Computer Aided Engineering Market

Computer Aided Engineering (CAE) Market by Software (FEA, CFD, Multibody Dynamics (MBD), Electromagnetics, Optimization & Simulation), Service, Vertical (Automotive, A&D, Healthcare & Life Sciences, Energy & Process), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The computer-aided engineering market is projected to reach USD 19.96 billion by 2030 from USD 12.28 billion in 2025, at a CAGR of 10.2% from 2025 to 2030. CAE is a technology framework that enables the design, simulation, and optimization of complex systems through virtual testing and analysis, reducing reliance on physical prototypes. Its market growth is fueled by the global shift toward automation and smart manufacturing, with the automotive, aerospace and defense, electronics and semiconductors, energy, and industrial equipment industries adopting CAE tools. CAE facilitates the virtual testing of automated processes and machinery, minimizing downtime, reducing costs, and enhancing operational efficiency. This transformation aligns with Industry 4.0 goals, driving deeper integration of CAE across manufacturing and engineering workflows.

KEY TAKEAWAYS

- The North America CAE market accounted for a 36.4% revenue share in 2025.

- By offering, services segment is projected to grow at the fastest rate from 2025 to 2030.

- By deployment mode, cloud segment is expected to register the highest CAGR of 11.2%.

- By organization size, SMEs segment will grow the fastest during the forecast period.

- By vertical, automotive segment is expected to dominate the market in terms of market share during the forecast period.

- Ansys + Synopsys, Siemens + Adair, and Dassault Systèmes lead the CAE market with advanced simulation platforms, multiphysics capabilities, and deeply integrated engineering ecosystems. Their strong innovation pipelines and end-to-end design-to-simulation workflows enable high-precision modeling, faster product development, and improved engineering efficiency across industries.

- SimScale, Tecosim, and Echelon CAE are emerging innovators offering cloud-native, cost-efficient, and highly scalable simulation solutions. Their tools provide accessible engineering analysis, rapid iteration, and collaborative workflows, helping organizations accelerate simulation-driven design and reduce development costs.

The computer-aided engineering market is projected to grow significantly over the next decade, driven by increasing demand for automation, smart manufacturing, and virtual product development. Organizations are increasingly adopting CAE for its ability to simulate, design, and optimize complex systems, reducing reliance on physical prototyping and lowering development costs. Rising adoption of Industry 4.0 initiatives, 3D printing, and digital twins further accelerates CAE’s role as a critical engineering tool, laying the foundation for widespread industry integration

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The figure highlights the shifting revenue dynamics and evolving client priorities across industries. Currently, 80% of revenue comes from existing services, with 20% from new initiatives. Over the next 4–5 years, this is projected to invert, emphasizing emerging technologies, AI-driven design, digital twins, and cloud-based simulation platforms. Key sectors such as automotive, aerospace & defense, and electronics & semiconductors prioritize faster product development cycles, lightweight and sustainable design, and cost optimization. These imperatives translate into client outcomes such as accelerated time-to-market, improved product reliability, reduced prototyping costs, enhanced compliance with safety standards, and greater innovation agility.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing adoption of advanced simulation techniques

-

Increased use in EVs and autonomous vehicles

Level

-

High initial setup costs

-

Data security concerns with cloud-based CAE

Level

-

AI-powered simulation and generative design

-

Integration of CAE with digital twin & Industry 4.0

Level

-

Complexity of multiphysics simulations

-

Interoperability issues across platforms

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising adoption of IoT and 3D printing

The growing adoption of IoT and 3D printing is driving CAE growth in manufacturing and product development. IoT enables real-time data integration into simulation models, supporting predictive maintenance and performance optimization. At the same time, 3D printing in aerospace, healthcare, and industrial manufacturing relies on CAE to validate the strength and reliability of printed components. These technologies enable precise digital twins, reduce physical prototyping, and accelerate innovation, helping companies shorten design cycles and bring products to market faster.

Restraint: High initial setup costs

A significant restraint in the CAE market is the high initial investment required for software licensing, advanced modules, and specialized training. Leading solutions, such as ANSYS, become costlier with add-ons such as CFD or thermal analysis. Additionally, hiring skilled professionals to manage complex simulations further increases expenses. While cloud-based and low-cost alternatives are available, they often lack enterprise-grade capabilities, limiting adoption. As a result, some businesses, mainly SMEs, continue using traditional prototyping methods despite their inefficiencies and higher long-term costs.

Opportunity: AI-powered simulation and generative design accelerate CAE innovation

The integration of AI and ML into CAE platforms is revolutionizing design and simulation by enabling faster, smarter, and more accurate modeling. Solutions such as Altair HyperWorks with PhysicsAI and Ansys SimAI dramatically reduce simulation times through real-time modeling and GPU acceleration. Cloud-native SimScale and NVIDIA Omniverse further enhance real-time aerodynamic and physical simulations. These advancements shorten R&D cycles, reduce prototyping costs, and make CAE more accessible and efficient across automotive, aerospace, electronics, and industrial equipment industries.

Challenge: Interoperability issues across platforms hinder CAE efficiency

A significant challenge in the CAE market is the lack of seamless interoperability between CAD, CAE, and PLM systems. Engineers frequently encounter geometry translation errors, lost metadata, and incompatible file formats when transferring models between AutoCAD, Creo, and simulation software. This necessitates additional time for remeshing, surface cleanup, and reassigning materials or boundary conditions. Smaller firms face integration difficulties, and the absence of standardized exchange protocols slows design cycles and raises the risk of costly errors.

COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Doppelmayr enhances ski lift safety and efficiency using Altair’s advanced CFD simulations, reducing testing time and costs. | UltraFluidX simulations achieved <5% drag deviation, accelerated design cycles, lowered costs, and provided deeper aerodynamic insights beyond traditional wind tunnel testing. |

|

PMF uses Dassault Systèmes’ 3DEXPERIENCE platform to design and manufacture innovative racing motorcycles, driving success in MotoStudent competitions. | PMF achieved a 50% reduction in rear swingarm weight, developed an aerodynamic airbrake device, streamlined collaboration, and ensured consistent competition success. |

|

Plaintiffs leverage DocuSign eSignature to enforce tenancy-in-common agreements, with courts upholding the signatures as legal and binding under common law. | DocuSign court-confirmed enforceability of eSignatures, streamlined agreement management, and strengthened legal compliance in property disputes. |

|

Bosch utilized Ansys Motor-CAD to enhance the design of electric motors, focusing on improving efficiency and performance across the full torque-speed operating range. | Ansys Motor-CAD helped Bosch speed up design cycles, improve motor efficiency, and enhance product reliability through advanced simulations. |

|

CAE Value AB employed Siemens' Simcenter Amesim and Simcenter HEEDS to perform multi-attribute balancing of hybrid vehicles, optimizing various performance parameters simultaneously. | Siemens' solutions improved hybrid vehicle performance, reduced development time through streamlined optimization, and enabled engineers to meet diverse design requirements efficiently. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The CAE market ecosystem comprises interconnected stakeholders, including CAE software providers, cloud service platforms, consulting and engineering service providers, and end users. Software vendors offer tools such as Finite Element Analysis (FEA), Computational Fluid Dynamics (CFD), and Multibody Dynamics for virtual design and testing. Cloud services and high-performance computing (HPC) enable scalable, faster simulations, while consulting firms support integration and customization. End users span automotive, aerospace and defense, electronics and semiconductors, energy, marine and offshore, and industrial equipment, adopting CAE to reduce prototyping costs, accelerate innovation, and improve product reliability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Computer-aided Engineering Market, By Offering

The software tools segment is expected to hold the largest market share in 2025. The rising need for advanced design, simulation, and analysis capabilities is driving demand for this segment. By leveraging cutting-edge CAE software, organizations can optimize product performance, reduce development costs, and accelerate time-to-market. Its seamless integration with cloud platforms and AI-driven analytics makes is essential for industries focusing on innovation, precision, and efficiency.

Computer-aided Engineering Market, By Software Tools

The Finite Element Analysis (FEA) segment is expected to dominate the overall computer-aided engineering market in 2025. The growing need for precise modeling, structural analysis, and failure prediction is driving demand for this segment. By using FEA software, organizations can simulate real-world conditions, optimize designs, and minimize physical prototyping costs. Its strong application across automotive, aerospace, and manufacturing industries makes it vital for improving product reliability and performance.

Computer-aided Engineering Market, By Deployment Mode

In 2025, the on-premises deployment mode is expected to hold the highest market share in the global computer-aided engineering market. The increasing need for data security, compliance, and control over proprietary design information is driving demand for this segment. On-premises deployment enables organizations to manage sensitive simulation data internally, ensuring privacy and regulatory adherence. Its suitability for industries with strict security standards, such as aerospace, defense, and automotive, makes it a preferred choice for mission-critical engineering operations.

Computer-aided Engineering Market, By Organization Size

Large enterprises are expected to dominate the global computer aided engineering market in 2025. The rising adoption of advanced CAE tools to support complex product designs, high-volume simulations, and global R&D operations is driving demand for this segment. Large enterprises benefit from robust infrastructure, higher budgets, and skilled teams, enabling them to leverage CAE for innovation, faster time-to-market, and improved product quality across diverse industries.

Computer-aided Engineering Market, By Vertical

The automotive sector is expected to hold the largest market share in 2025. The increasing need for lightweight materials, improved fuel efficiency, and enhanced vehicle safety is driving demand for this segment. CAE tools enable automotive manufacturers to simulate crash tests, optimize aerodynamics, and accelerate the design of electric and autonomous vehicles. Their role in reducing prototyping costs and speeding up innovation makes them critical to the industry’s growth and competitiveness.

REGION

Asia Pacific to be fastest-growing region in global computer-aided engineering market during forecast period

The Asia Pacific computer-aided engineering market is expected to register the highest CAGR during the forecast period, driven by rapid industrialization, expanding manufacturing sectors, and increasing investments in digital engineering. China, India, Japan, and Singapore are heavily focusing on advanced product design, electric vehicle development, and smart manufacturing initiatives. Rising demand for cost-effective simulation solutions and government support for innovation are accelerating CAE adoption across automotive, aerospace, and industrial sectors.

COMPUTER-AIDED ENGINEERING MARKET: COMPANY EVALUATION MATRIX

In the computer-aided engineering market matrix, Ansys (now part of Synopsys) (Star) leads with a strong market presence and a comprehensive CAE solution portfolio, driving adoption across industries such as automotive, aerospace, and electronics. Its advanced simulation capabilities, seamless integration with design workflows, and continuous innovation position it as a front-runner in enabling faster product development, reduced prototyping costs, and enhanced engineering precision globally.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 11.11 Billion |

| Market Forecast in 2030 (value) | USD 19.96 Billion |

| Growth Rate | CAGR of 10.2% from 2025-2030 |

| Years Considered | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

RECENT DEVELOPMENTS

- February 2025 : Foretellix and MathWorks partnered to accelerate Mazda's next-generation autonomous vehicle development. By integrating Foretellix’s Foretify platform with Simulink and the Automated Driving Toolbox, the collaboration enables large-scale scenario testing and analysis in a virtual environment. This helps Mazda improve system quality, identify edge cases, and reduce time to market for their AD/ADAS systems.

- October 2024 : Autodesk introduced AI-powered automations for Fusion, along with Form Explorer, a new AI-driven automotive design tool for Alias. Fusion has also gained performance boosts, a detailed Manufacturing Data Model, and a new API for seamless integration across the design and manufacturing ecosystem.

- April 2024 : Dassault Systèmes and Peugeot Sport partnered to enhance the aerodynamics of the PEUGEOT 9X8 Hybrid Hypercar for the 2024 World Endurance Championship. Utilizing Dassault’s SIMULIA on the 3DEXPERIENCE platform, Peugeot Sport conducted over 10,000 virtual simulations, optimizing design elements for performance and stability. This cloud-based approach enabled efficient, precise aerodynamics testing, supporting Peugeot Sport’s hybrid goals while demonstrating Dassault’s ability to drive innovation in electric mobility and motorsports.

- April 2024 : Emerson acquired AspenTech’s Process Optimization Division to expand its digital transformation capabilities, focusing on advanced process simulation tools for industrial automation and energy management.

- March 2024 : Ansys and NVIDIA announced a collaboration to enhance simulation solutions using GPU acceleration and generative AI. The partnership focuses on advancing 6G technologies, integrating NVIDIA AI into Ansys software, developing physics-based digital twins, and building custom LLMs with NVIDIA’s AI Foundry.

Table of Contents

Methodology

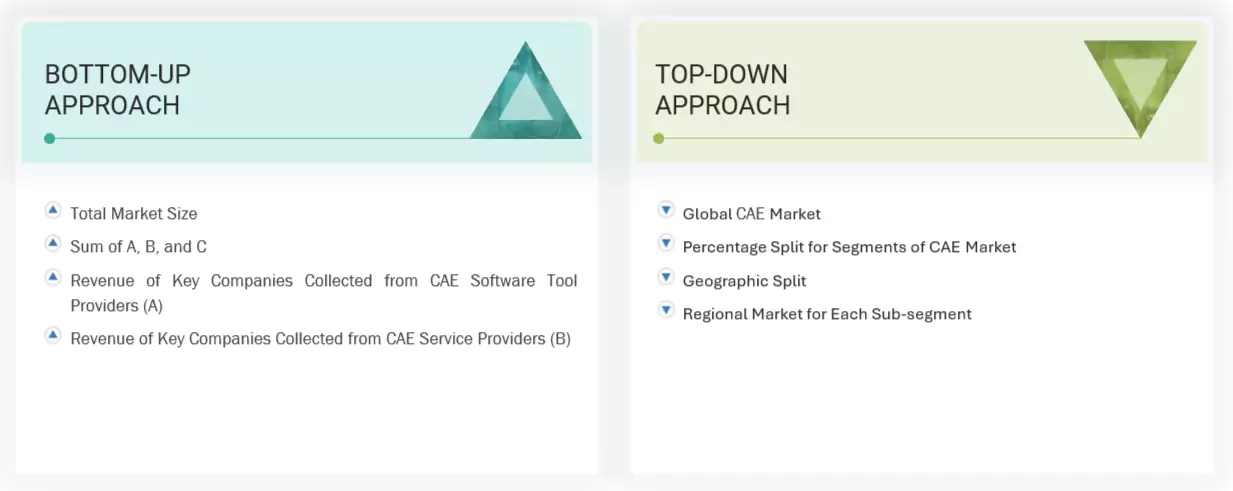

This study involved estimating the current CAE market size. Exhaustive secondary research was carried out to collect information on the CAE industry. The next step involved validating these findings and assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of segments and subsegments of the CAE market.

Secondary Research

The market for the companies offering CAE software tools and services was arrived at using secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

In the secondary research process, various secondary sources were referred to to identify and collect information related to the study. Secondary sources included annual reports, press releases, and investor presentations of CAE vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain essential information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the CAE market.

After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also undertaken to identify the segmentation types, industry trends, competitive landscape of CAE software tools and services offered by various market players, and fundamental market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Note: The companies were categorized based on their total annual revenue; tier 1 companies = revenue

greater than USD 10 billion; tier 2 companies = revenue between USD 1 billion and USD 10 billion; tier 3

companies = revenue between USD 500 million and USD 1 billion.

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the CAE market and the size of various other dependent sub-segments. The research methodology used to estimate the market size included the following details: key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of the top market players, and extensive interviews were conducted for key insights from the industry leaders, such as CEOs, VPs, directors, and marketing executives.

All percentage splits and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added to detailed inputs and analysis from MarketsandMarkets.

Computer Aided Engineering (CAE) Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

According to MarketsandMarkets, Computer Aided Engineering (CAE) encompasses the entire product engineering process, from design and virtual testing to manufacturing planning. Initially based on finite element methods, CAE now integrates a wide range of performance analysis techniques, including structural, thermal, electromagnetic, aeronautic, and acoustic simulations. By leveraging advanced analytical algorithms, CAE streamlines product development and enhances the efficiency of the manufacturing process.

Stakeholders

- Technology Providers

- Business Analysts

- Third-party Vendors

- Investors and Venture Capitalists

- System Integrators

- Value-added Resellers (VARs)

- Information Technology (IT) Security Agencies

- Distribution Partners

- Product Designers and Engineers

- Manufacturers

- CAE Software Providers

- Quality Assurance Teams

- Research and Development (R&D) Departments

- Project Managers

- Industry Regulators and Standards Organizations

- Suppliers and Material Vendors

- Consultants and CAE Service Providers

- Customers and End Users

Report Objectives

- To define, describe, and forecast the CAE market based on offering, deployment mode, organization size, vertical, and region

- To forecast the market size of the five main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

- To provide detailed information related to the primary factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

- To profile the key players of the market and comprehensively analyze their market size and core competencies

- To track and analyze competitive developments, such as product launches, mergers and acquisitions, partnerships, agreements, and collaborations in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis as per Feasibility

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

What are the opportunities in the CAE market?

The CAE market presents significant opportunities driven by the rising adoption of cloud-based platforms, integration of AI and digital twin technologies, and growing demand in emerging industries such as healthcare, renewable energy, and electric vehicles. Expansion in developing regions, particularly Asia Pacific and Latin America, offers untapped potential due to increasing industrialization and digital transformation. Additionally, the surge in demand for CAE-enabled engineering services and consulting is creating new revenue streams beyond traditional software licensing.

What is the definition of the CAE market?

According to MnM, "Computer-Aided Engineering (CAE) encompasses the entire product engineering process, from design and virtual testing to manufacturing planning. Initially based on finite element methods, CAE now integrates a wide range of performance analysis techniques, including structural, thermal, electromagnetic, aeronautic, and acoustic simulations. By leveraging advanced analytical algorithms, CAE streamlines product development and enhances the efficiency of the manufacturing process".

Which region is expected to account for the largest share of the CAE market?

North America is expected to account for the largest market share during the forecast period.

Which are the major market players covered in the report?

Major market vendors include Ansys (US), Autodesk (US), Dassault Systèmes (France), Hexagon AB (Sweden), Siemens (Germany), MathWorks (US), PTC (US), COMSOL (Sweden), Keysight US), Honeywell (US), Bentley Systems (US), Emerson (US), AspenTech (US), CAE, Inc. (Canada), SimScale (Germany), Gamma Technologies (US), Tecosim (Germany), Echleon CAE (Germany), ESPL (India), BETA CAE Systems (Switzerland), Prometech Software (Japan), Rescale (US), ESRD (US), nTopology (US), SimulationPlus (US), Rafinex (Luxembourg), AirShaper (Belgium), and ToffeeX (UK).

What is the current size of the CAE market?

In 2025, the CAE market is estimated to be USD 12.28 billion.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Computer Aided Engineering (CAE) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Computer Aided Engineering (CAE) Market