Fluoropolymer Processing Aid Market

Fluoropolymer Processing Aid Market by Polymer Type (PP, PE, PVC), Application (Blow Film & Cast Film, Pipes & Tubes, Wires & Cables, Fibers & Raffia), Form (Neat/Additive and Masterbatch) and Region - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The fluoropolymer processing aid market is estimated to grow from USD 1.48 billion in 2023 to USD 1.75 billion by 2029, at a CAGR of 2.73% between 2024 to 2029. A major driver for the fluoropolymer processing aid market is the rising demand for high-quality polymer films and extruded products, as manufacturers increasingly adopt processing aids to enhance surface finish, reduce melt fracture, and improve production efficiency in high-speed extrusion processes.

KEY TAKEAWAYS

-

BY POLYMER TYPEPolyethylene hold the largest market share in the fluoropolymer processing aid market. This is mainly because polyethylene is used in many industries including the packaging industry, construction and the automotive industries where high performance materials are required. The use of Fluoropolymer processing aids contributes to better control of flow, melt strength and stability of Polyethylene, leading to better control of the process and improved quality of the end product. Because, many industries are increasingly using polyethylene-based products, the demand for processing aids may act as a major market growth factor. Also, these aids enhance the streamlining of various production processes and hence cuts costs to meet efficient productions.

-

BY APPLICATIONThe second major application area in the fluoropolymer processing aid market, based on value, is for pipes and tubes. This growth is attributed through rising demand of pipes and tubes used in chemical processing, oil, and gas and/ or the pharmaceutical industries where there is a need for high performance pipes and tubes due to their resistance to chemicals and ability to endure high pressure. These fluoropolymer processing aids improve the flow characteristics and the melt strength of the materials and reduce manufacturing costs and improve product properties. With infrastructure development and industrialization in emerging economies, the use of high quality pipes and tubes are expected to expand resulting in higher market demand for processing aids. They also assist to bring down costs of production while at the same time increasing the efficiency of operation.

-

BY FORMIn the fluoropolymer processing aid market, the masterbatch form represents the second-largest segment, driven by its ease of handling, uniform dispersion, and compatibility with a wide range of polymer processing operations. Masterbatch formulations offer processors a convenient and dust-free method to introduce fluoropolymer additives, ensuring consistent performance and reduced processing defects. Their growing preference across film extrusion, wire and cable, and injection molding applications highlights their role in enhancing process stability and end-product quality while minimizing additive wastage.

-

BY TYPEThe non-PFAS type is witnessing the fastest growth, driven by increasing environmental regulations and a global shift toward sustainable, fluorine-free alternatives. Manufacturers are actively developing non-PFAS formulations that deliver comparable performance in reducing melt fracture and improving polymer flow during extrusion, without the persistence and toxicity concerns associated with PFAS-based products. This transition is further supported by brand owners and end-users prioritizing eco-friendly materials to meet tightening compliance standards and sustainability goals.

-

BY REGIONThe Middle East & Africa followed by Asia Pacific region is identified to have the second highest CAGR in the fluoropolymer processing market due to the increasing industrialization of the region and high investment on infrastructural. Large-scale investments in construction projects for mass housing applications and commerce and business establishments are pulling demand for superior quality polymer/ packaging materials which requires superior fluoropolymer processing aids. Also, population growth and urbanization around the region also complement the demand for high quality consumer good and packaging materials. There is also a rising trend towards sustainability with awareness of the same forcing technologies to embrace environment friendly processing aids. Similarly, the investment from the Middle East & African countries and emergence of new industrial projects also have a positive impact on the growth rate of fluoropolymer processing aid industry in this area and therefore it is expected to register a good growth rate in the coming future.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including expansion, collaborations, partnerships, acquisitions and investments. For instance, LyondellBasell Industries invested in the KARO 5.0 laboratory stretch machine from Brückner Maschinenbau. This investment in the R&D capabilities was made at its technical Center in Akron, Ohio.

Rising demand for plastics and composites in automobile industry has a lot to offer to the fluroropolymer processing aid market. Many of the programs for enhancing health and cleanliness exploits are directing the usage of superior materials in distinct sectors and making a demand of high-performance fluoropolymer processing aid. The rises in both infrastructure of various facilities and performance of industries have prompted the government to support fluoropolymers for applications that meet high performance standards in terms of durability and chemical resistance. Specifically, with governments of various countries opting to invest in new manufacturing technologies including the growing medical, aerospace, and chemical industries, ongoing processing aid demands are swiftly growing, especially in developing nations. These additives are essential in achieving the production of quality and most importantly, reliability in the products that are produced for today’s demanding market. Moreover, the rising population in the Middle East & Africa and Asia Pacific, changing customer needs, increasing industrial expansion in Asia Pacific region are driving the fluoropolymer processing aid market. In addition, due to changing sustanibility goals, environmental norms, and changing regulations, there is an escalating desire for sustainable processing aids.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Megatrends, such as digital transformation and the use of renewables, will impact a company's revenue stream. For instance, smart car interiors, micro-car sports plastic, and lightweight plastics are emerging trends in the automotive industry. This drives plastic manufacturers to add fluoropolymer processing aids with innovative technologies and performance. Similarly, upcoming trends in the construction and packaging industries force manufacturers to develop better-performing fluoropolymer processing aids. The demand for chemical and heat-resistant solutions within the packaging industry influences the fluoropolymer processing aids market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand for fluoropolymer processing aids for consumer goods and packaging industries in Asia Pacific

-

Increased demand for production of blown films & cast films

Level

-

Shift towards PFAS-free alternatives in commercial and industrial products

-

Implementation of stringent regulation policies for using fluoropolymer processing aids

Level

-

Growing demand for plastics and composites in automotive industry

Level

-

Higher cost of fluoropolymer processing aids than other processing aids

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand for fluoropolymer processing aids for consumer goods and packaging industries in Asia Pacific

The demand for fluoropolymer processing aids in consumer products industries and packaging operations across Asia Pacific helps expanding the market. The region's fast development requires advanced materials that help production run better and deliver superior final results. Products for consumer goods and packaging need fluoropolymer processing aids to create better-lasting items resistant to chemicals and extreme temperatures. The Asian middle-class expansion, alongside increasing personal incomes in China, India, and Southeast Asia, drives demand for packaged goods, which requires innovative packaging solutions. Manufacturers turn to fluoropolymer processing aids because environmental laws now require sustainable packaging while product performance needs remain high. Asia Pacific countries serve as major growth markets for fluoropolymer processing aids forecast into the future

Restraint: Implementation of stringent regulation policies for using fluoropolymer processing aids

Stringent rules about fluoropolymer production and usage are restraining the market growth of fluoropolymer processing aids. Growing concerns about the environment, plus government rules that control chemical production, are making it harder to manufacture and use fluoropolymers and their processing aids. New environmental rules force manufacturers to replace traditional materials with costlier, safe, and biodegradable products. New fluoropolymer technologies and products face difficulty reaching the market because these regulations make production more expensive and challenging to develop. Running businesses under many different sets of rules creates extra work for companies to handle. Regulatory controls make business growth more challenging especially in environmental strictness areas. Thus, the employment of stringent regulation policies for using fluoropolymer processing aids in restraining the market growth.

Opportunity: Growing demand for plastics and composites in automotive industry

The rising demand for composite and plastic materials from the automotive sector generates major opportunities for fluoropolymer processing aids. Manufacturers need fluoropolymers more than ever as auto companies adopt lightweight materials to save fuel and lower emissions. Fluoropolymer processing aids boost material processing for automotive applications by making material moves easier to manage while shortening manufacturing cycles and providing dependable high-performance solutions. Business growth in automotive manufacturing depends heavily on fluoropolymers because these materials add durability to products, including chemical and heat resistance. Vehicle technology changes such as electric vehicles and advanced electronics create greater market demand for polymers with strong performance features. Fluoropolymer processing aids can address market needs as they grow, which creates major new business potential. The market for fluoropolymer processing aids expects growing demand as the automotive industry invests more in material research over the next years.

Challenge: Higher cost of fluoropolymer processing aids than other processing aids

The expensive nature of fluoropolymer processing aids creates a major market challenge for industries. Due to their advanced production procedures and expensive raw materials fluoropolymer materials charge a high price for their top-level performance in extreme chemical and temperature environments. Higher processing aid costs push up production expenses for companies, making fluoropolymer solutions less attractive in price-sensitive market segments. Small and medium-sized businesses have trouble understanding the buying value of fluoropolymer processing aids in regions with small incomes. High market prices push companies toward affordable yet inferior solutions which limits the market's development. The slower adoption pattern in price-sensitive sectors with emerging economies reduces the use of fluoropolymer processing aids throughout the market. The unpredictable changes in the cost of basic materials make it hard for businesses to keep their costs steady over extended periods.

Fluoropolymer Processing Aid Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Used in blown and cast film extrusion to reduce melt fracture and die buildup during high-speed processing. | Enhances film clarity and surface quality, leading to improved packaging aesthetics. |

|

Applied in extrusion and thermoforming operations to improve melt flow and surface smoothness. | Enables faster production cycles with consistent product finish. |

|

Utilized in insulation and jacketing compounds to minimize die buildup and improve surface finish of extruded cables. | Improves extrusion efficiency and reduces downtime for die cleaning. |

|

Added to polymer compounds for seals, trims, and wiring insulation to improve processability and surface finish. | Ensures smoother component surfaces and enhances dimensional precision. |

|

Used in medical-grade polymer extrusion for catheters and tubing to reduce surface friction and die deposits. | Produces cleaner, smoother medical tubing with improved functional performance. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Prominent companies in this market include well-established, financially stable manufacturers of fluoropolymer processing aids. These companies offer a broad range of products, cutting-edge technologies, and robust international sales and marketing networks. The leading companies in this market are Arkema (France), 3M Company (US), The Chemours Company (US), Daikin Industries, Ltd. (Japan), Syensqo (Belgium), Adplast (Portugal), SCG Chemicals, Public Company Limited (Thailand), Tosaf Compounds LTD (Israel), Ampacet Corporation (US), and Shanghai Lanpoly Polymer Technology Co., Ltd. (China), and Plastiblends India Limited (India), among others.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Fluoropolymer Processing Aid Market, By Polymer Type

The polypropylene segment of the fluoropolymer processing aid market is expected to grow at the highest CAGR from 2024 to 2029. Polypropylene is gaining popularity because it has great strength, low cost, and works well in diversified applications, driving industry growth for automotive, electronic, medical, and packaging companies. Companies prefer using polypropylene for consumer applications as it makes processing easier, shorter, and better product quality. Also, the expanding need for better materials will increase the use of polypropylene in many fields. Because of its ability to be recycled and its green manufacturing traits, polypropylene gains attention for use in industries that care about sustainability. Polypropylene is ready to drive market growth because of its versatile properties and several benefits.

Fluoropolymer Processing Aid Market, By Form

The neat/additive form segment is estimated to register the highest CAGR in the fluoropolymer processing aid market during forecast period. The demand for performance improvement, like improved flow, lower friction, and longer life, drives the fluoropolymer processing aids market. Additives help factories process these top-performance materials better, and that is why companies in industries like automotive and electronics find them critical. Businesses are looking to make production processes less expensive and more efficient, driving the need for products made by adding materials to create new compounds. Additives give manufacturers the power to improve chemical resistance and enhance material durability. This expanded potential means fluoropolymer additives can be used in more applications. The move toward better products made with renewable materials and designed to last longer increase the use of additives in the fluoropolymer business.

REGION

Asia Pacific to be largest and fastest-growing fluoropolymer processing aid market during forecast period

Asia Pacific is expected to dominate the market for fluoropolymer processing aids because of the increasing rate of urbanization, increase in the disposal income of people, and a growing middle class across the region. Currently, an increasing number of consumers are shifting toward urban markets, and as a result, there is a demand for stylish and superior-quality consumer and packaging products, especially in markets such as China, India, and Southeast Asia. Moreover, the growing manufacturing sector in China, India, and Japan demands fast-developing industries and high-performance materials. Asia's growing manufacturing sector and improved businesses present unique situations where fluoropolymer processing aids can add value. New technology developments and increased demand for sustainable processing methods combine to drive market expansion quickly in this area. Due to Asia Pacific’s booming economy , it stands out as a must-win area for market growth.

Fluoropolymer Processing Aid Market: COMPANY EVALUATION MATRIX

In the fluoropolymer processing aid market matrix, Arkema (Star) leads with a strong market presence and wide product portfolio, driving large-scale adoption across applications. SCG Chemicals Public Company Limited (Emerging Leader) is gaining traction due to its diversified product portfolio and continuous investment in R&D. While Arkema dominates with scale, SCG Chemicals Public Company Limited shows strong growth potential to advance toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2023 | USD 1.48 BN |

| Revenue Forecast in 2029 | USD 1.75 BN |

| Growth Rate | CAGR of 2.73% from 2024-2029 |

| Actual data | 2018−2029 |

| Base year | 2023 |

| Forecast period | 2024−2029 |

| Units considered | Value (USD Billion) and Volume (Ton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: Fluoropolymer Processing Aid Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe -based Fluoropolymer Processing Aid Manufacturer | • Detailed Europe based company profiles of competitors (financials, product portfolio) • Customer landscape mapping by application sector • Partnership ecosystem analysis | • Identify interconnections and supply chain blind spots • Detect customer migration trends across the industry • Highlight untapped customer clusters for market entry |

| Asia Pacific-based Fluoropolymer Processing Aid Manufacturer | • Global & regional production capacity benchmarking • Customer base profiling across the applications | • Strengthen forward integration strategy • Identify high-demand customers for long-term supply contracts • Assess supply-demand gaps for competitive advantage |

RECENT DEVELOPMENTS

- September 2024 : LyondellBasell Industries invested in the KARO 5.0 laboratory stretch machine from Brückner Maschinenbau. This investment in the R&D capabilities was made at its technical Center in Akron, Ohio.

- March 2024 : Syensqo comprised a three-year strategic partnership with Ellen MacArthur Foundation to focus on advancing the sustainability and circularity agenda within the chemical sector.

- January 2024 : Tosaf Compounds LTD introduced non-PFAS-based polymer processing aids, AP9709PE EU and AP9711PE.

- January 2024 : Ampacet Corporation launched non-PFAS-based polymer processing aids, which will perform like fluoro-based polymer processing aids in blown & film applications.

Table of Contents

Methodology

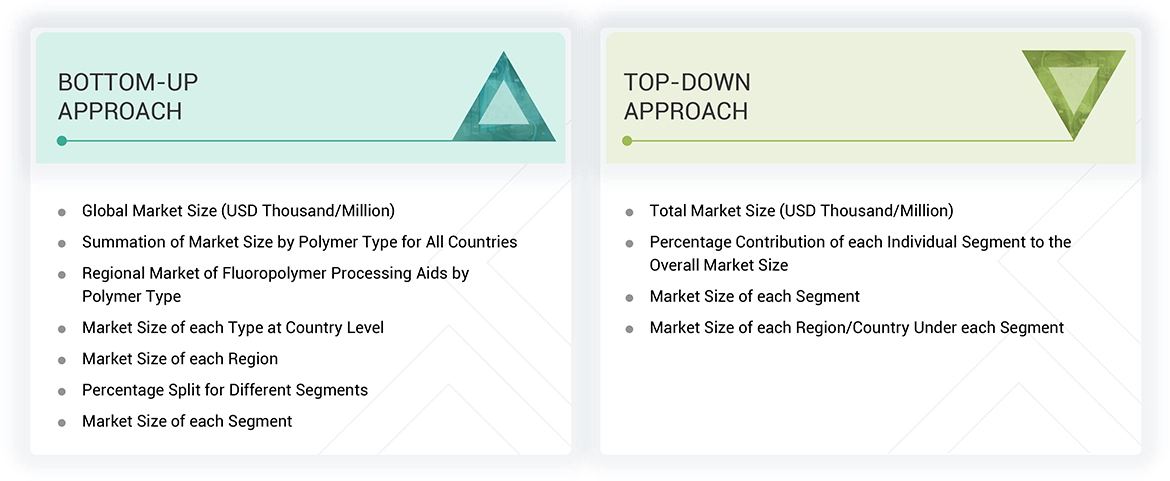

The study involved four major activities in estimating the market size for fluoropolymer processing aid market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The fluoropolymer processing aid market comprises several stakeholders, such as raw material suppliers, product manufacturers, distributors, and regulatory organizations in the supply chain. The demand side of this market is characterized by polyethylene, polypropylene, polyvinyl chloride, and other polymer types. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| Arkema | Senior Manager | |

| Syensqo | Innovation Manager | |

| Adplast | Vice-President | |

| The Chemours Company | Production Supervisor | |

| Daikin Industries, Ltd. | Sales Manager | |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the fluoropolymer processing aid market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Fluoropolymer Processing Aid Market: Bottom-Up and Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the fluoropolymer processing aid industry.

Market Definition

Fluoropolymer processing aids market relates to the business of manufacturing chemicals meant for optimizing the processing of fluoropolymers. These aids facilitate the process, increase the melt strength and stability of fluoropolymer material during the course of extrusion, injection molding and film manufacturing. They thin the melt and enhance melt stability and aid in the process and offer a way of manufacturing improved and higher performance parts with improved dimensional stability. Fluoropolymers are used in automotive, aerospace, and medical end-use industries and as their applications continue to grow, the requirement for efficient processing aids also grows. The market is fueled by technology, sustainability and increased concerns of quality across board due to innovation.

Stakeholders

- Fluoropolymer Processing Aid manufacturers

- Fluoropolymer Processing Aid suppliers

- Raw material suppliers

- Service providers

- End-use companies

- Government bodies

Report Objectives

- To define, describe, and forecast the fluoropolymer processing aid market in terms of value and volume

- To provide detailed information regarding the drivers, opportunities, restraints, and challenges influencing market growth

- To estimate and forecast the market size by polymer type, form, application, and region

- To forecast the size of the market for five main regions: Asia Pacific, Europe, North America, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets1 with respect to their growth trends, prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as deals and expansions, in the market

- To analyze the impact of the recession on the market

- To analyze the impact of COVID-19 on the market and application

- To strategically profile key players and comprehensively analyze their growth strategies

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Fluoropolymer Processing Aid Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Fluoropolymer Processing Aid Market