Industrial Edge Market Size, Share and Trends, 2025 To 2030

Industrial Edge Market by Edge Devices (Edge Sensors, Cameras, PLCs, DCS, HMIs), Edge Compute Devices (Industrial PCs, Single Board Computers), Edge Servers, Edge Networking (Edge Routers, Edge Gateways), Edge Platforms - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global industrial edge market is expected to grow from USD 21.19 billion in 2025 to USD 44.73 billion by 2030, registering a CAGR of 16.1%. This growth is driven by rapid digitalization across various industries, increased adoption of IoT devices, and the need for real-time data processing closer to operations. Key components such as hardware, platforms, and services are experiencing strong adoption, supported by advancements in edge AI, secure networking, and cloud-to-edge integration, along with government-backed Industry 4.0 and smart manufacturing initiatives.

KEY TAKEAWAYS

- The Services segment is expected to grow at the highest CAGR of 20.3% during the forecast period.

- The Energy & Power segment is expected to dominate the Industrial Edge market, accounting for 18.7% of the market in 2024.

- North America is expected to hold a market share of 43.9% in 2024.

- Hewlett Packard Enterprise (HPE), IBM and Dell Technologies, were identified as some of the star players in the Industrial Edge market (global), given their strong market share and product footprint.

- Moxa Inc., ADLINK Technology Inc. and Digi International Inc. among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The industrial edge market is anticipated to undergo substantial growth within the upcoming decade, propelled by rapid advancements in digital transformation across various sectors, increasing deployment of Internet of Things (IoT) devices, and heightened demand for real-time data processing at the network periphery. Developments in edge computing platforms, artificial intelligence-enabled analytics, and secure networking capabilities are augmenting performance, scalability, and operational efficiency. Consequently, industrial edge solutions are becoming essential facilitators for smart manufacturing, predictive maintenance, and the global adoption of Industry 4.0.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customers’ businesses in the industrial edge market arises from accelerating digital transformation and the increasing need for real-time data processing closer to operations. Manufacturing, energy, transportation, healthcare, and retail sectors are more frequently adopting industrial edge solutions, with smart factories and predictive maintenance emerging as key areas of focus. Moves toward AI-enabled analytics, secure connectivity, and IT-OT convergence are directly improving operational efficiency, reducing costs, and boosting competitiveness for end users. These changes, in turn, drive the growing demand for advanced industrial edge platforms, services, and infrastructure, shaping the market’s long-term path.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

5G network rollout

-

Reduced latency and bandwidth costs

Level

-

Complex infrastructure requirements

-

Interoperability issues

Level

-

Expansion of smart manufacturing

-

Growth of autonomous systems

Level

-

Latency variability

-

Cybersecurity concerns

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: 5G network rollout

The deployment of 5G networks is a key driver for the industrial edge market, enabling high-speed, low-latency connectivity essential for real-time data processing. This supports advanced applications such as predictive maintenance, robotics, and remote monitoring in industrial settings.

Restraint: Complex infrastructure requirements

Implementing industrial edge solutions requires substantial investment in hardware, software, and integration, which creates high entry barriers. The complexity of deploying and managing distributed edge systems often hinders adoption, especially for small and medium-sized businesses.

Opportunity: Expansion of smart manufacturing

The increasing adoption of Industry 4.0 and smart factory initiatives opens strong opportunities for industrial edge solutions. Edge computing allows for real-time monitoring, process automation, and predictive analytics, boosting efficiency and productivity.

Challenge: Latency variability

Despite advances in edge technology, latency can vary due to network conditions and distributed architecture. This variability creates challenges for applications that need ultra-reliable, real-time responses, such as autonomous vehicles or critical manufacturing operations.

Industrial Edge Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Industrial edge solutions integrating compute, storage, and networking for real-time data processing at the edge | Reduced latency, enhanced operational efficiency, and seamless IT-OT convergence |

|

Edge computing platforms with AI, automation, and hybrid cloud integration for industrial applications | Accelerated decision-making, improved predictive maintenance, and scalability across distributed environments |

|

Ruggedized edge infrastructure and IoT-enabled platforms for manufacturing, energy, and industrial automation | Reliable edge performance, simplified deployment, and enhanced security for mission-critical operations |

|

Edge networking and cybersecurity solutions enabling connected factories, industrial IoT, and secure remote operations | Secure connectivity, network resilience, and optimized industrial workflows |

|

Cloud-to-edge services enabling industrial analytics, machine learning, and real-time monitoring | Scalable edge intelligence, improved asset visibility, and faster time-to-value for industrial use cases |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The industrial edge market ecosystem includes hardware vendors, software and platform providers, network connectivity providers, cloud service providers, and system integrators, all working together to enable large-scale deployment of edge solutions. Hardware and networking vendors lay the groundwork with infrastructure, while software and cloud providers deliver platforms for real-time analytics, AI, and edge-to-cloud integration. System integrators play a crucial role in customizing deployments to meet industry needs and ensuring smooth IT-OT convergence. Industrial enterprises are at the core of adoption, leveraging edge technologies to enhance productivity, enable predictive maintenance, and support smart manufacturing. This interconnected ecosystem collectively fosters innovation, scalability, and operational efficiency, making industrial edge a vital part of digital transformation.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Industrial Edge Market, By Component

The hardware segment is expected to dominate the industrial edge market during the forecast period, driven by its essential role in enabling reliable edge infrastructure. Hardware solutions like ruggedized servers, gateways, sensors, and networking devices form the foundation of industrial edge deployments, providing the processing power and connectivity necessary for real-time data management at the edge. Their capability to support latency-sensitive applications, withstand harsh industrial environments, and ensure secure operations makes hardware a key element of industrial edge ecosystems. As industries accelerate digital transformation and adopt smart manufacturing, hardware will continue to lead large-scale edge deployments and serve as the base for scalable and resilient edge solutions.

Industrial Edge Market, By Industry

The semiconductor and electronics segment is expected to hold a large share of the industrial edge market in 2024, driven by the industry’s high demand for precision, speed, and real-time monitoring in manufacturing. Edge solutions support predictive maintenance, yield optimization, and advanced process control, aiding the production of more complex and smaller components. As the sector continues to adopt automation, IoT, and AI-driven analytics, industrial edge computing is becoming essential for boosting efficiency, ensuring quality, and staying competitive in global semiconductor and electronics manufacturing.

REGION

Asia Pacific to be fastest-growing region in global industrial edge market during forecast period

Asia Pacific is expected to experience the highest CAGR in the industrial edge industry during the forecast period, driven by rapid digitalization in industries, extensive deployment of IoT devices, and increasing use of AI-powered automation across major sectors. Governments in China, Japan, South Korea, and India are actively promoting Industry 4.0, smart manufacturing, and 5G-enabled infrastructure, creating favorable conditions for adopting industrial edge solutions. The region's strong manufacturing ecosystems, combined with rising investments in edge data centers and local processing, further enhance its position. With growth in the automotive, semiconductor, and electronics industries, Asia Pacific is becoming a global hub for industrial edge innovation and deployment.

Industrial Edge Market: COMPANY EVALUATION MATRIX

In the industrial edge companies matrix, Hewlett Packard Enterprise (Star) leads with a strong global presence and a comprehensive portfolio covering edge infrastructure, networking, and hybrid edge-to-cloud solutions. Its ability to deliver scalable, secure, and integrated platforms for industries such as manufacturing, energy, and transportation has established HPE as a dominant player in the market. NVIDIA Corporation (Emerging Leader), building on its leadership in GPUs and AI-driven platforms, is rapidly advancing edge computing capabilities through accelerated AI, machine vision, and real-time analytics. While HPE drives market leadership with scale and edge-to-cloud integration expertise, NVIDIA demonstrates strong growth momentum and is positioning itself to move toward the leaders’ quadrant within the evolving industrial edge market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 18.15 Billion |

| Market Forecast in 2030 (Value) | USD 44.73 Billion |

| Growth Rate | CAGR of 16.1% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, RoW |

WHAT IS IN IT FOR YOU: Industrial Edge Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Industrial OEM (Automotive/Manufacturing) |

|

|

| Telecom/Connectivity Provider |

|

|

| Software/Platform Provider |

|

|

RECENT DEVELOPMENTS

- December 2024 : Advanced Co., Ltd. launched the UNO-247 V2, an industrial IoT gateway powered by the Intel N97 processor. This gateway enhances automation and smart manufacturing by enabling remote control, decision-making, and connectivity at the edge of industrial networks. It supports advanced capabilities such as predictive maintenance, enhanced cybersecurity, and seamless integration with industrial IoT ecosystems, driving innovation and digital transformation in latency-sensitive environments.

- November 2024 : Dell Inc. improved its Dell NativeEdge platform, making edge AI deployment easier with updates like high-availability clustering, a wider Blueprint catalog for AI applications, and integrations with top AI/ML frameworks.

- October 2024 : Hewlett Packard Enterprise Development LP announced the HPE ProLiant Compute XD685, a high-performance server built for AI model training, supercomputing, and industrial edge applications. This server integrates AMD EPYC processors and M1325X accelerators to provide scalable, energy-efficient computing for complex AI tasks like large language model training and multi-modal processing.

- July 2024 : Amazon Web Services, Inc. launched AWS IoT SiteWise Edge on Siemens Industrial Edge, an industrial IoT solution that connects Operational Technology (OT) with Information Technology (IT). This product allows for collecting and transmitting industrial equipment data to the cloud, supporting use cases like asset monitoring, predictive maintenance, and energy management.

- May 2024 : Dell Inc. collaborated with ServiceNow to introduce the first closed-loop integration for industrial edge environments. This partnership leverages ServiceNow's Now Platform to streamline AI application development and deployment at the edge, offering end-to-end automation for IT.

Table of Contents

Methodology

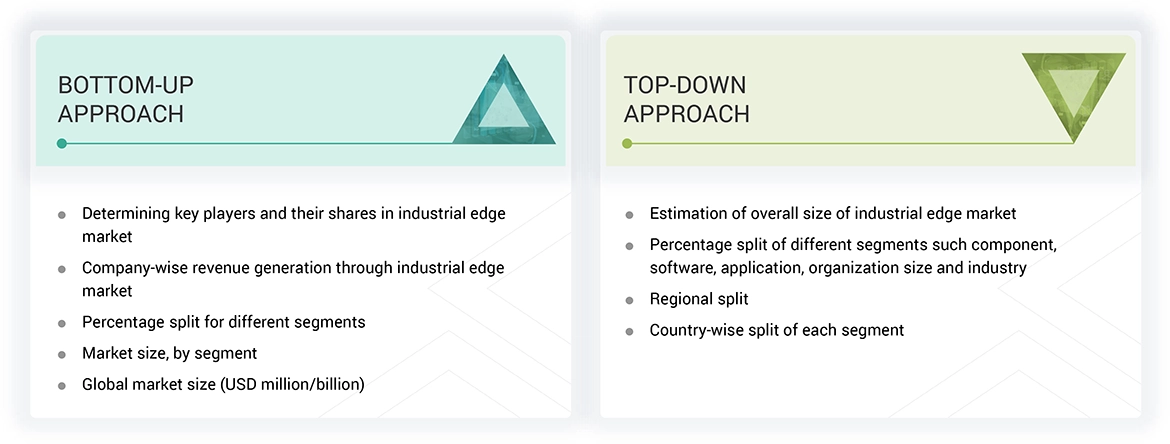

The study involved four major activities in estimating the current size of the industrial edge market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the industrial edge market.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect information important for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

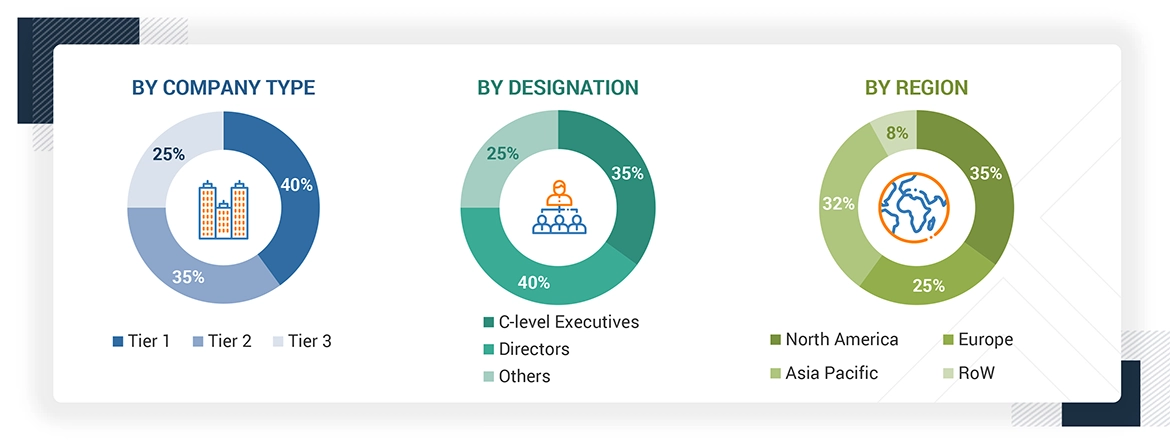

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the industrial edge market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions—North America, Europe, Asia Pacific and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

Note: The three tiers of the companies are defined based on their total revenue in 2023: Tier 1 - revenue

greater than or equal to USD 1 billion; Tier 2 - revenue between USD 100 million and USD 1 billion;

and Tier 3 revenue less than or equal to USD 100 million. Other designations include sales managers, marketing

managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the industrial edge market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Industrial Edge Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the industrial edge market from the market size estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Market Definition

The industrial edge market encompasses solutions, platforms, and infrastructure that enable edge computing in industrial environments. Unlike depending just on centralized cloud computing, this market encompasses hardware, software, and connectivity solutions meant to process, analyze, and manage data directly at the operational level—closer to industrial assets and production systems.

Industrial edge solutions enable scalable, secure software deployment on the production floor by combining operational technology (OT) with information technology (IT), so streamlining data collecting and increasing real-time analytics. Even as they help to lower IT expenses, these technologies increase efficiency, automation, and decision-making. The market is driven by increasing demand for predictive maintenance, real-time monitoring, and Industry 4.0 adoption—with uses spanning manufacturing, energy, logistics, and smart infrastructure.

Stakeholders

- Industrial Edge solution and service providers

- Cloud service providers

- Industrial IoT solution providers

- Cybersecurity Firm

- Raw material suppliers

- Semiconductor foundries

- Original Equipment Manufacturers (OEM)

- Government organizations, forums, alliances, and associations

- System Integrators (SIs) and Value-added Resellers (VARs)

- Research organizations

- Technology standard organizations, forums, alliances, and associations

- Technology investors

- End-user Industries

Report Objectives

- To define, describe and forecast the industrial edge market, in terms of component, software, application, organization size, industry and region.

- To describe and forecast the market, in terms of value, with regard to four main regions: North America, Europe, Asia Pacific, and Rest of the World (RoW) along with their respective countries

- To provide detailed information regarding major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To provide a detailed overview of the value chain of industrial edge market.

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market.

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive strategies, such as product launches, expansions, mergers and acquisitions, adopted by key market players in the industrial edge market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Industrial Edge Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Industrial Edge Market