North America Water Storage Systems Market by Material (Concrete, Steel, Plastic, Fiberglass), Application, End-Use Industry (Municipal, Industrial, Residential, Commercial), and Country (United States, Canada, and Mexico) - Forecast to 2024

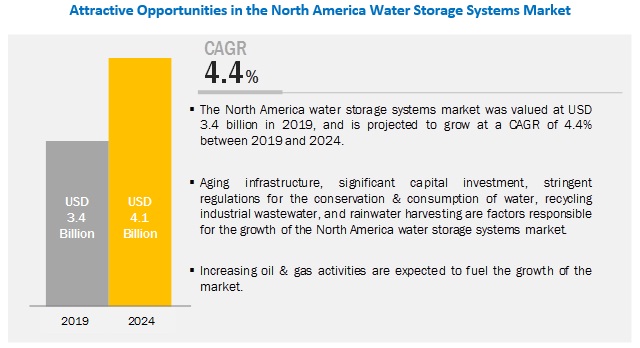

[105 Pages Report] The north America water storage systems market size is estimated to be USD 3.4 billion in 2019 and projected to reach USD 4.1 billion by 2024, growing at a CAGR of 4.4% from 2019 to 2024. Aging infrastructure, significant capital investment, stringent regulations for the conservation & consumption of water, recycling industrial wastewater, and rainwater harvesting are among major drivers for the growth of the North America water storage systems industry.

Fiberglass segment is projected to grow at the highest CAGR in the North America water storage systems market during the forecast period

Based on material, the fiberglass segment is projected to grow at the highest CAGR in the North America water storage systems market during the forecast period. The growth of the fiberglass segment is attributed to its superior properties, such as high mechanical strength, non-deterioration, and non-corrosiveness. Fiberglass is a tough plastic matrix further reinforced by fine fibers of glass. Fiberglass is a preferred material for various applications in the industry since it is lightweight and has robust properties. Storage tanks made from fiberglass are manufactured with food-grade coating on their interior surfaces, which enables storing water potable for longer periods of time.

Municipal end-use industry to lead the North America water storage systems market during the forecast period

Based on end-use industry, the market has been classified into municipal, industrial, commercial, and residential. In terms of value, municipal water storage systems are expected to lead the North America water storage systems market during the forecast period. This growth can be attributed to the aging infrastructure, significant capital investment, and stringent regulations for the conservation & consumption of water. The residential end-use industry is projected to grow at the highest CAGR during the forecast period.

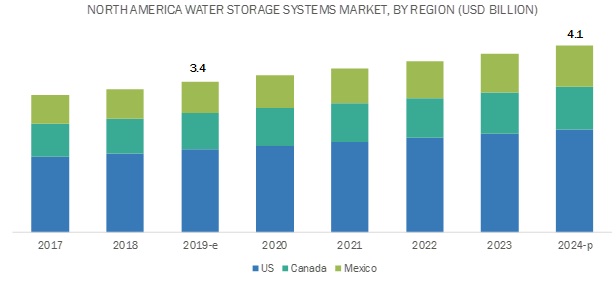

The US to lead the North America water storage systems market during the forecast period

In terms of value, the US accounted for the largest share of the North America water storage systems market. The market in Mexico is projected to grow at the highest CAGR during the forecast period. Aging infrastructure, significant capital investment, stringent regulations for the conservation & consumption of water, recycling of industrial wastewater, ineffective utilization of water, and rainfall harvesting are some of the major factors driving the growth of the US water storage systems market.

Key Market Players

Companies such as CST Industries, Inc. (US), McDermott International Inc. (US), Containment Solutions Inc. (US), DN Tanks (US), Caldwell Tanks (US), and Synalloy Corporation (US) are the major players in the North America water storage systems market. These players have been focusing on strategies such as acquisitions, new product developments & launches, agreements, and investments that have helped them expand their businesses in untapped and potential markets. Diversified product portfolios are factors responsible for strengthening the position of these companies in the North America water storage systems market.

Scope of the Report:

|

Report Metric |

Details |

|

Market size available for years |

2017-2024 |

|

Base year considered |

2018 |

|

Forecast period |

20192024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Material, Application, End-use Industry, and North America region |

|

Countries covered |

US, Canada, and Mexico |

|

Companies covered |

CST Industries, Inc. (US) McDermott International Inc. (US), Containment Solutions Inc., (US), DN Tanks (US), Caldwell Tanks (US), Synalloy Corporation (US), and others are considered for the study. |

This report categorizes the North America water storage systems market based on material, application, end-use industry, and country.

Based on material:

- Concrete

- Steel

- Plastic

- Fiberglass

- Others (Collapsible Tanks [Fabric], Wood Tanks, and Open-lined Pits)

Based on application:

- Rainwater Harvesting & Collection

- Fire Suppression Reserve & Storage

- On-site Water & Wastewater Collection

- Hydraulic Fracture Storage & Collection

- Potable Water Storage System

- Others (Irrigation, Secondary Containment Systems, and Marine Applications)

Based on end-use industry:

- Municipal

- Industrial

- Commercial

- Residential

Based on country:

- US

- Canada

- Mexico

Recent Developments

- In May 2018, McDermott International acquired Chicago Bridge & Iron Company N.V. (CB&I), headquartered in Hague, the Netherlands, a leading provider of conceptual design, technology, engineering, procurement, fabrication, modularization, construction, commissioning, maintenance, program management, and environmental services to customers in the energy and infrastructure market. This business combination with CB&I has transformed McDermott International, Inc. into a top -tier, integrated provider of engineering and construction solutions for the energy industry.

- In April 2019, CST Industries, Inc. partnered with Greatario Engineered Storage Systems, an established and recognized market leader in Ontario, Canada, to design and build bolted steel tanks and covers for liquid storage. With this partnership, CST Industries intends to expand its Aquastore brand of storage tanks in six province territories in the western region of Canada, including British Columbia, Alberta, Saskatchewan, Manitoba, Yukon, Northwest Territories, and Nunavut.

- In January 2018, CST Industries, Inc. announced the expansion of its product portfolio with pre-configured epoxy coated storage tank systems. The company launched Vulcan, a pre-engineered, pre-configured flat panel bolted storage tank line. The storage tank is made available in capacities of 15 cubic meters to 3,000 cubic meters and is designed specifically for the municipal water, wastewater, and fire protection markets.

Key Questions addressed by the report

- What are the future revenue pockets in the North America water storage systems industry?

- Which key developments are expected to have a long-term impact on the North America water storage systems market?

- Which materials and applications are expected to cannibalize existing markets?

- How is the current regulatory framework expected to impact the market?

- What will be the future product mix of the North America water storage systems industry?

- What are the prime strategies of leading companies in the North America water storage systems market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Primary and Secondary Research - Approach 1

2.1.2 Primary and Secondary Research - Approach 2

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Secondary Data

2.4 Primary Data

2.5 Research Assumptions and Limitations

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 19)

4 Premium Insights (Page No. - 22)

4.1 Attractive Opportunities in Water Storage Systems Market

4.2 North America Water Storage Systems Market, By End Use Industry

4.3 North America Water Storage Systems Market, By Application

5 Market Overview (Page No. - 24)

5.1 Market Dynamics

5.1.1 Drivers

5.1.1.1 Rapidly Increasing Population

5.1.1.2 Limited Availability of Water

5.1.2 Restraints

5.1.2.1 High Cost of Maintenance

5.1.3 Opportunities

5.1.3.1 Focus on Recycling and Reuse

5.1.3.2 Increasing Capital Expenditure for Water Infrastructure

5.1.3.3 Increasing Number of Desalination Plants

5.1.4 Challenges

5.1.4.1 Financing Gaps for Maintenance

5.2 Porters Five Forces Analysis

5.2.1 Threat of New Entrants

5.2.2 Threat of Substitutes

5.2.3 Bargaining Power of Suppliers

5.2.4 Bargaining Power of Buyers

5.2.5 Intensity of Competitive Rivalry

6 Industry Trends (Page No. - 30)

6.1 Introduction

6.2 Value Chain Analysis

7 North America Water Storage Systems Market, By Material (Page No. - 32)

7.1 Introduction

7.2 Concrete

7.3 Steel

7.4 Fiberglass

7.5 Plastic

7.6 Others

8 North America Water Storage Systems Market, By Application (Page No. - 39)

8.1 Introduction

8.2 Hydraulic Fracture Storage & Collection

8.3 On-Site Water & Wastewater Collection

8.4 Potable Water Storage

8.5 Fire Suppression Reserve & Storage

8.6 Rainwater Harvesting & Collection

8.7 Others

9 North America Water Storage Systems Market, By End Use (Page No. - 46)

9.1 Introduction

9.2 Municipal

9.3 Industrial

9.4 Commercial

9.5 Residential

10 Regional Analysis (Page No. - 51)

10.1 Introduction

10.1.1 North America Water Storage Systems Market, By Country

10.1.2 US

10.1.2.1 Aging Water Infrastructure and Significant Capital Investment for Infrastructure Improvements Will Drive Water Storage Systems Market

10.1.3 Canada

10.1.3.1 Lack of Investment in Water Infrastructure Will Restrain Market Growth During the Forecast Period

10.1.4 Mexico

10.1.4.1 Rainwater Harvesting to Cope With Severe Water Scarcity and the Use of Plastic Water Tanks in Residential Households Will Drive Market Growth

11 Company Profiles (Page No. - 63)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 CST Industries, Inc.

11.2 ZCL Composites, Inc.

11.3 Synalloy Corporation

11.4 AG Growth International Inc.

11.5 Grupo Rotoplas S.A.B. De C.V.

11.6 Mcdermott International, Inc.

11.7 BH Tank

11.8 Fiber Technology Corporation

11.9 Caldwell Tanks

11.10 Containment Solutions Inc.

11.11 Maguire Iron Inc.

11.12 Snyder Industries

11.13 Crom Corporation

11.14 Tank Connection

11.15 Contain Enviro Services Ltd.

11.16 HMT LLC

11.17 DN Tanks

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 98)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (32 Tables)

Table 1 Water Storage Systems Market Snapshot

Table 2 North America Water Storage Systems Market, By Material, 20172024 (USD Million)

Table 3 North America Concrete Water Storage Systems Market, By Country, 20172024 (USD Million)

Table 4 North America Steel Water Storage Systems Market, By Country, 20172024 (USD Million)

Table 5 North America Fiberglass Water Storage Systems Market, By Country, 20172024 (USD Million)

Table 6 North America Plastic Water Storage Systems Market, By Country, 20172024 (USD Million)

Table 7 North America Other Water Storage Systems Market, By Country, 20172024 (USD Million)

Table 8 North America Water Storage Systems Market, By Application, 20172024 (USD Million)

Table 9 North America Water Storage Systems Market for Hydraulic Fracture Storage & Collection, By Country, 20172024 (USD Million)

Table 10 North America Water Storage Systems Market for On-Site Water & Wastewater Collection, By Country, 20172024 (USD Million)

Table 11 North America Water Storage Systems Market for Potable Water Storage, By Country, 20172024 (USD Million)

Table 12 North America Water Storage Systems Market for Fire Suppression Reserve & Storage, By Country, 20172024 (USD Million)

Table 13 North America Water Storage Systems Market for Rainwater Harvesting & Collection, By Country, 20172024 (USD Million)

Table 14 North America Water Storage Systems Market for Other Applications, By Country, 20172024 (USD Million)

Table 15 North America Water Storage Systems Market Size, By End Use, 20172024 (USD Million)

Table 16 North America Municipal Water Storage Systems Market, By Country, 20172024 (USD Million)

Table 17 North America Industrial Water Storage Systems Market, By Country, 20172024 (USD Million)

Table 18 North America Commercial Water Storage Systems Market, By Country, 20172024 (USD Million)

Table 19 North America Residential Water Storage Systems Market, By Country, 20172024 (USD Million)

Table 20 North America Water Storage Systems Market, By Material, 20172024 (USD Million)

Table 21 North America Water Storage Systems Market, By Application, 20172024 (USD Million)

Table 22 North America Water Storage Systems Market, By End Use, 20172024 (USD Million)

Table 23 North America Water Storage Systems Market, By Country, 20172024 (USD Million)

Table 24 US Water Storage Systems Market, By Material, 20172024 (USD Million)

Table 25 US Water Storage Systems Market, By Application, 20172024 (USD Million)

Table 26 US Water Storage Systems Market, By End Use, 20172024 (USD Million)

Table 27 Canada Water Storage Systems Market, By Material, 20172024 (USD Million)

Table 28 Canada Water Storage Systems Market, By Application, 20172024 (USD Million)

Table 29 Canada Water Storage Systems Market, By End Use, 20172024 (USD Million)

Table 30 Mexico Water Storage Systems Market, By Material, 20172024 (USD Million)

Table 31 Mexico Water Storage Systems Market, By Application, 20172024 (USD Million)

Table 32 Mexico Water Storage Systems Market, By End Use, 20172024 (USD Million)

List of Figures (26 Figures)

Figure 1 Water Storage Systems Market Segmentation

Figure 2 Water Storage Systems Market: Bottom-Up Approach

Figure 3 Water Storage Systems Market: Top-Down Approach

Figure 4 US Expected to Dominate the North American Water Storage Systems Market During the Forecast Period

Figure 5 Fiberglass Segment Expected to Grow at the Highest Cagr Between 2019 and 2024

Figure 6 North America Water Storage Systems Market to Grow at A Modest Cagr During Forecast Period

Figure 7 Residential Segment Expected to Have the Highest Cagr During the Forecast Period

Figure 8 Rainwater Harvesting & Collection Segment Projected to Lead the Growth of Water Storage Systems Market During Forecast Period

Figure 9 Market Dynamics: Water Storage Systems Market

Figure 10 Porters Five Forces Analysis

Figure 11 Overview of the North American Water Storage Systems Market Value Chain

Figure 12 Fiberglass Segment to Grow at Highest Cagr During Forecast Period

Figure 13 Rainwater Harvesting & Collection Application Segment is Projected to Grow at the Highest Cagr During Forecast Period

Figure 14 Municipal Segment Expected to Lead the North America Water Storage Systems Market, 2019 & 2024

Figure 15 North America: Water Storage Systems Market Snapshot

Figure 16 CST Industries, Inc. : SWOT Analysis

Figure 17 ZCL Composites, Inc.: Company Snapshot

Figure 18 ZCL Composites, Inc.

Figure 19 Synalloy Corporation : Company Snapshot

Figure 20 Synalloy Corporation : SWOT Analysis

Figure 21 AG Growth International Inc.: Company Snapshot

Figure 22 AG Growth International Inc: SWOT Analysis

Figure 23 Grupo Rotoplas S.A.B. De C.V.: Company Snapshot

Figure 24 Mcdermott International, Inc.: Company Snapshot

Figure 25 Mcdermott International, Inc. : SWOT Analysis

Figure 26 Fiber Technology Corporation: SWOT Analysis

The study involved four major activities in estimating the current market size for North America water storage systems. Exhaustive secondary research was undertaken to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, United Nations Water, Global Water Intelligence (GWI), the National Association of Clean Water Agencies (NACWA), American Water Works Association (AWWA), US Department of Energy (DOE), National Rural Water Association (NRWA), American Water Resources Association (AWRA), Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to identify and collect information for this study. Secondary sources included annual reports, press releases and investor presentations of companies, whitepapers, certified publications, articles by recognized authors, gold standard & silver standard websites, associations, regulatory bodies, trade directories, and databases.

Primary Research

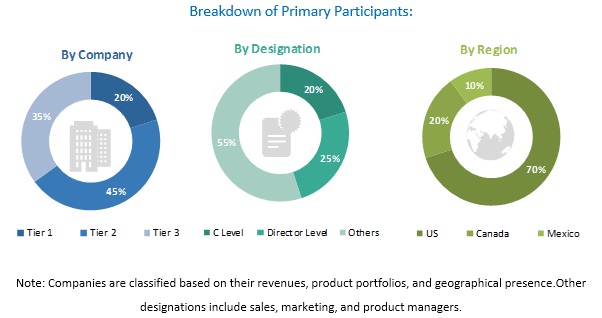

The North America water storage systems market comprises several stakeholders, such as raw material suppliers, North America water storage systems manufacturers, OEMs, installers, end product users, and regulatory organizations in the supply chain. The demand side of this market is characterized by the developments in the municipal, industrial, commercial, and residential end-use industries. The supply side is characterized by market consolidation activities undertaken by North America water storage systems producers. Several primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation:

Both, the top-down and bottom-up approaches were used to estimate and validate the total size of the North America water storage systems market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation:

After arriving at the overall market size-using the market size estimation process explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides.

Report Objectives:

- To analyze and forecast the size of the North America water storage systems market in terms of value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the North America water storage systems market

- To define, describe, and forecast the market by material, application, end-use industry, and country

- To strategically analyze markets with respect to individual growth trends, future prospects, and their contribution to the market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their share and core competencies in the market

Available Customizations:

Along with the market data, MarketsandMarkets offers customizations according to the specific needs of companies. The following customization options are available for the report:

Regional Analysis

- A further breakdown of the North America water storage systems market to the country level by material

Country Information

- Regional market split by major countries

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in North America Water Storage Systems Market

Determining growth potential of new water storage systems in select countries in Americas regions.

General information on North America Water Storage Systems

Customized information on Water storage by size in the range of 2000-10,000 gallons, collection, rainwater harvesting, fire suppression, and agriculture segments.

Need partner to market their product (water storage system)