TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 54)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 SPECIAL MISSION AIRCRAFT MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.4 YEARS CONSIDERED FOR THE STUDY

1.5 INCLUSIONS AND EXCLUSIONS

TABLE 1 INCLUSIONS AND EXCLUSIONS IN SPECIAL MISSION AIRCRAFT MARKET

1.6 CURRENCY & PRICING

1.7 LIMITATIONS

1.8 MARKET STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 59)

2.1 RESEARCH DATA

FIGURE 2 REPORT PROCESS FLOW

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

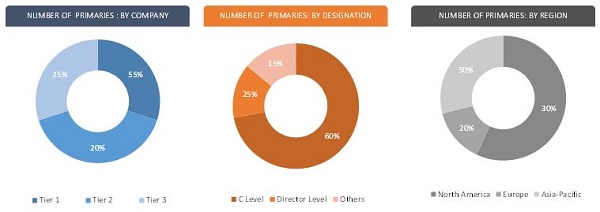

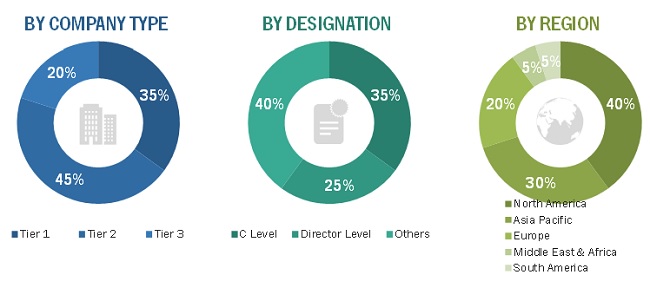

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.2.1 Increasing demand for special mission aircraft in defense and commercial applications

2.2.2.2 Effective execution of special missions

2.2.3 SUPPLY-SIDE ANALYSIS

2.2.3.1 Development of advanced sensors for remote sensing missions

2.2.3.2 Demand for increased reliability of special mission aircraft

2.3 MARKET SIZE ESTIMATION

2.3.1 MARKET DEFINITION & SCOPE

2.3.2 SEGMENTS AND SUBSEGMENTS

2.3.3 SEGMENT DEFINITIONS

2.3.3.1 market, by point of sale

2.3.3.2 market, by platform

2.3.3.3 market, by application

2.3.3.4 Special mission aircraft payload market, by component

2.3.3.5 market, by end user

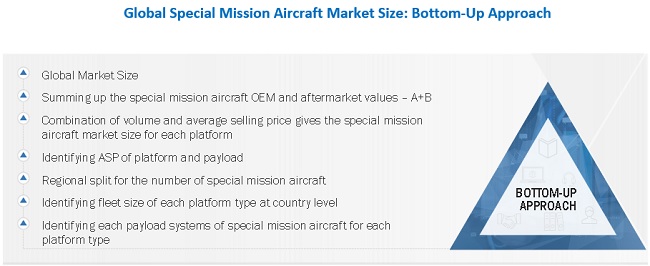

2.4 RESEARCH APPROACH & METHODOLOGY

2.4.1 BOTTOM-UP APPROACH

2.4.1.1 OEM special mission aircraft market

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.1.2 Special mission aircraft aftermarket

2.4.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4.2.1 Special mission aircraft aftermarket, by region and country

2.4.2.2 Special mission aircraft OEM market, by application

2.5 DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.6 ASSUMPTIONS FOR THE RESEARCH STUDY

2.7 RISKS

3 EXECUTIVE SUMMARY (Page No. - 71)

FIGURE 7 UAV PLATFORM TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 8 ISR APPLICATIONS TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 9 DEFENSE SEGMENT TO DOMINATE MARKET BY END USER

FIGURE 10 SENSORS TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 11 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF SPECIAL MISSION AIRCRAFT MARKET IN 2022

4 PREMIUM INSIGHTS (Page No. - 74)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN SPECIAL MISSION AIRCRAFT MARKET

FIGURE 12 INCREASING DEMAND FOR SPECIAL MISSION AIRCRAFT IN DEFENSE APPLICATIONS CONTRIBUTE TO MARKET GROWTH

4.2 MARKET, BY APPLICATION

FIGURE 13 INTELLIGENCE, SURVEILLANCE & RECONNAISSANCE (ISR) SEGMENT TO COMMAND MARKET FROM 2018 TO 2027

4.3 MARKET, BY PLATFORM

FIGURE 14 MILITARY AVIATION SEGMENT EXPECTED TO DOMINATE MARKET FROM 2018 TO 2027

4.4 MARKET, BY END USER

FIGURE 15 DEFENSE SEGMENT TO DOMINATE MARKET FROM 2018 TO 2027

4.5 MARKET, BY COMPONENT

FIGURE 16 SENSORS SEGMENT TO WITNESS UPWARD TREND FROM 2018 TO 2027

4.6 MARKET, BY COUNTRY

FIGURE 17 CHINA PROJECTED TO BE FASTEST-GROWING MARKET FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 77)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing need for air-to-air refueling to support overseas deployment

5.2.1.2 Increasing defense expenditure of countries

5.2.1.3 Incremental usage of UAVs in military operations

5.2.1.4 Rise in demand for emergency medical service (EMS) helicopters

5.2.2 RESTRAINTS

5.2.2.1 Lengthy period of product certification from aviation authorities

5.2.2.2 Stringent regulatory norms for manufacturing of special mission aircraft components

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for air-launched small satellites

TABLE 2 SMALL SATELLITE AIR LAUNCH VEHICLES

5.2.3.2 Advancements in sensor technology driving demand for unmanned aerial vehicles

5.2.4 CHALLENGES

5.2.4.1 Requirement for continuous and uninterrupted power supply in UAVs

5.2.4.2 Limited availability of skilled workforce

5.3 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS

5.4 TRENDS/DISRUPTION IMPACTING CUSTOMER BUSINESS

5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS OF MANUFACTURERS

FIGURE 20 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.5 TECHNOLOGY ANALYSIS

5.5.1 MULTI-MISSION UAVS

5.6 MARKET ECOSYSTEM

5.6.1 PROMINENT COMPANIES

5.6.2 PRIVATE AND SMALL ENTERPRISES

5.6.3 MARKET ECOSYSTEM

FIGURE 21 ECOSYSTEM

TABLE 3 SPECIAL MISSION AIRCRAFT: MARKET ECOSYSTEM

5.7 INNOVATION AND PATENT REGISTRATIONS

TABLE 4 PATENTS RELATED TO SPECIAL MISSION AIRCRAFT GRANTED BETWEEN 2016 AND 2021

5.8 TRADE ANALYSIS

5.8.1 EXPORT SCENARIO OF AIRCRAFTS

TABLE 5 COUNTRY-WISE EXPORTS, 2020-2021 (USD THOUSAND)

TABLE 6 COUNTRY-WISE IMPORTS, 2020-2021 (USD THOUSAND)

5.9 PORTER'S FIVE FORCES MODEL

FIGURE 22 PORTER'S FIVE FORCES ANALYSIS

TABLE 7 SPECIAL MISSION AIRCRAFT: PORTER'S FIVE FORCE ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 INTENSITY OF COMPETITIVE RIVALRY

5.10 TARIFF AND REGULATORY LANDSCAPE

5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.10.2 REGULATORY LANDSCAPE

5.10.3 NORTH AMERICA

5.10.4 EUROPE

5.11 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 13 CONFERENCES & EVENTS

5.12 PRICING ANALYSIS

5.12.1 AVERAGE SELLING PRICE OF SPECIAL MISSION AIRCRAFT, BY PLATFORM

FIGURE 23 AVERAGE SELLING PRICE OF SPECIAL MISSION AIRCRAFT

TABLE 14 AVERAGE SELLING PRICE OF SPECIAL MISSION AIRCRAFT FOR TOP TWO PLATFORMS (USD MILLION)

5.13 KEY STAKEHOLDERS & BUYING CRITERIA

5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 24 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP TWO PLATFORMS

TABLE 15 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP TWO PLATFORMS (%)

5.13.2 BUYING CRITERIA

FIGURE 25 KEY BUYING CRITERIA FOR TOP TWO PLATFORMS

TABLE 16 KEY BUYING CRITERIA FOR TOP TWO PLATFORMS

6 INDUSTRY TRENDS (Page No. - 100)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

6.2.1 HYBRID-ELECTRIC PROPULSION

6.2.2 AUTONOMOUS FLIGHT TECHNOLOGY

6.2.2.1 Artificial Intelligence (AI)

6.2.2.2 Big data analytics

6.2.2.3 Internet of Things (IoT)

6.2.3 MULTIROLE COMBAT AIRCRAFT WITH INTEGRATED AVIONICS AND WEAPONS

6.2.4 ULTRA-LIGHT MULTI-MODE RADAR

6.2.5 ADVANCED COCKPITS

6.2.6 AESA RADAR

6.3 USE CASE ANALYSIS

6.3.1 USE CASE: VTOL BUSINESS JET

TABLE 17 VTOL BUSINESS JET

6.3.2 USE CASE: CONFORMAL AIRBORNE EARLY WARNING & CONTROL

TABLE 18 CONFORMAL AIRBORNE EARLY WARNING & CONTROL

6.4 IMPACT OF MEGATRENDS

6.4.1 AUTONOMOUS AIRCRAFT

6.4.2 ELECTRIC PROPULSION

7 MARKET, BY PLATFORM (Page No. - 106)

7.1 INTRODUCTION

FIGURE 26 UAV SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 19 MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 20 MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

7.2 COMMERCIAL AVIATION

7.2.1 COMMERCIAL AIRCRAFT

7.2.1.1 Narrow-body aircraft

7.2.1.1.1 Increasing conversion of narrow-body aircraft expected to drive segment

7.2.1.2 Wide-body aircraft

7.2.1.2.1 Increasing cargo and VIP and VVIP transport drives procurement of wide-body aircraft

7.2.1.3 Regional transport aircraft

7.2.1.3.1 Increasing demand for transport of passengers and cargo over shorter distances boosts segment

7.2.2 GENERAL & BUSINESS AIRCRAFT

7.2.2.1 Ultralight & light aircraft

7.2.2.1.1 Implementation of lightweight components in ultralight and light aircraft expected to trend

7.2.2.2 Business jets

7.2.2.2.1 High demand for transporting VIPs/VVIPs expected to drive demand

7.2.3 HELICOPTERS

7.2.3.1 Light

7.2.3.1.1 Increasing application areas expected to drive demand

7.2.3.2 Medium

7.2.3.2.1 Varied application areas of medium operational range helicopters fuel growth

7.2.3.3 Heavy

7.2.3.3.1 Varied usage of helicopters with heavy payloads expected to drive demand

7.3 MILITARY AVIATION

TABLE 21 SPECIAL MISSION AIRCRAFT USAGE, BY COUNTRY (AS OF 2021)

7.3.1 FIXED WING

7.3.1.1 Fighter aircraft

7.3.1.1.1 Increasing procurement and modernization programs by militaries across the globe fuel segment

7.3.1.2 Transport aircraft

7.3.1.2.1 Increasing transport operations in military expected to drive demand

7.3.1.3 Reconnaissance & surveillance aircraft

7.3.1.3.1 Increasing strategic and tactical operations drive demand

7.3.2 HELICOPTERS

7.3.2.1 Light

7.3.2.1.1 Increasing application areas of ease to maneuver helicopters drive segment

7.3.2.2 Medium

7.3.2.2.1 Varied usage of helicopters with medium operational range fuel segment

7.3.2.3 Heavy

7.3.2.3.1 Segment driven by specific usage of helicopters with high operational range

7.4 UNMANNED AERIAL VEHICLES (UAV)

7.4.1 INCREASING ADOPTION FOR ISR AND COMBAT APPLICATIONS DRIVES SEGMENT

8 SPECIAL MISSION AIRCRAFT MARKET, BY APPLICATION (Page No. - 116)

8.1 INTRODUCTION

FIGURE 27 AIR /ROCKET LAUNCH SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 22 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 23 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.2 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE

8.2.1 COVERT SURVEILLANCE

8.2.1.1 Need for stealthy monitoring during military operations to drive demand

8.2.2 MARITIME PATROL

8.2.2.1 Importance of maritime surveillance fuels demand

8.2.3 BORDER SURVEILLANCE

8.2.3.1 Importance of border protection boosts segment

8.2.4 SIGNAL INTELLIGENCE

8.2.4.1 Importance of intelligence gathered by signal deception drives demand

8.2.5 AIRBORNE EARLY WARNING & CONTROL

8.2.5.1 Need for detection and warning systems on the rise

8.3 COMBAT SUPPORT

8.3.1 ELECTRONIC WARFARE

8.3.1.1 Increasing usage of electromagnetic spectrum in military operations to drive demand

8.3.2 ANTI-SURFACE & ANTI-SUBMARINE WARFARE

8.3.2.1 Need to combat attacks from different platforms drives demand

8.3.3 TARGETING & PRECISION STRIKE

8.3.3.1 Driver - need for targeting and precision strikes in military operations

8.4 COMMAND & CONTROL

8.4.1 USED FOR SURVEILLANCE AND ANTI-SUBMARINE WARFARE

8.5 EMERGENCY SERVICES

8.5.1 MEDICAL EVACUATION

8.5.1.1 Medical evacuation - prioritized application area for special mission aircraft

8.5.2 MEDICAL AID & SUPPLIES

8.5.2.1 Growing need for rapid transporting of medical and supplies boosts demand

8.5.3 DISASTER MANAGEMENT

8.5.3.1 Need for air services for disaster management to drive demand

8.6 TRANSPORTATION

8.6.1 VIP AND VVIP

8.6.1.1 Increasing demand for VIP and VVIP transportation contributes to growth

8.6.2 PASSENGER & CARGO TRANSPORT

8.6.2.1 Transportation of heavy combat vehicles gaining importance

8.7 AIR/ROCKET LAUNCH

8.7.1 LAUNCHING ROCKETS USING SPECIAL MISSION AIRCRAFT – POPULAR APPLICATION

8.8 SCIENTIFIC RESEARCH & GEOLOGICAL SURVEY

8.8.1 AIRCRAFT WIDELY USED TO COLLECT GEOPHYSICAL INFORMATION

8.9 OTHER APPLICATIONS

8.9.1 AIR-TO-AIR REFUELING

8.9.1.1 Rise in long-duration airborne missions to drive demand

8.9.2 PILOT & CREW TRAINING

8.9.2.1 Need for training aircrew and pilot with new and advanced safety features and procedures boosts demand

8.9.3 ENVIRONMENTAL MONITORING

8.9.3.1 NASA's involvement in monitoring environmental factors such as air, water, and soil quality drives demand

8.9.4 FLIGHT INSPECTION

8.9.4.1 Regular inspection of navigational aids growth in demand

8.9.5 MEDIA MISSIONS

8.9.5.1 Aerial photography and videography for news reporting and advertising – key applications

8.9.6 WEATHER MONITORING

8.9.6.1 Need for monitoring atmospheric variables boosts demand

9 SPECIAL MISSION AIRCRAFT MARKET, BY COMPONENT (Page No. - 125)

9.1 INTRODUCTION

FIGURE 28 SENSORS SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 24 MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 25 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

9.2 SENSORS

9.2.1 RADAR/MULTI-MISSION RADAR

9.2.1.1 Increasing need for radar sensors to generate flight path data

9.2.2 ESM/ELINT AND CSM/COMINT

9.2.2.1 Need for electronics and communication data expected to drive demand

9.2.3 EO/IR SYSTEM

9.2.3.1 Need for optical information in military applications

9.2.4 LAUNCHER & DISPENSER SYSTEM

9.2.4.1 Need for countermeasure systems fuels demand

9.2.5 NIGHT VISION SYSTEMS

9.2.5.1 Need for visibility during night operations drives demand

9.3 COMMUNICATION SUITE

9.3.1 SATCOM

9.3.1.1 Segment driven by need for communication over remote locations

9.3.2 HF AND V/UHF RADIOS

9.3.2.1 Need for long-range voice communication over remote locations – demand driver

9.3.3 DATA LINK

9.3.3.1 Need for transmitting operational messages drives demand

9.3.4 WEAPONS MANAGEMENT SYSTEM (WMS) AND MISSION MANAGEMENT SYSTEM (MMS)

9.3.4.1 Need for special systems to manage missions and weapons to

9.4 PROTECTION SUITE

9.4.1 RADAR WARNING AND LOCATING SYSTEM

9.4.1.1 Need for detecting radio signals boosts growth

9.4.2 MISSILE APPROACH WARNING SYSTEM

9.4.2.1 Requirement for detection of missiles fuels demand

9.4.3 RF JAMMER

9.4.3.1 Necessity for electronic countermeasure techniques to drive demand

9.4.4 OTHERS

9.5 OTHERS

9.5.1 FIRE CONTROL EQUIPMENT

9.5.2 PERSONNEL DEPLOYMENT SYSTEMS

10 SPECIAL MISSION AIRCRAFT MARKET, BY END USER (Page No. - 131)

10.1 INTRODUCTION

FIGURE 29 SPACE SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 26 MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 27 MARKET, BY END USER, 2022–2027 (USD MILLION)

10.2 COMMERCIAL & CIVIL

10.2.1 HEALTHCARE SERVICE PROVIDERS

10.2.1.1 Importance of medical evacuation and rescue operations boosts market growth

10.2.2 ENERGY & POWER ORGANIZATIONS

10.2.2.1 Inspection of difficult to reach components leads to market growth

10.2.3 MEDIA AGENCIES

10.2.3.1 Increasing aerial videography and photography drives demand

10.2.4 OTHERS

10.3 DEFENSE

10.3.1 MILITARY FORCES

10.3.1.1 Surveillance and Search & rescue are the major military applications drive demand

10.3.2 NATIONAL SECURITY AGENCIES

10.3.2.1 Increase in border protection activities drive market growth

10.3.3 LAW ENFORCEMENT AGENCIES

10.3.3.1 Monitoring terrorist activities and hazardous accidents boost demand

10.4 SPACE

10.4.1 SATELLITE OPERATORS/OWNERS

10.4.2 LAUNCH SERVICE PROVIDERS

10.4.3 NATIONAL SPACE AGENCIES

10.4.4 NEWSPACE INDUSTRY

11 SPECIAL MISSION AIRCRAFT MARKET, BY POINT OF SALE (Page No. - 136)

11.1 INTRODUCTION

FIGURE 30 AFTERMARKET SEGMENT PROJECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 28 MARKET, BY POINT OF SALE, 2018–2021 (USD MILLION)

TABLE 29 MARKET, BY POINT OF SALE, 2022–2027 (USD MILLION)

11.2 AFTERMARKET

11.2.1 UPGRADES

11.2.1.1 Technological upgrade of existing aircraft to drive growth

11.2.2 CONVERSION

11.2.2.1 Passenger-to-freighter conversion business booming in Asia Pacific

11.3 OEM

11.3.1 INCREASING USAGE OF DEDICATED AIRCRAFT FOR SPECIAL MISSIONS WILL DRIVE MARKET DEMAND

12 REGIONAL ANALYSIS (Page No. - 139)

12.1 INTRODUCTION

TABLE 30 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 31 MARKET, BY REGION, 2022–2027 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 31 NORTH AMERICA: SNAPSHOT

TABLE 32 NORTH AMERICA: BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 33 NORTH AMERICA: BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 34 NORTH AMERICA: BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 35 NORTH AMERICA: BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 36 NORTH AMERICA: BY COMMERCIAL AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 37 NORTH AMERICA: BY COMMERCIAL AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 38 NORTH AMERICA: BY MILITARY AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 39 NORTH AMERICA: BY MILITARY AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 40 NORTH AMERICA: BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 41 NORTH AMERICA: BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 42 NORTH AMERICA: BY END USER, 2018–2021 (USD MILLION)

TABLE 43 NORTH AMERICA: BY END USER, 2022–2027 (USD MILLION)

TABLE 44 NORTH AMERICA: BY POINT OF SALE, 2018–2021 (USD MILLION)

TABLE 45 NORTH AMERICA: BY POINT OF SALE, 2022–2027 (USD MILLION)

12.2.2 US

12.2.2.1 Growing military expenditure and modernization programs drive growth

TABLE 46 US: BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 47 US: BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 48 US: BY COMMERCIAL AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 49 US: BY COMMERCIAL AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 50 US: BY MILITARY AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 51 US: BY MILITARY AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 52 US: BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 53 US: BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 54 US: BY END USER, 2018–2021 (USD MILLION)

TABLE 55 US: BY END USER, 2022–2027 (USD MILLION)

TABLE 56 US: BY POINT OF SALE, 2018–2021 (USD MILLION)

TABLE 57 US: BY POINT OF SALE, 2022–2027 (USD MILLION)

12.2.3 CANADA

12.2.3.1 Increase in R&D investments fuel market

TABLE 58 CANADA: BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 59 CANADA: BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 60 CANADA: BY COMMERCIAL AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 61 CANADA: BY COMMERCIAL AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 62 CANADA: BY MILITARY AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 63 CANADA: BY MILITARY AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 64 CANADA: BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 65 CANADA: BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 66 CANADA: BY END USER, 2018–2021 (USD MILLION)

TABLE 67 CANADA: BY END USER, 2022–2027 (USD MILLION)

TABLE 68 CANADA: BY POINT OF SALE, 2018–2021 (USD MILLION)

TABLE 69 CANADA: BY POINT OF SALE, 2022–2027 (USD MILLION)

12.3 EUROPE

12.3.1 PESTLE ANALYSIS: EUROPE

FIGURE 32 EUROPE: SNAPSHOT

TABLE 70 EUROPE: BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 71 EUROPE: BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 72 EUROPE: BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 73 EUROPE: BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 74 EUROPE: BY COMMERCIAL AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 75 EUROPE: BY COMMERCIAL AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 76 EUROPE: BY MILITARY AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 77 EUROPE: BY MILITARY AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 78 EUROPE: BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 79 EUROPE: BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 80 EUROPE: BY END USER, 2018–2021 (USD MILLION)

TABLE 81 EUROPE: BY END USER, 2022–2027 (USD MILLION)

TABLE 82 EUROPE: BY POINT OF SALE, 2018–2021 (USD MILLION)

TABLE 83 EUROPE: BY POINT OF SALE, 2022–2027 (USD MILLION)

12.3.2 FRANCE

12.3.2.1 Advancements in aircraft technologies boost market

TABLE 84 FRANCE: BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 85 FRANCE: BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 86 FRANCE: BY COMMERCIAL AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 87 FRANCE: BY COMMERCIAL AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 88 FRANCE: BY MILITARY AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 89 FRANCE: BY MILITARY AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 90 FRANCE: BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 91 FRANCE: BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 92 FRANCE: BY END USER, 2018–2021 (USD MILLION)

TABLE 93 FRANCE: BY END USER, 2022–2027 (USD MILLION)

TABLE 94 FRANCE: BY POINT OF SALE, 2018–2021 (USD MILLION)

TABLE 95 FRANCE: BY POINT OF SALE, 2022–2027 (USD MILLION)

12.3.3 RUSSIA

12.3.3.1 Market driven by increase in R&D activities

TABLE 96 RUSSIA: BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 97 RUSSIA: BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 98 RUSSIA: BY COMMERCIAL AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 99 RUSSIA: BY COMMERCIAL AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 100 RUSSIA: BY MILITARY AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 101 RUSSIA: BY MILITARY AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 102 RUSSIA: BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 103 RUSSIA: BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 104 RUSSIA: BY END USER, 2018–2021 (USD MILLION)

TABLE 105 RUSSIA: BY END USER, 2022–2027 (USD MILLION)

TABLE 106 RUSSIA: BY POINT OF SALE, 2018–2021 (USD MILLION)

TABLE 107 RUSSIA: BY POINT OF SALE, 2022–2027 (USD MILLION)

12.3.4 GERMANY

12.3.4.1 Advancements in aircraft technologies – key market driver

TABLE 108 GERMANY: BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 109 GERMANY: BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 110 GERMANY: BY COMMERCIAL AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 111 GERMANY: BY COMMERCIAL AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 112 GERMANY: BY MILITARY AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 113 GERMANY: BY MILITARY AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 114 GERMANY: BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 115 GERMANY: BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 116 GERMANY: BY END USER, 2018–2021 (USD MILLION)

TABLE 117 GERMANY: BY END USER, 2022–2027 (USD MILLION)

TABLE 118 GERMANY: BY POINT OF SALE, 2018–2021 (USD MILLION)

TABLE 119 GERMANY: BY POINT OF SALE, 2022–2027 (USD MILLION)

12.3.5 UK

12.3.5.1 Upgrading of existing fleets – key opportunity

TABLE 120 UK: BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 121 UK: BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 122 UK: BY COMMERCIAL AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 123 UK: BY COMMERCIAL AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 124 UK: BY MILITARY AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 125 UK: BY MILITARY AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 126 UK: BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 127 UK: BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 128 UK: BY END USER, 2018–2021 (USD MILLION)

TABLE 129 UK: BY END USER, 2022–2027 (USD MILLION)

TABLE 130 UK: BY POINT OF SALE, 2018–2021 (USD MILLION)

TABLE 131 UK: BY POINT OF SALE, 2022–2027 (USD MILLION)

12.3.6 ITALY

12.3.6.1 Continuous investment in procurement of advanced aircraft contributes to market growth

TABLE 132 ITALY: BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 133 ITALY: BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 134 ITALY: BY COMMERCIAL AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 135 ITALY: BY COMMERCIAL AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 136 ITALY: BY MILITARY AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 137 ITALY: BY MILITARY AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 138 ITALY: BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 139 ITALY: BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 140 ITALY: BY END USER, 2018–2021 (USD MILLION)

TABLE 141 ITALY: BY END USER, 2022–2027 (USD MILLION)

TABLE 142 ITALY: BY POINT OF SALE, 2018–2021 (USD MILLION)

TABLE 143 ITALY: BY POINT OF SALE, 2022–2027 (USD MILLION)

12.3.7 REST OF EUROPE

12.3.7.1 Increase in special mission aircraft orders drives growth

TABLE 144 REST OF EUROPE: BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 145 REST OF EUROPE: BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 146 REST OF EUROPE: BY COMMERCIAL AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 147 REST OF EUROPE: BY COMMERCIAL AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 148 REST OF EUROPE: BY MILITARY AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 149 REST OF EUROPE: BY MILITARY AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 150 REST OF EUROPE: BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 151 REST OF EUROPE: BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 152 REST OF EUROPE: BY END USER, 2018–2021 (USD MILLION)

TABLE 153 REST OF EUROPE: BY END USER, 2022–2027 (USD MILLION)

TABLE 154 REST OF EUROPE: BY POINT OF SALE, 2018–2021 (USD MILLION)

TABLE 155 REST OF EUROPE: BY POINT OF SALE, 2022–2027 (USD MILLION)

12.4 ASIA PACIFIC

12.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: SNAPSHOT

TABLE 156 ASIA PACIFIC: BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 157 ASIA PACIFIC: BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 158 ASIA PACIFIC: BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 159 ASIA PACIFIC: BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 160 ASIA PACIFIC: BY COMMERCIAL AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 161 ASIA PACIFIC: BY COMMERCIAL AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 162 ASIA PACIFIC: BY MILITARY AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 163 ASIA PACIFIC: BY MILITARY AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 164 ASIA PACIFIC: BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 165 ASIA PACIFIC: BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 166 ASIA PACIFIC: BY END USER, 2018–2021 (USD MILLION)

TABLE 167 ASIA PACIFIC: BY END USER, 2022–2027 (USD MILLION)

TABLE 168 ASIA PACIFIC: BY POINT OF SALE, 2018–2021 (USD MILLION)

TABLE 169 ASIA PACIFIC: BY POINT OF SALE, 2022–2027 (USD MILLION)

12.4.2 CHINA

12.4.2.1 Increase in military expenditure – market booster

TABLE 170 CHINA: BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 171 CHINA: BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 172 CHINA: BY COMMERCIAL AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 173 CHINA: BY COMMERCIAL AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 174 CHINA: BY MILITARY AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 175 CHINA: BY MILITARY AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 176 CHINA: BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 177 CHINA: BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 178 CHINA: BY END USER, 2018–2021 (USD MILLION)

TABLE 179 CHINA: BY END USER, 2022–2027 (USD MILLION)

TABLE 180 CHINA: BY POINT OF SALE, 2018–2021 (USD MILLION)

TABLE 181 CHINA: BY POINT OF SALE, 2022–2027 (USD MILLION)

12.4.3 JAPAN

12.4.3.1 Key contributor to growth - technological advancements and investments

TABLE 182 JAPAN: BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 183 JAPAN: BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 184 JAPAN: BY COMMERCIAL AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 185 JAPAN: BY COMMERCIAL AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 186 JAPAN: BY MILITARY AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 187 JAPAN: BY MILITARY AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 188 JAPAN: BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 189 JAPAN: BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 190 JAPAN: BY END USER, 2018–2021 (USD MILLION)

TABLE 191 JAPAN: BY END USER, 2022–2027 (USD MILLION)

TABLE 192 JAPAN: BY POINT OF SALE, 2018–2021 (USD MILLION)

TABLE 193 JAPAN: BY POINT OF SALE, 2022–2027 (USD MILLION)

12.4.4 INDIA

12.4.4.1 Need to enhance border surveillance and medical services fuels market

TABLE 194 INDIA: BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 195 INDIA: BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 196 INDIA: BY COMMERCIAL AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 197 INDIA: BY COMMERCIAL AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 198 INDIA: BY MILITARY AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 199 INDIA: MARKET, BY MILITARY AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 200 INDIA: BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 201 INDIA: BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 202 INDIA: END USER, 2018–2021 (USD MILLION)

TABLE 203 INDIA: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 204 INDIA: MARKET, BY POINT OF SALE, 2018–2021 (USD MILLION)

TABLE 205 INDIA: BY POINT OF SALE, 2022–2027 (USD MILLION)

12.4.5 SOUTH KOREA

12.4.5.1 Need to reduce dependence on surveillance drives growth

TABLE 206 SOUTH KOREA: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 207 SOUTH KOREA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 208 SOUTH KOREA: MARKET, BY COMMERCIAL AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 209 SOUTH KOREA: BY COMMERCIAL AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 210 SOUTH KOREA: BY MILITARY AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 211 SOUTH KOREA: BY MILITARY AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 212 SOUTH KOREA: BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 213 SOUTH KOREA: BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 214 SOUTH KOREA: BY END USER, 2018–2021 (USD MILLION)

TABLE 215 SOUTH KOREA: BY END USER, 2022–2027 (USD MILLION)

TABLE 216 SOUTH KOREA: BY POINT OF SALE, 2018–2021 (USD MILLION)

TABLE 217 SOUTH KOREA: BY POINT OF SALE, 2022–2027 (USD MILLION)

12.4.6 REST OF ASIA PACIFIC

12.4.6.1 Increase in military spending – major growth factor

TABLE 218 REST OF ASIA PACIFIC: BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 219 REST OF ASIA PACIFIC: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 220 REST OF ASIA PACIFIC: BY COMMERCIAL AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 221 REST OF ASIA PACIFIC: BY COMMERCIAL AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 222 REST OF ASIA PACIFIC: BY MILITARY AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 223 REST OF ASIA PACIFIC: BY MILITARY AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 224 REST OF ASIA PACIFIC: BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 225 REST OF ASIA PACIFIC: BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 226 REST OF ASIA PACIFIC: BY END USER, 2018–2021 (USD MILLION)

TABLE 227 REST OF ASIA PACIFIC: BY END USER, 2022–2027 (USD MILLION)

TABLE 228 REST OF ASIA PACIFIC: BY POINT OF SALE, 2018–2021 (USD MILLION)

TABLE 229 REST OF ASIA PACIFIC: BY POINT OF SALE, 2022–2027 (USD MILLION)

12.5 MIDDLE EAST & AFRICA

12.5.1 PESTLE ANALYSIS: MIDDLE EAST & AFRICA

TABLE 230 MIDDLE EAST & AFRICA: BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 231 MIDDLE EAST & AFRICA: BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 232 MIDDLE EAST & AFRICA: BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 233 MIDDLE EAST & AFRICA: BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 234 MIDDLE EAST & AFRICA: BY COMMERCIAL AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 235 MIDDLE EAST & AFRICA: BY COMMERCIAL AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 236 MIDDLE EAST & AFRICA: BY MILITARY AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 237 MIDDLE EAST & AFRICA: BY MILITARY AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 238 MIDDLE EAST & AFRICA: BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 239 MIDDLE EAST & AFRICA: BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 240 MIDDLE EAST & AFRICA: BY END USER, 2018–2021 (USD MILLION)

TABLE 241 MIDDLE EAST & AFRICA: BY END USER, 2022–2027 (USD MILLION)

TABLE 242 MIDDLE EAST & AFRICA: BY POINT OF SALE, 2018–2021 (USD MILLION)

TABLE 243 MIDDLE EAST & AFRICA: BY POINT OF SALE, 2022–2027 (USD MILLION)

12.5.2 TURKEY

12.5.2.1 Advancements in aircraft technologies fuel growth

TABLE 244 TURKEY: BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 245 TURKEY: BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 246 TURKEY: BY COMMERCIAL AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 247 TURKEY: BY COMMERCIAL AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 248 TURKEY: BY MILITARY AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 249 TURKEY: BY MILITARY AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 250 TURKEY: BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 251 TURKEY: BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 252 TURKEY: BY END USER, 2018–2021 (USD MILLION)

TABLE 253 TURKEY: BY END USER, 2022–2027 (USD MILLION)

TABLE 254 TURKEY: BY POINT OF SALE, 2018–2021 (USD MILLION)

TABLE 255 TURKEY: BY POINT OF SALE, 2022–2027 (USD MILLION)

12.5.3 ISRAEL

12.5.3.1 Market growth owed to presence of leading market players

TABLE 256 ISRAEL: BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 257 ISRAEL: BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 258 ISRAEL: BY COMMERCIAL AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 259 ISRAEL: BY COMMERCIAL AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 260 ISRAEL: BY MILITARY AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 261 ISRAEL: BY MILITARY AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 262 ISRAEL: BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 263 ISRAEL: BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 264 ISRAEL: BY END USER, 2018–2021 (USD MILLION)

TABLE 265 ISRAEL: BY END USER, 2022–2027 (USD MILLION)

TABLE 266 ISRAEL: BY POINT OF SALE, 2018–2021 (USD MILLION)

TABLE 267 ISRAEL: BY POINT OF SALE, 2022–2027 (USD MILLION)

12.5.4 SAUDI ARABIA

12.5.4.1 Presence of advanced aviation industry spurs market growth

TABLE 268 SAUDI ARABIA: BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 269 SAUDI ARABIA: BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 270 SAUDI ARABIA: BY COMMERCIAL AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 271 SAUDI ARABIA: BY COMMERCIAL AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 272 SAUDI ARABIA: BY MILITARY AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 273 SAUDI ARABIA: BY MILITARY AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 274 SAUDI ARABIA: BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 275 SAUDI ARABIA: BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 276 SAUDI ARABIA: BY END USER, 2018–2021 (USD MILLION)

TABLE 277 SAUDI ARABIA: BY END USER, 2022–2027 (USD MILLION)

TABLE 278 SAUDI ARABIA: BY POINT OF SALE, 2018–2021 (USD MILLION)

TABLE 279 SAUDI ARABIA: BY POINT OF SALE, 2022–2027 (USD MILLION)

12.5.5 SOUTH AFRICA

12.5.5.1 Market growth result of increased investment in surveillance aircraft

TABLE 280 SOUTH AFRICA: SPECIAL MISSION AIRCRAFT MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 281 SOUTH AFRICA: SPECIAL MISSION AIRCRAFT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 282 SOUTH AFRICA: SPECIAL MISSION AIRCRAFT MARKET, BY COMMERCIAL AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 283 SOUTH AFRICA: SPECIAL MISSION AIRCRAFT MARKET, BY COMMERCIAL AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 284 SOUTH AFRICA: SPECIAL MISSION AIRCRAFT MARKET, BY MILITARY AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 285 SOUTH AFRICA: SPECIAL MISSION AIRCRAFT MARKET, BY MILITARY AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 286 SOUTH AFRICA: SPECIAL MISSION AIRCRAFT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 287 SOUTH AFRICA: SPECIAL MISSION AIRCRAFT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 288 SOUTH AFRICA: SPECIAL MISSION AIRCRAFT MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 289 SOUTH AFRICA: SPECIAL MISSION AIRCRAFT MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 290 SOUTH AFRICA: SPECIAL MISSION AIRCRAFT MARKET, BY POINT OF SALE, 2018–2021 (USD MILLION)

TABLE 291 SOUTH AFRICA: SPECIAL MISSION AIRCRAFT MARKET, BY POINT OF SALE, 2022–2027 (USD MILLION)

12.6 LATIN AMERICA

12.6.1 PESTLE ANALYSIS: LATIN AMERICA

TABLE 292 LATIN AMERICA: SPECIAL MISSION AIRCRAFT MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 293 LATIN AMERICA: SPECIAL MISSION AIRCRAFT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 294 LATIN AMERICA: SPECIAL MISSION AIRCRAFT MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 295 LATIN AMERICA: SPECIAL MISSION AIRCRAFT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 296 LATIN AMERICA: SPECIAL MISSION AIRCRAFT MARKET, BY COMMERCIAL AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 297 LATIN AMERICA: SPECIAL MISSION AIRCRAFT MARKET, BY COMMERCIAL AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 298 LATIN AMERICA: SPECIAL MISSION AIRCRAFT MARKET, BY MILITARY AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 299 LATIN AMERICA: SPECIAL MISSION AIRCRAFT MARKET, BY MILITARY AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 300 LATIN AMERICA: SPECIAL MISSION AIRCRAFT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 301 LATIN AMERICA: SPECIAL MISSION AIRCRAFT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 302 LATIN AMERICA: SPECIAL MISSION AIRCRAFT MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 303 LATIN AMERICA: SPECIAL MISSION AIRCRAFT MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 304 LATIN AMERICA: SPECIAL MISSION AIRCRAFT MARKET, BY POINT OF SALE, 2018–2021 (USD MILLION)

TABLE 305 LATIN AMERICA: SPECIAL MISSION AIRCRAFT MARKET, BY POINT OF SALE, 2022–2027 (USD MILLION)

12.6.2 BRAZIL

12.6.2.1 Established aircraft manufacturing industry drives growth

TABLE 306 BRAZIL: SPECIAL MISSION AIRCRAFT MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 307 BRAZIL: SPECIAL MISSION AIRCRAFT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 308 BRAZIL: SPECIAL MISSION AIRCRAFT MARKET, BY COMMERCIAL AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 309 BRAZIL: SPECIAL MISSION AIRCRAFT MARKET, BY COMMERCIAL AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 310 BRAZIL: SPECIAL MISSION AIRCRAFT MARKET, BY MILITARY AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 311 BRAZIL: SPECIAL MISSION AIRCRAFT MARKET, BY MILITARY AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 312 BRAZIL: SPECIAL MISSION AIRCRAFT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 313 BRAZIL: SPECIAL MISSION AIRCRAFT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 314 BRAZIL: SPECIAL MISSION AIRCRAFT MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 315 BRAZIL: SPECIAL MISSION AIRCRAFT MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 316 BRAZIL: SPECIAL MISSION AIRCRAFT MARKET, BY POINT OF SALE, 2018–2021 (USD MILLION)

TABLE 317 BRAZIL: SPECIAL MISSION AIRCRAFT MARKET, BY POINT OF SALE, 2022–2027 (USD MILLION)

12.6.3 MEXICO

12.6.3.1 Increasing focus on ISR capabilities fuels market

TABLE 318 MEXICO: SPECIAL MISSION AIRCRAFT MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 319 MEXICO: SPECIAL MISSION AIRCRAFT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 320 MEXICO: SPECIAL MISSION AIRCRAFT MARKET, BY COMMERCIAL AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 321 MEXICO: SPECIAL MISSION AIRCRAFT MARKET, BY COMMERCIAL AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 322 MEXICO: SPECIAL MISSION AIRCRAFT MARKET, BY MILITARY AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 323 MEXICO: SPECIAL MISSION AIRCRAFT MARKET, BY MILITARY AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 324 MEXICO: SPECIAL MISSION AIRCRAFT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 325 MEXICO: SPECIAL MISSION AIRCRAFT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 326 MEXICO: SPECIAL MISSION AIRCRAFT MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 327 MEXICO: SPECIAL MISSION AIRCRAFT MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 328 MEXICO: SPECIAL MISSION AIRCRAFT MARKET, BY POINT OF SALE, 2018–2021 (USD MILLION)

TABLE 329 MEXICO: SPECIAL MISSION AIRCRAFT MARKET, BY POINT OF SALE, 2022–2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 234)

13.1 INTRODUCTION

13.2 KEY STRATEGIES

TABLE 330 KEY DEVELOPMENTS OF LEADING PLAYERS (2018–2021)

13.3 RANKING ANALYSIS OF KEY PLAYERS, 2021

FIGURE 34 RANKING OF TOP FIVE PLAYERS 2021

13.4 REVENUE SHARE ANALYSIS

FIGURE 35 REVENUE SHARE ANALYSIS FOR KEY PLAYERS, 2019–2021

13.5 MARKET SHARE ANALYSIS

FIGURE 36 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2021

TABLE 331 DEGREE OF COMPETITION

13.6 COMPANY EVALUATION MATRIX

13.6.1 STARS

13.6.2 EMERGING LEADERS

13.6.3 PERVASIVE PLAYERS

13.6.4 PARTICIPANTS

FIGURE 37 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2021

13.6.5 COMPETITIVE BENCHMARKING

TABLE 332 COMPETITIVE BENCHMARKING

13.7 COMPETITIVE SCENARIO

13.7.1 PRODUCT LAUNCHES

TABLE 333 PRODUCT LAUNCHES, JANUARY 2017–DECEMBER 2021

13.7.2 DEALS

TABLE 334 DEALS, JANUARY 2017–MARCH 2022

14 COMPANY PROFILES (Page No. - 245)

14.1 INTRODUCTION

(Business overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key strengths and right to win, Strategic choices made, Weaknesses and competitive threats) *

14.2 KEY PLAYERS

14.2.1 THE BOEING COMPANY

TABLE 335 THE BOEING COMPANY: BUSINESS OVERVIEW

FIGURE 38 THE BOEING COMPANY: COMPANY SNAPSHOT

TABLE 336 THE BOEING COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 337 THE BOEING COMPANY: DEALS

14.2.2 LOCKHEED MARTIN CORPORATION

TABLE 338 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

FIGURE 39 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

TABLE 339 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 340 LOCKHEED MARTIN CORPORATION: DEALS

14.2.3 DASSAULT AVIATION SA

TABLE 341 DASSAULT AVIATION SA: BUSINESS OVERVIEW

FIGURE 40 DASSAULT AVIATION SA: COMPANY SNAPSHOT

TABLE 342 DASSAULT AVIATION SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 343 DASSAULT AVIATION SA: DEALS

14.2.4 TEXTRON AVIATION INC.

TABLE 344 TEXTRON AVIATION INC.: BUSINESS OVERVIEW

TABLE 345 TEXTRON AVIATION INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 346 TEXTRON AVIATION INC.: DEALS

14.2.5 NORTHROP GRUMMAN CORPORATION

TABLE 347 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

FIGURE 41 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

TABLE 348 NORTHROP GRUMMAN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 349 NORTHROP GRUMMAN CORPORATION: PRODUCT LAUNCHES

TABLE 350 NORTHROP GRUMMAN CORPORATION: DEALS

TABLE 351 NORTHROP GRUMMAN CORPORATION: OTHERS

14.2.6 BOMBARDIER INC.

TABLE 352 BOMBARDIER INC.: BUSINESS OVERVIEW

FIGURE 42 BOMBARDIER INC.: COMPANY SNAPSHOT

TABLE 353 BOMBARDIER INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 354 BOMBARDIER INC.: DEALS

14.2.7 ELBIT SYSTEMS LTD.

TABLE 355 ELBIT SYSTEMS LTD: BUSINESS OVERVIEW

FIGURE 43 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

TABLE 356 ELBIT SYSTEMS LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 357 ELBIT SYSTEMS LTD: DEALS

14.2.8 ISRAEL AEROSPACE INDUSTRIES LTD.

TABLE 358 ISRAEL AEROSPACE INDUSTRIES LTD.: BUSINESS OVERVIEW

TABLE 359 ISRAEL AEROSPACE INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 360 ISRAEL AEROSPACE INDUSTRIES LTD.: PRODUCT LAUNCHES

TABLE 361 ISRAEL AEROSPACE INDUSTRIES LTD.: DEALS

14.2.9 THALES SA

TABLE 362 THALES SA: BUSINESS OVERVIEW

FIGURE 44 THALES SA.: COMPANY SNAPSHOT

TABLE 363 THALES SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 364 THALES SA.: DEALS

14.2.10 BAE SYSTEMS

TABLE 365 BAE SYSTEMS: BUSINESS OVERVIEW

FIGURE 45 BAE SYSTEMS: COMPANY SNAPSHOT

TABLE 366 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.2.11 SAAB AB

TABLE 367 SAAB AB: BUSINESS OVERVIEW

FIGURE 46 SAAB AB: COMPANY SNAPSHOT

TABLE 368 SAAB AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 369 SAAB AB: PRODUCT LAUNCHES

TABLE 370 SAAB AB: DEALS

14.2.12 LEONARDO SPA

TABLE 371 LEONARDO SPA: BUSINESS OVERVIEW

FIGURE 47 LEONARDO SPA: COMPANY SNAPSHOT

TABLE 372 LEONARDO SPA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 373 LEONARDO SPA: DEALS

14.2.13 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.

TABLE 374 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: BUSINESS OVERVIEW

FIGURE 48 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: COMPANY SNAPSHOT

TABLE 375 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

TABLE 376 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: DEALS

14.2.14 GENERAL ATOMICS AERONAUTICAL SYSTEMS, INC.

TABLE 377 GENERAL ATOMICS AERONAUTICAL SYSTEMS, INC.: BUSINESS OVERVIEW

TABLE 378 GENERAL ATOMICS AERONAUTICAL SYSTEMS, INC.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

TABLE 379 GENERAL ATOMICS AERONAUTICAL SYSTEMS, INC.: DEALS

14.2.15 RAYTHEON TECHNOLOGIES CORPORATION

TABLE 380 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

FIGURE 49 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

TABLE 381 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 382 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

14.3 OTHER PLAYERS

14.3.1 AIRBUS SE

TABLE 383 AIRBUS: BUSINESS OVERVIEW

FIGURE 50 AIRBUS SE: COMPANY SNAPSHOT

TABLE 384 AIRBUS SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 385 AIRBUS SE: PRODUCT LAUNCHES

TABLE 386 AIRBUS SE: DEALS

14.3.2 L3HARRIS TECHNOLOGIES

TABLE 387 L3HARRIS TECHNOLOGIES, INC.: BUSINESS OVERVIEW

FIGURE 51 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

TABLE 388 L3HARRIS TECHNOLOGIES, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 389 L3HARRIS TECHNOLOGIES, INC.: DEALS

14.3.3 LUFTHANSA TECHNIK AG

TABLE 390 LUFTHANSA TECHNIK AG: BUSINESS OVERVIEW

FIGURE 52 LUFTHANSA TECHNIK AG: COMPANY SNAPSHOT

TABLE 391 LUFTHANSA TECHNIK AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 392 LUFTHANSA TECHNIK AG: DEALS

14.3.4 AEROVIRONMENT, INC.

TABLE 393 AEROVIRONMENT, INC.: BUSINESS OVERVIEW

FIGURE 53 AEROVIRONMENT, INC.: COMPANY SNAPSHOT

TABLE 394 AEROVIRONMENT, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 395 AEROVIRONMENT, INC.: PRODUCT LAUNCHES

TABLE 396 AEROVIRONMENT, INC.: DEALS

14.3.5 PILATUS AIRCRAFT LTD.

TABLE 397 PILATUS AIRCRAFT LTD.: BUSINESS OVERVIEW

FIGURE 54 PILATUS AIRCRAFT LTD.: COMPANY SNAPSHOT

TABLE 398 PILATUS AIRCRAFT LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 399 PILATUS AIRCRAFT LTD.: PRODUCT LAUNCHES

TABLE 400 PILATUS AIRCRAFT LTD.: DEALS

TABLE 401 PILATUS AIRCRAFT LTD.: OTHERS

14.3.6 NOVA SYSTEMS

TABLE 402 NOVA SYSTEMS: BUSINESS OVERVIEW

TABLE 403 NOVA SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.3.7 RUAG INTERNATIONAL HOLDING AG

TABLE 404 RUAG INTERNATIONAL HOLDING AG: BUSINESS OVERVIEW

FIGURE 55 RUAG INTERNATIONAL HOLDING AG: COMPANY SNAPSHOT

TABLE 405 RUAG INTERNATIONAL HOLDING AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 406 RUAG INTERNATIONAL HOLDING AG: DEALS

14.3.8 GULFSTREAM AEROSPACE CORPORATION

TABLE 407 GULFSTREAM AEROSPACE CORPORATION: BUSINESS OVERVIEW

TABLE 408 GULFSTREAM AEROSPACE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 409 GULFSTREAM AEROSPACE CORPORATION: DEALS

TABLE 410 GULFSTREAM AEROSPACE CORPORATION: OTHERS

14.3.9 VOX SPACE

TABLE 411 VOX SPACE: BUSINESS OVERVIEW

TABLE 412 VOX SPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 413 VOX SPACE: DEALS

14.3.10 BUTLER NATIONAL CORPORATION

TABLE 414 BUTLER NATIONAL CORPORATION: BUSINESS OVERVIEW

FIGURE 56 BUTLER NATIONAL CORPORATION: COMPANY SNAPSHOT

TABLE 415 BUTLER NATIONAL CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED?

TABLE 416 BUTLER NATIONAL CORPORATION: OTHERS

*Details on Business overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key strengths and right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 316)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Special Mission Aircraft Market