Livestock Identification Market Size, Share and Trends, 2025 To 2031

Livestock Identification Market by Livestock Type (Cattle (Dairy, Beef), Poultry, Swine, Equine), Electronic Identification Tags, Visual Identification Tags (GPS Tags, RFID Tags), Boluses, Data Analytics - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

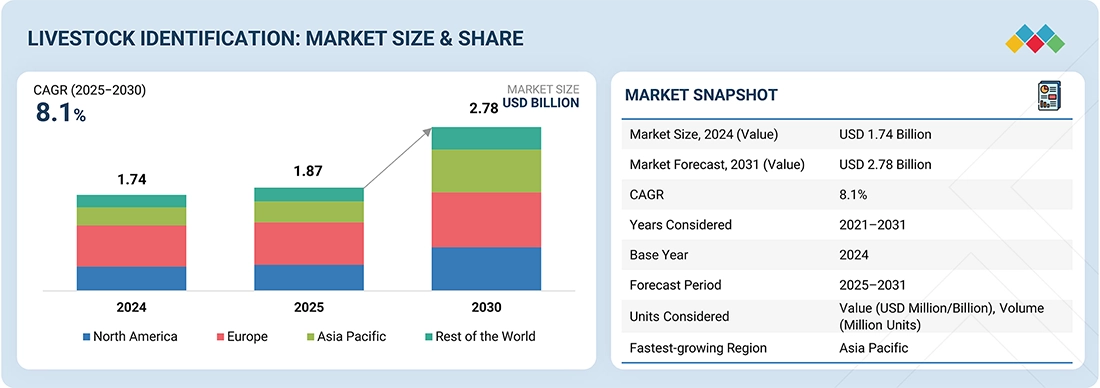

The livestock identification market is projected to grow from USD 1.74 billion in 2025 to USD 2.78 billion by 2030 at a CAGR of 8.1% during the forecast period. Growth is driven by the rapid adoption of electronic animal identification technologies, expanding government traceability mandates, and rising focus on food safety and disease control. Increasing investments in RFID, biometric, and IoT-enabled tagging systems, along with digital record integration for breeding, vaccination, and supply-chain monitoring, are accelerating market expansion. Additionally, the growing emphasis on sustainable livestock management, export certification compliance, and real-time data analytics is enhancing productivity, reducing livestock losses, and driving sustained growth across global farming and meat processing industries.

KEY TAKEAWAYS

-

BY REGIONEurope is estimated to dominate the livestock identification market with a share of 41.2% in 2025.

-

BY DEVICE LIFECYCLEThe electronic ID (EID) devices are estimated to dominate due to their accuracy, durability, and compatibility with digital herd management platforms for seamless data integration and compliance tracking.

-

BY FARM SIZEMedium-sized farms are gaining prominence due to their balanced adoption of cost-effective RFID and IoT-based systems, which enhance herd monitoring, breeding efficiency, and productivity.

-

BY LIVESTOCK TYPECattle identification is estimated to account for the largest share of 67.4% in 2025 due to government mandates, export traceability requirements, and large herd population across key markets.

-

BY OFFERINGBy offering, the software segment is projected to grow at the highest CAGR of 10.9% during the forecast period.

-

BY APPLICATIONBy application, the animal ownership identification segment is accounted for a share of 36.3% in 2024.

-

COMPETITIVE LANDSCAPEHerdDogg. Inc. (US), mOOvement (Australia), HerdX (US), and SmartAHC Technology (China) have emerged as the startups and SMEs driving technological innovation and market agility in the livestock identification market.

The livestock identification market is projected to grow significantly over the next decade, driven by rapid digital transformation in animal traceability systems, rising emphasis on food safety and disease control, and increasing government initiatives toward sustainable livestock management and smart farming ecosystems.

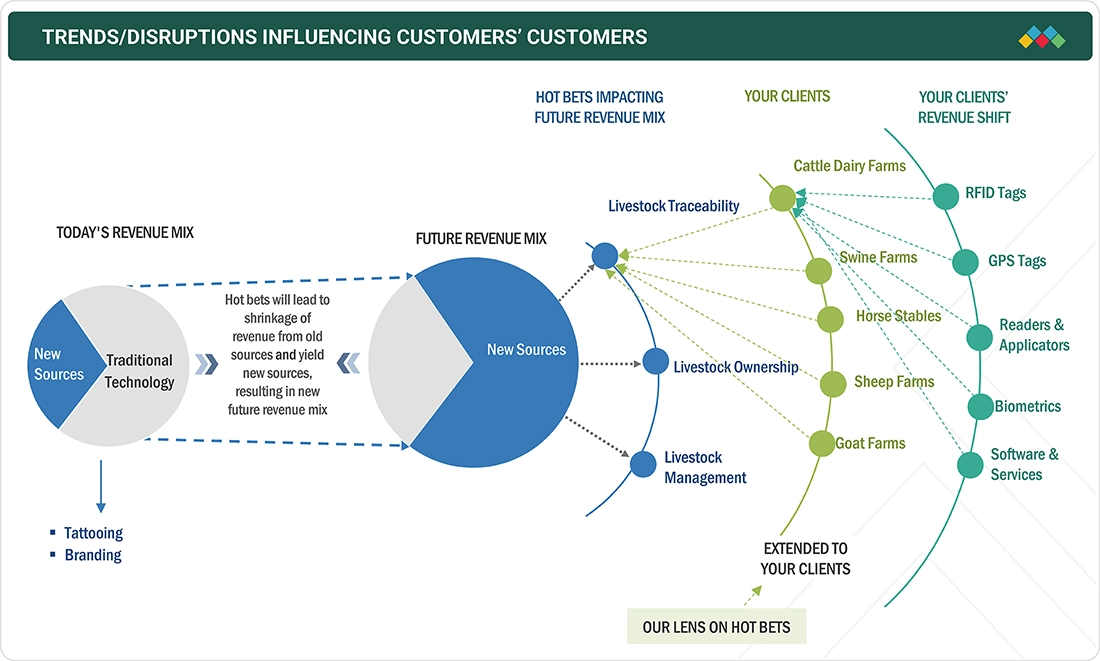

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The livestock and animal husbandry vertical primarily includes dairy cooperatives, meat processors, government veterinary agencies, and livestock producers. Livestock identification systems have been increasingly adopted across these segments to enable real-time animal tracking, ownership verification, and supply-chain traceability. Additionally, new opportunities are emerging with the integration of AI-driven analytics, GPS-enabled movement tracking, and cloud-based herd management platforms, enabling data-driven decision-making. These advancements are expected to shape the next generation of smart livestock ecosystems, driving improvements in productivity, operational efficiency, and sustainability, while ensuring traceable, safe, and high-quality animal products for both domestic and export markets.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing focus of farmers on reducing mortality and optimizing herd health and productivity

-

Rising inclination of livestock industry players toward data-driven decision-making

Level

-

Limited adoption among small farmers due to budget constraints

-

Rise of vegan dining trend in Europe

Level

-

Integration of blockchain technology into livestock identification tools

-

Government initiatives encouraging use of livestock identification technology

Level

-

Minimizing greenhouse gas emissions from livestock

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing focus of farmers on reducing mortality and optimizing herd health and productivity

Livestock identification systems are being increasingly implemented to address challenges related to herd management, ownership verification, and productivity optimization. Farmers and cooperatives are adopting RFID and IoT-enabled identification systems to enable seamless tracking of animal data, automate recordkeeping, and eliminate errors caused by manual monitoring. The shift toward digital tagging and data-driven livestock management, coupled with expanding government mandates and traceability programs, is fueling strong market adoption. Additionally, the integration of AI, cloud analytics, and smart sensors has enhanced traceability accuracy, data transparency, and herd performance analysis, further accelerating market growth.

Restraint: Limited adoption among small farmers due to budget constraints

Despite clear productivity benefits, the widespread implementation of electronic livestock identification systems requires significant upfront investment in tags, readers, and data management software. The cost of scaling and maintaining digital traceability infrastructure often limits adoption among small and marginal farmers, particularly in developing regions. Limited access to financing, lack of digital literacy, and fragmented regional compliance frameworks hinder integration across farming communities. Data management and system calibration challenges remain key barriers for smaller farms striving to maintain reliable livestock records and consistent reporting accuracy.

Opportunity: Government initiatives encouraging use of livestock identification technology

The ongoing expansion of smart agriculture and digital livestock management initiatives presents a strong growth opportunity for solution providers. Increasing public-sector investments in national animal identification programs, coupled with mandates for traceable meat and dairy exports, are redefining the global livestock data ecosystem. The integration of AI-driven analytics, RFID-enabled tracking, and cloud-based record systems is unlocking new opportunities for operational transparency and export compliance. Furthermore, public–private partnerships (PPP) and integrated database systems are driving modernization, improving productivity, and creating scalable solutions for sustainable livestock development.

Challenge: Minimizing greenhouse gas emissions from livestock

As livestock identification systems increasingly rely on digital data and cloud connectivity, concerns over data privacy, misuse of information, and system security are becoming more pronounced. Unauthorized access or data breaches could undermine ownership verification and compromise compliance tracking. Additionally, there is a growing challenge in monitoring and reporting greenhouse gas emissions associated with livestock operations. Ensuring alignment with sustainability standards, maintaining data transparency, and integrating emission-monitoring modules into livestock ID systems are emerging as critical focus areas for both regulators and technology providers.

Livestock Identification Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployment of RFID-enabled livestock identification system for dairy herd management, integrating real-time milk yield, health, and breeding data across farms | Improved milk yield traceability, 10–12% productivity gains, faster health issue detection, and transparent farmer payments through data-driven herd management |

|

Implementation of RFID and blockchain-based traceability solutions for swine operations to ensure end-to-end visibility from farm to processing | Enhanced export compliance, reduced product recalls, and gained a 5–8% price premium through verified animal origin and welfare certification |

|

Integration of RFID ear tagging across cooperative members for automated milk collection, quality monitoring, and herd health tracking | Fair and timely farmer payments, improved milk quality consistency, and reduced manual data errors, strengthening cooperative transparency. |

|

Adoption of cloud-based livestock identification and traceability system across beef supply chains to monitor animal health, movement, and sustainability compliance | 40% improvement in traceability efficiency, faster recall management, and increased global market access through verified supply chain transparency |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

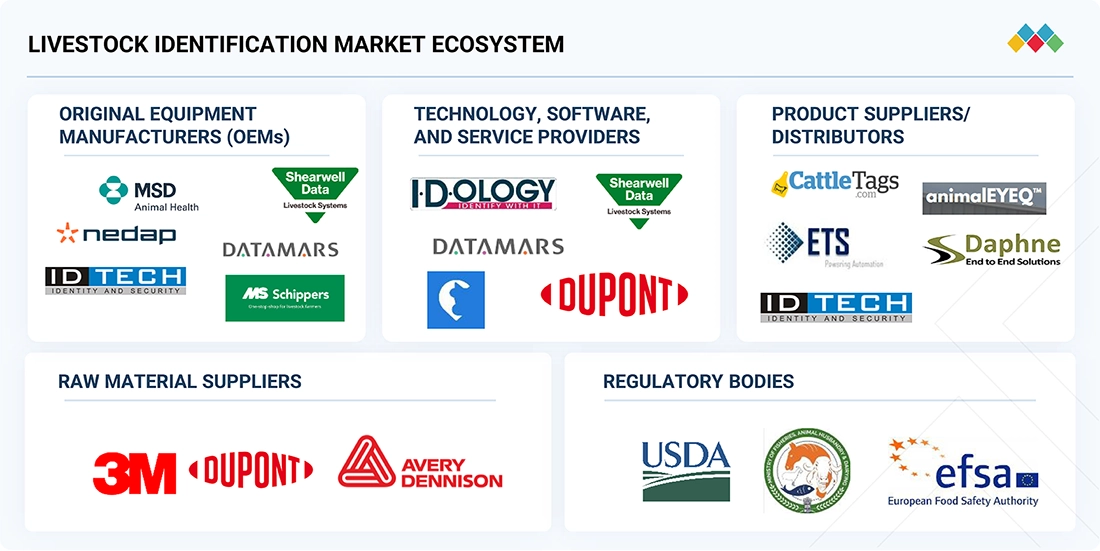

MARKET ECOSYSTEM

The livestock identification ecosystem comprises established providers, including MSD Animal Health, Datamars, Nedap N.V., Shearwell Data Ltd., and Allflex Livestock Intelligence. The synergy among these stakeholders taps new opportunities across areas such as AI-driven animal tracking, RFID and UHF-based identification, cloud-integrated data analytics, and precision livestock management. Continuous innovation in tag materials, data interoperability, and herd analytics platforms is driving greater efficiency, traceability, and compliance across the global livestock identification and smart farming market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Livestock Identification Market, by Device Lifecycle

The long device lifecycle segment held the largest market share in 2024, as durable and long-lasting RFID tags are increasingly preferred by farmers and cooperatives for minimizing replacement costs and ensuring continuous animal traceability. These tags, designed to withstand harsh farm environments and prolonged exposure to weather, offer enhanced reliability, low maintenance needs, and consistent data performance throughout the animal’s lifespan. The growing shift toward robust electronic identification solutions integrated with cloud-based data systems continues to strengthen adoption, particularly in large-scale and export-oriented livestock operations where long-term data retention and compliance are critical.

Livestock Identification Market, by Farm Size

The large farm segment accounted for a significant market share in 2024, supported by its higher livestock population, centralized management, and ability to integrate digital tracking at scale. Medium-sized farms are also gaining traction due to cost-effective RFID and IoT-enabled solutions that balance affordability with performance. Increasing access to digital management tools and cooperative-led traceability programs is further driving adoption.

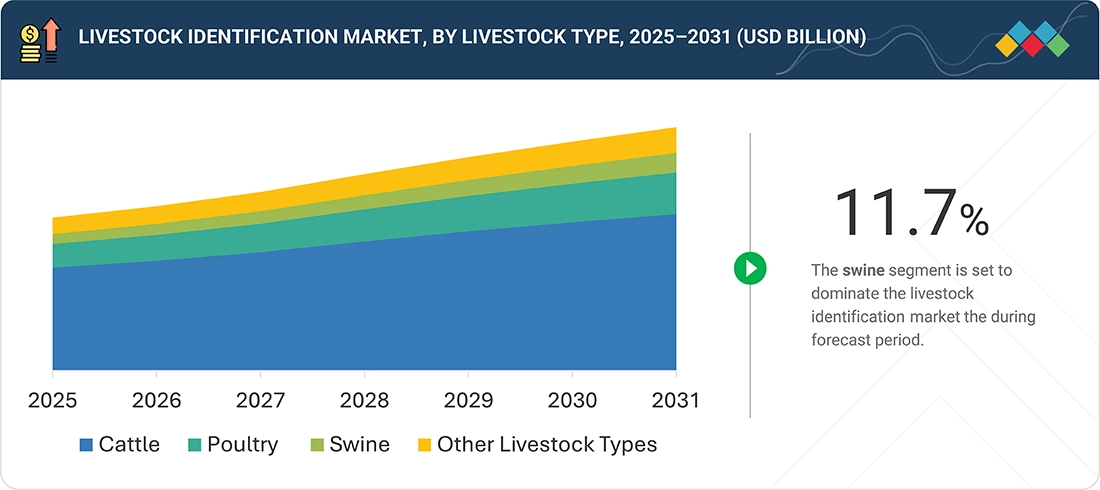

Livestock Identification Market, by Livestock Type

The cattle segment accounted for the largest market share in 2024, driven by strong demand for traceable beef and dairy products, regulatory tagging requirements, and growing export compliance needs. Swine and poultry segments are emerging as fast-growing categories as producers adopt identification systems to enhance operational efficiency, ensure supply-chain transparency, and meet rising food safety standards.

Livestock Identification Market, by Offering

The hardware segment captured the largest share in 2024, driven by growing demand for RFID tags, transponders, and readers integrated with herd management systems. The software and services segment is expanding rapidly, supported by adoption of cloud-based animal record systems, automated data analytics, and mobile-enabled farm dashboards that enhance traceability accuracy and simplify compliance reporting.

Livestock Identification Market, by Application

The animal ownership and traceability segment held the largest market share in 2024, owing to extensive deployment across national livestock registration programs, dairy cooperatives, and export-oriented farms. The rapid adoption of digital herd management and AI-driven productivity monitoring platforms is further accelerating market growth, as producers modernize their record-keeping and improve supply-chain visibility to meet regulatory and commercial standards.

REGION

Asia Pacific is expected to register the highest CAGR in the global livestock identification market during the forecast period.

The Asia Pacific region is projected to record the fastest growth, driven by nationwide livestock traceability programs and increasing government mandates for electronic animal identification across key economies such as India, China, Japan, and Australia. Governments are prioritizing digital livestock management systems to improve transparency in animal ownership, enhance productivity, and support disease-free certification for exports. The region’s progress is further supported by the declining cost of RFID tags and readers, the rapid expansion of dairy and meat production facilities, and strong policy and regulatory backing for large-scale adoption of electronic livestock identification technologies.

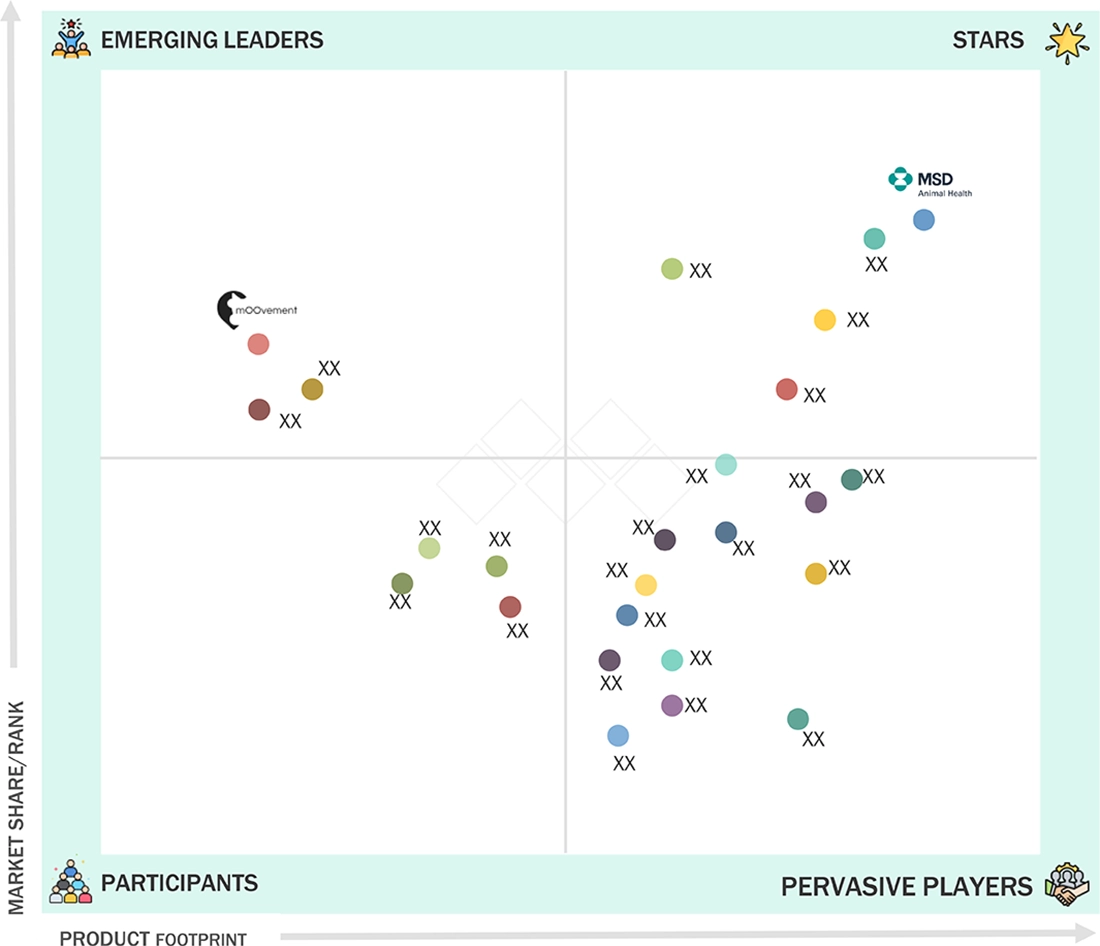

Livestock Identification Market: COMPANY EVALUATION MATRIX

In the livestock identification market, Merck & Co., Inc. (Star) holds a leading position with a robust global presence, a comprehensive range of RFID-based animal identification and monitoring solutions, and deep expertise in integrated livestock management systems. The company’s ongoing focus on traceability innovation, scalability, and digital data integration has reinforced its leadership across major dairy and meat-producing regions worldwide. mOOvement (Emerging Leader) is demonstrating strong market momentum through its GPS-enabled cattle tracking platform and cloud-based herd management tools, which offer real-time visibility and data-driven decision-making for farmers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 1.74 Billion |

| Market Forecast, 2030 (Value) | USD 2.78 Billion |

| Growth Rate | CAGR of 8.1% from 2025 to 2030 |

| Years Considered | 2021–2031 |

| Base Year | 2024 |

| Forecast Period | 2025–2031 |

| Units Considered | Value (USD Billion), Volume (Million Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, RoW |

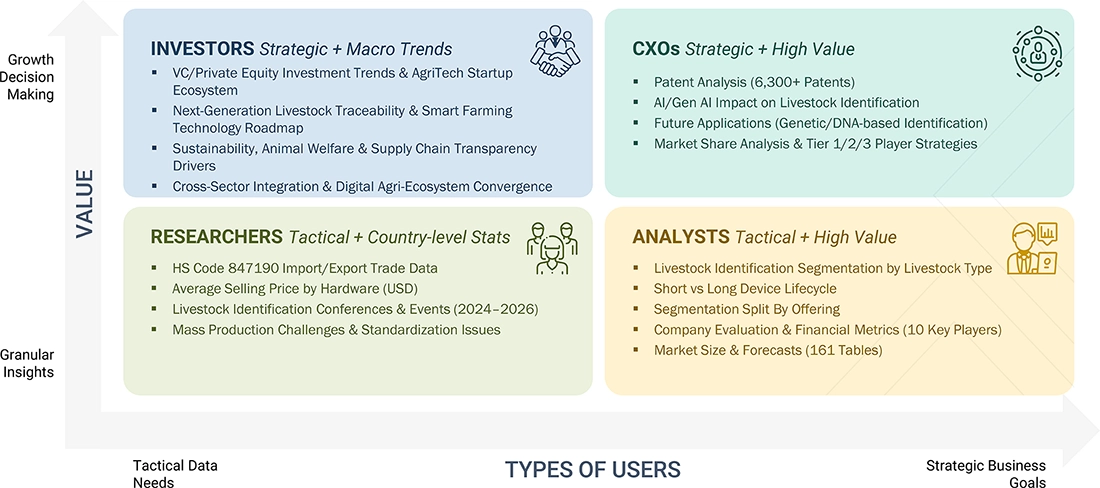

WHAT IS IN IT FOR YOU: Livestock Identification Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Livestock ID System Manufacturer |

|

|

| Livestock Cooperative/Dairy Processor |

|

|

| Agriculture/Veterinary Ministry |

|

|

| Technology Provider/Data Integrator |

|

|

RECENT DEVELOPMENTS

- December 2024 : Luoyang Laipson Information Technology Co., Ltd. launched the TPU Swine Sheep Ear Tags, often featuring bright colors and clear numbering or barcoding for easy visibility and identification from a distance.

- October 2024 : MSD Animal Health launched ALLFLEX APR handheld RFID readers APR650 and APFR250. These readers utilized advanced technology to scan and read various types of animal identification tags, enhancing traceability and management in livestock operations.

- September 2024 : Nedap launched the SmartTag Ear, which provided enhanced dairy herd management by providing real-time data on various health and productivity metrics.

Table of Contents

Methodology

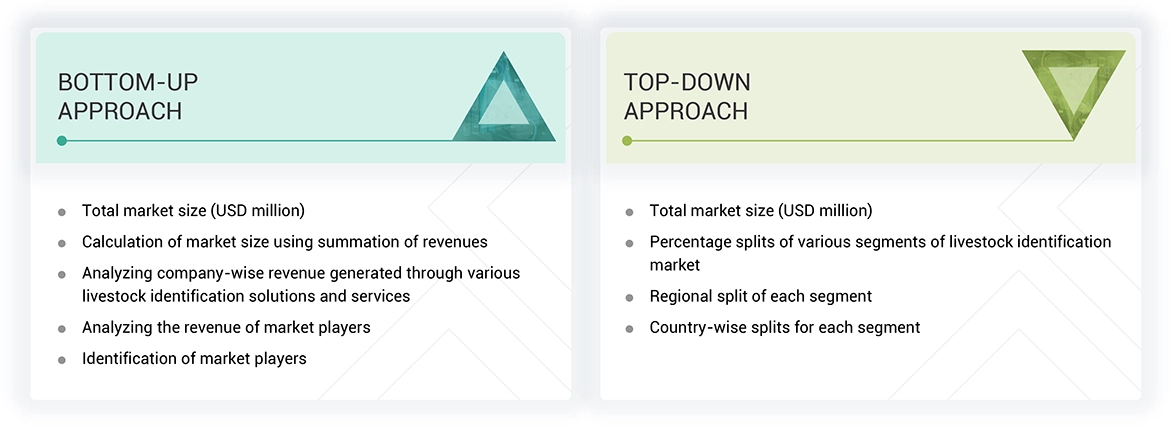

The research study involved 4 major activities in estimating the size of the livestock identification market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from both market and technology perspectives.

In the livestock identification market report, the global market size has been estimated using both the top-down and bottom-up approaches, along with several other dependent submarkets. The major players in the market were identified using extensive secondary research, and their presence in the market was determined using secondary and primary research. All the percentage shares splits, and breakdowns have been determined using secondary sources and verified through primary sources.

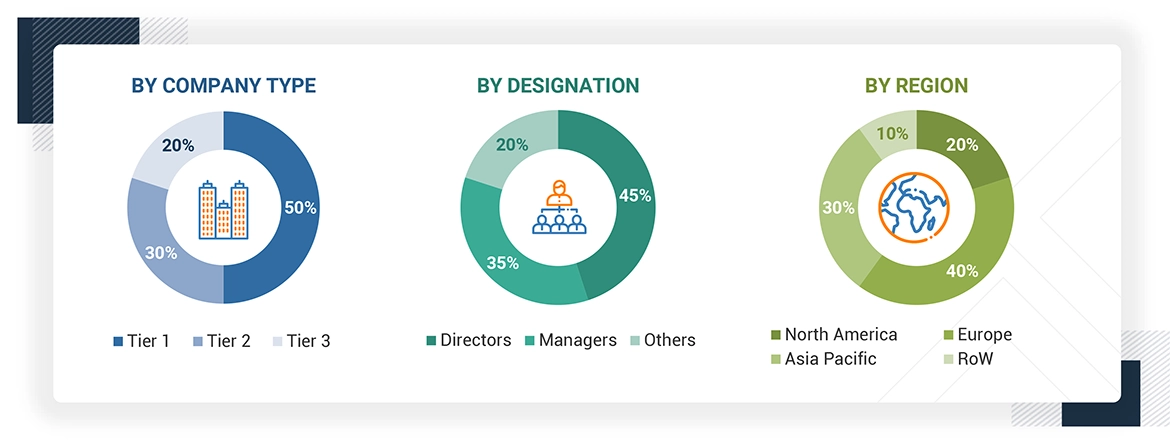

Primary Research

Extensive primary research has been conducted after understanding the livestock identification market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across 4 major regions— North America, Europe, Asia Pacific, and the Rest of the World. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report.

Note: “Others” includes sales, marketing, and product managers

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches, along with data triangulation methods, have been used to estimate and validate the size of the livestock identification and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying top-line investments and spending in the ecosystem and considering segment-level splits and major market developments

- Identifying different stakeholders in the livestock identification market that influence the entire market, along with participants across the supply chain

- Analyzing major manufacturers and service providers in the livestock identification market and studying their solutions and service portfolios

- Analyzing trends related to the adoption of livestock identification solutions and services

- Tracking recent and upcoming market developments, including investments, R&D activities, solution and service launches, collaborations, mergers and acquisitions, and partnerships, as well as forecasting the market size based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to identify the adoption trends of livestock identification solutions and services

- Segmenting the overall market into various other market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Livestock Identification Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the overall livestock identification market has been divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply side perspectives. Along with data triangulation and market breakdown, the market has been validated by top-down and bottom-up approaches.

Market Definition

Livestock identification, also known as animal identification, refers to gathering and keeping accurate records of individual farm animals or groups of farm animals so that they can be easily tracked from their birth through the marketing chain. It provides essential data such as animals' birth dates, production records, health and medical history, and other important livestock management information.

Key Stakeholders

- Suppliers of raw materials

- Technology investors

- Manufacturers and suppliers of a wide variety of livestock identification solutions

- Integrators, hardware and software suppliers, and service providers of livestock identification solutions

- Government bodies such as regulatory authorities and policymakers for the livestock industry

- Venture capitalists, startup companies, and private equity firms

- Technology developers

- Distributors, resellers, and traders

- Hardware component suppliers and distributors

- Standardization and testing firms

- Associations, forums, and alliances related to the livestock industry

- Research institutions and organizations

- Market research and consulting firms

- End users

Report Objectives

- To define, describe, and forecast the livestock identification market in terms of value on the basis of offering, device lifecycle, livestock type, farm size, application and region.

- To forecast the market size for various segments with respect to four main regions, namely, North America, Europe, Asia Pacific, and Rest of the World

- To define, describe, and forecast hardware offering by tag type in livestock identification market in terms of volume

- To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the livestock identification market

- To study the complete value chain and related industry segments for the livestock identification market

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze trends and disruptions; pricing trends; investment and funding scenario; patents and innovations; trade data (export and import data); regulatory environment; Porter's five forces analysis; case studies; key stakeholders & buying criteria; technology trends; the market ecosystem; and key conferences and events related to the livestock identification market.

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for the market leaders.

- To analyze competitive developments such as solution and service launches/developments, expansions, acquisitions, partnerships, collaborations, agreements, and research and development (R&D) activities carried out by players in the livestock identification market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:s

- Country-wise breakdown for North America, Europe, Asia Pacific, and Rest of the World

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

The Impacts are as follows:

|

Real-time Tracking |

9.6 |

|

Facial Recognition Technologies |

8.7 |

|

Data-driven Insights |

7.8 |

|

Integration with Mobile Applications |

6.4 |

|

Improved Accuracy and Efficiency |

7.0 |

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Livestock Identification Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Livestock Identification Market