Hemostats Market: Growth, Size, Share, and Trends

Hemostats Market by Type (Thrombin, Combination, Gelatin, Collagen), Formulation (Matrix & Gel, Sheet & Pad, Sponge, Powder), Application (Orthopedic, General, Cardiovascular), End User (Hospital, Specialty Clinic), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global hemostats market is projected to reach 4.0 billion in 2030 from USD 2.9 billion in 2025, at a CAGR of 6.4% during the forecast period. Hemostats are surgical agents designed to control bleeding by promoting clot formation during operative procedures. These products are primarily used by surgeons across specialties such as cardiovascular, orthopedic, neurosurgery, and general surgery where intraoperative blood management is critical. Absorbable hemostats, gelatin-based matrices, cellulose-based agents, and thrombin-based sealants are the most widely used products. The hemostats market is experiencing steady growth, primarily due to the rising volume of surgical procedures worldwide. The increasing prevalence of chronic diseases, trauma cases, and complex surgeries is driving the demand for effective bleeding management solutions, as reliable hemostats are essential to improve surgical outcomes and reduce perioperative complications

KEY TAKEAWAYS

-

BY TYPEThe hemostats market can be categorized into several types:oxidized regenerated cellulose-based hemostats, thrombin-based hemostats, combination hemostats, gelatin-based hemostats, collagen-based hemostats, and other hemostats . Oxidized regenerated cellulose-based hemostats are expected to account for the largest share during the forecast period due to their proven efficacy, biocompatibility, and widespread use across multiple surgical specialties. They offer advantages such as rapid hemostasis, complete absorbability, ease of handling, and lower risk of infection compared to some alternatives.

-

BY FORMULATIONThe global hemostats market is differentiated into matrix & gel hemostats, sheet & pad hemostats, sponge hemostats, and powder hemostats. Among them, the the matrix & gel hemostats segment dominated the hemostats market in 2024 due to reasons such as such as their superior ability to conform to irregular wound surfaces, rapid onset of action, and high efficacy in controlling bleeding in both minimally invasive and open surgeries. These products are versatile, easy to apply, and effective even in challenging surgical environments where conventional hemostatic agents may be less efficient.

-

BY END USERThe hemostats market can be divided by end user into three main categories: Hospitals, specialty clinics, and other end users. The hospitals are the most significant portion of the hemostats market due to the high number of surgical procedures conducted in hospitals and the presence of well-established surgical department.

-

BY REGIONThe hemostats market is segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Among these regions, Asia Pacific is anticipated to be the fastest-growing market with the CAGR of 8.8% for hemostats during the forecast period. This growth is due to the rapid increase in surgical procedures, rising healthcare expenditure, and expanding access to advanced surgical products.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including product launches, partnerships, and acquisitions. For example, in May 2022, Johnson & Johnson Services, Inc. (US) acquired GATT Technologies B.V. (Netherlands) to expand its biosurgery portfolio with synthetic polymer-based hemostatic technology and develop advanced solutions like the ETHIZIA Hemostatic Patch.

The hemostats market is experiencing consistent growth due to several factors. As the global population ages, the prevalence of chronic conditions and the number of surgical procedures are rising, leading to an increased demand for advanced hemostatic agents. Additionally, government support for improving surgical infrastructure and favorable reimbursement schemes for surgical interventions are further promoting market growth.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The dental consumables market is undergoing a significant transformation, driven by advancements in material science, evolving dental care models, rising prevalence of dental diseases, and changing patient expectations. In this evolving landscape, oxidized regenerated cellulose-based hemostats, gelatin-based hemostats, thrombin-based hemostats, and collagen-based hemostats remain central to surgical procedures. These hemostats help dentists achieve rapid and effective bleeding control, simplify procedures, and improve patient outcomes, making them a core component of modern dental practice.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing volume of surgical procedures performed

-

Increasing focus on R&D

Level

-

Side effects and allergic reactions associated with hemostats

Level

-

Growth potential in emerging economies

-

. Growing number of hospitals

Level

-

Lack of skilled personnel for effective use of biosurgery products

-

. Stringent regulatory framework

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing volume of surgical procedures performed

The increasing number of surgical procedures is largely due to the growing global burden of chronic and age-related diseases. The elderly are often affected by conditions like osteoporosis, arthritis, lumbar spinal stenosis (LSS), gastroesophageal reflux disease (GERD), and benign prostatic hyperplasia (BPH), which frequently require surgery to restore function or reduce pain. Patients who have arthritis or osteoporosis commonly present with compromised bone frameworks and weaker vasculature, predisposing them to excessive bleeding during surgeries such as joint arthroplasty or spinal procedures. Hemostatic agents then become pivotal in the attainment of quick and consistent bleeding control, which lowers the risk of hematoma formation, surgical wound infection, and longer operative times. Additionally, increasing popularity of minimally invasive surgical techniques, which continue to call for efficient hemostasis within closed surgical spaces, further stimulates demand for enhanced hemostatic products. Increased patient awareness, development in surgical facilities, and heightened emphasis on optimized recovery procedures also contribute to the increasing application of hemostats in various specialties of surgery

Restraint: Side effects and allergic reactions associated with hemostats

Hemostats, especially those originating from biological or animal sources, have been linked to side effects like fibrosis, allergic reactions, delayed wound healing, and in rare instances, surgical site infections. For instance, when used in tendon repair, absorbable gelatin-based sponges have been shown to induce excessive fibrotic responses, which may reduce tissue mobility. Furthermore, incomplete absorption of leftover hemostatic materials may cause localised inflammation or impede tissue regeneration. Such adverse consequences can raise the procedural difficulty, extend recovery periods, and lower clinician assurance for specific product types. Risk for adverse outcomes has also contributed to increased regulatory oversight and caution regarding uptake of new products—most notably in cost-cutting or resource-restricted environments. Consequently, manufacturers are under pressure to prove product safety and biocompatibility in order to sustain trust and achieve widespread adoption.

Opportunity: Growth opportunities in emerging economies

Emerging countries across the Asia Pacific, Latin America, and the Middle East & Africa offer significant growth opportunities to major market players operating in the hemostats market. This can be attributed to the healthcare infrastructural improvements in these countries, the growing patient population, and the rising healthcare expenditure. Moreover, the disposable income of populations in developing and emerging countries is on the rise. This increase is another key indicator of expanding access to healthcare. With rising disposable incomes and the increasing medical needs of the middle-class population, hemostats manufacturers are compelled to devise new strategies to meet this demand. Currently, emerging markets are underpenetrated by major players, which indicates a huge untapped market potential.

Challenge: Dearth of skilled personnel for effective use of hemostats

Trained professionals are required for effective usage of hemostats, since their misuse—e.g., inadequate arterial closure—may lead to continued bleeding or ischemia. Some hemostatic devices require procedural steps with more than one step, which demands technique and expertise. Despite the impact of such devices on reducing bleeding, there remains a shortage of trained surgeons and operating room personnel in developed as well as developing nations. In addition, as hemostatic products continue to rapidly evolve in technology and applications, healthcare professionals need to keep on updating their competence to handle them safely and effectively. Without proper training, even highly effective hemostats can be underutilized or wrongly applied, diminishing the maximum benefits of such products in the operating room

Hemostats Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Surgicel Absorbable Hemostats designed for adjunctive use in surgical procedures to control capillary, venous, and small arterial bleeding. | Provides effective bleeding control, fully absorbable, reduces intraoperative blood loss, lowers infection risk, and improves procedural efficiency. |

|

Floseal Hemostatic Matrix composed of gelatin granules and thrombin for controlling bleeding during surgery. | Rapid hemostasis even in challenging surgical fields, conforms to irregular wound surfaces, reduces transfusion need, and shortens surgical time. |

|

Gel-Flow Hemostat absorbable gelatin-based material used in surgical procedures for temporary control of bleeding | Provides safe and effective hemostasis, easy handling and application, fully resorbable, minimizes post-operative complications |

|

Sangustop absorbable cellulose-based hemostat used to control bleeding during surgical interventions. | Biocompatible and absorbable, promotes clot formation, reduces surgical complications, and improves wound healing outcomes. |

|

Arista AH Hemostat plant-based absorbable hemostatic powder for surgical procedures | Provides immediate and effective bleeding control, ready-to-use without preparation, resorbable, reduces operative risks, and enhances patient safety |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The hemostats market operates within a structured and interdependent ecosystem comprising manufacturers, distributors, healthcare providers, regulatory authorities, and advocacy organizations. Manufacturers are responsible for the development and innovation of hemostatic agents designed to meet a broad range of surgical requirements. Distributors play a critical role in ensuring the timely and efficient availability of these products across hospitals and surgical facilities. Healthcare providers, supported by skilled surgical teams, are key end users, applying these agents to manage intraoperative bleeding effectively. Regulatory bodies establish and enforce stringent standards to ensure product safety, quality, and efficacy prior to market entry. Advocacy groups contribute by promoting awareness, clinical best practices, and education related to bleeding control. Patients and caregivers remain central to this ecosystem, as clinical outcomes and safety considerations continue to drive product adoption. Additionally, advancements in surgical technologies and the increasing preference for minimally invasive procedures are expected to further support market growth

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Hemostats Market, By Type

The hemostats market is bifurcated into oxidized regenerated cellulose-based hemostats, thrombin-based hemostats, combination hemostats, gelatin-based hemostats, collagen-based hemostats, and other hemostats on the basis of type. Among them, combination hemostats is expected to witness highest CAGR during the forecast period. Combination hemostats tend to be more effective at inducing hemostasis than single-agent products because they are able to capitalize on the benefits of several hemostatic mechanisms. For instance, a combination of a gelatin matrix, which offers a physical scaffold, and thrombin, which actively induces clot formation, leads to quicker and more consistent bleeding control. Through the combination of both mechanical and biochemical mechanisms, these agents are able to control hemostasis faster than single-mechanism agents, serving to decrease surgical time and blood loss. Other benefits include decreased transfusion requirements, enhanced wound healing, lower postoperative complications, shorter hospitalization stays, and better efficacy for treating complex or diffuse bleeding cases—additionally propelling their increasing clinical and market utilization

Hemostats Market, By Formulation

The global hemostats market is differentiated into matrix & gel hemostats, sheet & pad hemostats, sponge hemostats, and powder hemostats. In 2024, the matrix & gel hemostats segment dominated the hemostats market. These formulations strike a balance between versatility and effectiveness, appealing to a broad spectrum of surgical scenarios. This segment's progress is fueled by the utility and efficacy of these formulations, which are easy to apply even in complex or minimally accessible surgical fields—highly surgeon-user-friendly. They can conform to irregular surfaces of wounds and provide good control of active and oozing bleeding. Matrix and gel hemostats find extensive applications in a number of different specialties such as orthopedic, neurosurgical, cardiovascular, and general surgery, thus increasing their clinical application. Several of these products are biocompatible and resorbable and reduce the risk of immune response while ruling out the necessity for removal following surgery. A number of these preparations are suitable for use with laparoscopic procedures and are blended with active ingredients such as thrombin, which also hastens clot formation and increases hemostatic action

Hemostats Market, By Application

The hemostats market has been segmented into orthopedic surgery, general surgery, neurological surgery, cardiovascular surgery, gynecological surgery, reconstructive surgery, and other surgical applications, based on application. Orthopedic surgery accounts for the largest share in the hemostats market because of the rising incidence of musculoskeletal disorders, especially among the geriatric population.Age-related conditions such as osteoarthritis, osteoporosis, and degenerative joint disorders are increasingly prevalent, propelling the demand for surgeries like joint replacements and spinal surgery. The increase in geriatric population further plays a role in the demand for orthopedic surgery, as older adults are more susceptible to fractures and mobility-related issues. Besides, the increasing number of sports injuries in younger age groups has tremendously raised the load of orthopedic surgeries. The surgeries are usually characterized by intricate tissue management and high blood loss, which demand the use of effective hemostatic agents on a broad scale to attain safe and effective outcomes

REGION

Asia Pacific to be fastest-growing region in global hemostats market during forecast period

The Asia Pacific hemostats market is projected to witness the highest growth during the forecast period. Rising awareness of advanced surgical procedures, increasing prevalence of surgical conditions, expanding healthcare infrastructure, and growing access to modern hospitals and clinics are driving demand in the region. Additionally, a rapidly expanding middle-class population, increasing healthcare spending, and government initiatives to improve healthcare services further support market growth. Countries such as China, India, and Japan are leading this surge due to high patient volumes and adoption of modern surgical techniques. Moreover, the growing number of private hospitals and clinics, along with increased medical tourism, is expected to further fuel market expansion.

Hemostats Market: COMPANY EVALUATION MATRIX

In the hemostats market matrix, Johnson & Johnson Services, Inc. (US) leads with a comprehensive product portfolio, strong global presence, and extensive distribution network, driving widespread adoption among hospitals and surgical centers. Baxter International (US) leverages its expertise in hemostatic and surgical care solutions to strengthen its position, particularly in advanced surgical procedures. Pfizer (US) focuses on innovative hemostatic therapies and solutions, enhancing its reach in both hospital and clinical settings. While Johnson & Johnson maintains leadership through scale and established networks, Baxter and Pfizer demonstrate strong potential for growth through targeted product innovations and expanding regional presence.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 2.76 Billion |

| Revenue Forecast in 2030 | USD 4.00 Billion |

| Growth Rate | CAGR of 6.4% from 2025-2030 |

| Actual data | 2023-2030 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Million), Volume (Thousands Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

WHAT IS IN IT FOR YOU: Hemostats Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | ||

| Company Information | ||

| Geographic Analysis |

RECENT DEVELOPMENTS

- April 2024 : In April 2024, Baxter (US) launched the HEMOPATCH Sealing Hemostat, a room-temperature collagen pad approved for Hemostasis and Sealing in Europe.

- November 2023 : In November 2023, Johnson & Johnson Services, Inc. (US) announced the approval for Ethizia, an adjunctive hemostat solution which has been clinically proven to achieve sustained hemostasis in difficult to control bleeding situations.

- August 2023 : In August 2023, Teleflex Incorporated (US) received US FDA clearance for the expanded indication for QuikClot Control+ in cardiac surgical procedures.

- July 2023 : In July 2023, Baxter International (US) launched its PERCLOT Absorbable Hemostatic Powder in the US. This will allow the company to provide surgeons with a full range of active and passive hemostatic products for bleeding control, helping to optimize care for patients.

- May 2022 : In May 2022, Johnson & Johnson Services, Inc. (US) acquired GATT Technologies B.V. (Netherlands) to expand its biosurgery portfolio with synthetic polymer-based hemostatic technology and develop advanced solutions like the ETHIZIA Hemostatic Patch.

Table of Contents

Methodology

The study analyzes key market dynamics, such as drivers, opportunities, restraints, challenges, and key player strategies. To track company developments such as acquisitions, product launches, expansions, agreements, and partnerships of the leading players, as well as the competitive landscape of the hemostats market, to analyze market players on various parameters within the broad categories of business and product strategy. Top-down approach was used to estimate the market size. The market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involved extensive use of various secondary sources, including directory databases like Bloomberg Business, Factiva, and D&B Hoovers, white papers, annual reports, company house documents, investor presentations, and SEC filings. This research was conducted to gather information valuable for a comprehensive, technical, market-oriented, and commercial study of the hemostats market. It also helped obtain critical insights about key players in the industry, market classification, and segmentation based on current industry trends down to the finest details. Additionally, a database of leading industry players was created through this secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess prospects.

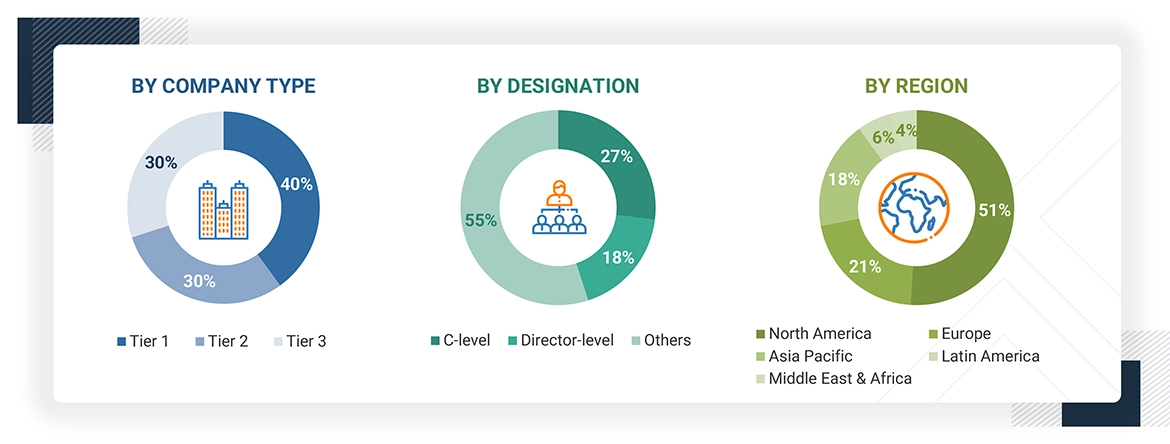

A breakdown of the primary respondents for the hemostats market is provided below:

Note 1: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 2: Others include sales, marketing, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024: Tier 1=>USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the hemostats market includes the following details.

The market sizing was undertaken from the global side.

Top-down was used to estimate and validate the hemostats market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- Primary and secondary research has determined the revenues generated by leading players operating in the hemostats market.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Hemostats Market Size: Top-down Approach

Data Triangulation

After arriving at the overall market size by applying the abovementioned process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

During surgical procedures, damage to blood vessels necessitates immediate intervention to mitigate hemorrhage—this process is referred to as hemostasis. Hemostatic agents work by facilitating the formation of fibrin clots, providing an interim solution to manage bleeding at the site. The application of hemostatic measures must be executed rapidly, precisely localized, and meticulously regulated, particularly in scenarios involving significant blood loss or in patients with congenital coagulopathies or trauma-induced vascular compromise.

Stakeholders

- Senior Management

- Finance Department

- Procurement Department

- Hospitals

- Specialty Clinics

- Trade Associations and Industry Bodies

- Regulatory Bodies and Government Agencies

- Business Research & Consulting Service Providers

- Market Research & Consulting Firms

- Venture Capitalists and Investors

Report Objectives

- To define, describe, segment, analyze, and forecast the hemostats market by type, formulation, application, end user, and region

- To provide detailed information about the factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets concerning individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the hemostats market in North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the hemostats market and comprehensively analyze their core competencies

- To track and analyze competitive developments such as agreements, collaborations, and partnerships; expansions; acquisitions; and product launches & approvals in the hemostats market

Key Questions Addressed by the Report

Which is the fastest growing segment of the hemostats market, by formulation?

Sponges form the fastest growing segment of the hemostats market based on formulation due to their ease of use, rapid absorption, and strong hemostatic efficacy. Their compatibility with various surgical procedures and improved shelf life also drive their adoption.

What are the recent trends affecting the hemostats market?

The hemostats market is growing due to rising surgical volumes, especially in aging populations and trauma cases. Recent trends include the adoption of biodegradable and combination hemostats, minimally invasive delivery formats, and rapid expansion in emerging markets such as the Asia Pacific.

Which segments have been included in this report?

This report has the following main segments:

- By Type

- By Formulation

- By Application

- By End User

- By Region

Which region is lucrative for the hemostats market?

The Asia Pacific region is expected to witness the highest CAGR in the hemostats market during the forecast period. This region comprises fast-expanding economies such as China and India, which presents promising market opportunities for hemostats.

Who are the top industry players in the global hemostats market?

The top market players in the global hemostats market are Johnson & Johnson Services, Inc. (US), Baxter (US), Pfizer Inc. (US), B. Braun SE (Germany), BD (US), Teleflex Incorporated (US), and Medtronic (Ireland).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Hemostats Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Hemostats Market