Flue Gas Analyzer Market by Installation Type (Inline, Portable), Technology (Electrochemical, Paramagnetic, Zirconia, Infrared), Gas Component (COx, NOx, SOx), Application (Oil & Gas, Waste Incineration), and Geography - Global Forecast to 2023

[120 Pages Report] The flue gas analyzer market was valued at USD 548.7 Million in 2016 and is expected to reach USD 814.2 Million by 2023, at a CAGR of 5.93% during the forecast period. The base year considered for the study is 2016, and the forecast period is between 2017 and 2023. A flue gas analyzer is an analytical device that measures the concentration of emitted gas from flue or stack in the industrial process. It plays an important part of emission monitoring systems. Flue gases such as carbon dioxide, oxygen, oxides of nitrogen, and carbon monoxide are emitted into the atmosphere. The flue gas analyzer can be used in small furnaces and in industrial application. The rise in the demand for environmental protection, stringent environmental and legal regulations, and increase in health and safety concerns drive the market growth. The objective of the report is to provide a detailed analysis of the market on the basis of installation type, gas component, application, and geography. The report provides detailed information regarding the major factors influencing the growth of the market. The report also provides a detailed overview of the positioning of key players in the market.

The flue gas analyzer market is estimated to be worth USD 576.2 Million in 2017 and is expected to reach USD 814.2 Million by 2023, at a CAGR of 5.93% between 2017 and 2023. The growth of this market is propelled by the rise in the demand for environmental protection, stringent environmental and legal regulations, and increase in health and safety concerns.

The market for inline flue gas analyzers is expected to grow at a higher CAGR than that of portable flue gas analyzers during 2017–2023. Most manufacturers prefer inline flue gas analyzers as they can be used for continuous emission monitoring of flue gases. Flue gas analyzers offer accuracy and reliability during long-term measurements. Inline flue gas analyzers are installed for applications in hazardous environments owing to their feature of weatherproof and explosion-proof enclosures. Hence, various industries have widely accepted inline flue gas analyzers and amassed huge installation base worldwide.

The market for the waste incineration application is expected to grow at the highest CAGR during the forecast period. Monitoring incineration emissions is a challenge as a large number of gaseous components need to be measured with high accuracy. Therefore, the demand for flue gas analyzers is expected to continue to remain high for monitoring emissions in incineration plants.

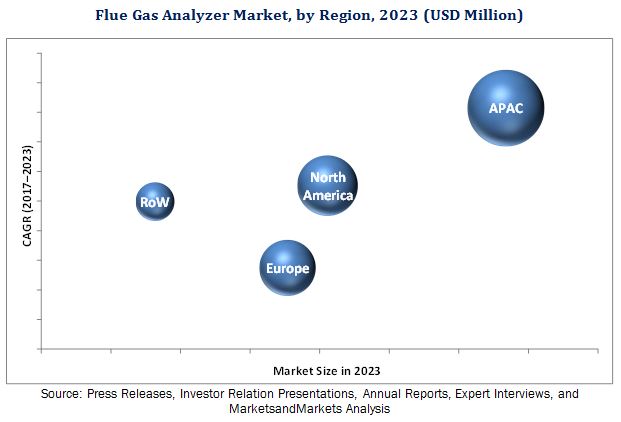

The market in APAC is expected to grow at the highest CAGR between 2017 and 2023. Applications, namely, power generation plants, waste incineration, oil & gas are expected to drive the growth of the flue gas analyzer market in APAC. The rise in the demand for stringent air pollution regulations, growth in power generation plants in countries such as China and India, and the rapid increase in industrialization and urbanization in the APAC region are the key factors responsible for the increasing adoption of flue gas analyzers in this region.

One of the key restraining factors for the flue gas analyzer market growth is the high cost of flue gas analyzers. Industrial facilities need sophisticated emission monitoring equipment to remain operational even in harsh environmental conditions, such as high gas temperature and high dust conditions. Flue gas analyzers need to provide highly accurate measurements. To obtain this high reliability and accuracy, manufacturers must regularly maintain their systems to keep them operational at all times. Flue gas analyzers are expensive. Since these products used in emission monitoring systems, they need to be certified by respective authorities and also adhere certain compliance based on the emission regulations of a country where they are intended to use. Hence, the overall cost of ownership of these analyzers is high, which is restraining the market growth.

ABB (Switzerland) is a pioneering technology leader that serves customers in utilities, industry, transport, and infrastructure globally. ABB is a customer-focused leading company in the industrial technology. The company is at the forefront of innovating digitally connected industrial equipment and systems. ABB received orders worth USD 33.4 billion in 2016. Strong brand of the company has a considerable positive impact on the flue gas analyzer market. SICK (Germany), Teledyne Analytical Instruments (US), Emerson (US), AMETEK (US), HORIBA (Japan), California Analytical Instruments (US), Environnement (France), Testo (Germany), Nova Analytical Systems (US), Dragerwerk (Germany), Thermo Fisher Scientific (US), and Siemens (Germany) are some major companies in this market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Breakdown of Primaries

2.1.2.3 Key Data From Primary Sources

2.1.3 Secondary and Primary Research

2.1.3.1 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Lucrative Opportunities in Flue Gas Analyzer Market Opportunities

4.2 Inline Flue Gas Analyzer Market, By Type

4.3 Market, By Installation

4.4 Market in APAC, By Application and Country

4.5 Market, By Geography

5 Market Overview (Page No. - 35)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Rise in Demand for Environmental Protection

5.1.1.2 Stringent Environmental and Legal Regulations

5.1.1.3 Increase in Health and Safety Concerns

5.1.2 Restraints

5.1.2.1 High Cost of Flue Gas Analyzers

5.1.3 Opportunities

5.1.3.1 Expanding Market in Emerging Economies

5.1.4 Challenges

5.1.4.1 Trade-Off Between Accuracy Cost and Value Proposition for End-Users

6 Flue Gas Analyzer Market, By Installation Type (Page No. - 39)

6.1 Introduction

6.2 Inline

6.2.1 Inline Market, By Type

6.2.1.1 Single-Gas Analyzers

6.2.1.2 Multi-Gas Analyzers

6.2.2 Inline Market, By Systems

6.2.3 CEMS

6.2.4 PEMS

6.3 Portable

7 Market, By Technology (Page No. - 50)

7.1 Introduction

7.2 Zirconia

7.3 Electrochemical

7.4 Paramagnetic

7.5 Infrared

7.6 Others

8 Flue Gas Analyzer Market, By Gas Component (Page No. - 53)

8.1 Introduction

8.2 COX

8.3 SOX

8.4 NOX

8.5 Others

9 Market, By Application (Page No. - 56)

9.1 Introduction

9.2 Power Generation Plants

9.3 Oil & Gas

9.4 Cement Plants

9.5 Chemicals

9.6 Pulp & Paper

9.7 Metals

9.8 Waste Incineration

9.9 Others

10 Geographic Analysis (Page No. - 66)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 UK

10.3.2 France

10.3.3 Germany

10.3.4 Rest of Europe

10.4 APAC

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 Rest of Asia Pacific

10.5 Rest of the World

10.5.1 Middle East & Africa

10.5.2 South America

11 Competitive Landscape (Page No. - 84)

11.1 Overview

11.2 Market Ranking Analysis: Flue Gas Analyzer Market

11.3 Competitive Scenario

11.3.1 Product Launches

12 Company Profiles (Page No. - 87)

(Business Overview, Products Offered, MnM View, SWOT Analysis)*

12.1 ABB

12.2 Emerson

12.3 Ametek

12.4 Teledyne Analytical Instruments

12.5 Horiba

12.6 Nova Analytical Systems

12.7 Testo

12.8 Environnement

12.9 Sick

12.10 Wohler Technik

12.11 Tekran

12.12 California Analytical Instruments

12.13 Kane

*Business Overview, Products Offered, MnM View, SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

12.14 Other Key Players

12.14.1 Drager

12.14.2 Thermo Fisher Scientific

12.14.3 Siemens

12.14.4 Opsis

12.14.5 Servomex

12.14.6 Mru Instruments

12.14.7 Afriso-Euro-Index

12.14.8 Imr Environmental Equipment

12.14.9 Endee Engineers

12.14.10 Vasthi Engineers

12.14.11 Labsol Enterprises

13 Appendix (Page No. - 111)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (63 Tables)

Table 1 Flue Gas Analyzer Market in Terms of Value and Volume, 2014–2023

Table 2 Market, By Installation Type, 2014–2023 (USD Million)

Table 3 Market in North America, By Installation Type, 2014–2023 (USD Million)

Table 4 Market in Europe, By Installation Type, 2014–2023 (USD Million)

Table 5 Market in APAC, By Installation Type, 2014–2023 (USD Million)

Table 6 Market in RoW, By Installation Type, 2014–2023 (USD Million)

Table 7 Market in South America, By Installation Type, 2014–2023 (USD Million)

Table 8 Market in Middle East & Africa, By Installation Type, 2014–2023 (USD Million)

Table 9 Inline Market, By Type, 2014–2023 (USD Million)

Table 10 Inline Single-Gas Analyzer Market, By Region, 2014–2023 (USD Million)

Table 11 Inline Multi-Gas Analyzer Market, By Region, 2014–2023 (USD Million)

Table 12 Inline Market, By System Type, 2014–2023 (USD Million)

Table 13 Inline Market in North America, By System Type, 2014–2023 (USD Million)

Table 14 Inline Market in Europe, By System Type, 2014–2023 (USD Million)

Table 15 Inline Market in APAC, By System Type, 2014–2023 (USD Million)

Table 16 Inline Market in RoW, By System Type, 2014–2023 (USD Million)

Table 17 Inline Market for CEMS, By Region, 2014–2023 (USD Million)

Table 18 Inline Market for PEMS, By Region, 2014–2023 (USD Million)

Table 19 Market, By Gas Component, 2014–2023 (USD Million)

Table 20 Market, By Application, 2014–2023 (USD Million)

Table 21 Market for Power Generation Plants, By Region, 2014–2023 (USD Million)

Table 22 Flue Gas Analyzer Market in RoW for Power Generation Plants, By Region, 2014–2023 (USD Million)

Table 23 Market for Oil & Gas, By Region, 2014–2023 (USD Million)

Table 24 Market in RoW for Oil & Gas, By Region, 2014–2023 (USD Million)

Table 25 Market for Cement Plants, By Region, 2014–2023 (USD Million)

Table 26 Market in RoW for Cement Plants, By Region, 2014–2023 (USD Million)

Table 27 Market for Chemicals, By Region, 2014–2023 (USD Million)

Table 28 Market in RoW for Chemicals, By Region, 2014–2023 (USD Million)

Table 29 Market for Pulp & Paper, By Region, 2014–2023 (USD Million)

Table 30 Market in RoW for Pulp & Paper, By Region, 2014–2023 (USD Million)

Table 31 Market for Metals, By Region, 2014–2023 (USD Million)

Table 32 Market in RoW for Metals, By Region, 2014–2023 (USD Million)

Table 33 Flue Gas Analyzer Market for Waste Incineration, By Region, 2014–2023 (USD Million)

Table 34 Market in RoW for Waste Incineration, By Region, 2014–2023 (USD Million)

Table 35 Market for Other Applications, By Region, 2014–2023 (USD Million)

Table 36 Market in RoW for Other Applications, By Region, 2014–2023 (USD Million)

Table 37 Global Market, By Region, 2014–2023 (USD Million)

Table 38 Portable Market, By Region, 2014–2023 (USD Million)

Table 39 Inline Market, By Region, 2014–2023 (USD Million)

Table 40 Market in North America, By Country, 2014–2023 (USD Million)

Table 41 Inline Market in North America, By Type, 2014–2023 (USD Million)

Table 42 Market in North America, By Application, 2014–2023 (USD Million)

Table 43 Inline Market in North America, By Country, 2014–2023 (USD Million)

Table 44 Portable Market in North America, By Country, 2014–2023 (USD Million)

Table 45 Market in Europe, By Country, 2014–2023 (USD Million)

Table 46 Inline Market in Europe, By Type, 2014–2023 (USD Million)

Table 47 Flue Gas Analyzer Market in Europe, By Application, 2014–2023 (USD Million)

Table 48 Inline Market in Europe, By Country, 2014–2023 (USD Million)

Table 49 Portable Market in Europe, By Country, 2014–2023 (USD Million)

Table 50 Market in APAC, By Country, 2014–2023 (USD Million)

Table 51 Inline Market in APAC, By Type, 2014–2023 (USD Million)

Table 52 Market in APAC, By Application, 2014–2023 (USD Million)

Table 53 Inline Market in APAC, By Country, 2014–2023 (USD Million)

Table 54 Portable Market in APAC, By Country, 2014–2023 (USD Million)

Table 55 Market in RoW, By Region, 2014–2023 (USD Million)

Table 56 Inline Market in RoW, By Type, 2014–2023 (USD Million)

Table 57 Market in South America, By Application, 2014–2023 (USD Million)

Table 58 Flue Gas Analyzer Market in RoW, By Application, 2014–2023 (USD Million)

Table 59 Market in Middle East & Africa, By Application, 2014–2023 (USD Million)

Table 60 Inline Market in RoW, By Region, 2014–2023 (USD Million)

Table 61 Portable Market in RoW, By Region, 2014–2023 (USD Million)

Table 62 Ranking of Key Players in Market (2016)

Table 63 Product Launches, 2017

List of Figures (44 Figures)

Figure 1 Flue Gas Analyzer Market Segmentation

Figure 2 Market, By Geography

Figure 3 Market: Research Design

Figure 4 Bottom-Up Approach to Arrive at the Market Size

Figure 5 Top-Down Approach to Arrive at the Market Size

Figure 6 Data Triangulation

Figure 7 Assumptions of the Research Study

Figure 8 Flue Gas Analyzer Market Segmentation

Figure 9 Inline Flue Gas Analyzers Expect to Dominate the Market

Figure 10 Continuous Emission Monitoring Systems Held the Largest Size of the Global Inline Market By 2023

Figure 11 Power Generation Application Held the Largest Size of Market in 2016

Figure 12 Flue Gas Analyzer Market in APAC Expect to Grow at the Highest CAGR During the Forecast Period

Figure 13 Attractive Growth Opportunities in the Market Between 2017 and 2023

Figure 14 Single-Gas Analyzers Estimated to Lead the Inline Market During 2017–2023

Figure 15 Inline Flue Gas Analyzers Expected to Capture A Higher Market Share By 2023

Figure 16 China Expected to Account for the Largest Share of the APAC Market in 2017

Figure 17 US Likely to Hold the Largest Share of the Market in 2017

Figure 18 Rise in Demand for Environmental Protection and Stringent Environmental and Legal Regulations Drive the Market

Figure 19 Overview of Global Carbon Dioxide Emission

Figure 20 APAC is the Largest Consumer of the Coal and It is Primarily Used Or Electricity Generation

Figure 21 Market, By Installation Type

Figure 22 Inline Flue Gas Analyzer Market, By Type

Figure 23 Inline Market, By Systems

Figure 24 Market, By Technology

Figure 25 Market, By Gas Components

Figure 26 Flue Gas Analyzer Market, By Application

Figure 27 Market, By Geography

Figure 28 Europe: Flue Gas Analyzer Market Snapshot

Figure 29 APAC: Market Snapshot

Figure 30 Product Launches has Been the Key Strategy in 2017

Figure 31 Companies Adopted Product Launches as the Key Growth Strategy Between 2015 and 2017

Figure 32 Regional Impact of Top Companies

Figure 33 ABB: Company Snapshot

Figure 34 ABB: SWOT Analysis

Figure 35 Emerson: Company Snapshot

Figure 36 Emerson: SWOT Analysis

Figure 37 Ametek: Company Snapshot

Figure 38 Ametek: SWOT Analysis

Figure 39 Teledyne Analytical Instruments: Company Snapshot

Figure 40 Teledyne Analytical Instruments: SWOT Analysis

Figure 41 Horiba: Company Snapshot

Figure 42 Environnement: Company Snapshot

Figure 43 Sick: Company Snapshot

Figure 44 Sick: SWOT Analysis

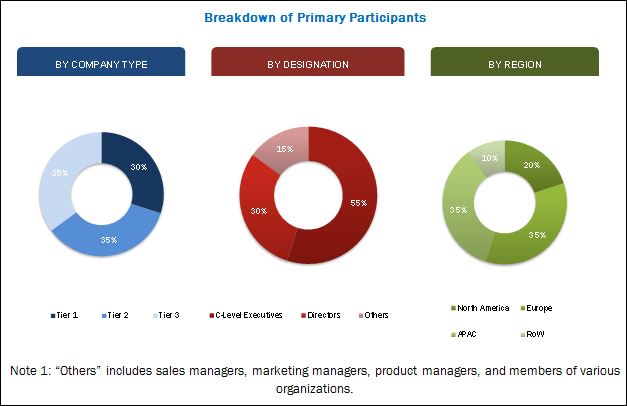

The research methodology used to estimate and forecast the flue gas analyzer market begins with capturing data on key vendor revenues through secondary research, such as IEEE publication, industrial automation conferences and exhibitions, and leading players’ newsletters. Vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the overall size of the global market from the revenue of key players. After arriving at the overall market size, the total market has been split into several segments and subsegments that have been verified through primary research by conducting extensive interviews with people holding key positions such as CEOs, VPs, directors, and executives. The market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of primaries is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

Major players involved in the flue gas analyzer market are ABB (Switzerland), SICK (Germany), Teledyne Analytical Instruments (US), Emerson (US), AMETEK (US), HORIBA (Japan), California Analytical Instruments (US), Environnement (France), Testo (Germany), Nova Analytical Systems (US), Dragerwerk (Germany), Thermo Fisher Scientific (US), and Siemens (Germany).

Target Audience of the Report:

- Supplier of gas analyzers

- Supplier and system integrators of emission monitoring systems

- Associations, organizations, forums, and alliances related to environment protection

- Component manufacturers

- Distributors and traders

- Original equipment manufacturers

- Process industries such as oil & gas, power generation, and chemicals

- Research organizations and consulting companies

- Technology investors

- Technology solution providers

This study answers several questions for stakeholders, primarily the market segments to focus on in the next 2 to 5 years for prioritizing efforts and investments.

Scope of the Report:

This research report categorizes the market on the basis of installation type, gas component, application, and geography.

Flue Gas Analyzer Market, by Installation Type:

-

Inline

-

Inline Market, by Type

- Single-gas analyzers

- Multi-gas analyzers

-

Inline Market, by Systems

- CEMS

- PEMS

-

Inline Market, by Type

- Portable

Market, by Gas Component:

- COx

- Sox

- NOx

- Others (Ammonia (NH3), Oxygen (O2), Hydrocarbons (HC), and Hydrogen Halides (HCl and HF))

Flue Gas Analyzer Market, by Application:

- Power Generation Plants

- Oil & Gas

- Cement Plants

- Chemicals

- Pulp & Paper

- Metals

- Waste Incineration

- Others (Glass and Ceramics)

Market, by Region:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companies’ specific needs. The following customization options are available for the report:

Company Information:

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Flue Gas Analyzer Market

Thanks for sharing such a wonderful information with us.