The lab automation market sizing was based on four primary studies to ensure accuracy. Secondary research provided the initial data from the lab automation market and related sectors, which was gathered from 3-5 sources. This information was validated through primary research to confirm the assumptions and market sizing. Both top-down and bottom-up approaches were used to determine the overall market size, which was then refined into segment and subsegment sizes. Finally, data triangulation was performed to ensure the accuracy of the findings.

Secondary Research

Secondary research sources included directories, Factiva, white papers, Bloomberg Businessweek, annual reports, SEC filings, business filings, and investor presentations. These sources provided valuable insights into market leaders, sector divisions, and technological differences within various segments of the lab automation industry.

Primary Research

Primary research included both, quantitative and qualitative insights gathered through interviews with key stakeholders. On the demand side, participants comprised physicians, researchers, department heads, and staff from diagnostic centers, hospitals, and research institutes. On the supply side, interviews were conducted with CEOs, area sales managers, territory and regional sales managers, and other top executives from relevant companies. These direct conversations helped validate the findings from secondary research and allowed assumptions to be directly questioned and confirmed.

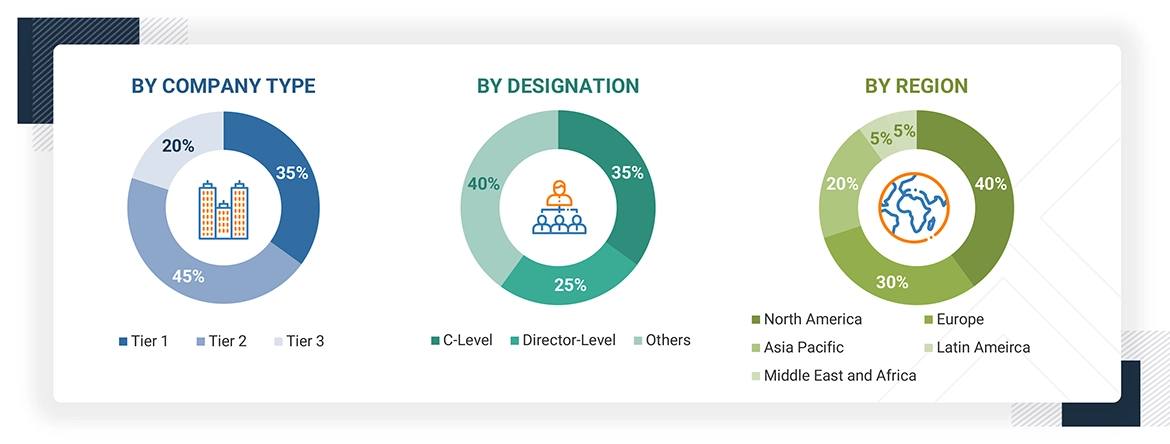

A breakdown of the primary respondents is provided below.

Note: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = >USD 1 billion, Tier 2 = < USD 500 million, and Tier 3 = < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The revenue share analysis of major companies was used in this report to assess the size of the global lab automation market. This analysis involved identifying key market participants and calculating their lab automation revenue based on a variety of data collected during the primary and secondary research phases. One component of the secondary research was examining the annual and financial reports of leading market players. In contrast, primary research included detailed interviews with significant thought leaders, such as directors, CEOs, and key marketing executives.

To determine the overall market value, the segmental revenue was calculated by mapping the revenue of the leading solution and service providers. The process involved several steps.

-

Making a list of leading international companies in lab automation industry

-

Charting annual profits made by leading companies in lab automation sector (or the closest stated business unit/product category)

-

2024 revenue mapping of leading companies to cover a significant portion of global market

-

Calculating global value of lab automation industry

Global Lab Automation Market: Bottom-up and Top-down approach

Data Triangulation

To ensure accurate data, the lab automation market was divided into various segments and subsegments. A data triangulation process that used both top-down and bottom-up approaches was applied. This involved analyzing factors and trends from both, the demand and supply sides to validate the findings for each segment. The combination of this segmentation with the triangulation process helps ensure that the market data is both accurate and reliable.

Market Definition

The lab automation market includes a variety of solutions designed to improve efficiency, productivity, and accuracy in laboratories. This market encompasses automated workstations, ready-to-use automated work cells, robotics, automated storage and retrieval systems, and software. These technologies streamline various laboratory processes, making complex operations, data collection, and repetitive tasks easier to manage. Key applications for lab automation solutions are found in drug discovery, diagnostics, proteomics, genomics, microbiology, and other fields, particularly within life sciences, academic institutions, diagnostics, and pharmaceutical research.

Stakeholders

-

Lab automation solution manufacturers, suppliers, and providers

-

Lab automation equipment and software solution providers

-

Lab automation integrated solution providers

-

Academic institutions and private research institutions

-

Environmental testing laboratories

-

Food & beverage testing centers

-

Hospitals and diagnostic centers

-

Forensic laboratories

-

CROs and CDMOs

-

Pharmaceutical & biopharmaceutical companies

-

Consulting firms

Report Objectives

-

To define, describe, and forecast the lab automation market based on product, application, end user, and region

-

To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

-

To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

-

To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

-

To forecast the revenue of the market segments with respect to five regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

-

To profile the key players and comprehensively analyze their market ranking and core competencies

-

To benchmark players within the market using a proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

-

To analyze competitive developments such as product launches, agreements, expansions, collaborations, and acquisitions in the lab automation market

Growth opportunities and latent adjacency in Lab Automation Market