the exact statistics for all the segments and subsegments, also data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by examining various factors and trends from both the demand- and supply sides. Along with this, the market has been validated through both the top-down and bottom-up approaches.

Market Definition

Produced water, which is a byproduct of oil and gas exploration process, requires active treatment to meet environmental regulations and helps in reuse or safe disposal. This produced water has a mixture of injected water, Natural formation water, and any other chemicals used in the exploration and drilling process.

Key Stakeholders

-

Produced water treatment manufacturers and providers

-

Manufacturing industries

-

R&D laboratories

-

Consulting companies from the energy & power sector

-

Distributors of produced water treatment

-

Government and research organizations

-

State and national regulatory authorities

Objectives of the Study

-

To define, describe, segment, and forecast the produced water treatment market by application, by source, and by treatment in terms of value and volume.

-

To describe and forecast the market for six key regions: North America, Europe, Asia Pacific, South America, the Middle East, and Africa, along with their country-level market sizes, in terms of value.

-

To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing market growth

-

To strategically analyze the micro markets with respect to individual growth trends, prospects, and contributions to the overall market size

-

To provide supply chain analysis, trends/disruptions impacting customer business, ecosystem/market map, pricing analysis, Porter’s five forces analysis, case study analysis, and regulatory standards pertaining to produced water treatment

-

To analyze opportunities for stakeholders in the produced water treatment and draw a competitive landscape of the market.

-

To strategically analyze the ecosystem, tariffs and regulations, patents, and trading scenarios pertaining to produced water treatment

-

To compare key market players based on product specifications and applications.

-

To strategically profile key players and comprehensively analyze their market rankings and core competencies

-

To analyze competitive developments, such as contracts and agreements, investments and expansions, mergers and acquisitions, partnerships, joint ventures, and collaborations, in produced water treatment

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Geographic Analysis

-

Further breakdown of region or country-specific analysis

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Produced Water Treatment Market