The study involved four major activities in estimating the current size of the electric coolant pump market—exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings and assumptions and size them with industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [such as publications of vehicle production, OEMs, EEA (European Energy Agency), German Association of the Automotive Industry or VDA, ACEA (European Automobile Manufacturers Association), Society of Automobile Engineers (SAE), country-level automotive associations and trade organizations], related magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, and technical articles have been used to identify and collect information useful for an extensive commercial study of the electric coolant pump market.

Primary Research

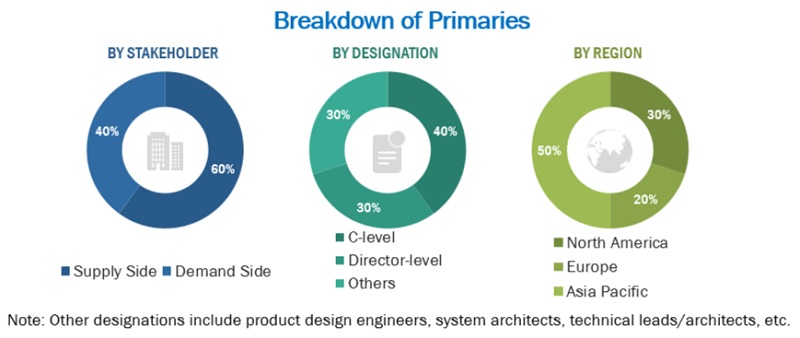

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary interviews have been conducted to gather insights such as electric coolant pump demand per vehicle type, future technology trends, and upcoming material level changes in the electric coolant pumps. The primary sources from the supply side included various industry experts, such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Below is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

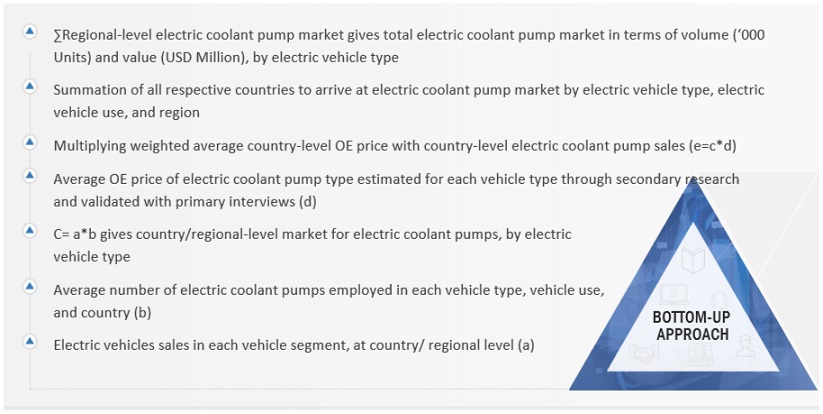

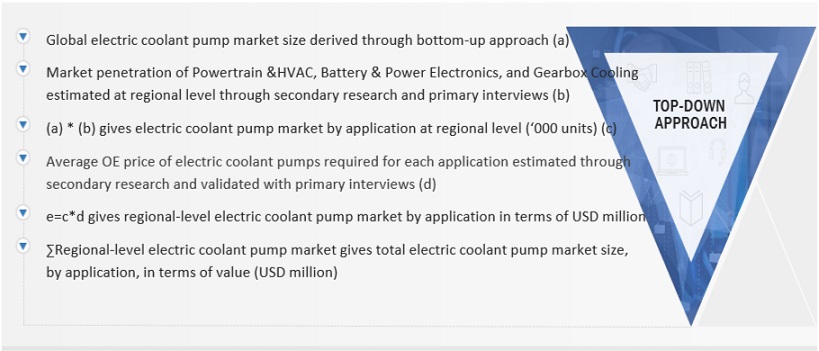

The bottom-up and top-down approaches were used to estimate and validate the total market size. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

-

The key players in the industry and markets have been identified through extensive secondary research.

-

The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

-

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Bottom-Up Approach For Electric Cars, By Vehicle Type And Vehicle Use

To know about the assumptions considered for the study, Request for Free Sample Report

The top-down approach was used to estimate and validate the size of the electric coolant pump market by application in terms of value and volume. The market by application segment, by volume, was further multiplied by the average OE price of electric coolant pumps used in respective applications, giving the market, by application, in terms of value at the regional level. The regional-level markets were then applied to the global market.

Top-Down Approach: Electric Coolant Pump Market, By Application

Data Triangulation

After arriving at the overall market size, the market was split into several segments and sub-segments—using the market size estimation processes as explained above. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at each market segment's and subsegment's statistics. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

The electric coolant pump market for vehicles includes the manufacturing, distributing, and selling of pumps specifically designed to circulate coolant within vehicle cooling systems using electric power. These pumps are primarily utilized in various vehicles, including internal combustion engines (ICE), hybrid cars, and electric vehicles (EVs), to regulate engine temperature and ensure optimal operating conditions.

List of key Stakeholders

-

Automobile OEMs

-

Automotive Components Manufacturers

-

Automotive Electronics Council (AEC)

-

Autonomous Vehicle Technology Providers

-

Association of European Automotive and Industrial Battery Manufacturers (EUROBAT)

-

Country-level Automotive Associations

-

Country-level Electric Vehicle Associations and Trade Organizations

-

Databases such as Factiva and Bloomberg

-

Department of Transportation (DoT)

-

Electric Auto Association

-

European Alternative Fuels Observatory (EAFO)

-

Electric Vehicle Association of Asia Pacific (EVAAP)

-

Energy Efficiency and Renewable Energy (EERE)

-

Environmental Protection Agency (EPA)

-

European Automobile Manufacturers' Association (ACEA)

-

Federal Communications Commission (FCC)

-

Government and Research Organizations

-

Heavy-duty Manufacturers Association (HDMA)

-

International Energy Agency (IEA)

-

Institute of Electrical and Electronics Engineers (IEEE)

-

International Council on Clean Transportation (ICCT)

-

International Electrotechnical Commission (IEC)

-

International Organization of Motor Vehicle Manufacturers (OICA)

-

Investor presentations and annual reports of key market players

-

Investor Presentations and Annual Reports of Key Market Players

-

National Highway Traffic Safety Administration (NHTSA)

-

Other Component Manufacturer Associations

-

Ridesharing Service Providers

-

Society of Manufacturers of Electric Vehicles (SMEV)

-

Wiring Harness Manufacturer's Association (WHMA)

-

World Electric Vehicle Association (WEVA)

Report Objectives

-

To analyze and forecast (2024 to 2030) the market size, in terms of volume (‘000 units) and value (USD million/billion), for the electric coolant pump market

-

To define, describe, and forecast the market size by application, type, sealless type, electric vehicle type, electric vehicle use, ICE vehicle type, voltage type, power output, communication interface, and region

-

To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the market

-

To analyze the regional-level market ranking of key players operating in the market

-

To analyze the global market share analysis of key players operating in the market

-

To understand the dynamics of the market competitors and distinguish them into visionary leaders, innovators, emerging companies, and dynamic differentiators according to the strength of their product portfolio and business strategies

-

To analyze recent developments, alliances, joint ventures, mergers & acquisitions, new product launches, and other activities carried out by key industry players in the electric coolant pump market

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs.

The following customization options are available for the report:

Electric Coolant Pump Market For Electric Passenger Cars By Vehicle Type

Note: The electric coolant pump market for electric passenger cars, by vehicle type, will be further offered at the regional level for regions: Asia Pacific, Europe, North America, and the Rest of the World.

Electric Coolant Pump Market For Electric Commercial Vehicles, By Vehicle Type

Note: The electric coolant pump Market for electric commercial vehicles, by vehicle type, will be provided at the regional level for regions: Asia Pacific, Europe, North America, and the Rest of the World.

Electric Coolant Pump Market For By 48v Passenger Cars By Region

-

Asia Pacific

-

Europe

-

North America

-

Rest of the World

Growth opportunities and latent adjacency in Electric Coolant Pump Market