Acrylic Processing Aid Market by Polymer Type (PVC), Fabrication Process (Extrusion, Injection Molding), End-Use Industry (Building & Construction, Packaging, Automotive, Consumer Goods) - Global Forecast to 2025

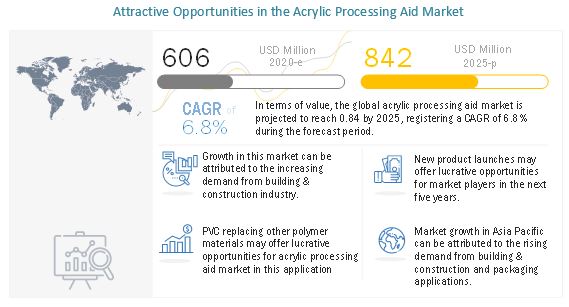

[200 Pages Report] The acrylic processing aid market size is estimated to be USD 606 million in 2020 and is projected reach USD 842 million by 2025, at a CAGR of 6.8% between 2020 and 2025. The market is mainly driven by the rising demand for acrylic processing aid industries such as automotive, consumer goods, building & construction, and packaging. Factors such as replacement of conventional material with PVC and rising demand for acrylic processing aid from Asia-Pacific will drive the acrylic processing aid market. Asia Pacific is the key market for acrylic processing aid, globally, followed by Europe and North America, in terms of volume and value.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on acrylic processing aid Market

In 2020, owing to outbreak of COVID-19 resulted in downfall for many industries across the globe. The decrease in demand of plastics from end-use industries such as automotive, building & construction, consumer goods, packaging and so on has resulted in decrease in demand of acrylic processing aid used in processing of plastics. After Q3 2020, industries are opened up, but with limited workforce and expected to be fully functional by end of 2020. Considering the above factors, the acrylic processing aid market is expected to witness negative growth in 2020 and expected rebound with positive growth during the forecast period.

Driver:Replacement of conventional material with PVC

PVC possesses superior mechanical, electrical, abrasion resistance, chemical resistance, among other properties compared to conventional materials such as metals, glass, paper, and ceramic. Continuous innovation and the need for lighter material in several applications are encouraging the replacement of these conventional materials by plastic in several applications. The manufacturers of PVC use acrylic processing aid during the fabrication process because it provides faster fusion, increased production output, improved melt strength and elasticity, reduced plate-out and melt texture, improved surface gloss and finishing, better thickness, and tensile strength. Acrylic processing aid is more popular in Asian countries due to its cost-effectiveness and properties for producing good quality products.

Restraints: Less R&D expenditure in emerging markets

Asia-Pacific and South America are emerging markets for acrylic processing aid. The market in Europe and North America is comparatively mature than these emerging markets. The amount of acrylic processing aid consumed in Asia Pacific is higher than North America and Europe. In Asia Pacific, China, Japan, and Taiwan are the major producers of acrylic processing aid. Small- and medium-sized players mainly dominate the market in these countries. However, the R&D expenditure by small companies is low because of lack of capital. This negatively affects the overall development of acrylic processing aid in the region. Similarly, the expenditure is lower than North America and Europe in other emerging plastic markets of South America.

Less focus on R&D activities in emerging countries is restraining the acrylic processing aid market. Some of the companies are still striving to develop new technologies for polymerization and produce better-quality plastics with enhanced features. R&D activities and technological advancements may gain momentum after 35 years. Hence, the less focus on R&D activities is considered as a restraining factor for the market in medium term.

Opportunities: Increasing demand from building & construction and automotive applications

Acrylic processing aid is widely used in plastics for PVC applications in the building & construction and automotive industries. The use of acrylic processing aid in plastics for PVC flooring, windows, pipes, automotive interior and exterior is attracting the customers owing to excellent clarity, surface quality, glossy effects, and cost-effectiveness. Acrylic processing aid is mainly used to increase the flow of plastic materials, reduce the shark skin effect during extrusion, and enhance processability. Use of acrylic processing aid in plastics is gaining momentum in major end-use industries such as packaging, building & construction, automotive, consumer goods, and others. With growth in these industries, the demand for APA is also expected to increase in the future.

Acrylic processing aid is widely used in plastics for PVC applications in the building & construction and automotive industries. The use of acrylic processing aid in plastics for PVC flooring, windows, pipes, automotive interior and exterior is attracting the customers owing to excellent clarity, surface quality, glossy effects, and cost-effectiveness. These applications are expected to create growth opportunities for acrylic processing aid in the long term. With the emergence of new application areas and opportunities, the demand for APA will eventually increase in the future.

PVC is the largest polymer type for acrylic processing aid in 2019

PVC is a synthetic resin, which is made from the polymerization of vinyl chloride. It has an amorphous structure with polar chlorine atoms and possesses fire retarding properties, durability, and oil & chemical resistance. It is an odorless and solid plastic, mainly used in automobile instrument panels, sheathing of electrical cables, pipes, and doors. PVC provides flexibility that is helpful in making modern automobiles cost-effective, safe, and of high quality. The composition of this material varies depending on requirement of various grades. It also helps in reducing the weight of vehicles because of its lightweight components in comparison to other materials. Most of the PVC resins are fabricated through extrusion, injection molding, thermoforming, calendaring, and blow molding to produce PVC products. This process requires a small amount of Acrylic Processing Aid during fabrication, depending on the type of application; for example, manufacturing of PVC pipes and window components requires less than 1.5 kg of Acrylic Processing Aid for 100 kg of PVC resin.

Extrusion is estimated to be the largest fabrication process in acrylic processing aid market between 2020 and 2025.

Extrusion is used to process high volume of plastics. The pellets, granules, flakes, or powders are fed into the extrusion machine and melted under high temperature (depending on the type of plastic to be extruded). Single & twin-screw extrusion and die extrusion are the two main types of extrusion techniques. Single & twin extrusion technique is used for melting and pumping of plastic materials, while die extrusion technique is used for the production of different plastic products, such as, pipes, sheet, tubing, and films. Several types of extrusion processes are used for processing plastic materials into finished products.

Building & construction end-use industry is projected to account for the largest share of the acrylic processing aid market between 2020 and 2025.

Plastics play a key role in the building & construction industry. The demand for plastics in this segment is expected to increase because of its increasing use in several applications, including pipes, flooring, roofing, windows & doors, containers, trim board, and others. Plastics are used in the building & construction industry owing to its characteristics such as high impact strength, good weatherability, resistant to oil & chemicals and high levels of light transmission.

Asia Pacific is expected to be the largest acrylic processing aid market during the forecast period, in terms of value and volume.

Asia Pacific is the most promising market for plastics and related industries, including acrylic processing aid. The region is characterized by growing population economic developments. The Asia Pacific market is segmented into China, India, Japan, South Korea, Indonesia, Taiwan, and the Rest of Asia Pacific (which includes Malaysia, Thailand, Philippines, Pakistan, and Bangladesh).

The increasing demand from the building & construction, packaging, consumer goods, and automotive industries is driving the market for acrylic processing aid in the region. The increase in employment rate, purchasing power of the middle class and an increase in foreign investments in various industries of the economy are some important factor that drives the market. The need for environment-friendly products is driving innovation in the plastics industry. High-end products such as consumer goods and electronic devices demand damage-free surfaces. This increases the need for anti-scratch products, which in turn drives the market for acrylic processing aid.

Europe is estimated to be the second largest acrylic processing aid market during the forecast period.

The European acrylic processing aid market is segmented into Germany, France, Italy, UK, Spain and the Rest of Europe (which includes Russia, Poland, Turkey, Romania, Benelux, Scandinavia, Sweden, and so on). The market in Europe is driven by innovation. Germany is the key market for acrylic processing aid in the region. However, it is estimated to witness slow growth between 2020 and 2025 because of recovery from the pandemic and reduced usage of plastic products. There are many untapped opportunities in the packaging industry of Eastern Europe, which shows growth prospects for the acrylic processing aid market in the region. The major players are reducing their production and shifting their facilities to emerging markets and serve the higher demand from Asia-Pacific. BASF, Arkema SA, and Akdeniz Chemson are the major players in the European acrylic processing aid market.

Key Market Players

The key market players profiled in the report include Mitsubishi Chemical Corporation (Japan), Arkema SA (France), Shandong Ruifeng Chemical Co. Ltd. (China), Akdeniz Chemson (Turkey), The Down Chemical Company (US), Kaneka Corporation (Japan), WSD Chemical Limited (China), Indofil Industries Limited (India), and Novista Group (China)

Scope of the report

|

Report Metric |

Details |

| Years considered for the study | 2018-2025 |

| Base Year | 2019 |

| Forecast period | 20202025 |

| Units considered | Volume (Kilotons); Value (USD Million) |

| Segments | Polymer Type, Fabrication Process, End-Use Industry, and Region |

| Regions | APAC, North America, Europe, Middle East & Africa, and South America |

| Companies | Mitsubishi Chemical Corporation (Japan), Arkema SA (France), Shandong Ruifeng Chemical Co. Ltd. (China), Akdeniz Chemson (Turkey), The Down Chemical Company (US), Kaneka Corporation (Japan), WSD Chemical Limited (China), Indofil Industries Limited (India), and Novista Group (China) |

This report categorizes the global acrylic processing aid market based on polymer type, fabrication process, end-use industry, and region.

On the basis of Polymer Type, the acrylic processing aid market has been segmented as follows:

- PVC

- Other

On the basis of Fabrication Process, the acrylic processing aid market has been segmented as follows:

- Extrusion

- Injection Molding

- Others

On the basis of End-Use Industry, the acrylic processing aid market has been segmented as follows:

- Building & Construction

- Packaging

- Automotive

- Consumer Goods

- Others

On the basis of region, the acrylic processing aid market has been segmented as follows:

- APAC

- North America

- Europe

- Middle East & Arica

- South America

Frequently Asked Questions (FAQ):

What are the factors Influencing the growth of acrylic processing aid?

Replacement of conventional material with PVC

What are extrusion and injection molding process?

Extrusion is used to process high volume of plastics. The pellets, granules, flakes, or powders are fed into the extrusion machine and melted under high temperature (depending on the type of plastic to be extruded). Injection molding process with acrylic processing aid is used for manufacturing plastic products. It consists of two main parts, an injection unit and a clamping unit.

What is the biggest Restraint for acrylic processing aid?

Less R&D Expenditure in Emerging Markets

Which polymers are processed using acrylic processing aid?

Polymer type are segmented as PVC, PC, PS, and ABS. PVC is amongst the most widely used polymer type. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of The Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for The Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

2.4.1 Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Significant Opportunities in APA Market

4.2 Asia-Pacific to Register The Highest CAGR in APA Market

4.3 APA Market, By Polymer Type

4.4 APA Market, By Fabrication Process

4.5 APA Market in Asia-Pacific, By Country and End-Use Industry, 2015

4.6 APA Market Attractiveness

4.7 APA Market, By End-Use Industry and Region

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Impact Analysis for Short, Medium, and Long Term

5.3.2 Drivers

5.3.2.1 Need for Cost-Effective Aid for Manufacturing Plastic Products

5.3.2.2 High Demand for APA-Based PVC in End-Use Applications

5.3.3 Restraints

5.3.3.1 Less R&D Expenditure in Emerging Markets

5.3.4 Opportunities

5.3.4.1 Increasing Demand From Building & Construction and Automotive Applications

6 Industry Trends (Page No. - 42)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Raw Material

6.2.2 Fabrication Process and Polymer

6.2.3 Distribution Network

6.2.4 End-Use Industries

6.3 Porters Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

6.4 Macroeconomic Indicators

6.4.1 Industry Outlook

6.4.1.1 Packaging

6.4.1.2 Automotive

6.4.1.3 Construction

7 APA Market, By Polymer Type (Page No. - 51)

7.1 Introduction

7.2 Market Size Estimation

7.3 Polyvinyl Chloride

7.3.1 Flexible PVC

7.3.2 Rigid PVC

7.4 Others

7.4.1 Acrylonitrile-Butadiene-Styrene

7.4.2 Polycarbonates

7.4.3 Poly Methyl-Methacrylate

7.4.4 Polystyrene

8 APA Market, By Fabrication Process (Page No. - 58)

8.1 Introduction

8.2 Fabrication Process Revenue Pocket Matrix

8.3 Extrusion

8.3.1 Sheet & Film

8.3.2 Tubing

8.3.3 Blown Film

8.3.4 Over Jacketing Extrusion

8.3.5 Coextrusion

8.3.6 Extrusion Coating

8.4 Injection Molding

8.4.1 2K Molding

8.4.2 Structural Foam Molding

8.4.3 Gas Assisted Molding

8.5 Others

8.5.1 Thermoforming

8.5.2 Calendering

9 APA Market, By End-Use Industry (Page No. - 68)

9.1 Introduction

9.2 Revenue Pocket Matrix

9.3 Building & Construction

9.3.1 Pipes & Fittings

9.3.2 Doors and Windows

9.3.3 Sidings

9.3.4 Fences & Fenestration

9.4 Packaging

9.4.1 Rigid Film

9.4.2 Flexible Film

9.4.3 Cling Film

9.5 Consumer Goods

9.5.1 Furniture

9.5.2 Footwear

9.5.3 Smart Cards

9.6 Automotive

9.6.1 Interior

9.6.2 Exterior

9.7 Others

10 APA Market, By Region (Page No. - 81)

10.1 Introduction

10.2 Asia-Pacific

10.2.1 China

10.2.2 Japan

10.2.3 Taiwan

10.2.4 India

10.2.5 South Korea

10.2.6 Indonesia

10.2.7 Australia & New Zealand

10.3 Europe

10.3.1 Germany

10.3.2 Italy

10.3.3 France

10.3.4 Spain

10.3.5 U.K.

10.4 North America

10.4.1 U.S.

10.4.2 Mexico

10.4.3 Canada

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 Iran

10.5.3 South Africa

10.6 South America

10.6.1 Brazil

10.6.2 Argentina

10.6.3 Chile

11 Competitive Landscape (Page No. - 123)

11.1 Overview

11.2 Market Share of Major Players

11.2.1 LG Chem Ltd.

11.2.2 Arkema SA

11.2.3 Kaneka Corporation

11.2.4 Mitsubishi Rayon Co., Ltd.

11.2.5 Chinese Manufacturers

11.3 Competitive Benchmarking

11.4 Competitive Situations and Trends

11.4.1 New Product Launch

11.4.2 Agreement

11.4.3 Merger & Acquisition

12 Company Profiles (Page No. - 128)

(Overview, Products and Services, Financials, Strategy & Development)*

12.1 LG Chem Ltd.

12.2 Kaneka Corporation

12.3 Arkema SA

12.4 The DOW Chemical Company

12.5 Mitsubishi Rayon Co., Ltd.

12.6 3M Company

12.7 BASF SE

12.8 Shandong Ruifeng Chemical Co. Ltd.

12.9 Akdeniz Kimya A.S.

12.10 Shandong Rike Chemicals Co., Ltd.

12.11 Other Key Market Players

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

13 Appendix (Page No. - 144)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (105 Tables)

Table 1 APA Market, By Polymer Type

Table 2 APA Market, By Fabrication Process

Table 3 APA Market, By End-Use Industry

Table 4 APA Market Size, By Polymer Type, 20142026 (USD Million)

Table 5 APA Market Size, By Polymer Type, 20142026 (Kiloton)

Table 6 PVC Market Size, By Region, 20142026 (USD Million)

Table 7 PVC Market Size, By Region, 20142026 (Kiloton)

Table 8 Other Polymer Type Market Size, By Region, 20142026 (USD Million)

Table 9 Other Polymer Type Market Size, By Region, 20142026 (Kiloton)

Table 10 APA Market Size, By Fabrication Process, 20142026 (USD Million)

Table 11 APA Market Size, By Fabrication Process, 20142026 (Kiloton)

Table 12 APA Market Size in Extrusion Fabrication Process, By Region, 20142026 (USD Million)

Table 13 APA Market Size in Extrusion Fabrication Process, By Region, 20142026 (Kiloton)

Table 14 APA Market Size in Injection Molding Fabrication Process, By Region, 20142026 (USD Million)

Table 15 APA Market Size in Injection Molding Fabrication Process, By Region, 20142026 (Kiloton)

Table 16 APA Market Size in Other Fabrication Process, By Region, 20142026 (USD Million)

Table 17 APA Market Size in Other Fabrication Process, By Region, 20142026 (Kiloton)

Table 18 APA Market Size, By End-Use Industry, 20142026 (USD Million)

Table 19 APA Market Size, By End-Use Industry, 20142026 (Kiloton)

Table 20 APA Market Size in Building & Construction Industry, By Region, 20142026 (USD Million)

Table 21 APA Market Size in Building & Construction Industry, By Region, 20142026 (Kiloton)

Table 22 APA Market Size in Packaging Industry, By Region, 20142026 (USD Million)

Table 23 APA Market Size in Packaging Industry, By Region, 20142026 (Kiloton)

Table 24 APA Market Size in Consumer Goods Industry, By Region, 20142026 (USD Million)

Table 25 APA Market Size in Consumer Goods Industry, By Region, 20142026 (Kiloton)

Table 26 APA Market Size in Automotive Industry, By Region, 20142026 (USD Million)

Table 27 APA Market Size in Automotive Industry, By Region, 20142026 (Kiloton)

Table 28 APA Market Size in Other End-Use Industries, By Region, 20142026 (USD Million)

Table 29 APA Market Size in Other End-Use Industries, By Region, 20142026 (Kiloton)

Table 30 APA Market Size, By Region, 20142026 (USD Million)

Table 31 APA Market Size, By Region, 20142026 (Kiloton)

Table 32 Asia-Pacific: APA Market Size, By Country, 20142026 (USD Million)

Table 33 Asia-Pacific: APA Market Size, By Country, 20142026 (Kiloton)

Table 34 Asia-Pacific: APA Market Size, By Polymer Type, 20142026 (USD Million)

Table 35 Asia-Pacific: APA Market Size, By Polymer Type, 20142026 (Kiloton)

Table 36 Asia-Pacific: APA Market Size, By Fabrication Process, 20142026 (USD Million)

Table 37 Asia-Pacific: APA Market Size, By Fabrication Process, 20142026 (Kiloton)

Table 38 Asia-Pacific: APA Market Size, By End-Use Industry, 20142026 (USD Million)

Table 39 Asia-Pacific: APA Market Size, By End-Use Industry, 20142026 (Kiloton)

Table 40 China: APA Market Size, By End-Use Industry, 20142026 (USD Million)

Table 41 China: APA Market Size, By End-Use Industry, 20142026 (Kiloton)

Table 42 Japan: APA Market Size, By End-Use Industry, 20142026 (USD Million)

Table 43 Japan: APA Market Size, By End-Use Industry, 20142026 (Kiloton)

Table 44 Taiwan: APA Market Size, By End-Use Industry, 20142026 (USD Million)

Table 45 Taiwan: APA Market Size, By End-Use Industry, 20142026 (Kiloton)

Table 46 Europe: APA Market Size, By Country, 20142026 (USD Million)

Table 47 Europe: APA Market Size, By Country, 20142026 (Kiloton)

Table 48 Europe: APA Market Size, By Polymer Type, 20142026 (USD Million)

Table 49 Europe: APA Market Size, By Polymer Type, 20142026 (Kiloton)

Table 50 Europe: APA Market Size, By Fabrication Process, 20142026 (USD Million)

Table 51 Europe: APA Market Size, By Fabrication Process, 20142026 (Kiloton)

Table 52 Europe: APA Market Size, By End-Use Industry, 20142026 (USD Million)

Table 53 Europe: APA Market Size, By End-Use Industry, 20142026 (Kiloton)

Table 54 Germany: APA Market Size, By End-Use Industry, 20142026 (USD Million)

Table 55 Germany: APA Market Size, By End-Use Industry, 20142026 (Kiloton)

Table 56 Italy: APA Market Size, By End-Use Industry, 20142026 (USD Million)

Table 57 Italy: APA Market Size, By End-Use Industry, 20142026 (Kiloton)

Table 58 France: APA Market Size, By End-Use Industry, 20142026 (USD Million)

Table 59 France: APA Market Size, By End-Use Industry, 20142026 (Kiloton)

Table 60 North America: APA Market Size, By Country, 20142026 (USD Million)

Table 61 North America: APA Market Size, By Country, 20142026 (Kiloton)

Table 62 North America: APA Market Size, By Polymer Type, 20142026 (USD Million)

Table 63 North America: APA Market Size, By Polymer Type, 20142026 (Kiloton)

Table 64 North America: APA Market Size, By Fabrication Process, 20142026 (USD Million)

Table 65 North America: APA Market Size, By Fabrication Process, 20142026 (Kiloton)

Table 66 North America: APA Market Size, By End-Use Industry, 20142026 (USD Million)

Table 67 North America: APA Market Size, By End-Use Industry, 20142026 (Kiloton)

Table 68 U.S.: APA Market Size, By End-Use Industry, 20142026 (USD Million)

Table 69 U.S.: APA Market Size, By End-Use Industry, 20142026 (Kiloton)

Table 70 Mexico: APA Market Size, By End-Use Industry, 20142026 (USD Million)

Table 71 Mexico: APA Market Size, By End-Use Industry, 20142026 (Kiloton)

Table 72 Canada: APA Market Size, By End-Use Industry, 20142026 (USD Million)

Table 73 Canada: APA Market Size, By End-Use Industry, 20142026 (Kiloton)

Table 74 Middle East & Africa: APA Market Size, By Country, 20142026 (USD Million)

Table 75 Middle East & Africa: APA Market Size, By Country, 20142026 (Kiloton)

Table 76 Middle East & Africa: APA Market Size, By Polymer Type, 20142026 (USD Million)

Table 77 Middle East & Africa: APA Market Size, By Polymer Type, 20142026 (Kiloton)

Table 78 Middle East & Africa: APA Market Size, By Fabrication Process, 20142026 (USD Million)

Table 79 Middle East & Africa: APA Market Size, By Fabrication Process, 20142026 (Kiloton)

Table 80 Middle East & Africa: APA Market Size, By End-Use Industry, 20142026 (USD Million)

Table 81 Middle East & Africa: APA Market Size, By End-Use Industry, 20142026 (Kiloton)

Table 82 Saudi Arabia: APA Market Size, By End-Use Industry, 20142026 (USD Million)

Table 83 Saudi Arabia: APA Market Size, By End-Use Industry, 20142026 (Kiloton)

Table 84 Iran: APA Market Size, By End-Use Industry, 20142026 (USD Million)

Table 85 Iran: APA Market Size, By End-Use Industry, 20142026 (Kiloton)

Table 86 South Africa: APA Market Size, By End-Use Industry, 20142026 (USD Million)

Table 87 South Africa: APA Market Size, By End-Use Industry, 20142026 (Kiloton)

Table 88 South America: APA Market Size, By Country, 20142026 (USD Million)

Table 89 South America: APA Market Size, By Country, 20142026 (Kiloton)

Table 90 South America: APA Market Size, By Polymer Type, 20142026 (USD Million)

Table 91 South America: APA Market Size, By Polymer Type, 20142026 (Kiloton)

Table 92 South America: APA Market Size, By Fabrication Process, 20142026 (USD Million)

Table 93 South America: APA Market Size, By Fabrication Process, 20142026 (Kiloton)

Table 94 South America: APA Market Size, By End-Use Industry, 20142026 (USD Million)

Table 95 South America: APA Market Size, By End-Use Industry, 20142026 (Kiloton)

Table 96 Brazil: APA Market Size, By End-Use Industry, 20142026 (USD Million)

Table 97 Brazil: APA Market Size, By End-Use Industry, 20142026 (Kiloton)

Table 98 Argentina: APA Market Size, By End-Use Industry, 20142026 (USD Million)

Table 99 Argentina: APA Market Size, By End-Use Industry, 20142026 (Kiloton)

Table 100 Chile: APA Market Size, By End-Use Industry, 20142026 (USD Million)

Table 101 Chile: APA Market Size, By End-Use Industry, 20142026 (Kiloton)

Table 102 Brand Influence on APA Market

Table 103 New Product Launches, 20142016

Table 104 Agreements, 20142016

Table 105 Mergers & Acquisitions, 20142016

List of Figures (58 Figures)

Figure 1 APA Market: Research Design

Figure 2 Market Size Estimation: Bottom-Up Approach

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 APA Market: Data Triangulation

Figure 5 PVC to Be The Largest Polymer Type in APA Market Between 2016 and 2021

Figure 6 Extrusion to Be The Largest Fabrication Process Between 2016 and 2021

Figure 7 Building & Construction to Be The Largest End-Use Industry Between 2016 and 2021

Figure 8 Asia-Pacific to Be The Fastest-Growing APA Market Between 2016 and 2021

Figure 9 APA Market to Register High CAGR Between 2016 and 2021

Figure 10 Asia-Pacific to Be The Key Market for APA Between 2016 and 2021

Figure 11 PVC to Account for The Highest CAGR in APA Market Between 2016 and 2021

Figure 12 Extrusion to Account for The Largest Share in APA Market Between 2016 and 2021

Figure 13 APA Market in Asia-Pacific: Building & Construction Accounted for The Largest Share in 2015

Figure 14 Asia-Pacific to Be The Fastest-Growing Market for APA Between 2016 and 2021

Figure 15 Building & Construction Industry Accounted for Major Share in APA Market in 2015

Figure 16 APA Market, By Region

Figure 17 Overview of Factors Governing APA Market

Figure 18 Value Chain of APA Market

Figure 19 Porters Five Forces Analysis

Figure 20 Packaging Industry, By Region

Figure 21 Packaging Industry, By End User

Figure 22 Vehicles Production, By Region, 2015

Figure 23 Construction Industry Growth Rate, 2014

Figure 24 PVC to Dominate APA Market Between 2016 and 2021

Figure 25 Asia-Pacific to Be The Largest Market for PVC Between 2016 and 2021

Figure 26 Europe to Be The Second-Largest Market for Other Polymer Type Between 2016 and 2021

Figure 27 Extrusion Fabrication Process to Dominate APA Market Between 2016 and 2021

Figure 28 Revenue Pocket Matrix: By Fabrication Process

Figure 29 Asia-Pacific to Be The Largest Market for APA in Extrusion Between 2016 and 2021

Figure 30 Europe to Be The Second-Largest Market for APA in Injection Molding Process Between 2016 and 2021

Figure 31 Asia-Pacific to Dominate APA Market in Other Fabrication Process Between 2016 and 2021

Figure 32 Building & Construction to Dominate APA Market Between 2016 and 2021

Figure 33 Revenue Pocket Matrix, By End-Use Industry

Figure 34 Asia-Pacific to Be The Largest Market for APA in Building & Construction Industry Between 2016 and 2021

Figure 35 Europe to Be The Second-Largest Market for APA in Packaging Industry Between 2016 and 2021

Figure 36 Asia-Pacific to Be The Largest APA Market in Consumer Goods Industry Between 2016 and 2021

Figure 37 Europe to Be The Second Largest APA Market in Automotive Industry Between 2016 and 2021

Figure 38 Asia-Pacific to Be The Largest APA Market in Other End-Use Industries Between 2016 and 2021

Figure 39 China, Taiwan, and India: Emerging Markets for APA

Figure 40 China Dominates APA Market in Asia-Pacific

Figure 41 India APA Market Size, 20142021

Figure 42 South Korea APA Market Size, 20142021

Figure 43 Indonesia APA Market Size, 20142021

Figure 44 Australia & New Zealand APA Market Size, 20142021

Figure 45 Germany to Register The Highest CAGR in European APA Market

Figure 46 Spain APA Market Size, 20142021

Figure 47 U.K. APA Market Size, 20142021

Figure 48 U.S. Dominates APA Market in North America

Figure 49 New Product Launches: The Most Preferred Growth Strategy Adopted By Key Players

Figure 50 LG Chem Ltd.: The Leading Player in APA Market, 2015

Figure 51 LG Chem Ltd.: Company Snapshot

Figure 52 Kaneka Corporation: Company Snapshot

Figure 53 Arkema SA: Company Snapshot

Figure 54 Arkema SA: SWOT Analysis

Figure 55 The DOW Chemical Company: Company Snapshot

Figure 56 Mitsubishi Rayon Co., Ltd.: Company Snapshot

Figure 57 3M Company: Company Snapshot

Figure 58 BASF SE: Company Snapshot

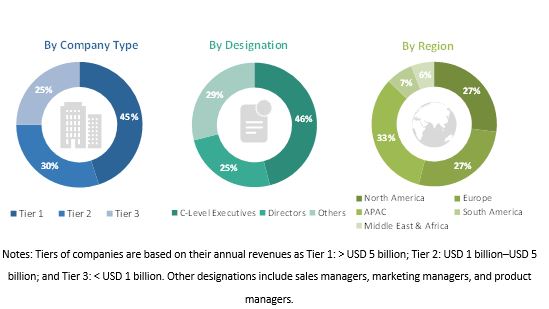

The study involved four major activities to estimate the market size for acrylic processing aid. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

The acrylic processing aid market comprises several stakeholders such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development in end-use industries such as automotive, construction, packaging, consumer goods, and others. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the acrylic processing aid market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry have been identified through extensive secondary research.

- The industrys supply chain and market size, in terms of volume and value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market sizeusing the market size estimation processes as explained abovethe market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the size of the acrylic processing aid market, in terms of volume and value

- To provide detailed information regarding key factors, such as drivers, restraints, and opportunities influencing the growth of the market

- To define, describe, and segment the acrylic processing aid market on the basis of polymer type fabrication process, and end-use industry

- To forecast the size of the market segments for regions such as APAC, North America, Europe, South America, and the Middle East & Africa

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments such as expansion, new product launch, merger & acquisition, and agreement in the acrylic processing aid market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional end-use industry

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Acrylic Processing Aid Market