Medical Equipment Maintenance Market Size, Growth, Share & Trends Analysis

Medical Equipment Maintenance Market by Device (MRI, X-ray, CT, Ultrasound, Patient Monitoring, Dental Equipment), Provider (OEM, ISO), Service (Preventive, Corrective), Contract Service (Customized, Add-on), End User (Hospital, ASCs) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global medical equipment maintenance market is projected to reach USD 101.52 billion by 2030 from USD 60.68 billion in 2025, growing at a CAGR of 10.8% during the forecast period. The medical equipment maintenance market expansion is driven by the increasing demand for appropriate and accurately functioning medical devices, higher healthcare investments, and increased attention to patient safety and equipment uptime. With an increase in the aging population and chronic disease burden, the extent of medical equipment utilization has increased; thus, medical equipment maintenance is now required on a regular basis.

KEY TAKEAWAYS

-

BY DEVICE TYPEBy device type, the medical equipment maintenance market is segmented into diagnostic imaging equipment, surgical equipment, dental equipment, radiotherapy devices, patient monitoring & life support devices, endoscopic devices, laboratory equipment, ophthalmology equipment, medical lasers, electrosurgical equipment, radiotherapy devices, and durable medical equipment. The diagnostic imaging equipment segment accounted for the largest share of the market, owing to the rising technological advancements in MRI, CT, and PET/SPECT, with frequent upgrades and expert servicing to ensure peak performance.

-

BY SERVICE PROVIDERThe medical equipment maintenance market is segmented by service provider into single-vendor OEMs, multi-vendor OEMs, ISOs, and in-house maintenance. The multi-vendor OEMs segment accounted for the largest share of the market in 2024. These service providers deliver custom maintenance solutions formulated to consider healthcare institutions' distinct requirements and financial limitations. Multi-vendor OEMs implement higher-end diagnostic tools and remote monitoring, allowing for predictive maintenance to guard against impending equipment failures.

-

BY SERVICE TYPEThe medical equipment maintenance market is segmented by service type into operational, corrective, and preventive maintenance. Preventive maintenance is expected to represent the highest CAGR during the forecast period. As diagnostic imaging systems grow more advanced and complex, proactive upkeep is essential to minimize breakdowns and maintain seamless operation. Ongoing technological innovations continue to introduce sophisticated components and subsystems that require specialized maintenance expertise and procedures.

-

BY CONTRACT TYPEBased on the contract type, the medical equipment maintenance market is segmented into basic contract, premium contract, customized contract, and add-on contract. The premium contract is projected to register the largest share in the medical equipment maintenance market. Premium contracts in the medical equipment maintenance market offer customizable service-level agreements tailored to the specific needs of healthcare facilities. This customization allows facilities to prioritize equipment, set response times, schedule maintenance, define performance metrics, manage spare parts, receive training, and adhere to budget constraints.

-

BY END USERThe medical equipment maintenance market is divided by end user into hospitals & clinics, diagnostic imaging centers, dialysis centers, ambulatory surgery centers, dental clinics, and other end users. Hospitals and clinics focus on enhancing operational efficiency and reducing costs to improve nursing services and patient satisfaction.To ensure equipment uptime and proper lifecycle management, many have established in-house biomedical engineering departments or long-term contracts with third-party service providers.

-

BY REGIONThe Asia-Pacific medical equipment maintenance market is growing rapidly due to the region’s expanding healthcare infrastructure, rising chronic disease burden, aging population, and adoption of advanced medical technologies that require regular servicing. Governments are increasing healthcare investments, while medical tourism drives demand for high-quality, reliable equipment. Hospitals also seek cost-effective ways to extend device lifespan, boosting preventive and predictive maintenance. These factors make Asia Pacific one of the fastest-growing regions in this market.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including partnerships and collaborations. For instance, in April 2024, Canon Inc. (Japan) launched Canon NorthStar, an all-in-one solution platform that provides end-to-end advisory, equipment, and associated services for setting up complete studio operations. This innovative platform combines the best technology companies and industry experts to assist customers.

The medical equipment maintenance market is projected to experience robust growth in the coming years, fueled by the rapid expansion of healthcare infrastructure and the rising demand for advanced medical technologies. With the increasing prevalence of chronic diseases and aging populations, hospitals and clinics are relying more heavily on sophisticated devices that require regular servicing, calibration, and preventive care to ensure patient safety and operational efficiency. Growing government investment, stricter regulatory standards, and the emphasis on cost-effective healthcare delivery further strengthen the market, positioning maintenance services as a critical component of the evolving connected healthcare ecosystem.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The medical equipment maintenance market is transitioning from reactive, OEM-driven service contracts and basic preventive maintenance to predictive, IoT- and AI-powered solutions. Key trends include real-time equipment monitoring, remote diagnostics, and integration with hospital asset management platforms. These innovations enable minimized equipment downtime, extended device lifecycles, faster access to functional equipment, improved quality and safety of care, regulatory compliance, and lower overall treatment costs, while creating opportunities for new service models, multi-vendor ecosystems, and subscription-based offerings.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growth in medical equipment market

-

Rising focus on preventive medical equipment maintenance

Level

-

High initial cost and significant maintenance expenditure

Level

-

Innovation in service offerings and use of IoT

-

Emergence of independent service organizations

Level

-

Survival of small players in highly fragmented and competitive market

-

Shortage of skilled biomedical engineers and technicians

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Medical Equipment Maintenance Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Preventive and corrective maintenance for imaging systems (MRI, CT, ultrasound) | Maximizes uptime, predictive service reduces unexpected failures, and extends equipment lifecycle |

|

Asset management and maintenance services for multi-vendor medical devices | Improves reliability, reduces downtime, cost-efficient lifecycle management |

|

Comprehensive maintenance for diagnostic and therapeutic devices with remote monitoring | Data-driven predictive maintenance, faster issue resolution, improved performance |

|

Service and lifecycle support for imaging systems and endoscopy equipment | Boosts clinical productivity, reduces total cost of ownership, and ensures regulatory compliance |

|

Maintenance and technical support for critical care equipment (ventilators, anesthesia machines, monitors) | Enhances patient safety, ensures continuous availability of life-support systems, extends device lifetime |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The medical equipment maintenance market operates within a complex ecosystem of OEMs, third-party service providers, healthcare institutions, regulators, and technology vendors. OEMs lead by bundling maintenance with equipment sales, while independent service organizations (ISOs) offer cost-effective alternatives, especially in emerging markets. Hospitals and clinics, key end-users, demand preventive and corrective services to ensure compliance, safety, and reliability. Regulatory frameworks (e.g., FDA, ISO) shape service quality standards, while emerging digital technologies such as AI, IoT, and predictive maintenance are transforming service models with real-time monitoring and remote troubleshooting. The ecosystem is increasingly focused on cost efficiency, uptime optimization, and digital integration, driving competition and innovation.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Medical Equipment Maintenance Market, By Service provider

In 2024, the multi-vendor OEMs segment held the largest share of the medical equipment maintenance market, reflecting the growing preference for flexible, comprehensive service solutions. These providers offer customized maintenance programs tailored to the diverse needs and budget constraints of healthcare institutions, while leveraging advanced diagnostic tools and remote monitoring technologies. By enabling predictive maintenance and reducing the risk of unexpected equipment failures, multi-vendor OEMs help hospitals and clinics optimize uptime, extend device lifecycles, and improve overall cost-efficiency.

Medical Equipment Maintenance Market, By Service Type

Preventive maintenance accounts for the largest share by service type in the medical equipment maintenance market. This dominance is driven by its proactive advantages, including minimizing unexpected equipment failures and extending the lifespan of critical assets. By implementing preventive maintenance protocols, healthcare facilities foster a culture of continuous improvement through early issue detection and ongoing enhancement of maintenance strategies. This approach ensures higher operational efficiency, reduced equipment downtime, and improved long-term reliability and performance of essential medical devices.

Medical Equipment Maintenance Market, By End User

Hospitals and clinics represent the leading end-user segment in the medical equipment maintenance market, driven by their need to enhance operational efficiency, reduce costs, and improve patient satisfaction. To ensure maximum equipment uptime and effective lifecycle management, many facilities rely on in-house biomedical engineering teams or enter long-term partnerships with third-party service providers. With the growing complexity and volume of devices such as diagnostic imaging systems and patient monitors, regular, high-quality maintenance has become essential to prevent service disruptions and safeguard continuity of care.

REGION

Asia Pacific to be the fastest-growing region in the global medical equipment maintenance market during the forecast period

The Asia Pacific medical equipment maintenance market is projected to record the fastest growth globally over the forecast period. This expansion is fueled by the rising prevalence of chronic diseases, the growing demand for advanced diagnostic and therapeutic devices, and the rapidly aging population across the region. Substantial investments in healthcare infrastructure in countries such as China and India are leading to the establishment of new hospitals, diagnostic centers, and specialty clinics, which significantly increase the need for reliable maintenance services. In addition, supportive government policies, rising healthcare expenditure, and initiatives to improve equipment safety and compliance further drive the adoption of preventive and predictive maintenance solutions. Together, these factors are positioning the Asia Pacific as a high-growth market.

Medical Equipment Maintenance Market: COMPANY EVALUATION MATRIX

In the Medical Equipment Maintenance market matrix, Siemens Healthineers (Star) leads the medical equipment maintenance market with a strong global presence, a comprehensive service portfolio, and advanced maintenance solutions for diagnostic imaging, laboratory, and therapeutic equipment, driving widespread adoption across hospitals and healthcare facilities. Canon (Pervasive Player) provides reliable and cost-effective maintenance services, focusing on emerging markets and smaller healthcare facilities, ensuring consistent service coverage and steady growth. While Siemens dominates with scale and technological leadership, Canon maintains broad market penetration across diverse regions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 55.22 Billion |

| Market Forecast in 2030 (Value) | USD 101.52 Billion |

| Growth Rate | CAGR of 10.8% from 2025-2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD million/billion), Volume (Thousand Tons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, the Middle East & Africa |

WHAT IS IN IT FOR YOU: Medical Equipment Maintenance Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Comparison of key maintenance types: Preventive Maintenance, Corrective Maintenance, and Operational Maintenance | Identify interconnections and supply chain blind spots; detect outsourcing trends among hospitals, clinics, and diagnostic centers |

| Company Information | GE Healthcare, Siemens Healthineers, Philips Healthcare, Drägerwerk, and Aramark Healthcare Technologies. Market share analysis of the top 3–5 players in Asia Pacific and Europe at country level | Insights on revenue shifts toward multi-vendor services, managed equipment services, and predictive maintenance solutions |

| Geographic Analysis | Detailed analysis for Rest of Asia Pacific; client focus on ASEAN countries for country-level medical equipment maintenance market insights | Country-level demand mapping for new service models, partnerships, and localization strategy planning |

RECENT DEVELOPMENTS

- January 2025 : GE Healthcare (US) and Sutter Health (US) entered a seven-year “Care?Alliance” in California to deploy GE’s latest AI-powered imaging systems, such as Omni Legend PET/CT, StarGuide SPECT/CT, Vscan Air SL ultrasound, and AIR Recon?DL MR software across over 300 facilities.

- October 2024 : Siemens?Healthineers AG (Germany) signed a 12-year Value Partnership with University Hospital Nantes (France) to modernize diagnostic and interventional imaging across 13 hospitals in the Loire-Atlantique region.

- October 2023 : GE Healthcare (US) and reLink Medical (US) collaborated to deliver asset management solutions aimed at helping healthcare providers minimize medical device waste, increase operational efficiency, and maximize equipment utilization.

- May 2023 : Siemens Healthineers AG (Germany) and CommonSpirit Health (US) acquired Block Imaging (US). This acquisition aims to offer more sustainable options and meet the growing demand from US hospitals, health systems, and other care sites for multi-vendor imaging parts and services.

Table of Contents

Methodology

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial medical equipment maintenance market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends, to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply & demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various companies and organizations in the medical equipment maintenance market. The primary sources from the demand side include medical OEMs, medical device ISOs, and service providers. Primary research was conducted to validate the market segmentation, identify key players, and gather insights into key industry trends & key market dynamics.

A breakdown of the primary respondents for the medical equipment maintenance market (supply side) is provided below:

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Others include sales, marketing, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 2 billion, Tier 2 = USD 50 million to USD 2 billion, and Tier 3 = < USD 50 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

This report determined the global medical equipment maintenance market size using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the medical equipment maintenance business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and marketing executives.

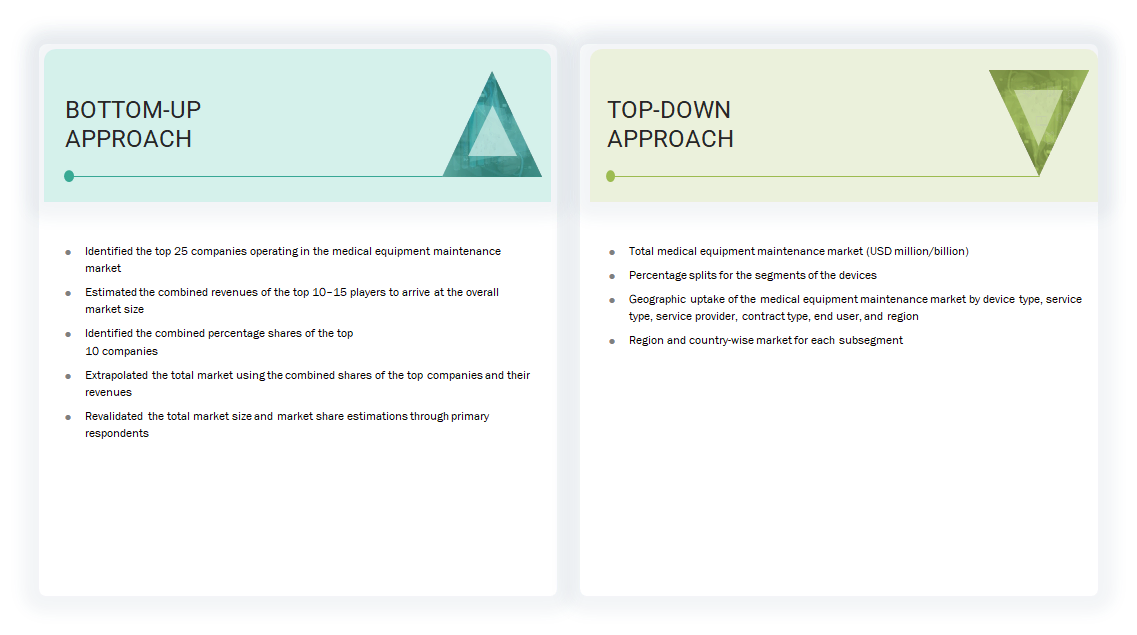

Segmental revenues were calculated based on the revenue mapping of major solution/service providers to calculate the global market value. This process involved the following steps:

- Generating a list of major global players operating in the medical equipment maintenance market

- Mapping annual revenues generated by major global players from the medical equipment maintenance segment (or nearest reported business unit/service category)

- Revenue mapping of key players to cover a significant share of the global market as of 2024

- Extrapolating the global value of the medical equipment maintenance industry

Global Medical Equipment Maintenance Market Size: Top-down & Bottom-up Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global medical equipment maintenance market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, top-down and bottom-up approaches validated the medical equipment maintenance market.

Market Definition

Medical equipment maintenance encompasses a comprehensive suite of services including monitoring, diagnosing failures, supplying spare parts, corrective maintenance, preventive maintenance, automation and upgrades, inventory management and testing, consulting, planning equipment renewal, and user training. It is indispensable for identifying and preempting potential performance issues before they escalate, thus optimizing equipment performance and curtailing operational costs. These critical services are typically executed internally or outsourced to Original Equipment Manufacturers (OEMs) or Independent Service Organizations (ISOs), ensuring the sustained reliability & efficiency of healthcare equipment.

Stakeholders

- Original equipment manufacturers

- Independent service providers

- Independent service organizations

- Product distributors and channel partners

- Hospitals & surgery centers

- Dental hospitals, laboratories, and clinics

- Dental academic & research institutes

- Ambulatory care centers & physician-operated laboratories

- Contract manufacturers & third-party suppliers

- Research laboratories & academic institutes

- Clinical research organizations

- Contract manufacturing organizations

- Government & non-governmental regulatory authorities

- Venture capitalists & investors

- Trade associations & industry bodies

- Insurance companies

- Market research & consulting firms

Report Objectives

- To define, describe, and forecast the medical equipment maintenance market based on device type, service type, service provider, contract type, end user, and region

- To provide detailed information regarding the major factors influencing the growth potential of the global medical equipment maintenance market (drivers, restraints, opportunities, challenges, and trends).

- To analyze the micro markets with respect to individual growth trends, prospects, and contributions to the global medical equipment maintenance market.

- To analyze key growth opportunities in the global medical equipment maintenance market for key stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of the global medical equipment maintenance market in North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa.

- To profile the key players in the global medical equipment maintenance market and comprehensively analyze their market shares and core competencies.

- To track and analyze the competitive developments undertaken in the global medical equipment maintenance market, such as agreements, collaborations, partnerships, expansions, and acquisitions.

Key Questions Addressed by the Report

What are the drivers for the medical equipment maintenance market?

The key drivers include the growing demand for advanced and reliable medical devices, increasing focus on patient safety, and the rising need to reduce equipment downtime in healthcare settings. The expansion of healthcare infrastructure, especially in emerging markets, and the aging population fuel demand for timely maintenance services.

Which device segment in the medical equipment maintenance market provides lucrative growth opportunities?

The diagnostic imaging equipment segment offers the highest growth potential. This is due to rapid technological advancements and the high value and complexity of imaging systems such as MRI, CT, and PET scanners.

What are the key medical equipment maintenance market opportunities?

The key opportunities include the shift towards multi-vendor services, increasing adoption of predictive maintenance powered by AI and IoT, and growing investments in digital health infrastructure.

What are the key challenges in the medical equipment maintenance market?

Challenges include high service costs, a shortage of skilled technicians, limited access to OEM parts, rapid technological changes, and strict regulatory requirements.

Which region is expected to witness the highest growth rate during the forecast period?

The Asia Pacific region is expected to grow at the highest CAGR during the forecast period (2025−2030).

Ask ChatGPT

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Medical Equipment Maintenance Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Medical Equipment Maintenance Market

Gerald

Mar, 2022

Can you share the detailed information on technological advancements in the Medical Equipment Maintenance Market?.

Harold

Mar, 2022

In what way COVID19 is Impacting the global growth of the Medical Equipment Maintenance Market?.

Sean

Mar, 2022

Can you enlighten us about the key players operating in the global Medical Equipment Maintenance Market?.