This is a technical, market-oriented, and commercial study of the distributed fiber optic sensor (DFOS) market, which was carried out through the structured collection, documentation, and analysis of data on companies operating in the market. Significant use of secondary sources, directories, and databases - Factiva, Oanda, and OneSource, was made to identify and collect the needed information. In-depth interviews were conducted with various primary respondents, mostly experts from the core and related industries and preferred manufacturers, in order to acquire and verify critical qualitative and quantitative information. The growth prospects of the market were measured. Using secondary research, the key players involved in the DFOS market were ascertained, and market rankings were identified through both primary and secondary research. This included research about the annual reports of the top players, interviews with senior industry experts such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information for this study. These include annual reports, press releases, and investor presentations of companies, whitepapers, certified publications, and articles from recognized associations and government publishing sources. Research reports from a few consortiums and councils were also consulted to structure qualitative content. Secondary sources included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; Journals and certified publications; articles by recognized authors; gold-standard and silver-standard websites; directories; and databases. Data was also collected from secondary sources, such as the International Trade Centre (ITC) (Switzerland), and the International Monetary Fund (IMF).

Primary Research

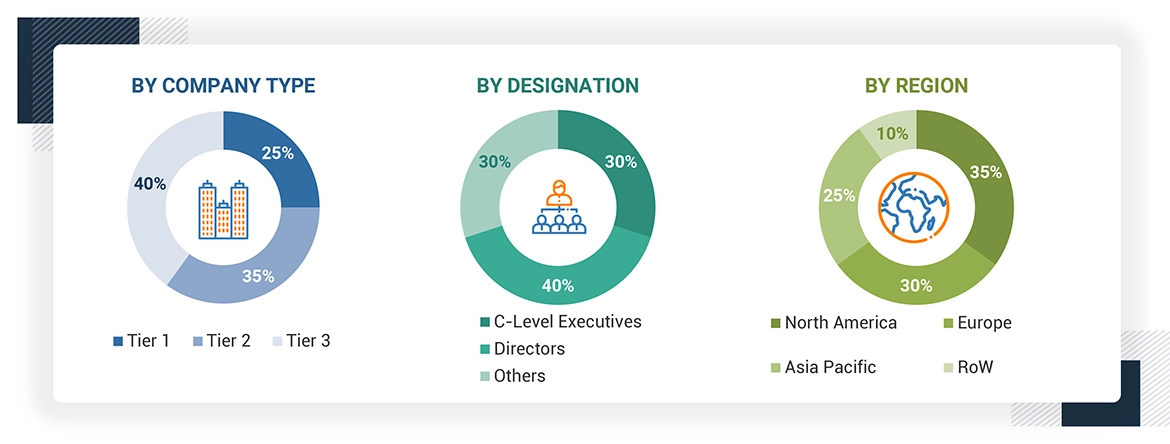

Extensive primary research was accomplished after understanding and analyzing the distributed fiber optic sensor (DFOS) market scenario through secondary research. Several primary interviews were conducted with key opinion leaders from both demand- and supply-side vendors across four major regions-North America, Europe, Asia Pacific, and RoW. The primary interviews were conducted with the demand side to the extent of 40% and with the supply side to the extent of 60%. Primary data collected through questionnaires, emails, telephonic interviews, through the contact of various departments in organizations, sales, operations, and administration are considered to provide a holistic viewpoint in the report.

Note: The three tiers of companies are based on their total revenue as of 2023: Tier 1 - equal to or more than USD 1,000 million; Tier 2 - between USD 500 million and USD 1,000 million; and Tier 3 - less than or equal to USD 500 million. Other designations include managers and academicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out on the complete market engineering process to list the key information/insights pertaining to distributed fiber optic sensor (DFOS) market.

The key players in the market were identified through secondary research, and their rankings in the respective regions determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, and interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for quantitative and qualitative key insights. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

Distributed Fiber Optic Sensor Market : Top-Down and Bottom-Up Approach

The bottom-up procedure was employed to arrive at the overall size of the distributed fiber optic sensor (DFOS) market from revenues of the key players and their share in the market. The overall market size was calculated on the basis of the revenues of the key companies identified in the market.

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research. For the calculation of the distributed fiber optic sensor market segments, the market size obtained by implementing the bottom-up approach was used to implement the top-down approach, which was later confirmed with the primary respondents across different regions. The bottom-up approach has also been implemented for the data extracted from secondary research to validate the market size of various segments.

The approximate market share of each company has been estimated to verify revenue shares used earlier in the bottom-up approach. With the help of the data triangulation procedure and the validation of data through primary interviews, the overall market size and each market size have been determined and confirmed in this study. The data triangulation procedure used for this study has been explained in the next section.

Data Triangulation

After arriving at the overall market size through the above process, the market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both the top-down and bottom-up approaches.

Market Definition

Distributed fiber optic sensors use a fiber optic cable to measure temperature, acoustics, pressure, and strain along the length of the fiber. The benefit of using a distributed fiber optic sensor is that it provides the real-time measurement of physical parameters such as temperature, vibration, or strain, which are recorded along the length of the optical sensor cable and are reliable for operating in harsh environments. Industries such as oil & gas, power & utility, safety & security, and civil engineering require distributed fiber optic sensors for monitoring as they can operate reliably in harsh working environments and are immune to electromagnetic interference.

Key Stakeholders

-

Raw Material Vendors

-

Component and Hardware Providers

-

Sensor Providers

-

System Integrators

-

Original Equipment Manufacturers (OEMs)/Device Manufacturers

-

Technology Standard Organizations, Forums, Alliances, and Associations

-

Governments, Financial Institutions, and Investment Communities

-

Research Organizations

-

Analysts and Strategic Business Planners

-

Venture Capitalists, Private Equity Firms, and Start-up Companies

Report Objectives

-

To define, describe, and forecast the size of the distributed fiber optic sensor market, by fiber type, operating principle, scattering method, application, and vertical, in terms of value

-

To forecast the size of market segments with respect to four regions, namely North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value

-

To define, describe, and forecast the size of the distributed fiber optic sensor market, by application, in terms of volume

-

To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the distributed fiber optic sensor market

-

To offer an ecosystem analysis, value chain analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter’s five forces analysis, and regulations pertaining to the market

-

To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

-

To strategically profile key players and comprehensively analyze their market shares and core competencies

-

To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market

-

To study competitive developments, such as collaborations, partnerships, product developments, and acquisitions, in the market

-

To understand the impact of Gen AI/AI on the distributed fiber optic sensor market

-

To understand the Macroeconomic outlook on the fiber optic sensor market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

-

Detailed analysis and profiling of additional market players (up to 7)

Tao

Mar, 2019

I am a new teacher focus on distributed fiber optic sensor, I want to know the right direction to study on. Can you provide me the future trends and scope of the report?.

Ron

Aug, 2017

Hi, This report looks very interesting but very expensive. Can you please send exec summary as well as level of projects description, methodology etc., so we can asses to provide good information..

Steven

Jun, 2017

Is there any reason why HiFi was not includes in the company list? We are deploying a significant amount of our high fidelity fiber optic sensing technology both downhole and on pipelines. The company is partly owned by Cenovus and Enbridge. We can also share performance testing to illustrate a significant improvement from the low fidelity / conventional DAS and DTS players referenced. We'd be happy to speak to an analyst/author at your convenience..