Immersion Cooling Market

Immersion Cooling Market by Type (Single Phase, Two Phase), Application (High-performance Computing, Edge Computing, Cryptocurrency Mining), Cooling Fluid, Component (Solutions, Services), and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

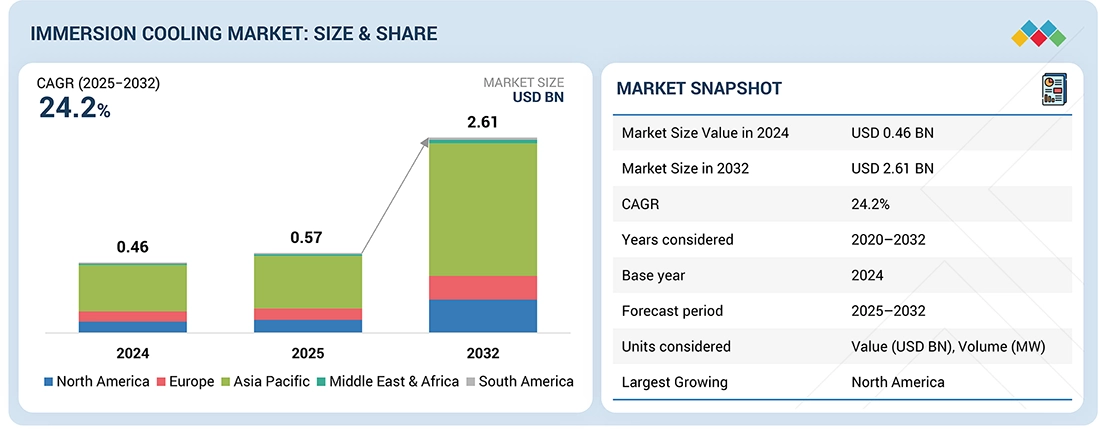

The immersion cooling market is projected to reach USD 2.61 billion by 2032 from USD 0.57 billion in 2025, at a CAGR of 24.2% from 2025 to 2032. The market is witnessing robust growth worldwide due to the growing applications of immersion cooling technologies in high-performance computing and cryptocurrency mining.

KEY TAKEAWAYS

-

BY TYPEThe immersion cooling market comprises single-phase immersion cooling and two-phase immersion cooling. High demand from cryptocurrency mining and high-performance computing is expected to drive the single-phase immersion cooling segment during the forecast period.

-

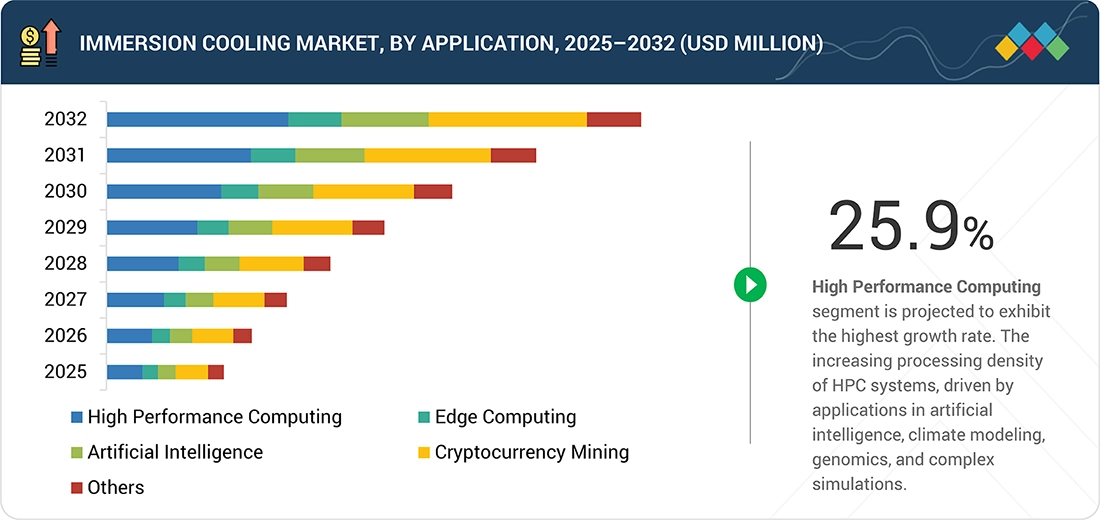

BY APPLICATIONThe key applications include high-performance computing, edge computing, artificial intelligence, cryptocurrency mining, and other applications. There is an increase in the adoption of immersion cooling in the cryptocurrency mining application as it is the most cost-effective method to gain the maximum hash rate from any ASIC or GPU-based cryptocurrency miner.

-

BY COMPONENTThe component segment includes solutions and services. The high demand for custom immersion cooling systems is expected to drive the services segment during the forecast period.

-

BY COOLING FLUIDThe cooling fluid segment includes synthetic fluids, mineral oil, fluorocarbon-based fluids, and other cooling fluids. The synthetic fluids segment is expected to lead the immersion cooling market during the forecast period owing to its extensive use in single-phase immersion cooling and its advantages, such as efficiency, cooling, capacity, low maintenance, and hardware reliability over the other fluid types.

-

BY REGIONImmersion cooling market covers Europe, North America, Asia Pacific, South America and Middle East and Africa. North America is the largest market for immersion cooling as it is one of the largest consumers of immersion cooling solutions globally due to presence of many data centers and the rise in the popularity of advanced technologies, such as AI and big data, in the region.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including new product launches, partnerships, and expansions. For instance, in October 2023, GRC (Green Revolution Cooling) Inc., a leader in single-phase immersion cooling for data centers, announced the launch of a new data center solution, Next-Gen Immersion Cooled Data Centers in the Middle East & Africa, in collaboration with Dell Technologies and DCV Industries.

The immersion cooling market is witnessing steady growth, driven by the escalating demands of high-performance computing (HPC) and artificial intelligence (AI) workloads in hyperscale data centers. These modern infrastructures generate significantly more heat than traditional IT environments, rendering conventional air-cooling methods increasingly inadequate. As a result, operators are transitioning toward more efficient, environmentally sustainable alternatives. Immersion cooling involves submerging IT hardware in thermally conductive, dielectric fluids, enabling superior heat dissipation, higher component density, and extended equipment lifespan.

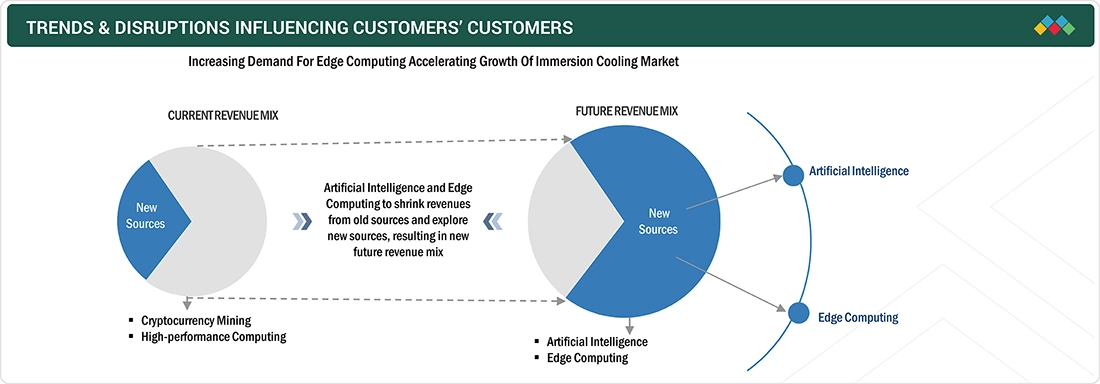

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Over the next five years, the immersion cooling market will shift from a niche 20% share to dominating the data center cooling value chain, as hyperscale, AI, and edge data centers adopt liquid-based thermal architectures. New opportunities will emerge across fluid innovation, system design, service models, and sustainability integration, creating an interconnected ecosystem that drives measurable decarbonization and operational gains across the digital infrastructure landscape.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Adoption of cryptocurrency mining & blockchain

-

•Growing density of servers

Level

-

•Susceptibility to leakage

-

•Dominance of air cooling technology

Level

-

•Adoption in low-density data centers

-

•Emergence of AI, high-performance electronics, telecom, and other technologies

Level

-

•High investments in existing infrastructure

-

•Retrofitting immersion cooling solutions in large and medium-scale data centers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Adoption of cryptocurrency mining and blockchain

The expansion of cryptocurrency mining and the broader adoption of blockchain technologies are expected to significantly drive the demand for immersion cooling. Cryptocurrency mining requires intensive computational power to solve complex cryptographic algorithms, generating substantial heat. Immersion cooling offers a highly effective thermal management solution that maintains optimal operating temperatures and reduces overall energy consumption. These benefits have renewed interest and investment in crypto mining infrastructure, with immersion cooling emerging as a strategic enabler. Key advantages include enhanced energy efficiency, extended hardware lifespan, and improved mining performance, all of which contribute to better ROI for operators in this space.

Restraint: Susceptibility to leakage

Despite its numerous advantages, immersion cooling faces certain operational challenges most notably, the risk of fluid leakage. Although immersion systems offer superior heat dissipation and significantly lower water usage, their susceptibility to leaks can compromise system performance and reliability. This concern is particularly evident with fluorocarbon-based dielectric fluids, which, although non-flammable and thermally stable, still present a leakage risk. Furthermore, limited industry familiarity with immersion cooling technologies and a lack of awareness around potential leakage issues may hinder broader adoption. Addressing these knowledge gaps and technical risks will be essential for sustaining long-term growth in this segment.

Opportunity: Adoption of low-density data centers

The adoption of low-density server architectures represents a strategic opportunity for the expansion of the immersion cooling market. As data center operators increasingly prioritize compact, scalable, and energy-efficient infrastructure, low-density servers complement immersion cooling technologies. These servers enable higher hardware consolidation and reduce the physical footprint of data centers, aligning well with the space optimization and thermal efficiency inherent to immersion cooling systems. When integrated, this combination delivers tangible benefits, including lower energy consumption, reduced maintenance requirements, and enhanced overall cost-effectiveness. With the continued growth in demand for data processing driven by emerging technologies such as the Internet of Things (IoT), artificial intelligence (AI), and blockchain, the synergy between low-density servers and immersion cooling is expected to play a pivotal role in supporting next-generation data center infrastructure.

Challenge: High investments in existing infrastructure

A key challenge hindering the broader adoption of immersion cooling technology is the substantial capital investment required for infrastructure and specialized equipment. Implementing immersion cooling systems necessitates the deployment of purpose-built components such as dielectric fluid tanks, pumps, and heat exchangers, all of which entail significant upfront costs. Moreover, retrofitting existing data center facilities to accommodate immersion cooling often requires extensive structural modifications, adding to the overall financial burden. These integration complexities and cost considerations can present barriers for operators with substantial investments in legacy infrastructure, potentially slowing the pace of adoption despite the long-term operational benefits.

Immersion Cooling Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployed two-phase immersion cooling in Azure data centers to support AI and high-density GPU workloads. Immersed entire servers in dielectric fluid for enhanced thermal control. | Reduced server power consumption by 5-15% through lower fan usage. | Achieved PUE < 1.07 in pilot facilities. |Enabled higher rack densities (>80 kW/rack). |

|

Evaluated immersion cooling for AI training clusters and next-gen data centers to manage extreme GPU heat loads. | Improved thermal uniformity across racks. | Lower operational noise and footprint. | Supports sustainable compute scaling for AI infrastructure. |

|

Developed SmartPod single-phase immersion cooling systems adopted by multiple colocation and enterprise clients (including Telefónica, Orange). | Up to 50% reduction in cooling energy vs air-cooled systems. | Space savings up to 45%. | Simplified maintenance (no air filters, fewer moving parts). |

|

Supplies ICEraQ and ICEtank systems for edge, enterprise, and hyperscale data centers (e.g., with Dell, HPE, Intel partnerships). | Modular retrofit design. | Density up to 100 kW/rack. | 30-50% reduction in cooling OPEX. | Easier deployment for HPC and AI clusters. |

|

Uses immersion cooling in Japan’s data centers for HPC and enterprise workloads; testing multi-phase fluids for energy reuse. | Energy efficiency improvements of 30-40%. | Reuse of waste heat for facility heating. | Reduced chiller requirements in dense compute setups. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The immersion cooling market ecosystem consists of immersion cooling fluids providers (e.g., Shell Plc, The Lubrizol Corporation), immersion cooling solution providers (e.g., Asperitas, Midas Immersion Cooling), distributors (e.g., Prasa, Hibernia), and immersion cooling solution users (e.g., Microsoft, Intel). Immersion cooling fluids like synthetic fluids, mineral oil are provided to immersion cooling solution providers for use in various applications. Immersion cooling solution users drive demand for data centers. Collaboration across the value chain is key to innovation and market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Immersion cooling Market, By Application

Based on application, the growing adoption of high-performance computing (HPC) is a major catalyst for the rising demand for immersion cooling technologies. As a critical solution within the broader data center cooling ecosystem, immersion cooling addresses the key challenges associated with HPC workloads, including extreme heat dissipation, energy efficiency requirements, environmental sustainability, and the need to support ongoing technological advancements. With traditional air-cooling systems approaching their thermal and spatial limitations, immersion cooling is emerging as a more viable and scalable alternative. The increasing processing density of HPC systems, driven by applications in artificial intelligence, climate modeling, genomics, and complex simulations, demands robust thermal management solutions that conventional methods struggle to deliver. Immersion cooling offers superior thermal efficiency, enabling higher server density, better space utilization, and support for more intensive processor loads. This alignment with performance and sustainability goals accelerates investment and innovation in next generation cooling technologies across the HPC landscape.

Immersion cooling Market, By Type

Single-phase immersion cooling is projected to be a larger segment of the global immersion cooling market. This dominance is primarily attributed to its proven efficiency in heat dissipation and operational simplicity. The dielectric fluids used in single-phase systems possess high heat capacity and strong thermal conductivity, enabling them to effectively absorb and transfer heat away from electronic components without undergoing a phase change. This consistent thermal performance supports the stable operation of high-performance computing (HPC) systems by maintaining optimal operating temperatures. As a result, single-phase immersion cooling not only enhances system efficiency and reliability but also contributes to extended hardware lifespan. These advantages, coupled with lower maintenance complexity and easier integration into existing infrastructure, continue to drive its widespread adoption across data centers and compute-intensive environments.

REGION

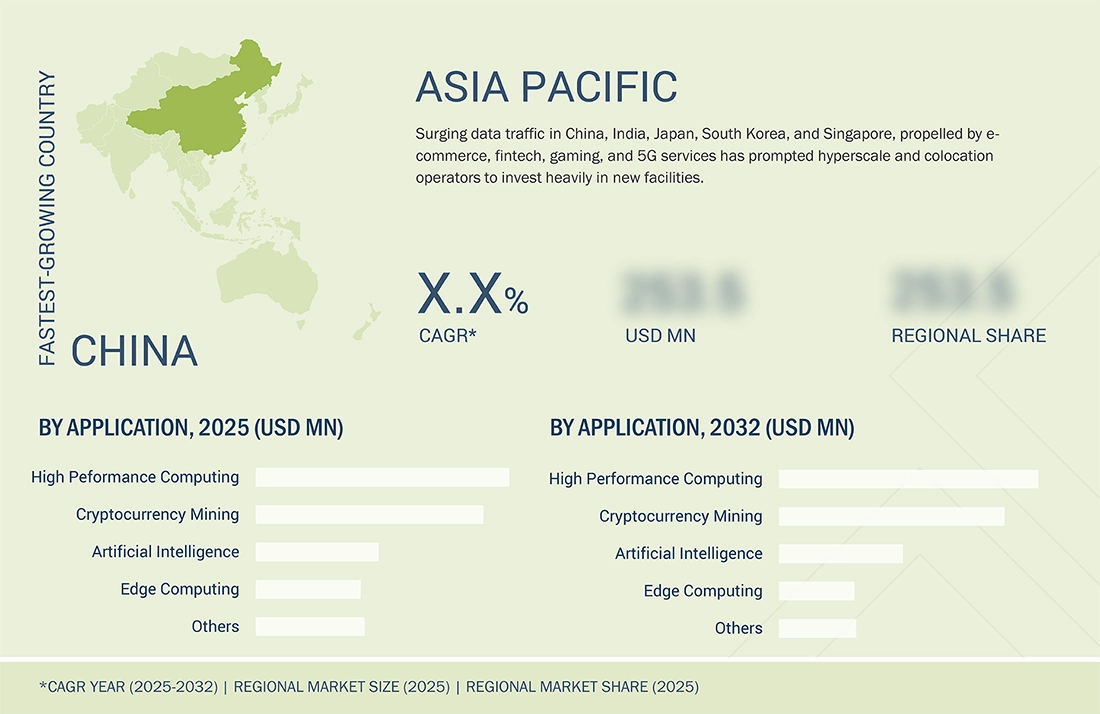

Asia Pacific immersion cooling market to register highest CAGR during forecast period

The Asia Pacific immersion cooling market is forecast to register the highest CAGR globally, driven by an accelerated expansion of data center capacity underpinned by digital transformation initiatives, near-universal internet access, and rapid adoption of cloud and artificial intelligence platforms. Surging data traffic in China, India, Japan, South Korea, and Singapore, propelled by e-commerce, fintech, gaming, and 5G services has prompted hyperscale and colocation operators to invest heavily in new facilities. Conventional air-cooling technologies are often cost-prohibitive in hot, humid Asia Pacific climates for next-generation data centers whose density and performance requirements continue to climb. Immersion cooling offers a sustainable, space-efficient solution capable of managing elevated heat loads while reducing energy consumption and footprint. Favorable government policies promoting energy-efficient, green technologies further catalyze the transition from air-based to immersion cooling systems. With data center deployments accelerating across the region, mounting environmental imperatives, and intensifying cost pressures, Asia Pacific is set to lead the global market for immersion cooling throughout the forecast period.

Immersion Cooling Market: COMPANY EVALUATION MATRIX

In the immersion cooling market matrix, Submer (Star) leads with a strong market share and extensive product footprint, driven by its immersion cooling solutions which is adopted by various applications. Midas Immersion Cooling (Emerging Leader) demonstrate substantial product innovations compared to their competitors. While Submer dominates through scale and diversified portfolio, Midas Immersion Cooling shows significant potential to move toward the leaders’ quadrant as demand for immersion cooling continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.46 BN |

| Market Forecast in 2032 | USD 2.61 BN |

| CAGR (2025–2032) | 24.2% |

| Years considered | 2020–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD BN), Volume (MW) |

| Report Coverage | The report defines, segments, and projects the immersion cooling market size based on product type, source, grade, form, purity, application, end-use industry, and region. It strategically profiles the key players and comprehensively analyzes their market share and core competencies. It also tracks and analyzes competitive developments, such as new product development, agreements, acquisitions, and expansions they undertake in the market. |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

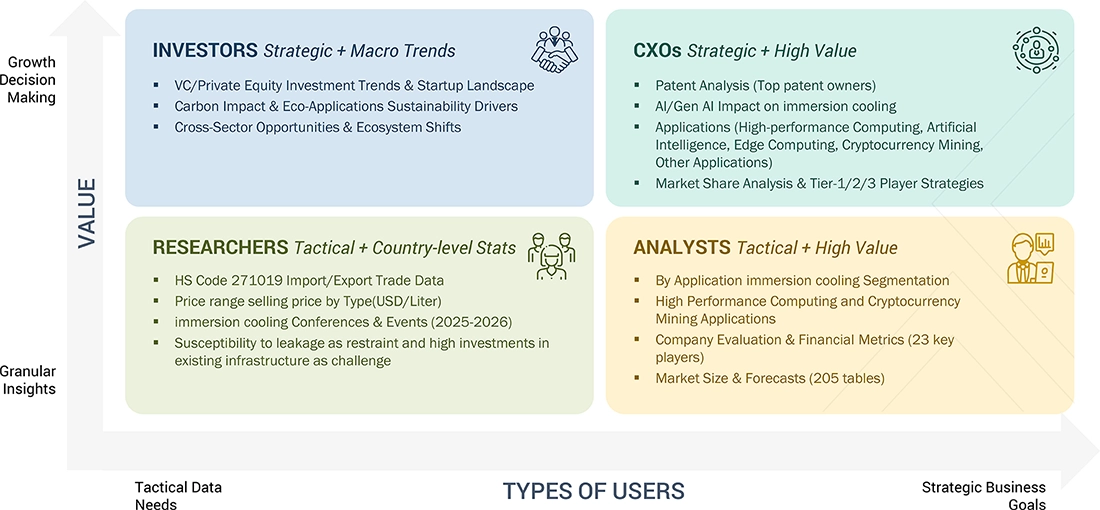

WHAT IS IN IT FOR YOU: Immersion Cooling Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Data Center Operators & Hyperscalers |

|

|

| Cloud & AI Infrastructure Providers |

|

|

| Edge & Telecom Infrastructure |

|

|

| Fluid Manufacturers & Chemical Suppliers |

|

|

| System Integrators & OEMs |

|

|

RECENT DEVELOPMENTS

- October 2023 : GRC (Green Revolution Cooling) Inc., a leader in single-phase immersion cooling for data centers, announced the launch of a new data center solution, Next-Gen Immersion Cooled Data Centers in the Middle East & Africa, in collaboration with Dell Technologies and DCV Industries.

- October 2023 : Submer and Intel collaborated to enhance single-phase immersion technology through a Forced Convection Heat Sink (FCHS) package. It reduces the quantity and cost of components required for comprehensive heat capture and the dissipation of chips with Thermal Design Power (TDP) exceeding 1000W.

- May 2020 : Asperitas partnered with Maincubes, a European data center owner/operator. The two companies planned to offer immersion cooling solutions in dedicated immersion cooling colocation suites in the Maincubes Amsterdam AMS01 data center. AMS01 is also home to the European Open Compute Project (OCP) Experience Center, while Asperitas is a leading OCP standards contributor in immersion cooling.

Table of Contents

Methodology

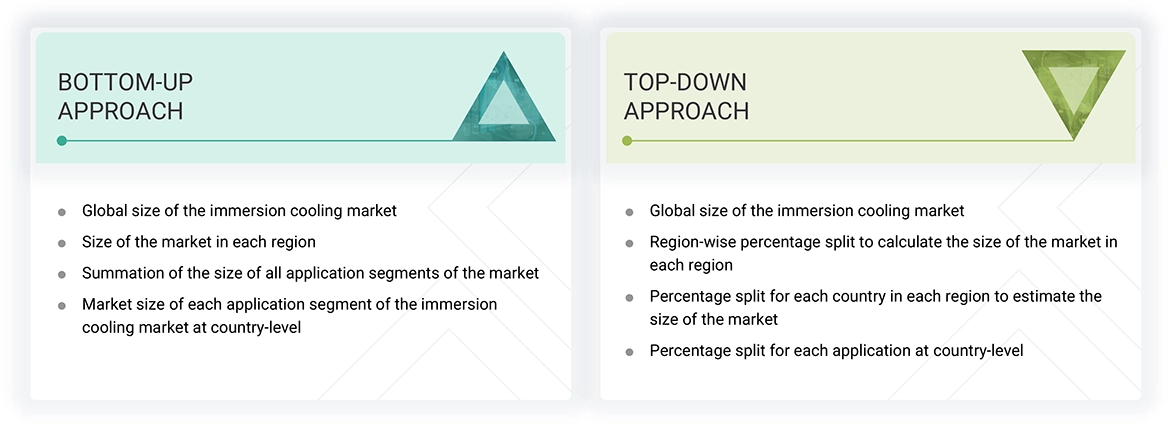

The estimation of the current size of the immersion cooling market was conducted through a structured four-phase approach. Extensive secondary research was undertaken to gather insights across the immersion cooling market, including related peer and parent markets. This phase involved the analysis of industry reports, company filings, investor presentations, white papers, and relevant publications. Preliminary findings, assumptions, and data points were validated through primary research involving in-depth interviews with key stakeholders across the immersion cooling value chain—such as technology providers, system integrators, data center operators, and regulatory experts. A combination of top-down and bottom-up methodologies was used to derive the overall market size. The top-down approach analyzed broader industry trends and macroeconomic indicators, while the bottom-up approach aggregated revenue contributions from key market participants and regional segments. Final estimates were refined using data triangulation techniques, ensuring consistency across various data sources. The market was segmented by type, application, cooling fluid, component, and region to determine the size of individual segments and sub-segments with a high degree of accuracy.

Secondary Research

The research methodology used to estimate and forecast the immersion cooling market begins with capturing data on the revenues of key vendors in the market through secondary research. In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, Factiva, and Industry Journals, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, notifications by regulatory bodies, trade directories, and databases. Vendor offerings have also been taken into consideration to determine market segmentation.

Primary Research

The immersion cooling market comprises several stakeholders in the supply chain, such as immersion cooling fluid providers, technology manufacturers, data center manufacturers, traders, associations, and regulatory organizations. The development of high-performance computing, edge computing, artificial intelligence, cryptocurrency mining, and other applications characterize the demand side of this market. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the immersion cooling market. These methods were also used extensively to determine the market size of various segments. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the immersion cooling market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that impact the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Immersion Cooling Market Size: Top-Down and Bottom-Up Approaches

Data Triangulation

The market was split into several segments and sub-segments after arriving at the overall market size using the market size estimation processes as explained above. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and determine each market segment’s and subsegment’s exact statistics. The market size was calculated globally by summing up the country-level and regional-level data.

Market Definition

The global immersion cooling industry centers on the provision of advanced thermal management solutions for high-performance electronic systems, particularly in data centers, supercomputing environments, and other high-density computing applications. The immersion cooling process involves submerging electronic components directly into thermally conductive, dielectric liquids that efficiently absorb and dissipate the heat generated during operation. This innovative cooling approach is gaining widespread adoption because it significantly improves energy efficiency, reduces operational costs, and enhances system performance and reliability. As demand for high-density computing infrastructure continues to escalate—driven by AI, HPC, cloud services, and edge computing—the role of immersion cooling in enabling scalable, sustainable, and efficient data center environments is becoming increasingly critical. The global immersion cooling market is expected to play a foundational role in supporting the next generation of green, energy-efficient digital infrastructure worldwide.

Stakeholders

- Data center operators

- Crypto miners

- Manufacturers of immersion cooling fluids

- Associations and industrial bodies (American National Standards Institute (ANSI), American Society of Heating, Refrigerating, and Air-Conditioning Engineers (ASHRAE), National Electrical Manufacturers Association (NEMA), Telecommunication Industry Association (TIA), Canadian Standards Association Group (CSA Group))

- NGOs, governments, investment banks, venture capitalists, and private equity firms

Report Objectives

- To define, describe, and forecast the size of the global immersion cooling market in terms of value

- To provide detailed information regarding the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the immersion cooling market

- To analyze and forecast the size of various segments (type, component, cooling fluid, application, and region) of the immersion cooling market based on five major regions—North America, Europe, Asia Pacific, South America, and Middle East & Africa, along with key countries in each of these regions

- To analyze recent developments and competitive strategies, such as expansions, product launches, collaborations, and acquisitions, to draw the competitive landscape of the market

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Key Questions Addressed by the Report

What is immersion cooling?

Immersion cooling technology, also known as direct liquid cooling, cools electrical and electronic components, including complete servers and storage devices, by submerging them in a thermally conductive but electrically insulating liquid coolant.

What is the current size of the global immersion cooling market?

The global immersion cooling market is estimated to be valued at USD 0.57 billion in 2025 to USD 2.61 billion by 2032, at a CAGR of 24.2%.

Who are the winners in the global immersion cooling market?

LiquidStack (Netherlands), Fujitsu (Japan), Green Revolution Cooling Inc (US), Submer (Spain), Asperitas (Netherlands), and Midas Green Technologies (US) are the leading players. They have adopted strategies such as expansions, agreements, mergers & acquisitions, partnerships, product launches, and technological developments to strengthen their market presence.

Which are the key regions in the global immersion cooling market?

North America is the major regional market due to the growing demand for immersion cooling in cryptocurrency mining.

What is the primary type of immersion cooling technology used in the global market?

The single-phase immersion cooling technology has witnessed notable growth due to several factors that make it an attractive solution for cooling high-performance computing systems.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Immersion Cooling Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Immersion Cooling Market