Natural Fiber Composites Market

Natural Fiber Composites Market by Type (Flax, Kenaf, Hemp), Resin Type (PP, PE, PA), Manufacturing Process (Compression Molding, Injection Molding), End-Use Industry (Automotive, Building & Construction), and Region - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The natural fiber composites market is projected to reach USD 0.46 billion by 2029 from USD 0.35 billion in 2024, at a CAGR of 5.3% from 2024 to 2029. Natural fiber composites are lightweight and exhibit high strength. These materials are made using natural fibers such as flax, kenaf, hemp, and others with polymer matrices including PP, PE, and PA. Natural fiber composites possess unique mechanical properties, such as high tensile and flexural strength, making them suitable for high-performance applications

KEY TAKEAWAYS

-

BY TYPEThe natural fiber composites market is categorized into types based on the fibers used in their production- flax, hemp, kenaf, and others. The flax type dominated the market as it offers excellent combination of low cost, lightweight, and high stiffness for applications such as infrastructure, automobiles, and consumer goods.

-

BY RESIN TYPENatural fiber composites are segmented based on the type of resins, which include PP, PE, PA, and other resin types. PP resin accounted for the largest share as it possesses various properties, such as chemical resistance, fatigue resistance, transmissivity, and toughness that makes it ideal as a polymer matrix for natural fibers.

-

BY MANUFACTURING PROCESSNatural fiber composites are fabricated by using traditional manufacturing techniques including, compression molding, injection molding, and other manufacturing process. The compression molding segment accounted for the largest share due to its ability to produce large quantities of complex composite parts.

-

BY END-USE INDUSTRYNatural fiber composites are used in various end-use industries, such as automotive, building & construction, and others. Automotive industry led the market as traditional internal combustion engine vehicles are increasingly incorporating natural fiber composites to reduce weight and enhance performance, as these materials offer superior strength-to-weight ratios compared to metals like steel and aluminum.

-

BY REGIONThe natural fiber composites market covers Europe, North America, Asia Pacific, and rest of the World. Europe is the largest market for natural fiber composites due to presence of established natural fiber composite manufacturers . It is also witnessing technological developments in automotive sector that is contributing to the increasing adoption of natural fiber composites.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance,Polyvlies Franz Beyer GmbH (Germany), Bcomp (Switzerland), and FlexForm Technologies (US)have entered into a number of agreements and partnerships to cater to the growing demand for natural fiber composites across innovative applications.

The natural fiber composites market is experiencing robust demand growth, driven by increased interest in sustainable, lightweight materials for automotive, building & construction, electrical & electronics, sporting goods, and consumer goods sectors. Growing environmental regulations and consumer awareness are prompting manufacturers to replace traditional composites with natural fiber-reinforced alternatives like flax, hemp, and jute, which offer lower carbon footprints and recyclability.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. The shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of natural fiber composites suppliers, which will further affect the revenues of natural fiber composite manufacturers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand for lightweight and fuel-efficient vehicles

-

Growing government regulations regarding environmentally friendly materials

Level

-

Lower durability compared to synthetic fiber composites

-

Fluctuating costs, availability, and quality of raw materials

Level

-

Growing use of natural fiber composites for household furniture

-

Increasing adoption of 3D printing for manufacturing natural fiber composites

Level

-

Low thermal stability and high moisture absorption

-

Dominance of glass fiber composites

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand for lightweight and fuel-efficient vehicles

The use of natural fiber composites is rising in the automotive industry because of its excellent strength-to-weight ratio, improving fuel efficiency and vehicle performance. Natural fibers such as flax, hemp, and kenaf are primarily used as a reinforcement for composites due to their unique mechanical properties, including low density, high impact strength and stiffness, renewability, and cost-effectiveness. Natural fiber composites are also used in electric vehicle (EV) production. Aura, a UK-based EV manufacturer, has utilized natural fiber composites in its sports car for body panels to reduce vehicle weight and achieve sustainable manufacturing. This growing adoption of natural fiber composites by OEMs is driving the automotive industry to meet stringent emission regulations and consumer preferences for eco-friendly automobiles

Restraint: Fluctuating costs, availability, and quality of raw materials

The cost of natural fibers is a major restraint in the natural fiber composites market. It depends upon the processing techniques being used for extracting fibers. The most common technique used for processing natural fibers is retting. Water retting is labor- and capital-intensive and is abandoned in many countries. Another restraint that impacts the market is the availability of natural fibers; it depends upon the region's climatic conditions. Natural fiber such as kenaf requires relatively warmer and wetter conditions for better yield and performance.

Opportunity: Increasing adoption of 3D printing for manufacturing natural fiber composites

The adoption of additive manufacturing (3D printing) technology is increasing due to its ability to produce natural fiber composites more economically and flexibly. 3D printing has changed the way of manufacturing by creating complex shapes with high precision and minimal material waste. Various research studies have been conducted to create and develop natural fiber composite components using 3D printing technology and enhance the natural fiber composites’ mechanical properties compared to existing manufacturing technologies. Fused deposition modeling is the most commonly used technique to produce natural fiber composites. It creates 3D structures through the layer-by-layer melt extrusion of plastic filament.

Challenge: Low thermal stability and high moisture absorption

The thermal stability of natural fiber composites plays a critical role in their manufacturing process. At higher temperatures, the natural fiber components (cellulose, hemicellulose, and lignin) start to degrade, and their mechanical and thermal properties change. Factors that affect the thermal properties of natural fiber composites include fiber and matrix type, the presence of fillers, fiber content and orientation, the treatment of the fibers, and the manufacturing process. Low thermal stability restricts their use to applications that operate at moderate temperatures and raises the likelihood of cellulose degradation and volatile material emissions, both of which may have an unfavorable impact on the characteristics of the natural fiber composite

Natural Fiber Composites Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Use of hemp and kenaf fiber composites in interior panels and door trims of electric and hybrid vehicles. | 25–30% weight reduction compared to conventional plastics, improved sustainability, and recyclability. |

|

Incorporation of flax and jute fiber composites in furniture and home décor products. | Renewable material sourcing, lower carbon footprint, and enhanced aesthetic appeal. |

|

Use of biocomposite materials (flax, hemp, and bamboo fibers) in sports equipment and footwear components. | Lightweight performance, improved environmental profile, and reduced petroleum-based material use. |

|

Natural fiber-reinforced composites in tractor and harvester body panels. | Improved impact resistance, corrosion resistance, and sustainability with reduced production costs. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The natural fiber composites ecosystem analysis involves identifying and analyzing interconnected relationships among various stakeholders, including raw material suppliers, manufacturers, distributors, contractors, and end users. The raw material suppliers provide natural fibers such as flax, hemp, kenaf, and jute to the natural fiber composite manufacturers. Manufacturers use techniques such as compression and injection molding to produce natural fiber composites. The distributors and suppliers are the ones who establish contact between the manufacturing companies and end users to concentrate the supply chain, increasing operational efficiency and profitability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Natural Fiber Composites Market, By Type

Flax segment held the largest share of the natural fiber composites market due to growing shift toward sustainable and environmentally friendly materials. Flax is a soft, lustrous, long, continuous, cellulosic fiber that offers high strength and stiffness and a natural and aesthetic appearance compared to other natural fibers. It is used as a reinforcement for composites. Flax fiber reinforcement composites are available in various formats, and are used in various structural and non-structural applications in the automotive, building & construction, electrical & electronics, sporting goods, consumer goods, and packaging industries

Natural Fiber Composites Market, By Resin Type

Polypropylene (PP)dominated the natural fiber composites market as it is one of the most widely used thermoplastic resins for the reinforcement of composites due to its cost-effectiveness and advanced mechanical properties. It acts as a key polymer matrix in the preparation of natural fiber-reinforced composites. PP offers low density, high melting temperature, flame resistance, transparency, dimensional stability, high chemical resistance, wear and tear resistance, low cost, recyclability, and easy processability, as compared to other thermoplastic resins such as PE, PA, epoxy, and polyester. PP is a versatile polymer and is ideal for reinforcing, filling, and bending

Natural Fiber Composites Market, By Manufacturing Process

The compression molding segment accounbted for the largest share of the natural fiber composites market. Compression molding is a widely used process in the natural fiber composites market due to its high strength, fast curing time, and better physical and mechanical properties than injection molding. In the compression molding process, an engineered composite layup is placed in the open mold cavity, the mold is closed, and a consolidating force is applied, producing a composite part with low void content and high fiber volume fraction

Natural Fiber Composites Market, By End-use Industry

The automotive industry is expected to dominate the natural fiber composites market. The demand for lightweight materials is rapidly increasing in the automotive industry to enhance fuel efficiency and performance. Natural fiber composites can reduce the weight of vehicles by 10–25%, leading to an improvement in fuel efficiency of 6–10%. The growing shift toward sustainable composite materials has enabled automobile companies to comply with strict environmental standards and mitigate greenhouse gas emissions

REGION

Asia Pacific to be fastest-growing region in global natural fiber composites market during forecast period

Asia Pacific is projected to register the highest CAGR in the natural fiber composites market during the forecast period. Rising urbanization, industrialization, and significant investments in the automotive and building & construction industries are the primary drivers for regional market growth. Asia Pacific is home to the world’s largest automobile manufacturers, especially in China, Japan, and South Korea. Companies in the region’s booming automotive industry are increasingly adopting natural fiber composites for applications in exterior and interior parts of vehicles, such as door panels, seat backs, trunk liners, headliners, package trays, and dashboards, due to their high tensile strength and stiffness, impact resistance, durability, low cost, non-abrasive, and lightweight properties

Natural Fiber Composites Market: COMPANY EVALUATION MATRIX

In the natural fiber composites market matrix, Polyvlies Franz Beyer GmbH (Star) leads with a strong market share and extensive product footprint, driven by its high quality natural fiber composite materials under the brand name Narodur, and Naroplast. GreenGran BN (Emerging Leader) is gaining visibility with its sustainable material innovation and scalable processing technology to produce bio-based pellet solutions that combine natural fibers with biodegradable or recyclable polymers. While Polyvlies Franz Beyer GmbH dominates through scale and a diverse portfolio, GreenGran BN shows significant potential to move toward the leaders’ quadrant as demand for high-qaulity natural fiber composites continue to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 0.34 Billion |

| Market Forecast in 2029 (Value) | USD 0.46 Billion |

| Growth Rate | CAGR of 5.3% from 2024-2029 |

| Years Considered | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Rest of the World |

WHAT IS IN IT FOR YOU: Natural Fiber Composites Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Automotive OEM |

|

|

| Construction Material Producer |

|

|

| Consumer Goods & Packaging Company |

|

|

| Raw Fiber Supplier |

|

|

RECENT DEVELOPMENTS

- October 2024 : Bcomp collaborated with Škoda Motorsport to integrate natural fiber composites into the Škoda Enyaq RS Race and Škoda Fabia RS Rally2. This development resulted in the extensive use of flax composites in the interior and exterior of the rally car, including bumpers, mirror housings, footrests, padel box, leg rests, and gearshift grommets

- May 2024 : MYNUSCo partnered with Renault Nissan Automotive India to supply biocomposites for automobile interiors, replacing traditional plastic materials with sustainable alternatives

- April 2024 : Kia Europe (GmbH) collaborated with Bcomp to develop sustainable interiors for the groundbreaking concept EV3 and concept EV4

Table of Contents

Methodology

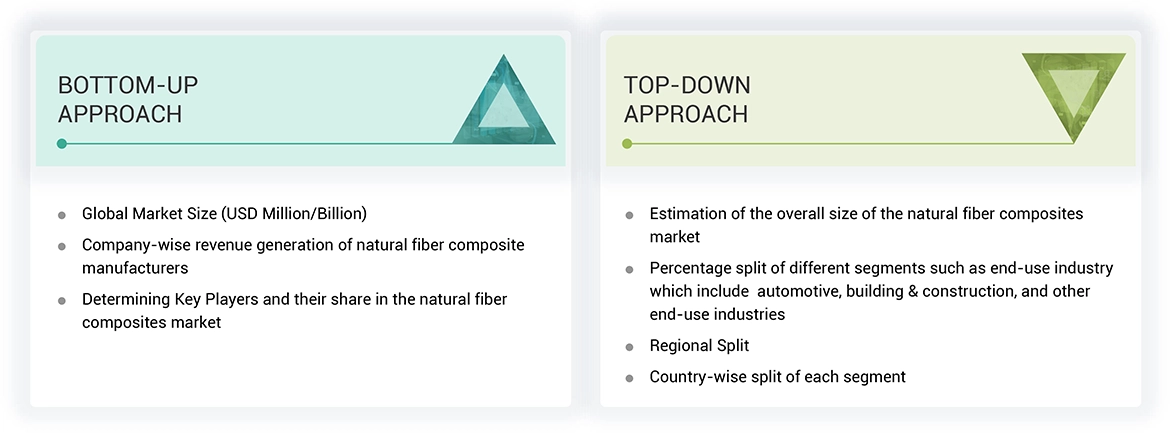

The study involves two major activities in estimating the current market size for the natural fiber composites market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering natural fiber composites and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the natural fiber composites market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the natural fiber composites market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, and Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from natural fiber composites industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, resin type, manufacturing process, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are seeking natural fiber composite services, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of natural fiber composites and future outlook of their business which will affect the overall market.

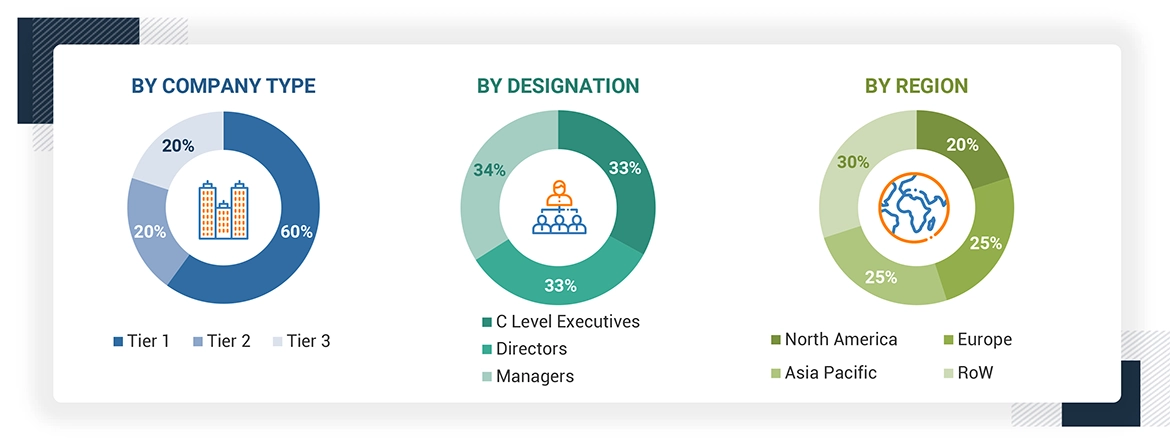

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the natural fiber composites market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on the demand for natural fiber composites in different end-use industries at a regional level. Such procurements provide information on the demand aspects of the natural fiber composites industry for each application. For each end-use, all possible segments of the natural fiber composites market were integrated and mapped.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Natural fiber composites are fabricated from natural fibers reinforced with polymer matrix, such as polypropylene, polyethylene, epoxy, and polyester. These natural fiber composites are non-wood composite fibers comprising flax, jute, hemp, kenaf, sisal, coir, etc. Natural fibers are low-cost fibers with low density and high specific properties. Owing to their low density and outstanding mechanical properties, natural fiber composites have piqued the interest of many researchers to replace synthetic fibers for fabricating fiber reinforced polymer composites for various end-use industries, such as building & construction, automotive, electrical & electronics, and consumer goods.

Stakeholders

- Natural Fiber Composites Manufacturers

- Natural Fiber Distributors and Suppliers

- End-use Industries

- Universities, Governments, and Research Organizations

- Associations and Industrial Bodies

- R&D Institutes

- Environmental Support Agencies

- Investment Banks and Private Equity Firms

- Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the natural fiber composites market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global natural fiber composites market by type, by resin type, by manufacturing process, end-use industry, and region

- To forecast the market size concerning four main regions (along with country-level data), namely, North America, Europe, Asia Pacific, and Rest of the World, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and new product developments/new product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Natural Fiber Composites Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Natural Fiber Composites Market

Rajib

Jan, 2019

Interested in Jute and Kenaf reports with automotive end-use covered.

Apr, 2017

General information on Natural Fiber Composites Market.

kiran

Feb, 2019

Report on natural fiber composites mainly giant nettle or hemp fiber .

Luana

Apr, 2018

General information on natural fibers market.

Siobhan

May, 2019

Looking for companies for ecocomp conference.

Nazmy

Aug, 2015

Natural fiber composites market report .

DHANAKODI

Jan, 2017

Detailed information on Natural Fibre Composite Market.

Julyane

Jan, 2017

Sample for Nanocomposites market.