This study involved four major activities in estimating the current size of the healthcare workforce management market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the healthcare workforce management market. The researchers used secondary sources, which means they looked at existing information instead of collecting new data themselves. These secondary sources included reports and publications from organizations like the World Health Organization (WHO), Healthcare Information and Management Systems Society (HIMSS), American Health Information Management Association (AHIMA), Centers for Medicare and Medicaid Services (CMS), US Department of Health and Human Services (HHS), Organisation for Economic Co-operation and Development (OECD), National Institutes of Health (NIH), Centers for Disease Control and Prevention (CDC), Annual Reports, SEC Filings, Investor Presentations, Expert Interviews, and MarketsandMarkets Analysis. This method allowed the researchers to gather information on the market size, segmentation (by component, deployment, organization size, and end-user), regional analysis, future trends, and technological advancements in the healthcare workforce management market.

Primary Research

In-depth interviews were conducted with various primary respondents; researchers conducted in-depth interviews with a variety of people. The primary sources from the supply side include Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), Managing Directors (MDs), marketing and sales directors, business development managers of healthcare workforce management companies. On the other hand, primary sources from the demand side include industry experts such as directors of hospitals, nursing homes, physicians, and related key opinion leaders. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

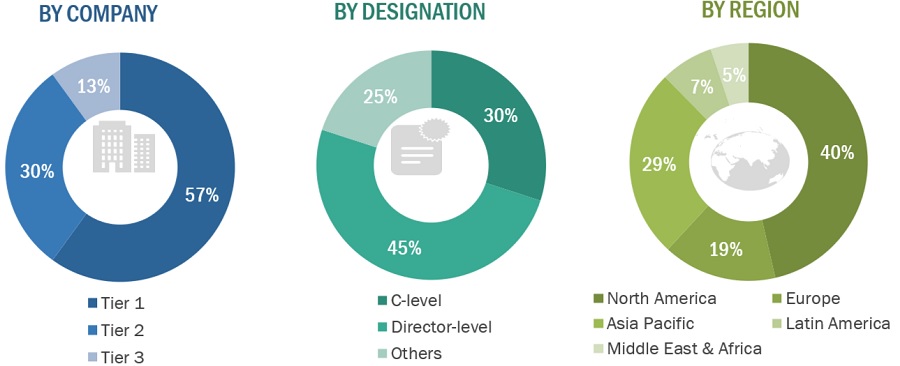

Breakdown of the primary respondents:

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product and service managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2023: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

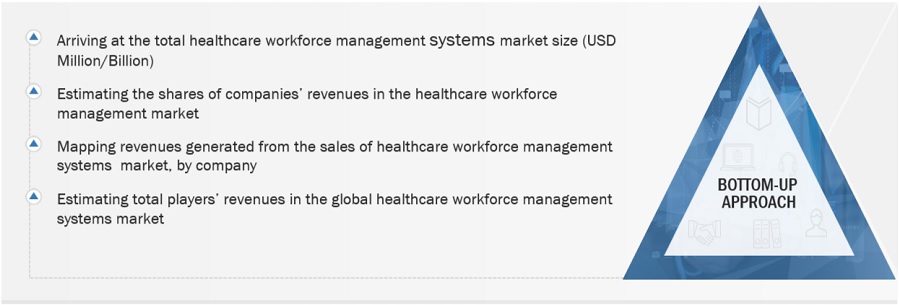

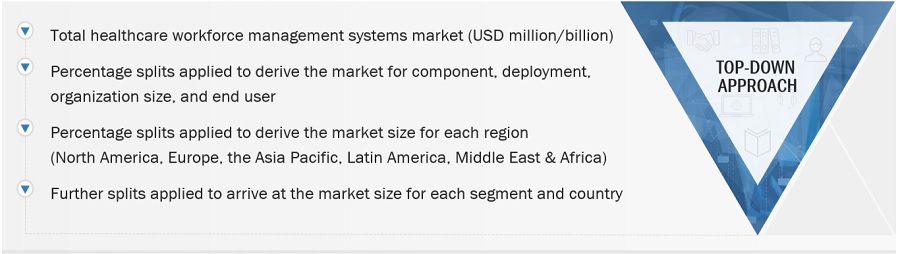

Both top-down and bottom-up approaches were used to estimate and validate the total size of the healthcare workforce management market as well as to estimate the market size of various other dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

-

The key players in the industry and market have been identified through extensive secondary research.

-

The revenues generated from the healthcare workforce management business of leading players have been determined through primary and secondary research.

-

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Healthcare Workforce Management Systems Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Healthcare Workforce Management Systems Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Healthcare workforce management systems encompass all the solutions needed to manage and maintain the productive workforce in a healthcare organization. Workforce management includes HR administration, career and succession planning, adherence to work schedules, talent acquisition, workforce tracking, payroll and benefits, and leave management.

Key Stakeholders:

-

Healthcare Workforce Management Vendors

-

Healthcare IT solution providers

-

Healthcare IT service providers

-

Healthcare providers

-

Assisted Living Centers/Nursing Homes

-

Ambulatory Care Centers

-

Integration Service Providers

-

Maintenance And Support Service Providers

-

Regulatory Bodies

-

Market research and consulting firms

-

Venture capitalists and investors

Report Objectives

-

To define, describe, and forecast the global healthcare workforce management market based on the component, deployment, organization size, end user and region.

-

To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, challenges, and opportunities)

-

To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall healthcare workforce management market.

-

To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

-

To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, Middle East & Africa.

-

To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies.

-

To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, collaboration, and partnerships in the healthcare workforce management market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

-

An additional five company profiles

Growth opportunities and latent adjacency in Healthcare Workforce Management System Market