Joint Replacement Devices Market: Growth, Size, Share, and Trends

Joint Replacement Devices Market by Product (Knee, Hip, Shoulder, Ankle, Elbow, Wrist, Bone Grafts), Surgery (Total, Partial, Revision), Type(Cemented, Cementless, Hybrid), Procedure type, End user (Hospitals, ASC, Trauma, Clinic) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global joint replacement devices market is projected to reach USD 31.1 billion by 2030 from USD 23.4 billion in 2024, at a CAGR of 4.8% from 2024 to 2030. The global joint replacement devices market is witnessing robust growth, driven by an aging population, rising prevalence of osteoarthritis, rheumatoid arthritis, and obesity-related joint degeneration. The market encompasses hip, knee, shoulder, and other extremity replacement systems and is undergoing significant transformation due to technological innovation in materials science, surgical robotics, and personalized implant design. With over 1.5 million joint replacement procedures performed annually worldwide, the market is transitioning from conventional metal-polyethylene systems toward next-generation hybrid, cementless, and 3D-printed implants that offer enhanced durability and anatomical fit. Major OEMs are expanding portfolios through AI-assisted planning tools, intraoperative navigation systems, and patient-specific instrumentation, positioning the sector for double-digit innovation-driven growth through 2030.

KEY TAKEAWAYS

-

By RegionThe significant share of North America in this market is attributed to the existence of major key players, change in lifestyle, increasing geriatric population, and rising prevalence of bone disorders. Furthermore, factors such as increasing healthcare expenditure and growing number of various joint replacement treatments due to increase in awareness among common people coupled with early detection supports the market growth in this region.

-

By Product TypeBy product type, The knee replacement devices segment is expected to hold major share of the market in forecast period. The increase in number of knee replacement procedures and the increasing incidence of knee osteoarthritis is driving the growth of this segment. Each year more than 70,000 knee replacement procedures are performed in England and wales each year (Source: NHS)

-

By Surgery TypeBy surgery type, the total replacement segment held a significant share of the market 2023. The growth in this segment is driven by the increasing number joint replacement surgerie such as hip and knee replacement and increasing incidence of osteoarthritis

-

By TypeBy type, the cemented fixation segment held largest share of the market. There are multiple factors attributing to the largest share of the segment such as enhanced bone fixation, improved stability of an implant in patient's body, and enhanced assistance drives the growth of the segment.

-

By End-userBy end-user,The major share of the market was contributed by hospitals & surgical centers segment in 2023. Consistent rise in new funding opportunities and increasing focus on research specifically in healthcare by various public and private organizations are fueling the segment growth. Furthermore, increasing number of hospitals and advanced surgical centers which are equipped with new and innovative surgical equipment support the growth of the segment.

-

By TechniqueBy Technique,the minimally invasive surgery held largest share in the global joint replacement devices market by technique. The factors contributing to its largest share are need for smaller incision, reduced pain, and increased awareness among individuals for early detection.

A pronounced shift toward minimally invasive and robot-assisted surgeries is redefining procedural efficiency, precision, and patient recovery outcomes. The integration of AI and preoperative 3D imaging enables surgeons to plan optimal implant positioning and alignment, thereby reducing revision rates. Additionally, polyethylene bearing surfaces with antioxidant stabilization and ceramic-ceramic articulations are gaining adoption to improve wear resistance. Demand from ambulatory surgical centers (ASCs) and outpatient orthopedic clinics is rising rapidly, reflecting the global shift toward value-based, day-care orthopedic procedures. Furthermore, digital ecosystems linking pre-, intra-, and post-operative data are driving the adoption of connected care pathways among hospitals and device OEMs.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Customers, including hospitals and orthopedic surgeons, face a paradigm shift as digitization, robotic precision, and outcome-based reimbursement models reshape the orthopedic ecosystem. The growing adoption of robotic-assisted joint replacement systems (e.g., Stryker’s Mako, Zimmer Biomet’s ROSA, Smith+Nephew’s CORI) is disrupting traditional implant selection workflows and increasing capital investment requirements. Moreover, patient expectations for faster recovery, lower infection risk, and improved long-term mobility are accelerating demand for smart implants with integrated sensors and remote monitoring capabilities. The emergence of 3D-printed and patient-specific implants is further redefining manufacturing and supply chain economics, compelling OEMs to shift toward localized production hubs and on-demand customization.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising prevalence of orthopedic diseases and disorders

-

Increasing demand for minimally invasive surgery

Level

-

Risks and complications associated with orthopedic surgical procedures

-

Reduced reimbursement rates for orthopedic surgeries

Level

-

Advancements in robotic surgery and 3D printing

-

Growth opportunities in emerging markets

Level

-

Dearth of skilled orthopedic surgeons

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing prevalence of orthopaedic diseases and disorder

The demographic shifts coupled with longer life expectancies have undoubtedly given rise to the global elderly population. A UN report estimate shows that there were 727 million people aged 65 years or older in the world in 2020, and By 2050 this figure will rise up to 1.5 billion. In addition, The US National Institute on Aging states that the population of persons aged over 65 will double between 2005 and 2030. It is also projected that around 40% of the population of Japan would be over the age of 65 by the year 2060 (Source: WHO). Complications related to bones are largely associated with the elderly population, and as a result, they are categorized as geriatric illnesses especially age-related bone disease. Osteoporosis is one of the most prevalent disorders of bone in old age. Bone mass decreases unceasingly with age. Change in the bone architecture increases the susceptibility for osteoporosis which results in hip and vertebrae compressive fractures in the elderly. The CDC reported that a total of 300,000 patients aged 65 years and older are admitted to hospitals in the U.S. due to hip fractures each year. According to Springer Nature 2021 published report in Iran, 24.6% in men and 62.7% in women would most likely have osteoporosis as based on the study with sample size of 2425 of who were above 60 years.

Restraint: High cost of associated with orthopaedic surgical treatments

Orthopedic treatments, such as knee and hip replacement surgeries, are quite costly due to multiple factors such as the use of innovative technologies, complex materials, and precise engineering. These factors become responsible to higher expenses. Additionally, any further procedures post joint replacement surgery can also be expensive. This may lead to limitations for people in low income countries to access this treatments, particularly in areas with limited insurance coverage. The high costs presence a significant challenge for surgeons. As a results, they struggle to find a balance between longevity, affordability, stability, and the quality of implants to deliver improved results to their patients. For instance, the average cost of knee replacement ranges from $5,500 to $11,500 in India. Furthermore, according to NCBI, the robotic total knee replacement in the US was found to be expensive in 2022. It was found to be 10% more expensive as compared to traditional total knee replacement procedure.

Opportunity: Advancement in robotic assisted orthopaedic surgeries and 3D printing

The worldwide demand for knee replacement procedures is on the rise as every year patients suffer from osteoarthritis are consistently increasing. This ultimately increases the need for minimally invasive solutions, which involves an use of small incisions that result in reduced discomfort once the operation is done, supports faster recovery, and reduced hospital stays. To achieve this, surgeons make an robot-assisted platform, that leverage the use of tiny 3D cameras and dime-sized surgical equipment inside the patient's body. This enables surgeons to access and have look into intricate details in different regions that would otherwise be difficult to access. The success rate of robot-assisted orthopedic surgery is notably high, at approximately 95%, which has contributed to the rise in the number of these procedures being performed. In November 2023, KIMS Hospital (UK) made an addition of Mako Smart Robotics by Stryker to perform total knee surgical procedures. Additionally, as per the study published in the Global Health Journal, the 3D printing can assist in surgical planning and helps the reduce the overall development costs of joint replacement device. This technology allows the creation of customized implants for individual patients using 3D models of hips, knees, shoulders, etc.

Challenge: Dearth of skilled orthopaedic surgeons

The joint replacement devices market is witnessing an increased prevalence of orthopedic disorders coupled with rise in the number of surgical procedures. This has resulted in a growing demand for specialists who can treat orthopedic disorders. However, the shortage of skilled professionals impacts the availability and accessibility of highly specialized treatments. As a result, patients have to wait for a long time period to undergo a surgery, which in turn decreases the acceptance rate for advanced orthopedic implants. Additionally, the limited workforce of orthopedic surgeons results in immense pressure on the overall staff at an end user facility, leading to potential negative consequences on patient care and outcomes. According to a report by the American Academy of Orthopedic Surgeons, the number of knee replacement surgeries in the US is projected to reach 3.5 million procedures annually by 2030. However, the Health Resources and Services Administration has predicted a shortage of approximately 5,080 orthopaedic surgeons in the US by 2025. This shortage is a result of the retirement of skilled orthopaedic surgeons, with around 60% of active surgeons over the age of 55 planning to retire within the next 15 years (Source: AMN Healthcare Company Merritt Hawkins). Furthermore, the Centers for Disease Control and Prevention reports that the number of hip replacements performed on individuals aged 45 and older increased from 138,700 to 310,800 in the first decade of this century. But the rate of those procedures increased from 142 per 100,000 people to 257 per 100,000. (Source: Centers for Disease Control and Prevention).

Joint Replacement Devices Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Utilization of advanced titanium and porous metal technologies in hip and knee implant | Enhanced osseointegration, reduced risk of implant loosening, and improved long-term joint stability. |

|

Adoption of 3D printing and robotic-assisted systems for patient-specific joint implants. | Greater surgical precision, reduced revision rates, and faster post-operative recovery. |

|

Integration of smart sensor-enabled implants for real-time data monitoring. | Improved patient outcomes through post-surgery analytics, enabling proactive rehabilitation. |

|

Use of advanced polyethylene and oxidized zirconium materials in knee and hip implants. | Use of advanced polyethylene and oxidized zirconium materials in knee and hip implants. |

|

Personalized joint replacement systems using AI-based preoperative planning and intraoperative navigation. | Personalized joint replacement systems using AI-based preoperative planning and intraoperative navigation. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The joint replacement ecosystem comprises implant manufacturers, robotic system developers, software and navigation technology providers, distributors, orthopedic surgeons, and healthcare payers. OEMs such as Stryker, Zimmer Biomet, Smith+Nephew, Johnson & Johnson (DePuy Synthes), and Medacta dominate the value chain with vertically integrated portfolios covering implants, surgical instruments, robotics, and digital analytics. Collaboration between hospitals and technology partners is intensifying, with integrated platforms linking preoperative imaging, intraoperative guidance, and postoperative monitoring forming the backbone of modern orthopedic care delivery.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Joint Replacement Devices Market, By Product

The knee replacement devices segment holds the largest market share, driven by the high global prevalence of osteoarthritis and the increasing adoption of minimally invasive total knee arthroplasty (TKA). Continuous innovation in polyethylene inserts, cementless fixation, and robotic-assisted systems has improved outcomes and reduced revision rates, strengthening market leadership. Hip replacement devices follow closely, benefiting from early adoption of ceramic-on-ceramic and metal-on-polyethylene implants for younger patient cohorts.

Joint Replacement Devices Market, By Surgery Type

Total replacement surgeries dominate the market due to their established clinical efficacy and extensive insurance coverage, especially in developed countries. These procedures offer comprehensive restoration of joint function and are widely supported by evidence-based orthopedic guidelines. Partial replacements, although growing, remain limited to specific indications and patient profiles but are expanding with improved implant design and robotic precision.

Joint Replacement Devices Market, By End User

Hospitals and specialty orthopedic centers represent the largest end-user segment, driven by high procedural volumes, availability of multidisciplinary surgical teams, and access to robotic and navigation systems. However, ambulatory surgical centers (ASCs) are witnessing the fastest growth, supported by lower cost-per-case, shorter hospital stays, and payer incentives for outpatient joint replacements.

REGION

North America holds major share in global joint replacement devices market during forecast period

North America leads the global market due to its well-established healthcare infrastructure, high procedural adoption, favorable reimbursement, and the strong presence of leading OEMs. The Asia-Pacific (APAC) region, however, is projected to grow at the fastest rate through 2030, fueled by rapid healthcare modernization, growing aging populations in China and Japan, and the expansion of orthopedic centers in India and Southeast Asia. Strategic localization of manufacturing by global players is further enhancing access and affordability across APAC markets.

Joint Replacement Devices Market: COMPANY EVALUATION MATRIX

The competitive landscape is moderately consolidated, with Stryker, Zimmer Biomet, DePuy Synthes, and Smith+Nephew collectively accounting for a significant market share. These players are differentiated by their robotic platforms, proprietary materials, and digital surgical planning ecosystems. Stryker’s Mako system continues to set the benchmark for robotic-assisted knee and hip surgeries, while Zimmer Biomet’s ROSA and Persona IQ (smart implant) underscore the convergence of hardware, AI, and data analytics. Mid-tier players such as Medacta, Exactech, and Corin Group are leveraging niche technologies like patient-matched implants and kinematic alignment to penetrate regional markets. The industry is expected to see accelerated M&A, joint ventures, and ecosystem partnerships as companies compete to deliver end-to-end, data-driven orthopedic solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 23.4 Billion |

| Market Forecast in 2030 (Value) | USD 31.1 Billion |

| Growth Rate | CAGR of 4.8% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe,Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Joint Replacement Devices Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Hospital Chain |

|

|

| Orthopedic Implant Manufacturer |

|

|

| Surgical Equipment Distributor |

|

|

| Raw Material Supplier |

|

|

| Government Health Authority / Regulator |

|

|

RECENT DEVELOPMENTS

- August 2024 : Zimmer Biomet signed an agreement to acquire OrthoGrid, which specializes in surgical guidance systems for total hip replacement driven by AI.

- Jun-24 : Zimmer Biomet announced a distribution agreement with THINK Surgical. Under this agreement, Zimmer Biomet technology will be incorporated with the TMINI robotic solution by THINK Surgical.

- September 2024 : Stryker acquired Care.ai to deliver ambient intelligence solutions, smart room technologies, and AI-assisted virtual care processes.

- COLUMN 'A' SHOULD BE IN TEXT FORMAT AND NOT DATE FORMAT :

Table of Contents

Methodology

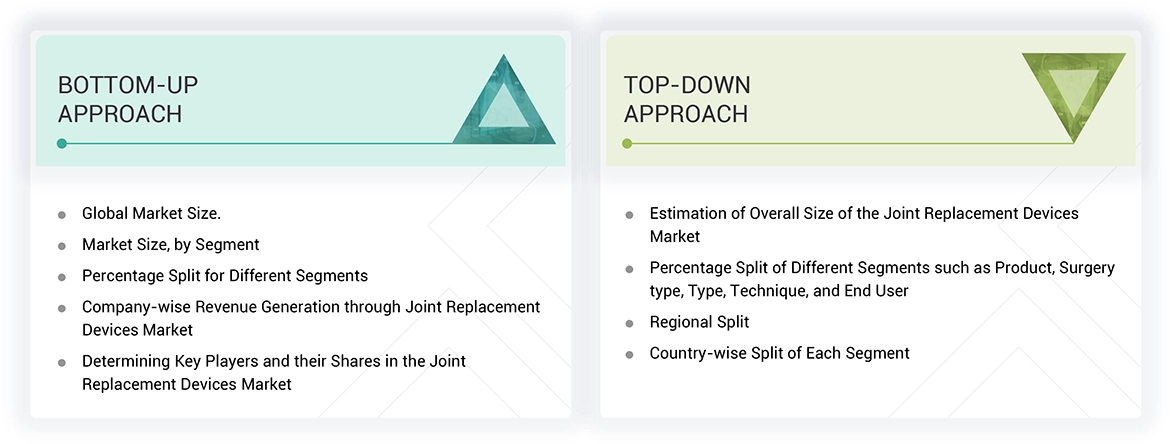

The study involved four major activities in estimating the current size of the joint replacement devices market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial joint replacement devices market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as Chief Executive Officers (CEOs), vice presidents (VPs), marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the joint replacement devices market. The primary sources from the demand side include hospitals & surgical centers, ambulatory care centers & trauma units, and orthopedic clinics. Primary research was conducted to validate the market segmentation, identify key players, and gather insights on key industry trends & key market dynamics.

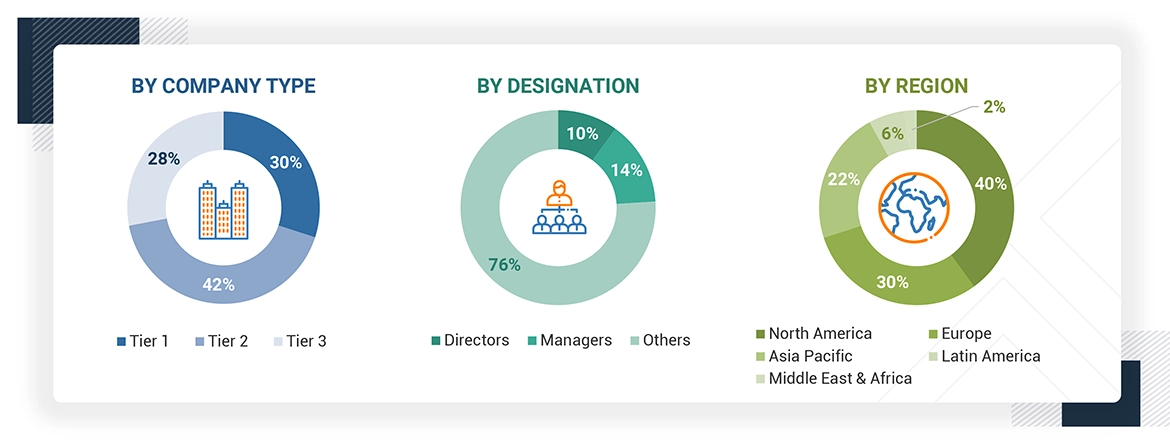

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The tiers of the companies are defined based on their total revenue. As of 2023: Tier 1 => USD 1 billion, Tier 2 = USD 200-500 million to USD 1 billion, and Tier 3 =< USD 200 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the joint replacement devices market. These methods were also used extensively to estimate the size of various subsegments in the market . The research methodology used to estimate the market size includes the following:

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the joint replacement devices market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the joint replacement devices market was validated using top-down and bottom-up approaches.

Market Definition

A joint replacement device is an implantable medical device, to correct a variety of bone, joint, or other tissue disorders, injuries, or disease. The products are utilized for multiple applications, including fractures, and for related surgeries, where a support or replacement part is installed in the bone. It supports healing and facilitate the restoration of mobility. Different biocompatible materials such as polymers, ceramics, metals and metal alloys, and hybrid implants are used for manufacturing joint replacement devices. The primary end users of this market include hospitals, ambulatory care centers, and trauma units.

Stakeholders

- Joint replacement device manufacturers

- Trauma care centers

- Ambulatory surgical centers

- Hospitals

- Joint replacement devices distributors and suppliers

- Orthopedic surgeons

Report Objectives

- To define, describe, and forecast the joint replacement devices market based on product type, surgery type, type, technique, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, Latin America, Middle East and Africa

- To profile the key players and comprehensively analyze their market ranking and core competencies

- To benchmark players within the market using a proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of market share and product footprint

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Joint Replacement Devices Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Joint Replacement Devices Market