The research uses extensive secondary sources, such as company annual reports/presentations, industry association publications, magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases, to identify and collect information on the self-driving car market. Primary sources, such as experts from related industries, OEMs, and suppliers, have been interviewed to obtain and verify critical information and assess the growth prospects and market estimations.

Secondary Research

Secondary sources for this research study include corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; whitepapers and self-driving car and ADAS-related journals; certified publications; articles by recognized authors; directories; and databases. Secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

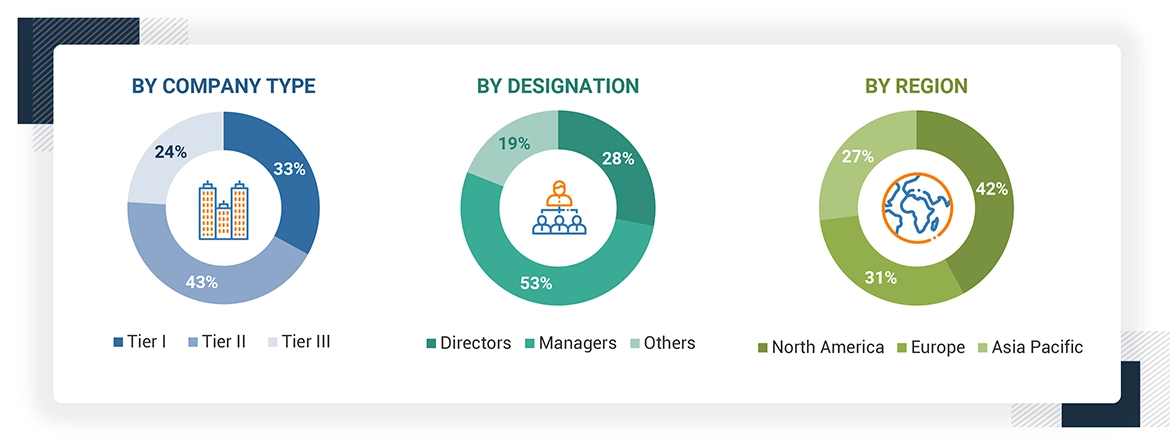

After understanding the self-driving cars market scenario through secondary research, extensive primary research has been conducted. Primary interviews have been conducted with market experts from both demand and supply sides across North America, Europe, and Asia Pacific. Approximately 35% of interviews have been conducted from the demand side, while 65% of primary interviews have been conducted from the supply side. The primary data has been collected through questionnaires, emails, and telephone interviews.

In the canvassing of primaries, various departments within organizations, such as sales and operations, have been covered to provide a holistic viewpoint in this report. Primary sources from the supply side include various industry experts, such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders have also been interviewed.

Note: Others include sales, managers, and product managers.

Company tiers are based on the value chain; the company's revenue is not considered.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the self-driving car market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Self-driving Cars Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size of the global market through the methodology mentioned above, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact market value data for the key segments and sub-segments, wherever applicable. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand and supply-side participants.

Market Definition

Self-driving cars are technologies capable of performing dynamic driving tasks, with or without human supervision. The California DMV defines autonomous mode as when the technology manages driving operations independently. At the same time, SAE Level 5 autonomy represents vehicles capable of moving under all conditions without human intervention, even with a user in the driver's seat.

Stakeholders

-

ADAS Integrators

-

ADAS Solution Suppliers

-

Associations, Forums, and Alliances related to Autonomous Vehicles

-

Automotive Component Manufacturers

-

Automotive Industry Associations, Government Authorities, and Research Organizations

-

Automotive OEMs

-

Automotive Sensor Manufacturers

-

Automotive SoC and ECU Manufacturers

-

Automotive Software and Platform Providers

-

Autonomous Driving Platform Providers

-

Autonomous Vehicle Manufacturers

-

Country-specific Automotive Associations

-

European Automobile Manufacturers Association (ACEA)

-

Government and Research Organizations

-

National Highway Traffic Safety Administration (NHTSA)

-

Transport Authorities

-

Vehicle Safety Regulatory Bodies

Report Objectives

-

To analyze and forecast the self-driving cars market in terms of volume (thousand units) and value (USD million) from 2024 to 2035

-

To segment the market by Level of Autonomy, Component Type, Mobility Type, Vehicle Class, and region

-

To segment and forecast the market by Level of Autonomy (Semi-autonomous (L1, L2, and L3), and Autonomous (L4 and L5))

-

To segment and forecast the market by Component Type (Camera, LiDAR, Radar, Ultrasonic Sensors, Infrared Sensors, and Others)

-

To segment and forecast the market by Mobility Type (Personal Mobility and Shared Mobility)

-

To segment and forecast the market by Vehicle Class (A&B, C&D, and E&F)

-

To forecast the market by region [North America, Europe, and Asia Pacific]

-

To identify and analyze key drivers, challenges, restraints, and opportunities influencing the market growth

-

To strategically analyze the market for individual growth trends, prospects, and contributions to the total market

-

To study the following with respect to the market

-

Pricing Analysis

-

Investment and Funding Scenario

-

Value Chain Analysis

-

Ecosystem Analysis

-

Technology Analysis

-

Trade Analysis

-

Case Study Analysis

-

Patent Analysis

-

Regulatory Landscape

-

Key Stakeholders and Buying Criteria

-

Key Conferences and Events

-

To strategically profile the key players and comprehensively analyze their market share and core competencies

-

To analyze the impact of AI on the market

-

To track and analyze competitive developments such as deals, product launches/developments, expansions, and other activities undertaken by the key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company's specific needs.

-

Additional Company Profiles (Up to 5)

-

Global Self-driving cars market, By Level of Autonomy, at Country Level

-

Global Self-driving cars market, By EV Type, at Country Level

Growth opportunities and latent adjacency in Self-driving Cars Market