eVTOL Aircraft Market Size, Share and Trends, 2025 To 2035

eVTOL Aircraft Market by Lift Technology (Vectored Thrust, Multirotor, Lift Plus Cruise), Propulsion Type (Fully Electric, Hybrid, Hydrogen), Application (Air Taxi, Air Metro), System, Mode of Operation, MTOW, Range and Region - Global Forecast to 2035

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The eVTOL Aircraft market is valued at USD 0.76 billion in 2024 and is projected to reach USD 4.67 billion by 2030, at a CAGR of 35.3 % from 2024 to 2030 and is projected to grow from USD 6.53 billion in 2031 to 17.34 billion by 2035 at a CAGR of 27.6 % from 2031 to 2035. The procurement volume of eVTOL is projected to grow from 2,157 units in 2031 to 5,280 units by 2035. The eVTOL aircraft market is emerging as a transformative sector in aviation, driven by the demand for efficient, flexible, and sustainable transportation solutions.

KEY TAKEAWAYS

- North America is projected to register a CAGR of 36.2% in the eVTOL aircraft market during the forecast period.

- By lift technology, the vectored thrust segment led the market, accounting for a 64% share in 2024.

- By propulsion type, the hydrogen electric segment is projected to grow at the fastest rate during the forecast period.

- By system, the batteries and cells segment is expected to dominate the market.

- Airbus SE, Elbit Systems Ltd., and Embraer SA were identified as some of the star players in the eVTOL aircraft market, given their strong market share and product footprint.

- E-Hang Holdings Ltd., Joby Aviation, Inc., and Archer Aviation, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The eVTOL industry is experiencing robust growth driven by the increasing demand for efficient, sustainable, and autonomous transportation solutions in urban areas. Rising concerns over traffic congestion, environmental impact, and the need for improved connectivity have positioned eVTOL aircraft as a transformative force in urban transportation. Some of the companies are Airbus SE, Bell Textron Inc., Joby Aviation Inc., Lilium GmbH, Volocopter GmbH as part of Diamond Aircraft Holdings, EHang Holdings Ltd., Vertical Aerospace, Jaunt Air Mobility, Archer Aviation, and Beta Technologies.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Advancements in existing aircraft and the trend toward more electric aircraft (MEA) to enhance aircraft performance and efficiency and minimize greenhouse gas transmission and noise pollution are expected to drive the market for eVTOL aircraft across the globe. Accelerated development in alternate transport projects, such as urban air mobility, is also expected to drive the demand for eVTOL aircraft.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing need for green energy and noise-free aircraft.

-

Increasing demand for alternative mode of transport.

Level

-

Regulatory hurdles.

-

High development and infrastructure costs.

Level

-

Autonomous operations.

-

Regional air mobility expansion.

Level

-

Short range due to battery limitations.

-

Cybersecurity concerns.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing need for green energy and noise-free aircraft.

According to the latest release by ATAG, a long-term climate change goal to cut CO2 emissions in half by 2050 has been set. The research and development in electric, hybrid, and hydrogen aircraft are expected to help shift from fossil fuel for power to sustainable aviation fuel. The growing need for green and noise-free aircraft is a major driver for the eVTOL market.

Restraint: Regulatory hurdles.

The regulatory landscape for eVTOL aircraft is still evolving, creating significant barriers for manufacturers and operators. Certification processes, governed by agencies like the Federal Aviation Administration (FAA) in the U.S. and the European Union Aviation Safety Agency (EASA) in Europe, are lengthy, complex, and costly. Traditional aviation regulations were designed for fixed-wing aircraft and helicopters, making them ill-suited to address the unique features of eVTOLs, such as distributed electric propulsion, vertical takeoff capabilities, and autonomous operations.

Opportunity: Autonomous operations.

Autonomous eVTOLs have the potential to address the pilot shortage that plagues the aviation industry while dramatically reducing costs associated with training, certification, and crew salaries. For operators, autonomy means increased fleet utilization, as aircraft can operate continuously without pilot rest periods, enhancing profitability. Companies like Wisk Aero are already testing fully autonomous eVTOL designs, aiming to eliminate pilot dependency entirely.

Challenge: Short range due to battery limitations.

One of the key challenges facing eVTOL aircraft is their limited range, primarily caused by current battery technology constraints. Most eVTOLs rely on lithium-ion batteries, which, while efficient, have energy densities far lower than traditional aviation fuels. This limits the operational range of eVTOLs to approximately 80-150 Kilometers per charge for many designs, making them suitable only for short intra-city routes or suburban connectivity.

eVTOL Aircraft Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Urban air taxi and airport transfer services connecting dense city centers with major hubs using the all-electric Joby aircraft. Ideal for premium commuter shuttles, on-demand ridesharing, and corporate mobility corridors in high traffic metros. | Low acoustic footprint for city operations, zero operational emissions, rapid point-to-point travel that cuts 60 to 90 percent off rush-hour trip times, and an integrated app-based booking flow designed for high utilization in advanced air mobility networks. |

|

Scheduled and on-demand short-haul routes across metro areas using Archer’s Midnight aircraft, focused on frequent city pair shuttles such as downtown to airport and business district to tech parks. | High sortie tempo with quick turnaround, optimized for repeatable 10 to 50 mile missions, reduced total cost per seat mile versus helicopters, and strong airline and airport ecosystem alignment for faster market entry. |

|

Regional air mobility linking secondary cities and suburbs with a network of vertiports using the Lilium Jet’s ducted electric fan architecture. Perfect for thin passenger routes and premium charter services where speed and comfort matter. | Cabin-forward design for passenger comfort, potential for longer stage lengths within eVTOL class, quiet operations over communities, and modular battery strategy to support scalable route networks. |

|

Inner-city aerial rides, event mobility, and airport feeder services with the multicopter Volocopter family. Well suited for short hops over congested corridors, tourism circuits, and first-mile or last-mile connections. | Simplified multicopter design for stable hover and precise landings, compact ground footprint for rooftop or parking-lot vertiports, community friendly acoustic profile, and strong partnerships with cities and airports for pilot deployments. |

|

Autonomous aerial mobility for smart-city tourism, short-range passenger shuttles, and public safety support using EHang’s pilotless eVTOL platforms. Applicable to sightseeing routes, resort transfers, and controlled urban corridors. | Autonomous flight reduces pilot dependency and operating cost, standardized vehicle for fleet operations, compact vertiport requirements, and rapid deployment potential for municipalities seeking scalable urban air services. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Prominent OEMs drive the development of eVTOL aircraft, designing, and manufacturing next-generation electric air vehicles. Companies like Archer Aviation (US) are developing advanced propulsion systems, lightweight materials, and autonomous technologies to create safe and scalable eVTOL solutions. Infrastructure providers are essential for enabling eVTOL commercialization, and developing vertiports, charging stations, and air traffic management (UTM) systems. Companies like Skyports (UK) invest in urban air mobility infrastructure, ensuring smooth take-off, landing, and charging operations. They collaborate with city planners, regulatory bodies, and private firms to integrate eVTOL-friendly facilities into metropolitan areas.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

eVTOL Aircraft Market, By Lift Technology

The lift plus cruise segment is expected to grow at the highest rate during forecast period. The lift plus cruise design strategy holds significant potential for advancing urban air mobility and regional transportation programs. eVTOL aircraft utilizing this technology can achieve enhanced operational efficiency, improved flight dynamics, and optimized energy consumption by enabling separate systems for vertical lift and forward flight. Continued advancements in propulsion, control systems, and aerodynamics will further propel the development and commercial viability of lift-plus-cruise eVTOLs, revolutionizing the future of aerial transportation.

eVTOL Aircraft Market, By Propulsion Type

In 2024, fully electric segment dominated the eVTOL aircraft market. Prominent advantage of electric propulsion is that it is quasi-silent, which presents a strategic advantage to combat noise pollution. Fully electric aircraft provide a shorter range of travel and lower take-off weights. This could be managed with increasing developments in battery technology. Fully electric eVTOLs produce zero direct emissions, aligning with eco-friendly objectives and contributing to improved air quality in urban environments. Electric propulsion systems offer favorable operating costs due to the relative affordability and stability of electricity pricing

eVTOL Aircraft Market, By System

Electric motors used for propulsion weigh less than their piston-engine counterparts. These motors can improve the disparity between electric and gasoline energy densities when used in smaller aircraft for shorter distances. The MagniX Magni500 electric motor weighs 135 kg dry and produces a power output of 560 kW compared to the respective petrol engine with a dry weight of 290 kg, producing 300 kW it is replacing.

eVTOL Aircraft Market, By Mode of Operation

In the autonomous segment, eVTOLs are designed to operate without direct human intervention, relying on advanced sensors, artificial intelligence, and sophisticated flight control systems to navigate and make decisions. Autonomous eVTOLs offer several notable advantages. Firstly, they have the potential to revolutionize the transportation industry by enabling on-demand and efficient aerial mobility without the need for human pilots. Autonomous systems can leverage advanced algorithms to optimize flight paths, minimize congestion, and enhance safety through real-time situational awareness. Autonomous eVTOLs have the advantage of consistent and precise flight performance, as they can adhere strictly to predefined routes and flight parameters.

eVTOL Aircraft Market, By Application

Private transport includes eVTOL aircraft manufactured for personal or recreational use. The personal air vehicle is intended to provide convenience like that of a private car in terms of accessibility and ease of operation. Private transport vehicles also include flying car concepts and hoverbikes. The integration of speed and routing efficiencies is poised to become a paramount driver of exponential growth in the market for personal eVTOL transport. The demand for streamlined and environmentally conscious mobility solutions escalates as urbanization continues unabated.

eVTOL Aircraft Market, By MTOW

The eVTOLs in the <100 kg MTOW category find extensive applications in surveillance, aerial photography, and small cargo delivery. Their lightweight design and maneuverability make them ideal for tasks requiring low-altitude, short-distance flights, such as monitoring remote areas, capturing aerial imagery, and transporting lightweight goods. eVTOLs in this category often feature multirotor configurations, making them versatile and capable of vertical take-off and landing. They are equipped with advanced sensors and cameras for real-time data acquisition, allowing for effective surveillance and reconnaissance operations.

eVTOL Aircraft Market, By Range

Batteries such as LiPo, Li-ion, and LiS are used in these eVTOL aircraft. eVTOL aircraft with a range of <=200 km is operated either autonomously or operated from the ground stations. Volocopter 2X and Drone DJ are a few examples of eVTOL aircraft with a range of <=200 km. SZ DJI Technology Co. Ltd., Volocoptor GmbH, Jaunt Air Mobility, and City Hawk manufacture these eVTOLs.

REGION

Europe to be fastest-growing region in global eVTOL aircraft market from 2024 to 2030.

Europe has one of the most liberalized and integrated markets in the world. The single aviation market created by the EU was expanded to the European Common Aviation Area (ECAA). The single market revolutionized mobility, providing cheaper and safer air travel and creating more jobs, and driving economic growth. However, the decision by Great Britain to withdraw from the EU, commonly known as Brexit, is evidence of a change in the political landscape. With the extension of community competency in aviation safety and security, the upgrade of the Single European Sky, and growing concerns over the environmental impacts of aviation, EU activities have increased relevance in this sector.

eVTOL Aircraft Market: COMPANY EVALUATION MATRIX

In the eVTOL aircraft market, Airbus SE, Elbit Systems Ltd., and Embraer SA have strong and established product portfolios with a strong market presence. Israel Aerospace Industries and Aurora Flight Sciences are players in the emerging leader category as they have demonstrated substantial product innovations compared to their competitors. Participants are companies with limited footprints and offerings. Often new entrants in the market fall under participants category as they require some time to gain significant traction, such as Terrafugia.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.76 Billion |

| Market Forecast in 2035 (Value) | USD 17.34 Billion |

| Growth Rate | CAGR of 27.6% from 2031-2035 |

| Years Considered | 2020-2035 |

| Base Year | 2024 |

| Forecast Period | 2025-2030; 2031-2035 |

| Units Considered | Value (USD Million/Billion), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: eVTOL Aircraft Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading eVTOL OEM | Market size estimation and forecasting for eVTOL Aircraft Market till 2050 |

|

| Leading Cross-Technology Future Solutions Provider | eVTOL Aircraft Market Forecasting based on Multiple Scenario Analysis |

|

RECENT DEVELOPMENTS

- October 2025 : Vertical Aerospace confirmed a minor demonstration flight incident involving its VX4 aircraft during a prepared landing sequence at Expo 2025 Osaka. The aircraft landed safely and the company issued a comprehensive quality control review to expedite resumed testing. Vertical also announced a global first look at its certified commercial-ready VX4 in December 2025, reinforcing a commitment to safety and regulatory compliance in the competitive eVTOL market.

- April 2025 : Joby Aviation advanced into the final stage of the FAA certification process with its first conforming electric air taxi now in full integration and systems testing. Designed for up to four passengers with approximately 100 miles range and very low noise emissions, the aircraft is positioned to launch commercial air taxi services by mid-decade. Joby continues to lead the US advanced air mobility market with strong airline partnerships and city-airport shuttle applications supporting faster, cleaner, congestion-free travel.

- Mar-25 : Eve Air Mobility confirmed that its total liquidity surpassed USD 530 million, aligning financial readiness with its upcoming commercial passenger service milestones. Eve also announced intent to launch autonomous-ready eVTOL routes in Bahrain starting 2028 and expand to additional Middle Eastern hubs by 2029. The aircraft’s future-ready design and partnership ecosystem strengthen global confidence in sustainable regional air transport.

- COLUMN 'A' SHOULD BE IN TEXT FORMAT AND NOT DATE FORMAT :

Table of Contents

Methodology

This research study involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information relevant to the eVTOL Aircraft market. Primary sources included industry experts from the core and related industries, as well as preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all the segments of this industry’s value chain. All primary sources were interviewed to obtain and verify critical qualitative and quantitative information and assess prospects for market growth during the forecast period.

Secondary Research

The share of companies in the eVTOL Aircraft Market was determined using secondary data made available through paid and unpaid sources and analyzing product portfolios of major companies in the eVTOL Aircraft market. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred to for this research study on the eVTOL Aircraft market included financial statements of companies offering and developing eVTOL Aircraft and information from various trade, business, and professional associations, among others. Secondary data was collected and analyzed to determine the total size of the eVTOL Aircraft market, which primary respondents further validated.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the eVTOL Aircraft market through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across North America, Europe, Asia Pacific, the Middle East, and Afrca. This primary data was collected through questionnaires, emails, and telephonic interviews. In the primary research process, varied primary sources from the supply and demand sides were interviewed to get qualitative and quantitative information on the market. Primary sources from the supply side include different industry experts like vice presidents, directors, regional managers, technology providers, product development teams, distributors, and end users.

Primary research has been done through interviews to get information that includes market statistics, revenue collection data from the products and services, and market breakups, size estimations, market forecasting, and data triangulation. Through primary research, the trends of Range, application, lift technology, and region were also understood. Demand-side stakeholders, such as CXOs, production managers, engineers, and installation teams of end users of eVTOL Aircraft, were interviewed to understand the buyer’s perspective on the suppliers, products, service providers, and their current usage and future outlook of their business, which could affect the eVTOL Aircraft market.

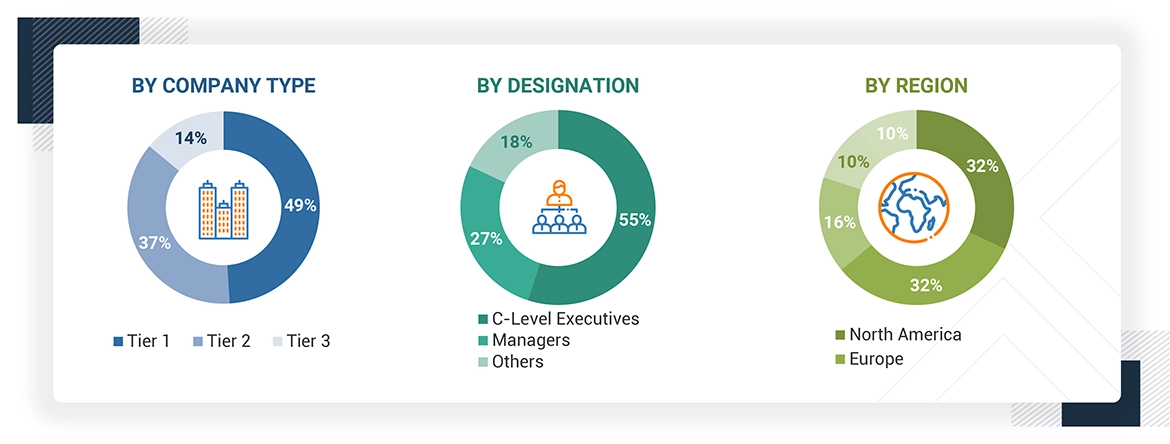

Note: C-level Executives include the CEO, COO, and CTO, among others. *Others include Sales Managers, Marketing Managers, and Product Managers. The tiers of the companies have been defined based on their total revenue as of 2022. Tier 1 = > USD 1 billion, Tier 2 = USD 100 million to USD 1 billion, and Tier 3 = < USD 100 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the eVTOL Aircraft market. The research methodology used to estimate the market size includes the following details:

- Key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

eVTOL Aircraft Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the eVTOL Aircraft market from the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for various market segments and sub-segments, the data triangulation and market breakdown procedures explained below were implemented, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

The eVTOL Aircraft (AIS) market focuses on technologies that streamline and optimize airport operations, integrating software, hardware, and real-time data for efficient passenger processing, flight management, resource allocation, and security. Key components like Departure Control Systems (DCS), Airport Operational Databases (AODB), and Flight Information Display Systems (FIDS) enhance decision-making, operational efficiency, and passenger experiences. AIS supports applications in baggage handling, airside management, and dynamic revenue optimization while fostering collaboration among airlines, air traffic control, airport authorities, and ground handlers. AIS solutions are vital for smarter, more connected airport ecosystems by addressing congestion, improving security, and enabling sustainable practices.

Key Stakeholders

Various stakeholders of the market are listed below:

- Raw Material Suppliers

- Aircraft Subsystem Manufacturers

- Aerostructure Manufacturers

- Technology Support Providers

- Distributors

- Maintenance, Repair, and Overhaul (MRO) Companies

- System Integrators

- Government Agencies

- Investors and Financial Community Professionals

- Research Organizations

Report Objectives

- To define, describe, segment, and forecast the size of the eVTOL aircraft market based on hybrid lift eVTOL, infrastructure, lift technology, propulsion type, system, mode of operation, application, MTOW, range, and region.

- To forecast sizes of various segments of the market with respect to five major regions, namely, North America, Europe, Asia Pacific, Latin America, and Middle East & Africa along with major countries in each of these regions.

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market across the globe.

- To identify industry trends, market trends, and technology trends that are currently prevailing in the market.

- To provide an overview of the regulatory landscape with respect to eVTOL aircraft regulations across regions.

- To analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders by identifying key market trends.

- To profile key market players and comprehensively analyze their market shares and core competencies.

- To analyze the degree of competition in the market by identifying key growth strategies, such as, investments, agreements, acquisitions, contracts, and partnerships, adopted by leading market players.

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market.

- To provide a detailed competitive landscape of the market, along with market ranking analysis, market share analysis, and revenue analysis of key players.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Regional Analysis

- Further breakdown of the market segments at the country level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the eVTOL Aircraft Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in eVTOL Aircraft Market

Soumyadeb

Aug, 2019

Surveying new developments in the aerospace market - the abstract would enable the management to judge if further study in the area is required. .

Tylo

May, 2019

We are currently researching and developing out own evtol craft, and I am seeking more information on the economics of the evtol market..