Over The Counter/OTC Test Market by Product (Glucose Monitoring Test, Cholesterol Monitoring Test, Infectious Disease Testing, Fecal Occult Test, Urine Analysis Test, Drug Abuse Test), Technology (Immunoassay, Lateral Flow Assay)-Global Forecast to 2024

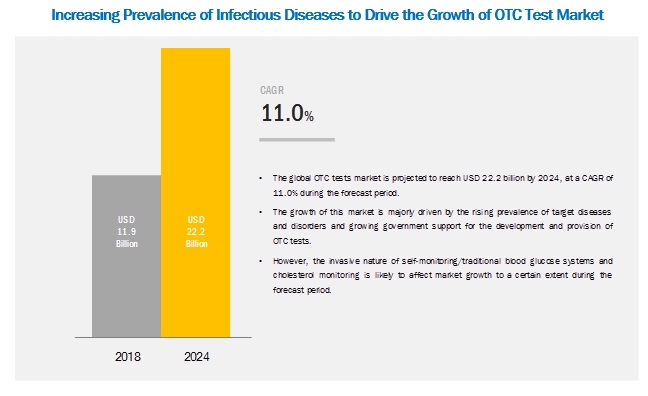

The Over The Counter Test Market is projected to reach USD 22.2 billion by 2024, at CAGR of 11.0%. The growth of the OTC tests market is mainly driven by the rising prevalence of target diseases and disorders, such as diabetes and infectious diseases, both prominent ailments across the globe that require rapid and effective testing.

By product type, infectious disease tests are expected to be the fastest-growing segment in the OTC Test market during the forecast period.

The infectious disease tests segment is projected to grow at the highest CAGR between 2018 and 2024. Growth in this market can be attributed to factors such as the increasing number of HIV-infected individuals across the globe, coupled with increasing availability and awareness about HIV OTC testing in emerging markets such as India, Brazil, and China.

By technology, the lateral flow assays segment is growing at the highest rate.

The lateral flow assays segment is projected to grow at the highest rate in the market, by technology. In the past few years, the lateral flow assay POC testing market has grown significantly due to the increasing adoption of LFA testing products in home care. Companies are increasingly focusing on the development of innovative LFA-based OTC devices for the confirmation of pregnancy (using hCG levels) and ovulation, screening for infectious diseases and drugs of abuse are the factors expected to drive the growth of these markets during the forecast period

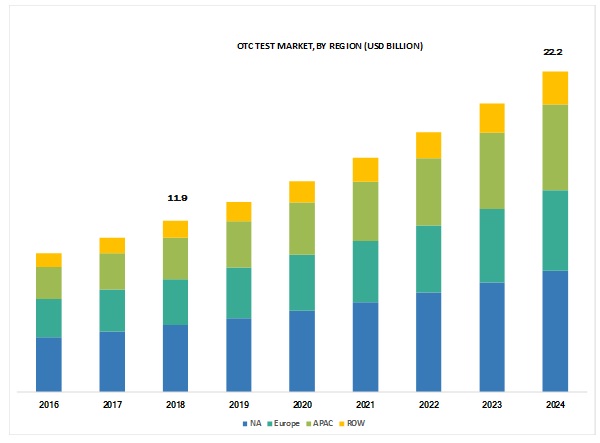

The market in the Asia Pacific is growing at the highest CAGR during the forecast period.

The Asia Pacific is estimated to grow at the highest CAGR during the forecast period. The high growth in this regional segment is majorly attributed to the increasing patient population base and the growing prevalence of infectious diseases.

The key players operating in the global Over The Counter Market are OraSure Technologies (US), Roche Diagnostics (Switzerland), and i-Health Lab (US). A majority of the leading players in the market focus on both organic and inorganic growth strategies such as collaborations, partnerships, acquisitions, and agreements to maintain and enhance their market shares in the OTC tests market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20162024 |

|

Base year considered |

2017 |

|

Forecast period |

20182024 |

|

Forecast units |

Values (USD Billion) |

|

Segments covered |

Product, Technology, and Region |

|

Geographies covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

OraSure Technologies (US), Roche Diagnostics (Switzerland), and i-Health Lab (US). 10 major players covered, in total |

On the basis of product, the OTC Test market is segmented as follows:

- Glucose Monitoring Tests

- Pregnancy & Fertility Tests

- Infectious Disease Tests

- Coagulation Monitoring Tests

- Urinalysis Tests

- Cholesterol Tests

- Drugs-of-abuse Tests

- Other Tests (Fecal Occult Test and among others)

On the basis of technology, the OTC Test market is segmented as follows:

- Lateral Flow Assays

- Immunoassays

- Dipsticks

On the basis of region, the OTC Test market is segmented as follows:

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- RoE

- Asia Pacific

- RoW

Recent Developments:

- In 2019, SD Biosensor launched STANDARD GlucoNavii GDH for blood glucose monitoring.

- In 2019, LabStyle Innovations entered into an agreement with Better Living Now (BLN) for the distribution of its Blood Glucose Monitoring System and the DarioEngage digital health platform.

- In 2018, DarioHealth partners with Byram Healthcare to further expand insurance health coverage for consumers in the US.

- In 2016, Sinocare acquired PTS Diagnostics, to strengthen its product portfolio and accelerate future growth in the diagnostic testing market

Key questions addressed by the report:

- Who are the major market players in the OTC Test market?

- What are the regional growth trends and the largest revenue-generating regions for OTC Test market?

- What are the major drivers and challenges in the OTC Test market?

- What are the major product segments in the OTC Test market?

- What are the major technology segments in the OTC Test market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Covered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Primary Data

2.1.1 Key Data From Primary Sources

2.2 Secondary Data

2.2.1 Key Data From Secondary Sources

2.3 Market Size Estimation

2.4 Market Breakdown and Data Triangulation

2.4.1 Assumptions for the Study

3 Executive Summary (Page No. - 22)

4 Premium Insights (Page No. - 25)

4.1 OTC Tests: Market Overview

4.2 OTC Tests Market, By Technology (20182024)

4.3 North America: OTC Tests Market, By Product (2018)

5 Market Overview (Page No. - 28)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Prevalence of Diabetes

5.2.1.2 High Prevalence of Infectious Diseases in Developing Countries

5.2.1.3 Growing Support and Collaboration for Developing OTC Tests

5.2.2 Opportunities

5.2.2.1 Introduction of Combined Kits for Testing Pregnancy and Ovulation

5.2.3 Challenges

5.2.3.1 Invasiveness of Blood Glucose Monitors and Cholesterol Monitors

6 Over the Counter Tests Market, By Technology (Page No. - 32)

6.1 Introduction

6.2 Lateral Flow Assays

6.2.1 Lateral Flow Assays to Register the Highest Growth During the Forecast Period

6.3 Immunoassays

6.3.1 Increasing Use of Immunoassays for Pregnancy & Infectious Disease Testing is Driving Market Growth

6.4 Dipsticks

6.4.1 Dipsticks Provide Only A Qualitative Analysis, Which is A Major Factor Restraining Market Growth

7 Over the Counter Tests Market, By Product (Page No. - 38)

7.1 Introduction

7.2 Glucose Monitoring Tests

7.2.1 Glucose Monitoring Tests Dominated the OTC Tests Market in 2018

7.3 Pregnancy & Fertility Tests

7.3.1 Advantages of Pregnancy & Fertility Tests Have Driven Companies to Focus on Product Development

7.4 Infectious Disease Tests

7.4.1 Increasing Prevalence of Infectious Diseases is Driving Market Growth

7.5 Coagulation Monitoring Tests

7.5.1 Coagulation Monitoring Tests Provide Quick and Reliable Results

7.6 Urinalysis Tests

7.6.1 Increasing Prevalence of Urinary Tract Infections is A Major Factor Driving Market Growth

7.7 Cholesterol Tests

7.7.1 Convenience of Home-Use Tests has Expanded their Use

7.8 Drugs-Of-Abuse Tests

7.8.1 Rising Production and Consumption of Illegal Drugs Have Driven the Focus on Testing

7.9 Other Tests

8 Over the Counter Tests Market, By Region (Page No. - 51)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 US to Dominate The North America OTC Tests Market

8.2.2 Canada

8.2.2.1 Increasing Government Initiatives to Support the Adoption of Poc Products to Drive Market Growth in Canada

8.3 Europe

8.3.1 Germany

8.3.1.1 Germany is the Fastest-Growing Market in Europe

8.3.2 France

8.3.2.1 High Demand for Glucose Testing Kits to Drive Market Growth in France

8.3.3 UK

8.3.3.1 Increasing Awareness of Oct Tests Among the Users

8.3.4 Rest of Europe

8.4 Asia Pacific

8.4.1 Asia Pacific is the Fastest-Growing Segment of the Global OTC Tests Market

8.5 Rest of the World

9 Competitive Landscape (Page No. - 69)

9.1 Overview

9.2 Vendor Benchmarking

9.3 Competitive Leadership Mapping

9.3.1 Visionary Leaders

9.3.2 Innovators

9.3.3 Dynamic Differentiators

9.3.4 Emerging Companies

9.4 Market Ranking Analysis, 2017

9.5 Competitive Situation and Trends

9.5.1 Product Launches

9.5.2 Collaborations, Partnerships, and Agreements

9.5.3 Acquisitions

10 Company Profiles (Page No. - 74)

(Business Overview, Products Offered, Recent Developments, MnM View)*

10.1 Roche Diagnostics

10.2 Abbott Laboratories

10.3 Orasure Technologies

10.4 Accubiotech

10.5 LIA Diagnostics

10.6 Labstyle Innovations

10.7 SD Biosensor

10.8 Acon Laboratories Inc

10.9 Sinocare

10.10 Nowdiagnostics Company

10.11 I Health Lab

10.12 Biolytical Laboratories

*Business Overview, Products Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 91)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (62 Tables)

Table 1 Top 10 Countries With the Highest Number of Diabetics (2079 Years), 2017 vs. 2045 (Million)

Table 2 OTC Tests Market, By Technology, 20162024 (USD Million)

Table 3 OTC Tests Market for Lateral Flow Assays, By Region, 20162024 (USD Million)

Table 4 North America: OTC Tests Market for Lateral Flow Assays, By Country, 20162024 (USD Million)

Table 5 Europe: OTC Tests Market for Lateral Flow Assays, By Country, 20162024 (USD Million)

Table 6 OTC Tests Market for Immunoassays, By Region, 20162024 (USD Million)

Table 7 North America: OTC Tests Market for Immunoassays, By Country, 20162024 (USD Million)

Table 8 Europe: OTC Tests Market for Immunoassays, By Country, 20162024 (USD Million)

Table 9 OTC Tests Market for Dipsticks, By Region, 20162024 (USD Million)

Table 10 North America: OTC Tests Market for Dipsticks, By Country, 20162024 (USD Million)

Table 11 Europe: OTC Tests Market for Dipsticks, By Country, 20162024 (USD Million)

Table 12 OTC Tests Market, By Product, 20162024 (USD Million)

Table 13 OTC Glucose Monitoring Tests Market, By Region, 20162024 (USD Million)

Table 14 North America: OTC Glucose Monitoring Tests Market, By Country, 20162024 (USD Million)

Table 15 Europe: OTC Glucose Monitoring Tests Market, By Country, 20162024 (USD Million)

Table 16 OTC Pregnancy & Fertility Tests Market, By Region, 20162024 (USD Million)

Table 17 North America: OTC Pregnancy & Fertility Tests Market, By Country, 20162024 (USD Million)

Table 18 Europe: OTC Pregnancy & Fertility Tests Market, By Country, 20162024 (USD Million)

Table 19 OTC Infectious Disease Tests Market, By Region, 20162024 (USD Million)

Table 20 North America: OTC Infectious Disease Tests Market, By Country, 20162024 (USD Million)

Table 21 Europe: OTC Infectious Disease Tests Market, By Country, 20162024 (USD Million)

Table 22 OTC Coagulation Monitoring Tests Market, By Region, 20162024 (USD Million)

Table 23 North America: OTC Coagulation Monitoring Tests Market, By Country, 20162024 (USD Million)

Table 24 Europe: OTC Coagulation Monitoring Tests Market, By Country, 20162024 (USD Million)

Table 25 OTC Urinalysis Tests Market, By Region, 20162024 (USD Million)

Table 26 North America: OTC Urinalysis Tests Market, By Country, 20162024 (USD Million)

Table 27 Europe: OTC Urinalysis Tests Market, By Country, 20162024 (USD Million)

Table 28 OTC Cholesterol Tests Market, By Region, 20162024 (USD Million)

Table 29 North America: OTC Cholesterol Tests Market, By Country, 20162024 (USD Million)

Table 30 Europe: OTC Cholesterol Tests Market, By Country, 20162024 (USD Million)

Table 31 OTC Drugs-Of-Abuse Tests Market, By Region, 20162024 (USD Million)

Table 32 North America: OTC Drugs-Of-Abuse Tests Market, By Country, 20162024 (USD Million)

Table 33 Europe: OTC Drugs-Of-Abuse Tests Market, By Country, 20162024 (USD Million)

Table 34 OTC Other Tests Market, By Region, 20162024 (USD Million)

Table 35 North America: OTC Other Tests Market, By Country, 20162024 (USD Million)

Table 36 Europe: OTC Other Tests Market, By Country, 20162024 (USD Million)

Table 37 Over The Counter Test Market, By Region, 20162024 (USD Million)

Table 38 North America: Over The Counter Test Market, By Country, 20162024 (USD Million)

Table 39 North America: Over The Counter Test Market, By Product, 20162024 (USD Million)

Table 40 North America: Over The Counter Test Market, By Technology, 20162024 (USD Million)

Table 41 US: Over The Counter Test Market, By Product, 20162024 (USD Million)

Table 42 US: Over The Counter Test Market, By Technology, 20162024 (USD Million)

Table 43 Canada: Over The Counter Test Market, By Product, 20162024 (USD Million)

Table 44 Canada: Over The Counter Test Market, By Technology, 20162024 (USD Million)

Table 45 Europe: Over The Counter Test Market, By Country, 20162024 (USD Million)

Table 46 Europe: Over The Counter Test Market, By Product, 20162024 (USD Million)

Table 47 Europe: Over The Counter Test Market, By Technology, 20162024 (USD Million)

Table 48 Germany: Over The Counter Test Market, By Product, 20162024 (USD Million)

Table 49 Germany: Over The Counter Test Market, By Technology, 20162024 (USD Million)

Table 50 France: Over The Counter Test Market, By Product, 20162024 (USD Million)

Table 51 France: Over The Counter Test Market, By Technology, 20162024 (USD Million)

Table 52 UK: Over The Counter Test Market, By Product, 20162024 (USD Million)

Table 53 UK: Over The Counter Test Market, By Technology, 20162024 (USD Million)

Table 54 RoE: Over The Counter Test Market, By Product, 20162024 (USD Million)

Table 55 RoE: Over The Counter Test Market, By Technology, 20162024 (USD Million)

Table 56 APAC: Over The Counter Test Market, By Product, 20162024 (USD Million)

Table 57 APAC: Over The Counter Test Market, By Technology, 20162024 (USD Million)

Table 58 RoW: Over The Counter Test Market, By Product, 20162024 (USD Million)

Table 59 RoW: Over The Counter Test Market, By Technology, 20162024 (USD Million)

Table 60 Product Launches, 20162019

Table 61 Collaborations, Partnerships, and Agreements, 20162019

Table 62 Acquisitions, 2016-2019

List of Figures (20 Figures)

Figure 1 Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Over The Counter Test Market, By Product, 2018 vs. 2024 (USD Million)

Figure 7 Over The Counter Test Market, By Technology, 2018 vs. 2024 (USD Million)

Figure 8 Geographical Snapshot of the OTC Tests Market

Figure 9 Rising Prevalence of Target Diseases and Disorders is A Key Driver for the OTC Tests Market

Figure 10 Lateral Flow Assays to Continue to Dominate the OTC Tests Market in 2024

Figure 11 Glucose Monitoring Tests Accounted for the Largest Share of the North American OTC Tests Market in 2018

Figure 12 OTC Tests Market: Drivers, Restraints, Opportunities, and Challenges

Figure 13 North America: OTC Tests Market Snapshot

Figure 14 APAC: OTC Tests Market Snapshot

Figure 15 OTC Tests Market (Global), Competitive Leadership Mapping, 2017

Figure 16 Rank of Companies in the Global OTC Tests Market, 2017

Figure 17 Roche Diagnostics: Company Snapshot (2018)

Figure 18 Abbott Laboratories: Company Snapshot (2018)

Figure 19 Orasure Technologies: Company Snapshot (2017)

Figure 20 Labstyle Innovations: Company Snapshot (2017)

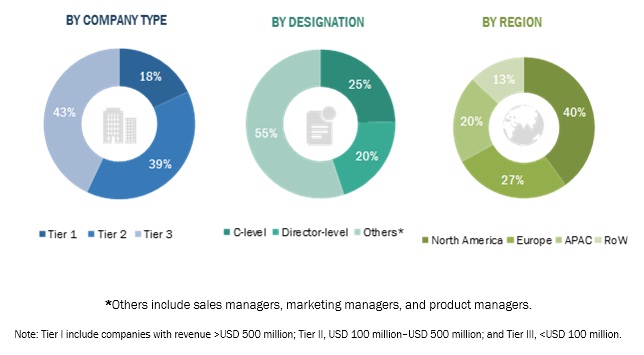

The study involved four major activities for estimating the current market size for OTC Test. Exhaustive research was conducted to collect information on the market as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the use of widespread secondary sources; directories; databases such as D&B, Bloomberg Business, and Factiva; white papers; annual reports; and companies house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the global OTC Test market. It was also used to obtain important information about the top players, market classification and segmentation according to industry trends to the bottom-most level, geographic markets, key developments related to the market, and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the global OTC Test market. The primary sources from the demand side included industry include expert researchers from home care service providers, academic research institutes, home healthcare associations, and lay users. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends, and key market dynamics. Given below is a breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The report presents a detailed assessment of the global OTC Test market, along with qualitative inputs and insights from MarketsandMarkets. Both top-down and bottom-up approaches were used to anticipate and validate the size of the global OTC Test market and estimate the sizes of various other dependent sub-markets.

The procedure included the study of the annual and financial reports of top market players and extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives for key insights.

- All percentage shares, splits, and breakdowns were determined using secondary sources and MarketsandMarkets repository and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

- The above-mentioned data is consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

The market forecast provided in this study was arrived at after a detailed assessment of various qualitative and quantitative factors, such as historical revenue growth trend of leading players; major market growth drivers and restraints, and their impact over the forecast period; innovation trends; and relevant macro and micro-economic indicators. However, the forecast for top-level markets and subsegments does not account for the effects of inflation, economic downturns, exchange rate forecast, and any unforeseen regulatory and policy changes over the forecast period of 20182024.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides of the OTC Test industry.

Report Objectives

- To define, segment, and estimate the global market size for OTC Test.

- To understand the structure of the OTC Test market by identifying its subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, opportunities, and challenges)

- To estimate the size of the market and its submarkets, in terms of value, with respect to four regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify the major growth strategies adopted by players across key regions

- To analyze competitive developments such as expansions & investments, product launches, and acquisitions in the OTC Test market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Regional Analysis

- Further breakdown of the Asia Pacific OTC Test market, by key country

- Further breakdown of the RoW OTC Test market, by country

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Over The Counter/OTC Test Market