Green Data Center Market

Green Data Center Market by Infrastructure (Renewable Power Generator, Energy-Effective Power Distribution, Power Backup & Energy Storage, Green Air Cooling, Green Liquid Cooling), Software (DCIM, Building Management, Compliance) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

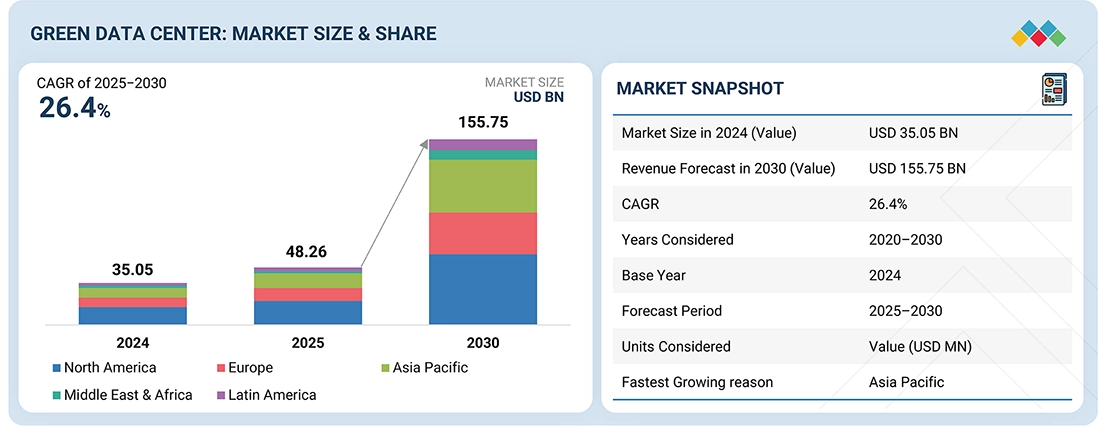

The green data center market is projected to reach USD 155.75 billion by 2030 from USD 48.26 billion in 2025, at a CAGR of 26.4%. The global green data center market is gaining momentum, driven by rising energy costs, stringent sustainability regulations, and enterprise commitments to carbon reduction.

KEY TAKEAWAYS

- Asia Pacific is expected to grow fastest, with a CAGR of 29.8%, driven not only by China’s carbon-neutral targets, Japan’s renewable-powered data center initiatives, and India’s government-backed green infrastructure programs, but also by rapid adoption in emerging markets such as Singapore, South Korea, Indonesia, and Malaysia, where rising digitalization, renewable integration, and large-scale investment in sustainable facilities are creating new growth frontiers, making these regions the key reason for the highest CAGR.

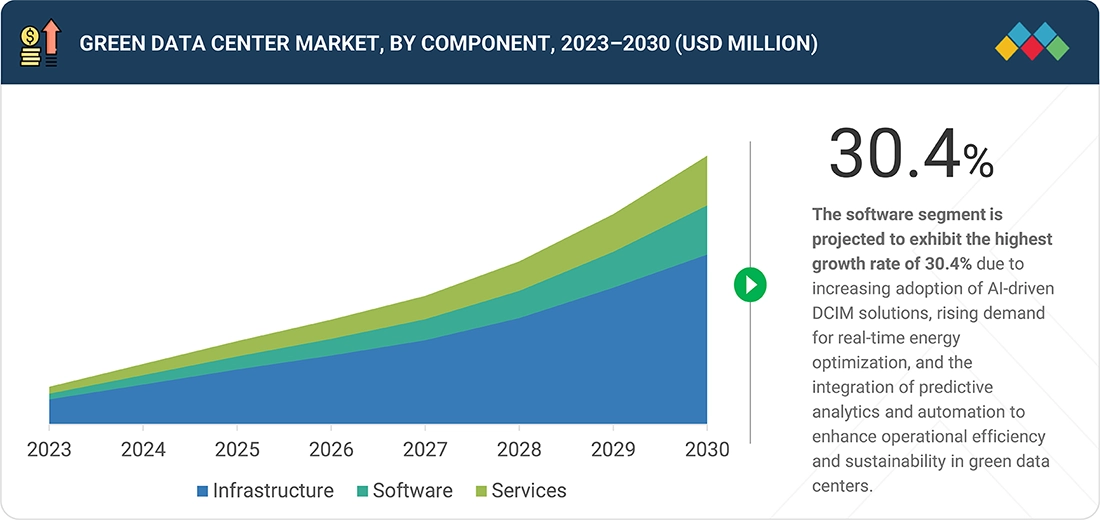

- By component, software is expected to grow at the fastest rate, achieving a CAGR of 30.4% during the forecast period.

- Large and hyperscale centers are expected to grow the fastest driven by rising demand for massive compute consolidation, the need to interconnect global networks at scale, and the ability to secure long-term power purchase agreements for renewable energy.

- Cloud and hyperscale centers lead adoption due to multi-region deployment needs, high-density computing, and integration of liquid cooling and AI-driven energy optimization.

- Retail and e-commerce enterprises are rapidly scaling data center capacity to support AI-driven personalization, real-time analytics, and omnichannel operations, driving sector growth and are expected to achieve the highest CAGR of 18.3% during the forecast period.

- The major market players have adopted organic and inorganic strategies, including partnerships and investments. For instance, Schneider Electric, Vertiv, Eaton, Daikin, and ABB are entering into agreements and collaborations to cater to the growing demand for sustainable data center solutions, such as efficient PDUs, AI-energy monitoring, and green cooling infrastructure

- Riello UPS, Alfa Laval, and Submer have distinguished themselves among startups and SMEs due to their robust product portfolios and effective business strategies.

The green data center market is projected to reach USD 155.75 billion by 2030 from USD 48.26 billion in 2025, at a CAGR of 26.4%. The global green data center market is gaining momentum, driven by rising energy costs, stringent sustainability regulations, and enterprise commitments to carbon reduction. Advanced green cooling, renewable energy integration, and efficient power management enable operators to cut operational expenses while meeting environmental goals. Growing ESG mandates and government incentives position green data centers as a strategic choice for enterprises seeking compliance and cost optimization. By embedding efficiency and resilience, they deliver long-term value as the sustainable backbone of digital infrastructure.

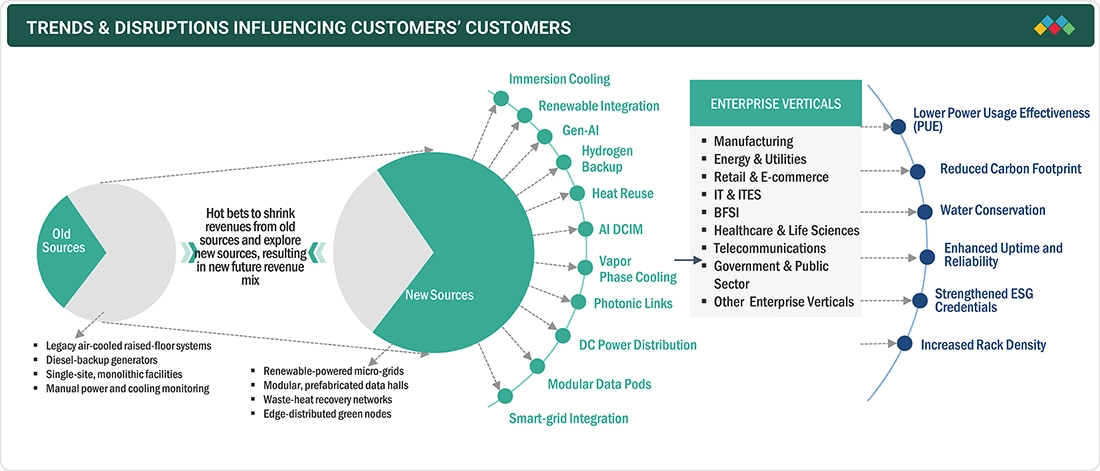

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The section highlights the significant trends and disruptions influencing customer businesses, focusing on how revenue models shift toward emerging technologies and new use cases. It emphasizes the changing priorities of key client segments such as hyperscale and cloud providers, colocation and data center operators, and government and public sector. It connects their strategic imperatives to measurable client outcomes such as sustainable cooling infrastructure, net-zero carbon emissions, reduced PUE, and enhanced brand reputation.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

AI workloads to drive the adoption of green data center solutions

-

Net-zero mandates to accelerate renewable-powered facilities

Level

-

Limited renewable availability to restrict large-scale deployments

-

High upfront CAPEX to slow green data center adoption

Level

-

Prefabricated green modules to accelerate facility deployment

-

Circular IT asset management to expand service scope

Level

-

Regional policy fragmentation to complicate vendor compliance

-

Supply chain gaps limit access to eco-friendly components

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: AI workloads to drive adoption of green data center solutions

Rising AI workloads accelerate green data center adoption, as high-density servers demand sustainable cooling and power solutions. Operators are deploying advanced liquid cooling and AI-optimized energy systems to cut consumption and enhance performance. Schneider Electric’s December 2024 launch of its liquid-cooled AI cluster design exemplifies how sustainable innovations drive scalability and efficiency for AI-ready facilities.

Restraint: High upfront CAPEX to slow green data center adoption

High upfront CAPEX is a significant restraint in the green data center market, as deploying sustainable infrastructure requires costly technologies such as liquid cooling, renewable energy integration, and low-carbon materials. In June 2024, Vertiv highlighted that liquid cooling alone can add millions to deployment costs, prompting enterprises to seek modular, scalable, and finance-friendly models to ease adoption.

Opportunity: Prefabricated green modules to accelerate facility deployment

Prefabricated green modules present a strong opportunity in the green data center market by enabling faster deployment, predictable efficiency, and lower environmental impact. Schneider Electric’s June 2025 EcoStruxure Pod Data Center highlights this shift, offering liquid-cooled, renewable-ready infrastructure with reduced deployment time and improved PUE. Modular builds allow vendors to deliver scalable, standardized solutions while generating recurring revenues through bundled services and upgrades.

Challenge: Regional policy fragmentation to complicate vendor compliance

Policy fragmentation poses a critical challenge for the green data center market, with energy, emissions, and reporting requirements differing sharply across regions. The EU’s November 2024 directives mandate detailed metrics, while US rules remain fragmented at the state level, driving compliance complexity and cost. Vendors must adopt adaptive frameworks, flexible reporting tools, and proactive monitoring to ensure sustainable, risk-free growth.

Green Data Center Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Greenergy and A-Kaabel drive green data center growth with Vertiv rack PDUS’ | Seamless scaling from 4-6 kW racks to over 10 kW, improved energy efficiency with PUE reduced to 1.4, enhanced uptime performance surpassing 99.982% |

|

Siemens supports BMO Financial Group with white space cooling optimization (WSCO) | Achieved 55% reduction in CRAH fan energy consumption, reduced the number of continuously operating CRAH units by 64%, improved thermal control & stability |

|

Siemens AI-powered optimization at Greenergy Data Centers, Estonia | Improved cooling efficiency by 30%, achieved a PUE below 1.2, enabled AI-based predictive cooling, and reduced carbon footprint by reusing waste heat for office heating |

|

Green Revolution Cooling enables green supercomputing at Texas Advanced Computing Center (TACC) with immersion cooling | Achieved a PUE of 1.1, significantly improving energy efficiency, reduced carbon footprint by up to 40%, enabled reliable cooling of 280W CPUs |

|

Rittal lowers carbon footprint at Scottish Qualifications Authority (SQA) Data Centers | Reduced energy consumption and carbon footprint, freed up floor space by shifting to rack-mounted UPS and in-row cooling, enabled higher system reliability with N+1 redundancy in both cooling and UPS |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

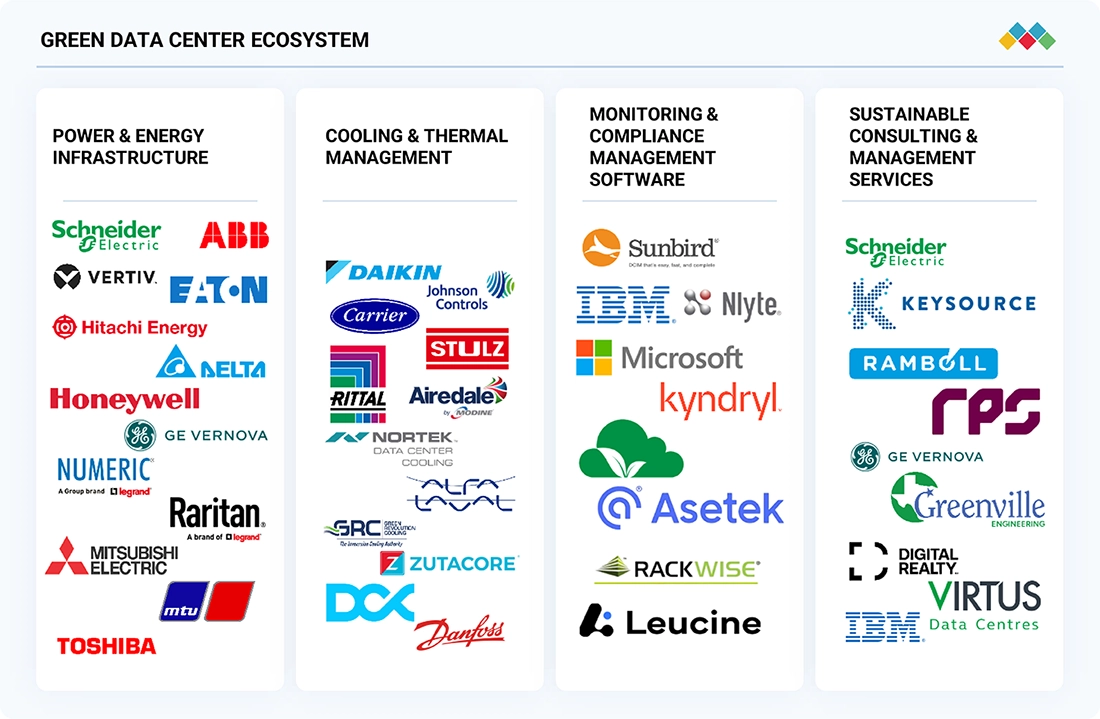

MARKET ECOSYSTEM

The green data center market ecosystem has four pillars: power and energy infrastructure, cooling and thermal management, monitoring and compliance software, and sustainable consulting services. Together, they deliver resilient electrical systems, advanced cooling, real-time ESG reporting, and strategic guidance, forming an integrated framework that enables organizations to design, operate, and optimize sustainable, net-zero-ready data centers.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Green Data Center Market, By Component

Infrastructure accounts for the largest market share in the green data center market, creating major opportunities for vendors and solution providers to deliver energy-efficient and sustainable systems. By incorporating renewable energy, modular UPS, PDUs, and green cooling, operators can reduce costs and emissions while deploying advanced cooling and intelligent airflow solutions to improve reliability, optimize thermal management, and strengthen overall environmental performance.

Green Data Center Market, By Data Center Size & Capacity

Large and hyperscale data centers (50 MW and above) hold the largest market share in the green data center market, serving as the backbone of cloud platforms, AI workloads, and global applications. Vendors and solution providers can capture opportunities by delivering modular high-efficiency power systems, scalable liquid and hybrid cooling, and monitoring software for emissions visibility. Strategic partnerships with hyperscale operators and renewable energy providers further enable sustainable, high-performance operations at scale.

Green Data Center Market, By Data Center Type

Cloud and hyperscale data centers hold the largest market share in the green data center market, driving the sustainable transformation of global digital infrastructure. By adopting renewable energy, advanced cooling, and highly efficient power systems, these facilities deliver performance at scale while minimizing environmental impact. Vendors and solution providers can unlock significant opportunities by offering modular, scalable solutions and building strategic partnerships that accelerate worldwide low-carbon, resilient, and sustainable operations.

Green Data Center Market, By Enterprise Data Center

BFSI will hold the largest market share in enterprise data centers, as the sector requires secure, reliable, and sustainable infrastructure to manage transactions, payments, and risk systems. Green data centers enable BFSI institutions to lower power use with efficient servers, virtualization, and advanced cooling, while ensuring compliance, data privacy, and ESG alignment. Vendors and solution providers gain opportunities to deliver scalable, energy-efficient, and compliant solutions that support financial sector digital transformation.

REGION

Asia Pacific to be the fastest-growing region in the global green data center market during the forecast period

Asia Pacific is expected to register the highest CAGR during the green data center market forecast period. Asia Pacific is rapidly becoming a global leader in green data center development, powered by sustainability mandates, rising digital workloads, and the push for energy efficiency. Operators are embracing modular power, advanced cooling, and integrated AI-monitoring to cut consumption, while large-scale solar, wind, and hydropower adoption reduces carbon intensity. Liquid cooling and energy reuse systems strengthen resilience across diverse climates and dense urban hubs.

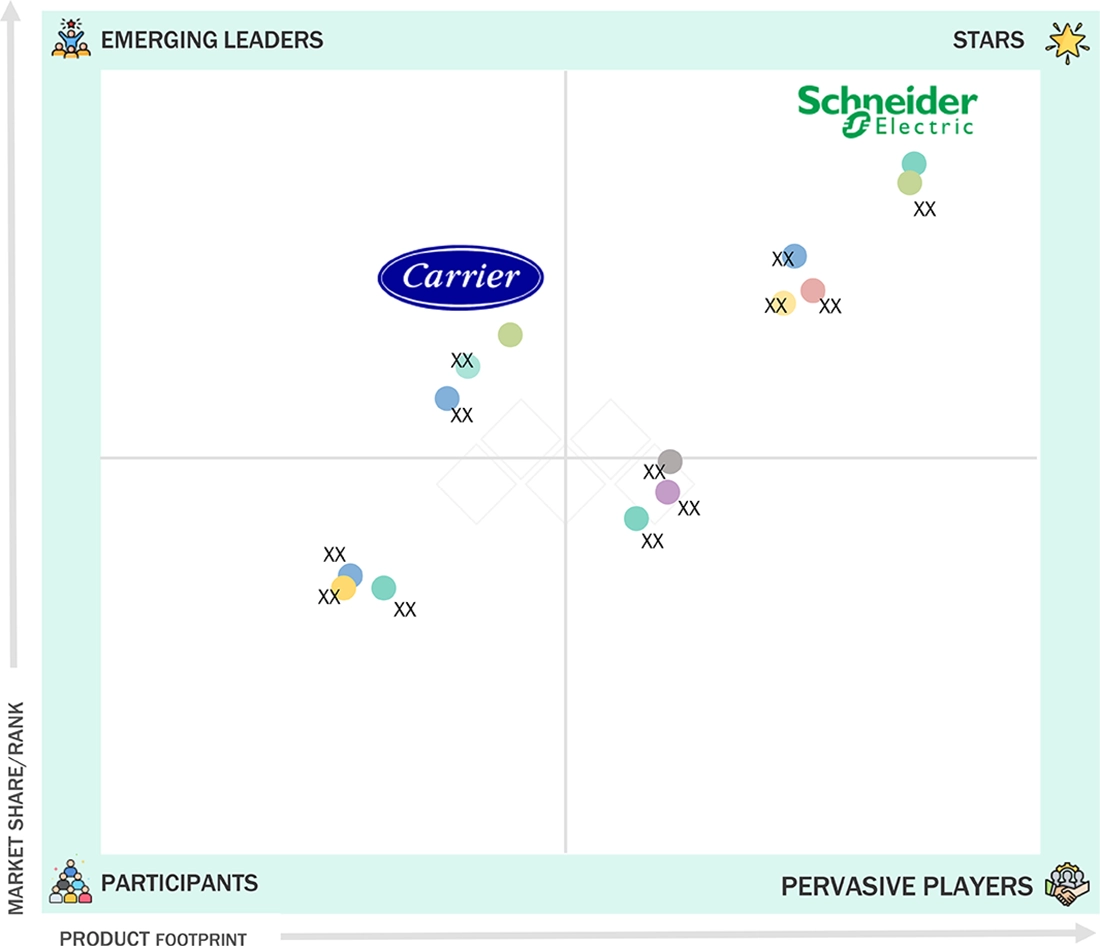

Green Data Center Market: COMPANY EVALUATION MATRIX

In the green data center market matrix, Schneider Electric (Star) leads with a strong market presence and an extensive portfolio spanning power, cooling, and digital energy management, enabling large-scale adoption across enterprise and hyperscale environments. Carrier (Emerging Leader) is gaining momentum with innovative, energy-efficient cooling systems tailored for sustainable operations. While Schneider Electric drives global deployments with scale, Carrier is advancing steadily toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | 35.04 Billion |

| Market Forecast in 2030 (value) | 155.75 Billion |

| Growth Rate | 26.40% |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

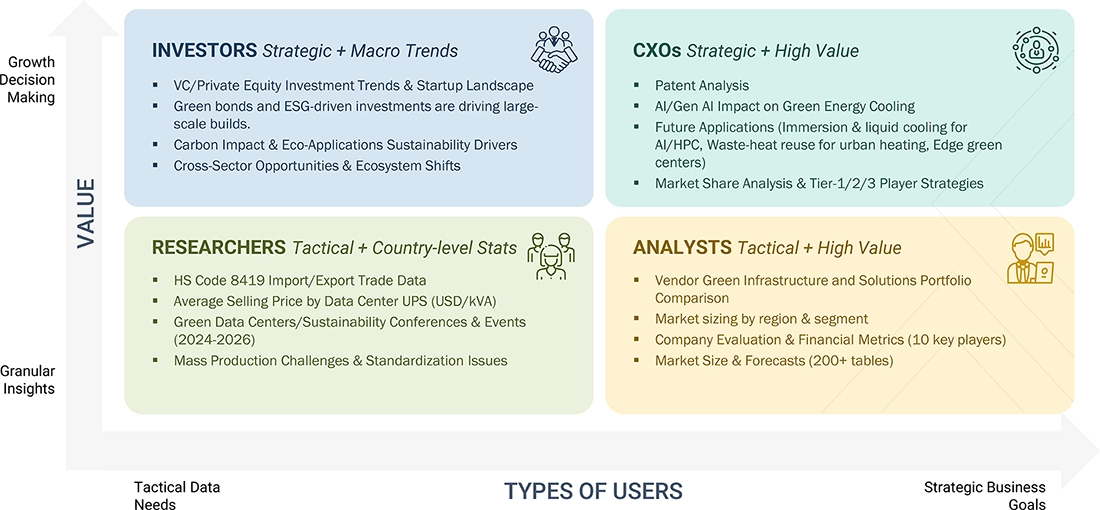

WHAT IS IN IT FOR YOU: Green Data Center Market REPORT CONTENT GUIDE

RECENT DEVELOPMENTS

- July 2025 : Daikin signed a five-year collaboration agreement with Greater Manchester to scale up low-carbon heating and support the city-region’s 2038 carbon neutrality goal. The partnership includes installing low-carbon heating systems, developing green skills, conducting community outreach, and deploying innovative heat pump technologies to advance sustainable energy solutions.

- June 2025 : Oklo and Vertiv partnered to co-develop advanced power and thermal management solutions for US hyperscale and colocation data centers. The partnership leverages Oklo’s advanced nuclear power plants and Vertiv’s cooling and power systems to enhance energy efficiency, provide resilient AI and high-performance computing power, and produce end-to-end reference designs for integrated, sustainable data center operations.

- June 2025 : At GTC Paris 2025, Schneider Electric and NVIDIA released a co-developed infrastructure for European AI factories, integrating OCP racks, EcoStruxure Pods, and advanced liquid cooling for high-density AI clusters. Leveraging their proficiency in AI-ready infrastructure, grid coordination, and sustainability, Schneider Electric and NVIDIA are jointly responding to the European Commission’s “AI Continent Action Plan,” which summarizes a shared mission to set up a minimum of 13 AI factories within Europe while founding up to five AI gigafactories.

- June 2025 : Eaton partnered with Siemens Energy to accelerate AI data center construction through integrated on-site power systems and modular infrastructure. The collaboration includes medium and low-voltage switchgear, UPS systems, busways, IT racks, and scalable 500 MW power plants with gas turbines, battery storage, and clean-air grid connections. The joint approach reduces CO2 emissions, eliminates diesel backup, and enables rapid deployment of high-availability, AI-ready data centers.

- June 2025 : ABB partnered with Applied Digital to deliver AI-ready electrical infrastructure at a 400 MW greenfield data center campus in North Dakota. The collaboration implements ABB’s HiPerGuard Medium Voltage UPS to increase power density, reduce electrical plant footprint, and improve energy efficiency. The project covers the complete design, development, and optimization of the site’s electrical infrastructure to support advanced AI workloads.

- March 2025 : Delta Electronics collaborated with NVIDIA to introduce advanced power and liquid cooling solutions for AI and HPC data centers at NVIDIA GTC 2025. The showcase included new power capacitance shelves, high-efficiency server power shelves, battery backup systems, and 1.5 MW coolant distribution units designed to optimize energy efficiency and thermal management for next-generation GPU infrastructures.

Table of Contents

Methodology

This research study on the green data center market involved extensive secondary sources, directories, IEEE Communication-Efficient: Algorithms and Systems, International Journal of Innovation and Technology Management, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred green data center providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews with primary respondents, including key industry participants and subject matter experts, were conducted to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors’ websites. Additionally, the green data center spending of various countries was extracted from the respective sources.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and directors specializing in business development, marketing, and green data center service providers. It also included key executives from green data center vendors, system integrators (SIs), professional service providers, industry associations, and other key opinion leaders.

Note: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range

between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Other designations include sales managers, marketing managers, and product managers.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the green data center market. The first approach involved estimating the market size by companies’ revenue generated through the sale of green data center products.

Market Size Estimation Methodology- Top-down approach

The top-down approach prepared an exhaustive list of all the vendors offering products in the green data center market. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on platform, degree of customization, type, application, end user, and region. The markets were triangulated through primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Market Size Estimation Methodology-Bottom-up approach

The bottom-up approach identified the adoption rate of the green data center products among different verticals in key countries, considering their regions contributing the most to the market share. For cross-validation, the adoption of green data center products among enterprises and other use cases for their regions was identified and extrapolated. Use cases identified in different areas were weighed for market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included an analysis of the green data center market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socioeconomic analysis of each country, strategic vendor analysis of major green data center service providers, and organic and inorganic business development activities of regional and global players were estimated.

Green Data Center Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. Data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and determine the exact statistics of each market segment and subsegment. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

Considering the views of various associations and sources, MarketsandMarkets defines a green data center as a wide range of energy and cooling infrastructure, software, and services designed to support energy-efficient and sustainable solutions across data centers.

It includes energy infrastructure components, such as renewable power generators, power backup & energy generators, energy power distribution, and cooling infrastructure components, such as green air cooling and liquid cooling. Different software comprises data center infrastructure management (DCIM), building management, compliance, and others, along with strategy consulting & energy audits, eco-friendly integration & deployment, sustainable operation & maintenance, and other services. These solutions are deployed across hyperscale, colocation, and enterprise data centers as per their size and capacity, which aid varied workloads.

According to IBM, a green data center, or sustainable data center, refers to a facility that encompasses energy-efficient infrastructure and uses eco-friendly systems and technologies to improve energy usage and reduce environmental impact. Different measurement components of green data center include reduced building footprint, efficient cooling systems, usage of waste heat, renewable energy sources, and many more.

Stakeholders

- Infrastructure & Equipment Vendors

- Software Solution Providers

- Software Solution Providers (DCIM, Energy Management, AI/ML Optimization)

- Colocation Service Providers

- Hyperscale Cloud Providers

- Enterprises

- Renewable Energy Providers (Solar, Wind, Fuel Cells)

- Regulatory Bodies & Standards Organizations (ASHRAE, Uptime Institute, ISO)

- Consulting & Advisory Firms (Sustainability, Energy Audits, Certifications)

- Construction, Engineering, & Real Estate Firms

- Investors and Real Estate Investment Trusts (REITs)

- Regulatory Bodies & Standards Organizations

- System Integrators (SIs)

- Industry Alliances & Advocacy Groups

Report Objectives

- To define, describe, and forecast the green data center market based on component, data center size & capacity, data center type, and enterprise data center

- To forecast the market size for North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To strategically analyze the market subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To strategically analyze macro and micro markets concerning growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, patents and innovations, and pricing data related to the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To analyze the impact of AI/generative AI on the market

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments such as mergers & acquisitions, product launches, and partnerships & collaborations in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix providing a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakup of the North American green data center market

- Further breakup of the European green data center market

- Further breakup of the Asia Pacific green data center market

- Further breakup of the Middle East & Africa green data center market

- Further breakup of the Latin American green data center market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the current market size of the Data Center Power market?

The global Data Center Power market was valued at USD 35.15 billion in 2025 and is projected to reach USD 50.51 billion by 2030, growing at a CAGR of 7.5% from 2025 to 2030.

Which region leads the market?

North America leads the Data Center Power market, followed by Europe and Asia Pacific, with Asia Pacific advancing fastest due to rapid expansion of cloud computing, hyperscale data centers, and digital transformation initiatives across countries in the region.

What are the emerging trends in the Data Center Power market?

Key emerging trends in the Data Center Power market include the growing adoption of AI-driven energy management, liquid cooling, and modular UPS systems to enhance efficiency and sustainability. Additionally, the integration of renewable energy sources and advanced battery storage is driving greener, more resilient data center operations.

Who are the key companies in this market?

Leading players in the market include ABB (Switzerland), Schnieder Electric (France), Vertiv (US), Eaton (Ireland), and Delta Electronics (Taiwan).

What factors are driving market growth?

The data center power market is driven by rise in data center around the world. High-performance computing driving ultra-dense power requirements. Rising AI Workloads Escalating Energy Consumption and Grid Pressure

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Green Data Center Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Green Data Center Market