Industrial Coatings Market

Industrial Coatings Market by type (Acrylic, Alkyd, Polyester, Polyurethane, Epoxy, Fluoropolymer), Technology (Solventborne Coatings, Waterborne Coatings, Powder Coatings), End-use Industry (General Industrial), and Region - Global Forecast to 2030

Updated on : December 16, 2025

INDUSTRIAL COATINGS MARKET

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

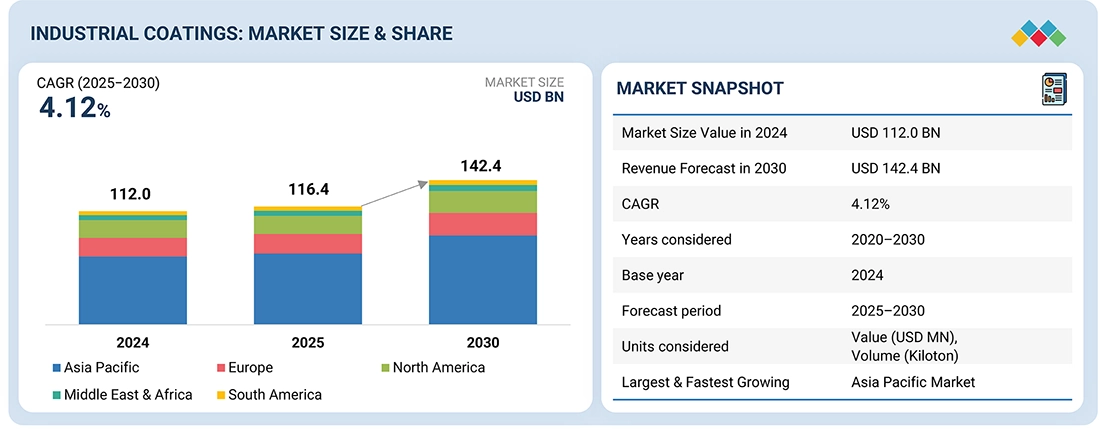

Industrial Coatings Market was valued at USD 112.04 billion in 2024 and is projected to reach USD 142.35 billion by 2030, growing at 4.12% cagr from 2025 to 2030. The market is experiencing robust growth due to strong environmental regulations favoring VOC-free systems, increasing demand in the automotive industry, and ongoing development of new coating technologies. The market is further boosted by rapid industrialization in the Asia Pacific region and the need for long product life with minimal maintenance.

KEY TAKEAWAYS

-

BY RESIN TYPEEpoxy resins are estimated to fastest growing resin type in the industrial coatings market, primarily because they perform better and cost more than the other resins available today. It is common to find epoxy coatings in marine, oil & gas, automotive, and infrastructure settings because they adhere well, resist chemicals, possess high strength, and are quite durable. Their ability to last significantly longer against wear and rust justifies the higher cost of high-alloy superalloys in specialized fields.

-

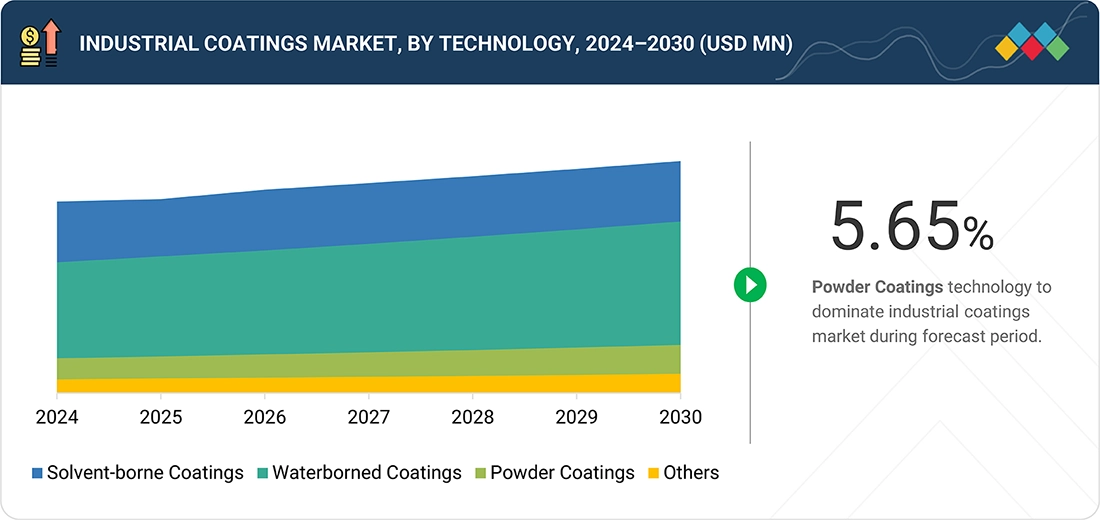

BY TECHNOLOGYPowder coatings are estimated to witness the highest growth rate in the industrial coatings market during the forecast period due to various technological factors. Powder coatings do not pollute the air, emit high levels of VOCs, and can last a long time without becoming damaged or worn out. With stringent regulations on emission control and an increased emphasis on sustainability, the use of powder coatings is on the rise in the automotive, appliance, and industrial sectors.

-

BY END-USE INDUSTRYThe general industrial category accounted for the largest share of the industrial coatings market. The reason for this dominance is that many types of machinery, equipment, metal fabrication, and consumer goods require durable and protective coatings. This area benefits from consistent demand in both affluent and developing countries due to ongoing advancements in industry and construction production. Being used in many industries and constantly requiring upkeep and finishes, general industrial is the biggest and most dependable part of the market.

-

BY REGIONAsia Pacific is projected to be the fastest-growing region in the industrial coatings market over the forecast period, driven by rapid economic growth, infrastructure development, and increasing industrialization in countries like China, India, Indonesia, and Vietnam. The automotive, construction, and manufacturing industries are thriving in the region, generating strong demand for advanced coating technologies that ensure performance, protection, and compliance with upcoming environmental regulations. Additionally, growing foreign investments, favorable government policies, and a shift toward sustainable and energy-efficient production processes are encouraging the adoption of new industrial coatings.

-

COMPETITIVE LANDSCAPELeading market participants focus on innovation, sustainable coating solutions, and strategic partnerships through collaborations, acquisitions, and new product launches. Major players such as PPG Industries, Sherwin-Williams, Axalta Coating Systems, and AkzoNobel are actively expanding their portfolios of industrial coatings to address the rising demand for high-performance, durable, and environmentally responsible coatings across sectors such as automotive, construction, aerospace, and general industrial applications.

The growing popularity of industrial coatings is due to their essential protection, durability, and performance enhancements for equipment, machinery, and infrastructure across various industries. Given businesses’ desire for longer product life and reduced maintenance needs, there is a shift toward highly advanced coatings that resist corrosion, wear, and environmentally harsh conditions. As the world adopts stricter regulations concerning emissions and environmental degradation, firms are transitioning to greener technologies, including the use of waterborne and powder-based coating systems that emit low levels of volatile organic compounds (VOCs).

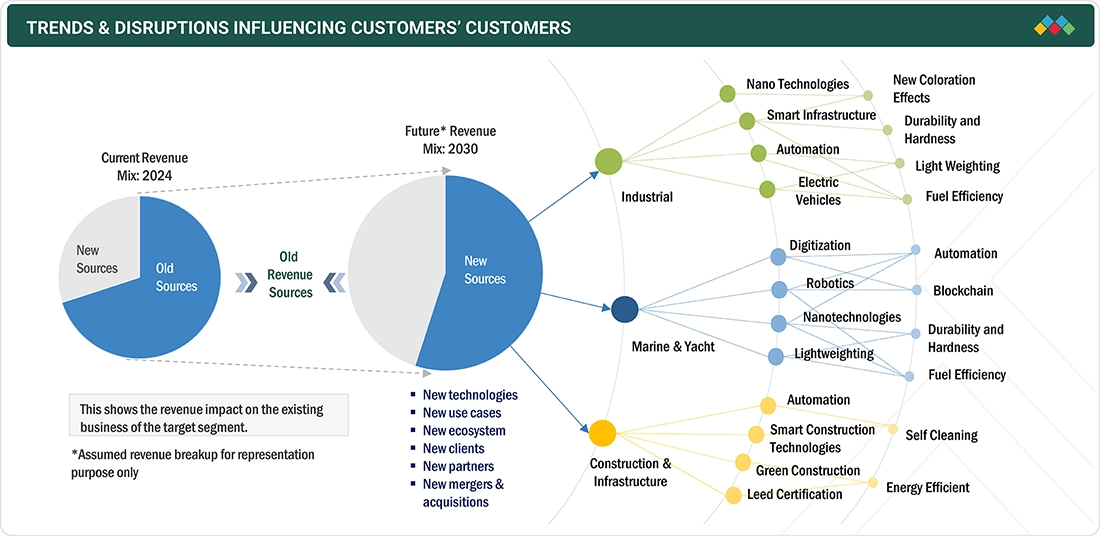

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business in the industrial coatings sector stems from evolving safety regulations, sustainability mandates, and technological disruptions across end-use industries. Industrial coating consumers include machinery and equipment manufacturers, construction firms, oil & gas operators, and transportation OEMs, which rely on coatings for corrosion protection, durability, chemical resistance, and enhanced aesthetics. Developments such as stricter VOC emission norms, energy-efficient manufacturing trends, and the shift toward waterborne and powder-based systems influence procurement decisions, production costs, and compliance frameworks for these end users. Consequently, changes in downstream industries including infrastructure expansion, renewable energy investments, and automation in manufacturing directly affect demand patterns, coating consumption volumes, and revenue flows for industrial coating consumers, thereby shaping the growth trajectory and strategic priorities of coating suppliers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

INDUSTRIAL COATINGS MARKET DYNAMICS

Level

-

Stringent environmental regulations boosting demand for VOC-free coatings

-

Increasing demand from automotive industry

Level

-

Difficulty in achieving thin films with powder coatings

-

Longer drying time of waterborne coatings

Level

-

Increasing demand for powder coatings in shipbuilding and pipeline sectors

-

Increasing use of nano-coatings

Level

-

Stringent regulatory policies

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand from automotive industry

The automotive industry is a major growth factor in the industrial coatings market. The demand for high-performance coatings is continuously increasing as automotive manufacturers shift their focus toward improving the durability, appearance, and environmental resistance of vehicles. Industrial coatings serve crucial purposes, such as protecting vehicles from corrosion, UV rays, and wear and tear while enhancing aesthetic value through high-tech finishes. As global automobile production rises and the preference for electric vehicles grows, coating manufacturers are embracing new and innovative technologies, such as green and low-VOC coatings, to meet performance demands and regulations emissions.

Restraints: Fluctuating raw material prices

Price instability of raw materials, particularly specialty additives and advanced coating materials, is one of the major obstacles in the industrial coatings market. Geopolitical tensions, supply chain disruptions, and changes in trade policies contribute to the dynamic fluctuations in the prices of key raw materials, such as titanium dioxide, epoxy resins, and specialty chemicals. Manufacturers become uncertain in their production planning and cost estimation due to these price volatilities. Smaller players, in particular, struggle to absorb sudden price increases, which can impact their profitability and, subsequently, their capacity to invest in innovation. Consequently, the fluctuation of raw materials has been one of the greatest challenges to consistent market expansion competitiveness

Opportunities: Increasing use of nanocoatings

The increasing use of nanocoatings is recognized as a key opportunity in the industrial coatings market. These advanced coatings have exceptional properties, including enhanced corrosion resistance, self-cleaning abilities, greater toughness, and improved surface finishes compared to conventional coatings. Nanocoatings are utilized across various industries, like automotive, aviation, electronics, and healthcare, as they can significantly enhance product performance and longevity. The application of nanocoatings is anticipated to grow as industries pursue high-performance and eco-friendly solutions. The commercial potential of these coatings is becoming increasingly evident due to ongoing research and development and technological advancements that open new opportunities for growth.

Challenges: Stringent regulatory policies

One of the key problems the industrial coatings market faces is the presence of strict regulatory measures. Governments and environmental agencies worldwide are imposing strict regulations on the use of volatile organic compounds (VOCs) and hazardous chemicals in coatings. Manufacturers struggle to comply with these regulations, which are intended to reduce environmental impact and protect human health. The evolving standards require companies to invest heavily in reformulating products, modifying production processes, and conducting extensive tests. Although these policies promote sustainability, they increase overall operational costs, and the product approval process is extremely slow, making it difficult for smaller players to compete.

Industrial Coatings Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Protective systems for corrosion, high-temperature, fire protection, tank linings, and e-coat/powder across industrial infrastructure and equipment | Durable barrier protection with process efficiencies and powder advantages such as strong edge coverage, transfer efficiency, and weathering resistance |

|

Low-bake Interpon D2525 Low-E architectural/industrial powder coatings and International protective linings for harsh environments | Cures at about 150°C enabling up to 20% energy savings or faster throughput while maintaining durability and color integrity on metal substrates |

|

High-performance protective and marine coatings and linings for steel fabrication and marine vessels to combat corrosion and speed return-to-service | Solutions include rapid return-to-service marine systems and thermal-insulative Heat-Flex AEB designed to address corrosion under insulation |

|

Low-temperature-cure industrial powder coatings for fabricated metal, urban furniture, and machinery with anti-gassing performance on galvanised substrates | Powder cures near 150°C to cut energy and cycle time while being VOC-free and delivering robust corrosion resistance in Alesta BE+ systems |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

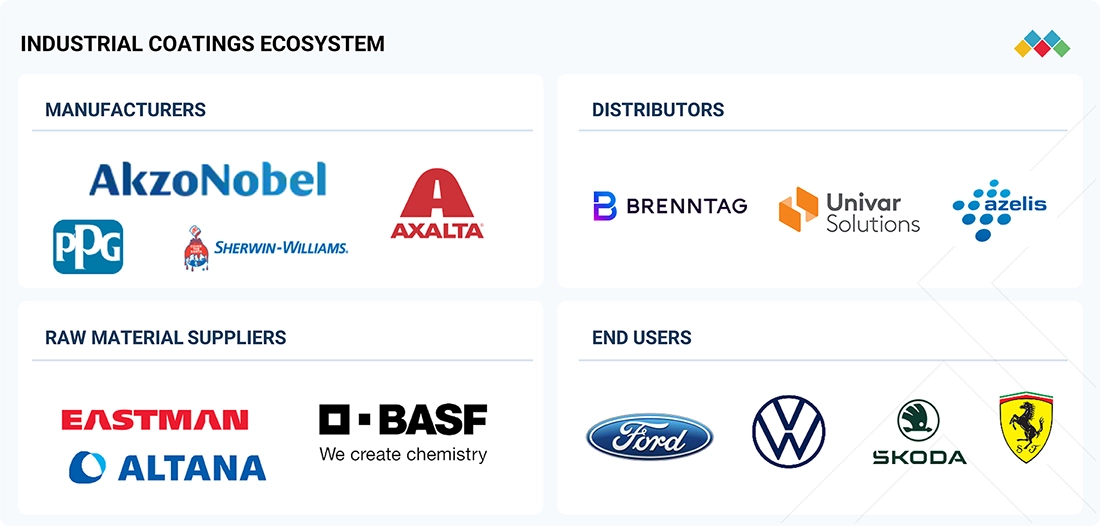

INDUSTRIAL COATINGS MARKET ECOSYSTEM

The industrial coatings ecosystem comprises raw material suppliers, coating formulators, distributors, and end users. Suppliers provide resins, pigments, solvents, additives, and curing agents to formulators, who develop protective and functional coatings through advanced dispersion, blending, and curing technologies to deliver superior corrosion resistance, chemical durability, adhesion, and aesthetics. Distributors bridge coating manufacturers with key industries such as construction, machinery, oil & gas, marine, and transportation, ensuring consistent supply, product performance, and regulatory compliance. End users apply these coatings on equipment, metal structures, pipelines, and industrial components, forming an integrated value chain influenced by sustainability trends, emission reduction mandates, and technological innovation in coating formulations and application processes.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

INDUSTRIAL COATINGS MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Industrial Coatings Market, By Resin Type

Acrylic resin holds the largest share of the industrial coatings market due to its versatility, affordability, and various application methods. Primarily used for industrial and automotive purposes, acrylic coatings are praised for their weather resistance, vibrant colors, and quick drying times. They can exist in both water and solvent forms, meeting the requirements set by environmental and regulatory authorities. Given that acrylic resins are easy to handle and utilized across multiple industries, their usage remains significantly high across the market world.

Industrial Coatings Market, By Technology

Powder coating technology is projected to be the fastest-growing segment due to its environmental advantages, high-performance features, and economic efficiency. Powder coatings do not contain volatile organic compounds (VOCs), unlike conventional solvent-borne coatings, which makes them the coating of choice as environmental regulations rise and sustainability objectives become more prominent. This technology offers a long-lasting, high-quality finish that is highly resistant to corrosion, chemicals, weathering, and mechanical abrasion, making it suitable for a wide variety of industrial applications, such as automotive components, machinery, appliances, architectural elements, and furniture.

Industrial Coatings Market, By End-Use

In 2024, the general industrial segment held the largest share of the industrial coatings market due to the high number of applications and steady demand across various industries. This segment includes equipment, machinery, metal fabrication, pipes, storage tanks, and other industrial components used in the manufacturing, infrastructure, and energy sectors. The diversity of uses ensures consistent demand for protective and performance coatings, which enhance strength, prevent corrosion, and improve appearance. It play a vital role in extending the service life of machines and equipment operating in harsh environments, such as chemical settings, high temperatures, and moisture. As industrialization continues to grow in developing economies, the demand for heavy machinery, construction equipment, and fabricated metal products rises, thereby increasing the consumption of coatings in this segment.

REGION

Asia Pacific to be largest & fastest-growing region in global industrial coatings market during forecast period

The Asia Pacific represents the largest and most valuable market for industrial coatings, both in terms of value and volume, driven by robust industrialization, increasing infrastructure development, and rising manufacturing in leading economies such as China, India, Japan, and South Korea. This region is characterized by low-cost labor, heightened urbanization, and favorable government policies that encourage industrialization and foreign investments in the manufacturing and construction sectors.

Industrial Coatings Market: COMPANY EVALUATION MATRIX

In the industrial coatings market, PPG Industries leads with a strong global presence and a comprehensive portfolio of protective, marine, and performance coatings designed to enhance durability, corrosion resistance, and surface aesthetics across a wide range of industrial applications. The company’s focus on sustainability, innovation, and advanced coating technologies, including waterborne, powder, and high-solids formulations, has positioned it as a preferred partner across key sectors such as construction, oil & gas, transportation, and heavy machinery. PPG’s continuous investments in low-VOC and energy-efficient coating systems, coupled with its development of smart and self-healing coatings, underscore its commitment to improving both environmental performance and operational efficiency for end users. Through strategic collaborations with OEMs, applicators, and infrastructure developers, PPG Industries continues to expand its market presence and deliver tailored coating solutions that meet evolving regulatory standards and sustainability goals worldwide.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

INDUSTRIAL COATINGS MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 112.0 Billion |

| Revenue Forecast in 2030 | USD 142.4 Billion |

| Growth Rate | CAGR of 4.12% from 2025-2030 |

| Actual data | 2020-2030 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Million), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Resin Type: Acrylic Resin, Alkyd Resin, Epoxy Resin, Polyester Resin, Polyurethane Resin, Fluoropolymer Resin, and Other Resin Types By Technology: Waterborne Coatings, Solventborne Coatings, Powder Coating and Other Technologies By End-Use: General Industrial, Protective, Automotive Refinish, Automotive OEM, Wood, Marine, Coil, Packaging, Aerospace, and Rail |

| Regional Scope | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

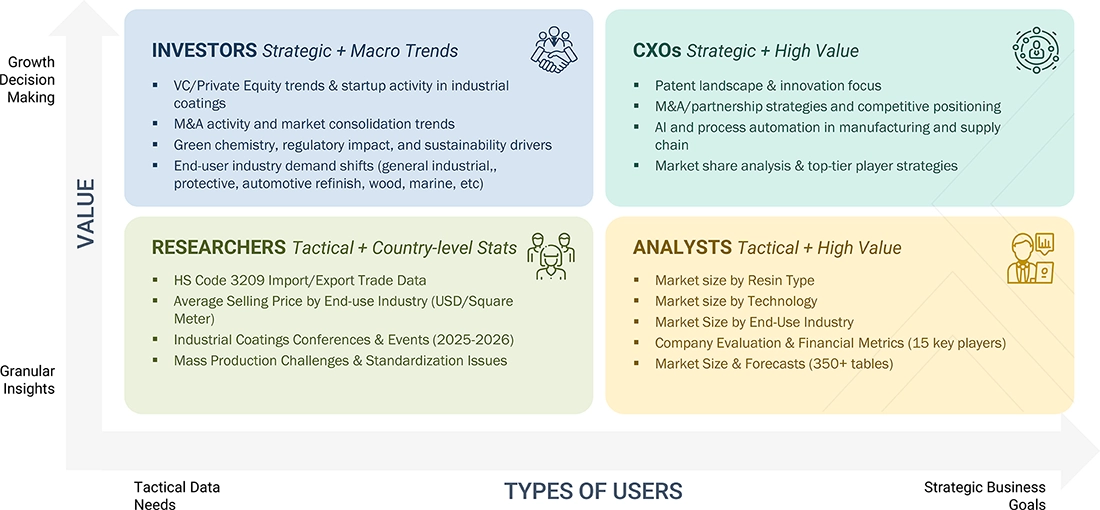

WHAT IS IN IT FOR YOU: Industrial Coatings Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe-based Industrial Coatings Producer |

|

Optimize production planning based on regional demand patterns Identify high-margin industrial users for strategic focus |

| Asia Pacific-based Industrial Coatings Manufacturer |

|

|

| North America-based Protective Coatings Supplier |

|

|

RECENT DEVELOPMENTS

- February 2025 : AkzoNobel India Ltd. aims to complete the sale of its decorative paints and industrial coatings businesses within 6–9 months, following Akzo Nobel N.V.’s directive to sell the powder coatings and R&D operations to an Akzo Nobel NV subsidiary. AkzoNobel India Ltd. may acquire the intellectual property of decorative paints from Akzo Nobel NV.

- July 2024 : Axalta Coating Systems Ltd. introduced Cerulean, a new line of waterborne industrial wood coatings designed to deliver the premium aesthetics of solvent-based finishes while significantly reducing environmental impact. The product line includes various finishes and undercoats, providing versatile solutions for high-performance, eco-friendly wood applications.

- August 2024 : Jotun A/S launched the industry’s first and only CX-rated anticorrosive powder coating, designed to protect steel used in the most extreme and aggressive environments, such as offshore and industrial areas with high salinity and humidity.

- November 2024 : PPG company formed a strategic partnership with SARO/Siccardi, Italy’s largest distributor of powder coatings, to strengthen its distribution network and customer service in the Italian market. This collaboration will expand customer access to PPG’s high-quality powder coatings.

Table of Contents

Methodology

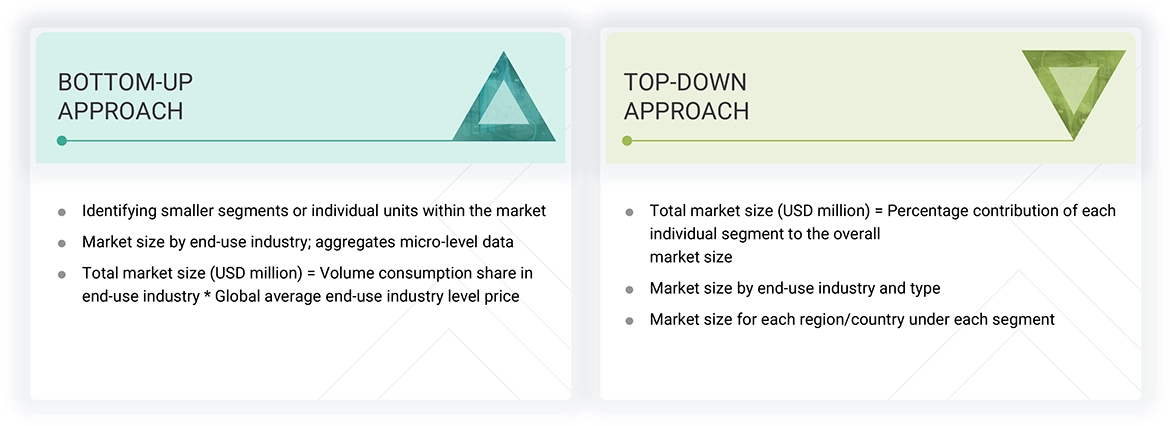

The study involved four major activities in estimating the market size for the industrial coatings market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of the profiles of the primary interviewees is illustrated in the figure below.

Primary Research

The industrial coatings market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by key opinion leaders in various applications for the industrial coatings market. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023/2024, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| PPG Industries Inc. | Sales Manager | |

| Axalta Coating Systems LLC | Product Development Manager | |

| Asian Paints | Business Development Manager | |

| BASF SE | Marketing Manager | |

| AkzoNobel N.V. | Senior Manager | |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the industrial coatings market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Industrial Coatings Market: Bottom-up and Top-down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the industrial coatings industry.

Market Definition

Industrial coatings are specialized paints and coatings used to protect, enhance durability, and improve the appearance of infrastructure, machinery, equipment, and goods. Such coatings are found in the automotive, general manufacturing, marine, oil & gas, construction, and appliances industries. Examples of industrial coatings include those that use solvents, water, powder, and various other technologies. These technologies employ resins such as epoxy, polyurethane, acrylic, polyester, fluoropolymer, and alkyd, among others. The primary function of paints is to protect surfaces from rust, wear, and pollution while also enhancing their appearance and performance.

Stakeholders

- Industrial Coating Manufacturers

- Industrial Coating Distributors

- Raw Material Suppliers

- Service Providers

- Packaging Companies

- Government and Research Organizations

Report Objectives

- To analyze and forecast the size of the global industrial coatings market in terms of value and volume

- To provide detailed information about the important drivers, restraints, challenges, and opportunities influencing the market growth

- To define, describe, and segment the market based on resin type, technology, end-use industry, and region

- To forecast the size of the market segments based on regions such as Asia Pacific, North America, Europe, the Middle East & Africa, and South America

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contributions to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments such as expansions, partnerships & collaborations, mergers & acquisitions, agreements, and product launches in the market

- To strategically profile the key companies and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Who are the major players in the industrial coatings market?

The key players profiled in the report include The Sherwin-Williams Company (US), PPG Industries Inc. (US), AkzoNobel N.V. (Netherlands), Axalta Coating Systems LLC (US), Jotun A/S (Norway), Nippon Paint Holdings Co., Ltd. (Japan), Kansai Paint Co., Ltd. (Japan), RPM International Inc. (US), Hempel A/S (Denmark), and BASF Coatings GmbH (Germany).

What are the drivers and opportunities for the industrial coatings market?

Rapid industrialization in the Asia Pacific is a key driver. Countries like China, India, Vietnam, and Indonesia are expanding in manufacturing, construction, and automotive sectors. Favorable government policies, foreign direct investments, and industrial corridor developments are also boosting demand for industrial coatings.

Which strategies are the key players focusing on in the industrial coatings market?

Key players are focusing on product launches, partnerships, mergers and acquisitions, agreements, and expansions to strengthen their global market presence.

What is the expected growth rate of the industrial coatings market between 2025 and 2030?

The industrial coatings market is projected to grow at a CAGR of 4.12% in terms of value during the forecast period.

Which major factors are expected to restrain the growth of the industrial coatings market during the forecast period?

The longer drying time of waterborne coatings and the difficulty in achieving thin films with powder coatings are expected to restrain market growth.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Industrial Coatings Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Industrial Coatings Market