Lithium-Ion Battery Materials Market

Lithium-Ion Battery Materials Market by Battery Chemistry (LFP, LCO, NMC, NCA, LMO), Material (Cathode, Anode, Electrolyte), Application (Portable Device, Electric Vehicle, Industrial, Power Tool, Medical Device) & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The lithium-ion battery materials market is expected to increase from USD 40.04 billion in 2025 to USD 95.34 billion by 2030 while achieving a CAGR of 14.6% during 2025 to 2030. The automotive and consumer electronics industries create increasing demand for lithium-ion battery materials because these batteries provide energy storage and power delivery capabilities.

KEY TAKEAWAYS

-

By RegionThe Europe is expected to register the highest CAGR (15.8%) during the forecast period.

-

By Battery ChemistryBy battery chemistry, the lithium iron phosphate (LFP) segment is expected to register the highest CAGR (18.9%) during the forecast period.

-

By MaterialBy material, the cathode material segment accounted for a 51.3% share of the market in 2024.

-

By ApplicationBy application, electric vehicle is expected to dominate the market.

-

Competitive Landscape - Key PlayersUmicore, POSCO Future M, and BASF were identified as some of the star players in the lithium-ion battery materials market, given their strong market share and product footprint.

-

Competitive Landscape - StartupsEcoPro BM, Capchem, and Ascend Elements, Inc. have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Increase in demand for EVs and consumer electronics products leads to an increase in demand for lithium-ion batteries, which directly leads to higher requirements for lithium-ion battery materials. The widespread installation of energy storage systems for renewable energy integration purposes has increased the need for advanced battery materials. The ongoing development of battery technology, which produces better energy density and longer battery life, and faster charging capabilities, has created material requirements for automotive, industrial, and grid-scale applications.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The rising trend among multiple industries to use battery-powered equipment and vehicles directly fuels the expansion of the lithium-ion battery materials market. The development of batteries compatible with smart factory systems and IoT devices will create new business opportunities for manufacturers of lithium-ion battery materials. Advanced materials are required to meet the needs of these technologies, which need better battery performance, better connectivity, and better integration with smart systems. The MnM engagement model helps lithium-ion battery material manufacturers focus on high-growth, niche opportunities to reach their revenue goals.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing adoption of electric vehicles

-

Surging demand for consumer electronics

Level

-

Safety concerns related to gadgets with lithium-ion batteries

-

Supply concentration of lithium, cobalt, and natural graphite creates procurement risk

Level

-

Declining lithium-ion battery prices

-

Growing R&D to upgrade lithium-ion batteries

Level

-

Fluctuating raw material prices

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing adoption of electric vehicles

Electric vehicles require a power source in the form of lithium batteries. The demand for lithium batteries is bound to grow as the number of users of battery-electric vehicles and plug-in hybrids increases.

Restraint: Availability of substitute

Various applications now have access to new energy storage options, including hydrogen fuel cells and sodium-ion batteries as alternatives to lithium-ion batteries. Hydrogen fuel cells function as electrochemical devices that convert hydrogen and oxygen into electrical power and water, delivering high energy density and total emissions-free operation. The system provides an extended power supply for electric vehicles and industrial equipment because it can be quickly refueled and maintains its operational performance. The existing hydrogen network infrastructure, along with the costs of producing and maintaining hydrogen systems, restrains market growth

Opportunity: Growing R&D to upgrade lithium-ion batteries

Multiple manufacturers conduct research and development to create lithium-ion batteries with greater durability and enhanced safety features. The worldwide shift toward clean energy solutions has led battery manufacturers to increase their research and development efforts to develop new battery technologies. The expansion of the electric vehicle market has led manufacturers to invest substantial resources in research and development to develop reliable electric vehicle batteries. The rising number of research and development projects will increase demand for lithium-ion batteries, which will create a need for lithium-ion battery production materials.

Challenge: Fluctuating raw material prices

The price of lithium used in lithium-ion battery production will experience significant fluctuations due to supply-demand imbalances, geopolitical conflicts, and natural disasters. The profit margins of lithium-ion battery producers will be affected by this development, which will create a need for battery components. Lithium-ion battery manufacturers protect their businesses from raw material price changes by using hedging strategies that include forward contracts and options to lock in future purchase prices. Companies dedicate resources to research and development to discover new raw material sources, thereby reducing their need for specific materials. The price changes of raw materials exhibit large variations, which strongly affect raw material demand patterns.

LITHIUM-ION BATTERY MATERIALS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Supplies cathode materials, electrolytes, binders, and additives used as raw materials in lithium-ion batteries for EVs, stationary energy storage, and industrial applications | Improves battery energy density, thermal stability, safety, and scalability for high-volume battery manufacturing |

|

Produces cathode and anode materials used in lithium-ion batteries for electric vehicles and grid-scale energy storage systems | Enables longer driving range, fast charging, improved durability, and cost-efficient battery production |

|

Provides high-purity nickel, cobalt, and cathode materials used in lithium-ion batteries for automotive, electronics, and industrial energy storage applications | Delivers high energy density, consistent electrochemical performance, and extended battery lifecycle |

|

Develops cathode materials and precursors used in lithium-ion batteries for EVs, plug-in hybrids, and stationary energy storage systems | Supports high-performance batteries, sustainable sourcing, recycling integration, and reduced lifecycle emissions |

|

Supplies graphite anodes and conductive materials for EV and industrial batteries | Enhances charging efficiency, power output, and battery reliability |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The lithium-ion battery material's ecosystem consists of raw material suppliers (e.g., BHP, Eramet, Glencore, and others), producers (e.g., Umicore, BASF, POSCO Future M, and others), distributors (e.g., RecycleINMe, Riverland Trading), and end users (e.g., Panasonic, Clarios, and others).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Lithium-ion Battery Materials Market, By Material

The cathode materials segment is projected to be the fastest-growing segment in the global lithium-ion battery materials market during the forecast period, as these offer significant value-added properties and are crucial to the energy density, power, cycle life, and safety attributes of lithium-ion batteries. The demand for cathode materials has been increasing rapidly due to growth in the EV industry and in stationary energy storage system installations, especially those utilised with renewable energy sources.

Lithium-ion Battery Materials Market, By Application

The electric vehicle segment is expected to be the fastest-growing in the global lithium-ion battery material market during the forecast period, in terms of value. The design of lithium-ion batteries enables high energy storage capacity in a compact, lightweight form, supporting multiple charging and discharging cycles. The combination of these traits makes lithium-ion batteries the ideal power solution for electric vehicles, driving higher demand for their battery materials.

REGION

Europe to be fastest-growing country in lithium-ion battery materials market during forecast period

Europe is becoming the fastest-growing region in the lithium-ion battery materials market driven by strong decarbonization goals and effective regulatory measures and fast development of electric vehicle technology. The EU Green Deal together with local battery value chain policies has increased investments in cathode anode and precursor material manufacturing throughout important markets including Germany and France. The regional market continues to grow because of rising electric vehicle adoption and expansion of gigafactories and growing demand for energy storage systems which support renewable energy integration. European battery materials development emerges as a fundamental growth center through the combination of shared research and development programs with sustainable sourcing practices.

LITHIUM-ION BATTERY MATERIALS MARKET: COMPANY EVALUATION MATRIX

In the lithium-ion battery materials market matrix, Umicore (Star) leads with its integrated supply chain to maximize market reach and product diversification. Players in the Stars category primarily focus on new service & technology launches and on acquiring leading market positions by providing broad portfolios that cater to customers' different requirements. They are also focused on innovations and are geographically diversified. They have broad industry coverage, strong operational and financial strength, and endeavor to grow organically and inorganically in the market. EcoPro BM (Emerging Leader) has a strong potential to build strategies to expand its business and stay on par with the star players. However, emerging leaders have not adopted effective growth strategies for their businesses as a whole.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Umicore (Belgium)

- Sumitomo Metal Mining Co., Ltd. (Japan)

- BASF (Germany)

- POSCO Future M (South Korea)

- Resonac Holdings Corporation (Japan)

- Tanaka Chemical Corporation (Japan)

- Toda Kogyo Corp. (Japan)

- L&F Co., Ltd. (South Korea)

- JFE Chemical Corporation (Japan)

- 3M (US)

- SGL Carbon (Germany)

- NEI Corporation (US)

- Kureha Corporation (Japan)

- BTR New Material Group Co., Ltd. (China)

- UBE Corporation (Japan)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 40.04 BN |

| Market Forecast in 2030 (Value) | USD 95.34 BN |

| CAGR (2025–2032) | 14.6% |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD BN) & Volume (Kilotons) |

| Report Coverage | Revenue forecast, competitive landscape, growth factors, and trends |

| Segments Covered | By Material (Anode, Cathode, Electrolyte, and Others) |

| Regions Covered | North America, Asia Pacific, Europe, and Rest of the World |

WHAT IS IN IT FOR YOU: LITHIUM-ION BATTERY MATERIALS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| The study investigates battery material regulations and sustainability standards required by EU Battery Regulation and ESG standards and local sourcing requirements. | The study examined the different regulatory frameworks which required material traceability and carbon footprint disclosure and recycling content requirements throughout Europe and Asia-Pacific and North America. | The organization achieved three benefits through its enhanced regulatory preparedness which decreased compliance risks while enabling better access to markets in multiple regions. |

| The process of material portfolio optimization requires assessing battery chemistries, including LFP, NMC, NCA, LTO, and emerging chemistries. | The research investigated how material demand patterns and cost-performance relationships and OEM preferences for different battery chemistries to establish optimal material requirements for high-demand battery segments. | The company achieved three benefits through its product development process. |

| The evaluation process includes the examination of raw material sourcing risks together with the assessment of supply security for lithium, nickel, cobalt, and graphite. | The assessment of supply chain risks included three factors which were geographic concentration and price volatility and alternative sourcing strategies. | The organization achieved better supply resilience while decreasing its risk of raw material disruptions and enhancing its procurement planning process. |

| The process of customer qualification needs to use appropriate support which enables companies to obtain their original equipment manufacturer approval. | The testing standards and performance benchmarks for OEM material qualification were studied to create specific guidelines which were tailored to different regional and application requirements. | The process of customer onboarding now takes less time while companies can launch their products more quickly and their relationships with original equipment manufacturers have grown stronger. |

| The process of recognizing downstream integration methods and value-added possibilities begins with the identification of precursors, CAM, and recycling linkages. | The evaluation process assessed integration possibilities which existed between precursors and cathode/anode materials and recycling operations based on regional demand and policy support. | The company achieved three benefits through its stronger value-chain position, which included operational cost control and sustained business growth potential |

| The company achieved three benefits through its stronger value-chain position, which included operational cost control and sustained business growth potential | The development team created three different material solutions which included low-carbon pathways and recycled content usage and methods for reducing emissions throughout product lifecycles | The organization achieved three outcomes through its ESG performance improvements which resulted in better brand reputation and compliance with worldwide sustainability standards |

RECENT DEVELOPMENTS

- November 2025 : Umicore established a strategic alliance with HS Hyosung Advanced Materials from South Korea to develop and produce and market silicon carbon composite anode materials which they use in electric vehicle lithium-ion batteries.

- July 2025 : CATL and BASF established a global framework agreement which enables their partnership to develop advanced cathode active materials with BASF acting as a main supplier while assisting CATL to expand its operations through its international manufacturing facilities.

- March 2025 : Panasonic Energy has established its initial closed-loop recycling program which collects nickel from automotive lithium-ion battery cathodes and uses Sumitomo Metal Mining as its partner in Japan. The program builds upon the company's previous partnership with Redwood Materials which took place in the United States during 2022. The program serves as a crucial advancement toward improved battery material recycling and circularity practices within Japan.

Table of Contents

Methodology

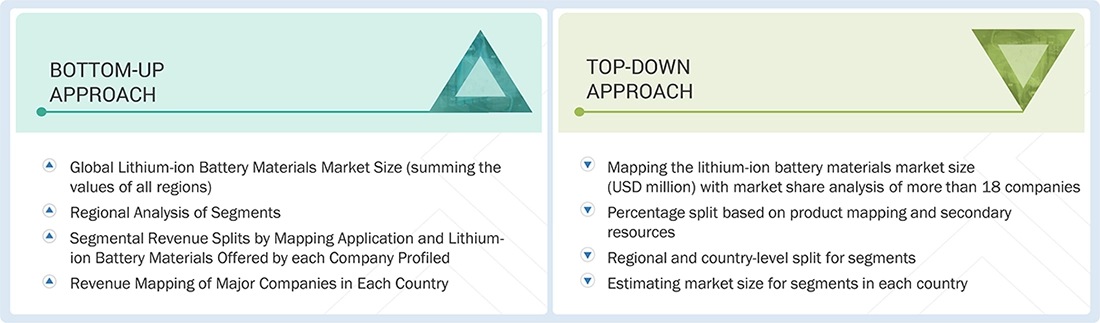

The research methodology used to estimate the current size of the lithium-ion battery materials market consisted of four major activities. Extensive secondary research was conducted to obtain detailed information on the market, peer markets, and parent markets. These findings, assumptions, and metrics were verified through primary research with experts from both the demand and supply sides of the lithium-ion battery materials value chain. Both top-down and bottom-up approaches were used to estimate the total market size. The estimation of market sizes for various segments and subsegments in the market was finalized using complete market segmentation and data triangulation techniques.

Secondary Research

The research methodology for estimating and forecasting the lithium-ion battery materials market begins with gathering data on key vendors' revenues through secondary research. The secondary research process involves consulting a range of secondary sources, including D&B Hoover's, Bloomberg Businessweek, Factiva, the World Bank, and industry-specific journals. These sources include annual reports, press releases, investor presentations, white papers, peer-reviewed publications, articles from recognized authors, regulatory notifications, trade directories, and databases. Vendor offerings are also considered to inform market segmentation.

Primary Research

The lithium-ion battery materials market comprises several stakeholders throughout the supply chain, including raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development of various industries, including portable devices, electric vehicles, and industrial applications, among others. The supply side is characterized by technological advancements and a wide range of diverse applications. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been employed to estimate and validate the total size of the lithium-ion battery materials market. These approaches have also been widely used to estimate the sizes of various dependent market subsegments. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study:

- Extensive primary and secondary research was done to identify the key players.

- The value chain and market size of the lithium-ion battery materials market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were collected through secondary sources and verified through primary sources.

- All possible parameters that affect the market were covered in this research study and are viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives, is included in this research.

Lithium-lon Battery Materials Market : Top-Down and Bottom-Up Approach

Data Triangulation

After estimating the overall market size using the above estimation, the market was split into various segments and subsegments. Data triangulation and market segmentation techniques, along with the market engineering process, were employed to obtain precise market analysis data for each segment and its subsegments. Research Methodology: The research methodology used to estimate and forecast the global market size began by aggregating data and information from various levels, including country-level data.

Market Definition

Lithium-ion battery materials are the components and substances used in the construction of lithium-ion batteries. These materials include the cathode and anode materials that store and release lithium ions, the separator that prevents electrical contact between them, the electrolyte that facilitates ion movement, and collector foils for electrical connections. These materials, when installed and built in the required format, enable the operation of lithium-ion batteries, which are widely used in electronic devices and electric vehicles due to their high energy density and rechargeability.

Key Stakeholders

- Lithium-ion battery materials manufacturers, processors, and refining technology providers

- End-use/application, including portable devices, electric vehicles, industrial, and other applications

- Research institutions, standards organizations, and regulatory agencies such as ASTM, ISO, IAEA, and National Materials Authorities

- NGOs, governments, investment banks, venture capitalists, and private equity firms

Report Objectives

- To define, describe, and forecast the market size of lithium-ion battery materials, in terms of value and volume

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the lithium-ion battery materials market

- To analyze and forecast the size of various segments (battery material, battery chemistry, and application) of the lithium-ion battery materials market based on four major regions - North America, Europe, Asia Pacific, and Rest of the World, along with key countries in each of these regions

- To analyze recent developments and competitive strategies, including expansions, partnerships, and acquisitions, to understand the market's competitive landscape

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Available customizations:

Based on the given market data, MarketsandMarkets offers customizations tailored to client-specific needs.

The following customization options are available for the report:

Product Analysis

- Additional country-level analysis of the lithium-ion battery materials market

- Profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Lithium-Ion Battery Materials Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Lithium-Ion Battery Materials Market