Intraocular Lens Market Size, Growth, Share & Trends Analysis

Intraocular Lens Market by Type (Monofocal IOLs (Spheric Monofocal IOLs), Premium IOLs (Accommodating IOLs)), Material (Hydrophobic Acrylic IOLs, PolyMethylMethAcrylate, Silicon IOLs), Application (Presbyopia), End User (Hospitals) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global intraocular lens market, valued at US$4.38 billion in 2024, stood at US$4.62 billion in 2025 and is projected to advance at a resilient CAGR of 6.0% from 2024 to 2030, culminating in a forecasted valuation of US$6.17 billion by the end of the period. The IOLs market is driven by the rising prevalence of cataracts, the rapid adoption of premium lenses, and technological advancements that improve surgical outcomes. However, the high cost of premium IOLs and limited reimbursement in developing regions restrain adoption. Opportunities arise from expanding healthcare access in emerging markets, the increasing demand for personalized optics, and ongoing innovations such as EDOF and presbyopia-correcting lenses that enhance visual performance and broaden the market’s value potential.

KEY TAKEAWAYS

-

BY REGIONThe Asia Pacific is projected to witness the highest CAGR of 6.5% in the IOLs market during the forecast period. The Asia Pacific is projected to witness the highest CAGR in the IOLs market due to its rapidly aging population, the rising incidence of cataracts, and expanding access to ophthalmic care. Increasing government investments in eye health programs, the growing adoption of advanced surgical technologies, and a surge in medical tourism are all factors that will contribute to strengthening regional growth. Additionally, improving healthcare infrastructure, rising disposable incomes, and the expanding presence of global and local IOL manufacturers further accelerate market penetration and premium IOL adoption across the APAC.

-

BY TYPEBy type, premium IOLs are expected to register the highest CAGR of 7.0% during the forecast period. Premium IOLs are expected to register the highest CAGR due to the rising patient preference for enhanced vision without glasses, strong adoption of multifocal, toric, and EDOF lenses, and improved surgical technologies that increase surgeon confidence. Growing awareness of refractive benefits, expanding availability in emerging markets, and higher disposable incomes further accelerate uptake. Additionally, continuous innovations focused on personalized optics and improved postoperative outcomes strengthen the demand for premium lenses throughout the forecast period.

-

BY MATERIALBy material, hydrophobic acrylic IOLs are projected to record the highest CAGR of 6.4% during the forecast period. Hydrophobic acrylic IOLs are projected to record the highest CAGR as they offer superior biocompatibility, low posterior capsular opacification rates, and excellent optical clarity, making them the preferred material for cataract surgeons globally. Their stability, reduced glistening, and long-term performance drive strong clinical adoption. The growing demand for premium and advanced monofocal lenses, along with expanding availability in emerging markets, further strengthens the growth outlook for hydrophobic acrylic IOLs.

-

BY END USERBy end user, hospitals are expected to register the highest CAGR of 6.3% in the IOLs market during the forecast period. Hospitals are expected to register the highest CAGR in the IOLs market as they handle a large volume of cataract surgeries, supported by advanced surgical infrastructure and access to skilled ophthalmologists. The increasing adoption of premium IOLs, the availability of femtosecond laser systems, and comprehensive postoperative care further strengthen hospital preference. Expanding government funding, growing patient inflow for subsidized procedures, and rising investments in modern ophthalmic departments also drive faster growth in this end-user segment.

-

COMPETITIVE LANDSCAPE - Key PlayersAlcon Inc., Johnson & Johnson Vision Care, Inc., Carl Zeiss Meditec AG, Hoya Surgical Optics were identified as Star players in the intraocular lens market, as they have focused on innovation and have broad industry coverage and strong operational & financial strength.

-

COMPETITIVE LANDSCAPE - Start UpsVisusNano, Nayam Innovations, Omega Ophthalmics, LensGen have distinguished themselves among startups and SMEs due to their strong product portfolio and business strategy

The IOLs market grows with increasing cataract cases, aging populations, demand for premium lenses, and advanced surgical technologies. Yet high costs and limited reimbursement restrict access. Emerging markets, customized and presbyopia-correcting IOLs, and innovations enhancing outcomes and reducing complications offer significant growth opportunities.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The IOLs market is rapidly advancing, driven by innovations in optical design, biomaterials, and digital surgical integration. While monofocal lenses remain essential, demand is shifting toward premium options such as toric, multifocal, and EDOF IOLs that offer superior visual outcomes and spectacle independence. AI-powered biometry, femtosecond laser–assisted surgery, and image-guided planning are improving refractive precision and workflow efficiency. The rising demand for refractive lens exchange and personalized digital planning tools is further expanding market potential, enabling more predictable and patient-centered outcomes.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increase in geriatric population and subsequent rise in ophthalmic disorders

-

Rising number of cataract surgeries

Level

-

High cost of intraocular lenses

Level

-

High growth potential of emerging economies

Level

-

Shortage of skilled ophthalmologists

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising number of cataract surgeries

The rising number of cataract surgeries is a major driver of the IOLs market, as each procedure requires lens implantation, directly increasing demand. Aging populations, improved surgical accessibility, and expanding government-led eye care programs are accelerating procedure volumes worldwide. Advancements in minimally invasive techniques and faster recovery times are encouraging more patients to undergo surgery earlier. Additionally, greater awareness of vision correction options and increasing adoption of premium IOLs further amplify market growth as cataract surgery volumes continue to rise globally.

Restraint: High cost of intraocular lenses

The high cost of IOLs, especially premium options such as toric, multifocal, and EDOF lenses, acts as a significant restraint in the market. Many patients in developing regions face affordability challenges, as premium IOLs are often not fully reimbursed and require substantial out-of-pocket spending. Hospitals and clinics may also limit adoption due to budget constraints. This cost barrier reduces access to advanced vision-correcting lenses, slows premium segment growth, and widens the gap between high-income and price-sensitive markets.

Opportunity: High growth potential of emerging economies

Emerging economies offer significant growth opportunities for the IOLs market due to expanding healthcare infrastructure, rising cataract surgery volumes, and increasing government investment in eye care programs. Growing middle-class populations and improved insurance coverage are boosting demand for better visual outcomes and premium IOL options. Additionally, the availability of cost-effective lenses from regional manufacturers supports wider adoption. As awareness of cataract treatment improves and access to advanced ophthalmic technologies expands, emerging markets are poised to become major contributors to future IOL market growth.

Challenge: Shortage of skilled ophthalmologists

The shortage of skilled ophthalmologists is a major challenge in the IOLs market, as it limits the number of cataract surgeries that can be performed, particularly in developing regions. Many countries face uneven distribution of specialists, long patient wait times, and overburdened surgical centers. This restricts timely access to cataract treatment and slows the adoption of advanced IOL technologies that require higher surgical expertise. As a result, procedure backlogs grow, delaying patient outcomes and constraining overall market expansion.

Intraocular Lens Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Develops a wide portfolio of monofocal, toric, multifocal, and EDOF IOLs supported by advanced biometry and surgical planning platforms. | Enhances refractive accuracy, improves spectacle independence, and ensures superior visual outcomes for patients undergoing cataract and refractive lens exchange procedures. |

|

Offers premium IOL technologies, including multifocal, accommodating, and monofocal-plus lenses with proprietary material science. | Provides high-quality vision across distances, reduces dysphotopsia, and boosts patient satisfaction with optimized postoperative performance. |

|

Designs premium toric and multifocal IOLs integrated with advanced diagnostics such as biometry and image-guided surgery platforms. | Enables precise alignment, reduces refractive error, and improves surgical workflow efficiency through integrated planning and guidance. |

|

Manufactures hydrophobic acrylic IOLs with aspheric optics, glistening-free materials, and monofocal-plus options. | Ensures stable long-term clarity, reduces the risk of posterior capsular opacification, and delivers enhanced contrast sensitivity. |

|

Offers innovative monofocal, toric, and EDOF IOLs, including customizable optic technologies and enhanced material designs. | Improves visual quality, reduces visual disturbances, and provides surgeons with flexible solutions for tailored patient outcomes. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The IOLs market functions through a well-connected ecosystem involving raw material suppliers, polymer manufacturers, and optical designers who support the production of advanced lens technologies. Leading companies such as Alcon, Johnson & Johnson Vision, HOYA, Rayner, and Carl Zeiss Meditec use specialized biomaterials to develop monofocal, premium, and phakic IOLs. These products are distributed through global ophthalmic networks and partnered distributors that support hospitals and surgical centers. Key end users include major eye hospitals, ambulatory surgical centers, and specialized institutes, all of which focus on improving surgical outcomes and advancing modern cataract care.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Ophthalmic Equipment Market, By Type

Aspheric monofocal IOLs hold the largest market share because they offer reliable visual outcomes, improved contrast sensitivity, and reduced spherical aberrations at an affordable cost. Their strong clinical performance, wide surgeon preference, and broad reimbursement coverage make them the standard choice for routine cataract surgeries. High patient acceptance and consistent availability across global markets further reinforce their dominant position.

Ophthalmic Equipment Market, By Application

Cataract surgery holds the largest market share in the IOLs market because it is the most commonly performed ophthalmic procedure worldwide, driven by the rising prevalence of cataracts and the rapidly aging population. IOL implantation is a standard part of cataract treatment, ensuring consistent demand. Technological advancements, improved surgical outcomes, and widespread reimbursement support further strengthen cataract surgery’s dominance in the overall IOLs market.

Ophthalmic Equipment Market, By End User

Hospitals hold the largest market share in the IOLs market because they perform the majority of cataract surgeries and are equipped with advanced surgical infrastructure, skilled ophthalmologists, and comprehensive diagnostic capabilities. They handle high patient volumes, including complex cases, and often serve as referral centers for other healthcare providers. Hospitals also benefit from government funding, insurance coverage, and structured reimbursement systems, which support wider adoption of both standard and premium IOLs. Their ability to offer integrated preoperative and postoperative care further strengthens their dominant position.

REGION

Asia Pacific to be fastest-growing region in global intraocular lens market during forecast period

The APAC is the fastest-growing market in the IOLs sector, driven by its rapidly aging population, rising cataract incidence, and expanding access to affordable eye care. Governments across the region are increasing investments in national cataract programs, improving surgical capacity, and promoting early detection initiatives. Growing healthcare infrastructure, higher adoption of advanced biometry and surgical technologies, and the presence of cost-effective regional IOL manufacturers further accelerate market expansion. Rising disposable incomes and increasing awareness of premium IOL options are also driving demand. Additionally, high unmet needs in rural areas create significant long-term growth potential across the APAC.

Intraocular Lens Market: COMPANY EVALUATION MATRIX

In the IOLs market matrix, Alcon (Star) leads with a dominant global presence, an extensive portfolio of premium and monofocal IOLs, and strong integration of advanced surgical planning technologies. Its scale, innovation capabilities, and established surgeon network solidify its leadership position. Care Group (Emerging Leader) is gaining momentum with competitively priced lenses and expanding manufacturing capabilities, positioning itself for accelerated growth in emerging markets. While Alcon maintains clear market leadership, Care Group demonstrates strong potential to advance toward the leaders' quadrant as it broadens its product offerings and geographic reach.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Bausch Health Companies, Inc. (Canada)

- Alcon (US)

- Carl Zeiss Meditec AG (Germany)

- Johnson & Johnson Vision Care (US)

- HOYA Corporation (Japan)

- Santen Pharmaceutical Co., Ltd. (Japan)

- NIDEK CO., LTD. (Japan)

- Lenstec, Inc. (US)

- Rayner Group (England)

- BVI (US)

- Ophtec B.V. (Netherlands)

- SAV-IOL SA (Switzerland)

- Biotech (Switzerland)

- Appasamy Associates Private Limited (India)

- Atia Vision, Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 4.38 Billion |

| Market Forecast in 2030 (Value) | USD 6.17 Billion |

| Growth Rate | CAGR of 6.0% from 2025–2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Material, Type, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, the Middle East & Africa, and GCC Countries |

WHAT IS IN IT FOR YOU: Intraocular Lens Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis |

|

|

| Company Information |

|

|

| Geographic Analysis |

|

|

RECENT DEVELOPMENTS

- April 2025 : Alcon launched the CLAREON PanOptix Pro trifocal IOL, which features proprietary ENLIGHTEN NXT optical technology delivering 94% light utilization and half the light scatter of its predecessor. The new lens offers enhanced image contrast and uninterrupted vision across distance and near, reinforcing Alcon's leadership in premium IOL innovation

- March 2025 : Alcon received CE Mark approval for its CLAREON Vivity IOL and CLAREON Toric Vivity IOL, enabling commercialization across Europe from early 2025. The lenses combine Alcon’s CLAREON hydrophobic acrylic material with X-WAVE extended-vision technology, offering a broader range of vision and reduced visual disturbances compared to traditional multifocal IOLs.

- September 2024 : Johnson & Johnson Vision Care, Inc. launched the TECNIS Odyssey IOL, a next-generation full-range intraocular lens that provides precise vision at all distances and under any lighting conditions. The lens enhances visual clarity and consistency for cataract patients, reinforcing J&J’s leadership in advanced presbyopia-correcting IOL technology.

- January 2023 : Bausch + Lomb acquired AcuFocus, an ophthalmic medical device company focused on delivering advanced small aperture intraocular technology to address diverse unmet needs in eye care.

- September 2023 : ZEISS expanded its portfolio of trifocal IOLs with the AT ELANA 841P IOL launch. This is a single-piece hydrophobic acrylic implant based on the optical design of the single-piece and four-point-haptic AT LISA tri 839MP.

Table of Contents

Methodology

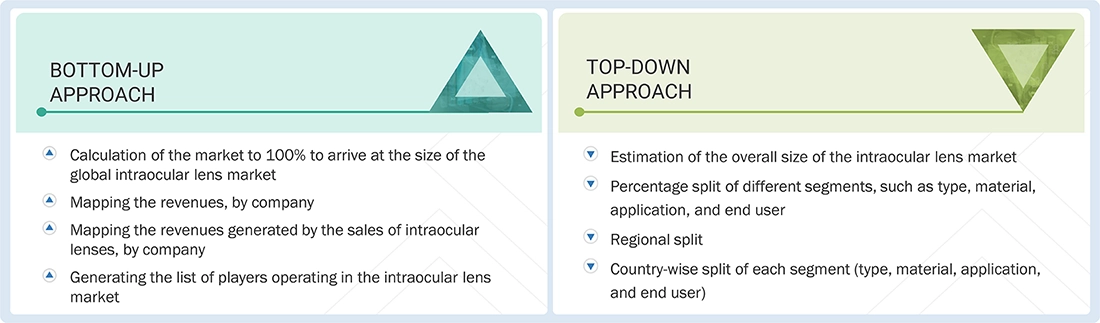

The study involved major activities in estimating the current market size for the intraocular lens market. Exhaustive secondary research was done to collect information on the intraocular lens market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, including top-down and bottom-up methods, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the intraocular lens market.

Secondary Research

This research study involved the extensive use of secondary sources, including directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva, as well as whitepapers and company house documents. Secondary research was undertaken to identify and collect information for this extensive, technical, market-oriented, and commercial study of the intraocular lens market. It was also used to obtain important information about top players, market classification, and segmentation according to industry trends, as well as geographic markets and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply- and demand-side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, VPs/managing directors, marketing heads/directors and sales directors, marketing/sales managers, regional/area sales managers, export/import heads/managers, and other ophthalmic market-related personnel from various companies and organizations operating in the intraocular lens market. Primary sources from the demand side included the vice presidents of hospitals and clinics, C-level executives, department heads, doctors/eye physicians, supply management teams of hospitals, clinic personnel, and laboratory technicians.

Breakdown of Primary Interviews

Note 1: C-level executives include CEOs, COOs, and CTOs.

Note 2: Others include sales, marketing, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, Tier 3 = < USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the intraocular lens market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Data Triangulation

The entire market was split into four segments when the market size was determined. Data triangulation and market breakdown processes were used where necessary to complete the entire market engineering process and arrive at precise statistics for all segments.

Approach to derive the market size and estimate market growth.

Using secondary data from paid and unpaid sources, the market rankings for the major players were determined following a thorough analysis of their sales of intraocular lenses. Due to data restrictions, the revenue share in certain cases was determined after a thorough analysis of the product portfolio of big corporations and their individual sales performance. This information was verified at each stage by in-depth interviews with professionals in the field.

Market Definition

Intraocular lenses, or IOLs, refer to artificial lenses that are implanted in the eye, usually during cataract surgery or for other problems with vision. These lenses are made of biocompatible materials like silicone or acrylic and are intended to replace the natural lens of the eye that has been clouded by cataracts or to improve focusing ability for clearer vision. IOLs are available in several types: monofocal lenses, which provide clear vision at a single distance (near or far); multifocal lenses, which correct the vision at numerous distances; toric lenses, which correct astigmatism; and accommodating lenses, which replicate the focusing capacity of a natural lens.

Stakeholders

- Manufacturers of Intraocular Lenses

- Eye Research Institutions

- Contract Manufacturing Organizations (CMOs)

- Government Associations

- Market Research and Consulting Firms

- Venture Capitalists and Investors

- Distributors of Intraocular Lenses

- Ophthalmic Device Research & Development (R&D) Companies

- Ophthalmology Hospitals & Clinics

Report Objectives

- To describe, analyze, and forecast the intraocular lens market by type, material, application, end user, and region

- To describe and forecast the intraocular lens market for key regions: North America, Europe, the Asia Pacific, Latin America, the Middle East & Africa, and the GCC Countries

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the intraocular lens market

- To strategically analyze the ecosystem, regulations, patenting trend, value chain, Porter’s five forces, and prices pertaining to the market under study

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market players

- To profile key players and comprehensively analyze their market shares and core competencies in the intraocular lens market

- To analyze competitive developments such as collaborations, acquisitions, product launches, expansions, and R&D activities in the intraocular lens market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Intraocular Lens Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Intraocular Lens Market