Composite Decking & Railing Market by Type (Capped and Uncapped), by Resin Type (Polyethylene, Polypropylene, Polyvinylchloride, and Others), by Application (Residential and Non-Residential) & by Region Global Trends and Forecasts to 2020

The composite decking market & railing market is projected to reach USD 3.09 Billion by 2020, at a CAGR of 12.60%. The report aims at estimating the market size and future growth potential of composite decking & railing market across different segments such as application, type, resin types, and region. The base year considered for the study is 2014 and the market size is forecasted from 2015 to 2020. A shift in the trend from natural wood towards composite decking & railing is witnessed. Composite decking & railing offers properties such as low thermal expansion, resistance to slip and colour fading and a few others resulting in increased demand of the product. Capped composite decking & railing product is expected to substantially increase the growth of the market during the forecast period.

The research methodology used to estimate and forecast the composite decking market & railing market begins with capturing data on key company revenues and raw material costs through secondary research. The product offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global composite decking & railing from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and sub-segments which are then verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, Directors and executives. This data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments.

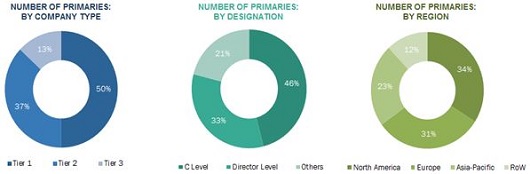

The breakdown of profiles of primary discussion participants is depicted in the below figure:

The composite decking market & railing market comprises of manufacturers such as Trex Company, Inc. (U.S.), UPM Biocomposites (Finland), Advanced Environmental Recycling Technologies, Inc. (U.S.), TAMKO Building Products, Inc. (U.S.), TimberTech (U.S.) and so on.

Target audience

- Resin manufacturers

- composite decking & railing manufacturer

- Raw material suppliers

- Distributors & suppliers

- Industry associations

Study answers several questions for the stakeholders, primarily which market segments to focus in next two to five years for prioritizing the efforts and investments.

Scope of the Composite Decking & Railing Market Report

The research report segments the composite decking market & railing market to following submarkets:

By Type:

- Capped Composites

- Uncapped Composites

By Resin Type:

- Polyethylene

- Polypropylene

- Polyvinyl chloride

- Other Resins

By Application:

- Residential

- Non-Residential

By Region:

- North America

- Europe

- Asia-Pacific

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the North America composite decking market & railing market

- Further breakdown of the Europe composite decking & railing market

- Further breakdown of the Asia-Pacific composite decking & railing market

- Further breakdown of the RoW composite decking & railing market

Company Information

- Detailed analysis and profiling of additional market players

MarketsandMarkets expects the global composite decking market & railing market to grow from USD 1.70 Billion in 2015 to USD 3.09 Billion by 2020, at a compound annual growth rate (CAGR) of 12.60% from 2015 to 2020. The global composite decking & railing market has witnessed a strong growth in the past few years considering the high demand of capped composites in the U.S., Germany and developing countries such as Middle East, Brazil and China. The growing construction industry in these countries is driving the composite decking market & railing market.

The major applications of composite decking & railing are in residential and non-residential sectors. The non-residential application is the fastest growing application in composite decking market & railing market during the forecast period. The properties offered by composite decking & railing such as resistance to thermal expansion and contraction when exposed to sunlight, resistance to splinter & rot and so on, is useful in application areas such as docks, marinas, patios, pool areas, hotels and resorts.

The major resins used for the manufacturing of composite decking & railing include polyethylene, polypropylene and polyvinylchloride. The polyethylene based composite decking & railing has the largest market share in the global composite decking & railing market. Polyethylene resin has high strength and stiffness which is ideal for residential application requiring joist 16 inch on center. Polypropylene composite decking & railing is the fastest growing resin type in the composite decking & railing market globally. Polypropylene resin resists thermal expansion & contraction, making it useful in production of composite decking & railing in high temperature regions.

The composite decking market & railing market is majorly dominated by capped composites type because of its properties such as resistance to splintering, rotting, growth of mold & mildew, and color fading. Capped composites also provide ultralow maintenance cost and superior aesthetics as compared to natural wood decking & railing products. They are widely used in residential and non-residential applications due to its physical properties. North America is the major market for capped composite decking & railing. It is also the biggest non-residential market for composite decking & railing, followed by Europe .The introduction of capped composites in RoW and Asia-Pacific region along with increasing product awareness and the benefits associated with it, is projected to witness high growth rate during the forecast period. These are some of the factors driving the capped composites in composite decking & railing market.

Currently, North America is the largest consumer of composite decking & railing. U.S., Germany, and China are among the major markets of composite decking & railing. The Middle East market for composite decking & railing within the RoW region is projected to register the highest CAGR during the forecast period. The growth of the construction industry and improving financial condition in the region has led to an increase in the demand of composite decking & railing.

Cellular PVC decking, aluminum decking & railing products are some of the substitute products available in the decking & railing market. They constitute a micro share in the decking & railing market. Trex Company, Inc. (U.S.) is the leading player in the composite decking market & railing market. The large scale of their operations offers cost efficiency in manufacturing, marketing and sale of composite decking.

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Composite Decking Market & Railing Market Size (2015-2020)

4.2 Composite Decking Market & Composite RailingMarket, By Application

4.3 Composite Decking Market & Composite RailingMarket, By Resin Type

4.4 Market Attractiveness, By Country

4.5 Composite Decking Market & Composite Railing Market, By Type

4.6 Market, By Application

4.7 Market, Developing vs Developed Countries, 2015–2020

4.8 Lifecycle Analysis, By Region

5 Composite Decking Market & Composite Railing Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Recovery of U.S. Residential Market

5.3.1.2 Development of Innovative Products

5.3.1.3 Increasing Demand for Low-Maintenance Building Products

5.3.2 Restraints

5.3.2.1 Availability of Substitutes

5.3.3 Opportunities

5.3.3.1 Rising Demand From Emerging Countries

5.3.3.2 Growing Awareness of Capped Composite

5.3.4 Challenges

5.3.4.1 Growing Need for Producing Low-Cost Composite Decking & Railing

5.3.4.2 Lawsuits Filed Against Composite Decking & Railing Companies

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Value-Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Threat 0f New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Buyers

6.3.4 Bargaining Power of Suppliers

6.3.5 Intensity of Rivalry

7 Composite Decking Market & Railing Market, By Type (Page No. - 49)

7.1 Introduction

7.2 Capped Composite Decking & Railing

7.3 Uncapped Composite Decking & Railing

8 Composite Decking Market & Railing Market, By Resin Type (Page No. - 55)

8.1 Introduction

8.2 Polyethylene Composite Decking & Composite Railing Market

8.3 Polypropylene Composite Decking & Composite Railing Market

8.4 Polyvinyl Chloride Composite Decking & Composite Railing Market

8.5 Other Resins Composite Decking & Composite Railing Market

9 Composite Decking & Railing Market, By Application (Page No. - 67)

9.1 Introduction

9.2 Residential Composite Decking & Railing

9.3 Non-Residential Composite Decking & Railing

10 Market, By Region (Page No. - 74)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 U.K.

10.3.3 France

10.4 Asia-Pacific

10.4.1 China

10.4.2 Japan

10.4.3 Australia

10.5 RoW

10.5.1 Middle East

10.5.2 Brazil

11 Competitive Landscape (Page No. - 104)

11.1 Overview

11.2 Competitive Scenario and Trends

11.2.1 New Product Launch is the Most Popular Growth Strategy

11.2.2 New Product Launches

11.2.3 Agreements

11.2.4 Expansion

12 Company Profiles (Page No. - 109)

(Overview, Financial*, Products & Services, Strategy, and Developments)

12.1 Introduction

12.2 Trex Company, Inc.

12.3 UPM Biocomposites

12.4 Advanced Environmental Recycling Technologies, Inc. (AERT)

12.5 Tamko Building Products, Inc.

12.6 Timbertech (U.S.)

12.7 Fiberon LLC (U.S.)

12.8 Universal Forest Products, Inc. (UFPI)

12.9 Green Bay Decking, LLC (U.S.)

12.10 Axion International, Inc.

12.11 Integrity Composites LLC (U.S.)

*Details Might Not Be Captured in Case of Unlisted Companies

13 Appendix (Page No. - 133)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Introducing RT: Real Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

List of Tables (76 Tables)

Table 1 Composite Decking Market & Composite Railing Market Size, By Value and Volume, 2013–2020

Table 2 Composite Decking Market, By Type

Table 3 Composite Decking Market, By Resin Type

Table 4 Composite Decking Market, By Application

Table 5 New Residential Building Construction Activities in U.S. (2008-2014)

Table 6 Composite Decking Market Size, By Type, 2013–2020 (Kiloton)

Table 7 Composite Decking Market & Railing Market Size, By Type, 2013–2020 (USD Million)

Table 8 Capped Composites in Market Size, 2013–2020

Table 9 Uncapped Composites in Market Size, 2013–2020

Table 10 Composite Decking Market Size, By Resin Type, 2013–2020 (Kiloton)

Table 11 Composite Decking Market Size, By Resin Type, 2013–2020 (USD Million)

Table 12 Polyethylene Composite Decking Market & Composite Railing Market Size, By Region, 2013–2020 (Kiloton)

Table 13 Polyethylene Composite Decking & Composite Railing Market Size, By Region, 2013–2020 (USD Million)

Table 14 Polypropylene Market Size, By Region, 2013–2020 (Kiloton)

Table 15 Polypropylene Market Size, By Region, 2013–2020 (USD Million)

Table 16 Polyvinyl Chloride Market Size , By Region, 2013–2020 (Kiloton)

Table 17 Polyvinyl Chloride Composite Decking & Railing Market Size , By Region, 2013–2020 (USD Million)

Table 18 Other Resins Market Size, By Region, 2013–2020 (Kiloton)

Table 19 Other Resins Market Size, By Region, 2013–2020 (USD Million)

Table 20 Composite Decking Market & Railing Market Size, By Application, 2013–2020 (Kiloton)

Table 21 Market Size, By Application, 2013–2020 (USD Million)

Table 22 Residential Composite Decking & Railing Market Size, By Region, 2013–2020 (Kiloton)

Table 23 Residential Composite Decking Market & Composite Railing Market Size, By Region, 2013–2020 (USD Million)

Table 24 Non-Residential Composite Decking & Composite Railing Market Size, By Region, 2013–2020 (Kiloton)

Table 25 Non-Residential Market Size, By Region, 2013–2020 (USD Million)

Table 26 Market Size, By Region, 2013–2020 (Kiloton)

Table 27 Market Size, By Region, 2013–2020 (USD Million)

Table 28 North America: Composite Decking Market & Composite Railing Market Size, By Country, 2013–2020 (Kiloton)

Table 29 North America: Composite Decking Market Size, By Country, 2013–2020 (USD Million)

Table 30 North America: Composite Decking Market Size, By Resin Type, 2013-2020 (Kiloton)

Table 31 North America: Composite Decking Market Size, By Resin Type, 2013–2020 (USD Million)

Table 32 North America: Composite Decking Market Size, By Application, 2013–2020 (Kiloton)

Table 33 North America: Composite Decking Market & Railing Market Size, By Application, 2013–2020 (USD Million)

Table 34 U.S.: Composite Decking Market Size, By Application, 2013–2020 (Kiloton)

Table 35 U.S.: Composite Decking Market Size, By Application, 2013–2020 (USD Million)

Table 36 Canada: Composite Decking Market Size, By Application, 2013–2020 (Kiloton)

Table 37 Canada: Composite Decking Market Size, By Application, 2013–2020 (USD Million)

Table 38 Mexico: Composite Decking Market Size, By Application, 2013–2020 (Kiloton)

Table 39 Mexico: Composite Decking Market Size, By Application, 2013–2020 (USD Million)

Table 40 Europe: Composite Decking Market & Railing Market Size, By Country, 2013–2020 (Kiloton)

Table 41 Europe: Composite Decking Market Size, By Country, 2013–2020 (USD Million)

Table 42 Europe: Composite Decking Market Size, By Resin Type, 2013–2020 (Kiloton)

Table 43 Europe: Composite Decking Market Size, By Resin Type, 2013–2020 (USD Million)

Table 44 Europe: Composite Decking Market Size, By Application, 2013–2020 (Kiloton)

Table 45 Europe: Composite Decking Market Size, By Application, 2013–2020 (USD Million)

Table 46 Germany: Composite Decking Market Size, By Application, 2013–2020 (Kiloton)

Table 47 Germany: Composite Decking Market Size, By Application, 2013–2020 (USD Million)

Table 48 U.K.: Composite Decking Market & Railing Market Size, By Application, 2013–2020 (Kiloton)

Table 49 U.K.: Composite Decking Market Size, By Application, 2013–2020 (USD Million)

Table 50 France: Composite Decking Market Size, By Application, 2013–2020 (Kiloton)

Table 51 France: Composite Decking Market Size, By Application, 2013–2020 (USD Million)

Table 52 Asia-Pacific: Composite Decking Market & Railing Market Size, By Country, 2013–2020 (Kiloton)

Table 53 Asia-Pacific: Composite Decking Market Size, By Country, 2013–2020 (USD Million)

Table 54 Asia-Pacific: Composite Decking Market Size, By Resin Type, 2013–2020 (Kiloton)

Table 55 Asia-Pacific: Composite Decking Market Size, By Resin Type, 2013-2020 (USD Million)

Table 56 Asia-Pacific: Composite Decking Market Size, By Application, 2013–2020 (Kiloton)

Table 57 Asia-Pacific: Composite Decking Market & Railing Market Size, By Application, 2013–2020 (USD Million)

Table 58 China: Composite Decking Market Size, By Application, 2013–2020 (Kiloton)

Table 59 China: Composite Decking Market Size, By Application, 2013–2020 (USD Million)

Table 60 Japan: Market Size, By Application, 2013–2020 (Kiloton)

Table 61 Japan: Composite Decking Market & Railing Market Size, By Application, 2013–2020 (USD Million)

Table 62 Australia: Market Size, By Application, 2013–2020 (Kiloton)

Table 63 Australia: Market Size, By Application, 2013–2020 (USD Million)

Table 64 RoW: Composite Decking Market & Railing Market Size, By Country, 2013–2020 (Kiloton)

Table 65 RoW: Market Size, By Country, 2013–2020 (USD Million)

Table 66 RoW: Market Size, By Resin Type, 2013–2020 (Kiloton)

Table 67 RoW: Market Size, By Resin Type, 2013–2020 (USD Million)

Table 68 RoW: Market Size, By Application, 2013–2020 (Kiloton)

Table 69 RoW: Market Size, By Application, 2013–2020 (USD Million)

Table 70 Middle East: Composite Decking Market & Railing Market Size, By Application, 2013–2020 (Kiloton)

Table 71 Middle East: Market Size, By Application, 2013–2020 (USD Million)

Table 72 Brazil: Market Size, By Application, 2013–2020 (Kiloton)

Table 73 Brazil: Market Size, By Application, 2013–2020 (USD Million)

Table 74 New Product Launches

Table 75 Agreement, Partnership, and Collaborations

Table 76 Expansions

List of Figures (46 Figures)

Figure 1 Composite Decking Market & Railing Market Segmentation

Figure 2 Composite Decking Market & Railing Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Composite Decking Market & Railing Market Snapshot, By Resin Type (2015-2020)

Figure 6 Composite Decking Market & Railing Market Rankings, By Country, 2015

Figure 7 Composite Decking Market & Railing Market Share, By Volume, 2014

Figure 8 Attractive Market Opportunities in the Composite Decking & Railing Market, 2015–2020

Figure 9 Non-Residential Segment Projected to Be the Fastest-Growing Application in the Composite Decking & Railing Market, 2015–2020

Figure 10 North America Was the Biggest Market for Composite Decking & Railing

Figure 11 Middle East Projected to Be the Fastest-Growing Market During the Forecast Period

Figure 12 Capped Composites Accounted for Largest Share of Composite Decking & Railing Market

Figure 13 Residential Application Dominates Composite Decking & Railing Market, By Value, 2015-2020

Figure 14 Developing Countries to Register Faster Growth Rate Than Developed Ones

Figure 15 RoW Expected to Witness Exponential Growth, Followed By Asia-Pacific, 2015–2020

Figure 16 Drivers, Restraints, Opportunities, and Challenges in Composite Decking & Railing Market

Figure 17 Composite Decking & Railing Value Chain

Figure 18 Porter’s Five Forces Analysis of Composite Decking Market & Railing Market

Figure 19 Properties Comparison Chart

Figure 20 Capped Composite Expected to Be the Fastest-Growing Segment (2015–2020), By Volume

Figure 21 High Demand for Capped Composites in Composite Decking & Railing Market, 2015-2020

Figure 22 Demand for Uncapped Composites in Composites Decking & Railing Market, 2015–2020

Figure 23 Composite Decking & Railing Market, By Resin Type

Figure 24 Polyethylene Composite Decking & Railing Segment to Account for Largest Share of the Market, By Value (2015–2020)

Figure 25 Polypropylene Composite Decking & Railing Market Projected to Be the Fastest-Growing Segment (2015–2020), By Volume

Figure 26 North America Leads in the Consumption of Polyethylene Composite Decking & Railing Market, 2013–2020, By Volume

Figure 27 Polypropylene Based Composite Decking & Railing to Witness Highest Growth Rate in RoW, 2015-2020, By Volume

Figure 28 RoW Projected to Register Highest Growth Rate Between 2015 and 2020, By Volume

Figure 29 North America Dominates Composite Decking & Railing Market in Other Resins Segment, 2013-2020, By Volume

Figure 30 Non-Residential Application to Be the Fastest-Growing Segment in the Composite Decking & Railing Market, 2015–2020

Figure 31 North America Composite Decking Market & Railing Market in Residential Application, By Volume (2015–2020)

Figure 32 RoW Composite Decking & Railing in the Non-Residential Application Segment, By Value (2015–2020)

Figure 33 Composite Decking & Railing Market, By Region

Figure 34 Regional Snapshot - Rapid Growth Markets are Emerging as New Strategic Locations (2015–2020)

Figure 35 Composite Decking Market & Railing Market in Different Applications, By Region, 2015–2020

Figure 36 North America Composite Decking & Railing Market Snapshot - U.S. is the Most Lucrative Market

Figure 37 Germany Accounts for Largest Share of European Composite Decking & Railing Market (2015-2020)

Figure 38 China is the Biggest Market for Composite Decking & Railing in Asia-Pacific

Figure 39 Polypropylene Based Composite Decking & Railing Projected to Be the Fastest-Growing Segment in RoW Region (2015–2020)

Figure 40 Companies Adopt New Product Launches as Key Growth Strategy (2011-2015)

Figure 41 Yearly Market Developments in the Global Composite Decking Market & Railing Market, 2011–2015

Figure 42 Trex Company, Inc.: Company Overview

Figure 43 UPM Biocomposites: Company Snapshot

Figure 44 AERT: Company Snapshot

Figure 45 UFPI: Company Snapshot

Figure 46 Axion International, Inc.: Company Snapshot

Growth opportunities and latent adjacency in Composite Decking & Railing Market